As filed with the Securities and Exchange Commission

on March 30, 2022

Registration No. 333-_____

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

SUNSHINE BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

| Colorado |

|

20-5566275 |

| (State of incorporation) |

|

(IRS Employer Identification No.) |

6500 Trans-Canada Highway

4th Floor

Pointe-Claire, Quebec, Canada H9R 0A5

(514) 426-6161

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Dr. Steve N. Slilaty

6500 Trans-Canada Highway

4th Floor

Pointe-Claire, Quebec, Canada H9R 0A5

(514) 426-6161

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Gregory Sichenzia, Esq.

Jeff Cahlon, Esq.

Sichenzia Ross Ference LLP

1185 Avenue of the Americas, 31st Floor

New York, New York 10036

(212) 930-9700

Approximate date of commencement

of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being

registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ¨

If any of the securities being

registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other

than securities offered only in connection with dividend or interest reinvestment plans, check the following box: x

If this Form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering: ¨

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering: ¨

If this Form is a registration

statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the

Commission pursuant to Rule 462(e) under the Securities Act, check the following box: ¨

If this Form is a post-effective

amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional

classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box: ¨

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| |

|

|

|

|

|

|

|

|

| Large accelerated filer ☐ |

|

Accelerated filer ☐ |

| Non-accelerated filer x |

|

Smaller reporting company x |

| |

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Exchange Act. ¨

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant

to said Section 8(a), may determine.

| |

|

|

| The information in this

prospectus is not complete and may be changed. These securities

may not sold until the registration statement filed with the Securities and Exchange Commission is effective. This

prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where

the offer or sale is not permitted. |

| PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION |

DATED MARCH 30, 2022 |

7,207,208 Shares of Common Stock

Pursuant to this prospectus,

the selling stockholders identified herein are offering on a resale basis an aggregate of 7,207,208 shares of common stock, par value

$0.001 per share, of Sunshine Biopharma, Inc., of which (i) 2,301,353 shares are issued and outstanding, (ii) 1,302,251 shares are issuable

upon exercise of pre-funded warrants, or the Pre-Funded Warrants, each exercisable into one share of common stock at an exercise price

per share of $0.001, without expiration, and (iii) 3,603,604 shares are issuable upon exercise of common warrants, or the Common Warrants,

each exercisable into one share of common stock at an exercise price per share of $2.22, expiring on March 14, 2027. We refer to the Pre-Funded

Warrants and the Common Warrants, collectively, as the Private Placement Warrants. The outstanding shares of common stock and the Private

Placement Warrants were issued to the selling stockholders in connection with a private placement we completed on March 14, 2022, or the

Private Placement. We will not receive any of the proceeds from the sale by the selling stockholders of the common stock. Upon any exercise

of the Private Placement Warrants by payment of cash, however, we will receive the exercise price of the Private Placement Warrants.

The selling stockholders may

sell or otherwise dispose of the common stock covered by this prospectus in a number of different ways and at varying prices. We provide

more information about how the selling stockholders may sell or otherwise dispose of the common stock covered by this prospectus in the

section entitled “Plan of Distribution” on page 9. Discounts, concessions, commissions and similar selling expenses

attributable to the sale of common stock covered by this prospectus will be borne by the selling stockholders. We will pay all expenses

(other than discounts, concessions, commissions and similar selling expenses) relating to the registration of the common stock with the

Securities and Exchange Commission, or the SEC.

You should carefully read

this prospectus and any accompanying prospectus supplement, together with the documents we incorporate by reference, before you invest

in our common stock.

Our common stock is listed

on The Nasdaq Capital Market under the symbol “SBFM.” On March 29, 2022, the last reported sale price for our common stock

was $2.51 per share.

Investing in our common

stock involves substantial risk. Please read “Risk Factors” beginning on page 4 of this prospectus and in the documents we

incorporate by reference.

Neither the SEC nor any

state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus.

Any representation to the contrary is a criminal offense.

The date of this prospectus is

______________, 2022.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is a part

of a registration statement that we filed with the SEC utilizing a “shelf” registration process. Under this shelf registration

process, the selling stockholders may sell the securities described in this prospectus in one or more offerings. A prospectus supplement

may add to, update or change the information contained in this prospectus. You should read this prospectus and any applicable prospectus

supplement, together with the information incorporated herein by reference as described under the heading “Information Incorporated

by Reference.”

You should rely only on the

information that we have provided or incorporated by reference in this prospectus and any applicable prospectus supplement. We have not

authorized, nor has any selling stockholder authorized, any dealer, salesman or other person to give any information or to make any representation

other than those contained or incorporated by reference in this prospectus or any applicable prospectus supplement. You should not rely

upon any information or representation not contained or incorporated by reference in this prospectus or the accompanying prospectus supplement.

