As filed with the U.S. Securities and

Exchange Commission on March 11 , 2022

Registration No. 333-257978

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

BLACKSTAR ENTERPRISE GROUP, INC.

(Exact name of registrant as specified in its

charter)

|

DELAWARE

(State or jurisdiction of incorporation or organization) |

6799

(Primary Standard Industrial Classification

Code Number) |

27-1120628

(I.R.S. Employer

Identification No.) |

4450 Arapahoe Ave., Suite 100, Boulder, CO

80303/ Phone (303) 500-3210

(Address and telephone number of principal executive

offices)

John Noble Harris, Chief Executive Officer

4450 Arapahoe Ave., Suite 100, Boulder, CO

80303/ Phone (303) 500-3210

(Name, address and telephone number of agent

for service)

COPIES OF ALL COMMUNICATIONS TO:

Christen Lambert, Attorney at Law

2920 Forestville Rd. Ste. 100 PMB 1155, Raleigh,

NC 27616 / Phone (919) 473-9130

Approximate date of commencement of proposed

sale to the public: As soon as possible after this Registration Statement becomes effective.

If any of the securities being registered on

this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following

box. [X]

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment

filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

[___] |

|

Accelerated filer |

[___] |

| Non-accelerated filer |

[_X_] |

|

Smaller reporting company |

[_X_] |

| |

|

|

Emerging growth company |

[_X_] |

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. [___]

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities To Be Registered |

Amount To Be Registered(1) |

Proposed Maximum Offering Price Per Share(2) |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee(3) |

| |

|

|

|

|

| Shares of Common Stock Underlying Convertible Notes, $0.001 par value |

46,000,000 |

$0.0344 |

$1,582,400 |

$172.64 (4) |

| |

|

|

|

|

| |

(1) |

In accordance with Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement shall be deemed to cover an indeterminate number of additional shares to be offered or issued from stock splits, stock dividends or similar transactions with respect to the shares being registered. This amount represents a good faith estimate of the shares of common stock underlying convertible notes issued by the registrant in private placements, with such amount equal to the maximum number of shares issuable upon conversion of such notes, assuming for purposes hereof that (x) such notes are convertible at $0.02 per share, and (y) interest on such note accrues at 10% per annum until the maturity dates of the convertible notes, without taking into account the limitations on the conversion of such notes (as provided for therein). |

| |

(2) |

Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(c) under the Securities Act of 1933 ("the Securities Act") based on the average of the 5-day average of the high and low prices of the common stock on July 12, 2021 as reported on the OTCQB. |

| |

(3) |

Based on the average price per share of $0.0344 for BlackStar Enterprise Group, Inc.’s common stock on July 12, 2021 as reported by the OTC Markets Group. The fee is calculated by multiplying the aggregate offering amount by .0001091, pursuant to Section 6(b) of the Securities Act of 1933. |

| |

(4) |

$172.64 previously paid, based on the 5-day average of the high and low prices of the common stock on July 12, 2021 ($0.0344), which was higher than the 5-day average of the high and low prices of the common stock on March 7 , 2022 ($0 .00684 ). |

The Registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment

which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant

to said Section 8(a), may determine.

ii

PRELIMINARY PROSPECTUS SUBJECT

TO COMPLETION DATED MARCH __, 2022

The information in this prospectus

is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities

and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting

an offer to buy these securities in any state where the offer or sale is not permitted.

BLACKSTAR ENTERPRISE GROUP, INC.

46,000,000 Shares of Common Stock Underlying

Convertible Notes

This Prospectus relates to the resale from

time to time of an aggregate of up to 46,000,000 shares of common stock par value $0.001 per share, (the “Common Shares”)

of BlackStar Enterprise Group, Inc., a Delaware corporation, by the Selling Shareholders (each a “Selling Shareholder”,

and collectively, the “Selling Shareholders”), underlying, and pursuant to the conversion of convertible notes (the

“Notes”) which were acquired from the Company pursuant to subscription agreements for an aggregate purchase price of $803,275.

