UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-SA

(Mark One)

☒

SEMIANNUAL REPORT PURSUANT TO REGULATION A

or

☐

SPECIAL FINANCIAL REPORT PURSUANT TO REGULATION A

For the fiscal semiannual period ended June

30, 2021

| Starstream Entertainment, Inc. |

| (Exact name of registrant as specified in its charter) |

Nevada

(State of other jurisdiction of incorporation or

organization)

1917 Bayview Drive

New Smyrna Beach, FL 32168

Phone: (833) 422-7300

(Address, including zip code, and telephone number,

including area code of issuer’s principal

executive office)

STARSTREAM ENTERTAINMENT, INC.

SEMIANNUAL REPORT ON FORM 1-SA

TABLE OF CONTENTS

| Item 1. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

The following discussion of our financial condition

and results of operations should be read in conjunction with our condensed consolidated financial statements and the related notes included

in Item 3 of this report, and together with our audited consolidated financial statements and the related notes included in our Form 1-A

for the fiscal year ended December 31, 2020. Historical results are not necessarily indicative of future results.

Certain statements and other information set forth

in this semi-annual report on Form 1-SA may address or relate to future events and expectations and as such constitute “forward-looking

statements” within the meaning of the Private Securities Litigation Act of 1995. Such forward-looking statements involve significant

risks and uncertainties. Such statements may include, without limitation, statements with respect to our plans, objectives, projections,

expectations and intentions and other statements identified by words such as “may”, “could”, “would”,

“should”, “will”, “believes”, “expects”, “anticipates”, “estimates”,

“intends”, “plans” or similar expressions. Forward-looking statements include, but are not limited to, statements

about: expectations regarding our future revenue, the timing and release of our games, the implementation of our business model, our ability

to enter into further licensing and publishing agreements, proceeds, timing and other expectations regarding the sale of Fig Game Shares,

our expectations regarding our cash flow, our financial performance, our ability to obtain funding for our operations, our expectations

regarding our cost of revenue, operating expenses and capital expenditures, and our future capital requirements.

All forward-looking statements are predictions

or projections and involve known and unknown risks, estimates, assumptions, uncertainties and other factors that may cause our actual

transactions, results, performance, achievements and outcomes to differ adversely from those expressed or implied by such forward-looking

statements. You should not place undue reliance on forward-looking statements.

The cautionary statements set forth in this report

and in the section entitled “Risk Factors” in our Annual Statement on Form 1-A (File No. 024-11197), which was filed with

the Securities and Exchange Commission, or SEC, on April 16, 2020 identify important factors that you should consider in evaluating our

forward-looking statements. These factors include, among other things: (1) our history of losses; (2) our ability to continue as a going

concern; (3) we may not be able to have our content accepted by the marketplace; (4) markets for our products and services; (5) our cash

flows; (6) our operating performance; (7) our financing activities; (8) Our ability to compete effectively; (9) our ability to source

and finance video entertainment products (10) our tax status; (11) national, international and local economic and business conditions

that could affect our business; (12) industry developments affecting our business, financial condition and results of operations; and

(13) governmental approvals, actions and initiatives and changes in laws and regulations or the interpretation thereof, including without

limitation tax laws, regulations and interpretations.

Although we believe that the expectations reflected

in our forward-looking statements are reasonable, we cannot guarantee future transactions, results, performance, achievements or outcomes.

No assurance can be given that the expectations reflected in our forward-looking statements will be attained or that deviations from them

will not be material and adverse. We undertake no obligation, other than as may be required by law, to re-issue this report or otherwise

make public statements in order to update our forward-looking statements beyond the date of this report.

In this report, all references to “Starstream,”

“we,” “us,” “our,” or “the Company” mean Starstream Entertainment, Inc. and its consolidated

entities.

This report contains trademarks, service marks

and trade names that are the property of their respective owners.

Overview

Our subsidiary, Facetime Consulting and Promotions

LLC (“FCP”), is primarily focused in the on-demand event staffing industry. The primary placements that FCP makes are to companies

in the consumer goods industry.