We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

This prospectus and any accompanying

prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered

securities to which they relate, nor do this prospectus and any accompanying prospectus supplement constitute an offer to sell or the

solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation

in such jurisdiction. You should not assume that the information contained in this prospectus or any applicable prospectus supplement

is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by

reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus or any

applicable prospectus supplement is delivered or securities are sold on a later date.

As used in this prospectus

and unless otherwise indicated, the terms “we,” “us,” “our,” “Sunshine Biopharma,” or

the “Company” refer to Sunshine Biopharma, Inc. and its wholly owned subsidiaries.

SUMMARY

This summary highlights

certain information appearing elsewhere in this prospectus and in the documents we incorporate by reference into this prospectus. The

summary is not complete and does not contain all of the information that you should consider before investing in our common stock. After

you read this summary, you should read and consider carefully the entire prospectus and any prospectus supplement and the more detailed

information and financial statements and related notes that are incorporated by reference into this prospectus and any prospectus supplement.

If you invest in our shares, you are assuming a high degree of risk.

About Us—Business Overview

We are a pharmaceutical and

nutritional supplement company focusing on the research and development of proprietary drugs including our anti-cancer compound Adva-27a,

and anti-coronavirus lead compound, SBFM-PL4.

We also, through our wholly

owned Canadian subsidiary, Sunshine Biopharma Canada Inc. (“Sunshine Canada”), develop science-based nutritional supplements,

and currently sell one nutritional supplement product.

Corporate Information

Our principal executive offices

are located at 6500 Trans-Canada Highway, 4th Floor, Pointe-Claire, Quebec, Canada H9R 0A5, and our telephone number is (514) 426-6161.

Our website address is www.sunshinebiopharma.com. Information on our website is not part of this prospectus.

Private Placement

On March 10, 2022, the

Company entered into a securities purchase agreement, or the Purchase Agreement, with the selling stockholders, pursuant to which

the Company issued and sold, (i) an aggregate of 2,301,353 shares of common stock, (ii) Pre-Funded Warrants to purchase up to an

aggregate of 1,302,251 shares of common stock and (iii) Common Warrants to purchase up to an aggregate of 3,603,604 shares of common

stock. Each share of common stock and accompanying Common Warrant were sold together at a combined offering price of $2.22, and each

Pre-Funded Warrant and accompanying Common Warrant were sold together at a combined offering price of $2.219. Subject to certain

ownership limitations, the Private Placement Warrants are exercisable upon issuance. Each Pre-Funded Warrant is exercisable into one

share of common stock at an exercise price per share of $0.001 (as adjusted from time to time in accordance with the terms thereof)

and does not expire. Each Common Warrant is exercisable into one share of common stock at an exercise price per share of $2.22 (as

adjusted from time to time in accordance with the terms thereof) and will expire on the fifth anniversary of the date of issuance.

In connection with the Private Placement, the Company engaged Aegis Capital Corp. to serve as exclusive placement agent. The Private

Placement closed on March 14, 2022.

The issuance and sale of the

shares of common stock and the Private Placement Warrants pursuant to the Purchase Agreement and the issuance and sale of the shares of

common stock issuable upon exercise of the Private Placement Warrants were not registered under the Securities Act of 1933, as amended,

or the Securities Act, and were offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Regulation

D promulgated thereunder.

In connection with the Purchase

Agreement, on March 10, 2022, the Company entered into a registration rights agreement, with the selling stockholders. Pursuant to the

registration rights agreement, the Company agreed to file a registration statement on Form S-3 for the resale by the selling stockholders

of the outstanding shares of common stock that were issued in connection with the closing of the Private Placement, and the shares of

common stock issuable upon exercise of the Private Placement Warrants, within the earlier of (a) 15 days after the filing of the Company’s

annual report for the year ended December 31, 2021 (which occurred on March 21, 2022) or (b) 30 days after the date of the registration

rights agreement. .

We are filing the registration

statement of which this prospectus forms a part to satisfy our obligations under the registration rights agreement.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking

statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, or

the Exchange Act. Forward-looking statements give current expectations or forecasts of future events or our future financial or operating

performance. We may, in some cases, use words such as “anticipate,” “believe,” “could,” “estimate,”

“expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,”

“should,” “will,” “would” or the negative of those terms, and similar expressions that convey uncertainty

of future events or outcomes to identify these forward-looking statements.

These forward-looking statements

reflect our management’s beliefs and views with respect to future events, are based on estimates and assumptions as of the date

of this prospectus and are subject to risks and uncertainties, many of which are beyond our control, that could cause our actual results

to differ materially from those in these forward-looking statements. We discuss many of these risks in greater detail in this prospectus

under “Risk Factors” and in our Annual Report on Form 10-K filed with the SEC on March 21, 2022, as well as those described

in the other documents we file with the SEC. Moreover, new risks emerge from time to time. It is not possible for our management to predict

all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may

cause actual results to differ materially from those contained in any forward-looking statements we may make. Given these uncertainties,

you should not place undue reliance on these forward-looking statements.

