Current Report Filing (8-k)

March 21 2022 - 4:31PM

Edgar (US Regulatory)

0001349706

false

0001349706

2022-03-21

2022-03-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

____________________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

___________________________________________________________________

Date of Report (Date of earliest event reported): March

21, 2022

IMPERALIS HOLDING

CORP.

(Exact name of registrant as specified in its charter)

| Nevada |

|

000-52140 |

|

20-5648820 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

11411 Southern Highlands Parkway, Suite 240,

Las Vegas, NV 89141

(Address of principal executive offices) (Zip Code)

(949) 444-5464

(Registrant's telephone number, including area

code)

(Former address, if

changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act: None.

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

| ITEM 1.01 | ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT |

On March 20, 2022, BitNile Holdings, Inc., a Delaware

corporation (the “Parent”) and its majority owned subsidiary, Imperalis Holding Corp., a Nevada corporation (“IMHC”)

entered into a Securities Purchase Agreement (the “Agreement”) with TurnOnGreen, Inc., a Nevada corporation (“TOGI”),

a wholly owned subsidiary of the Parent.

Pursuant to the Agreement, Parent will (i) deliver

to IMHC all of the outstanding shares of common stock of TOGI held by the Parent, and (ii) forgive and eliminate the intracompany accounts

(the “Accounts”) between the Parent and TOGI evidencing historical equity investments made by the Parent to TOGI, in

the approximate amount of $25,000,000, in consideration for the issuance by IMHC to the Parent (the “Transaction”)

of an aggregate of 25,000 newly designated shares of Series A Preferred Stock (the “IMHC Preferred Stock”), with each

such share having a stated value of $1,000. The closing of the Transaction is subject to the Parent’s delivery to IMHC of audited

financial statements of TOGI and other customary closing conditions.

Immediately following the completion of the Transaction,

TOGI will be a wholly owned subsidiary of IMHC. Outstanding shares of common stock of IMHC (the “IMHC Common Stock”)

will remain outstanding and unaffected upon completion of the Transaction, as will outstanding warrants and options to purchase IMHC Common

Stock. The IMHC Common Stock will continue to be registered under the Securities Exchange Act of 1934, as amended, immediately following

the Transaction.

The parties to the Agreement (the “Parties”)

have agreed that, upon completion of the Transaction, IMHC will change its name to TurnOnGreen, Inc., and, through an upstream merger

whereby the current TurnOnGreen shall cease to exist and have two operating subsidiaries, TOG Technologies Inc. and Digital Power Corporation.

Promptly following the closing of the Transaction, IMHC will dissolve its three dormant subsidiaries.

The Parties have further agreed that the IMHC

Preferred Stock shall have an aggregate liquidation preference of $25 million; be convertible into IMHC Common Stock at the Parent’s

option; be redeemable by the Parent, and entitle the Parent to vote with IMHC Common Stock on an as-converted basis.

| ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

IMPERALIS HOLDING CORP. |

| |

|

| |

|

| Dated: March 21, 2022 |

/s/ Darren Magot |

|

| |

Darren Magot |

| |

Chief Executive Officer |

-3-

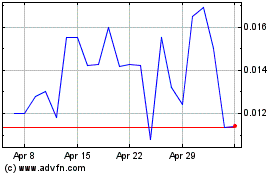

Imperalis (PK) (USOTC:IMHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

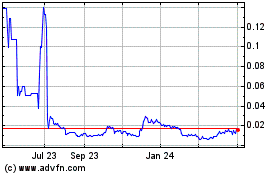

Imperalis (PK) (USOTC:IMHC)

Historical Stock Chart

From Apr 2023 to Apr 2024