UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

| Filed by the Registrant |

☒ |

| |

☐ |

| Filed by a Party other than the Registrant |

|

| Check the appropriate box: |

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under Rule 14a-12 |

THE JOINT CORP.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other

than the registrant)

Payment of Filing Fee (Check all boxes that

apply):

| ☒ |

No fee required. |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

Dear

Fellow Stockholders:

Our mission is to improve

quality of life through routine and affordable chiropractic care.

Our mission

at The Joint Corp. is to improve quality of life for the patients we serve through routine and affordable chiropractic care.

We are leaders of a movement revolutionizing access to essential healthcare services like chiropractic for a population that is

underserved in the marketplace. Located in convenient retail settings, our clinics provide concierge-style, membership-based

services. Our patients benefit from attractive pricing and convenient hours without the need for insurance or appointments.

Our growth strategy

is to build our brand, increase awareness of the efficacy of chiropractic care, deliver an exceptional patient experience, and open more

clinics. We are the largest and most recognizable provider of chiropractic in the country. And yet, we only account for approximately

2% of a highly fragmented, nearly $18 billion chiropractic care market. As such, we have a significant opportunity to continue increasing

our market share as we expand the market itself.

|

|

Peter

D. Holt

President

and Chief Executive Officer |

Record Operations Fuel Momentum

| The Joint delivered record operational performance in 2021, continuing to demonstrate resilience to pandemic pressures as evidenced by

our growing number of patients, franchisees, clinics, and franchise license sales. This was reflected in our strong financial and operating

performance in 2021: |

|

|

| • |

38% growth in revenue to $80.9 million |

| • |

39% increase in system-wide sales1 to $361.1 million |

| • |

29% increase in system-wide comp2 sales |

| • |

$12.6 million in Adjusted EBITDA3, compared to $9.1 million in 2020 |

| • |

156 franchise licenses sold in 2021, compared to 121 in 2020 |

| • |

110 franchised clinics opened in 2021, compared to 70 in 2020 |

| • |

20 corporate greenfields opened in 2021, compared to 3 in 2020 |

| • |

10.9 million patient visits in 2021, up from 8.3 million in 2020 |

| • |

807,000 new patients in 2021, up from 584,000 in 2020 |

| And while so much time and energy has been focused

on COVID-19, there are also other serious epidemics we face as a society – such as pain and obesity. Increasingly, younger generations

are seeking more holistic ways of treating these ailments and frequently choose chiropractic care with its focus on wellness care as

a first line of defense. As such, we are well-positioned for sustained momentum. Additionally, our affordable, convenient approach is

particularly attractive to younger consumers. In fact, 61% of those who visited our clinics in 2021 were either Millennial or Gen Z,

with a median age of just 36 years. |

|

|

| |

|

|

| Our momentum further validates our opportunity for

continued growth and to create shareholder value. Our mission, along with our vision and values, continue to guide our organization: |

|

|

Our Vision: Be the

First Choice in Chiropractic Care

| • |

Educate consumers on the efficacy of chiropractic care |

| • |

Make chiropractic care accessible to everyone |

| • |

Provide the most desired career path in chiropractic care |

| • |

Build a culture committed to improving society through chiropractic care |

| • |

Become the global leader in chiropractic care |

| 1 |

System-wide sales include

revenues generated by all clinics, whether operated by the company or by franchisees. While franchise revenues are not recorded as

revenues by the company, management believes the information is important in understanding the company’s financial performance,

because these revenues are the basis on which the company calculates and records royalty fees and are indicative of the financial

health of the franchisee base. |

| 2 |

Comp Sales refers to

the amount of revenues a clinic generates in the most recent accounting period, compared to revenues in the comparable period of

the prior year, and (i) includes revenues only from clinics that have been open at least 13 full months and (ii) excludes any clinics

that have closed. |

| 3 |

The Company defines

Adjusted EBITDA as EBITDA before acquisition-related expenses, bargain purchase net gain, gain/(loss) on disposition or impairment,

and stock-based compensation expenses. The Company defines EBITDA as net income/(loss) before net interest, tax expense, depreciation,

and amortization expenses. |

Our Core

Values

| • |

Trust: We believe in the reliability, truthfulness, and ability of others. |

| • |

Integrity: We adhere to moral and ethical principles. |

| • |

Excellence: We continually pursue optimal levels of performance. |

| • |

Respect: We appreciate the intrinsic value of each individual. |

| • |

Accountability: We hold ourselves and others responsible. |

Our 2021 Operational Highlights

Asserting chiropractic care as an essential healthcare service

remained a critical point of differentiation for our brand, successfully positioning us during the Delta and Omicron COVID variant outbreaks

of 2021. Through video and blogs, public relations and clinic signage, this message continued to serve as the backbone of our approach

to the pandemic, reinforcing our commitment to providing patients with accessible chiropractic care. We also increased our investment

into awareness-building advertising, fueled by our growing national marketing fund and strengthening regional co-ops. This activity contributed

to record new patient growth and boosted the proportion of our patients who were new to chiropractic care. In fact, in our February 2022

annual, independently conducted patient survey, we found that 36% of patients who visited our clinics in 2021 had no previous experience

with chiropractic care. To put this in perspective, in 2013, the first year of this survey, that number was only 16%. This demonstrates

our growing ability to penetrate the larger population of “relief seekers” who lack fundamental awareness of the efficacy

of chiropractic.

To attract future team members and educate Doctors of Chiropractic

about The Joint, we continued to deepen our relationships with state associations and the 16 accredited schools of chiropractic in the

United States. In September 2021, we became Life University’s official athletic scoreboard sponsor, increasing our ability to engage

its student body to provide internships and employment opportunities in our clinics. In October, our network raised over $60,000 in donations

for Life University’s annual Founder’s Month. This complements our standing partnerships with Palmer University and Sherman

College of Chiropractic, as well as our athletic sponsorships with schools, such as the University of Houston and the University of Miami,

and professional sports teams, like the Atlanta United soccer club. Relationships like these enable us to highlight the natural connections

between chiropractic care and sports performance as well as expose our brand to a wider audience, both inside and outside of the profession.

Our primary call-to-action for chiropractic care prospects

is our $29 new patient special, which is emphasized in much of our advertising. However, our data also enables us to execute campaigns

targeting our existing audience of active and former patients. Leveraging this advantage, in June, we launched our annual “Summer

Sale” marketing promotion to lapsed patients. As a result, we increased the number of membership reactivations by 32% compared to

prior year period. In the fourth quarter, we launched our annual holiday promotions – our “Back Friday” package sale

and our “End-of-Year” membership promotions. Both significantly exceeded prior year performance, growing 27% and 42%, respectively,

compared to prior year. These numbers are indicative of the growth potential of our limited time promotions, as well as the engagement

of our clinic teams and success of our marketing practices.

In July, we achieved our milestone of launching our new

CRM platform, Axis. Given that our patients can visit any clinic in our network to receive their chiropractic care, we did not have the

option of implementing the new platform through a phased, regional rollout. Thus, upgrading our IT infrastructure was particularly challenging

for our model, with over 700 clinics providing healthcare services requiring HIPPA compliance. Nonetheless, after extensive testing, we

successfully switched our entire system overnight – quite an undertaking. Naturally, migrating from a homegrown, legacy system to

a licensed, scalable platform caused a few bumps to our operation, but we were pleased to accomplish it without major disruption. I want

to take this opportunity to thank our franchisees and clinic users for their patience throughout this process.

