Filed

pursuant to Rule 424(b)(5)

Registration

No. 333-259984

PROSPECTUS

SUPPLEMENT

(to

Prospectus dated October 14, 2021)

OZOP

ENERGY SOLUTIONS, INC.

Up

to Two Hundred Million (200,000,000) Shares of Common Stock

This

prospectus supplement relates to the issuance and sale of up to Two Hundred Million (200,000,0000) shares of the common stock of Ozop

Energy Solutions, Inc., a Nevada corporation (“OZSC” or the “Company”) to GHS Investments LLC (“GHS”),

a Nevada limited liability company. The issuance and sale to GHS will occur under a purchase agreement entered into on April 4,

2022 (the “GHS Purchase Agreement”). GHS may be considered an underwriter of this offering under the meaning of Section 2(a)(11)

of the Securities Act of 1933, as amended.

The

shares being offered are shares of our common stock that we may sell from time to time over a six (6)- month period ending October 4,

2022, at our sole discretion, to GHS under the GHS Purchase Agreement. See “The Offering” on page S-3 of this prospectus

supplement and “Purchase Agreement with GHS” on page S-3 of this prospectus supplement.

Our

Common Stock is currently quoted on the OTC Markets Pink under the symbol “OZSC.” On March 28, 2022, the closing price as

reported was $0.0251 per share.

INVESTING

IN OUR COMMON STOCK INVOLVES CERTAIN RISKS. SEE “RISK FACTORS” ON PAGE S-4 OF THIS PROSPECTUS SUPPLEMENT AND ON PAGES 3 -

8 OF THE ACCOMPANYING PROSPECTUS TO READ ABOUT FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR COMMON STOCK. YOU SHOULD ALSO REVIEW

CAREFULLY THE RISKS AND UNCERTAINTIES DESCRIBED IN OUR ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2020, OUR QUARTERLY

REPORT ON FORM 10-Q FOR THE QUARTER ENDED SEPTEMBER 30, 2021, AND IN OUR PERIODIC AND CURRENT REPORTS THAT WE FILE WITH THE SECURITIES

AND EXCHANGE COMMISSION AFTER THE DATE OF THIS PROSPECTUS SUPPLEMENT, WHICH ARE INCORPORATED BY REFERENCE INTO THIS PROSPECTUS SUPPLEMENT.

YOU SHOULD READ THE ENTIRE PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS CAREFULLY BEFORE YOU MAKE YOUR INVESTMENT DECISION.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THESE SECURITIES OR DETERMINED

IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Our

independent registered public accounting firm has included a “going concern” paragraph in the notes to our consolidated financial

statements.

The

date of this Prospectus Supplement is April 8, 2022.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document contains two parts. The first part is this prospectus supplement, which describes the terms of this offering of common stock

and also adds to and updates information contained in the accompanying prospectus and the documents incorporated or deemed incorporated

by reference in this prospectus supplement and the accompanying prospectus. The second part is the accompanying prospectus, which contains

a description of our common stock and gives more general information, some of which may not apply to this offering. If there is any inconsistency

between the information in this prospectus supplement and the accompanying prospectus, you should rely on this prospectus supplement.

Before purchasing any shares of our common stock, you should read carefully both this prospectus supplement and the accompanying prospectus,

together with the documents incorporated or deemed incorporated by reference in this prospectus supplement or accompanying prospectus

(as described below under the heading “Incorporation of Certain Documents by Reference”), any related free writing prospectus

and the additional information described below under the heading “Where You Can Find More Information.”