We undertake no obligation

to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as

may be required by applicable laws or regulations.

RISK

FACTORS

An investment in our securities

involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks and uncertainties

discussed below, as well as those under the heading “Risk Factors” contained in our Annual Report on Form 10-K for the year

ended December 31, 2021 as filed with the SEC, and as incorporated by reference in this prospectus, as the same may be amended, supplemented

or superseded by the risks and uncertainties described under similar headings in the other documents that are filed by us after the date

hereof and incorporated by reference into this prospectus. Please also read carefully the section above titled “Special Note Regarding

Forward-Looking Statements.”

The sale of a substantial

amount of our common stock, including resale of the shares of common stock held by the selling stockholders in the public market, could

adversely affect the prevailing market price of our common stock.

We are registering for resale

7,207,208 shares of common stock, including 4,905,855 shares of common stock issuable upon the exercise of Private Placement Warrants

held by the selling stockholders. Sales of substantial amounts of our common stock in the public market, or the perception that such sales

might occur, could adversely affect the market price of our common stock. We cannot predict if and when selling stockholders may sell

such shares in the public market.

USE OF PROCEEDS

We will not receive any of the proceeds from any sale or other disposition of the common stock covered by this prospectus.

All proceeds from the sale of the common stock will be paid directly to the selling stockholders. We will receive proceeds upon the cash

exercise of the Private Placement Warrants, however. Assuming full cash exercise of the Private Placement Warrants, we would receive

proceeds of approximately $8 million. We currently intend to use any cash proceeds from Private Placement Warrant exercises for our drug

development activities and general corporate purposes, including working capital.

To the extent the resale

of the shares of common stock underlying the Common Warrants is registered under the Securities Act and there is a prospectus available

for such registered resale, holders of Common Warrants are required to pay the exercise price for the Common Warrants in cash. If no

such registration statement and prospectus are available following September 14, 2022, the Common Warrants may be exercised through cashless

exercise, where the holder of the Common Warrant receives fewer shares upon exercise of its Common Warrant, but does not pay the Company

any cash to exercise the Common Warrant.

SELLING STOCKHOLDERS

The common stock being offered

by the selling stockholders are those previously issued to the selling stockholders, and those issuable to the selling stockholders, upon

exercise of the Private Placement Warrants. For additional information regarding the issuances of those shares of common stock and Private

Placement Warrants, see the description of the Private Placement in “Summary - Private Placement” above. We are registering

the shares of common stock in order to permit the selling stockholders to offer the shares for resale from time to time. None of the selling

stockholders have had any material relationship with us within the past three years. None of the selling stockholders is a broker-dealer

or an affiliate of a broker-dealer.

The table below lists the

selling stockholders and other information regarding the beneficial ownership of the shares of common stock by each of the selling stockholders.

The second column lists the number of shares of common stock beneficially owned by each selling stockholder, based on its ownership of

the shares of common stock and warrants, as of March 28, 2022, assuming exercise of the warrants (including the Private Placement Warrants)

held by the selling stockholders on that date, without regard to any limitations on exercises.

The third column lists the

shares of common stock being offered by this prospectus by the selling stockholders.

In accordance with the terms

of a registration rights agreement with the selling stockholders, this prospectus generally covers the resale of the sum of (i) the number

of shares of common stock issued to the selling stockholders in the description of the Private Placement referenced above and (ii) the

maximum number of shares of common stock issuable upon exercise of the related Private Placement Warrants, determined as if the outstanding

Private Placement Warrants were exercised in full as of the trading day immediately preceding the date this registration statement was

initially filed with the SEC, each as of the trading day immediately preceding the applicable date of determination and all subject to

adjustment as provided in the registration rights agreement, without regard to any limitations on the exercise of the Private Placement

Warrants. The fourth column assumes the sale of all of the shares offered by the selling stockholders pursuant to this prospectus.

Under the terms of the Private

Placement Warrants, a selling stockholder may not exercise the Private Placement Warrants to the extent such exercise would cause such

selling stockholder, together with its affiliates and attribution parties, to beneficially own a number of shares of common stock which

would exceed 4.99% or 9.99% of our then outstanding common stock following such exercise, excluding for purposes of such determination

shares of common stock issuable upon exercise of the Private Placement Warrants which have not been exercised. The number of shares in

the second column does not reflect this limitation. The selling stockholders may sell all, some or none of their shares in this offering.