This amount represents a good faith estimate of the shares of common stock underlying convertible notes issued by the registrant

in private placements, with such amount equal to the maximum number of shares issuable upon conversion of such notes, assuming

for purposes hereof that (x) such notes are convertible at $0.02 per share, and (y) interest on such note accrues at 10% per annum

until the maturity dates of the convertible notes, without taking into account the limitations on the conversion of such notes

(as provided for therein). The 46,000,000 shares being registered includes 1,386,459, 9,016,394, and 27,500,000 shares, respectively,

that may be issued pursuant to the conversion of the principal amount of the Notes, as well as 110,917, 1,100,000, and 2,750,000

additional shares that may be issued pursuant to the conversion of accrued interest over the term of the Notes, assuming a conversion

price of $0.024, $0.0244, and $0.02 per share, respectively, 300,000 shares issued to cure a default, and 3,836,230 additional

shares to cover any differences in conversion price. The Selling Shareholders have informed us that they are not “underwriters”

within the meaning of the Securities Act. The Securities and Exchange Commission (“SEC”) may take the view that, under

certain circumstances, any broker-dealers or agents that participate with the Selling Shareholders in the distribution of the Common

Shares may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities

Act”). Commissions, discounts or concessions received by any such broker-dealer or agent may be deemed to be underwriting

commissions under the Securities Act. The Selling Shareholders may sell Common Shares underlying the Notes from time to time in

the principal market on which the Registrant’s Common Stock is quoted and traded at the prevailing market price or in negotiated

transactions. We will not receive any of the proceeds from the sale of those Common Shares being sold by the Selling Shareholders.

We did, however, receive net proceeds of approximately $803,275 pursuant to the sale of the Notes to the Selling Shareholders.

We will pay the expenses of registering these Common Shares underlying the Notes.

Pursuant to registration rights granted to

the Selling Shareholders, we are obligated to register the Common Shares underlying the Notes. We will not receive any proceeds

from the sale of the Common Shares by the Selling Shareholders.

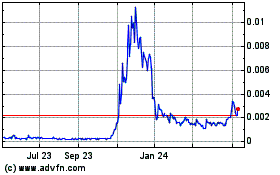

Our selling shareholders plan to sell common

shares at market prices for so long as our Company is quoted on OTCQB and as the market may dictate from time to time. There is

a limited market for the common stock, which has been trading on the OTCQB (“BEGI”) at an average of $ 0 .00684

in the past 5 days as of March 7, 2022 .

| Title |

Price Per Share |

| Common Stock |

$ 0.0344 * |

*Five-day average market sale price at July

12, 2021. The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance

with Rule 457(c). The average trading price in the 5 days prior to this amended registration statement on March 7, 2022

was $0 .00684 (less than the original calculation), so no additional fee was required.

The Selling Shareholders are offering the Common

Shares underlying the Notes. The Selling Shareholders may sell all or a portion of these Common Shares from time to time in market

transactions through any market on which the Common Stock is then traded, in negotiated transactions or otherwise, and at prices

and on terms that will be determined by the then prevailing market price or at negotiated prices directly or through a broker or

brokers, who

may act as agent or as principal or by a combination

of such methods of sale. The Selling Shareholders will receive all proceeds from such sales of the Common Shares. For additional

information on the methods of sale, you should refer to the section entitled “Plan of Distribution.”

In aggregate, the Selling Shareholders may

sell up to 46,000,000 Common Shares under this Prospectus, which includes 37,902,853 shares to be issued upon conversion of the

principal amount of convertible notes, as well as 3,960,917 additional shares that may be issued based on 10% interest per annum

until the maturity date of the convertible notes, assuming a conversion price of $0.02 per share, 300,000 shares issued to cure

a default, and 3,836,230 additional shares to cover any differences in conversion price. We are obligated to file a supplemental

registration statement or registration statements in order to register all of the Common Shares, in the event that the conversion

price is lower than $0.02 per share due to adjustments as is further described in this Registration Statement, resulting in additional

shares being issued that have not been registered pursuant to this Registration Statement.

We have one class of authorized common stock

and the Company has also issued warrants for common stock. Outstanding shares of common stock represent approximately 40% of the

voting power of our outstanding capital stock at the time of this registration, and outstanding shares of Class A Super Majority

Voting Preferred Stock held by, or subject to voting control by, our parent company, International Hedge Group, Inc., our CEO,

John Noble Harris, and our CFO, Joseph Kurczodyna, represent approximately 60% of the voting power of our outstanding capital stock

at the time of this registration statement.

This offering involves a high degree of

risk; see “RISK FACTORS” beginning on page 8 to read about factors you should consider before buying shares

of the common stock.

