UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2022

Commission File Number: 001-38307

RETO

ECO-SOLUTIONS, INC.

(Translation

of registrant’s name into English)

c/o Beijing REIT Technology Development Co.,

Ltd.

Building X-702, 60 Anli Road, Chaoyang District,

Beijing

People’s Republic of China 100101

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Entry into a Material Definitive Agreement.

On March 10, 2022, ReTo Eco-Solutions, Inc. (the “Company”)

entered into a Securities Purchase Agreement (the “Agreement”) pursuant to which the Company issued an unsecured convertible

promissory note (the “Note”) to Streeterville Capital, LLC, an institutional accredited investor (the “Investor”).

The Note will mature 12 months after the purchase price of the Note is delivered from the Investor to the Company (the “Purchase

Price Date”). The Note has an original principal amount of $3,105,000 and Investor gave consideration of $3,000,000, reflecting

an original issue discount of $90,000 and $15,000 for Investor’s fees, costs and other transaction expenses incurred in connection

with the purchase and sale of the Note. The transaction contemplated under the Agreement was closed on March 11, 2022 and the Company

anticipates using the proceeds for general working capital purposes.

Interest accrues on the outstanding balance of the Note at 5% per annum.

Upon the occurrence of an Event of Default as defined in the Note, interest accrues at the lesser of 22% per annum or the maximum rate

permitted by applicable law. In addition, upon any Event of Default, the Investor may accelerate the outstanding balance payable under

the Note, which will increase automatically upon such acceleration by 15% or 5%, depending on the nature of the Event of Default.

Pursuant to the terms of the Note, the Company must obtain Investor’s

consent for certain fundamental transactions such as consolidation, merger with or into another entity (excerpt for a reincorporation

merger), disposition of substantial assets, change of control, reorganization or recapitalization. Any occurrence of a fundamental transaction

without Investor’s prior written consent will be deemed an Event of Default.

Investor may convert all or any part the outstanding balance of the Note

at any time after six months from the Purchase Price Date upon three trading days’ notice, into the Company’s common shares,

par value $0.001 (the “Common Shares”), at a price equal to the lower of (i) $2.00 per share, and (ii) 85% multiplied by the

lowest daily volume weighted average price during the ten trading days immediately preceding the applicable measurement date, subject

to a floor price of $1.00 per share, as adjusted pursuant to the terms of the Note, as well as certain adjustments and ownership limitations

specified in the Note. In the event that the floor price is higher than the conversion price, the Company may either agree to lower the

floor price to equal the applicable conversion price or satisfy the conversion in cash in an amount equal to 110% multiplied by the portion

of the outstanding balance being converted. The reduction in the floor price will be limited to each specific conversion.

The cumulative number of Common Shares issued upon conversion may not exceed

20% of the issued and outstanding shares of the Company before the issuance (the “Issuance Cap”). However, the Company agrees

to use reasonable commercial efforts to obtain shareholder approval of the issuance of additional Common Shares exceeding the Issuance

Cap, if necessary, in accordance with Nasdaq rules or seek to rely on the home country exemption under the Nasdaq rules. If the Company

fails to obtain such shareholder approval or rely on the home country exemption rule, the Company must pay the outstanding balance under

the Note in cash. Investor is prohibited from effecting any conversion of the Note to the extent that, as a result of such conversion,

Investor together with its affiliates, would beneficially own more than 4.99% of the number of Common Shares outstanding immediately after

giving effect to the issuance of Common Shares upon such conversion of the Note, which beneficial ownership limitation may be increased

by the holder up to, but not exceeding, 9.99%.

The Note provides for liquidated damages upon failure to comply with

any of the terms or provisions of the Note. The Company may prepay the outstanding balance of the Note, in part or in full, subject to

certain notice requirements, as long as no Event of Default has occurred and is continuing.

Pursuant to the terms of the Agreement, the Company has reserved 13,000,000

Common Shares from its authorized and unissued Common Shares to provide for all issuances of Common Shares under the Note (the “Share

Reserve”). The Company further agrees to add additional Common Shares to the Share Reserve in increments of 1,000,000 shares under

certain circumstances.

The Agreement contains customary representations, warranties and covenants.

The Company has agreed, among others, to grant the Investor a participation right of 25% of the amount raised in any equity or debt financing

of the Company. The Company has further agreed not to engage in future variable rate transactions without the Investor’s consent,

subject to certain exemptions.

The Company relied on the exemption from registration afforded by Section

4(a)(2) of the Securities Act of 1933, as amended and Regulation D promulgated thereunder in connection with the issuance and sale of

the Note and underlying Common Shares.

The foregoing description is qualified in its entirety by reference

to the full text of the Note and the Agreement, a copy of each of which is filed as Exhibit 4.1 and Exhibit 10.1 hereto, respectively

and each of which is incorporated herein by reference.

Financial Statements and Exhibits.

The following is filed as an exhibit to this report:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: March 14, 2022

RETO ECO-SOLUTIONS, INC.

| By: |

/s/

Hengfang Li |

|

| |

Name: |

Hengfang Li |

|

| |

Title: |

Chief Executive Officer |

|

3

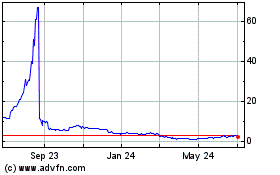

ReTo Eco Solutions (NASDAQ:RETO)

Historical Stock Chart

From Mar 2024 to Apr 2024

ReTo Eco Solutions (NASDAQ:RETO)

Historical Stock Chart

From Apr 2023 to Apr 2024