See “Plan of Distribution.”

| Name of Selling stockholder |

Number of Shares of Common Stock Owned

Prior to Offering

(1) |

|

Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus |

|

Number of Shares of

Common Stock Owned

After Offering

(2) |

|

Percentage of Outstanding Common Stock Owned After the Offering (30) |

| Armistice Capital Master Fund Ltd. (3) |

4,488,206 |

(4) |

3,603,606 |

(5) |

632,120 (31) |

|

4.99 |

| Iroquois Capital Investment Group LLC (6) |

738,466 |

(7) |

585,586 |

(8) |

152,880 |

|

1.3 |

| Iroquois Master Fund Ltd. (9) |

419,900 |

(10) |

315,316 |

(11) |

104,584 |

|

* |

| Bigger Capital Fund LP (12) |

700,133 |

(13) |

562,900 |

(14) |

137,233 |

|

1.1 |

| District 2 Capital Fund LP (15) |

338,000 |

(16) |

338,000 |

(17) |

0 |

|

- |

| Empery Asset Master, LTD (18) |

688,200 |

(19) |

542,096 |

(20) |

146,104 |

|

1.2 |

| Empery Tax Efficient, LP (21) |

191,250 |

(22) |

154,944 |

(23) |

36,306 |

|

* |

| Empery Tax Efficient III, LP (24) |

256,650 |

(25) |

203,860 |

(26) |

52,790 |

|

* |

| Hudson Bay Master Fund Ltd. (27) |

960,900 |

(28) |

900,900 |

(29) |

60,000 |

|

* |

___________________

| * |

Denotes less than 1%. |

| |

|

| (1) |

Under applicable SEC rules, a person is deemed to beneficially own securities which the person has the right to acquire within 60 days through the exercise of any option or warrant or through the conversion of a convertible security. Also under applicable SEC rules, a person is deemed to be the “beneficial owner” of a security with regard to which the person directly or indirectly, has or shares (a) voting power, which includes the power to vote or direct the voting of the security, or (b) investment power, which includes the power to dispose, or direct the disposition, of the security, in each case, irrespective of the person’s economic interest in the security. To our knowledge, subject to community property laws where applicable, each person named in the table has sole voting and investment power with respect to the common stock shown as beneficially owned by such selling stockholder, except as otherwise indicated in the footnotes to the table. |

| (2) |

Represents the amount of shares that will be held by the selling stockholder after completion of this offering based on the assumptions that (a) all common stock underlying Private Placement Warrants registered for sale by the registration statement of which this prospectus is part will be sold and (b) no other shares of common stock are acquired or sold by the selling stockholder prior to completion of this offering. However, each selling stockholder may sell all, some or none of the such shares offered pursuant to this prospectus and may sell other shares of common stock that they may own pursuant to another registration statement under the Securities Act or sell some or all of their shares pursuant to an exemption from the registration provisions of the Securities Act, including under Rule 144. |

| (3) |

The securities are directly held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company (the “Master Fund”), and may be deemed to be indirectly beneficially owned by: (i) Armistice Capital, LLC (“Armistice Capital”), as the investment manager of the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. Armistice Capital and Steven Boyd disclaim beneficial ownership of the securities except to the extent of their respective pecuniary interests therein. The address of the Master Fund and Armistice Capital is 510 Madison Ave, 7th Floor, New York, NY 10022. |

| (4) |

Ownership prior to the offering represents (i) 635,002 shares of common stock, (ii) 1,166,801 shares of common stock issuable upon exercise of Pre-Funded Warrants (subject to a 9.99% beneficial ownership limitation), (iii) 1,801,803 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation), and (iv) 884,600 shares of common stock issuable upon exercise of other warrants (subject to a 4.99% beneficial ownership limitation). |

| (5) |

Represents (i) 635,002 shares of common stock, (ii) 1,166,801 shares of common stock issuable upon exercise of Pre-Warrants (subject to a 9.99% beneficial ownership limitation), and (iii) 1,801,803 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation). |

| (6) |

Richard Abbe is the Managing Member of Iroquois Capital

Investment Group, LLC and may be deemed to have voting and dispositive power with respect to the shares. The business address of Iroquois

Capital Investment Group, LLC is 2 Overhill Road, Scarsdale, New York 10583. |

| (7) |

Ownership prior to the offering represents (i) 292,793 shares of common stock, (ii) 292,793 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation), and (iii) 152,880 shares of common stock issuable upon exercise of other warrants. |

| (8) |

Represents (i) 292,793 shares of common stock and (ii) 292,793 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation). |

| (9) |

Richard Abbe and Kim Page are Managing Members of Iroquois Capital Management

LLC, investment advisor to Iroquois Master Fund, Ltd and may be deemed to have voting and dispositive power with respect to the shares.