Across the Event Staffing Industry there are countless

dedicated event staff that complete amazing work to represent brands and help them connect with their customers. FCP, a division of Starstream

Entertainment, Inc., hand-picks and personally interviews Brand Ambassadors to ensure the ideal fit for its clients’ programs.

The Event Staffing and Experiential Marketing

Industry has existed in its current form for 30 years and has operated with what amounts to an ‘ad hoc’ workforce. Brand Ambassadors,

Field Managers, Promotional Models and other Experiential Marketing workers can join with FCP to legitimize their careers, gain accountability,

receive career development, and increase the stability the industry. FCP is positioning itself to become a cornerstone of the event marketing

industry by partnering with not only individual workers but with companies throughout the industry.

FCP works with clients to maximize brand messaging.

FCP staff works to capture the key brand attributes and client messaging that are essential to telling our client’s story and optimizing

conversions. FCP personally interviews each brand ambassador to ensure we present the “optimal fit” for our client’s

needs. FCP strives to understand the importance of each client’s brand.

Our offices are located at 1917 Bayview Drive,

New Smyrna Beach, FL 32168. We maintain a website at http://www.facetimepromo.com. Our phone number is 833-422-7300 and our email address

is carla@facetimepromo.com. We do not incorporate the information on or accessible through our website into this report, and you should

not consider any information on, or that can be accessed through, our website a part of this report.

Organizational History

SSF was organized on April 11, 2012 in Delaware

as a single purpose entity to invest into Butler Films, LLC, a Delaware limited liability company, formed for the purpose of financing,

developing, producing, distributing and exploiting the motion picture entitled “Lee Daniels’ The Butler,” which was

theatrically released on August 16, 2013. SSF originally had two members, Charles Bonan (President and Chairman of SSET) (70%) and Lawrence

Ladove (30%). In August 2013, Mr. Bonan and Mr. Ladove assigned their membership interests in SSF to SSE. In connection with and in consideration

of the assignment by Mr. Ladove, on August 2, 2013, SSF assigned 30% of its films rights with respect to “Lee Daniels’ The

Butler” to the Ladove Family Trust. As a result, SSF became a wholly owned subsidiary of SSE entitled to 70% of such rights. See

"Our Portfolio of Films" below.

In July 2014, Starstream Entertainment, Inc. (the

“Company”) formed a new, wholly owned subsidiary, YHSSE, LLC, a Delaware limited liability company (“YHSSE”),

in connection with the Company’s plans to produce and invest in a new feature-length motion picture. The Company no longer produces

or invests in films.

The Company currently has one subsidiary. Our

subsidiary, Facetime Consulting and Promotions LLC (“FCP”), is primarily focused in the on-demand event staffing industry.

Results of Operations

On July 22, 2020, the offering circular for our

Reg A offering of Starstream Entertainment, Inc. was qualified by the SEC, which was an important milestone in the expansion of our operations

and the execution of our business model.

As of June 30, 2021, we have cash balance of $92,475.

Our cash balance is not sufficient to fund our limited level of operations for any substantive period of time. We have been utilizing,

and may continue to utilize, funds from the sale of Company stock.

In order to implement our plan of operations for

the next twelve-month period, we require a minimum of $500,000 of funding. We plan to obtain this funding from the sale of shares of our

common stock or through debt financing.

During the six month period ended June 30, 2021,

a total of 10,000,000 shares of common stock were sold for a total of $100,000.00.

The Six Months Ended June 30, 2021 and June

30, 2020

Revenue: The company generated $469,742

in revenue for the six months ended June 30, 2021 and $353,315 for the six months ended June 30, 2020.

Operating Expenses: Operating expenses

for the six months ended June 30, 2021, were $349,411 and $61,193 for the six months ended June 30, 2020. Operating expenses for the six

months ended June 30, 2021 comprised of general and administrative expenses.

Net Income/Loss: Net loss for the six months

ended June 30, 2021, was $131,717 and $33,934 net income for the six months ended June 30, 2020. The net loss for the six months ended

June 30, 2021, was the result of general and administrative expenses.

