Rogers Communications Inc. today announced its unaudited financial

and operating results for the first quarter ended March 31,

2022.

Consolidated Financial Highlights

|

|

Three months ended March 31 |

|

|

(In millions of Canadian dollars, except per share amounts,

unaudited) |

|

2022 |

|

|

2021 |

|

% Chg |

|

|

|

|

|

|

|

|

Total revenue |

|

3,619 |

|

|

3,488 |

|

4 |

|

|

Total service revenue |

|

3,196 |

|

|

3,021 |

|

6 |

|

|

Adjusted EBITDA 1 |

|

1,539 |

|

|

1,391 |

|

11 |

|

|

Net income |

|

392 |

|

|

361 |

|

9 |

|

|

Adjusted net income 1 |

|

462 |

|

|

394 |

|

17 |

|

|

|

|

|

|

|

|

Diluted earnings per share |

|

$0.77 |

|

|

$0.70 |

|

10 |

|

|

Adjusted diluted earnings per share 1 |

|

$0.91 |

|

|

$0.77 |

|

18 |

|

|

|

|

|

|

|

|

Cash provided by operating activities |

|

813 |

|

|

679 |

|

20 |

|

|

Free cash flow 1 |

|

515 |

|

|

394 |

|

31 |

|

"Rogers delivered strong first quarter results

across all our businesses, driven by better execution and the

continued improvement in Canada's economy," said Tony Staffieri,

President and CEO. "We are very confident about the opportunities

ahead, driven by the exceptional quality of our assets and the

dedicated efforts of the Rogers team. As a result, we are

increasing Rogers' 2022 service revenue, adjusted EBITDA, and free

cash flow guidance to reflect our improved outlook, ahead of

further growth associated with the Shaw transaction."

"In March, the CRTC approved the transfer of the

broadcast distribution undertaking licences held by Shaw to Rogers.

This approval is an important milestone and brings us one step

closer to completing our transformational transaction, which we

expect to close in Q2. Teams from both Rogers and Shaw continue to

work constructively with the Competition Bureau and ISED Canada to

ensure they have the information they need to assess the

significant benefits the combined company will bring to Canadians

and the Canadian economy."

______________________________

1 Mobile phone ARPU is a supplementary financial

measure. Adjusted EBITDA is a total of segments measure. Free cash

flow is a capital management measure. Adjusted diluted earnings per

share is a non-GAAP ratio. Adjusted net income is a non-GAAP

financial measure and is a component of adjusted diluted earnings

per share. See "Non-GAAP and Other Financial Measures" in our Q1

2022 Management's Discussion and Analysis (MD&A), available at

www.sedar.com, and this earnings release for more information about

each of these measures. These are not standardized financial

measures under International Financial Reporting Standards (IFRS)

and might not be comparable to similar financial measures disclosed

by other companies.2 See "Financial Guidance".

Operating Environment and Strategic

Highlights

The Canadian economy is recovering and beginning

to grow as immigration levels increase and COVID-19 restrictions

have increasingly been relaxed or removed, including travel and

capacity restrictions, masking mandates, and vaccine mandates.

Travel volumes have increased in recent months, resulting in higher

roaming revenue, and sporting events can now be filled to venue

capacity, which will result in greater attendance and game day

revenue as we welcome fans back to Rogers Centre.

While the general recovery is encouraging,

COVID-19 remains a risk and we will continue to stay focused on

keeping our employees safe and our customers connected. We remain

confident we have the right team, a strong balance sheet, and the

world-class networks that will allow us to get through the pandemic

having maintained our long-term focus on growth and doing the right

thing for our customers.

Our four focus areas guide our work and

decision-making as we further improve our operational execution and

make well-timed investments to grow our core businesses and deliver

increased shareholder value. Below are some highlights for the

quarter.

Successfully complete the Shaw acquisition and

integration

- Received approval from the Canadian

Radio-television and Telecommunications Commission (CRTC) for the

transfer of Shaw Communications Inc.'s (Shaw) broadcasting

services, achieving a significant regulatory milestone on the

journey to closing the transformational transaction with Shaw

(Transaction).

- Issued a combined $13.3 billion of

Cdn$-equivalent senior notes at a weighted average cost of

borrowing of 4.21% and a weighted average term to maturity of 13.9

years for net proceeds of $13.1 billion, successfully refinancing

the committed credit facility we arranged to support the

Transaction in March 2021.

- Issued US$750 million of

subordinated notes due 2082 with an initial coupon of 5.25% for the

first five years in February 2022.

Invest in our networks to deliver world-class

connectivity to Canadian consumers and businesses

- Awarded Best In Test in umlaut's

first Canadian fixed broadband report in January, winning fastest

upload and download speeds and scoring more than 60% higher than

our nearest competitor in average download speeds amongst national

Internet service providers.

- Recognized in January as Canada's

most consistent national wireless and broadband provider, with the

fastest Internet in Ontario, New Brunswick, and Newfoundland and

Labrador, by Ookla, the global leader in fixed broadband and mobile

network testing applications.

- Launched the first commercial 5G

standalone network in Canada, bringing network slicing capabilities

and lower latency, expanding Rogers 5G footprint, and supporting

future enterprise and consumer applications.

- Successfully completed 8 gigabits

per second symmetrical upload and download tests in both lab and

customer trials on our fibre-powered network, the fastest published

Internet speed in Canada among major Internet service

providers.

- Announced six new cellular towers,

and upgrades of two existing towers, bringing critical connectivity

along Highway 4 in British Columbia and helping to bridge the

digital divide.

- Announced we will invest almost

$200 million to upgrade our network in New Brunswick with 100% pure

fibre, delivering the latest Internet technology and an ultimate

entertainment experience.

- Expanded Canada's largest and most

reliable 5G network to 18 new communities as part of the

partnership with the Eastern Ontario Regional Network, alongside

the Government of Canada and the Province of Ontario.

- Announced Canada's first 5G

Wireless Private Network in a mining operation at Detour Lake

Mine.

Invest in our customer experience to deliver

timely, high-quality customer service consistently to our

customers

- Announced a five-year strategic

alliance with Microsoft that will leverage Azure's public cloud

capabilities to enhance customers' digital experiences, power

hybrid work, and drive 5G innovation across the country.

- Announced a suite of Smart Cities

and Smart Buildings Internet of Things solutions to deliver on the

growing needs of businesses and municipalities for sustainable,

secure, and operationally efficient infrastructure.

- Partnered with Corus Entertainment

to bring STACKTV to Ignite TV™ and Ignite™ SmartStream™ customers,

a first for a Canadian telecommunications provider.

- Expanded Rogers Pro On-the-Go™ to

Kelowna and Montreal. Pro On-the-Go is now available to Rogers

customers in communities in British Columbia, Alberta, Manitoba,

Ontario, Quebec, and Nova Scotia.

Improve execution and deliver strong financial

performance across all lines of business

- Generated total service revenue of

$3,196 million, up 6%, and adjusted EBITDA of $1,539 million, up

11%, and net income of $392 million, up 9%, reflecting improvements

across our business.

- Attracted 66,000 net postpaid

mobile phone subscribers, up from 22,000 last year, with churn of

0.71%.