This

prospectus supplement and the accompanying prospectus are part of an effective registration statement that we filed with the Securities

and Exchange Commission (the “SEC”) using a “shelf” registration process. This prospectus supplement and the

accompanying prospectus, which form a part of the registration statement, do not contain all of the information set forth in the registration

statement. For further information with respect to us and our common stock, reference is made to the registration statement, including

the exhibits to the registration statement and the documents incorporated by reference into the registration statement. Statements contained

in this prospectus supplement and the accompanying prospectus as to the contents of any contract or other document referred to in this

prospectus supplement and accompanying prospectus are not necessarily complete and, where that contract or other document is an exhibit

to the registration statement, we refer you to the full text of the contract or other document filed as an exhibit to the registration

statement. The registration statement and the exhibits can be obtained from the SEC as indicated under the heading “Where You Can

Find More Information.”

You

should rely only on the information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus

and the other information to which we refer you. Neither we nor any underwriter, broker-dealer, agent or other person have authorized

anyone to provide you with any information other than that contained in or incorporated by reference into this prospectus supplement

or the accompanying prospectus. If anyone provides you with different or inconsistent information, you should not rely on it.

This

prospectus supplement and the accompanying prospectus do not constitute an offer to sell or the solicitation of an offer to buy securities

in any jurisdiction to any person to whom it is unlawful to make such an offer or solicitation in that jurisdiction. You should assume

that the information appearing in this prospectus supplement and the accompanying prospectus is accurate as of the date on its respective

cover, and that any information incorporated by reference in this prospectus supplement or the accompanying prospectus is accurate only

as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of

operations and prospects may have changed since those dates.

Unless

the context indicates otherwise, as used in this prospectus, unless the context otherwise requires, references to “we,” “us,”

“our,” “the Company” and “OZSC” refer to Ozop Energy Solutions, Inc, and its subsidiaries.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement and the accompanying prospectus and the information incorporated by reference in this prospectus supplement and

the accompanying prospectus contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended

(the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

These statements are therefore entitled to the protection of the safe harbor provisions of these laws. These statements may be identified

by the use of forward-looking terminology such as “anticipate,” “believe,” “budget,” “contemplate,”

“continue,” “could,” “envision,” “estimate,” “expect,” “forecast,”

“guidance,” “indicate,” “intend,” “may,” “might,” “outlook,”

“plan,” “possibly,” “potential,” “predict,” “probably,” pro-forma,”

“project,” “seek,” “should,” “target,” “will,” “would,” “will

be,” “will continue” or the negative of or other variation on these words or comparable terminology.

We

have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these

expectations, assumptions, estimates and projections are reasonable, these forward-looking statements are only predictions and involve

a number of risks and uncertainties, many of which are beyond our control. These and other important factors may cause our actual results,

performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking

statements. Management cautions that the forward-looking statements contained in this prospectus supplement and the information incorporated

by reference are not guarantees of future performance, and we cannot assume that such statements will be realized or the forward-looking

events and circumstances will occur. The risks, uncertainties and assumptions that could cause actual results to differ materially from

those anticipated or implied in our forward-looking statements include, but are not limited to, those set forth in the section entitled

“Risk Factors” in the accompanying prospectus and in “Risk Factors” section below.

Some

of the factors that could cause actual results to differ from our expectations are:

| |

● |

The

early state of the Company’s development; |

| |

● |

The

Company’s ability to continue as a going concern; |

| |

● |

The

Company’s ability to compete in an unproven market; |

| |

● |

Resistance

by potential customers to new technologies; |

| |

● |

Performance

issues with the Company’s products; |

| |

● |

Uncertainties

related to estimates, assumptions and projections relating to unpaid losses and loss adjustment expenses and other accounting policies; |

| |

● |

Reliance

on key personnel; |

| |

● |

Introduction

of competing products by other companies; |

| |

● |

Inflation

and other changes in economic conditions, including changes in the financial markets; |

| |

● |

Security

breaches and other system disruptions; |

| |

● |

Legislative

and regulatory developments, especially in the gathering and use of information about private citizens; |

| |

● |

Weather

conditions and natural disasters (including, but not limited to, the severity and frequency of storms, hurricanes, tornados and hail);

