Current Report Filing (8-k)

May 06 2022 - 9:01AM

Edgar (US Regulatory)

|

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

|

|

Date of Report: May 3, 2022 (Date of earliest event reported) |

PennantPark Floating Rate Capital Ltd. (Exact name of registrant as specified in its charter) |

|

|

|

|

Maryland (State or other jurisdiction of incorporation) |

814-00891 (Commission File Number) |

27-3794690 (IRS Employer Identification Number) |

|

|

|

|

1691 Michigan Avenue Miami Beach, Florida (Address of principal executive offices) |

|

33139 (Zip Code) |

|

212-905-1000 (Registrant's telephone number, including area code) |

|

|

Not Applicable (Former Name or Former Address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered |

Common Stock, par value $0.001 per share |

PFLT |

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.02 - Departure of Directors or Principal Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On May 3, 2022, the Board of Directors (the “Board”) of PennantPark Floating Rate Capital, Ltd, (the “Company”) increased the size of the Board from five to six members and, on the recommendation of the Nominating and Governance Committee of the Board, appointed José Briones as an interested director to fill the vacancy created by such increase, effective immediately. Mr. Briones will serve as a Class III director with a term expiring at the Company's Annual Meeting of Stockholders in 2023. The Company announced the appointment of Mr. Briones in its May [6], 2022 press release. A copy of that press release is being filed with this Form 8-K as Exhibit 99.1.

Mr. Briones was nominated by the Company's Nominating and Corporate Governance Committee after a thorough review of Mr. Briones’ background, relevant experience and professional and personal reputations. Mr. Briones is a Senior Partner at PennantPark Investment Advisers, LLC, the Company’s investment adviser (the “Adviser”). He joined the Adviser in December 2009, and oversees originating, underwriting, executing and monitoring investments for the Company. He is also responsible for various strategic initiatives.

Mr. Briones has not been elected to serve as a member of the Board pursuant to any agreement or understanding with the Company or any other person, and there are no related party transactions with regard to Ms. Briones that are reportable under Item 404(a) of Regulation S-K. Mr. Briones. will not receive director fees.

Item 5.05. Amendments to the Registrant’s Code of Ethics, or Waiver of a Provision of the Code of Ethics.

On May 3, 2022, the Board adopted an amended Joint Code of Ethics (as amended, the “Code”) applicable to, among others, the Company and the Adviser. The Code was amended to, among others, extend the Trading Window (as defined in the Code), in the case of the Company’s and the Adviser’s decision to buy the Company’s equity securities, from no later than 30 days after the release of financial results for a fiscal quarter to no later than the end of the quarter during which such financial results have been publicly released.

The amendments reflected in the Code did not relate to or result in any waiver, explicit or implicit, of any provision of the previous Joint Code of Ethics.

The foregoing description of the amendments reflected in the Code is not complete and is qualified in its entirety by reference to the full text of the Code, a copy of which is attached hereto as Exhibit 14.1 and is incorporated by reference into this Item 5.05. A copy of the Code is also publicly available in the governance documents section of the Company’s website at: https://pflt.pennantpark.com.

Forward-Looking Statements

This report on Form 8-K, including Exhibit 99.1 furnished herewith, may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You should understand that under Section 27A(b)(2)(B) of the Securities Act and Section 21E(b)(2)(B) of the Exchange Act the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 do not apply to forward-looking statements made in periodic reports PennantPark Floating Rate Capital Ltd. files under the Exchange Act. All statements other than statements of historical facts included in this press release are forward-looking statements and are not guarantees of future performance or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described from time to time in filings with the Securities and Exchange Commission. PennantPark Floating Rate Capital Ltd. undertakes no duty to update any forward-looking statement made herein. You should not place undue influence on such forward-looking statements as such statements speak only as of the date on which they are made.

Item 9.01. Financial Statements and Exhibits

(a) Financial statements:

None

(b) Pro forma financial information:

None

(c) Shell company transactions:

None

(d) Exhibits

14.1 Joint Code of Ethics of PennantPark Floating Rate Capital, Ltd.

99.1 Press Release of PennantPark Floating Rate Capital Ltd. Dated May 6, 2022

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Dated: May 6, 2022 |

PENNANTPARK FLOATING RATE CAPITAL LTD. By: /s/ Richard Cheung Richard Cheung Chief Financial Officer & Treasurer |

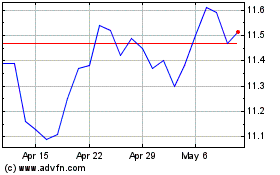

PennantPark Floating Rat... (NYSE:PFLT)

Historical Stock Chart

From Mar 2024 to Apr 2024

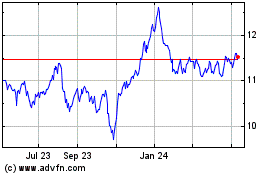

PennantPark Floating Rat... (NYSE:PFLT)

Historical Stock Chart

From Apr 2023 to Apr 2024