Prepaid Assets

As of June 30, 2021, the Company prepaid expenses

of $17,500.

Liquidity and Capital Resources

We had cash of $341,506 at June 30, 2021 and $206,338

at June 30, 2020.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements

that have, or are reasonably likely, to have a current or future effect on our financial condition, changes in financial condition, revenues

or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Critical Accounting Policies

We have identified the policies outlined below

as critical to our business operations and an understanding of our results of operations. The list is not intended to be a comprehensive

list of all of our accounting policies. In many cases, the accounting treatment of a particular transaction is specifically dictated by

accounting principles generally accepted in the United States, with no need for management’s judgment in their application. The

impact and any associated risks related to these policies on our business operations is discussed throughout management’s Discussion

and Analysis or Plan of Operation where such policies affect our reported and expected financial results. Note that our preparation of

the financial statements requires us to make estimates and assumptions that affect the reported amount of assets and liabilities, disclosure

of contingent assets and liabilities at the date of our financial statements, and the reported amounts of revenue and expenses during

the reporting period. There can be no assurance that actual results will not differ from those estimates.

Share-Based Compensation

ASC 718, “Compensation – Stock

Compensation”, prescribes accounting and reporting standards for all share-based payment transactions in which employee services

are acquired. Transactions include incurring liabilities, or issuing or offering to issue shares, options, and other equity instruments

such as employee stock ownership plans and stock appreciation rights. Share-based payments to employees, including grants of employee

stock options, are recognized as compensation expense in the financial statements based on their fair values. That expense is recognized

over the period during which an employee is required to provide services in exchange for the award, known as the requisite service period

(usually the vesting period).

The Company accounts for stock-based compensation

issued to non-employees and consultants in accordance with the provisions of ASC 505-50, “Equity – Based Payments to Non-Employees.”

Measurement of share-based payment transactions with non-employees is based on the fair value of whichever is more reliably measurable:

(a) the goods or services received; or (b) the equity instruments issued. The fair value of the share-based payment transaction is determined

at the earlier of performance commitment date or performance completion date.

The Company had no stock-based compensation plans

on June 30, 2021.

Going Concern

Our ability to continue as a going concern depends

upon our ability to successfully accomplish the plans embodied in our business model and eventually secure other sources of financing

and attain profitable operations. To date, we have had no revenue and significant losses. Accordingly, we have depended on sale of Web

Global Holdings Shares to fund our operations and there is a risk that we may be unable to obtain the financing, on acceptable terms or

at all, necessary to continue our operations. As such, there is substantial doubt regarding our ability to continue as a going concern

for a period of one year from the date our condensed consolidated financial statements are issued. The accompanying condensed consolidated

financial statements do not include any adjustments that might be necessary if we are unable to continue as a going concern. These condensed

consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts,

or amounts and classification of liabilities that might result from this uncertainty.

| Item 2. |

Other Information |

None.

| Item 3. |

Financial Statements |

STARSTREAM ENTERTAINMENT,

INC.

CONSOLIDATED

BALANCE SHEETS AT JUNE 30, 2021 & 2020 (UNAUDITED)

| |

|

2020 |

|

|

2019 |

|

| |

|

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| CURRENT ASSETS |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Cash |

|

$ |

341,506 |

|

|

$ |

206,338 |

|

| |

|

|

|

|

|

|

|

|

| Prepaid expenses |

|

|

17,500 |

|

|

|

– |

|

| |

|

|

|

|

|

|

|

|

| TOTAL CURRENT ASSETS |

|

|

359,006 |

|

|

|

206,338 |

|

| |

|

|

|

|

|

|

|

|

| FIXED ASSETS |

|

|

8,000 |

|

|

|

– |

|

| |

|

|

|

|

|

|

|

|

| OTHER ASSETS |

|

|

39,737 |

|

|

|

– |

|

| |

|

|

|

|

|

|

|

|

| TOTAL ASSETS |

|

$ |

406,743 |

|

|

$ |

206,338 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Accounts Payable |

|

$ |

6,497 |

|

|

$ |

2,818 |

|

| |

|

|

|

|

|

|

|

|

| Accrued Interest Payable |

|

|

6,444 |

|

|

|

1,093 |

|

| |

|

|

|

|

|

|

|

|

| Due to Stockholder |

|

|

27,490 |

|

|

|

– |

|

| |

|

|

|

|

|

|

|

|

| Notes Payable (Note 2) |

|

|

98,500 |

|

|

|

123,500 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL CURRENT LIABILITIES |

