Can Stocks Recover After the S&P 500 Pullback In the Last Week?

May 08 2022 - 5:25PM

Finscreener.org

The last week saw all major

indices lose significant value as investors remain wary

about

macro-economic challenges

that include inflation, geopolitical

tensions, supply chain disruptions, steep valuations surrounding

growth stocks, and tepid forecasts provided by

corporates.

In the week ended on May 6, the

S&P 500 index fell 0.2% while the NASDAQ Composite Index was

down 1.5%. Comparatively, the Dow Jones index fell 0.24%. Right

now, the S&P 500, Nasdaq Composite, and Dow Jones have

slumped 13.9%, 23.3%, and 10.1% respectively year to

date.

Several tech stocks have burnt

massive investor wealth as rate hikes by the central bank and

inflation worries coupled with a sluggish macro-environment are

likely to impact consumer spending which has forced market

participants to reassess their equity portfolios.

Last week,

Shopify (NYSE:

SHOP) fell 15% in a single trading session after it

missed earnings and revenue estimates in Q1. Further, shares of

ride-sharing company Lyft (NASDAQ: LYFT)

plunged 36% after it provided weak guidance for Q2.

Bill.com (NYSE:

BILL) lost 30% in market

cap on the back of allowing top-line growth while

Cloudflare (NYSE:

NET) sunk 24% after it

forecast a loss in the June quarter.

The market mayhem is likely to continue

In an

interview with

CNBC, economist Brunello

Rosa who is the CEO and head of research

at Rosa & Roubini

expects quantitative tightening measures will negatively impact

economic activity. Rosa believes heavy selling in stock markets to

gain momentum as global central banks will continue to hike base

rates to offset inflation. Last week, the Fed raised base rates by

0.5% which is the largest hike since 2000.

Rosa explained, “Now it’s time

for a reappreciation of the economic fundamentals around the world

in terms of growth. It’s hard for markets to be totally optimistic

when inflation is going up, growth is going down and interest rates

are rising fast across the globe.”

The Bank of England which is the

central bank of the U.K. also warned about a looming recession as

the tightening of balance sheets by regulators will lead to a

contraction in economic activity.

Rosa also emphasized the

Russia-Ukraine war will last longer than anticipated adding to

headwinds in supply chains and keeping commodity prices

higher.

Investors will closely watch data

for the consumer price index for April which will release on

Wednesday as well as the producer price index which will publish on

Thursday. Economists expect CPI in April to rise by 0.3% for April

or 8.2% compared to the year-ago period.

Additionally, the 10-year

Treasury yield also surged past 3% for the first time in almost

four years. On Friday, the yield stood at 3.13%, up from 2.94% in

the prior week.

Where do invest when S&P 500 is under

pressure?

While the energy sector remains

the top-performing one in the last year, oil and gas stocks are

highly capital-intensive and cyclical. So, higher crude oil prices

will boost profits but climbing interest rates will eat into profit

margins as well. Additionally, if recession fears come true, there

is a good chance for energy stocks to trade at far lower multiples

next year.

Investors need to eliminate

company-specific risk and purchase funds or ETFs which will

diversify their overall portfolio. You also need to re-evaluate

your holdings of growth stocks and increase exposure to value

stocks in the near term. Investing in companies that are cheap and

have pricing power may seem the ideal bet in a challenging market

environment.

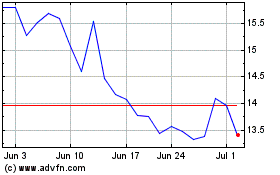

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Apr 2023 to Apr 2024