Current Report Filing (8-k)

April 29 2022 - 11:15AM

Edgar (US Regulatory)

|

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

|

|

Washington,

D.C. 20549

|

|

|

|

CURRENT

REPORT

|

|

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

Date

of Report (Date of earliest event

reported): April 28, 2022

|

|

Data

I/O Corporation

|

|

(Exact

name of registrant as specified in its charter)

|

|

|

|

Washington

|

0-10394

|

91-0864123

|

|

(State

or other jurisdiction of incorporation)

|

(Commission

File Number)

|

(IRS

Employer Identification No.)

|

|

6645

185th Ave. N.E., Suite 100, Redmond, WA 98052

|

|

(Address

of principal executive offices, including zip code)

|

|

|

|

(425)

881-6444

|

|

(Registrant’s

telephone number, including area code)

|

|

|

|

Not

Applicable

|

|

(Former

name or former address, if changed since last report)

|

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

□

Written communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

□

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

□

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b))

□

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to

Section 12(b) of the Act:

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which

registered

|

|

Common Stock

|

DAIO

|

NASDAQ

|

|

|

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the

Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company □

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act □

Items reported in this filing:

Item 2.02 Results of Operation and

Financial Condition

Item 9.01 Financial Statements and

Exhibits

______________________________________________________________________________________________________

Item 2.02 Results of Operation and

Financial Condition

A press release

announcing first quarter 2022 results was made April 28, 2022 and a copy of the

release is being furnished as Exhibit 99.0 in this current report.

______________________________________________________________________________________________________

Item 9.01

Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No.

|

Description

|

|

99.0

|

Press Release: Data I/O Reports First Quarter 2022 Results

|

SIGNATURE

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly

caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

|

|

Data I/O

Corporation

|

|

|

|

|

April 28, 2022

|

By: /s/

Joel S. Hatlen

Joel S. Hatlen

Vice President

Chief Operating and Financial Officer

|

Exhibit 99.0

Data

I/O Reports First Quarter 2022 Results

Revenue

in Line with Preannouncement; Bookings of $6.2 Million

Redmond, WA –

April 28, 2022 -- Data I/O

Corporation (NASDAQ: DAIO), the leading global provider of advanced security and data deployment solutions for

microcontrollers, security ICs and memory devices, today announced financial results for the first quarter ended March

31, 2022.

First Quarter 2022 Highlights

· Net sales of $5.0 million; bookings of $6.2 million

·

Quarter-end backlog of $4.1

million

· Gross margin as a percentage of sales of 46.4%

· Net loss of ($1.8) million or ($0.21) per share

· Adjusted EBITDA* of ($932,000)

· Cash & Equivalents of $12.3 million; no debt

· Automotive Electronics represented 63% of first

quarter 2022 bookings

·

SentriX® security deployment platform – NXP and Avnet

collaboration

· Repatriated $4.4 million of cash from China

subsidiary, incurring dividend withholding tax of $442,000

*Adjusted EBITDA is a non-GAAP financial

measure. A reconciliation is provided in the tables of this press release.

Management

Comments

Commenting on the

fiscal first quarter ended March 31, 2022, Anthony Ambrose, President and CEO

of Data I/O Corporation, said, “Our first quarter started well but faced

curtailments and disruptions due to the Russian

invasion of Ukraine and the COVID-19 outbreaks in China. The fallout and resulting restrictions led to

business closures and reduced operating activities for several regions in China

as well as imposing widespread logistical and economic challenges for Data I/O,

our semiconductor partners, and our customers. As we announced on March 29, our

manufacturing and shipping facility operations in Shanghai were forced to shut

down. The government imposed lockdown is still in effect. With the COVID

restrictions and shutdowns impacting our facility and many of our customers and

business partners, first quarter revenue shipments of approximately $1 million

were delayed, although no orders have been cancelled.

“For the second

consecutive quarter, we achieved bookings of $6.2 million. Backlog at the end of

the first quarter was $4.1 million, compared with $2.9 million at the end of

the fourth quarter of 2021. Automotive electronics represented 63% of orders

in the first quarter, and we had 6 new customer wins.

