Additional Proxy Soliciting Materials (definitive) (defa14a)

March 28 2022 - 8:57AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange

Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive

Proxy Statement |

| ☒ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material Pursuant to §240.14a-12 |

ADVAXIS,

INC.

(Name

of Registrant(s) as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

| ☒

|

No

fee required. |

| |

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Advaxis,

Inc.

9

Deer Park Drive, Suite K-1

Monmouth

Junction, NJ 08852

This

Supplement to Proxy Statement (this “Supplemental Proxy Statement”), which supplements the Definitive Proxy Statement filed

by Advaxis, Inc. (the “Company”) on February 28, 2022 (the “Definitive Proxy Statement”), includes additional

information about how to vote regarding Proposal No. 1 to be voted on at the Company’s Special Meeting of Stockholders scheduled

for March 31, 2022 (the “Special Meeting”).

The

following disclosure is added to supplement the disclosure appearing on page 5 of the Definitive Proxy Statement, and will appear immediately

above “May I change my vote?”

********

Q:

Will choosing not to vote my shares have the same effect as casting a vote against Proposal No. 1?

A:

No. If you prefer that Proposal No. 1 not be approved, you should cast your vote against the proposal. Approval of Proposal No. 1 requires

the affirmative vote of the holders of a majority of the outstanding voting power of Advaxis Common Stock and Preferred Stock entitled

to vote on the proposal, voting as a single class, assuming a quorum is present. Since the Preferred Stock has 30,000 votes per share

on Proposal No. 1, the failure of a share of Common Stock to be voted will effectively have no impact on the outcome of the vote. However,

votes of the shares of Preferred Stock, when cast, are automatically voted in a manner that “mirrors” the proportions on

which the shares of Common Stock (excluding any shares of Common Stock that are not voted) are voted on Proposal No. 1. Therefore, shares

of Common Stock voted against the proposal will have the effect of causing the proportion of Preferred Stock voted against the proposal

to increase accordingly and vice versa.

********

The

Special Meeting will be held entirely online. You will be able to attend and participate in the Special Meeting online by visiting http://www.virtualshareholdermeeting.com/ADXS2022SM

on March 31, 2022, beginning at 10:00 am, local time.

Important

Information and Where to Find It

This

Supplemental Proxy Statement contains information that relates to Proposal No. 1 in the Definitive Proxy Statement, which is a proposal

to approve an amendment to the Company’s Amended and Restated Certificate of Incorporation (the “Charter”) to effect

a reverse stock split of the Company’s common stock at a ratio to be determined by the Board of Directors of the Company within

a range of one-for-twenty to one-for-eighty (or any number in between), without reducing the authorized number of shares of the common

stock, to be effected in the sole discretion of the Board of Directors at any time within one year of the date of the Special Meeting

without further approval or authorization of the Company’s stockholders. The Definitive Proxy Statement has been mailed by the

Company to its stockholders of record on February 25, 2022 and was filed by the Company with the Securities and Exchange Commission.

This Supplemental Proxy Statement does not contain all the information that should be considered concerning Proposal No. 1. It is not

intended to form the basis of any decision in respect of Proposal No. 1. Advaxis stockholders and other interested persons are advised

to read the Definitive Proxy Statement in connection with the solicitation of proxies for the Special Meeting. Stockholders are also

able to obtain a copy of the Definitive Proxy Statement free of charge at the Company’s website at www.advaxis.com or by written

request to the Company at 9 Deer Park Drive, Suite K-1, Monmouth Junction, NJ, Attention: Igor Gitelman, VP of Finance and Chief Accounting

Officer.

Participants

in the Solicitation

The

Company and its directors and executive officers may be considered participants in the solicitation of proxies with respect to Proposal

No. 1. Information regarding such directors and executive officers, including a description of their interests, by security holdings

or otherwise, in the actions contemplated by Proposal No. 1 is in the Definitive Proxy Statement. Stockholders, potential investors and

other interested persons should read the Definitive Proxy Statement carefully before making any voting or investment decisions. The Definitive

Proxy Statement can be obtained free of charge as described in the preceding paragraph.

Forward-Looking

Statements

This

press release contains forward-looking statements that are made pursuant to the safe harbor provisions within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements

are any statements that express the current beliefs and expectations of management, including but not limited to statements related to

the Company’s history of net operating losses and uncertainty regarding its ability to achieve profitability; expected clinical

development of the Company’s drug product candidates, statements about the Company’s balance sheet position, including the

sufficiency of the Company’s cash and cash equivalents to fund its obligations into the future, and statements related to the goals,

plans and expectations for the Company’s ongoing clinical studies. These and other risks are discussed in the Company’s filings

with the SEC, including, without limitation, the definitive proxy statement on Schedule 14A, filed on February 28, 2022, its Annual Report

on Form 10-K, filed on February 14, 2022, and its periodic reports on Form 10-Q and Form 8-K. Any statements contained herein that do

not describe historical facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results,

performance and achievements to differ materially from those discussed in such forward-looking statements. The Company cautions readers

not to place undue reliance on any forward-looking statements, which speak only as of the date they were made. The Company undertakes

no obligation to update or revise forward-looking statements, except as otherwise required by law, whether as a result of new information,

future events or otherwise.

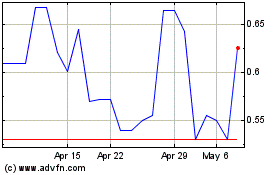

Ayala Pharmaceuticals (QX) (USOTC:ADXS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ayala Pharmaceuticals (QX) (USOTC:ADXS)

Historical Stock Chart

From Apr 2023 to Apr 2024