The business address of Iroquois Master Fund Ltd is 2 Overhill Road, Scarsdale, New York 10583. |

| (10) |

Ownership prior to the offering represents (i) 157,658 shares of common stock, (ii) 157,658 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation), and (iii) 104,584 shares of common stock issuable upon exercise of other warrants (subject to a 4.99% beneficial ownership limitation). |

| (11) |

Represents (i) 157,658 shares of common stock and (ii) 157,658 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation). |

| (12) |

Michael Bigger, the authorized agent of Bigger Capital Fund, LP (“Bigger

Capital”), has discretionary authority to vote and dispose of the securities held by Bigger Capital. Michael Bigger may be deemed

to be the beneficial owner of these securities. The business address of Bigger Capital Fund, LP is 11700 West Charleston Blvd., #170-659,

Las Vegas, NV 89135. |

| (13) |

Ownership prior to the offering represents (i) 281,450 shares of common stock, (ii) 281,450 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation) and (iii) 137,233 shares of common stock issuable upon exercise of other warrants. |

| (14) |

Represents (i) 281,450 shares of common stock and (ii) 281,450 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation). |

| (15) |

Michael Bigger, the authorized agent of District 2 Capital Fund (“District”),

has discretionary authority to vote and dispose of the securities held by District. Michael Bigger may be deemed to be the beneficial

owner of these securities. The business address of District 2 Capital Fund LP is 14 Wall Street, Suite 200, Huntington, NY 11743. |

| (16) |

Ownership prior to the offering represents (i) 169,000 shares of common stock and (ii) 169,000 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation). |

| (17) |

Represents (i) 169,000 shares of common stock and (ii) 169,000 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation). |

| (18) |

Empery Asset Management LP, the authorized agent of Empery Asset Master Ltd (“EAM”), has discretionary authority to vote and dispose of the shares held by EAM and may be deemed to be the beneficial owner of these shares. Martin Hoe and Ryan Lane, in their capacity as investment managers of Empery Asset Management LP, may also be deemed to have investment discretion and voting power over the shares held by EAM. EAM, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these shares. |

| (19) |

Ownership prior to the offering represents (i) 271,048 shares of common stock, (ii) 271,048 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation), and (iii) 146,104 shares of common stock issuable upon exercise of other warrants (subject to a 4.99% beneficial ownership limitation). |

| (20) |

Represents (i) 271,048 shares of common stock and (ii) 271,048 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation). |

| (21) |

Empery Asset Management LP, the authorized agent of Empery Tax Efficient, LP (“ETE”), has discretionary authority to vote and dispose of the shares held by ETE and may be deemed to be the beneficial owner of these shares. Martin Hoe and Ryan Lane, in their capacity as investment managers of Empery Asset Management LP, may also be deemed to have investment discretion and voting power over the shares held by ETE. ETE, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these shares. |

| (22) |

Ownership prior to the offering represents (i) 77,472 shares of common stock, (ii) 77,472 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation), and (iii) 36,306 shares of common stock issuable upon exercise of other warrants (subject to a 4.99% beneficial ownership limitation). |

| (23) |

Represents (i) 77,472 shares of common stock and (ii) 77,472 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation). |

| (24) |

Empery Asset Management LP, the authorized agent of Empery Tax Efficient III, LP (“ETE III”), has discretionary authority to vote and dispose of the shares held by ETE III and may be deemed to be the beneficial owner of these shares. Martin Hoe and Ryan Lane, in their capacity as investment managers of Empery Asset Management LP, may also be deemed to have investment discretion and voting power over the shares held by ETE III. ETE III, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these shares. |

| (25) |

Ownership prior to the offering represents (i) 101,930 shares of common stock, (ii) 101,930 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation), and (iii) 52,790 shares of common stock issuable upon exercise of other warrants (subject to a 4.99% beneficial ownership limitation). |

| (26) |

Represents (i) 101,930 shares of common stock and (ii) 101,930 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation). |

| (27) |

Hudson Bay Capital Management LP, the investment manager of Hudson Bay Master Fund Ltd., has voting and investment power over these securities. Sander Gerber is the managing member of Hudson Bay Capital GP LLC, which is the general partner of Hudson Bay Capital Management LP. Each of Hudson Bay Master Fund Ltd. and Sander Gerber disclaims beneficial ownership over these securities. The address for Hudson Bay Master Fund Ltd. Is c/o Hudson Bay Capital Management LP, 28 Havemeyer Place, 2nd Floor, Greenwich, Connecticut 06830. |

| (28) |

Ownership prior to the offering represents (i) 315,000 shares of common stock, (ii) 135,450 shares of common stock issuable upon exercise of Pre-Funded Warrants (subject to a 4.99% beneficial ownership limitation), (iii) 450,450 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation), and (iv) 60,000 shares of common stock issuable upon exercise of other warrants (subject to a 4.99% beneficial ownership limitation). |

| (29) |

Represents (i) 315,000 shares of common stock, (ii) 135,450 shares of common stock issuable upon exercise of Pre-Funded Warrants (subject to a 4.99% beneficial ownership limitation), and (iii) 450,450 shares of common stock issuable upon exercise of Common Warrants (subject to a 4.99% beneficial ownership limitation). |

| (30) |

Based on 7,129,778 shares of common stock outstanding as of March 28, 2022, and assumes that following the offering all of the 4,905,855