It is important to remember that this launch was only the

first iteration of Axis – primarily a “lift and shift” in functionality, with updated accounting and reporting systems,

and greatly improved security. Our future roadmap will layer in additional innovations that will unlock greater value, including improvements

to the user experience, enhanced promotional capabilities, advanced analytics, marketing automation, a native mobile app, and elevated

risk control measures. In January 2022, we were also excited to welcome the newest member of our executive team, Chief Technology Officer

Charles Nelles, who will help lead this mission. Charles draws from more than 20 years of experience in the healthcare and financial services

industries. He and his team will spearhead technology development, leverage our IT platform to sustain our position as a trailblazer,

and utilize our data to improve business performance.

In 2021, our franchise concept continued to

attract sophisticated, well-capitalized franchisees and increasing interest in multi-unit licenses, reflecting the growing momentum

of our brand. During 2021, 56% of franchise license sales were to existing owners reinvesting in our brand, which is very strong

validation of this business. In fact, since 2018, more than half the licenses sold in our network have been to existing franchisees.

Our regional developer (RD) program continued to contribute as a key component to our clinic expansion strategy. In 2021, 81% of our

franchise licenses were sold by our RDs. Additionally, at the end of 2021, our 21 RDs supported 71% of our clinics in territories

that covered 59% of Metropolitan Statistical Areas, or MSAs. Our aggregate, 10-year minimum development schedule for new RD

territories established since 2017 is 713 clinics. While a portion of that clinic count has already opened, the remaining

unopened clinics still provide a large foundation to fuel our continued clinic expansion and sales growth.

Regarding company-owned or managed clinics, our expansion

is focused on strategically opening greenfields in new markets, enlarging our presence in existing corporate clinic clusters, and purchasing

previously franchised clinics that will be accretive to our financial results. During 2021, we established a corporate clinic foothold

in the Southeast region, while extending the reach of our existing corporate portfolio in Virginia, Southern California, New Mexico, and

Arizona. In July, we were proud to announce an agreement with the Army & Air Force Exchange Service (AAFES) to provide on-installation

chiropractic care to members of the military and their families, which will further expand our corporate clinic portfolio domestically.

As we have repeatedly stated, corporate clinics contribute 100% of revenues to our top and bottom lines; therefore, when greenfields mature,

they can have a greater economic benefit, compared to franchised clinics, for our financial results. However, we expect greenfields to

compress margins when they first open.

In summary, at December 31, 2021, we had 706 clinics in

operation, consisting of 610 franchised clinics and 96 company-owned or managed clinics. We also had 283 franchise licenses in active

development, reflecting our strong pipeline for franchised clinic openings.

Driving Long-term Growth

In 2021, our confidence to achieve our goal of opening 1,000

clinics in operation by the end of 2023 strengthened. Upon reaching this tipping point for franchise systems, we expect to see even greater

growth momentum. To achieve our brand’s growth strategy, we have entered 2022 focused on three enterprise initiatives:

| 1. |

Forge the Chiropractic Dream. Like most

employers, we are navigating a challenging labor market some are calling the “great resignation.” By leveraging our

considerable advantages as a market leader, we are creating a must-have employment experience by building a modern and relevant

employer brand and a connected community of chiropractic doctors. We will offer our doctors unrivaled career paths that provide

financial success, choices and opportunities that fit their needs and interests, with exceptional professional development and

hands-on experience. |

| 2. |

Harness the Power of Our Data. As discussed over the past several years, we have allocated considerable resources to technology.

Now that we have fortified our foundation with improved accounting, reporting and security, we are turning our attention toward utilizing

our accumulated data to transform that patient experience, drive business innovation and optimization, and sustain our revenue growth.

We are excited to build upon Axis to unlock greater value in our model. |

| 3. |

Accelerate the Pace of Clinic Growth. We are implementing new clinic growth strategies through real estate optimization and strengthening

of our development team. We are utilizing innovation to shorten our development timeline, enabling us to open clinics faster, reduce

costs, and provide quality direction for our franchisees. In our expansion, we are evaluating additional location profiles that can deliver

our brand of affordable and accessible chiropractic care, such as in highly urbanized markets; in micro-markets where the franchisee

is typically owned by a Doctor of Chiropractic; and on military bases by leveraging our agreement with AAFES. Additionally, we are working

with high-performing franchisees to further leverage clinic development, such as by adding a second clinic within their existing trade

areas. |

Our Commitment to Sound Corporate

Governance

Speaking for management and our Board of Directors, I reiterate

that we are committed to expert, objective, proactive administration on behalf of our stockholders to drive long-term value. We continue

to closely examine the strategic needs of our organization and actively manage the evolution of our Board leadership to meet our emerging

requirements. Heading our core value of excellence, we strive for continuous improvement in all we do. We are resolute in advancing our

governance structure as our company, our industry, and our stockholder base grow. You can rely on our dedication to accountability and

clear communication with stockholders as a key element of our governance process.

Our Exciting Future and Your

Support

With our Board’s

guidance, we are more committed than ever before to our mission and vision. We are more focused on our patients. We are more

aligned with franchisees and company employees. And, we are better positioned to deliver operational excellence at great clinics

that satisfy patients today and over the years to come. The confidence that you have placed in us is humbling and gratifying as we

continue to build The Joint brand and revolutionize access to chiropractic care across this nation.

On April 26, 2022, we mailed

to our stockholders our 2021 Annual Report and proxy statement, along with the proxy card. The proxy card includes instructions on how

to vote online, by phone, and by mail. Your vote is important regardless of the number of shares you own. Whether or not you plan to attend

the Annual Meeting, we encourage you to consider the matters presented in the proxy statement and vote as soon as possible. We hope that

you will be able to join us on May 26th. Thank you for your ownership and support of The Joint Corp.

Peter D. Holt

President and Chief Executive Officer

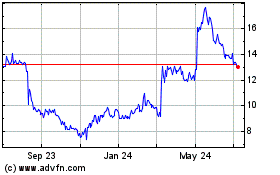

2021 Financial Highlights

We demonstrated continued strength and resilience, even as the pandemic evolved with the variants

during the year. For 2021, The Joint reached another record level for system-wide sales, delivered steady annual same-store sales growth,

and generated $15.2 million of cash from operations. These achievements reflect the company business model’s resiliency and the

validation of future opportunities and growth.

|

• Opened 127 new clinics, net of closures, bringing total to 706

|

|

• Total number of unique patients

treated reached 1.4 million, up from

1.1 million in 2020 |

|

• Expanded corporate clinic

portfolio by 32 |

| |

|

|

|

|

• Increased system-wide sales by

39% to $361 million |

|

• Sold 156 franchise licenses,

an improvement from 121 in 2020 |

|

• Improved cash flow from operations

by $3 million to $15.2 million |

|

|

| |

1 For the period ended December 31, 2021. 2 June 201 Kentley

Insights Chiropractic Care Market Research Report. 3 Comp sales refers to the revenues a clinic generates in the most recent accounting

period, compared to revenues in the comparable period of the prior year, and (i) includes revenues only from clinics that have been open

at least 13 full months and (ii) excludes any clinics that have closed. 4 System-wide sales include revenues generated by all clinics,

whether operated by the company or by franchisees. While franchise sales are not recorded as revenues by the company, management believes

the information is important in understanding the company’s financial performance, because these revenues are the basis on which

the company calculates and records royalty fees and are indicative of the financial health of the franchisee base. |

16767 N. Perimeter Drive, Suite 110

Scottsdale, AZ 85260

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS TO

BE HELD ON MAY 26, 2022

Dear Stockholder:

We are writing today concerning the upcoming 2022 Annual Meeting

of Stockholders (the “Annual Meeting”), which will be held on Thursday, May 26, 2022, at 9:00 a.m. Mountain Standard Time.

At the Annual Meeting, you will be asked to consider and vote

on the following items:

| · | the election to the Board of the seven nominees for director named in this proxy statement; |

| · | approval, on an advisory basis, of the compensation of our named executive officers; |

| · | ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm

for the year ending December 31, 2022; and |

| · | any other matter that properly comes before the meeting. |

Only stockholders of record at the close of business on the record

date of April 12, 2022 are entitled to vote at the Annual Meeting.