“The Shanghai

lockdown triggered several changes in our operations. All of our

Shanghai-based employees are safe at home and working remotely, providing

technical support to our customers or assisting the transition to alternate

supply chains. We have been able to keep up with system demand through our

Redmond, Washington, USA manufacturing facility, and have accelerated ramp-up

of alternate manufacturing for our adapters. We anticipate logistics

challenges as we plan to re-open our Shanghai operations in May, including

freight forwarding capacity, partner availability and supply chain performance.

“Short-term demand

indicators are turbulent in Q2, as our main markets and customers digest the

impact of the Russia-Ukraine war and China lockdown. We expect this will

further destabilize supply chains, and we are prepared to react to shifts in

demand as we have done before. We have a strong sales funnel, bolstered by

several million dollars of increase in opportunities in Q1. Bookings in Q2

will be determined by how much of this business is awarded in Q2, and how much

is delayed to subsequent quarters.

“For our SentriX

security deployment platform, we had a significant announcement with NXP and

Avnet earlier this week. We announced support for the NXP LPC55S6x series of

microcontrollers using SentriX Product CreatorTM and the

SentriX security deployment platform offered through our partners at Avnet.

Several customers completed first articles in the quarter and we won a repeat

customer through a channel partner.

“As we look forward

to the balance of 2022, we have adjusted our growth expectations to account for

the present economic challenges, with a resumption of growth contingent upon

re-opening in China, stabilization of supply chains and restoration of business

confidence in EMEA.”

Financial Results

Due to

the previously mentioned issues with shipping $1 million of planned revenue,

many of the Company’s financial indicators are well outside normal ranges for

the quarter. Net sales in the

first quarter of 2022 were

$5.0 million, down 17% as compared with $6.0 million in the first quarter of

2021. The decrease reflects the previously

announced COVID restrictions and

shutdowns which impacted potential revenue shipments of approximately $1

million that have been held up or delayed until the second quarter. Total recurring and consumable revenues which

includes adapter sales represented $2.4 million or 48% of total revenues in the

first quarter of 2022, as compared with $2.7 million or 45% of the higher first

quarter 2021 total.

First

quarter 2022 bookings were $6.2 million, up from $5.4 million in the first

quarter of the prior year. Backlog at March 31, 2022 was approximately $4.1

million, up from $2.9 million at December 31, 2021 and $3.0 million at March

30, 2021.

Gross

margin as a percentage of sales was 46.4% in the first quarter of 2022, as

compared to 55.5% in the same period of the prior year. The difference in gross

margin as a percentage of sales primarily reflects the impact of lower sales

volume on fixed costs and the mix of channels and products.

Total

operating expenses in the first quarter of 2022 of $3.7 million were flat as

compared to the 2021 period. Data I/O maintained consistent R&D expenses

of $1.6 million in the first quarter of 2022, as compared to the first quarter

of the prior year. Lower selling commissions on reduced sales volume and

channel mix were offset by higher marketing and rent expenses.

Net loss in the

first quarter of 2022 was ($1.8 million), or ($0.21) per share, compared with a

net loss of ($333,000), or ($0.04) per share, for the first quarter of 2021.

Included in net loss are foreign currency transaction losses of ($60,000) for

the first quarter of 2022 and a gain of $26,000 for the first quarter of 2021.

Adjusted

earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”), which excludes equity compensation, was

($932,000) in the first quarter of 2022, compared to Adjusted EBITDA of

$173,000 in the first quarter of 2021.

Data

I/O’s balance sheet remained strong with cash at the end of the first quarter of 2022 of $12.3 million. The use of cash was due largely to

one-time or annual seasonal cash requirements in the first quarter of 2022 of $1.6 million, consisting of cash tax withholding on

repatriation dividend, annual planned spending on incentive compensation

payouts, 401(k) annual match payments, and public company seasonal expenses.

The Company repatriated $4.4 million of

cash from China to the U.S. in the form of a one-time dividend distribution,

which led to a corresponding tax withholding expense of approximately $442,000

in the first quarter of 2022. Data

I/O had net working capital of $16.9 million at March 31, 2022. The Company

continues to have no debt.

Conference Call Information

A

conference call discussing financial results for the first quarter ended March

31, 2022 will follow this release today at 2 p.m. Pacific Time/5 p.m. Eastern

Time. To listen to the conference call, please dial 412-317-5788. A replay

will be made available approximately one hour after the conclusion of the call.

