Current Report Filing (8-k)

April 29 2022 - 9:40AM

Edgar (US Regulatory)

0001096938false00010969382022-04-292022-04-29iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 29, 2022

UNITED HEALTH PRODUCTS, INC. |

(Exact name of registrant as specified in its charter) |

Nevada | | 000-27781 | | 84-1517723 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

10624 S. Eastern Ave., Ste. A209

Henderson, NV 89052

(Address of principal executive offices, zip code)

(877) 358-3444

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2. below):

☐ Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240. 13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

In connection with the Securities and Exchange Commission’s investigation against the Company, Douglas Beplate, the former Chief Executive Officer and Chairman and a former director of the Company, and Louis Schiliro, the former Chief Operating Officer and a former director of the Company, concerning possible violations of certain provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934, the Commission’s Enforcement Division has presented proposed settlement terms which the Enforcement Division has indicated it would recommend to the Commission to resolve the matter as to the Company, if acceptable to the Company. The investigation was previously reported by the Company in its prior periodic reports including its Annual Report for the year ended December 31, 2021 under Item 1A “Risk Factors” which disclosure is incorporated into this report by reference.

The proposed resolution terms of the investigation presented by the Commission would include a consent judgment against the Company on the following terms, among others, without the Company admitting or denying the Commission’s allegations:

| · | The Company being permanently enjoined from violating: Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5 under the Exchange Act; Section 17(a) of the Securities Act of 1933; Section 13(a) of the Exchange Act and Rules 12b-20, 13a-1 and 13a-13 under the Exchange Act; Section 13(b)(2)(A) of the Exchange Act; and Section 13(b)(2)(B) of the Exchange Act. |

| | |

| · | The Company being required to pay a civil penalty of $450,000, payable in four installments as follows: $50,000 upon the entry of the judgment; $100,000 within 90 days of the entry of the judgment; $150,000 within 180 days of the entry of the judgment; and $150,000 within 270 days of the entry of the judgment, plus statutory interest on payments made after 30 days of the entry of the judgment pursuant to U.S.C. Section 1961. |

Additionally, the Company’s consent would include the Company’s agreement not to take any action or make any public statement denying any allegations in the Commission’s complaint or creating the impression that the complaint is without factual basis; and not to make any public statement to the effect that the Company does not admit the allegations in the complaint without also stating that the Company does not deny the allegations. This restriction would not affect the Company’s right to take legal or factual positions in litigation or other legal proceedings in which the Securities Exchange Commission is not a party, nor would it affect the Company’s testimonial obligations.

The Company has asked the Enforcement Division for clarification on certain points in the settlement relating to the proposed injunctive relief involving Section 13(b)(2)(B) of the Exchange Act, and for a draft of the allegations in the complaint on which the consent judgment would be based to review. Subject to the clarification on the injunctive relief and the complaint allegations not being unacceptable to the Company, the Company is predisposed to accepting the settlement terms presented.

Although the Commission’s Enforcement Division has presented proposed terms of settlement to the Company, they have no obligation to recommend those terms to the Commission and they may withdraw or change the terms in their discretion. If the Enforcement Division decides to recommend the terms of settlement to the Commission, there can be no assurance that the Commission will proceed with the Enforcement Division’s recommendation. If this matter is not settled on the terms proposed, we cannot predict whether this matter will be settled without any enforcement action being taken. If this matter is not settled, the Commission may institute legal proceedings or enforcement actions against the Company to seek injunctive relief and monetary penalties in excess of the injunctions and civil penalties presented in the proposed settlement terms and we could not predict what the outcome, remedies or the duration of any legal proceedings or enforcement actions that may be brought will be.

The proposed settlement terms of the investigation presented to the Company do not include matters in the investigation pertaining to Mr. Beplate and Mr. Schiliro.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| United Health Products, Inc. |

| |

Dated: April 29, 2022 | /s/ Brian Thom |

| Brian Thom, Chief Executive Officer |

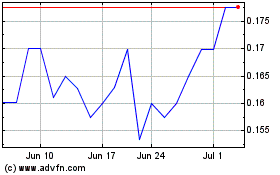

United Health Products (PK) (USOTC:UEEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

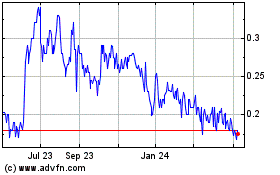

United Health Products (PK) (USOTC:UEEC)

Historical Stock Chart

From Apr 2023 to Apr 2024