|

|

138,931 |

|

|

|

127,411 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES |

|

|

138,931 |

|

|

|

127,411 |

|

| |

|

|

|

|

|

|

|

|

| STOCKHOLDERS’ EQUITY (DEFICIT) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Preferred A Stock $.001 par value 10,000,000 Authorized 2 issued, and outstanding at June 30, 2021 and June 30, 2020 respectively |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Preferred B Stock $.001 par value 1,000,000 Authorized I issued and Outstanding at June 30, 2021 and 0 authorized and 0 issued and Outstanding at June 30, 2020 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Common Stock, $.001 par value 450,000,000 Authorized 115,010,196 issued and outstanding at June 30, 2021 and 18,010,196 Issued and outstanding June 30, 2019 |

|

|

115,010 |

|

|

|

18,010 |

|

| |

|

|

|

|

|

|

|

|

| Additional paid-in-capital |

|

|

333,678 |

|

|

|

– |

|

| |

|

|

|

|

|

|

|

|

| Accumulated earnings |

|

|

(180,876 |

) |

|

|

60,917 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL STOCKHOLDERS’ EQUITY (DEFICIT) |

|

|

267,812 |

|

|

|

78,927 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) |

|

$ |

406,743 |

|

|

$ |

206,338 |

|

The accompanying notes are

an integral part of the financial statements.

STARSTREAM ENTERTAINMENT,

INC.

CONSOLIDATED

STATEMENT OF OPERATIONS

FOR THE THREE AND SIX MONTHS

ENDED JUNE 30, 2021 & 2020

(UNAUDITED)

| |

|

For the Three

Months Ended

June 30, 2021 |

|

|

For the Three

Months Ended

June 30, 2020 |

|

|

For the Six

Months Ended

June 30, 2021 |

|

|

For the Six

Months Ended

June 30, 2020 |

|

| REVENUES: |

| Sales |

|

$ |

221,552 |

|

|

$ |

153,175 |

|

|

$ |

469,742 |

|

|

$ |

353,315 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL REVENUE |

|

|

221,552 |

|

|

|

153,175 |

|

|

|

469,742 |

|

|

|

353,315 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COST OF SALES |

|

|

127,478 |

|

|

|

83,387 |

|

|

|

250,616 |

|

|

|

257,097 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GROSS MARGIN |

|

|

94,074 |

|

|

|

69,788 |

|

|

|

219,126 |

|

|

|

96,218 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| General & administrative expenses |

|

|

52,931 |

|

|

|

18,373 |

|

|

|

190,088 |

|

|

|

22,734 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Marketing |

|

|

16,402 |

|

|

|

4,431 |

|

|

|

20,086 |

|

|

|

5,911 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Wages |

|

|

59,085 |

|

|

|

– |

|

|

|

110,369 |

|

|

|

– |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Meals & entertainment |

|

|

2,842 |

|

|

|

1,566 |

|

|

|

5,679 |

|

|

|

3,272 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Professional Fees |

|

|

933 |

|

|

|

8,158 |

|

|

|

3,405 |

|

|

|

19,960 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Insurance |

|

|

2,427 |

|

|

|

739 |

|

|

|

5,891 |

|

|

|

1,386 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Travel |

|

|

2,781 |

|

|

|

118 |

|

|

|

4,733 |

|

|

|

680 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Rent & related expenses |

