Current Report Filing (8-k)

April 29 2022 - 5:03PM

Edgar (US Regulatory)

false 0000075362 --12-31 0000075362 2022-04-25 2022-04-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) April 25, 2022

PACCAR Inc

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-14817 |

|

91-0351110 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

777 106th Avenue NE, Bellevue, WA 98004

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (425) 468-7400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common stock, $1 par value |

|

PCAR |

|

The NASDAQ Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Item 5.02(f). On April 25, 2022, the Compensation Committee of the Board of Directors approved the Long Term Performance Cash Awards (“LTIP Cash Awards”) for the 2019-2021 cycle under the Long Term Incentive Plan for the Named Executive Officers identified in the Company’s March 15, 2022 proxy statement (“Proxy Statement”). The total compensation for each Named Executive Officer reported in the Summary Compensation Table on page 25 of the Proxy Statement has been recalculated to include the LTIP Cash Awards as follows:

|

|

|

|

|

|

|

|

|

| Named Executive Officer |

|

Non-Equity

Incentive Plan

Compensation

LTIP Cash Award |

|

|

Total

Compensation |

|

| R. P. Feight |

|

$ |

864,990 |

|

|

$ |

12,800,753 |

|

| H. C. Schippers |

|

$ |

1,035,760 |

|

|

$ |

6,295,730 |

|

| M. T. Barkley |

|

$ |

549,408 |

|

|

$ |

2,778,126 |

|

| C. M. Dozier |

|

$ |

377,370 |

|

|

$ |

3,056,071 |

|

| D. C. Siver |

|

$ |

512,800 |

|

|

$ |

2,845,987 |

|

CEO Pay Ratio Disclosure

As required by Item 402(u) of Regulation S-K, we are providing the following information:

As permitted by the SEC rules, the median employee utilized for 2021 is the same employee identified in 2020 because there have been no changes in our employee population or employee compensation arrangements that we reasonably believe would result in a significant change to this pay ratio disclosure. For 2021, our last completed fiscal year:

| |

a) |

the annual total compensation of PACCAR’s median employee (excluding Mr. Feight, our Chief Executive Officer) was $76,395; |

| |

b) |

the annual total compensation of our Chief Executive Officer was $12,800,753; and |

| |

c) |

the ratio of the annual total compensation of our Chief Executive Officer to the annual total compensation of PACCAR’s median employee was 168 to 1. |

Item 5.03. Amendments to Articles of Incorporation or Bylaws

On December 7, 2021, upon the recommendation of the Board’s Nominating and Governance Committee, which is comprised entirely of independent directors, the Board of Directors approved, and recommended for approval by the stockholders, an amendment to our Amended and Restated Certificate of Incorporation to eliminate supermajority vote provisions. On April 26, 2022, our stockholders approved the amendment to our Amended and Restated Certificate of Incorporation, effective upon filing with the Secretary of State of Delaware.

The foregoing summary is qualified by reference to the full text of the Certificate of Amendment of Amended and Restated Certificate of Incorporation attached hereto as Exhibit 3(i).

Item 5.07. Submission of Matters to a Vote of Security Holders

(a) The annual meeting of stockholders was held on April 26, 2022.

(b) Following is a brief description and vote count of all items voted on at the annual meeting:

Item No. 1. Election of Directors.

The following persons were elected to serve as directors with a term expiring in 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nominee |

|

Shares Voted

“For” |

|

|

Shares Voted

“Against” |

|

|

Abstentions |

|

|

Broker

Nonvotes |

|

| M. C. Pigott |

|

|

292,938,331 |

|

|

|

12,156,838 |

|

|

|

234,843 |

|

|

|

0 |

|

| A. J. Carnwath |

|

|

289,870,497 |

|

|

|

15,286,466 |

|

|

|

173,049 |

|

|

|

0 |

|

| F. L. Feder |

|

|

295,623,400 |

|

|

|

9,521,354 |

|

|

|

185,258 |

|

|

|

0 |

|

| R. P. Feight |

|

|

299,847,262 |

|

|

|

5,219,471 |

|

|

|

263,279 |

|

|

|

0 |

|

| B. E. Ford |

|

|

294,064,350 |

|

|

|

11,095,950 |

|

|

|

169,712 |

|

|

|

0 |

|

| K. S. Hachigian |

|

|

294,703,549 |

|

|

|

10,362,905 |

|

|

|

263,558 |

|

|

|

0 |

|

| R. C. McGeary |

|

|

280,743,973 |

|

|

|

24,331,439 |

|

|

|

254,600 |

|

|

|

0 |

|

| J. M. Pigott |

|

|

297,493,951 |

|

|

|

7,674,366 |

|

|

|

161,695 |

|

|

|

0 |

|

| G. Ramaswamy |

|

|

301,841,344 |

|

|

|

3,272,981 |

|

|

|

215,687 |

|

|

|

0 |

|

| M. A. Schulz |

|

|

275,218,964 |

|

|

|

29,505,692 |

|

|

|

605,356 |

|

|

|

0 |

|

| G. M. E. Spierkel |

|

|

282,812,497 |

|

|

|

22,287,765 |

|

|

|

229,750 |

|

|

|

0 |

|

Item No. 2. Amendment to Amended and Restated Certificate of Incorporation to eliminate supermajority vote provisions.

Item No. 2 received the affirmative vote of more than two-thirds of the shares outstanding and entitled to vote at the meeting.

|

|

|

|

|

|

|

| Shares Voted

“For” |

|

Shares Voted “Against” |

|

Abstentions |

|

Broker

Nonvotes |

| 297,280,943 |

|

5,238,242 |

|

2,810,827 |

|

0 |

Item No. 3. Stockholder proposal to reduce special meeting threshold.

Item No. 3 did not receive the affirmative vote of a majority of the shares present and entitled to vote at the meeting.

|

|

|

|

|

|

|

| Shares Voted

“For” |

|

Shares Voted “Against” |

|

Abstentions |

|

Broker

Nonvotes |

| 91,720,010 |

|

212,435,527 |

|

1,174,475 |

|

0 |

(c) Not applicable.

(d) Not applicable.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

The following is furnished as an Exhibit to this Report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

PACCAR Inc |

|

|

|

|

| Date: April 29, 2022 |

|

|

|

By: |

|

/s/ M. K. Walton |

|

|

|

|

|

|

M. K. Walton Vice President and General Counsel |

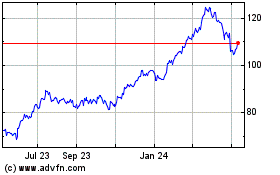

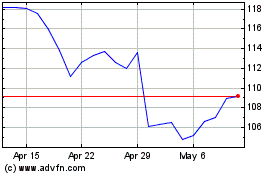

PACCAR (NASDAQ:PCAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

PACCAR (NASDAQ:PCAR)

Historical Stock Chart

From Apr 2023 to Apr 2024