Private Placement Warrants will have been exercised (such that 12,035,633 shares of common stock will be outstanding), and all of the

shares offered by the selling stockholders hereunder will have been sold. |

| (31) | Following the offering, the selling stockholder will own 884,600 warrants. Such warrants

are subject to a 4.99% beneficial ownership limitation and the number of shares deemed beneficially following the offering is limited

accordingly. |

PLAN OF DISTRIBUTION

Each selling stockholder of

the securities and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities

covered hereby on the Nasdaq Capital Market or any other stock exchange, market or trading facility on which the securities are traded

or in private transactions. These sales may be at fixed or negotiated prices. A selling stockholder may use any one or more of the following

methods when selling securities:

| · | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| · | block trades in which the broker-dealer will attempt to sell the securities as agent but may position

and resell a portion of the block as principal to facilitate the transaction; |

| · | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| · | an exchange distribution in accordance with the rules of the applicable exchange; |

| · | privately negotiated transactions; |

| · | settlement of short sales; |

| · | in transactions through broker-dealers that agree with the Selling Stockholders to sell a specified number

of such securities at a stipulated price per security; |

| · | through the writing or settlement of options or other hedging transactions, whether through an options

exchange or otherwise; |

| · | a combination of any such methods of sale; or |

| · | any other method permitted pursuant to applicable law. |

The selling stockholders may

also sell securities under Rule 144 or any other exemption from registration under the Securities Act, if available, rather than under

this prospectus.

Broker-dealers engaged by

the selling stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts

from the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts

to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in excess of a

customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or markdown in

compliance with FINRA IM-2440.

In connection with the sale

of the securities or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial

institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The selling

stockholders may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities

to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or other transactions with

broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer

or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution

may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling stockholders and

any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning

of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any

profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities

Act. Each selling stockholder has informed the Company that it does not have any written or oral agreement or understanding, directly

or indirectly, with any person to distribute the securities.

The Company is required to

pay certain fees and expenses incurred by the Company incident to the registration of the securities. The Company has agreed to indemnify

the selling stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to keep this prospectus

effective until the earlier of (i) the date on which the securities may be resold by the Selling Stockholders without registration and

without regard to any volume or manner-of-sale limitations by reason of Rule 144, and provided the Company is in compliance with the current

public information under Rule 144 under the Securities Act or any other rule of similar effect or (ii) all of the securities have been

sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The resale securities will

be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain

states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable

state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and

regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market

making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement

of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions of the Exchange Act and the rules

and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the common stock by the Selling

Stockholders or any other person. We will make copies of this prospectus available to the Selling Stockholders and have informed them

of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule

172 under the Securities Act).

LEGAL MATTERS

The validity of the shares

of common stock offered hereby will be passed upon for us by Andrew I. Telsey, P.C.

EXPERTS

The consolidated financial

statements of Sunshine Biopharma, Inc. at December 31, 2021 and 2020 appearing in our Annual Report on From 10-K for the year ended December

31, 2021 have been audited by of B F Borgers CPA PC, independent registered public accountants, as set forth in its report thereon, included

therein, and incorporated herein by reference. Such financial statements are incorporated herein by reference in reliance upon such report

given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC

a registration statement on Form S-3 under the Securities Act that registers the shares of our common stock covered by this prospectus.

This prospectus does not contain all of the information set forth in the registration statement and the exhibits thereto. For further

information with respect to us and our common stock, you should refer to the registration statement and the exhibits filed as a part of

the registration statement. Statements contained in or incorporated by reference into this prospectus concerning the contents of any contract

or any other document are not necessarily complete. If a contract or document has been filed as an exhibit to the registration statement

or one of our filings with the SEC that is incorporated by reference into the registration statement, we refer you to the copy of the

contract or document that has been filed. Each statement contained in or incorporated by reference into this prospectus relating to a

contract or document filed as an exhibit is qualified in all respects by the filed exhibit.

We are subject to the informational

reporting requirements of the Exchange Act. We file reports, proxy statements and other information with the SEC. Our SEC filings are

available over the Internet at the SEC’s website at http://www.sec.gov.

We make available, free of charge, on our website

at www.sunshinebiopharma.com, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments

to those reports and statements as soon as reasonably practicable after they are filed with the SEC. The contents of our website are

not part of this prospectus, and the reference to our website does not constitute incorporation by reference into this prospectus of

the information contained on or through that site, other than documents we file with the SEC that are specifically incorporated by reference

into this prospectus.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate

by reference” into this prospectus the information in documents we file with it, which means that we can disclose important information

to you by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus, and

information that we file later with the SEC will automatically update and supersede this information. Any statement contained in any document

incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus

to the extent that a statement contained in or omitted from this prospectus or any accompanying prospectus supplement, or in any other

subsequently filed document which also is or is deemed to be incorporated by reference herein, modifies or supersedes such statement.

Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We incorporate by reference

the documents listed below and any future documents that we file with the SEC (excluding any portion of such documents that are furnished

and not filed with the SEC) under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (i) after the date of the initial filing of the

registration statement of which this prospectus forms a part prior to the effectiveness of the registration statement and (ii) after the

date of this prospectus until the offering of the securities is terminated:

| · | our Annual Report on Form 10-K for our fiscal year ended December 31, 2021, filed with the SEC on March

21, 2022; |

| · | our Current Reports on Form 8-K filed with the SEC on February 10, 2022, February 17, 2022, February 25,

2022, March 15, 2022 and March 24, 2022; and |

| · | the description of our common stock contained in our Registration Statement on Form 8-A, registering our

common stock under Section 12(b) under the Exchange Act, filed with the SEC on February 10, 2022. |

You may request a copy of

these filings, at no cost, by writing or telephoning us at the following address: Sunshine Biopharma, Inc., 6500 Trans-Canada Highway,

4th Floor, Pointe-Claire, Quebec, Canada H9R 0A5; telephone number (514) 426-6161.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table provides

information regarding the various expenses (other than placement agent fees) payable by us in connection with the issuance and distribution

of the securities being registered hereby. All amounts shown are estimates except the SEC registration fee.

| Securities and Exchange Commission Registration Fee | |

$ | 1,707 | |

| Legal Fees and Expenses | |

$ | 150,000 | |

| Accounting Fees and Expenses | |

$ | 10,800 | |

| Miscellaneous | |

$ | 5,000 | |

| Total | |

$ | 167,507 | |

Item 15. Indemnification of Officers and Directors.

Section 7-108-402 of the

Colorado Business Corporation Act (the “CBCA”) provides, generally, that the articles of incorporation may contain a provision

eliminating or limiting the personal liability of a director to the corporation or its shareholders for monetary damages for breach of

fiduciary duty as a director, except that any such provision shall not eliminate or limit the liability of a director for (i) any breach

of the director’s duty of loyalty to the corporation or its shareholders, (ii) acts or omissions not in good faith or which involve

intentional misconduct or a knowing violation of law, (iii) acts specified in Section 7-108-403 of the CBCA, or (iv) any transaction

from which the director directly or indirectly derived an improper personal benefit.

Section 7-109-102(1) of the

CBCA permits indemnification of a director of a Colorado corporation, in the case of a third party action, if the director (a) conducted

himself or herself in good faith, (b) reasonably believed that (i) in the case of conduct in his or her official capacity, his or her

conduct was in the corporation’s best interest, or (ii) in all other cases, his or her conduct was not opposed to the corporation’s

best interest, and (c) in the case of any criminal proceeding, had no reasonable cause to believe that his conduct was unlawful. Section

7-109-103 further provides for mandatory indemnification of directors and officers who are successful on the merits or otherwise in litigation.

Section 7-109-102(4) of the

CBCA limits the indemnification that a corporation may provide to its directors in two key respects. A corporation may not indemnify

a director in a derivative action in which the director is held liable to the corporation, or in any proceeding in which the director

is held liable on the basis of his improper receipt of a personal benefit. Sections 7-109-104 of the CBCA permits a corporation to advance

expenses to a director, and Section 7-109-107(1)(c) of the CBCA permits a corporation to indemnify and advance litigation expenses to

officers, employees and agents who are not directors to a greater extent than directors if consistent with law and provided for by the

bylaws, a resolution of directors or shareholders, or a contract between the corporation and the officer, employee or agent.

Our bylaws include provisions

that require the company to indemnify our directors or officers against monetary damages for actions taken as a director or officer of

our Company. We are also expressly authorized to carry directors’ and officers’ insurance to protect our directors, officers,

employees and agents for certain liabilities. Our articles of incorporation do not contain any limiting language regarding director immunity

from liability.

Insofar as indemnification

for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling us pursuant to the foregoing

provisions, we have been informed that, in the opinion of the SEC, such indemnification is against public policy as expressed in the

Securities Act and is therefore unenforceable. In the event that a claim for indemnification against such liabilities (other than the

payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful

defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities

being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent, submit to a court

of appropriate jurisdiction the question whether such indemnification by us is against public policy as expressed hereby in the Securities

Act and we will be governed by the final adjudication of such issue.