- Generated free cash flow of $515

million, up 31%, and cash provided by operating activities of $813

million, up 20%.

Financial Guidance

We are adjusting our consolidated guidance

ranges for full-year 2022 total service revenue, adjusted EBITDA,

and free cash flow from the original ranges provided on January 27,

2022. The revised guidance ranges are presented below. The upward

adjustments primarily reflect improved execution and the continued

Canadian economic growth.

|

|

2021 |

|

2022 Original |

|

2022 Revised |

| (In

millions of dollars, except percentages) |

Actual |

|

Guidance Ranges 1 |

|

Guidance Ranges 1 |

|

|

|

|

|

|

|

|

|

|

|

| Total service revenue |

12,533 |

|

Increase of 4% |

to |

increase of 6% |

|

Increase of 6% |

to |

increase of 8% |

| Adjusted EBITDA |

5,887 |

|

Increase of 6% |

to |

increase of 8% |

|

Increase of 8% |

to |

increase of 10% |

| Capital expenditures 2 |

2,788 |

|

2,800 |

to |

3,000 |

|

2,800 |

to |

3,000 |

| Free

cash flow |

1,671 |

|

1,800 |

to |

2,000 |

|

1,900 |

to |

2,100 |

1 Guidance ranges presented as percentages

reflect percentage increases over full-year 2021

results.2 Includes additions to property, plant and equipment

net of proceeds on disposition, but does not include expenditures

for spectrum licences or additions to right-of-use assets.

The above table outlines guidance ranges for

selected full-year 2022 consolidated financial metrics without

giving effect to the Transaction (see "Shaw Transaction"), the

associated financing, or any other associated transactions or

expenses. Guidance ranges will be reassessed once the Transaction

has closed. Our guidance, including the various assumptions

underlying it, is forward-looking and should be read in conjunction

with "About Forward-Looking Information" in this earnings release,

including the material assumptions underlying it, and in our 2021

Annual MD&A and the related disclosure and information about

various economic, competitive, legal, and regulatory assumptions,

factors, and risks that may cause our actual future financial and

operating results to differ from what we currently expect.

Quarterly Financial Highlights

RevenueTotal revenue and total

service revenue increased by 4% and 6%, respectively, this quarter,

driven by revenue growth in our Wireless and Media businesses.

Wireless service revenue increased by 7% this

quarter, mainly as a result of higher roaming revenue associated

with significantly increased travel as COVID-19-related global

travel restrictions were less strict than last year, and a larger

postpaid mobile phone subscriber base. Wireless equipment revenue

decreased by 10%, as a result of fewer device upgrades by existing

subscribers and fewer of our new subscribers purchasing

devices.

Cable service revenue increased by 1% this

quarter, primarily as a result of service pricing changes this

quarter and the increases in our Internet and Video subscriber

bases, partially offset by declines in our Home Phone and Smart

Home Monitoring subscriber bases.

Media revenue increased by 10% this quarter,

primarily as a result of higher sports-related revenue, partially

offset by lower Today's Shopping Choice™ revenue.

Adjusted EBITDA and

marginsConsolidated adjusted EBITDA increased 11% this

quarter and our adjusted EBITDA margin increased by 260 basis

points primarily due to increases in Wireless and Cable adjusted

EBITDA.

Wireless adjusted EBITDA increased by 7%,

primarily as a result of the flow-through of revenue growth. This

gave rise to an adjusted EBITDA service margin of 63.0%.

Cable adjusted EBITDA increased by 13%,

primarily as a result of cost efficiencies, including lower content

and people related costs. This gave rise to an adjusted EBITDA

margin of 53.2%.

Media adjusted EBITDA decreased by $7 million

this quarter, primarily due to higher programming, production, and

other operating costs as a result of increased activities as

COVID-19 restrictions eased, and the timing of player salaries

pertaining to Toronto Blue Jays™ player trades, partially offset by

higher revenue as discussed above.

Net income and adjusted net

incomeNet income and adjusted net income increased this

quarter by 9% and 17%, respectively, primarily as a result of

higher adjusted EBITDA.

Cash flow and available

liquidityThis quarter, we generated cash flow from

operating activities of $813 million, up 20%, as a result of higher

adjusted EBITDA with the impact of lower income taxes paid largely

offset by a higher investment in net operating assets. We also

generated free cash flow of $515 million, up 31%, primarily as a

result of higher adjusted EBITDA and lower cash income taxes.

This quarter, we issued $13.3 billion senior

notes (US$7.05 billion and $4.25 billion) with a weighted average

interest rate and term to maturity of 4.21% and 13.9 years,

respectively. We also issued US$750 million subordinated notes due

2082 with a coupon of 5.25% for the first five years. See "Managing

our Liquidity and Financial Resources" in our Q1 2022 MD&A for

more information. Our debt leverage ratio3 was 3.3 as at March 31,

2022, down from 3.4 as at December 31, 2021.

As at March 31, 2022, we had $3.9 billion

of available liquidity3 (December 31, 2021 - $4.2 billion),

including $0.8 billion in cash and cash equivalents and a combined

$3.1 billion available under our bank credit facilities. We also

held $13.1 billion in restricted cash and cash equivalents that

will be used to partially fund the cash consideration of the

Transaction (see "Managing our Liquidity and Financial Resources"

in our Q1 2022 MD&A).

We also returned $252 million in dividends to

shareholders this quarter and we declared a $0.50 per share

dividend on April 19, 2022.

______________________________

3 Debt leverage ratio and available liquidity

are capital management measures. See "Non-GAAP and Other Financial

Measures" and "Financial Condition" in our Q1 2022 MD&A for

more information about these measures, available at

www.sedar.com.

Shaw Transaction

On March 15, 2021, we announced an agreement

with Shaw to acquire all of Shaw's issued and outstanding Class A

Participating Shares and Class B Non-Voting Participating Shares

for a price of $40.50 per share in cash, with the exception of the

shares held by the Shaw Family Living Trust, the controlling

shareholder of Shaw, and related persons (Shaw Family

Shareholders). The Shaw Family Shareholders will receive 60% of the

consideration for their shares in the form of RCI Class B

Non-Voting common shares on the basis of the volume-weighted

average trading price for such shares for the ten trading days

ended March 12, 2021, and the balance in cash. The Transaction is

valued at approximately $26 billion, including the assumption of

approximately $6 billion of Shaw debt.

The Transaction will be implemented through a

court-approved plan of arrangement under the Business Corporations

Act (Alberta). The Transaction is subject to other customary

closing conditions, including receipt of applicable approvals and

expiry of certain waiting periods under the Competition Act

(Canada) and the Radiocommunication Act (Canada) (collectively, Key

Regulatory Approvals). Subject to receipt of all required approvals

and satisfaction of other conditions prior to closing, the

Transaction is expected to close in the second quarter of 2022.

Rogers has extended the outside date for closing the Transaction

from March 15, 2022 to June 13, 2022 in accordance with the terms

of the arrangement agreement.

In connection with the Transaction, we entered

into a binding commitment letter for a committed credit facility

with a syndicate of banks in an original amount up to $19 billion.