and |

| |

● |

Acts

of war and terrorist activities, among other man-made disasters. |

Given

these risks and uncertainties, you are cautioned not to place undue reliance on any forward-looking statements. The forward-looking statements

included or incorporated by reference into this prospectus supplement and in the information incorporated by reference are made only

as of the date of this prospectus supplement. Except as required by applicable law, including the securities laws of the United States

and the rules and regulations of the SEC, we do not undertake and specifically decline any obligation to update or revise any forward-looking

statements in this prospectus supplement after we distribute this prospectus supplement, or publicly announce the results of any revisions

to any such statements to reflect future events or developments, whether as a result of any new information, future events or otherwise.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights selected information about us and this offering appearing in this prospectus supplement, the accompanying prospectus

and the documents incorporated or deemed incorporated by reference herein and therein. This summary may not contain all of the information

that you should consider before making an investment decision. You should read carefully the more detailed information included or referred

to under the heading “Risk Factors” of this prospectus supplement and the other information included in this prospectus supplement,

the accompanying prospectus, the documents incorporated or deemed incorporated by reference herein and therein, including our Annual

Report on Form 10-K for the year ended December 31, 2020, before deciding to invest in our common stock.

The

Company

Ozop

Energy Solutions, Inc. (the” Company,” “we,” “us” or “our”) was originally incorporated

as Newmarkt Corp. on July 17, 2015, under the laws of the State of Nevada. On October 29, 2020, the Company formed a new wholly owned

subsidiary, Ozop Surgical Name Change Subsidiary, Inc., a Nevada corporation (“Merger Sub”). The Merger Sub was formed under

the Nevada Revised Statutes for the sole purpose and effect of changing the Company’s name to “Ozop Energy Solutions, Inc.”

That same day the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with the Merger Sub and filed

Articles of Merger (the “Articles of Merger”) with the Nevada Secretary of State, merging the Merger Sub into the Company,

which were stamped effective as of November 3, 2020. As permitted by the Section 92.A.180 of the Nevada Revised Statutes, the sole purpose

and effect of the filing of Articles of Merger was to change the name of the Company to “Ozop Energy Solutions, Inc.”

THE

OFFERING

| The

common stock offered by us |

|

Up

to two hundred million (200,000,000) shares of common stock |

| |

|

|

| Common

stock outstanding before the offering |

|

4,622,362,977

(1) |

| |

|

|

| Risk

Factors |

|

Investing

in our common stock involves certain risks. See “Risk Factors” on page S-4 of this prospectus supplement and on pages 3-8

of the accompanying prospectus. |

| |

|

|

| Use

of Proceeds |

|

Proceeds

will be used as described in the “Use of Proceeds” section of this prospectus supplement. |

(1)

As of March 28, 2022.

PURCHASE

AGREEMENT WITH GHS

On

April 4, 2022, we entered into the GHS Purchase Agreement with GHS under which the Company may require GHS to purchase a maximum

of Two Hundred Million (200,000,000) shares of common stock (“GHS Purchase Shares”) over a six-month term that ends on October

4, 2022.

The

GHS Purchase Agreement provides that, upon the terms and subject to the conditions and limitations set forth in the agreement, the Company

has the right from time to time during the term of the agreement, in its sole discretion, to deliver to GHS a purchase notice (a “Purchase

Notice”) directing GHS to purchase (each, a “GHS Purchase”) a specified number of GHS Purchase Shares. A GHS Purchase

will be made in a minimum amount of Ten Thousand Dollars ($10,000) and up to a maximum of: (a) one hundred percent (100%) of the average

daily volume traded for the Common Stock during the relevant Valuation Period (as defined in the GHS Purchase Agreement) if the lowest

VWAP during the Valuation Period is below $0.03 (subject to adjustments for stock splits, dividends, and similar occurrences), (2) one

hundred and fifty percent (150%) of the average daily volume traded fort the Common Stock during the Valuation Period if the lowest VWAP

during the relevant Valuation Period is between $0.03 and $0.035 (subject to adjustments for stock splits, dividends, and similar occurrences),

and (3) two hundred percent (200%) of the average daily volume traded for the Common Stock during the Valuation Period if the lowest

VWAP during the relevant Valuation Period is above $0.035 per share (subject to adjustments for stock splits, dividends, and similar

occurrences), all subject to the Available Amount.

