Current Report Filing (8-k)

April 06 2022 - 6:10AM

Edgar (US Regulatory)

0001006655FALSE00010066552022-01-212022-01-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 1, 2022

Evolution Petroleum Corporation

(Exact name of registrant as specified in its charter)

001-32942

(Commission File Number)

| | | | | | | | |

| Nevada | | 41-1781991 |

| (State or Other Jurisdiction of Incorporation) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

1155 Dairy Ashford Road, Suite 425, Houston, Texas | | 77079 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(713) 935-0122

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange On Which Registered |

| Common Stock, $0.001 par value | | EPM | | NYSE American |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o |

Item 2.01 Completion of Acquisition or Disposition of Assets.

On April 1, 2022, Evolution Petroleum Corporation (the “Company”) completed the acquisition of non-operated oil and gas assets in the Jonah Field in Sublette County, Wyoming (the “Transaction”) from Exaro Energy III, LLC (“Exaro”), for $26.2 million, net of preliminary purchase price adjustments and a $1.5 million deposit made upon signing of the Purchase and Sale Agreement. The final purchase price before adjustments of the Transaction was $27.5 million, which included preferential rights exercised by Jonah Energy, the operator of the assets, of $1.9 million. The Transaction had an effective date of February 1, 2022.

The acquired assets includes an average net working interest of 19.6% and an average net revenue interest of 14.9% in 595 producing wells and 956 net acres. Current estimated net daily production from the asset is approximately 10.8 million cubic feet of natural gas, 120 barrels of natural gas liquids, and 112 barrels of oil. The commodity mix of the assets is 88% natural gas, 6% natural gas liquids, and 6% oil. The assets had an average net production of 2,141 barrels of oil equivalent per day, for the six months ended December 31, 2021.

The Transaction was funded from cash on hand and $17 million borrowings under the Company’s existing senior credit facility.

Cautionary Statement

This Current Report on Form 8-K contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical facts, included in this Current Report on Form 8-K that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. The Company has based these forward-looking statements largely on its current expectations and projections about future events and financial trends affecting the financial condition of its business. These forward-looking statements are subject to a number of risks and uncertainties, most of which are difficult to predict and many of which are beyond its control, including the completion of the proposed transaction on the terms or timeline currently contemplated or at all. Please read the Company’s filings with the Securities and Exchange Commission, including “Risk Factors” in its Annual Report on Form 10-K for the year ended June 30, 2021, for a discussion of risks and uncertainties that could cause actual results to differ from those in such forward-looking statements. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “plan,” “expect,” “indicate” and similar expressions are intended to identify forward-looking statements. All statements other than statements of current or historical fact contained in this Current Report on Form 8-K are forward-looking statements. Although the Company believes that the forward-looking statements contained in this Current Report on Form 8-K are based upon reasonable assumptions, the forward-looking events and circumstances discussed in this press release may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements.

Item 7.01 Regulation FD Disclosure.

On April 4, 2022, the Company issued a press release disclosing the closing of the Transaction. A copy of the press release is furnished herewith as Exhibit 99.1.

On April 6, 2022, the Company is hosting an investor update call and will be reviewing an updated investor presentation posted to the Company’s website. A copy of this presentation is furnished herewith as Exhibit 99.2.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| | |

Exhibit 99.1 | | |

| Exhibit 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| |

| | | |

| | Evolution Petroleum Corporation (Registrant) |

| | |

Date: | April 6, 2022 | By: | /s/ RYAN STASH |

| | Name: | Ryan Stash |

| | Title: | Senior Vice President, Chief Financial Officer and Treasurer |

| | | |

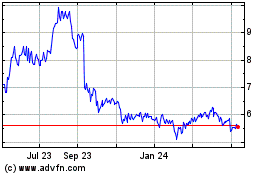

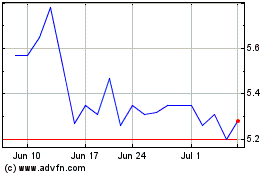

Evolution Petroleum (AMEX:EPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Evolution Petroleum (AMEX:EPM)

Historical Stock Chart

From Apr 2023 to Apr 2024