During the second quarter of 2021, we entered into a $6 billion

non-revolving credit facility (Shaw term loan facility), which

reduced the amount available under the committed credit facility to

$13 billion. This quarter, we issued US$7.05 billion and $4.25

billion senior notes, which reduced the amount available under the

committed credit facility to nil and the facility was terminated.

The arrangement agreement between Rogers and Shaw requires us to

maintain sufficient liquidity to ensure we are able to fund the

Transaction upon closing and, as a result of the termination of the

committed credit facility, we have restricted $13,131 million in

funds, which are recognized as "restricted cash and cash

equivalents" on our first quarter interim condensed consolidated

statement of financial position. These funds have been invested in

short-term, highly liquid investments such as bank term deposits

and Canadian federal and provincial government bonds and are

readily convertible to cash. These notes (except the $1.25 billion

senior notes due 2025) also contain a "special mandatory

redemption" clause, which requires them to be redeemed at 101% of

face value if the Transaction cannot be consummated by December 31,

2022. See "Managing our Liquidity and Financial Resources" in our

Q1 2022 MD&A for more information on the committed facility and

our restricted cash and cash equivalents balance.

We also expect that RCI will either assume

Shaw's senior notes or provide a guarantee of Shaw's payment

obligations under those senior notes upon closing the Transaction

and, in either case, Rogers Communications Canada Inc. (RCCI) will

guarantee Shaw's payment obligations under those senior notes.

On March 24, 2022, the CRTC approved our

acquisition of Shaw's broadcasting services, subject to a number of

conditions and modifications that are detailed in "Regulatory

Developments". The CRTC approval only relates to the broadcasting

elements of the Transaction. The Transaction continues to be

reviewed by the Competition Bureau and Innovation, Science and

Economic Development Canada (ISED Canada).

About Rogers

Rogers is a leading Canadian technology and

media company that provides world-class communications services and

entertainment to consumers and businesses on our award-winning

networks. Our founder, Ted Rogers, purchased his first radio

station, CHFI, in 1960. Today, we are dedicated to providing

industry-leading wireless, cable, sports, and media to millions of

customers across Canada. Our shares are publicly traded on the

Toronto Stock Exchange (TSX: RCI.A and RCI.B) and on the New York

Stock Exchange (NYSE: RCI).

|

Investment community contact |

Media contact |

| |

|

| Paul Carpino |

Chloe Luciani-Girouard |

| 647.435.6470 |

647.241.3946 |

|

paul.carpino@rci.rogers.com |

chloe.luciani@rci.rogers.com |

Quarterly Investment Community

Teleconference

Our first quarter 2022 results teleconference

with the investment community will be held on:

- April 20, 2022

- 8:00 a.m. Eastern Time

- webcast available at

investors.rogers.com

- media are welcome to participate on

a listen-only basis

A rebroadcast will be available at

investors.rogers.com for at least two weeks following the

teleconference. Additionally, investors should note that from time

to time, Rogers' management presents at brokerage-sponsored

investor conferences. Most often, but not always, these conferences

are webcast by the hosting brokerage firm, and when they are

webcast, links are made available on Rogers' website at

investors.rogers.com.

For More Information

You can find more information relating to us on

our website (investors.rogers.com), on SEDAR (sedar.com), and on

EDGAR (sec.gov), or you can e-mail us at

investor.relations@rci.rogers.com. Information on or connected to

these and any other websites referenced in this earnings release is

not part of, or incorporated into, this earnings release.

You can also go to investors.rogers.com for

information about our governance practices, environmental, social,

and governance (ESG) reporting, a glossary of communications and

media industry terms, and additional information about our

business.

About this Earnings Release

This earnings release contains important

information about our business and our performance for the three

months ended March 31, 2022, as well as forward-looking

information about future periods. This earnings release should be

read in conjunction with our First Quarter 2022 Interim Condensed

Consolidated Financial Statements (First Quarter 2022 Interim

Financial Statements) and notes thereto, which have been prepared

in accordance with International Accounting Standard 34, Interim

Financial Reporting, as issued by the International Accounting

Standards Board (IASB); our 2021 Annual MD&A; our 2021 Annual

Audited Consolidated Financial Statements and notes thereto, which

have been prepared in accordance with IFRS as issued by the IASB;

and our other recent filings with Canadian and US securities

regulatory authorities, including our Annual Information Form,

which are available on SEDAR at sedar.com or EDGAR at sec.gov,

respectively.

Effective January 1, 2022, we have changed the

way in which we report certain subscriber metrics in both our

Wireless and Cable segments. Commencing this quarter, we will begin

presenting postpaid mobile phone subscribers, prepaid mobile phone

subscribers, and mobile phone ARPU in our Wireless segment. We will

also no longer report blended average billings per unit (ABPU). In

Cable, we will begin presenting retail Internet, Video (formerly

Television), Smart Home Monitoring, and Home Phone subscribers.

These changes are a result of shifts in the ways in which we manage

our business, including the significant adoption of our wireless

device financing program, and to better align with industry

practices. See "Results of our Reportable Segments" and "Key

Performance Indicators" for more information. We have

retrospectively amended our 2021 comparative segment results to

account for this redefinition.

For more information about Rogers, including

product and service offerings, competitive market and industry

trends, our overarching strategy, key performance drivers, and

objectives, see "Understanding Our Business", "Our Strategy, Key

Performance Drivers, and Strategic Highlights", and "Capability to

Deliver Results" in our 2021 Annual MD&A.

We, us, our, Rogers, Rogers Communications, and

the Company refer to Rogers Communications Inc. and its

subsidiaries. RCI refers to the legal entity Rogers Communications

Inc., not including its subsidiaries. Rogers also holds interests

in various investments and ventures.

All dollar amounts in this earnings release are

in Canadian dollars unless otherwise stated and are unaudited. All

percentage changes are calculated using the rounded numbers as they

appear in the tables. This earnings release is current as at

April 19, 2022 and was approved by RCI's Board of Directors

(the Board) on that date. This earnings release includes

forward-looking statements and assumptions. See "About

Forward-Looking Information" for more information.

We are publicly traded on the Toronto Stock

Exchange (TSX: RCI.A and RCI.B) and on the New York Stock Exchange

(NYSE: RCI).

In this earnings release, this quarter, the

quarter, or first quarter refer to the three months ended

March 31, 2022, unless the context indicates otherwise. All

results commentary is compared to the equivalent period in 2021 or

as at December 31, 2021, as applicable, unless otherwise

indicated. References to COVID-19 are to the pandemic from the

outbreak of this virus and to its associated impacts in the

jurisdictions in which we operate and globally, as applicable.