To access the replay, please dial 412-317-0088, access code 4785456. The

conference call will also be simultaneously webcast over the Internet; visit

the Webcasts and Presentations section of the Data I/O Corporation website at www.dataio.com to access the call from the site. This webcast

will be recorded and available for replay on the Data I/O Corporation website

approximately one hour after the conclusion of the conference call.

About Data I/O Corporation

Since 1972 Data I/O has developed

innovative solutions to enable the design and manufacture of electronic

products for automotive, Internet-of-Things, medical, wireless, consumer

electronics, industrial controls and other electronic devices. Today, our customers

use Data I/O security deployment and programming solutions to reliably,

securely, and cost-effectively bring innovative new products to life. These

solutions are backed by a portfolio of patents and the global network of Data

I/O support and service professionals, ensuring success for our

customers.

Learn more at dataio.com

Forward

Looking Statement and Non-GAAP financial measures

Statements in this news release concerning economic outlook, expected

revenue, expected margins, expected savings, expected results, orders,

deliveries, backlog and financial positions, semiconductor chip shortages,

supply chain expectations, as well as any other statement that may be construed

as a prediction of future performance or events are forward-looking statements

which involve known and unknown risks, uncertainties and other factors which

may cause actual results to differ materially from those expressed or implied

by such statements. Forward-looking statement disclaimers also apply to the

global COVID-19 pandemic, including the

expected effects on the Company’s business from Shanghai’s COVID-19 lockdowns,

the duration and scope, impact on the demand for the Company’s products, and

the pace of recovery for the COVID-19 pandemic to subside, and the Russian invasion of Ukraine including any related

international trade restrictions. These factors include uncertainties as to the ability

to record revenues based upon the timing of product deliveries, shipping

availability, installations and acceptance, accrual of expenses, coronavirus

related business interruptions, changes in economic conditions, part shortages

and other risks including those described in the Company's filings on Forms

10-K and 10-Q with the Securities and Exchange Commission (SEC), press releases

and other communications.

Non-GAAP financial measures, such as EBITDA, Adjusted EBITDA excluding

equity compensation and impairment & related charges, and Adjusted gross

margin should not be considered a substitute for, or superior to, measures of

financial performance prepared in accordance with GAAP. We believe that these

non-GAAP financial measures provide meaningful

supplemental information regarding the Company’s results and facilitate the

comparison of results.

Contacts:

|

Joel Hatlen

|

|

|

Chief Operating and Financial Officer

|

|

|

Data I/O Corporation

6645 185th Ave. NE, Suite

100

|

|

|

Redmond, WA 98052

|

|

|

|

|

|

Darrow Associates, Inc.

|

|

|

Jordan Darrow

|

|

|

(512) 551-9296

jdarrow@darrowir.com

|

|

- tables follow -

DATA I/O CORPORATION

CONSOLIDATED

STATEMENTS OF OPERATIONS

(in

thousands, except per share amounts)

(UNAUDITED)

| |

|

Three

Months Ended

March 31,

|

| |

|

2022

|

|

2021

|

| |

|

|

|

|

|

Net Sales

|

|

$4,965

|

|

$6,015

|

|

Cost of goods sold

|

|

2,662

|

|

2,677

|

|

Gross

margin

|

|

2,303

|

|

3,338

|

|

Operating expenses:

|

|

|

|

|

|

Research

and development

|

|

1,616

|

|

1,606

|

|

Selling,

general and administrative

|

|

2,048

|

|

2,062

|

|

Total

operating expenses

|

|

3,664

|

|

3,668

|

|

Operating income (loss)

|

|

(1,361)

|

|

(330)

|

|

Non-operating income

(loss):

|

|

|

|

|

|

Interest

income

|

|

1

|

|

3

|

|

Gain on

sale of assets

|

|

58

|

|

-

|

|

Foreign

currency transaction gain (loss)

|

|

(60)

|

|

26

|

|

Total

non-operating income (loss)

|

|

(1)

|

|

29

|

|

Income (loss) before

income taxes

|

|

(1,362)

|

|

(301)

|

|

Income tax (expense)

benefit

|

|

(458)

|

|

(32)

|

|

Net income (loss)

|

|

($1,820)

|

|

($333)

|

| |

|

|

|

|

| |

|

|

|

|

|

Basic

earnings (loss) per share

|

|

($0.21)

|

|

($0.04)

|

|

Diluted

earnings (loss) per share

|

|

($0.21)

|

|

($0.04)

|

|

Weighted-average

basic shares

|

|

8,622

|

|

8,420

|

|

Weighted-average

diluted shares

|

|

8,622

|

|

8,420

|

DATA I/O CORPORATION

CONSOLIDATED

BALANCE SHEETS

(in

thousands, except share data)