These securities have not been approved

or disapproved by the Securities and Exchange Commission (the “SEC”) or any state or provincial securities commission,

nor has the SEC or any state or provincial securities commission passed upon the accuracy or adequacy of this prospectus. Any representation

to the contrary is a criminal offense.

This offering will be on a delayed and continuous

basis for sales of selling shareholders’ shares. The selling shareholders are not paying any of the offering expenses and

we will not receive any of the proceeds from the sale of the shares by the selling shareholders. (See “Description of Securities

– Shares”).

The information in this prospectus is not complete

and may be changed. These securities may not be sold until the date that the registration statement relating to these securities,

which has been filed with the Securities and Exchange Commission, becomes effective. This prospectus is not an offer to sell these

securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The date of this Prospectus is March __,

2022 .

iii

TABLE OF CONTENTS

ITEM 3. PROSPECTUS SUMMARY INFORMATION,

RISK FACTORS AND RATIO OF EARNINGS TO FIXED CHARGES

Please read this prospectus carefully. It describes

our business, our financial condition and results of operations. We have prepared this prospectus so that you will have the information

necessary to make an informed investment decision.

You should rely only on information contained

in this prospectus. We have not authorized any other person to provide you with different information. This prospectus is not an

offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information

in this prospectus is complete and accurate as of the date on the front cover, but the information may have changed since that

date.

PROSPECTUS SUMMARY

This summary highlights selected information

contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing

in the common stock. You should carefully read the entire prospectus, including “Risk Factors,” “Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” and the Financial Statements, before making an

investment decision. In this Prospectus, the terms “BlackStar,” “Company,” “we,” “us,”

and “our,” refer to BlackStar Enterprise Group, Inc.

COMPANY OVERVIEW

GENERAL

BlackStar Enterprise Group, Inc. is incorporated

in the State of Delaware with operations located in Boulder, Colorado. We are engaged in Merchant Banking and Finance and are expanding

our services into the blockchain industry.

The following is a summary of some of the information

contained in this document. Unless the context requires otherwise, references in this document to “BlackStar,” “Company,”

“we,” “us,” or “our,” are to BlackStar Enterprise Group, Inc.

DESCRIPTION OF BUSINESS

We are based in Boulder, Colorado and

are engaged in Merchant Banking and Finance in the United States. Since 2018 we have also been developing a blockchain-based software

platform, the BlackStar Digital Trading Platform TM (“BDTP TM”), to trade free trading shares

of our common stock. Once completed, the platform design should enable us to become a Platform as a Service (“PaaS”)

provider for other publicly traded companies, providing revenue to finance our merchant banking. We have recognized net losses

of $772,953 in the three months ended September 30, 2021 and recognized net losses of ($1,565,591) in the year ended December 31,

2020. We have relied solely on sales of our securities, convertible note financing, and private loans to fund our operations.

The Company is in the final stages of

software development and is working to initiate platform operations but will need further funding to fund operations of the merchant

bank and to expand its services into the blockchain industry. To fund ongoing operations, we may raise funds in the future, which

are not yet committed.

Reports to Security Holders

We are subject to the reporting requirements

of Section 12(g) of the Exchange Act, and as such, we intend to file all required disclosures.

You may read and copy any materials

we file with the SEC in the SEC’s Public Reference Section, Room 1580, 100 F Street N.E., Washington, D.C. 20549. You may

obtain information on the operation of the Public Reference Section by calling the SEC at 1-800-SEC-0330. Additionally, the SEC

maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that

file electronically with the SEC, which can be found at http://www.sec.gov.

Jumpstart Our Business Startups Act

We qualify as an “emerging growth

company” as defined in Section 101 of the Jumpstart our Business Startups Act (“JOBS Act”) as we did not have

more than $1,000,000,000 in annual gross revenue and did not have such amount as of December 31, 2020, our last fiscal year.

We may lose our status as an emerging

growth company on the last day of our fiscal year during which (i) our annual gross revenue exceeds $1,000,000,000 or (ii) we issue

more than $1,000,000,000 in non-convertible debt in a three-year period. We will lose our status as an emerging growth company

if at any time we are deemed to be a large accelerated filer. We will lose our status as an emerging growth company on the last

day of our fiscal year following the fifth anniversary of the date of the first sale of common equity securities pursuant to an

effective registration statement.

As an emerging growth company, we may

take advantage of specified reduced reporting and other burdens that are otherwise applicable to generally reporting companies.