On

the first trading day after the last day of the relevant Valuation Period, the Company will cause to be delivered to GHS that number

of shares of common stock that equal one hundred percent (100%) of the aggregate GHS Purchase Shares specified in the Purchase Notice.

The purchase price for each GHS Purchase Shares specified in the Purchase Notice shall be 85% of lowest VWAP during the respective Valuation

Period.

The

GHS Purchase Agreement prohibits the Company from directing GHS to purchase any shares of common stock if those shares, when aggregated

with all other shares of our common stock then beneficially owned by GHS and its affiliates, would result in GHS and its affiliates having

beneficial ownership, at any single point in time, of more than 4.99% of the then total outstanding shares of our common stock.

There

are no trading volume requirements or restrictions under the GHS Purchase Agreement. We will control the timing and amount of any sales

of our common stock to GHS.

Events

of default under the GHS Purchase Agreement include the following:

| |

● |

The

effectiveness of the registration statement registering the resale of the GHS Purchase Shares lapses for any reason; |

| |

● |

The

common stock is suspended from trading on the OTC Pink for a period of two consecutive trading dates, during which time the Company

may not direct GHS to purchase any shares during that time; |

| |

● |

The

common stock is delisted from the OTC Pink provided, however, that the common stock is not immediately thereafter trading on the

NASDAQ Capital Market, the NASDAQ Global Market, the NASDAQ Global Select Market, the New York Stock Exchange, the NYSE American,

or the OTCQB or the OTCQX operated by the OTC Markets Group, Inc. (or any nationally recognized successor to any of the foregoing); |

| |

● |

The

failure for any reason by the transfer agent to issue GHS Purchase Shares to GHS within three (3) business days after the date on

which GHS was entitled to receive the shares; |

| |

● |

The

Company breaches any representation, warranty, covenant or other term or condition under the GHS Purchase Agreement, its Schedules,

or any related document if the breach could have a material adverse effect and except, in the case of a breach of a covenant that

is reasonably curable, only if the breach continues for a period of at least five (5) Business Days; |

| |

● |

A

proceeding against the Company is commenced by any person or entity pursuant to or within the meaning of any bankruptcy law; |

| |

● |

The

Company, pursuant to or within the meaning of any bankruptcy law, (i) commences a voluntary case, (ii) consents to the entry of an

order for relief against it in an involuntary case, (iii) consents to the appointment of a Custodian of it or for all or substantially

all of its property, or (iv) makes a general assignment for the benefit of its creditors or is generally unable to pay its debts

as they become due; |

| |

● |

A

court of competent jurisdiction enters an order or decree under any bankruptcy law that (i) is for relief against the Company in

an involuntary case, (ii) appoints a custodian of the Company or for all or substantially all of its property, or (iii) orders the

liquidation of the Company; or |

| |

● |

If

at any time the Company is not eligible to transfer its common stock electronically as DWAC Eligible. |

So

long as an Event of Default has occurred and is continuing, the Company shall not deliver to the Investor any Purchase Notice.

The

preceding summary of the GHS Purchase Agreement is qualified in its entirety by reference to the full text of the GHS Purchase Agreement,

which is incorporated by reference into this prospectus supplement.

RISK

FACTORS

Investing

in our securities involves a high degree of risk. You should carefully review the risks and uncertainties discussed below and in the

“Risk Factors” section that is found at pages 3 - 8 of the accompanying prospectus before deciding whether to purchase any

common stock being offered under this prospectus supplement. Each of the risk factors described in this prospectus supplement or in the

accompanying prospectus could adversely affect our business, operating results and financial condition, as well as adversely affect the

value of an investment in the common stock. The occurrence of any of these risks might cause you to lose all or part of your investment.