(UNAUDITED)

| |

March 31,

2022

|

|

December 31,

2021

|

| |

|

|

|

|

ASSETS

|

|

|

|

|

CURRENT ASSETS:

|

|

|

|

|

Cash

and cash equivalents

|

$12,296

|

|

$14,190

|

|

Trade

accounts receivable, net of allowance for

|

|

|

|

|

doubtful accounts of $73 and $89, respectively

|

3,055

|

|

3,995

|

|

Inventories

|

6,625

|

|

6,351

|

|

Other

current assets

|

817

|

|

737

|

|

TOTAL

CURRENT ASSETS

|

22,793

|

|

25,273

|

| |

|

|

|

|

Property, plant and

equipment – net

|

953

|

|

946

|

|

Other assets

|

2,742

|

|

2,838

|

|

TOTAL

ASSETS

|

$26,488

|

|

$29,057

|

| |

|

|

|

|

LIABILITIES AND

STOCKHOLDERS’ EQUITY

|

|

|

|

|

CURRENT LIABILITIES:

|

|

|

|

|

Accounts

payable

|

$1,463

|

|

$1,373

|

|

Accrued

compensation

|

1,526

|

|

2,496

|

|

Deferred

revenue

|

1,466

|

|

1,507

|

|

Other

accrued liabilities

|

1,439

|

|

1,413

|

|

Income

taxes payable

|

3

|

|

-

|

|

TOTAL

CURRENT LIABILITIES

|

5,897

|

|

6,789

|

| |

|

|

|

|

Operating lease

liabilities

|

2,138

|

|

2,277

|

|

Long-term other payables

|

193

|

|

138

|

| |

|

|

|

|

COMMITMENTS

|

-

|

|

-

|

| |

|

|

|

|

STOCKHOLDERS’ EQUITY

|

|

|

|

|

Preferred stock -

|

|

|

|

|

Authorized,

5,000,000 shares, including

|

|

|

|

|

200,000

shares of Series A Junior Participating

|

|

|

|

|

Issued

and outstanding, none

|

-

|

|

-

|

|

Common stock, at stated

value -

|

|

|

|

|

Authorized,

30,000,000 shares

|

|

|

|

|

Issued

and outstanding, 8,622,369 shares as of March 31,

|

|

|

|

|

2022

and 8,621,007 shares as of December 31, 2021

|

21,183

|

|

20,886

|

|

Accumulated earnings

(deficit)

|

(3,831)

|

|

(2,011)

|

|

Accumulated other comprehensive

income

|

908

|

|

978

|

|

TOTAL

STOCKHOLDERS’ EQUITY

|

18,260

|

|

19,853

|

|

TOTAL

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

$26,488

|

|

$29,057

|

DATA I/O CORPORATION

NON-GAAP

FINANCIAL MEASURE RECONCILIATION

| |

|

Three

Months Ended

March 31,

|

| |

|

2022

|

|

2021

|

|

(in thousands)

|

|

|

|

|

|

Net Income (loss)

|

|

($1,820)

|

|

($333)

|

|

Interest (income)

|

|

(1)

|

|

(3)

|

|

Taxes

|

|

458

|

|

32

|

|

Depreciation and amortization

|

|

140

|

|

199

|

|

EBITDA earnings (loss)

|

|

($1,223)

|

|

($105)

|

| |

|

|

|

|

|

Equity compensation

|

|

291

|

|

278

|

| |

|

|

|

|

|

Adjusted EBITDA, excluding equity

compensation

|

|

($932)

|

|

$173

|

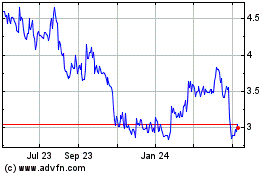

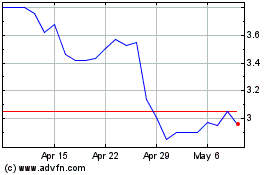

Data I O (NASDAQ:DAIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Data I O (NASDAQ:DAIO)

Historical Stock Chart

From Apr 2023 to Apr 2024