If you need directions to the meeting, please call Investor

Relations at (480) 245-5960.

Whether or not you plan on attending the

annual meeting, we ask that you vote by proxy by following instructions provided in the enclosed proxy card as promptly as possible.

If you return your proxy card and later decide

to attend the Annual Meeting in person, or if for any other reason you want to revoke your proxy, you may do so at any time before your

proxy is voted. If you hold your shares through a broker, bank, or other nominee, please see the instructions in the General Information

section on how to vote your shares, either by written instruction or in person at the meeting. Please read carefully the enclosed information

and our 2021 Annual Report, which includes our Form 10-K for the year ended December 31, 2021, before voting your proxy. This proxy statement

and annual report are also available for your review at www.cstproxy.com/thejoint/2022.

This proxy statement and accompanying materials

are first being made available to stockholders on or about April 22, 2022.

By Order of the Board of Directors,

Craig Colmar

Secretary

Scottsdale, Arizona

April 22, 2022

SUMMARY INFORMATION

This summary highlights information contained elsewhere

in this proxy statement. It does not contain all information that you should consider, and you should read the entire proxy statement

carefully before voting.

Annual Meeting of Stockholders

| • Time and Date: |

Thursday, May 26, 2022, at 9:00 a.m. Mountain Standard Time |

| • Place: |

16767 N. Perimeter Drive, Suite 110, Scottsdale, Arizona 85260 |

| • Record Date: |

April 12, 2022 |

| • Voting: |

Stockholders as of the record date are entitled to vote. |

Items of Business and Voting Recommendations

| |

Agenda Item |

|

Board Recommendation |

|

Page |

| 1. |

Election of seven directors |

|

FOR EACH NOMINEE |

|

5 |

| 2. |

Approval, on an advisory basis, of the compensation of our named executive officers |

|

FOR |

|

30 |

| 3. |

Ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for 2022 |

|

FOR |

|

30 |

Board Nominees

The following table provides summary information about the

nominees for director. Each director is elected by a majority of votes cast.

|

Nominee |

Age |

Director

Since |

Principal Occupation |

Committees |

| Matthew E. Rubel |

64 |

2017 |

Current Chair of The Executive Board, MidOcean Partners Private Equity Consumer Group; current Chair of Holley Inc.; current director of TreeHouse Foods, Inc.; former director of Hudson’s Bay Company and HSNi; former director, President and CEO of Varsity Brands, Inc.; former Chair, President and CEO of Collective Brands, Inc. and Cole Haan, Inc.; former Senior Advisor with Roark Capital Group & TPG Capital, L.P.

|

· Compensation

· Nominating and Governance

|

| James H. Amos, Jr. |

76 |

2015 |

Current director of ASP UPF Holdings LP and subsidiaries, which owns and operates 170 Planet Fitness Gyms under franchise agreements with Pla-Fit Franchise LLC; current Chair of the advisory board of APFI, Procter and Gamble’s franchising initiative; former Chair and CEO of Mail Boxes, Etc.; former Chair of the International Franchise Association

|

· Nominating

and Governance (Chair)

· Audit |

| Ronald V. DaVella |

64 |

2014 |

Current Vice Chair of the Strategic Advisory Board, AURA Ventures; current director of Delta Dental of Arizona; current director of Mobile Holding Properties, LLC; current director of NorthStar Security Holdings; former Audit Partner, Deloitte & Touche LLP; former Executive Vice President of Finance, The Alkaline Water Company; former director and CFO of Nanoflex Power Corporation; former CFO of Amazing Lash Studio LLC

|

· Audit

(Chair)

· Nominating and

Governance |

| Suzanne M. Decker |

60 |

2017 |

Current Executive Project Sponsor and former Chief Human Resources Officer for Aspen Dental Management, Inc.; current Human Resources and Talent Acquisition Advisor for Bond Veterinary, Inc. (Bond Vet); former director of Refresh Mental Health;

|

· Compensation

(Chair) |

| Peter D. Holt |

63 |

2016 |

President and Chief Executive Officer, The Joint Corp.

|

|

| Abe Hong |

50 |

2018 |

Current Executive Vice President and Chief Technology Officer, Learning Care Group, former Chief Operations Officer, Technologent; former Executive Vice President & Chief Information Officer at Discount Tire Company

|

· Compensation |

| Glenn J. Krevlin |

62 |

2019 |

Founder and Current Managing Partner, Principal and Portfolio Manager of Glenhill Capital Advisors LLC; current director and former chair of Design Within Reach, Inc.; current director of Ember Technologies; former director of Centric Brands, Inc. and Restoration Hardware, Inc. |

· Audit |

16767 N. Perimeter Drive, Suite 110

Scottsdale, AZ 85260

PROXY STATEMENT

2022 Annual Meeting of Stockholders

To Be Held on

May 26, 2022

EXPLANATORY NOTE

Because our public float (the market value of our common shares held by

non-affiliates) was greater than $700 million as of June 30, 2021, we became a large accelerated filer as of December 31, 2021 and no

longer qualified as a “smaller reporting company,” as defined in the Securities Exchange Act of 1934 (the “Exchange

Act”), as of January 1, 2022. Because we remained qualified to use the scaled disclosure available to smaller reporting companies

in our Form 10-K for the fiscal year ended December 31, 2021, we continued to be eligible to use such scaled disclosure in our proxy statement

with respect to executive compensation and other disclosures which may be incorporated by reference into our 2021 Form 10-K. We have elected

to provide such scaled disclosure in this proxy statement.

In this proxy statement, “we,” “us,” “our”

and the “Company” all refer to The Joint Corp.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding

beneficial ownership of our common stock outstanding as of April 12, 2022, by:

| · | each person, or group of affiliated persons, known by us to beneficially own more than 5% of our common

stock; |

| · | each of our named executive officers; and |

| · | all of our directors and executive officers as a group. |

The percentage ownership information shown

in the table is based upon 14,461,320 shares of common stock outstanding as of April 12, 2022. Beneficial ownership is determined in accordance

with the rules of the Securities and Exchange Commission (SEC). To calculate a stockholder's percentage of beneficial ownership, we include

in the numerator and denominator those shares underlying options that are vested or that will vest within 60 days of April 12, 2022. Options

held by other stockholders, however, are disregarded in the calculation of beneficial ownership. Therefore, the denominator used in calculating

beneficial ownership among our stockholders may differ.

Unless otherwise indicated, the persons

or entities identified in this table have sole beneficial ownership with respect to all shares shown as beneficially owned by them, subject

to applicable community property laws.

Except as otherwise noted below, the

address for each person or entity listed in the table is c/o The Joint Corp., 16767 N. Perimeter Drive, Suite 110, Scottsdale, AZ, 85260.

| | |

| Number of Shares

Beneficially Owned | | |

| Percentage

of Shares | |

| Named Executive Officers and Directors | |

| | | |

| | |

| Matthew E. Rubel | |

| 2,672 | | |

| * | |

| James H. Amos, Jr. | |

| 43,647 | | |

| * | |

| Ronald V. DaVella | |

| 2,738 | | |

| * | |

| Suzanne M. Decker | |

| 21,302 | | |

| * | |

| Peter D. Holt | |

| 314,551 | | |

| 2.1% | |

| Abe Hong | |

| 11,352 | | |

| * | |

| Glenn J. Krevlin | |

| 19,679 | | |

| * | |

| Jake Singleton | |

| 97,431 | | |

| * | |

| Named executive officers and directors as a group (8 persons) | |

| 513,372 | | |

| 3.5% | |

| Beneficial holders of 5% or more of our outstanding common stock | |

| | | |

| | |

| BlackRock Fund Advisors (1) | |

| 2,194,331 | | |

| 15.2% | |

| Alger Associates, Inc. (2) | |

| 1,648,320 | | |

| 11.4% | |

| The Vanguard Group, Inc. (3) | |

| 1,134,903 | | |

| 7.8% | |

| Bandera Partners LLC (4)

| |

| 931,000 | | |

| 6.4% | |

* Less than 1% of our shares

| (1) | Based on Schedule 13G/A filed by BlackRock Inc. with the SEC on January 27, 2022.