Moreover, the risks described are not the only risks we face. Additional risks and uncertainties not currently known to us or that we

currently deem to be immaterial may also materially and adversely affect our business, financial condition, and results of operations.

If any of these risks actually occurs, our business, financial condition and results of operations could suffer. In that case, the trading

price of our common stock could decline, and you may lose all or part of your investment.

Our

management team will have broad discretion to use the net proceeds from this offering and its investment of these proceeds may not yield

a favorable return.

Our

management team will have broad discretion in the application of the net proceeds from this offering and could spend or invest the proceeds

in ways with which our stockholders disagree. Accordingly, investors will need to rely on our management team’s judgment with respect

to the use of these proceeds. We intend to use the proceeds from this offering in the manner described in the section titled “Use

of Proceeds.” The failure by management to apply these funds effectively could negatively affect our ability to operate and grow

our business. We cannot specify with certainty all of the particular uses for the net proceeds to be received upon the completion of

this offering. In addition, the amount, allocation and timing of our actual expenditures will depend upon numerous factors, including

any milestone payments received from any future strategic partnerships and royalties on sales of any future approved product. Accordingly,

we will have broad discretion in using these proceeds. Until the net proceeds are used, they may be placed in investments that do not

produce significant income or that may lose.

We

do not anticipate paying cash dividends and, accordingly, stockholders must rely on share appreciation for any return on their investment.

We

have never paid any dividends on our capital stock. We currently intend to retain our future earnings, if any, to fund the development

and growth of our businesses and do not anticipate that we will declare or pay any cash dividends on our capital stock in the foreseeable

future. As a result, capital appreciation, if any, of our common stock will be your sole source of gain on your investment for the foreseeable

future. Investors seeking cash dividends should not invest in our common stock.

Our

auditor has expressed substantial doubt about our ability to continue as a going concern.

The

financial statements incorporated by reference into the registration statement of which this prospectus is a part have been prepared

on a going concern basis. We may not be able to generate profitable operations in the future and/or obtain the necessary financing to

meet our obligations and pay liabilities arising from normal business operations when they come due. The outcome of these matters cannot

be predicted with any certainty at this time. These factors raise substantial doubt that we will be able to continue as a going concern.

Our financial statements do not include any adjustments to the amounts and classification of assets and liabilities that may be necessary

should we be unable to continue as a going concern.

DESCRIPTION

OF THE COMPANY’S CAPITAL STOCK

We

are issuing up to Two Hundred Million (200,000,000) shares of the Company’s common stock. There is only one class of common stock.

See “Common Stock” in the accompanying prospectus for a description of the rights of holders of common stock. There are three

(3) classes of preferred stock. See “Preferred Stock” in the accompanying prospectus for a description of the rights, preferences

and privileges of the preferred stock.

USE

OF PROCEEDS

The

Company will retain broad discretion over the use of the net proceeds from the sale of the securities. We currently intend to use the

net proceeds for working capital, capital expenditures and general corporate purposes. We may also use a portion of the net proceeds

to invest in or acquire businesses or technologies that we believe are complementary to our own, although we have no current plans, commitments

or agreements with respect to any acquisitions as of the date of this prospectus.

DILUTION

Dilution

represents the difference between the price at which a share of the Company’s common stock is being offered and the net tangible

book value per share of that common stock immediately after completion of this offering. Net tangible book value is the amount that results

from subtracting total liabilities and intangible assets from total assets. Dilution arises mainly as a result of our arbitrary determination

of the offering price of the common stock being offered. Dilution of the value of the shares of common stock that you purchase is also

a result of the lower book value of the shares of common stock held by our existing shareholders.

The

deficit net tangible book value of our common stock as of September 30, 2021, was approximately ($29.7 million), or approximately $(0.006)

per share of common stock, based on 4,612,362,997 shares of common stock outstanding as of September 30, 2021.