|

|

4,810 |

|

|

|

2,900 |

|

|

|

9,160 |

|

|

|

7,250 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Operating expenses |

|

|

142,211 |

|

|

|

36,285 |

|

|

|

349,411 |

|

|

|

61,193 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET OPERATING INCOME/ (LOSS) |

|

|

(48,137 |

) |

|

|

33,503 |

|

|

|

(130,285 |

) |

|

|

35,025 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME/(EXPENSE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income |

|

|

345 |

|

|

|

|

|

|

|

400 |

|

|

|

– |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Finance and interest fees |

|

|

(921 |

) |

|

|

(748 |

) |

|

|

(1,832 |

) |

|

|

(1,097 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME/ (LOSS) |

|

$ |

(48,713 |

) |

|

$ |

32,755 |

|

|

$ |

(131,717 |

) |

|

$ |

33,934 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted Net Income/Loss per Common Share |

|

|

(.00042 |

) |

|

|

.0018 |

|

|

|

(.00114 |

) |

|

|

.0019 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted Average Number of Common Shares Outstanding |

|

|

115,010,196 |

|

|

|

18,010,196 |

|

|

|

115,010,196 |

|

|

|

18,010,196 |

|

The accompanying notes are

an integral part of the financial statements.

STARSTREAM ENTERTAINMENT,

INC.

CONSOLIDATED

STATEMENTS OF CASH FLOWS

FOR THE SIX MONTHS ENDED

JUNE 30, 2021 & 2020

(UNAUDITED)

| |

|

2021 |

|

|

2020 |

|

| CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Net Income / (Loss) |

|

$ |

(131,717 |

) |

|

$ |

33,934 |

|

| |

|

|

|

|

|

|

|

|

| Adjustments to reconcile net income to net cash provided By operating activities: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stock Issued for Services |

|

|

28,782 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Increase/(decrease in accrued interest payable |

|

|

3,663 |

|

|

|

1,093 |

|

| |

|

|

|

|

|

|

|

|

| Increase/(decrease) in accrued payroll |

|

|

– |

|

|

|

(85 |

) |

| |

|

|

|

|

|

|

|

|

| (Increase)/decrease in prepaid expenses |

|

|

(17,500 |

) |

|

|

– |

|

| |

|

|

|

|

|

|

|

|

| Increase/ (decrease) in accounts payable |

|

|

(5,502 |

) |

|

|

2,675 |

|

| |

|

|

|

|

|

|

|

|

| (Increase)/decrease in other assets |

|

|

(32,987 |

) |

|

|

7,492 |

|

| |

|

|

|

|

|

|

|

|

| NET CASH PROVIDED (USED) BY OPERATING ACTIVITIES |

|

$ |

(155,261 |

) |

|

$ |

45,106 |

|

| |

|

|

|

|

|

|

|

|

| CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Acquisition of fixed assets |

|

|

(8,000 |

) |

|

|

– |

|

| |

|

|

|

|

|

|

|

|

| NET CASH PROVIDED (USED) BY INVESTING ACTIVITIES |

|

|

(8,000 |

) |

|

|

|

|

| |

|

|

|

|

|

|

|

|

| CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| (Decrease)/Increase in REG A |

|

|

371,495 |

|

|

|

– |

|

| |

|

|

|

|

|

|

|

|

| (Decrease)/Increase in notes payable |

|

|

– |

|

|

|

112,510 |

|

| |

|

|

|

|

|

|

|

|

| (Decrease)/Increase in Due from Stockholder |

|

|

– |

|

|

|

(6,963 |

) |

| |

|

|

|

|

|

|

|

|

| NET CASH PROVIDED (USED) BY FINANCING ACTIVITIES |

|

|

371,495 |

|

|

|

105,547 |

|

| |

|

|

|

|

|

|

|

|

| NET INCREASE (DECREASE) IN CASH |

|

|

208,234 |

|

|

|

150,656 |

|

| |

|

|

|

|

|

|

|

|

| CASH AND EQUIVALENTS, BEGINNING OF PERIOD |

|

|

133,272 |

|

|

|

55,682 |

|

| |

|

|

|

|

|

|

|

|

| CASH AND EQUIVALENTS, END OF PERIOD |

|

$ |

341,506 |

|

|

$ |

206,388 |

|

| |

|

|

|

|

|

|

|

|

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Common stock issued for compensation |

|

|

|

|

|

|

|

|

The accompanying notes are

an integral part of the financial statements.

