TOMI Environmental Solutions, Inc.® (“TOMI”) (NASDAQ:TOMZ), a

global company specializing in disinfection and decontamination

utilizing its premier Binary Ionization Technology (BIT) platform

through its SteraMist brand of products, today announced its

financial results for the first quarter of 2022.

TOMI Chief Executive Officer, Dr. Halden Shane, stated, “In the

first quarter, we delivered improved financial results as

demonstrated by increased sales, enhanced gross profit, lower

operating expenses and positive cash flow as compared to the same

period last year. First quarter sales grew approximately 11% as

compared to first quarter of 2021 and 15% sequentially over the

fourth quarter of 2021, primarily due to increased demand for our

mobile equipment and iHP service. We continue to see strong demand

in the marketplace for our products and received approximately $3.5

million in orders during the quarter largely attributable to higher

demand for our mobile equipment and Custom Engineered Systems (CES)

from both the life science and hospital sectors, where we continue

to win bids and gained significant brand recognition in the

marketplace over the last few years. A portion of the $3.5 million

in new orders was realized in the first quarter with the balance

expected to be realized in late 2022 and 2023. We were cash flow

positive in the first quarter largely due to customer deposits we

received in connection with these orders.”

“As previously announced, during the quarter we improved our

production capacity and capabilities through our partnership with

ARM Enertech Associates, who will manufacture our CES in their

Pennsylvania facility. In addition, our current manufacturer,

Planet Innovation, has expanded their business into California from

Australia, providing easier access to our internal technology team

and a lower cost in domestic shipment charges. We anticipate

both manufacturing partnerships will provide additional logistical

support as we expand our business and reduce our overall costs and

lead times of shipment to our customers.”

“We intend to build on our first quarter results to deliver

continued improved financial results in 2022 and remain focused on

growing our revenue, expanding our customer base, adding key

employees and increasing our brand recognition in the marketplace,”

Dr. Shane concluded.

Financial Results for the Three Months Ended March 31,

2022 compared to March 31, 2021

- Total net revenue was $2,309,000 compared to $2,073,000, an

increase of 11%, and increased 15% sequentially as compared to

fourth quarter 2021.

- Gross margin was 61.5% compared to 59.6%.

- Operating loss improved to ($660,000) compared to ($1,510,000).

The improved operating loss was attributable to higher sales, gross

profit, and lower operating expenses.

- Net loss improved to ($660,000) or ($0.03) per basic and

diluted share, compared to ($1,511,000) or ($0.09) per basic share,

representing an improvement of $851,000 or $0.06 per basic

share.

- EBITDA was a loss of ($578,000) compared to ($1,427,000),

representing an improvement of $849,000. A table reconciling EBITDA

to the appropriate GAAP financial measure is included with the

Company's financial information below.

- Cash provided from operations was $27,000 compared to cash used

in operations of ($1,225,000). The increased cash flow from

operations was primarily due to cash deposits received from

customers in the first quarter.

Balance sheet highlights as of March 31,

2022

- Cash and cash equivalents were approximately $5.3 million.

- Working capital was $10.8 million.

- Shareholders’ equity was $13.3 million.

Recent Business and Financial Highlights:

- 14% and 3% growth in SteraMist product based and iHP service

revenue, respectively when compared to the same prior year

period.

- 4% and 60% increase in domestic and international revenue,

respectively when compared to the same prior year period.

- Received approximately $3.5 million in orders, of which the

Company anticipate approximately $3.2 million will be recognized in

calendar year 2022 and early 2023.

- Of the $3.5 million in orders, $1.7 million of orders was for

our CES products from a Fortune 500 pharmaceuticals company and a

leading research facility focused on immunology and infectious

disease.

- Positive cash flow from operations.

- Onboarded and sold to seven (7) separate ServPro locations all

in Colorado and Arizona.

- Exhibited at FDIC International - The Largest Fire and Rescue

Conference.

- Presented SteraPak at RIA 2022 International Restoration

Convention & Industry Expo.

- Fulfilled an urgent shipment of multiple SteraPak units to a

local distributor in Hong Kong, TOMIMIST Hong Kong, which were

deployed by a well-known real-estate conglomerate in Hong Kong for

use in shopping malls, commercial and residential buildings, and

numerous other business premises to effectively combat the massive

outbreak of COVID-19 Omicron variant infections in the city.

- Provided SteraMist Environmental Systems to assist the

decontamination of the modular cleanroom of On Demand

Pharmaceuticals, an innovative technology company transforming how

medicines are made.

- Partnered with ARM EnerTech Associates, LLC, a U.S.-based

engineering services & custom control panel manufacturer, to

further develop its SteraMist brand of products.

- Received great preliminary biotoxin iHP inactivation data

against Ricin A Chain by a U.S. government agency expanding testing

to Botulinum and SEB toxoids.