This beneficial holder has the sole power to vote or to direct the vote of 2,182,056 shares and sole power to dispose or to direct the

disposition of 2,194,331 shares. The address reported in the Schedule 13 G/A is 55 East 52nd Street, New York, NY 10055. |

| (2) | Based on Schedule 13G filed by Alger Associates, Inc. with the SEC on March 10, 2022.

The schedule 13G was filed with respect to 1,648,320 shares beneficially owned by one or more open-end investment companies or other managed

accounts that are investment management clients of Fred Alger Management, LLC (“FAM”), a registered investment adviser. FAM

is a 100% owned subsidiary of Alger Group Holdings, LLC (“AGH”), a holding company. AGH is a 100% owned subsidiary of Alger

Associates, Inc., a holding company. This beneficial holder has the sole power to vote or to direct the vote, and sole power to dispose

or to direct the disposition of, all 1,648,320 shares. |

| (3) | Based on Schedule 13G filed by The Vanguard Group with the SEC on February 10, 2022.

This beneficial holder has the sole power to vote or to direct the vote of 0 shares, shared power to vote or to direct the vote of 26,790

shares, sole power to dispose or to direct the disposition of 1,097,811 shares, and shared power to dispose or to direct the disposition

of 37,092 shares. The address reported in the Schedule 13G is 100 Vanguard Blvd. Malvern, PA 19355. |

| (4) | Based on Schedule 13G filed by Bandera Partners LLC, Gregory Bylinsky, and Jefferson

Gramm with the SEC on March 11, 2022. The Schedule 13G was filed with respect to 931,000 shares (the “Master Fund’s Shares”)

directly held by Bandera Master Fund L.P., a Cayman Islands exempted limited partnership (“Bandera Master Fund”). Bandera

Partners is the investment manager of Bandera Master Fund and may be deemed to have beneficial ownership over the Master Fund’s

Shares by virtue of the sole and exclusive authority granted to Bandera Partners by Bandera Master Fund to vote and dispose of the Master

Fund’s Shares. Mr. Bylinsky and Mr. Gramm are Managing Partners, Managing Directors and Portfolio Managers of Bandera Partners and

may be deemed to have shared power to vote or dispose of the Master Fund’s Shares. The address reported in the Schedule G/A is 50

Broad Street, Suite 1820, New York, New York 10004. |

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors is currently composed

of seven directors. With the exception of Peter D. Holt, our President and Chief Executive Officer, all of our directors are outside directors

(i.e., directors who are neither officers nor employees of ours).

Our common stock is listed on The NASDAQ

Capital Market and in SEC rules, and accordingly, we have used the definition of “independence” of the NASDAQ Stock Market

to determine whether our directors are deemed to be independent. Based on those definitions, we have determined that, with the exception

of Peter D. Holt, our President and Chief Executive Officer, all of our directors are independent. The relationships and transactions

reviewed and considered are more fully described in “Corporate Governance -- Director Independence” below.

Each director elected at the Annual Meeting

will hold office until our annual meeting of stockholders in 2023 or until his or her successor is elected and qualified.

The election of directors is uncontested.

Voting in Uncontested Director Election

Under our bylaws, each director shall be

elected by the vote of a majority of the votes cast in an uncontested election (an election in which the number of nominees for election

is the same as the number of directors to be elected). In other words, the nominee must receive more “for” votes than “against”

votes, with abstentions and broker non-votes not having any effect on the voting.

If a nominee for election as a director

is an incumbent director and the nominee is not re-elected, Delaware law provides that the director continues to serve as a “holdover”

director until his successor is elected and qualified or until he or she resigns. Under our bylaws, if an incumbent director is not re-elected,

the director shall tender his or her resignation to the board of directors. The Nominating and Governance Committee shall make a recommendation

to the Board whether to accept or reject the director’s resignation or whether other action should be taken. The Board shall act

on the Committee's recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date of certification

of the election results. The director who tendered his or her resignation shall not participate in the Committee’s deliberations

(if he or she is a member of the Committee) or in the Board’s decision.

Nominees for Director

The following table provides information about the nominees

for election as directors.

|

Nominee

|

Position with the Company

|

Age

|

| Matthew E. Rubel |

Lead Director |

64 |

| James H. Amos, Jr. |

Director |

76 |

| Ronald V. DaVella |

Director |

64 |

| Suzanne M. Decker |

Director |

60 |

| Peter D. Holt |

President, Chief Executive Officer and Director |

63 |

| Abe Hong |

Director |

50 |

| Glenn J. Krevlin |

Director |

62 |

|

The Joint Corp.

2021 Board of Directors

|

|

|

Matthew

E. Rubel

Current Chair of The Executive Board, MidOcean Partners Private

Equity;

Current Chair, Holley Inc.;

Current Director, TreeHouse Foods, Inc.;

Former Director, Hudson’s Bay Company, and HSNi;

Former Director, President and CEO, Varsity Brands, Inc.;

Former Chair, President and CEO, Collective Brands, Inc.;

Former Chair, President and CEO, Cole Haan, Inc.;

Former Senior Advisor, Roark Capital Group & TPG Capital, L.P.

Director Since: 2017 Age: 64

Biography:

Matthew E. Rubel has served as a director since June 2017. Mr.

Rubel currently serves as the Chair of the executive board for MidOcean Partners Private Equity. Mr. Rubel also currently serves as Chair

of Holley Inc. and TreeHouse Foods, Inc. Previously, he served as director, President, and CEO of Varsity Brands, Inc. Starting in 2015,

he served as a Senior Advisor at Roark Capital Group. From 2011 to March 2015, he served as Senior Advisor to both TPG Capital, L.P. and

TPG Growth.

Prior to his advisor roles, Mr. Rubel served as President and

Chief Executive Officer of Collective Brands, Inc. from 2005, and as its Chair from 2008, until 2011. From February 1999 to July 2005,

he served as Chair, President and Chief Executive Officer of Cole Haan. Prior to joining Cole Haan, Mr. Rubel served as an Executive Vice

President of J. Crew Group and Chief Executive Officer of Popular Club Plan from 1994 to 1999. Mr. Rubel has been a director of numerous

multi-national retail companies and consumer brands.

In addition, Mr. Rubel has served on the Board of Hudson’s

Bay Company and HSN, Inc. (also known as HSNi), the holding company of HSN and Cornerstone Brands, and Supervalu. In 2010, Mr. Rubel became

a Presidential Appointee to the House Advisory Council on Trade Policy Negotiation.

Education: BS in

Journalism, Ohio University; MBA in Marketing & Finance, University of Miami

|

|

Skills & Qualifications:

Franchising & Industry Expertise

Financial Acumen & Expertise

Senior Management Leadership

CEO Leadership

Operations

Management Expertise

Public Company Board Service

Corporate Finance & M&A Expertise

Marketing & Branding Expertise

Risk Management

Expertise

Independent Director

The Joint Corp Committees:

Compensation, Nominating & Governance

Other Public Company Boards:

Current

Holley Inc.

TreeHouse Foods, Inc.

Previous

Collective Brands, Inc.

Hudson’s Bay Company

HSN, Inc.

