Amended Statement of Beneficial Ownership (sc 13d/a)

April 18 2022 - 4:14PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)

| AMARANTUS BIOSCIENCE HOLDINGS, INC. |

| (Name of Issuer) |

| Common Stock, $0.001 par value |

| (Title of Class of Securities) |

|

Eliyahu Hassett

Lorient Ventures Limited

Palm Grove House, P.O. Box 438

Road Town, Tortola, British

Virgin Islands

+3 (505) 600-4050

With a copy to:

David E. Danovitch, Esq.

Sullivan& Worcester LLP

1633 Broadway – 32nd

Floor

New York, NY 10019

(212) 660-3000 |

| (Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications) |

| |

| April 18, 2022 |

| (Date of Event which Requires Filing of this Statement) |

If the filing person has previously filed

a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because

of 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐.

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See 240.13d-7(b) for other parties to whom copies

are to be sent.

*The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for

any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder

of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of

1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

SCHEDULE 13D

| 1 |

NAMES OF REPORTING PERSONS |

| Lorient Ventures Limited |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

|

(a) ☒

(b) ☐ |

| 3 |

SEC USE ONLY |

| |

| 4 |

SOURCE OF FUNDS (See Instructions) |

| OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) |

| ☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| British Virgin Islands |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER |

|

| |

|

| 8 |

SHARED VOTING POWER |

|

| 14,176,424* |

|

| 9 |

SOLE DISPOSITIVE POWER |

|

| |

|

| 10 |

SHARED DISPOSITIVE POWER |

|

| 14,176,424* |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| 14,176,424* |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

| ☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| 4.99%* |

| 14 |

TYPE OF REPORTING PERSON (See Instructions) |

| OO |

| |

|

|

|

|

* Includes 14,176,424 shares of Common

Stock issuable upon the conversion of convertible notes that are subject to a 4.99% blocking provision, meaning that they can be

exercised only to the extent that such conversion would not cause the holder’s and its affiliates’ beneficial ownership

of shares of Common Stock to exceed 4.99%. Excludes 358,010,446 shares of Common Stock issuable upon the conversion of convertible

notes, none of which can be converted within 60 days of the date hereof, and are, therefore, not deemed to be beneficially owned

by the Reporting Person. See Items 5(a) and 5(b).

SCHEDULE 13D

| 1 |

NAMES OF REPORTING PERSONS |

| Eliyahu Hassett |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

|

(a) ☒

(b) ☐ |

| 3 |

SEC USE ONLY |

| |

| 4 |

SOURCE OF FUNDS (See Instructions) |

| OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) |

| ☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| Gibraltarian |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER |

|

| |

|

| 8 |

SHARED VOTING POWER |

|

| 14,176,424* |

|

| 9 |

SOLE DISPOSITIVE POWER |

|

| |

|

| 10 |

SHARED DISPOSITIVE POWER |

|

| 14,176,424* |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| 14,176,424* |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

| ☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| 4.99%* |

| 14 |

TYPE OF REPORTING PERSON (See Instructions) |

| IN |

| |

|

|

|

|

* Includes 14,176,424 shares of Common

Stock issuable upon the conversion of convertible notes that are subject to a 4.99% blocking provision, meaning that they can be

exercised only to the extent that such conversion would not cause the holder’s and its affiliates’ beneficial ownership

of shares of Common Stock to exceed 4.99%. Excludes 358,010,446 shares of Common Stock issuable upon the conversion of convertible

notes, none of which can be converted within 60 days of the date hereof, and are, therefore, not deemed to be beneficially owned

by the Reporting Person. See Items 5(a) and 5(b).

This Amendment No. 1 (“Amendment

No. 1”) is being filed by Lorient Ventures Limited, a British Virgin Islands company (the “Investment Entity”)

and Eliyahu Hassett (collectively, the “Reporting Persons”) with respect to the common stock, par value $0.001 (the

“Common Stock”) of Amarantus Biosciences Holdings, Inc., a Nevada corporation (the “Issuer”). This Amendment

No. 1 amends and supplements the Schedule 13D filed with the Securities and Exchange Commission (the “SEC”) on October

5, 2020 (the “October 2020 Schedule 13D”). Except as specifically provided herein, this Amendment No. 1 does not modify

any of the information previously reported in the October 2020 Schedule 13D. Information in response to each item shall be deemed

to be incorporated by reference in all other items. Capitalized terms used but not defined in this Amendment No. 1 shall have the

meanings ascribed to such terms in the October 2020 Schedule 13D.

| |

Item 4. |

Purpose of Transaction |

“Item 4. Purpose of Transaction”

is hereby supplemented as follows:

The Reporting Persons, Dominion Capital

LLC and Anson Investments Master Fund LP (collectively, the “Group”) have tentatively reached a satisfactory arrangement

with the Issuer with respect to the issues discussed in the October 2020 Schedule 13D. On November 23, 2021, the Group and the

Issuer entered into a term sheet (the “Term Sheet”) intended to resolve such issues. The Term Sheet contemplates resolution

of such issues and outstanding claims to be covered in definitive agreements.

|

Item 7. |

Material to Be Filed as Exhibits |

Exhibit 99.1 – Term Sheet, dated as of November 23, 2021, by and among Amarantus BioScience Holdings, Inc., Dominion Capital LLC, Anson Investments Master Fund LP, Lorient Ventures Ltd. and WilCarr Ventures.

Signature

After reasonable inquiry and to the best

of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: April 18,

2022

| |

|

|

| |

LORIENT VENTURES LIMITED |

| |

|

|

| |

By: |

/s/ Eliyahu Hassett |

| |

|

Eliyahu Hassett |

| |

|

Director |

| |

|

|

| |

/s/ Eliyahu Hassett |

| |

Eliyahu Hassett |

The original statement shall be signed

by each person on whose behalf the statement is filed or his authorized representative. If the statement is signed on behalf of

a person by his authorized representative (other than an executive officer or general partner of this filing person), evidence

of the representative’s authority to sign on behalf of such person shall be filed with the statement, provided, however,

that a power of attorney for this purpose which is already on file with the Commission may be incorporated by reference. The name

and any title of each person who signs the statement shall be typed or printed beneath his signature.

Attention: Intentional misstatements

or omissions of fact constitute Federal criminal violations (See 18 U.S.C. 1001).

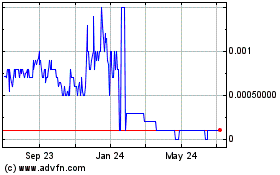

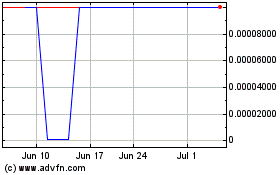

Amarantus Bioscience (CE) (USOTC:AMBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amarantus Bioscience (CE) (USOTC:AMBS)

Historical Stock Chart

From Apr 2023 to Apr 2024