- SteraMist iHP was highlighted as the treatment for deactivating

Mycotoxins and rendering them inert the book “Mycotoxin

Deactivation: A Successful Mycotoxin Treatment and Reduction Case

Study” by Bio-Risk Decontamination and Restoration owner David Mark

Quigley.

Conference Call Information

TOMI will hold a conference call to discuss First Quarter 2022

results at 4:30 p.m. ET today, May 5, 2022.

To participate in the call by phone, dial (888) 272-8703

approximately five minutes prior to the scheduled start time.

International callers please dial (713) 481-1320. To access the

live webcast or view the press release, please visit the Investor

Relations section of the TOMI website

at:https://www.webcaster4.com/Webcast/Page/2262/45468

A replay of the teleconference will be available until May 19,

2022 and may be accessed by dialing (877) 481-4010. International

callers may dial (919) 882-2331. Callers should use replay access

code: 45468. A replay of the webcast will be available for at least

90 days on the company’s website, starting approximately one hour

after the completion of the call.

TOMI™ Environmental Solutions, Inc.: Innovating for

a safer world®TOMI™ Environmental Solutions, Inc.

(NASDAQ:TOMZ) is a global decontamination and infection prevention

company, providing environmental solutions for indoor surface

disinfection through the manufacturing, sales and licensing of its

premier Binary Ionization Technology® (BIT™) platform.

Invented under a defense grant in association with the Defense

Advanced Research Projects Agency (DARPA) of the U.S. Department of

Defense, BIT™ solution utilizes a low percentage Hydrogen

Peroxide as its only active ingredient to produce a fog of ionized

Hydrogen Peroxide (iHP™). Represented by the SteraMist® brand

of products, iHP™ produces a germ-killing aerosol that works

like a visual non-caustic gas.TOMI products are designed to

service a broad spectrum of commercial structures, including, but

not limited to, hospitals and medical facilities, cruise ships,

office buildings, hotel and motel rooms, schools, restaurants, meat

and produce processing facilities, military barracks, police and

fire departments, and athletic facilities. TOMI products

and services have also been used in single-family homes and

multi-unit residences.

TOMI develops training programs and application protocols

for its clients and is a member in good standing with The American

Biological Safety Association, The American Association of Tissue

Banks, Association for Professionals in Infection Control and

Epidemiology, Society for Healthcare Epidemiology of America,

America Seed Trade Association, and The Restoration Industry

Association.

For additional information, please

visit http://www.tomimist.com/ or contact us

at info@tomimist.com.

Forward-Looking Statements

This press release contain forward-looking statements that are

based on current expectations, estimates, forecasts and projections

of future performance based on management’s judgment, beliefs,

current trends, and anticipated product performance. These

forward-looking statements include, without limitation, statements

relating to anticipated recognition of revenue in the remainder of

2022; financial performance and operating results; upcoming launch

of new products; expected growth in sales and market demand;

revenue opportunities of CES products in 2022; timing and process

relating to research studies and testing; production capacity of

our suppliers; and anticipated cost saving and lead time in the

manufacturing of our products. Forward-looking statements involve

risks and uncertainties that may cause actual results to differ

materially from those contained in the forward-looking statements.

These factors include, but are not limited to, the impact of

COVID-19 pandemic on our business and customers; our ability to

maintain and manage growth and generate sales, our reliance on a

single or a few products for a majority of revenues; the general

business and economic conditions; and other risks as described in

our SEC filings, including our Annual Report on Form 10-K for the

fiscal year ended December 31, 2020 filed by us with the SEC and

other periodic reports we filed with the SEC. The information

provided in this document is based upon the facts and circumstances

known at this time. Other unknown or unpredictable factors or

underlying assumptions subsequently proving to be incorrect could

cause actual results to differ materially from those in the

forward-looking statements. Although we believe that the

expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee future results, level of activity,

performance, or achievements. You should not place undue reliance

on these forward-looking statements. All information provided in

this press release is as of today’s date, unless otherwise stated,

and we undertake no duty to update such information, except as

required under applicable law.