™Rogers and related marks are trademarks of

Rogers Communications Inc. or an affiliate, used under licence. All

other brand names, logos, and marks are trademarks and/or copyright

of their respective owners. ©2022 Rogers Communications

Reportable segmentsWe report

our results of operations in three reportable segments. Each

segment and the nature of its business is as follows:

|

Segment |

Principal activities |

|

Wireless |

Wireless telecommunications operations for Canadian consumers and

businesses. |

|

Cable |

Cable telecommunications operations, including Internet, television

and other video (Video), telephony (Home Phone), and smart home

monitoring services for Canadian consumers and businesses, and

network connectivity through our fibre network and data centre

assets to support a range of voice, data, networking, hosting, and

cloud-based services for the business, public sector, and carrier

wholesale markets. |

|

Media |

A diversified portfolio of media properties, including sports media

and entertainment, television and radio broadcasting, specialty

channels, multi-platform shopping, and digital media. |

Wireless and Cable are operated by our wholly

owned subsidiary, RCCI, and certain of our other wholly owned

subsidiaries. Media is operated by our wholly owned subsidiary,

Rogers Media Inc., and its subsidiaries.

Summary of Consolidated Financial Results

| |

Three months ended March 31 |

|

|

|

(In millions of dollars, except margins and per share amounts) |

|

2022 |

|

|

|

2021 |

|

|

|

% Chg |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

Wireless |

|

2,140 |

|

|

|

2,074 |

|

|

|

3 |

|

|

|

Cable |

|

1,036 |

|

|

|

1,020 |

|

|

|

2 |

|

|

|

Media |

|

482 |

|

|

|

440 |

|

|

|

10 |

|

|

|

Corporate items and intercompany eliminations |

|

(39 |

) |

|

|

(46 |

) |

|

|

(15 |

) |

|

|

Revenue |

|

3,619 |

|

|

|

3,488 |

|

|

|

4 |

|

|

|

Total service revenue 1 |

|

3,196 |

|

|

|

3,021 |

|

|

|

6 |

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

|

|

|

Wireless |

|

1,085 |

|

|

|

1,013 |

|

|

|

7 |

|

|

|

Cable |

|

551 |

|

|

|

487 |

|

|

|

13 |

|

|

|

Media |

|

(66 |

) |

|

|

(59 |

) |

|

|

12 |

|

|

|

Corporate items and intercompany eliminations |

|

(31 |

) |

|

|

(50 |

) |

|

|

(38 |

) |

|

|

Adjusted EBITDA |

|

1,539 |

|

|

|

1,391 |

|

|

|

11 |

|

|

|

Adjusted EBITDA margin 2 |

|

42.5 |

|

% |

|

39.9 |

|

% |

|

2.6 |

|

pts |

|

|

|

|

|

|

Net income |

|

392 |

|

|

|

361 |

|

|

|

9 |

|

|

|

Basic earnings per share |

|

$0.78 |

|

|

|

$0.71 |

|

|

|

10 |

|

|

|

Diluted earnings per share |

|

$0.77 |

|

|

|

$0.70 |

|

|

|

10 |

|

|

|

|

|

|

|

|

Adjusted net income |

|

462 |

|

|

|

394 |

|

|

|

17 |

|

|

|

Adjusted basic earnings per share 2 |

|

$0.91 |

|

|

|

$0.78 |

|

|

|

17 |

|

|

|

Adjusted diluted earnings per share |

|

$0.91 |

|

|

|

$0.77 |

|

|

|

18 |

|

|

|

|

|

|

|

|

Capital expenditures |

|

649 |

|

|

|

484 |

|

|

|

34 |

|

|

|

Cash provided by operating activities |

|

813 |

|

|

|

679 |

|

|

|

20 |

|

|

|

Free cash flow |

|

515 |

|

|

|

394 |

|

|

|

31 |

|

|

1 As defined. See "Key Performance

Indicators". 2 Adjusted EBITDA margin is a supplementary

financial measure. Adjusted basic earnings per share is a non-GAAP

ratio. Adjusted net income is a non-GAAP financial measure and is a

component of adjusted basic earnings per share. These are not

standardized financial measures under IFRS and might not be

comparable to similar financial measures disclosed by other

companies. See "Non-GAAP and Other Financial Measures" in our Q1

2022 MD&A for more information about each of these measures,

available at www.sedar.com.

Results of our Reportable Segments

WIRELESS

Wireless Financial Results

| |

Three months ended March 31 |

|

|

|

(In millions of dollars, except margins) |

2022 |

|

|

2021 |

|

|

% Chg |

|

|

|

|

|

|

|

|

|

|

Revenue |

|

|

|

|

|

|

Service revenue |

1,723 |

|

|

1,609 |

|

|

7 |

|

|

|

Equipment revenue |

417 |

|

|

465 |

|

|

(10 |

) |

|

|

Revenue |

2,140 |

|

|

2,074 |

|

|

3 |

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

Cost of equipment |

426 |

|

|

466 |

|

|

(9 |

) |

|

|

Other operating expenses |

629 |

|

|

595 |

|

|

6 |

|

|

|

Operating expenses |

1,055 |

|

|

1,061 |

|

|

(1 |

) |

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

1,085 |

|

|

1,013 |

|

|

7 |

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA service margin 1 |

63.0 |

|

% |

63.0 |

|

% |

— |

|

pts |

|

Adjusted EBITDA margin 2 |

50.7 |

|

% |

48.8 |

|

% |

1.9 |

|

pts |

|

Capital expenditures |

337 |

|

|

225 |

|

|

50 |

|

|

1 Calculated using service

revenue.2 Calculated using total revenue.

Wireless Subscriber Results 1

| |

Three months ended March 31 |

|

|

|

(In thousands, except churn and mobile phone ARPU) |

2022 |

|

|

2021 |

|

|

Chg |

|

|

|

|

|

|

|

|

|

|

Postpaid mobile phone |

|

|

|

|

|

|

Gross additions |

254 |

|

|

231 |

|

|

23 |

|

|

|

Net additions |

66 |

|

|

22 |

|

|

44 |

|

|

|

Total postpaid mobile phone subscribers 2 |

8,913 |

|

|

8,466 |

|

|

447 |

|

|

|

Churn (monthly) |

0.71 |

|

% |

0.83 |

|

% |

(0.12 |

|

pts) |

|

Prepaid mobile phone |

|

|

|

|

|

|

Gross additions |

151 |

|

|

106 |

|

|

45 |

|

|

|

Net losses |

(16 |

) |

|

(56 |

) |

|

40 |

|

|

|

Total prepaid mobile phone subscribers 2 |

1,150 |

|

|

1,204 |

|

|

(54 |

) |

|

|

Churn (monthly) |

4.82 |

|

% |

4.36 |

|

% |

0.46 |

|

pts |

|

Mobile phone ARPU (monthly) |

$57.25 |

|

|

$55.42 |

|

|

$1.83 |

|

|

1 Subscriber counts and subscriber churn

are key performance indicators. See "Key Performance

Indicators".2 As at end of period.

Service revenueThe 7% increase

in service revenue this quarter was primarily a result of:

- higher roaming revenue associated

with significantly increased travel as COVID-19-related global

travel restrictions were less strict than last year; and

- a larger postpaid mobile phone

subscriber base.

The 3% increase in mobile phone ARPU this

quarter was a result of the increased roaming revenue.

The increase in postpaid gross additions and the

higher postpaid net additions this quarter were a result of strong

execution and an increase in market activity by Canadians with the

continuing improvement of the economy.

Equipment revenueThe 10%

decrease in equipment revenue this quarter was a result of:

- fewer device upgrades by existing

customers; and

- fewer of our new subscribers

purchasing devices.