Supervalu

|

James

H. Amos, Jr.

Current Director, ASP UPF Holdings LP, and subsidiaries;

Current Chair of the advisory board of APFI, Procter & Gamble’s franchising initiatives;

Former Chair and Chief Executive Officer, Mail Boxes, Etc.;

Former Chair of the International Franchise Association

Director Since: 2015 Age: 76

Biography:

James H. Amos, Jr. has served as a director since September 2015. Mr. Amos is also currently a director of ASP UPF Holdings LP and subsidiaries, which owns and operates 170 Planet Fitness Gyms. In addition, Mr. Amos is currently the Chair of the advisory board of Agile Pursuits Franchising, Inc. (APFI), a wholly owned subsidiary of Procter & Gamble dedicated to franchising.

Mr. Amos is the former Chief Executive Officer and Chair of the board of Mail Boxes, Etc. (MBE), now The UPS Store. Under his leadership, MBE became the world’s largest and fastest growing franchisor of retail business, communication and postal service centers. Based in San Diego, the MBE Network is comprised of nearly 5,000 locations worldwide, with master licensing agreements in more than 80 countries. In 2001, Mr. Amos was instrumental in orchestrating the sale of MBE to UPS and executing the largest re-branding in history of a retail system from MBE to The UPS Store.

He is past Chair of the International Franchise Association (IFA) and in 2011 was an inductee into the IFA’s Hall of Fame.

Mr. Amos has served on or is serving on the board of directors of The National Veteran’s Administration, The Marine Military Academy, The Marine Corps Heritage Foundation, Meineke Car Care Centers, Oreck Corporation, Zig Ziglar Corporation, WSI of Canada, The University of Missouri, SkinPhD, The HealthStore Foundation, Ken Blanchard’s Faith Walk Leadership Foundation, Aspen Dental, and Planet Fitness.

Education: AB in Political Science and History, University of Missouri-Columbia

|

|

Skills & Qualifications:

Franchising & Industry Expertise

Financial Acumen & Expertise

Senior Management Leadership

CEO Leadership

Operations Management

Expertise

Public Company Board Service

Corporate Finance & M&A Expertise

Marketing & Branding Expertise

Risk Management Expertise

Independent

Director

The

Joint Corp Committees:

Nominating & Governance Audit

Other Public Company Boards:

Current

Agile Pursuits

Franchising, Inc.

(a subsidiary of Procter & Gamble)

|

|

Ronald

V. DaVella

Current Vice Chairman of the Strategic Advisory Board, AURA Venture;

Current Director, Delta Dental of Arizona;

Current Director, Mobile Holding Properties, LLC;

Current Director, NorthStar Security Holdings;

Former Executive Vice President of Finance, The Alkaline Water Company;

Former Director and Chief Financial Officer, NanoFlex Power Corp.;

Former Chief Financial Officer, Amazing Lash Studio Franchise LLC;

Former Audit Partner, Deloitte & Touche LLP

Director Since: 2014 Age: 64

Biography:

Ronald V. DaVella has served as a director since our initial

public offering in 2014. Mr. DaVella currently serves as the Vice Chairman of the Strategic Advisory Board for AURA Ventures, a global

impact strategy and creative firm since April 2020. He also serves as a member of the board of directors at Delta Dental of AZ, a dental

insurance company, Mobile Holding Properties, LLC, a company rolling up mobile home parks and NorthStar Security Holdings, a company rolling

up physical security businesses.

From April 2019 to January 2020, he served as Senior Vice President

of Finance for The Alkaline Water Company, a consumer public company producing and selling alkaline water under the brand name Alkaline

88. From May 2017 to March 2019, he served as director and Chief Financial Officer for NanoFlex Power Corporation, a public company that

was commercializing two disruptive solar technologies. He also formerly served as the Chief Financial Officer for Amazing Lash Studio

Franchise LLC, a franchisor of eyelash extension service studios with over 200 operating locations in the US, from March 2016 to May 2017.

From August 2015 to February 2019, Mr. DaVella was also a franchise owner with Amazing Lash Studio Franchise LLC. Mr. DaVella was an audit

partner with Deloitte & Touche LLP from June 1989 to July 2014.

Mr. DaVella is a certified public accountant in the state of

Arizona. He has assisted his clients with mergers and acquisitions, operational and financial controls, internal and external reporting,

financings and public offerings and filings with the SEC.

Education:

BS in Accounting, Queens College; MBA in Finance, Pace University

|

|

Skills & Qualifications:

Franchising & Industry Expertise

Public Company Board Service

Financial Acumen & Expertise

Senior Management Leadership Corporate

Finance & M&A Expertise

Real Estate Expertise

Operations Management Expertise

Risk Management Expertise

Independent Director

The Joint Corp Committees:

Audit

Nominating & Governance

Other Public Company Boards:

Previous

Nanoflex Power Corporation |

Suzanne

M. Decker

Current Executive Project Sponsor and

former Chief Human Resource Officer, Aspen Dental Management, Inc.

Current Advisor, Bond Veterinary, Inc.;

Former Director, Refresh Mental Health;

Director Since: 2017 Age: 60

Biography:

Suzanne Decker has served as a director since June 2017. In

April 2022, Ms. Decker joined Bond Veterinary, Inc. as an Advisor for Human Resources and Talent Acquisition. Ms. Decker also has served

since April 2021 as the Executive Project Sponsor for Aspen Dental Management, Inc. (ADMI). Prior to her appointment, she was ADMI’s

Chief Human Resources Officer. ADMI supports more than 880 dentist-owned branded dental practices in 46 states doing business as Aspen

Dental. As Executive Project Sponsor, Ms. Decker’s role is to bridge the communications gap between influencers and implementers

in driving organizational change. She focuses on operationalizing projects that are aligned with ADMI’s corporate strategies, ensuring

collaboration between corporate functional departments, field operations leadership and practice teams.

ADMI acquired WellNow Urgent Care (formerly Five Star Urgent

Care) in 2016 and Rejuv Medical Aesthetic Clinic and ClearChoice Management Services (CCMS) in 2020. Prior to her appointment as Executive

Project Sponsor, Ms. Decker provided HR advisory support services to WellNow Urgent Care, Rejuv and ClearChoice, with 80, 1 and 66 facilities,

respectively, throughout the United States. Additionally, Ms. Decker was responsible for all HR-related activities to support ADMI’s

and Aspen Dental’s 15,000 team members including compensation, benefits, performance and talent management, engagement and employee

relations, talent acquisition, learning and development, field HR and employment practices liability. Ms. Decker joined ADMI’s field

operations team in 2002, supporting practice operations. Prior to joining ADMI, Ms. Decker was Director of Human Resources for the Davis

Vision Companies, a vertically integrated vision services provider. Prior to its sale in February 2022, Ms. Decker served as a board member

at Refresh Mental Health, which promotes clinical excellence and client access to high-quality healthcare.

Education: BS in Childhood Education,

Russell Sage College

|

|

Skills & Qualifications:

Franchising & Industry Expertise Senior Management Leadership

Marketing & Branding Expertise

Operations Management Expertise

Independent Director

The Joint Corp Committees:

Compensation

Other Public Company Boards:

None

|

|

Peter

D. Holt

President and Chief Executive Officer,

The Joint Corp.

Director Since: 2016 Age: 63

Biography:

Peter D. Holt has served as President and Chief Executive Officer

of the Company since January 2017. At various times between April 2016 and January 2017, Mr. Holt served as Chief Executive Officer, acting

Chief Executive Officer, and Chief Operating Officer. Mr. Holt began serving as a director of the Company in August 2016. Mr. Holt has

had extensive operational experience in senior management with companies that have multiple store locations and franchises.