STARSTREAM ENTERTAINMENT,

INC.

CONSOLIDATED

STATEMENTS OF CHANGES IN STOCKHOLDERS’ DEFICIT

FOR THE THREE MONTHS ENDED

JUNE 30, 2021

(UNAUDITED)

| |

|

|

PREFERRED STOCK |

|

|

|

COMMON STOCK |

|

|

|

ADDITIONAL

PAID |

|

|

|

ACCUMULATED

EQUITY |

|

|

|

TOTAL

SHAREHOLDERS’ EQUITY |

|

| |

|

|

SHARES |

|

|

|

VALUE |

|

|

|

SHARES |

|

|

|

VALUE |

|

|

|

IN CAPITAL |

|

|

|

(DEFICIT) |

|

|

|

(DEFICIT) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BALANCE DECEMBER 31, 2017 |

|

|

2 |

|

|

$ |

0 |

|

|

|

18,010,196 |

|

|

$ |

18,010 |

|

|

$ |

0 |

|

|

$ |

(14,128 |

) |

|

$ |

3,882 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME DECEMBER 31, 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

8,865 |

|

|

$ |

8,865 |

|

| BALANCE DECEMBER 31, 2018 |

|

|

2 |

|

|

$ |

0 |

|

|

|

18,010,196 |

|

|

$ |

18,010 |

|

|

$ |

0 |

|

|

$ |

(5,263 |

) |

|

$ |

12,747 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ISSUANCE OF PREFERRED B SHARES |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME DECEMBER 31,2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32,246 |

|

|

|

32,247 |

|

| BALANCE DECEMBER 31, 2019 |

|

|

3 |

|

|

$ |

0 |

|

|

|

18,010,196 |

|

|

$ |

18,010 |

|

|

$ |

0 |

|

|

$ |

26,983 |

|

|

$ |

44,993 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common Stock Issued as Compensation |

|

|

|

|

|

|

|

|

|

|

35,000,000 |

|

|

|

35,000 |

|

|

$ |

(30,000 |

) |

|

|

|

|

|

|

5,000 |

|

| Common Stock Issued under REG A |

|

|

|

|

|

|

|

|

|

|

15,000,000 |

|

|

|

15,000 |

|

|

$ |

10,401 |

|

|

|

|

|

|

|

25,401 |

|

| NET LOSS DECEMBER 31, 2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(76,142 |

) |

|

|

(76,142 |

) |

| BALANCE DECEMBER 31, 2020 |

|

|

3 |

|

|

$ |

0 |

|

|

|

68,010,196 |

|

|

$ |

68,010 |

|

|

$ |

(19,599 |

) |

|

$ |

(49,159 |

) |

|

$ |

(748 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common Stock Issued for Services |

|

|

|

|

|

|

|

|

|

|

6,000,000 |

|

|

|

6,000 |

|

|

|

54,000 |

|

|

|

|

|

|

|

60,000 |

|

| Common Stock Issued under REG A |

|

|

|

|

|

|

|

|

|

|

15,000,000 |

|

|

|

15,000 |

|

|

|

131,495 |

|

|

|

|

|

|

|

146,495 |

|

| Common Stock Issued for note conversion |

|

|

|

|

|

|

|

|

|

|

2,500,000 |

|

|

|

2,500 |

|

|

|

22,500 |

|

|

|

|

|

|

|

25,000 |

|

| NET LOSS MARCH 31, 2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(83,004 |