Operating expensesCost of

equipmentThe 9% decrease in the cost of equipment this quarter was

a result of the same factors discussed in equipment revenue

above.

Other operating expensesThe 6% increase in other

operating expenses this quarter was primarily a result of higher

costs associated with the increased roaming revenue.

Adjusted EBITDAThe 7% increase

in adjusted EBITDA this quarter was a result of the revenue and

expense changes discussed above.

CABLE

Cable Financial Results

| |

Three months ended March 31 |

|

|

|

(In millions of dollars, except margins) |

2022 |

|

|

2021 |

|

|

% Chg |

|

|

|

|

|

|

|

|

|

|

Revenue |

|

|

|

|

|

|

Service revenue |

1,030 |

|

|

1,018 |

|

|

1 |

|

|

|

Equipment revenue |

6 |

|

|

2 |

|

|

200 |

|

|

|

Revenue |

1,036 |

|

|

1,020 |

|

|

2 |

|

|

|

|

|

|

|

|

|

|

Operating expenses |

485 |

|

|

533 |

|

|

(9 |

) |

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

551 |

|

|

487 |

|

|

13 |

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA margin |

53.2 |

|

% |

47.7 |

|

% |

5.5 |

|

pts |

|

Capital expenditures |

256 |

|

|

212 |

|

|

21 |

|

|

Cable Subscriber Results 1

|

|

Three months ended March 31 |

|

|

|

(In thousands, except ARPA and penetration) |

2022 |

|

|

2021 |

|

|

Chg |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Homes passed 2 |

4,728 |

|

|

4,599 |

|

|

129 |

|

|

|

Customer relationships |

|

|

|

|

Net additions |

5 |

|

|

6 |

|

|

(1 |

) |

|

|

Total customer relationships 2,3 |

2,589 |

|

|

2,536 |

|

|

53 |

|

|

|

ARPA (monthly) 4 |

$132.87 |

|

|

$133.95 |

|

|

($1.08 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Penetration 2 |

54.8 |

|

% |

55.1 |

|

% |

(0.3 |

|

pts) |

|

|

|

|

|

|

Retail Internet |

|

|

|

|

Net additions |

13 |

|

|

16 |

|

|

(3 |

) |

|

|

Total retail Internet subscribers 2,3 |

2,245 |

|

|

2,156 |

|

|

89 |

|

|

|

Video |

|

|

|

|

Net additions (losses) |

14 |

|

|

(12 |

) |

|

26 |

|

|

|

Total Video subscribers 2,3 |

1,507 |

|

|

1,481 |

|

|

26 |

|

|

|

Smart Home Monitoring |

|

|

|

|

Net losses |

(4 |

) |

|

(3 |

) |

|

(1 |

) |

|

|

Total Smart Home Monitoring subscribers 2 |

109 |

|

|

128 |

|

|

(19 |

) |

|

|

Home Phone |

|

|

|

|

Net losses |

(22 |

) |

|

(29 |

) |

|

7 |

|

|

|

Total Home Phone subscribers 2,3 |

890 |

|

|

967 |

|

|

(77 |

) |

|

1 Subscriber results are key performance

indicators. See "Key Performance Indicators".2 As at end of

period.3 On March 16, 2022, we acquired approximately 3,000

retail Internet subscribers, 2,000 Video subscribers, 1,000 Home

Phone subscribers, and 3,000 customer relationships as a result of

our acquisition of a small regional cable company in Nova Scotia,

which are not included in net additions, but do appear in the

ending total balance for March 31, 2022.4 ARPA is a

supplementary financial measure. See "Non-GAAP and Other Financial

Measures" in our Q1 2022 MD&A for an explanation as to the

composition of this measure, available at www.sedar.com.

Service revenueThe 1% increase

in service revenue was a result of:

- service pricing changes this

quarter; and

- the increase in total customer

relationships over the past year, due to growth in our Internet and

Video subscriber bases; partially offset by

- declines in our Home Phone and

Smart Home Monitoring subscriber bases.

The 1% decrease in ARPA was primarily a result

of an increase in our customer relationships on lower monthly price

plans.

Operating expensesThe 9%

decrease in operating expenses this quarter was primarily a result

of cost efficiencies, including lower content-related costs,

partially due to negotiation of certain content rates with

suppliers, and lower people-related costs.

Adjusted EBITDAThe 13% increase

in adjusted EBITDA this quarter was a result of the service revenue

and expense changes discussed above.

MEDIA

Media Financial Results

|

|

Three months ended March 31 |

|

|

|

(In millions of dollars, except margins) |

2022 |

|

|

2021 |

|

|

% Chg |

|

|

|

|

|

|

|

|

|

|

Revenue |

482 |

|

|

440 |

|

|

10 |

|

|

|

Operating expenses |

548 |

|

|

499 |

|

|

10 |

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

(66 |

) |

|

(59 |

) |

|

12 |

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA margin |

(13.7 |

) |

% |

(13.4 |

) |

% |

(0.3 |

|

pts) |

|

Capital expenditures |

22 |

|

|

18 |

|

|

22 |

|

|

RevenueThe 10% increase in

revenue this quarter was a result of:

- higher sports-related revenues,

including negotiation of certain content rates; partially offset

by

- lower Today's Shopping Choice revenue.

Operating expensesThe 10%

increase in operating expenses this quarter was a result of:

- higher programming costs;

- higher production costs and other

general operating costs as a result of increased activities as

COVID-19 restrictions eased; and

- the timing of player salaries

pertaining to Toronto Blue Jays player trades.

Adjusted EBITDAThe decrease in

adjusted EBITDA this quarter was a result of the revenue and

expense changes discussed above.

CAPITAL EXPENDITURES

|

|

Three months ended March 31 |

|

|

|

(In millions of dollars, except capital intensity) |

2022 |

|

|

2021 |

|

|

% Chg |

|

|

|

|

|

|

|

|

|

|

Wireless |

337 |

|

|

225 |

|

|

50 |

|

|

|

Cable |

256 |

|

|

212 |

|

|

21 |

|

|

|

Media |

22 |

|

|

18 |

|

|

22 |

|

|

|

Corporate |

34 |

|

|

29 |

|

|

17 |

|

|

|

|

|

|

|

|

|

|

Capital expenditures 1 |

649 |

|

|

484 |

|

|

34 |

|

|

|

|

|

|

|

|

|

|

Capital intensity 2 |

17.9 |

|

% |

13.9 |

|

% |

4.0 |

|

pts |

1 Includes additions to property, plant and

equipment net of proceeds on disposition, but does not include

expenditures for spectrum licences or additions to right-of-use

assets.2 Capital intensity is a supplementary financial

measure. See "Non-GAAP and Other Financial Measures" in our Q1 2022

MD&A for an explanation as to the composition of this measure,

available at www.sedar.com.

One of our focus areas for the year is to

deliver world-class connectivity to Canadian consumers and

businesses. To do this, we expect to spend more on our wireless and

wireline networks this year than we have in the past several years.

This year, we will continue to roll out our 5G network, the largest

and most reliable 5G network in Canada, across the country. We will

also continue to invest in fibre deployments, including

fibre-to-the-home (FTTH), in our cable network and we will expand

our network footprint to reach more homes and businesses.