Most recently, he served as President and CEO of Tasti D-Lite

LLC, a retailer of lower-fat dairy desserts. He held that position from 2013 until Tasti D-Lite was purchased by Kahala Brands in June

of 2015. From 2007 through 2012, he was Chief Operating Officer of Tasti D-Lite. While at Tasti D-Lite, among other achievements, he led

the team to convert the licensed retail network into a business format franchise structure. He also led the acquisition of Planet Smoothie

and managed the integration of the two brands.

Prior to Tasti D-Lite, from 2005 until 2007, Mr. Holt served

as Executive in Residence of Great Hill Partners, a Boston-based private equity firm. At Great Hill Partners, he was responsible for identifying,

qualifying and assisting in the due diligence process of potential franchisor acquisitions.

He was the Chief Operating Officer of 24Seven Vending (U.S.),

a subsidiary of the New Zealand publicly traded company, VTL Group Limited, from 2004 until 2005. At 24Seven Vending (U.S.), Mr. Holt

was responsible for all aspects of the implementation of an acquisition-to-franchise conversion expansion strategy in parallel with managing

the financing, sales, operations, technology and training for the company.

From 1997 through 2003, Mr. Holt held various positions with

Mail Boxes, Etc., including Executive Vice President of Franchise Sales and Development, Senior Vice President, International, and Vice

President, International. He was responsible for all franchise sales functions including domestic sales, site selection/retail center

development, and the international sales and operations division. Mr. Holt also held positions at Brice Foods, Inc. (1990-1996) and International

Franchise Association (1986-1990).

Education: BA in

Political Science, University of Washington; MA in Latin American History, University of London

|

|

Skills & Qualifications:

Franchising & Industry Expertise

Public Company Board Service

Financial Acumen &

Expertise

Senior Management Leadership

CEO Leadership

Operations Management Expertise

Corporate Finance & M&A Expertise

Marketing & Branding Expertise

Real Estate Expertise

Risk Management Expertise

Non-Independent Director

The Joint Corp Committees:

None

Other Public Company Boards:

None

|

Abe

Hong

Current Chief Technology Officer, Learning

Care Group;

Former Chief Operations Officer, Technologent;

Former Executive Vice President and Chief Information Officer,

Discount Tire Company;

Former Senior Vice President and Chief Information Officer, Red Rock Resorts, Inc.;

Former Vice President, Global IT Infrastructure & Technology Architecture Starbucks Corp.

Director Since: 2018

Age: 50

Biography:

Abe Hong has served as a director since June 2018. Mr. Hong

is currently the Chief Technology Officer for Learning Care Group, the second-largest for-profit childcare provider in North America.

Mr. Hong served as COO for Technologent, a global technology services company from June 2020 to September 2021. Mr. Hong served as Executive

Vice President and Chief Information Officer for Discount Tire Company from August 2017 to February 2020. In this role, Mr. Hong was responsible

for all customer-facing and back-of-house systems and people and for the company’s digital technology strategy. Discount Tire Company

is a $5 billion privately held retail company, headquartered in Scottsdale, Arizona, with 950+ stores and a strong online presence.

Prior to Discount Tire, Mr. Hong served as Senior Vice President

and Chief Information Officer at Red Rock Resorts, Inc. Mr. Hong was instrumental in modernizing the company’s enterprise systems

to facilitate its 2016 initial public offering and its overall digital business strategy. Before that, Mr. Hong was responsible for international

IT and all customer and back-office technology at Starbucks Corporation. In that role, he led and supported key IT initiatives, including

enabling strong international store growth, managing the global rollout of a new point-of-sale mobile application and integrating retail

infrastructure across three continents.

Education:

BE in Engineering, United States Military Academy at West Point

|

|

Skills & Qualifications:

Franchise & Industry Expertise

Public Company Board Service

Senior Management Leadership

Operations Management

Expertise

IT and Risk Management Expertise

Independent Director

The Joint Corp Committees:

Compensation

Other Public Company Boards:

None

|

|

Glenn J. Krevlin

Current

Founder, Managing Partner, Principal and Portfolio Manager of Glenhill Capital Advisors LLC;

Current Director and Former Chair, Design Within Reach, Inc.;

Current Director, Ember Technologies

Former Director, Centric Brands, Inc.;

Former Director, Restoration Hardware

Director Since: 2019 Age: 62

Biography:

Glenn Krevlin has served as a director since June 2019. Mr.

Krevlin is the Founder, Managing Partner, Principal and Portfolio Manager of Glenhill Capital Advisors LLC ("GCA"), a fundamental

equity investment manager. Mr. Krevlin founded and has worked at GCA since 2001. Currently, Mr. Krevlin also serves on the board of Ember

Technologies, a research and development consumer products company, and continues to serve on the board of Design Within Reach, Inc.,

a modern furniture design company (where he has been on the board since August 2009, including as Chair from August 2009 to July 2014).

Mr. Krevlin is also on the boards or otherwise involved with several start-up companies.

Previously, Mr. Krevlin was a Partner and Portfolio Manager

at Cumberland Associates, Cumberland Partners, and Long View Partners (collectively, “Cumberland Associates”), an affiliated

group of value oriented private investment partnerships, from 1994 to 2000. Before attaining partnership, Mr. Krevlin worked as an associate

at Cumberland Associates from 1989 to 1994. Prior to that, Mr. Krevlin served as Vice President & Associate at The Goldman Sachs Group,

Inc., in the Institutional Equity Sales department, from 1982 to 1989.

Additionally, Mr. Krevlin served on the Board of Directors

of Centric Brands Inc. (f/k/a Differential Brands Group Inc.), a leading lifestyle brands collective, from October 2018 to October 2020.

Prior to that, Mr. Krevlin served on the Board of Directors of Restoration Hardware, a home-furnishings company, from 2001 to 2012.

Education:

BA in Economics & Government, Wesleyan University; MBA New York University

|

|

Skills & Qualifications:

Franchising & Industry Expertise

Financial Acumen & Expertise

Senior Management Leadership

Public Company Board Expertise

Independent Director

The Joint Corp Committees:

Audit

Other Public Company Boards:

Current

Design Within Reach, Inc.

(a subsidiary of Herman Miller, Inc.)

Previous

Centric Brands, Inc.

|

Director Qualifications

We believe that our seven director nominees

possess the experience, qualifications and skills that warrant their election as directors. Our directors have in common, among other

qualities, a breadth of business experience, seasoned judgment and an insistence on looking beyond the next quarter or the next year in

directing and supporting our management. From their service in management, on the boards of other public and private companies, and in

counseling other companies and their directors, our directors also bring to us the insights that they gain from the operating policies,

governance structures and growth dynamics of these other companies. One of our director nominees self-identifies as female, one as Asian

and five as Caucasian. One of our director nominees declined to self-identify as to their ethnicity, gender or LGBTQ+ status.

The Board regularly reviews the skills, experience

and background that it believes are desirable to be represented on the Board.

Diversity Summary

We provide the following information about our directors for purposes of our compliance

with Nasdaq rules. We ask our directors to indicate their self-identification with respect to race/ethnicity, gender, gender identity,

and sexual orientation, subject to applicable laws.

| Board Diversity Matrix (as of February 1, 2022]) |

| Board Size: |

|

| Total Number of Directors |

7 |

| |

Female |

Male |

Non-Binary |

Gender Undisclosed |

| Gender: |

|

|

|

|

| Directors |

1 |

5 |

- |

1 |

| Self-Identified Demographic Background: |

|

|

|

|

| African American or Black |

- |

- |

- |

- |

| Alaskan Native or Native American |

- |

- |

- |

- |

| Asian |

- |

1 |

- |

- |

| Hispanic or Latinx |

- |

- |

- |

- |

| Native Hawaiian or Pacific Islander |

- |

- |

- |

- |

| White |

1 |

4 |

- |

- |

| Two or More Races or Ethnicities |

- |

- |

- |

- |

| LGBTQ+ |

- |

- |

- |

- |

| Did not Disclose Demographic Background |

- |

- |

- |

1 |

|

The Joint Corp.