After

giving effect to the sale of 200,000,000 shares of our common stock being offered in this offering at an offering price of $0.020825,

based on 85% of the lowest volume weighted average price for the ten days preceding the date of a Purchase Notice, which was $0.0245

on the Over-The-Counter Market (OTC) on March 17, 2022, and after deducting offering commissions and estimated aggregate offering expenses

payable by us, our as adjusted deficit net tangible book value as of September 30, 2021, would have been approximately ($25.6 million),

or ($0.005) per share of common stock. This represents an immediate decrease in the deficit net tangible book value of $0.001 per share

to our existing stockholders and an immediate and substantial dilution in net tangible book value of $0.025825 per share to new investors

in this offering at the assumed public offering price.

The

following table illustrates this calculation on a per share basis based on the range of prices per share of common stock we expect to

receive from the Investors:

| Scenario #1: ($ per share received) | |

| | | |

| | |

| Assumed public offering price per share | |

| | | |

$ | 0.020825 | |

| Shares issued | |

| | | |

| 200,000,000 | |

| Net tangible book value (deficit) per share as of September 30, 2021 | |

$ | (0.006 | ) | |

| | |

| Increase in net tangible book value per share attributable to this offering | |

$ | 0.001 | | |

| | |

| | |

| | | |

| | |

| As adjusted deficit net tangible book value per share after giving effect to offering | |

| | | |

$ | (0.005 | ) |

| Dilution per share to new investors purchasing shares in this offering | |

| | | |

$ | 0.025825 | |

If

you are investing in the shares expecting to own a certain percentage of the Company or expecting each share of common stock to hold

a certain amount of value, you should realize that the value of a share of common stock can decrease by actions taken by the Company.

If the Company issues additional capital stock, the shares of common stock sold by this prospectus supplement will represent a smaller

percentage of the Company’s total outstanding capital. An increase in the amount of capital stock could result from the issuance

of additional common stock, additional shares of Series F Convertible Preferred Stock, or one or more additional series of preferred

stock. If that occurs, the Company’s value may have increased but a holder of shares of common stock would own a smaller piece

of the Company. This would result in a purchaser of common stock in this offering experiencing value dilution, with each share of common

stock being worth less than its value before the additional capital stock was issued, and control dilution, with the total percentage

of the Company that a shareholder owns being lower than the percentage before the additional capital stock was issued.

PLAN

OF DISTRIBUTION

This

prospectus supplement and the accompanying prospectus cover the offer and sale of up to Two Hundred Million (200,000,000) shares of the

Company’s common stock that we may sell from time to time in our sole discretion to GHS. The terms and conditions of these offers

and sales are described in the section entitled “Purchase Agreement with GHS” and are based on the provisions of the GHS

Purchase Agreement (with a term ending on October 4, 2022).

We

will pay a finder’s fee to J. H. Darbie & Co., Inc. of 2% of the net proceeds that we receive from sales of our common stock

to GHS under the GHS Purchase Agreement.

We

estimate the Company’s total sales expenses for this offering, assuming that we sell the maximum offering amount of Two Hundred

Million (200,000,000) shares of the Company’s common stock, will be $85,000.

Because

GHS may be considered an underwriter with respect to this offering, it will acquire the securities for its own account and may resell

the securities from time to time in one or more transactions at a fixed public offering price or at varying prices determined at the

time of sale.

We

may provide agents and underwriters with indemnification against civil liabilities related to this offering, including liabilities under

the Securities Act, or contribution with respect to payments that the agents or underwriters may make with respect to these liabilities.

Agents and underwriters may engage in transactions with, or perform services for, us in the ordinary course of business.