) |

|

|

(83,004 |

) |

| BALANCE MARCH 31, 2021 |

|

|

3 |

|

|

$ |

0 |

|

|

|

91,510,196 |

|

|

$ |

91,510 |

|

|

$ |

188,396 |

|

|

$ |

(132,163 |

) |

|

$ |

147,743 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common Stock Issued for Services |

|

|

|

|

|

|

|

|

|

|

3,500,000 |

|

|

|

3,500 |

|

|

|

25,282 |

|

|

|

|

|

|

|

28,782 |

|

| Common Stock Issued under REG A |

|

|

|

|

|

|

|

|

|

|

200,000,00 |

|

|

|

20,000 |

|

|

|

180,000 |

|

|

|

|

|

|

|

200,000 |

|

| NET LOSS JUNE 30, 2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(48,713 |

) |

|

|

(48,713 |

) |

| BALANCE JUNE 30, 2021 |

|

|

3 |

|

|

$ |

0 |

|

|

|

115,010,196 |

|

|

$ |

115,010 |

|

|

$ |

333,678 |

|

|

$ |

(180,876 |

) |

|

$ |

267,812 |

|

The accompanying notes are

an integral part of the financial statements.

STARSTREAM ENTERTAINMENT,

INC.

NOTES

TO THE FINANCIAL STATEMENTS JUNE 30, 2021

(UNAUDITED)

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

| |

A. |

ORGANIZATION AND OPERATIONS |

Starstream Entertainment, Inc. (The

“Company”) is the successor entity to the business of Gelia Group Corp. a corporation formed in Nevada on August 20, 2012.

The Corporation was the financing entity for various movie production projects. In November 2013 the Company changed its name to Starstream

Entertainment, Inc.

In June of 2019, the Company acquired

all of the assets of Facetime Consulting & Promotions. The merger requires that the Company divest itself of its media subsidiary

and maintain the name to Starstream Entertainment, Inc. the Company retains the name Starstream Entertainment, Inc. and the symbol to

SSET.

On July 26, 2019 the Corporation

amended its Articles of Incorporation to raise its authorized stock to 450,000,000 (four hundred and fifty million). And the Corporation

further amended its Articles of Incorporation to designate 1,000,000 Preferred Shares as Convertible Preferred Series B Stock with a par

value of $.001. The holders of the Convertible Preferred Series B Stock are entitled to vote together with the holders of the Company's

Common Stock and Series A Preferred Stock. The total aggregate issued shares of Series B Preferred Stock at any given time, regardless

of their number, shall have voting rights equal to four times the sum of: i) the total number of shares of Common Stock which are issued

and outstanding at the time of voting, plus ii) the total number of votes Preferred Series A holders are entitled. At no time can the

combination of votes by Common shareholders and Series A Preferred shareholders be equal to or greater than the votes entitled to Convertible

Preferred Series B shareholders. The holders of the Convertible Preferred Series B Stock are entitled to 100,000,000 shares of Common

Stock for every 1 share of Convertible Preferred Series B Stock. The Corporation issued 1 share of Convertible Series B Preferred Stock

to Carla Rissell.

The Company utilizes the cash method

of accounting, whereby revenue is recognized when received and expenses when paid. The unaudited financial statements have been prepared

in accordance with generally accepted accounting principles for interim financial information with the exception of the utilization of

the cash basis method rather than the accrual method. As such, the financial statements do not include all of the information and footnotes

required by generally accepted accounting principles for complete financial statements. In the opinion of management, all adjustments

considered necessary for a fair presentation have been included and these adjustments are of a normal recurring nature. The results of

operations for the Six months ended June 31, 2021 and June 31, 2020 are not necessarily indicative of the results for the full fiscal

year ending December 31, 2020.

The preparation of financial statements

in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the

reported amounts of revenues and expenses during the period. Actual results could differ from those estimates.

| |

D. |

CASH AND CASH EQUIVALENTS |

Cash and cash equivalents

include cash on hand; cash in banks and any highly liquid investments with maturity of three months or less at the time of purchase. The

Company maintains cash and cash equivalent balances at several financial institutions, which are insured by the Federal Deposit Insurance

Corporation up to $250,000.

STARSTREAM

ENTERTAINMENT, INC.