2022 Director Skills & Qualifications

|

|

|

The Board of Directors recommends that stockholders vote “FOR”

each of the seven nominees to the Board.

Committees of the Board

Our Board of Directors has standing Compensation,

Audit, and Nominating and Governance Committees. All of the members of each committee are outside directors who are independent under

the applicable listing standards of The Nasdaq Stock Market LLC and SEC rules.

Compensation Committee

The Compensation Committee is responsible

for, among other things, determining the cash compensation and equity compensation of our executive officers, subject to the review of

our full Board of Directors and approval by the Board in the case of cash compensation only. On an annual basis, the Compensation Committee

reviews the respective salaries of our executive officers in light of the goals and objectives relevant to each officer, including, as

the Compensation Committee deems appropriate, consideration of (i) the individual officer’s position, scope of responsibilities

and level of experience, (ii) the rate of inflation, (iii) the range of salary increases for our employees generally, and (iv) the salaries

paid to comparable officers in comparable companies. On an annual basis, the Compensation Committee also determines appropriate cash bonuses,

if any, for the Company’s executive officers (based upon an applicable percentage of base salary as determined by the Compensation

Committee), after consideration of specific individual and Company performance goals and criteria. Furthermore, the Committee grants stock

awards under the stock plan to our executive officers and other employees and determines the terms, conditions, restrictions and limitations

of the awards granted. In this regard, the number of shares of stock for which awards are granted are based on, as the Compensation Committee

deems appropriate, each individual’s position and our financial performance, the Compensation Committee’s assessment of the

individual’s performance, initiative, contribution to our success and total compensation package. The Board, upon the Compensation

Committee’s recommendation, has delegated authority to our CEO to grant restricted stock awards in connection with new hires and

promotions of current employees who are not Section 16 officers under specific guidelines set by the Compensation Committee. This delegation

of authority does not extend to awards granted under our annual incentive stock program or any awards falling outside the stated guidelines.

The Compensation Committee has the sole authority, at our expense, to select, retain, compensate and oversee any compensation consultant

to be used to assist in its evaluation of the compensation of our directors and executive officers. The Committee also has the authority

to obtain legal counsel, accountants, and other advisers of its choice to further assist the Compensation Committee in connection with

its functions and to set the compensation and oversee the work of such advisers.

In 2021, the Compensation Committee engaged

the consulting firm of Korn Ferry to evaluate the compensation packages for our leadership team, including our executive officers. In

its report, Korn Ferry compared pay levels for our executive officers against data from Korn Ferry’s survey database of executive

compensation and from proxies of peer group companies. The comparison data consisted of base salary, targets for short-term incentives,

targets for total cash compensation, long-term incentives and target total direct compensation. The report then determined for each category

the percentile into which our executive officers’ compensation fell relative to the executive officers of comparable companies.

The Compensation Committee used these data, along with the Board of Director’s assessments of the performance of our executive officers,

to determine our executive officers’ compensation packages. Additionally, the Compensation Committee considered recommendations

made by Mr. Holt regarding Mr. Singleton’s compensation package. The compensation packages for our leadership team, including our

executive officers, were not re-evaluated by the consulting firm of Korn Ferry or any other consulting firm in 2022.

Our directors determine the compensation

that they receive for their services as directors of the Company. In doing so, they consider the compensation directors receive for their

service at companies that are comparable to the Company. From time to time, the directors recommend adjustments to the directors’

compensation structure to ensure both continued competitiveness and the appropriate level and mix of compensation. Based upon the review

conducted in 2021, the directors recommended and approved the following changes to director compensation:

| • | increase the annual cash retainer by $10,000; |

| • | increase the annual equity retainer by $10,000; |

| • | increase the annual stipend for the Audit Committee chair by $2,500; and |

| • | increase the annual stipend for the Lead director by $5,000. |

These changes are intended to better align compensation levels

with those of our compensation comparator group.

Audit Committee

The Audit Committee has been established

in accordance with Section 3(a)(58)A of the Securities Exchange Act of 1934. The Audit Committee oversees our accounting and financial

reporting processes and the integrity of our financial statements. The Audit Committee’s responsibilities also include oversight

of our internal accounting and financial controls, the qualifications and independence of our independent accountants, and our compliance

with legal and regulatory requirements. In addition, the Audit Committee is responsible for reviewing, setting policy regarding and evaluating

the effectiveness of our processes for assessing significant risk exposures and the measures that management has taken to minimize such

risks. In carrying out these responsibilities, the Audit Committee is charged with, among other things: overseeing our internal audit

department, reviewing and approving the internal audit plan, and reviewing and discussing internal audit department reports related to

the department’s activities and mission; appointing, replacing, compensating, retaining, evaluating, terminating and overseeing

our independent registered public accounting firm; discussing with our independent registered public accounting firm its independence

from management; reviewing with our independent registered public accounting firm the scope and results of its audit; approving all audit

and permissible non-audit services to be performed by our independent registered public accounting firm; discussing with management and

our independent registered public accounting firm the interim and annual consolidated financial statements that we file with the SEC;

reviewing periodically with our counsel and/or principal regulatory compliance officer any legal and regulatory matters that may have

a material adverse effect on our financial statements, operations, compliance policies and programs; reviewing and approving procedures

for the confidential anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters; reviewing

and approving related person transactions; annually reviewing the Audit Committee charter and the Audit Committee’s performance;

and handling such other matters that are specifically delegated to the Audit Committee by our Board of Directors from time to time.

Nominating and Governance Committee

The Nominating and Governance Committee is

responsible for overseeing our corporate governance guidelines and reporting and making recommendations to the Board of Directors concerning

corporate governance matters and the structure, composition and function of the Board of Directors and its committees.

The Nominating and Governance Committee is

also responsible for developing and recommending to the Board of Directors criteria for identifying and evaluating candidates for directorships

and making recommendations to the full Board regarding candidates for election or reelection to the Board of Directors at each annual

stockholders’ meeting.

The Nominating and Governance Committee endeavors

to select nominees that possess certain basic personal and professional qualities that are necessary in order to properly discharge their

fiduciary duties to stockholders, provide effective oversight of management, and monitor adherence to principles of sound corporate governance.

With limited exceptions, the Committee believes that all persons nominated to serve as director should possess certain minimum qualifications

consisting of:

| · | integrity and ethical character and an appreciation of these qualities in others, |

| · | an absence of conflicts of interest, |

| · | the ability to provide fair and equal representation of all stockholders, |

| · | demonstrated achievement in one or more fields of business, professional, governmental, communal, scientific

or educational endeavor, |

| · | sound judgment, resulting from management or policy-making experience, that demonstrates an ability to

function effectively in an oversight role, |

| · | business understanding, with a general appreciation of major issues facing public companies of a size

and operational scope similar to ours, |

| · | available time to devote to the business of the Board of Directors and its committees, |

| · | competencies and skills which are complementary to those of the existing members of the Board, which

skills should include experience in one or more of the following areas: franchising, small box retail, company governance, management,

financial matters, marketing and branding, real estate, technology, strategy, risk management and legal affairs, and |

| · | professional background, experience, expertise, perspective, age, gender, ethnicity and country of citizenship

which will promote diversity on the Board of Directors. |

We are of the view that the continuing

service of qualified incumbents promotes stability and continuity in the board room, contributing to the Board of Director's ability

to work as a collective body, while giving us the benefit of the familiarity and insight into our affairs that our directors have

accumulated during their tenure. Accordingly, the process of the Nominating and Governance Committee for identifying nominees

reflects the practice of re-nominating incumbent directors who continue to satisfy the Committee's criteria for membership on the

Board and whom the Committee believes continue to make important contributions to the Board. Consistent with this policy, in

considering candidates for election at annual meetings of stockholders, the Committee will first determine the incumbent directors

whose terms expire at the upcoming meeting and who wish to continue their service on the Board. The Committee will then evaluate

their qualifications and performance, and if the Committee determines that an incumbent director continues to be qualified and has

satisfactorily performed his or her duties during the preceding term, the Committee will propose the incumbent director for

re-election, absent special circumstances.