The

common stock will be listed on the Over-the-Counter (OTC) Market Pink Sheets under the symbol “OZSC.” To facilitate the offering

of the common stock, certain persons participating in the offering may engage in transactions that stabilize, maintain or otherwise affect

the price of the securities. The effect of these transactions may be to stabilize or maintain the market price of the securities at a

level above that which might otherwise prevail in the open market. These transactions may be discontinued at any time.

We

may engage in at the market offerings into an existing trading market in accordance with Rule 415(a)(4) under the Securities Act. In

addition, we may enter into derivative transactions with third parties, or sell securities not covered by this prospectus to third parties

in privately negotiated transactions.

This

offering will end on the date that the Two Hundred Million (200,000,000) shares of the Company’s common stock offered by this prospectus

supplement have been sold or such earlier date that the Company, in its sole discretion, terminates the offering.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

We

are incorporating by reference into this prospectus supplement and the accompanying prospectus the documents listed below that we have

filed with the SEC, which means we can disclose important information to you by referring you to those documents. The information incorporated

by reference is considered to be a part of this prospectus supplement and the accompanying prospectus. We incorporate by reference:

| |

● |

Our

Annual Report on Form 10-K for the year ended December 31, 2020 filed on April 15, 2021; |

| |

|

|

| |

● |

Our

Quarterly Report on Form 10-Q/A for the quarter ended March 31, 2021 filed on May 19, 2021; |

| |

|

|

| |

● |

Our

Quarterly Report on Form 10-Q for the quarter ended June 30, 2021 filed on August 17, 2021; |

| |

|

|

| |

● |

Our

Quarterly Report on Form 10-Q for the quarter ended September 30, 2021 filed on November 19, 2021; |

| |

|

|

| |

● |

Our

Current Report on Form 8-K filed April 8, 2022; |

| |

|

|

| |

● |

Our

Current Report on Form 8-K filed December 21, 2021; |

| |

|

|

| |

● |

Our

Current Report on Form 8-K filed on November 17, 2021; |

| |

|

|

| |

● |

Our

Current Report on Form 8-K filed on October 22, 2021; |

| |

|

|

| |

● |

Our

Current Report on Form 8-K filed on September 2, 2021; |

| |

|

|

| |

● |

Our

Current Report on Form 8-K filed on August 26, 2021; |

| |

|

|

| |

● |

Our

Current Report on Form 8-K filed on August 2, 2021; |

| |

|

|

| |

● |

Our

Current Report on Form 8-K filed on July 19 2021; |

| |

● |

Our

Current Report on Form 8-K filed on June 29, 2021; |

| |

|

|

| |

● |

Our

Current Report on Form 8-K filed on June 17, 2021; |

| |

|

|

| |

● |

Our

Current Report on Form 8-K filed on June 11, 2021; |

| |

|

|

| |

● |

Our

Current Report on Form 8-K filed on May 12 2021; |

| |

|

|

| |

● |

Our

Current Report on Form 8-K filed on March 30, 2021; |

| |

|

|

| |

● |

Our

Current Report on Form 8-K filed on March 15, 2021; |

| |

|

|

| |

● |

Our

Current Report on Form 8-K filed on February 25, 2021; |

| |

|

|

| |

● |

Our

Current Report on Form 8-K filed on February 19, 2021; |

| |

|

|

| |

● |

Our

Current Report on Form 8-K filed on February 8, 2021; |

| |

|

|

| |

● |

Our

Current Report on Form 8-K filed on January 26, 2021; |

| |

|

|

| |

● |

Our

Current Report on Form 8-K filed on January 14, 2021; and |

| |

|

|

| |

● |

Our

Current Report on Form 8-K filed on January 13, 2021. |

In

addition, we also incorporate by reference into this prospectus supplement and the accompanying prospectus all documents (other than

current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on that form which are related to those items)

that are filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act before the termination of the offering

of our common stock to which this prospectus supplement and the accompanying prospectus relate, except for any document or portion of

such document deemed to be “furnished” and not filed in accordance with SEC rules.