Use of Non-GAAP Financial Measures

To supplement our unaudited consolidated financial statements

presented on a basis consistent with U.S. GAAP, we disclose certain

non-GAAP financial measures for our historical performance,

including EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin. We

define EBITDA as net income (loss), adjusted to exclude: interest,

taxes, depreciation and amortization (EBITDA) is a non-GAAP

financial measure and is intended to serve as a supplement to our

results provided in accordance with GAAP. We define Adjusted EBITDA

as net income (loss), adjusted to exclude: interest, taxes,

depreciation and amortization; stock-based compensation expense. We

define Adjusted EBITDA margin as Adjusted EBITDA divided by net

revenue. We believe that these historical non-GAAP financial

measures provide useful information to both management and

investors by excluding certain items and expenses that are not

indicative of our core operating results or do not reflect our

normal business operations. In addition, our management uses

non-GAAP measures to evaluate our performance internally and to

benchmark our performance externally against competitors. Our use

of non-GAAP financial measures has certain limitations in that such

non-GAAP financial measures may not be directly comparable to those

reported by other companies. Although we believe that the use of

non-GAAP financial measures enhances its investors’ understanding

of its business and performance, our use of non-GAAP financial

measures should not be considered an alternative to GAAP basis

financial measures and should be read in conjunction with the

relevant GAAP financial measures. Other companies may use the same

or similarly named measures, but exclude different items, which may

not provide investors with a comparable view of our performance in

relation to other companies. Because of these limitations, the

non-GAAP financial measure used in this release should not be

considered in isolation or as a substitute for performance measures

calculated in accordance with GAAP. We seek to compensate for the

limitation of our non-GAAP presentation by providing a detailed

reconciliation of the non-GAAP financial measures to the most

directly comparable U.S. GAAP as set forth below. Investors are

encouraged to review the related U.S. GAAP financial measures and

the reconciliation of these non-GAAP financial measures to their

most directly comparable U.S. GAAP financial measures.

|

|

|

TOMI ENVIRONMENTAL SOLUTIONS, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

| |

|

|

|

|

ASSETS |

|

|

|

| Current

Assets: |

|

|

|

|

March 31, 2022 (Unaudited) |

December 31, 2021 |

|

Cash and Cash Equivalents |

$ |

5,330,473 |

|

|

$ |

5,317,443 |

|

| Accounts Receivable - net |

|

2,500,408 |

|

|

|

1,964,776 |

|

| Other Receivables |

|

164,150 |

|

|

|

235,904 |

|

| Inventories |

|

5,100,095 |

|

|

|

4,743,280 |

|

| Vendor Deposits |

|

314,836 |

|

|

|

288,586 |

|

| Prepaid Expenses |

|

456,058 |

|

|

|

343,573 |

|

|

Total Current Assets |

|

13,866,020 |

|

|

|

12,893,562 |

|

| |

|

|

|

| Property and Equipment –

net |

|

1,413,751 |

|

|

|

1,488,319 |

|

| |

|

|

|

| Other Assets: |

|

|

|

| Intangible Assets – net |

|

953,042 |

|

|

|

956,284 |

|

| Operating Lease - Right of Use

Asset |

|

570,297 |

|

|

|

583,271 |

|

| Capitalized Software

Development Costs - net |

|

- |

|

|

|

10,476 |

|

| Other Assets |

|

390,549 |

|

|

|

341,006 |

|

|

Total Other Assets |

|

1,913,888 |

|

|

|

1,891,037 |

|

| Total Assets |

$ |

17,193,659 |

|

|

$ |

16,272,918 |

|

|

|

|

|

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

| |

| Current Liabilities: |

|

|

|

|

Accounts Payable |

$ |

1,814,153 |

|

|

$ |

1,054,040 |

|

|

Accrued Expenses and Other Current Liabilities |

|

553,126 |

|

|

|

664,608 |

|

|

Customer Deposits |

|

606,984 |

|

|

|

6,000 |

|

|

Current Portion of Long-Term Operating Lease |

|

94,539 |

|

|

|

91,775 |

|

|

Total Current Liabilities |

|

3,068,802 |

|

|

|

1,816,423 |

|

| |

|

|

|

| Long-Term Liabilities: |

|

|

|

|

Long-Term Operating Lease, Net of Current Portion |

|

837,158 |

|

|

|

861,415 |

|

|

Total Long-Term Liabilities |

|

837,158 |

|

|

|

861,415 |

|

|

Total Liabilities |

|

3,905,959 |

|

|

|

2,677,838 |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| Shareholders’ Equity: |

|

|

|

|

Cumulative Convertible Series A Preferred Stock; |

|

|

|

|

par value $0.01 per share, 1,000,000 shares authorized; 63,750

shares issued |

|

|

|

and outstanding at March 31, 2022 and December 31, 2021 |

|

638 |

|

|

|

638 |

|

|

Cumulative Convertible Series B Preferred Stock; $1,000 stated

value; |

|

|

|

7.5% Cumulative dividend; 4,000 shares authorized; none issued |

|

|

|

and outstanding at March 31, 2022 and December 31, 2021 |

|

- |

|

|

|

- |

|

|

Common stock; par value $0.01 per share, 250,000,000 shares

authorized; |

|

|

|

19,732,705 and 16,761,513 shares issued and outstanding |

|

|

|

at March 31, 2022 and December 31, 2021, respectively. |

|

197,327 |

|

|

|

196,810 |

|

|

Additional Paid-In Capital |

|

57,292,795 |

|

|

|

56,941,209 |

|

|

Accumulated Deficit |

|

(44,203,060 |

) |

|

|

(43,543,576 |

) |

|

Total Shareholders’ Equity |

|

13,287,700 |

|

|

|

13,595,080 |

|

| Total Liabilities and

Shareholders’ Equity |

$ |

17,193,659 |

|

|

$ |

16,272,918 |

|

|

|

|

TOMI ENVIRONMENTAL SOLUTIONS, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(UNAUDITED) |

