Current Report Filing (8-k)

March 18 2022 - 3:35PM

Edgar (US Regulatory)

0000826253

false

0000826253

2022-03-18

2022-03-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): March

18, 2022

AURA SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

0-17249 |

|

95-4106894 |

| (State or other jurisdiction of incorporation or organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

20431 North Sea Circle

Lake Forest, CA 92630

(Address of principal executive offices)

(310) 643-5300

(Registrant’s telephone number, including area

code)

Not Applicable

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On March 14, 2022, Aura Systems, Inc. (the “Company”) reached

an agreement with former director Robert Kopple and his related entities (collectively the “Kopple Parties”) to resolve all

remaining litigation between them stemming from the previously disclosed litigation originally brought by the Kopple Parties against the

Company and various other defendants in 2017.

In connection with this litigation the Kopple Parties claimed to be owed

in excess of $13 million as a result of various loans made by the Kopple Parties between 2013 and 2016. Additionally, the Kopple Parties

were seeking the current equivalent of the approximately 23 million warrants, exercisable for seven years at a price of $0.10 per share,

which they claimed should have been originally issued to them pursuant to a 2014 agreement with the Company.

Under the terms of the settlement, the Company has agreed to pay the Kopple

Parties an aggregate amount of $10 million over a period of seven years; $3 million of which is to be paid within approximately three

months, after which, interest will accrue on the unpaid balance at a rate of 6%, compounded annually. All amounts, including all accrued

interest, are to be paid no later than eight years from the date of the initial payment. The Company may prepay any amount at any time

without penalty. Plaintiffs will additionally receive seven-year warrants to purchase up to an aggregate of approximately 3.3 million

shares of the Company’s common stock at a price of $0.85 per share. The settlement also provides for standard mutual general release

provisions and includes customary representations, warranties, and covenants, including certain increases in the amount payable to the

Kopple Parties and the right of such parties to enter judgment against the Company if the Company remains in uncured default in its payment

obligations under the settlement.

The settlement resolves all claims asserted against the Company by the

Kopple Parties without any admission, concession or finding of any fault, liability or wrongdoing by the Company.

Item 8.01 Other Events.

A press release, dated March 18, 2022, with respect to the settlement

described in Item 1.01 of this Current Report, is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: March 18, 2022 |

By: |

/s/ Cipora Lavut |

| |

|

Cipora Lavut |

| |

|

President |

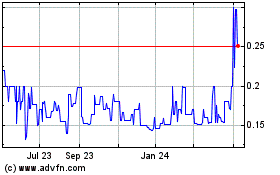

Aura Systems (PK) (USOTC:AUSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

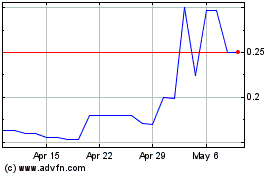

Aura Systems (PK) (USOTC:AUSI)

Historical Stock Chart

From Apr 2023 to Apr 2024