NOTES TO

THE FINANCIAL STATEMENTS JUNE 30, 2021

(UNAUDITED)

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES (continued)

| |

E. |

COMPUTATION OF EARNINGS PER SHARE |

Net income per share is computed by dividing the net income

by the weighted average number of common shares outstanding during the period.

In February 1992, the Financial Accounting

Standards Board issued Statement on Financial Accounting Standards 109 of "Accounting for Income Taxes." Under Statement 109,

deferred tax assets and liabilities are recognized for the estimated future tax consequences attributable to differences between the financial

statement carrying amounts of existing assets and liabilities and their respective tax bases.

Revenue for license fees is recognized upon

the receipt of the amount of the contract. Contract fees are generally due based upon various progress milestones. Revenue from contract

payments are recorded as received. Any adjustments between actual contract payments and estimates are made to current operations in the

period they are determined.

| |

H. |

FAIR VALUE OF FINANCIAL INSTRUMENTS |

Statement of Financial Accounting

Standards No. 107, “Disclosures about Fair Value of Financial Instruments”, requires disclosures of information about the

fair value of certain financial instruments for which it is practicable to estimate the value. For purpose of this disclosure, the fair

value of a financial instrument is the amount at which the instrument could be exchanged in a current transaction between willing parties,

other than in a forced sale or liquidation. The carrying amounts reported in the balance sheet for cash, accounts receivable, inventory,

accounts payable and accrued expenses, and loans payable approximate their fair market value based on the short-term maturity of these

instruments.

NOTE 2 –NOTES AND OTHER LOANS PAYABLE

The Company borrowed $10,990 as a

demand note on December 31, 2017 from Carla Rissell. The note carries no interest it was originally from a shareholder. On January 1,

2020 the note holder added $3,000 to the demand note. The note is carried as a current liability and the noteholder could call it due

at any time. The note was paid off in the second quarter of 2020. On February 18, 2020 the Company borrowed $25,000 as a convertible promissory

note from Tiger Trout Capital of Puerto Rico Inc. The note has a due date of February 18, 2021 and has a per annum interest rate of 12%.

The note has a conversion option whereby the holder can convert all or any part of the principal face into Common Stock equal to a 50%

discount of the lowest traded price of the market for the period of 30 days prior to the notice of conversion. On October 13, 2020 the

note holder converted the note through the REG A for 2,500,000 shares. On June 30, 2020 the Company secured a $98,500.00 from the Small

Business Administration, the interest rate is 3.75% per annum and is a 30 year note with the first payment due in 8 months.

NOTE 3– ACCRUED SALARIES

There were no salaries accrued in the

six months ended June 31, 2021 and June 31, 2020 respectively.

NOTE 4- SUBSEQUENT EVENTS

were no events that would require

additional disclosure at the time of financial statement presentation.

Index to Exhibits

_________

(1) Filed as an exhibit to the Company’s

Form 1-A dated March 18, 2022 and incorporated herein by reference.

SIGNATURES

Pursuant to the requirements

of Regulation A, the issuer has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

STARSTREAM ENTERTAINMENT, INC. |

|

| |

|

|

| Dated: March 22, 2022 |

By: |

/s/ Carla Rissell |

|

| |

|

Carla Rissell |

|

| |

|

Chief Executive Officer |

|

| By: |

/s/ James DiPrima |

|

| |

James DiPrima |

|

| |

Chief Financial Officer,

Chief Accounting Officer and Director |

|

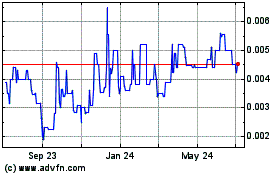

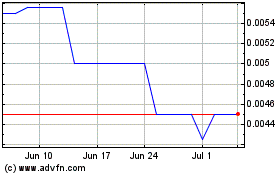

Starstream Entertainment (PK) (USOTC:SSET)

Historical Stock Chart

From Mar 2024 to Apr 2024

Starstream Entertainment (PK) (USOTC:SSET)

Historical Stock Chart

From Apr 2023 to Apr 2024