These investments will help us bridge the

digital divide and expand our network to underserved areas through

participation in various programs and projects. To connect these

underserved areas, we are deploying unified access transport

technology, which allows wireline and wireless networks to converge

over a unified Internet protocol and optical transport network.

WirelessThe increase in capital

expenditures in Wireless this quarter was a result of investments

made to upgrade our wireless network to continue to deliver

reliable performance for our customers. We continued to emphasize

our 5G deployments in the 600 MHz band, and preparing our network

to deploy the newly acquired 3500 MHz spectrum licences later this

year, as we have deployed our 5G network in more than 1,500

communities and we launched the first commercial 5G standalone

network in Canada.

CableThe increase in capital

expenditures in Cable this quarter reflects continued investments

in our network infrastructure, including additional fibre

deployments to increase our FTTH distribution. These upgrades will

lower the number of homes passed per node and incorporate the

latest technologies to help deliver more bandwidth and an even more

reliable customer experience as we progress in our connected home

roadmap, including service footprint expansion and upgrades to our

DOCSIS 3.1 platform to evolve to DOCSIS 4.0, to offer increased

download speeds over time.

Capital intensityCapital

intensity increased this quarter as a result of higher capital

expenditures, partially offset by higher revenue, as discussed

above.

Regulatory Developments

See our 2021 Annual MD&A for a discussion of

the significant regulations that affected our operations as at

March 3, 2022. The following are the significant regulatory

developments since that date.

CRTC review of the

TransactionOn March 24, 2022, the CRTC approved our

acquisition of Shaw's broadcasting services, subject to a number of

conditions and modifications, including:

- the contribution of $27.2 million

in benefits to the broadcasting system through various initiatives

and funds, including those that support the production of content

by Indigenous producers and members of equity-seeking groups;

- annual reporting on our commitments

to increase our support for local news, including by employing more

journalists at our Citytv™ stations across the country and by

producing an additional 48 news specials each year that reflect

local communities;

- the distribution of at least 45

independent English- and French-language services on each of our

cable and satellite services; and

- safeguards to ensure that cable

providers relying on signals delivered by us will continue to be

able to serve their communities, including those in rural and

remote areas.

The CRTC approval only relates to the

broadcasting elements of the Transaction. The Transaction continues

to be reviewed by the Competition Bureau and ISED Canada.

Key Performance Indicators

We measure the success of our strategy using a

number of key performance indicators that are defined and discussed

in our 2021 Annual MD&A and this earnings release. We believe

these key performance indicators allow us to appropriately measure

our performance against our operating strategy and against the

results of our peers and competitors. The following key performance

indicators, some of which are non-GAAP or other financial measures

(see "Non-GAAP and Other Financial Measures" in our Q1 2022

MD&A), are not measurements in accordance with IFRS. They

include:

|

• |

subscriber counts; |

|

• |

Cable average revenue per account (ARPA); |

|

|

• |

Wireless; |

|

• |

Cable customer relationships; |

|

|

• |

Cable; and |

|

• |

Cable market penetration (penetration); |

|

|

• |

homes passed (Cable); |

|

• |

capital intensity; and |

|

• |

Wireless subscriber churn (churn); |

|

• |

total service revenue. |

|

• |

Wireless mobile phone average revenue per user (ARPU); |

|

|

|

Commencing this quarter, we are disclosing

mobile phone subscribers in Wireless, which represent devices with

voice-only or voice-and-data plans. Our previous definition

included devices on data-only plans and customers who subscribe to

our wireless home phone service. As a result, our definition of

ARPU has also shifted to mobile phone ARPU. We also no longer

report blended ABPU given the significant adoption of our wireless

device financing program resulting in this metric being less

meaningful.

In Cable, we have adjusted our definition of an

Internet subscriber such that it only includes retail Internet

subscribers, representing customers who have Internet service

installed and operating, and are being billed directly by us. Our

previous definition included third-party Internet access

subscribers and Smart Home Monitoring subscribers. We will also

begin reporting Video (consisting of Ignite TV and legacy

Television subscribers), Smart Home Monitoring, and Home Phone

subscribers in separate categories. Our updated definitions are as

follows:

Subscriber countsSubscriber

count (Wireless)

- A wireless subscriber is

represented by each identifiable telephone number.

- We report wireless subscribers in

two categories: postpaid mobile phone and prepaid mobile phone.

Postpaid and prepaid include voice-only subscribers and subscribers

with service plans including both voice and data.

- Usage and overage charges for

postpaid subscribers are billed a month in arrears. Prepaid

subscribers cannot incur usage and/or overage charges in excess of

their plan limits or account balance.

- Wireless prepaid subscribers are

considered active for a period of 90 days from the date of their

last revenue-generating usage.

Subscriber count (Cable)

- Cable retail Internet, Video, and

Smart Home Monitoring subscribers are represented by a dwelling

unit; Cable Home Phone subscribers are represented by line

counts.

- When there is more than one unit in

a single dwelling, such as an apartment building, each tenant with

cable service is counted as an individual subscriber, whether the

service is invoiced separately or included in the tenant's rent.

Institutional units, such as hospitals or hotels, are each

considered one subscriber.

- Cable retail Internet, Video, Smart

Home Monitoring, and Home Phone subscribers include only those

subscribers who have service installed and operating, and who are

being billed accordingly.

- Subscriber counts exclude certain

business services delivered over our fibre network and data centre

infrastructure, and circuit-switched local and long distance voice

services and legacy data services where access is delivered using

leased third-party network elements and tariffed ILEC

services.

Mobile phone average revenue per user

(Wireless) Mobile phone ARPU helps us identify trends and

measure our success in attracting and retaining higher-value

subscribers. Mobile phone ARPU is a supplementary financial

measure. See "Non-GAAP and Other Financial Measures" in our Q1 2022

MD&A for an explanation as to the composition of this

measure.

Non-GAAP and Other Financial Measures

Reconciliation of adjusted EBITDA

|

|

Three months ended March 31 |

|

|

(In millions of dollars) |

2022 |

|

2021 |

|

|

|

|

|

|

|

Net income |

392 |

|

361 |

|

|

Add: |

|

|

|

|

Income tax expense |

153 |

|

128 |

|

|

Finance costs |

258 |

|

218 |

|

|

Depreciation and amortization |

646 |

|

638 |

|

|

EBITDA |

1,449 |

|

1,345 |

|

|

Add (deduct): |

|

|

|

|

Other (income) expense |

(6 |

) |

1 |

|

|

Restructuring, acquisition and other |

96 |

|

45 |

|

|

|

|

|

|

|

Adjusted EBITDA |

1,539 |

|

1,391 |

|

Reconciliation of adjusted net income

|

|

Three months ended March 31 |

|

|

(In millions of dollars) |

2022 |

|

2021 |

|

|

|

|

|

|

Net income |

392 |

|

361 |

|

|

Add (deduct): |

|

|

|

Restructuring, acquisition and other |

96 |

|

45 |

|

|

Income tax impact of above items |

(26 |

) |

(12 |

) |

|

|

|

|

|

Adjusted net income |

462 |

|

394 |

|

Rogers Communications Inc.Interim

Condensed Consolidated Statements of Income(In millions of

Canadian dollars, except per share amounts, unaudited)