|

|

For The Three Months Ended |

|

|

March 31, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

|

|

|

|

Sales, net |

$ |

2,308,584 |

|

|

$ |

2,073,455 |

|

|

Cost of Sales |

|

887,889 |

|

|

|

838,297 |

|

|

Gross Profit |

|

1,420,695 |

|

|

|

1,235,158 |

|

|

|

|

|

|

| Operating Expenses: |

|

|

|

|

Professional Fees |

|

190,530 |

|

|

|

173,493 |

|

|

Depreciation and Amortization |

|

82,292 |

|

|

|

83,449 |

|

|

Selling Expenses |

|

340,789 |

|

|

|

474,389 |

|

|

Research and Development |

|

37,076 |

|

|

|

195,620 |

|

|

Consulting Fees |

|

63,210 |

|

|

|

106,174 |

|

|

General and Administrative |

|

1,366,625 |

|

|

|

1,712,366 |

|

| Total Operating Expenses |

|

2,080,522 |

|

|

|

2,745,491 |

|

| Income (loss) from

Operations |

|

(659,827 |

) |

|

|

(1,510,333 |

) |

|

|

|

|

|

| Other Income (Expense): |

|

|

|

|

Interest Income |

|

343 |

|

|

|

427 |

|

|

Interest Expense |

|

- |

|

|

|

(1,035 |

) |

| Total Other Income

(Expense) |

|

343 |

|

|

|

(608 |

) |

|

|

|

|

|

| Income (loss) before income

taxes |

|

(659,484 |

) |

|

|

(1,510,941 |

) |

| Provision for Income

Taxes |

|

- |

|

|

|

- |

|

| Net Income (loss) |

$ |

(659,484 |

) |

|

$ |

(1,510,941 |

) |

|

|

|

|

|

| Net income (loss) Per Common

Share |

|

|

|

|

Basic |

$ |

(0.03 |

) |

|

$ |

(0.09 |

) |

|

Diluted |

$ |

(0.03 |

) |

|

$ |

(0.09 |

) |

|

|

|

|

|

| Basic Weighted Average Common

Shares Outstanding |

|

19,718,330 |

|

|

|

16,805,402 |

|

| Diluted Weighted Average

Common Shares Outstanding |

|

19,718,330 |

|

|

|

16,805,402 |

|

|

|

|

|

|

| |

The following is a reconciliation of net income (loss) to EBITDA

and Adjusted EBITDA (in thousands, except percentages;

unaudited):

| |

For The Three Months Ended |

| |

March 31, |

| |

2022 |

|

2021 |

| |

(Unaudited) |

|

(Unaudited) |

| Net income (loss) |

$ |

(659,484 |

) |

|

$ |

(1,510,941 |

) |

| |

|

|

|

|

Interest Income |

|

(343 |

) |

|

|

(427 |

) |

|

Interest Expense |

|

- |

|

|

|

1,035 |

|

|

Depreciation and Amortization |

|

82,292 |

|

|

|

83,449 |

|

|

Other |

|

- |

|

|

|

- |

|

|

EBITDA (Loss) |

$ |

(577,535 |

) |

|

$ |

(1,426,884 |

) |

| |

|

|

|

|

Equity Compensation Expense |

|

297,766 |

|

|

|

- |

|

|

Other |

|

- |

|

|

|

- |

|

|

Adjusted EBITDA (Loss) |

$ |

(279,769 |

) |

|

$ |

(1,426,884 |

) |

| |

|

|

|

|

Net revenue |

$ |

2,308,584 |

|

|

$ |

2,073,455 |

|

|

Adjusted EBITDA Margin |

|

-12 |

% |

|

|

-69 |

% |

INVESTOR RELATIONS CONTACT:John Nesbett/Jennifer

BelodeauIMS Investor

Relationstomi@imsinvestorrelations.com

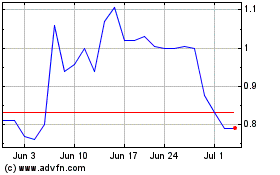

TOMI Environmental Solut... (NASDAQ:TOMZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

TOMI Environmental Solut... (NASDAQ:TOMZ)

Historical Stock Chart

From Apr 2023 to Apr 2024