The

information relating to us contained in this prospectus supplement and the accompanying prospectus does not purport to be comprehensive

and should be read together with the information contained in the documents incorporated or deemed to be incorporated by reference into

this prospectus supplement and the accompanying prospectus.

We

will provide to each person, including any beneficial owner, to whom a prospectus supplement and accompanying prospectus is delivered,

without charge, upon written or oral request, a copy of any or all of the documents that are incorporated by reference into this prospectus

supplement and the accompanying prospectus but not delivered with the prospectus supplement and accompanying prospectus, including exhibits

that are specifically incorporated by reference into such documents. You may request a copy of these filings without charge by contacting

Ozop Energy Solutions, Inc., 42 North Main St., Florida, NY 10921.

Information

that we file later with the SEC and that is incorporated by reference in this prospectus supplement will automatically update and supersede

information contained in this prospectus supplement and the accompanying prospectus as if that information were included in this prospectus

supplement and the accompanying prospectus. That information will become part of this prospectus supplement and the accompanying prospectus

from the date the information is filed with the SEC.

WHERE

YOU CAN FIND MORE INFORMATION

We

are subject to the informational requirements of the Exchange Act and, accordingly, file periodic reports, proxy statements and other

information with the SEC. You can obtain these reports, proxy statements and other information that we file electronically with the SEC

on the SEC’s website at www.sec.gov. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K

and amendments to these reports that are filed or furnished pursuant to Section 13 of the Exchange Act are available on our website at

www.ozop energy.com, as soon as reasonably practicable after they are electronically filed with the SEC. The information on our website

is not part of this prospectus, except to the extent filed with the SEC and specifically incorporated into this prospectus by reference.

This

prospectus is part of a registration statement that we filed with the SEC under the Securities Act. This prospectus does not contain

all of the information presented in the registration statement and its exhibits in accordance with SEC rules. Our descriptions in this

prospectus of the provisions of documents filed as exhibits to the registration statement or otherwise filed with the SEC are only summaries

of the terms of those documents and are not intended to be comprehensive. For a complete description of the content of the documents,

you should obtain copies of the full document.

LEGAL

MATTERS

Certain

legal matters in connection with the offering and the validity of the securities offered by this prospectus will be passed upon by Brunson

Chandler & Jones, PLLC, Salt Lake City, Utah.

EXPERTS

The

consolidated financial statements of Ozop Energy Solutions, Inc., a Nevada corporation (the “Company”), as of December 31,

2020, and December 31, 2019, and for the two years then ended have been incorporated by reference into this prospectus from the Company

Annual Report on Form 10-K upon the reports of Prager Metis CPA’s LLC, independent registered public accounting firm, and Goff

Backa Alfera & Company, LLC, and upon the authority of said firms as experts in accounting and auditing. The report thereon contains

an explanatory paragraph which describes the conditions that raise substantial doubt about the ability of the Company to continue as

a going concern and are contained in Footnote 2 to the consolidated financial statements.

DISCLOSURE

OF COMMISSION POSITION ON INDEMNIFICATION

Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers or persons controlling

the Company pursuant to the provisions of the Company’s charter documents or bylaws, the Company has been informed that in the

opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is therefore

unenforceable.

Up

to Two Hundred Million (200,000,000) Shares of Common Stock

OZOP

ENERGY SOLUTIONS, INC.

Prospectus

Supplement

Dated

April 8, 2022

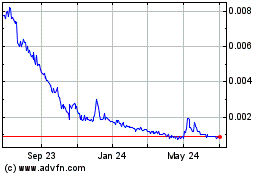

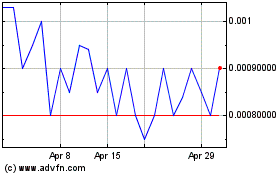

Ozop Energy Solutions (PK) (USOTC:OZSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ozop Energy Solutions (PK) (USOTC:OZSC)

Historical Stock Chart

From Apr 2023 to Apr 2024