Item 16. Exhibits.

| * |

Filed herewith. |

| |

|

| (1) |

Incorporated by reference to SB-2 filed with the SEC on October 19, 2007. |

| (2) |

Incorporated by reference to 8-K filed with the SEC on November 6, 2009. |

| (3) |

Incorporated by reference to 10-Q filed with the SEC on August 4, 2010. |

| (4) |

Incorporated by reference to 8-K filed with the SEC on June 1, 2015. |

| (5) |

Incorporated by reference to 8-K filed with the SEC on June 24, 2020. |

| (6) |

Incorporated by reference to 8-K filed February 10, 2022. |

Item 17. Undertakings.

The undersigned registrant hereby undertakes:

(1) To file, during any period

in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus

required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus

any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof)

which individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding

the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed

that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the

form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no

more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table

in the effective Registration Statement; and

(iii) To include any material

information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to

such information in the Registration Statement;

provided, however, that paragraphs (1)(i),

(1)(ii) and (1)(iii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs

is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Securities

Exchange Act of 1934 that are incorporated by reference in the Registration Statement, or is contained in a form of prospectus filed pursuant

to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose

of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona

fide offering thereof.

(3) To remove from registration

by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose

of determining liability under the Securities Act to any purchaser:

(A) Each prospectus filed by

the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus

was deemed part of and included in the registration statement; and

(B) Each prospectus required

to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering

made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities

Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is

first used after effectiveness or the date of the first contract of sale of securities in the offering described in prospectus. As provided

in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be

a new effective date of the registration statement relating to the securities in the registration statement to which the prospectus relates,

and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however,

that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated

or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as

to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration

statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date;

and

(5) The undersigned hereby

undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report

pursuant to Section 13(a) or Section 15(d) of the Exchange Act of 1934 that is incorporated by reference in the Registration Statement

shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at

that time shall be deemed to be the initial bona fide offering thereof.

(6) Insofar as indemnification

for liabilities arising under the Securities Act may be permitted to directors, officers, and controlling persons of the registrant pursuant

to the foregoing provisions, or otherwise, the registrant has been advised that, in the opinion of the Securities and Exchange Commission,

such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a

claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director,

officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director,

officer, or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel

the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification

by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized,

in the City of Point-Claire, Quebec, Canada, on March 30, 2022.

| |

SUNSHINE BIOPHARMA, INC. |

|

| |

|

|

|

| Dated: March 30, 2022 |

By: |

/s/ Dr. Steve N. Slilaty |

|

| |

|

Dr. Steve N. Slilaty, Chief Executive Officer (principal executive officer) |

|

| |

|

|

|

| |

|

|

|

| |

|

/s/ Camille Sebaaly |

|

| |

|

Camille Sebaaly, Chief Financial Officer (principal financial and accounting officer) |

|

Each person whose signature

appears below constitutes and appoints Dr. Steve N. Slilaty, his true and lawful attorney-in-fact and agent, with full power of substitution

and re-substitution for him and in his name, place and stead, and in any and all capacities, to sign for him and in him name in the capacities

indicated below any and all amendments (including post-effective amendments) to this registration statement (or any other registration

statement for the same offering that is to be effective upon filing pursuant to Rule 462(b) under the Securities Act of 1933, as amended),

and to file the same, with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission,

granting unto said attorney-in-fact and agent, full power and authority to do and perform each and every act and thing requisite or necessary

to be done in and about the premises, as full to all intents and purposes as he might or could do in person, hereby ratifying and confirming

all that said attorney-in-fact and agent, or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements

of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates

indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Dr. Steve N. Slilaty |

|

Chief Executive Officer and Director |

|

March 30, 2022 |

| Dr. Steve N. Slilaty |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/ Camille Sebaaly |

|

Chief Financial Officer |

|

March 30,, 2022 |

| Camille Sebaaly |

|

(Principal Financial and Accounting Officer) |

|

|

| |

|

|

|

|

| /s/ Dr. Abderrazzak Merzouki |

|

Director |

|

March 30, 2022 |

| Dr. Abderrazzak Merzouki |

|

|

|

|

| |

|

|

|

|

| /s/ David Natan |

|

Director |

|

March 30, 2022 |

| David Natan |

|

|

|

|

| |

|

|

|

|

| /s/ Dr. Andrew Keller |

|

Director |

|

March 30, 2022 |

| Dr. Andrew Keller |

|

|

|

|

| |

|

|

|

|

| /s/ Dr. Rabi Kiderchah |

|

Director |

|

March 30, 2022 |

| Dr. Rabi Kiderchah |

|

|

|

|

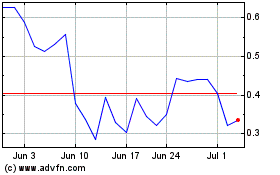

Sunshine Biopharma (NASDAQ:SBFM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sunshine Biopharma (NASDAQ:SBFM)

Historical Stock Chart

From Apr 2023 to Apr 2024