The Nominating and Governance Committee will

identify and evaluate new candidates for election to the Board in order to fill vacancies on the Board when there is no qualified and

available incumbent. In evaluating new candidates, the Nominating and Governance Committee will consider whether the candidates meet the

minimum qualifications discussed above. These qualifications include consideration as to whether and how the candidate would contribute

to the Board’s diversity, defined broadly to include gender and ethnicity as well as background and experience. The Nominating and

Governance Committee will solicit recommendations for nominees from persons that the Nominating and Governance Committee believes are

likely to be familiar with qualified candidates, which may include current Board members and management, and the Nominating and Governance

Committee has the authority to retain a professional search firm for assistance if appropriate. The Nominating and Governance Committee

will consider candidates proposed by stockholders and will evaluate any candidate proposed by a stockholder using the same criteria used

to evaluate any other candidate, except that the Nominating and Governance Committee may consider, as one of the factors in its evaluation

of stockholder-recommended nominees, the size and duration of the interest of the recommending stockholder in our equity. The Nominating

and Governance Committee may also consider the extent to which the recommending stockholder intends to continue holding its interest,

including, in the case of nominees recommended for election at an annual meeting, whether it intends to continue holding its interest

at least through the time of such annual meeting.

Procedures for Submitting Stockholder-Recommended Nominees.

Any stockholder who wants to propose a candidate should submit a written recommendation to the Nominating and Governance Committee indicating

the candidate’s qualifications and other relevant biographical information and providing preliminary confirmation that the candidate

would be willing to serve as a director. Any such recommendation should be addressed to the Board of Directors, The Joint Corp., 16767

N. Perimeter Drive, Suite 110, Scottsdale, Arizona 85260.

In addition to recommending director candidates

to the Nominating and Governance Committee, stockholders may also, pursuant to procedures established in our bylaws, directly nominate

one or more director candidates to stand for election at an annual meeting of stockholders. A stockholder wishing to make such a nomination

must deliver written notice of the nomination to the secretary of the Company not less than 90 days nor more than 120 days prior to the

first anniversary of the preceding year’s annual meeting of stockholders. If, however, the date of the annual meeting is more than

30 days before or after the first anniversary, the stockholder’s notice must be received no later than the close of business on

the 90th day, and no earlier than the 120th day, prior to the annual meeting.

Stockholders may also submit director nominees

to the Board to be included in our annual proxy statement, known as “proxy access.” Stockholders who intend to submit director

nominees for inclusion in our proxy materials for the 2023 Annual Meeting of Stockholders must comply with the requirements of proxy access

as set forth in our bylaws. The stockholder or group of stockholders who wish to submit director nominees pursuant to proxy access must

deliver the required materials to the Company not less than 120 days nor more than 150 days prior to the anniversary of the date that

the Company first mailed its proxy materials for the annual meeting of the previous year.

Committee Charters

Each of the Audit, Compensation, and Nominating and Governance

Committees operates under a written charter adopted by the Board, which charters are available on our website https://ir.thejoint.com/governance-docs.

Committee Members and Meetings

The following tables provide information about the membership of the

committees of the Board of Directors during 2021:

| (1) | The Board of Directors has determined that all members of the Audit Committee are

audit committee financial experts as described in the applicable rules of the SEC and are independent under the applicable listing standards

of The Nasdaq Stock Market LLC and SEC rules. |

Our Board of Directors held five meetings

by teleconference or in person during 2021 and acted without a formal meeting on a number of occasions by the unanimous written consent

of the directors. The Audit Committee held four meetings during the year, the Compensation Committee held five meetings during the year,

and the Nominating and Governance Committee held four meetings during the year.

All of our directors participated by teleconference

or in person in all of the meetings of the Board of Directors during 2021. All of the members of the Audit, Compensation, and Nominating

and Governance Committees participated by teleconference or in person in all of the meetings of those committees during the year. One

board member attended our 2021 annual meeting of stockholders.

Director Compensation

The following table sets forth compensation paid to our non-employee

directors for the year ended December 31, 2021:

| Name |

Fees Earned or Paid

in Cash |

Stock(1)(2)

Awards |

Option Awards |

Non-Equity Incentive Plan

Compensation |

Nonqualified Deferred Compensation

Earnings |

All Other

Compensation |

Total |

| Matthew E. Rubel |

$58,833 |

$50,000 |

$ - |

$ - |

$ - |

$ - |

$108,833 |

| James H. Amos, Jr. |

50,889 |

50,000 |

- |

- |

- |

- |

100,889 |

| Ronald V. DaVella |

59,861 |

50,000 |

- |

- |

- |

- |

109,861 |

| Suzanne M. Decker |

50,889 |

50,000 |

- |

- |

- |

- |

100,889 |

| Abe Hong |

50,889 |

50,000 |

- |

- |

- |

- |

100,889 |

| Glenn J. Krevlin |

47,067 |

50,000 |

- |

- |

- |

- |

97,067 |

| (1) | The

amounts in this column represent the aggregate grant date fair value of stock awards granted

to the director in the applicable fiscal year, computed in accordance with FASB ASC Topic

718. For a discussion of the assumptions used in reaching this valuation, see “Restricted

Stock” in Note 8 to our audited financial statements included in our annual report

on Form 10-K for the year ended December 31, 2021, filed with the SEC on March 11, 2022. |

| (2) | The

aggregate number of unvested stock awards outstanding at December 31, 2021 held by each non-employee

director was as follows: Mr. Rubel – 703; Mr. Amos – 703; Mr. DaVella –

703; Ms. Decker – 703; Mr. Hong – 703; and Mr. Krevlin – 703. |

As discussed under the heading “Compensation

Committee” above, based upon the review conducted in 2021, the directors recommended and approved the following revised director

compensation policy effective May 28, 2021:

| · | Each director who was not also one of our employees, upon election or re-election

to the Board of Directors, received a fee of $50,000 per year. |

| · | Each non-employee director, upon his or her election or re-election as a director,

also received that number of restricted shares equal to $50,000, divided by the closing price of our stock on the election date. This

restricted stock was granted under The Joint Corp. 2014 Stock Plan and will vest on the earlier of (i) one year from the grant date and

(ii) the date of the next annual meeting of the shareholders of the Company occurring after the date of grant. |

In addition to the compensation described

above, each committee chair received an annual committee chair stipend in the following amount:

| · | Audit Committee chair: $10,000 |

| · | Compensation Committee chair: $5,000 |

| · | Nomination and Governance Committee chair: $5,000 |

Our lead director received an annual stipend

in the amount of $15,000. The Board of Directors formed a special Information Technology Committee to oversee the selection, development

and implementation of our new IT platform. The members of this committee received a stipend in the amount of $5,000. Each non-Chair member

of the committees received an annual stipend of $2,000. All fees payable to directors are payable quarterly.

All of our non-employee directors are reimbursed

for reasonable out-of-pocket expenses incurred in attending meetings of the Board of Directors or the committees thereof and for other

expenses reasonably incurred in their capacity as directors.

CORPORATE GOVERNANCE

Executive Sessions of the Board

Our Board of Directors excuses Mr. Holt, our

President and Chief Executive Officer, as well as any of our other executive officers who may be present by invitation, from a portion

of each meeting of the Board in order to allow the Board to review Mr. Holt’s performance as President and Chief Executive Officer