Current Report Filing (8-k)

March 15 2022 - 5:29PM

Edgar (US Regulatory)

false

0000039092

0000039092

2022-03-11

2022-03-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 11, 2022

FRIEDMAN INDUSTRIES, INCORPORATED

(Exact name of registrant as specified in its charter)

|

Texas

|

1-07521

|

74-1504405

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

1121 Judson Road Suite 124, Longview, Texas 75601

(Address of principal executive offices, including zip code)

(903) 758-3431

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d- 2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which

registered

|

|

Common Stock, $1 Par Value

|

FRD

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On March 11, 2022, Friedman Industries, Incorporated (the “Company”) entered into a First Amendment (the “Amendment”) to that certain Amended and Restated Credit Agreement by and among the Company, the lenders party thereto and JPMorgan Chase Bank, N.A., as administrative agent, dated as of May 19, 2021 (the “A&R Credit Agreement”). The Amendment amends the A&R Credit Agreement in order to increase the asset-based revolving loans available thereunder from an aggregate principal amount of up to $40.0 million to an aggregate principal amount of up to $75.0 million (the “ABL Facility”). Subject to the conditions set forth in the A&R Credit Agreement (as amended by the Amendment), the ABL Facility may be increased by up to an aggregate of $10.0 million, in minimum increments of $5.0 million.

The Amendment also amends the A&R Credit Agreement such that the interest accruing on outstanding borrowings under the ABL Facility is based on either Term SOFR or the Prime Rate rather than LIBOR. As amended by the Amendment, interest shall accrue on outstanding Term SOFR borrowings under the ABL Facility at a rate equal to Term SOFR plus a 0.10% adjustment plus a margin equal to 1.70% per annum. Under the Amendment, borrowings not made under a Term SOFR basis shall accrue interest based on the Prime Rate.

The Company entered into the Amendment as a precautionary measure due to recent volatility in both the physical and financial markets related to the Company’s products and further uncertainty associated with industry and geopolitical circumstances.

The foregoing description of the Amendment, the A&R Credit Agreement and the ABL Facility do not purport to be complete and are qualified in their entirety by reference to the complete text of the agreement, a copy of which will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the period ended March 31, 2022 to be filed with the Securities and Exchange Commission.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The information provided in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: March 15, 2022

|

|

FRIEDMAN INDUSTRIES, INCORPORATED

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Alex LaRue

|

|

|

|

|

Alex LaRue

|

|

|

|

|

Chief Financial Officer - Secretary and Treasurer

|

|

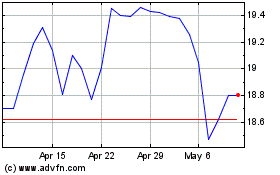

Friedman Industries (AMEX:FRD)

Historical Stock Chart

From Mar 2024 to Apr 2024

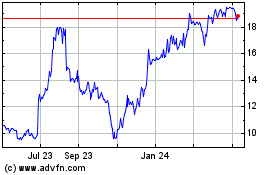

Friedman Industries (AMEX:FRD)

Historical Stock Chart

From Apr 2023 to Apr 2024