| |

Three months ended March 31 |

|

|

|

2022 |

|

2021 |

|

|

|

|

|

|

Revenue |

3,619 |

|

3,488 |

|

| |

|

|

|

Operating expenses: |

|

|

|

Operating costs |

2,080 |

|

2,097 |

|

|

Depreciation and amortization |

646 |

|

638 |

|

|

Restructuring, acquisition and other |

96 |

|

45 |

|

|

Finance costs |

258 |

|

218 |

|

|

Other (income) expense |

(6 |

) |

1 |

|

|

|

|

|

|

Income before income tax expense |

545 |

|

489 |

|

|

Income tax expense |

153 |

|

128 |

|

|

|

|

|

|

Net income for the period |

392 |

|

361 |

|

|

|

|

|

|

Earnings per share: |

|

|

|

Basic |

$0.78 |

|

$0.71 |

|

|

Diluted |

$0.77 |

|

$0.70 |

|

Rogers Communications Inc.Interim

Condensed Consolidated Statements of Financial Position(In

millions of Canadian dollars, unaudited)

|

|

As atMarch 31 |

|

As atDecember 31 |

|

| |

2022 |

|

2021 |

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents |

809 |

|

715 |

|

|

Restricted cash and cash equivalents |

13,131 |

|

— |

|

|

Accounts receivable |

3,565 |

|

3,847 |

|

|

Inventories |

540 |

|

535 |

|

|

Current portion of contract assets |

112 |

|

115 |

|

|

Other current assets |

606 |

|

497 |

|

|

Current portion of derivative instruments |

222 |

|

120 |

|

|

Total current assets |

18,985 |

|

5,829 |

|

| |

|

|

|

|

|

Property, plant and equipment |

14,790 |

|

14,666 |

|

|

Intangible assets |

12,275 |

|

12,281 |

|

|

Investments |

2,510 |

|

2,493 |

|

|

Derivative instruments |

1,293 |

|

1,431 |

|

|

Financing receivables |

771 |

|

854 |

|

|

Other long-term assets |

401 |

|

385 |

|

|

Goodwill |

4,025 |

|

4,024 |

|

|

|

|

|

|

|

|

Total assets |

55,050 |

|

41,963 |

|

|

|

|

|

|

|

|

Liabilities and shareholders' equity |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Short-term borrowings |

2,695 |

|

2,200 |

|

|

Accounts payable and accrued liabilities |

2,782 |

|

3,416 |

|

|

Income tax payable |

186 |

|

115 |

|

|

Other current liabilities |

303 |

|

607 |

|

|

Contract liabilities |

406 |

|

394 |

|

|

Current portion of long-term debt |

1,225 |

|

1,551 |

|

|

Current portion of lease liabilities |

346 |

|

336 |

|

|

Total current liabilities |

7,943 |

|

8,619 |

|

|

|

|

|

|

|

|

Provisions |

51 |

|

50 |

|

|

Long-term debt |

30,195 |

|

17,137 |

|

|

Lease liabilities |

1,642 |

|

1,621 |

|

|

Other long-term liabilities |

676 |

|

565 |

|

|

Deferred tax liabilities |

3,430 |

|

3,439 |

|

|

Total liabilities |

43,937 |

|

31,431 |

|

|

|

|

|

|

|

|

Shareholders' equity |

11,113 |

|

10,532 |

|

|

|

|

|

|

|

|

Total liabilities and shareholders' equity |

55,050 |

|

41,963 |

|

Rogers Communications Inc.Interim

Condensed Consolidated Statements of Cash Flows(In

millions of Canadian dollars, unaudited)

| |

Three months ended March 31 |

|

|

|

2022 |

|

2021 |

|

|

Operating activities: |

|

|

|

Net income for the period |

392 |

|

361 |

|

|

Adjustments to reconcile net income to cash provided by operating

activities: |

|

|

|

Depreciation and amortization |

646 |

|

638 |

|

|

Program rights amortization |

20 |

|

20 |

|

|

Finance costs |

258 |

|

218 |

|

|

Income tax expense |

153 |

|

128 |

|

|

Post-employment benefits contributions, net of expense |

6 |

|

16 |

|

|

Other |

13 |

|

26 |

|

|

Cash provided by operating activities before changes in net

operating assets and liabilities, income taxes paid, and interest

paid |

1,488 |

|

1,407 |

|

|

Change in net operating assets and liabilities |

(321 |

) |

(187 |

) |

|

Income taxes paid |

(140 |

) |

(325 |

) |

|

Interest paid |

(214 |

) |

(216 |

) |

|

|

|

|

|

Cash provided by operating activities |

813 |

|

679 |

|

|

|

|

|

|

Investing activities: |

|

|

|

Capital expenditures |

(649 |

) |

(484 |

) |

|

Additions to program rights |

(12 |

) |

(12 |

) |

|

Changes in non-cash working capital related to capital expenditures

and intangible assets |

(172 |

) |

(116 |

) |

|

Acquisitions and other strategic transactions, net of cash

acquired |

(9 |

) |

— |

|

|

Other |

12 |

|

(6 |

) |

|

|

|

|

|

Cash used in investing activities |

(830 |

) |

(618 |

) |

|

|

|

|

|

Financing activities: |

|

|

|

Net proceeds received from short-term borrowings |

503 |

|

22 |

|

|

Net issuance (repayment) of long-term debt |

13,311 |

|

(1,450 |

) |

|

Net payments on settlement of debt derivatives and forward

contracts |

(74 |

) |

(2 |

) |

|

Transaction costs incurred |

(169 |

) |

— |

|

|

Principal payments of lease liabilities |

(77 |

) |

(62 |

) |

|

Dividends paid |

(252 |

) |

(252 |

) |

|

|

|

|

|

Cash provided by (used in) financing activities |

13,242 |

|

(1,744 |

) |

|

|

|

|

|

Change in cash and cash equivalents and restricted cash and cash

equivalents |

13,225 |

|

(1,683 |

) |

|

Cash and cash equivalents and restricted cash and cash equivalents,

beginning of period |

715 |

|

2,484 |

|

|

|

|

|

|

Cash and cash equivalents and restricted cash and cash equivalents,

end of period |

13,940 |

|

801 |

|

|

|

|

|

|

Cash and cash equivalents |

809 |

|

801 |

|

|

Restricted cash and cash equivalents |

13,131 |

|

— |

|

|

|

|

|

|

Cash and cash equivalents and restricted cash and cash equivalents,

end of period |

13,940 |

|

801 |

|

About Forward-Looking Information

This earnings release includes "forward-looking

information" and "forward-looking statements" within the meaning of

applicable securities laws (collectively, "forward-looking

information"), and assumptions about, among other things, our

business, operations, and financial performance and condition

approved by our management on the date of this earnings release.

This forward-looking information and these assumptions include, but

are not limited to, statements about our objectives and strategies

to achieve those objectives, and about our beliefs, plans,

expectations, anticipations, estimates, or intentions.

