Current Report Filing (8-k)

March 25 2022 - 4:46PM

Edgar (US Regulatory)

0001723517

false

0001723517

2022-03-22

2022-03-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March

22, 2022

UC ASSET, LP

(Exact name of registrant as specified in its

charter)

| |

|

|

|

|

| Delaware |

|

024-10802 |

|

30-0912782 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| |

|

|

|

|

| |

|

2299 Perimeter Park Drive, Suite 120

Atlanta, Georgia 30341

(Address of principal executive offices) |

|

|

| |

Registrant’s

telephone number: (470) 475-1035 |

|

| |

|

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

| N/A |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act ☐

Item 4.02. Non-Reliance on Previously Issued Financial Statements

or a Related Audit Report or Completed Interim Review.

On March 22, 2022, the management

of UC Asset LP (the “Company”) was notified orally, and subsequently, on March 24, 2022, the management of the Company was

notified in writing, by the US Security and Exchange Commission (the “SEC”), that the SEC has objected to the Company’s

conclusion that UC Asset LP and its subsidiaries met the criteria to apply Investment Company accounting under ASC 946 for certain historical

periods. Accordingly, the Company’s previously issued financial statements for certain periods should no longer be relied upon.

Specifically, the following filings should not be relied upon.

The Company’s registration

statement on Form 10-12 G filed on September 18, 2020; The Company’s registration statement on Form 10-12 G/A filed on December

21, 2020; the Company’s registration statement on Form 10-12G/A filed on March 11, 2021; the Company’s registration statement

on Form 10-12G/A filed on April 29, 2021; the Company’s Annual Report on Form 10-K filed on August 3, 2021; the Company’s

quarterly report on Form 10-Q filed on September 10, 2021; the Company’s quarterly report on Form 10-Q filed on September 10, 2021;

the Company’s registration statement on Form 10-12G/A filed on September 16, 2021; the Company’s amended annual report on

Form 10-K/A filed on November 1, 2021, and the Company’s quarterly report on Form 10-Q filed on November 23, 2021.

The Company has historically used

investment company accounting based on its understanding of the rules relating to the use of such accounting methods; however, in light

of the conclusion of the Staff of the SEC disclosed above, management has concluded that the financial statements listed above should

not be relied upon. Management has further determined to withdraw from the registration requirements under the Securities Act of 1934

by filing SEC Form 15, which it is qualified to do. As a result, the SEC filings previously mentioned will not be amended, and future

filings will be made under the Regulation A rules in accordance with its prior filing requirements.

Management of the Company has

discussed the matters disclosed herein with its independent auditors, BF Borgers & Co., an independent registered public accounting

firm.

Caution Regarding Forward-Looking Statements

This Form 8-K includes

information that constitutes forward-looking statements. Forward-looking statements often address our expected future business and financial

performance, and often contain words such as “believe,” “expect,” “anticipate,” “intend,”

“plan,” or “will.” By their nature, forward-looking statements address matters that are subject to risks and uncertainties.

Any such forward-looking statements may involve risk and uncertainties that could cause actual results to differ materially from any future

results encompassed within the forward-looking statements. Examples of such forward-looking statements include, but are not limited to,

statements regarding our expectations with regard to decreases in revenue and bad debt expense, an increase in net cash provided by operating

activities, reclassification of any portion of cash to restricted cash or our expectations with respect to any restated amount in our

financial statements for the Restated Periods. Factors that could cause or contribute to such differences include: the review of the Company’s

accounting, accounting policies and internal control over financial reporting; and the subsequent discovery of additional adjustments

to the Company’s previously issued financial statements. Actual events or results may differ materially from the Company’s

expectations. In addition, our financial results and stock price may suffer as a result of this review and any subsequent determinations

from this process, or any actions taken by governmental or other regulatory bodies as a result of this process. We do not undertake to

update our forward-looking statements, except as required by applicable securities laws.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: March 25, 2022 |

UC ASSET LP |

| |

|

| |

By: |

/s/ Xianghong Wu |

| |

|

Xianghong Wu |

| |

|

Majority Member of General Partner |

| |

|

|

| |

|

|

| |

By: |

/s/ Gregory Charles Bankston |

| |

|

Gregory Charles Bankston |

| |

|

Managing General Partner |

UC Asset Limited Partner... (QB) (USOTC:UCASU)

Historical Stock Chart

From Mar 2024 to Apr 2024

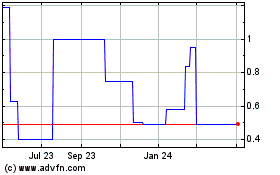

UC Asset Limited Partner... (QB) (USOTC:UCASU)

Historical Stock Chart

From Apr 2023 to Apr 2024