Forward-looking information

- typically includes words like

could, expect, may, anticipate, assume, believe, intend, estimate,

plan, project, guidance, outlook, target, and similar

expressions;

- includes conclusions, forecasts,

and projections that are based on our current objectives and

strategies and on estimates, expectations, assumptions, and other

factors that we believe to have been reasonable at the time they

were applied but may prove to be incorrect; and

- was approved by our management on

the date of this earnings release.

Our forward-looking information includes

forecasts and projections related to the following items, among

others:

- revenue;

- total service revenue;

- adjusted EBITDA;

- capital expenditures;

- cash income tax payments;

- free cash flow;

- dividend payments;

- the growth of new products and services;

- expected growth in subscribers and the services to which they

subscribe;

- the cost of acquiring and retaining subscribers and deployment

of new services;

|

|

- continued cost reductions and efficiency improvements;

- our debt leverage ratio;

- statements relating to plans we have implemented in response to

COVID-19 and its impact on us;

- the expected timing and completion of the Transaction;

- the benefits expected to result from the Transaction, including

corporate, operational, scale, and other synergies, and their

anticipated timing; and

- all other statements that are not historical facts.

|

Specific forward-looking information included or

incorporated in this document includes, but is not limited to, our

information and statements under "Financial Guidance" relating to

our 2022 consolidated guidance on total service revenue, adjusted

EBITDA, capital expenditures, and free cash flow, which were

originally provided on January 27, 2022.

Key underlying assumptionsOur 2022 guidance

ranges presented in "Financial Guidance" are based on many

assumptions including, but not limited to, the following material

assumptions for the full-year 2022:

- a steady improvement in the general

COVID-19 environment throughout 2022, including:

- the continued reopening of the

economy, including increasing immigration and the return of foreign

students;

- no further significant

restrictions, such as border closures, travel restrictions,

capacity restrictions, sports venue closures, or stay-at-home

orders; and

- no material negative impact

resulting from global supply chain interruptions;

- continued competitive intensity in

all segments in which we operate consistent with levels experienced

in 2021;

- no significant additional legal or

regulatory developments, other shifts in economic conditions, or

macro changes in the competitive environment affecting our business

activities;

- Wireless customers continue to

adopt, and upgrade to, higher-value smartphones at similar rates in

2022 compared to 2021;

- overall wireless market penetration

in Canada grows in 2022 at a similar rate as in 2021;

- continued subscriber growth in

Internet;

- declining Video subscribers,

including the impact of customers migrating to Ignite TV from our

legacy product, as subscription streaming services and other

over-the-top providers continue to grow in popularity;

- in Media, continued growth in

sports and relative stability in other traditional media

businesses;

- with respect to the increase in

capital expenditures:

- we continue to invest to ensure we

have competitive wireless and cable networks through (i) expanding

our 5G wireless network, including building on Canada's first

standalone 5G core network and using our 3500 MHz spectrum licences

to introduce new 5G innovation and services and (ii) upgrading our

hybrid fibre-coaxial network to lower the number of homes passed

per node, utilize the latest technologies, and deliver an even more

reliable customer experience; and

- we continue to make expenditures

related to our connected home roadmap in 2022 and we make progress

on our service footprint expansion projects;

- a substantial portion of our 2022

US dollar-denominated expenditures is hedged at an average exchange

rate of $1.29/US$;

- key interest rates remain

relatively stable throughout 2022; and

- we retain our investment-grade

credit ratings.

Our conclusions, forecasts, and projections are

based on a number of estimates, expectations, assumptions, and

other factors, including, among others:

- general economic and industry growth rates;

- currency exchange rates and interest rates;

- product pricing levels and competitive intensity;

- subscriber growth;

- pricing, usage, and churn rates;

- changes in government regulation;

- technology and network deployment;

|

|

- availability of devices;

- timing of new product launches;

- content and equipment costs;

- the integration of acquisitions;

- industry structure and stability; and

- the impact of COVID-19 on our operations, liquidity, financial

condition, or results.

|

Except as otherwise indicated, this earnings

release and our forward-looking information do not reflect the

potential impact of any non-recurring or other special items or of

any dispositions, monetizations, mergers, acquisitions, other

business combinations, or other transactions that may be considered

or announced or may occur after the date on which the statement

containing the forward-looking information is made.

Risks and uncertaintiesActual

events and results can be substantially different from what is

expressed or implied by forward-looking information as a result of

risks, uncertainties, and other factors, many of which are beyond

our control, including, but not limited to:

- regulatory changes;

- technological changes;

- economic, geopolitical, and other conditions affecting

commercial activity;

- unanticipated changes in content or equipment costs;

- changing conditions in the entertainment, information, and

communications industries;

- sports-related work stoppages or cancellations and labour

disputes;

- the integration of acquisitions;

- litigation and tax matters;

- the level of competitive intensity;

- the emergence of new opportunities;

|

|

- external threats, such as epidemics, pandemics, and other

public health crises, natural disasters, the effects of climate

change, or cyberattacks, among others;

- risks related to the Transaction, including the timing,

receipt, and conditions of the Key Regulatory Approvals;

satisfaction of the various conditions to close the Transaction;

financing the Transaction; and the anticipated benefits and

successful integration of the businesses and operations of Rogers

and Shaw; and the other risks outlined in "Updates to Risks and

Uncertainties - Shaw Transaction" in our Q1 2022 MD&A; and

- new interpretations and new accounting standards from

accounting standards bodies.

|

These factors can also affect our objectives, strategies, and

intentions. Many of these factors are beyond our control or our

current expectations or knowledge. Should one or more of these

risks, uncertainties, or other factors materialize, our objectives,

strategies, or intentions change, or any other factors or

assumptions underlying the forward-looking information prove

incorrect, our actual results and our plans could vary

significantly from what we currently foresee.

Accordingly, we warn investors to exercise

caution when considering statements containing forward-looking

information and caution them that it would be unreasonable to rely

on such statements as creating legal rights regarding our future

results or plans. We are under no obligation (and we expressly

disclaim any such obligation) to update or alter any statements

containing forward-looking information or the factors or

assumptions underlying them, whether as a result of new

information, future events, or otherwise, except as required by

law. All of the forward-looking information in this earnings

release is qualified by the cautionary statements herein.

Before making an investment

decisionBefore making any investment decisions and for a

detailed discussion of the risks, uncertainties, and environment

associated with our business, its operations, and its financial

performance and condition, fully review the section of this

earnings release entitled "Regulatory Developments" and fully

review the sections in our 2021 Annual MD&A entitled

"Regulation in our Industry" and "Environmental, Social, and

Governance (ESG)", as well as our various other filings with

Canadian and US securities regulators, which can be found at

sedar.com and sec.gov, respectively. Information on or connected to

sedar.com, sec.gov, our website, or any other website referenced in

this document is not part of or incorporated into this earnings

release.

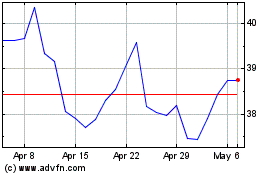

Rogers Communications (NYSE:RCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rogers Communications (NYSE:RCI)

Historical Stock Chart

From Apr 2023 to Apr 2024