These provisions include:

| |

- |

A requirement to have only two years of audited financial statement and only two years of related Management Discussion and Analysis Disclosures: |

| |

- |

Reduced disclosure about the emerging growth company’s executive compensation arrangements; and |

| |

- |

No non-binding advisory votes on executive compensation or golden parachute arrangements. |

As an emerging growth company, we are

exempt from Section 404(b) of the Sarbanes-Oxley Act of 2002 and Section 14A(a) and (b) of the Securities Exchange Act of 1934.

Such sections are provided below:

Section 404(b) of the Sarbanes-Oxley

Act of 2002 requires a public company’s auditor to attest to, and report on, management’s assessment of its internal

controls.

Sections 14A(a) and (b) of the Securities

and Exchange Act, implemented by Section 951 of the Dodd-Frank Act, require companies to hold shareholder advisory votes on executive

compensation and golden parachute compensation.

We have already taken advantage of these

reduced reporting burdens in our Form 10-K, which are also available to us as a smaller reporting company as defined under Rule

12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

As long as we qualify as an emerging

growth company, we will not be required to comply with the requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002 and

Section 14A(a) and (b) of the Securities Exchange Act of 1934.

In addition, Section 107 of the JOBS

Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B)

of the Securities Act of 1933, as amended (the “Securities Act”) for complying with new or revised accounting standards.

We are choosing to irrevocably opt out of the extended transition period for complying with new or revised accounting standards

under Section 102(b)(2) of the JOBS Act.

HISTORY

Our Company, BlackStar Enterprise Group, Inc.,

was originally formed on December 17, 2007 as NPI08, Inc. in the State of Delaware. Our name was changed in 2010 to BlackStar Energy

Group, Inc. In August of 2016, our name was changed to BlackStar Enterprise Group, Inc. Unless the context requires otherwise,

references in this document to “BlackStar,” “Company,” “we,” “us,” or “our,”

are to BlackStar Enterprise Group, Inc.

Our Company was divested from Kingsley

Capital, Inc. in a bankruptcy proceeding in 2008, in which Kingsley was the debtor. Our Company attempted to start up in the energy

business in 2010 without success, resulting in losses totaling $1,819,530 over a three-year period. Our Company was inactive until

2016 when new management and capital were introduced.

BlackStar is engaged in Merchant Banking

and Finance. BlackStar’s venue is private early-stage companies throughout various industries that, in our judgement, exhibit

a potential for sustained growth. We are a publicly traded

specialized merchant banking firm, facilitating

joint venture capital to earl- stage revenue companies. We are actively seeking opportunity for discussion with revenue generating

enterprises and emerging companies for financing. BlackStar intends to offer consulting and regulatory compliance services to crypto-equity

companies, and blockchain entrepreneurs for securities, tax, and commodity issues. BlackStar is conducting ongoing analysis for

opportunities in involvement in crypto-equity related ventures though our wholly-owned subsidiary, Crypto Equity Management Corp.

(“CEMC”) formed in September 2017. BlackStar Enterprise Group, Inc. is traded on the OTCQB under the symbol “BEGI.”

In addition to the services described above, on December 31, 2017, BlackStar formed a subsidiary nonprofit company, Crypto Industry

SRO Inc., a self-regulatory membership organization for the crypto-equity industry. Further details about the business plan for

CEMC, the operating subsidiary of BlackStar, and Crypto Industry SRO can be found in the “Current Business” section

below.

Our principal executive offices are

located at 4450 Arapahoe Ave., Suite 100, Boulder, CO 80303 and our office telephone number is (303) 500-3210. We maintain a website

at www.blackstarenterprisegroup.com, and such website is not incorporated into or a part of this filing.

International Hedge Group, Inc. (“IHG”),

our parent company, owns 4,792,702 shares of common stock (3. 01 %) and 1,000,000 of Class A Supermajority Voting Preferred

Stock (100%); Class A Preferred has that number of votes equal to that number of common shares which is not less than 60% of the

vote required to approve any action and has the right to convert all of the Class A Preferred Convertible Stock (1,000,000 shares)

into shares of Common Stock of the Company, on the basis of 100 common shares for each share of Class A Preferred Stock. IHG is

our controlling shareholder and is engaged in providing management services to companies, and, on occasion, capital consulting.

IHG’s strategy in investing in BlackStar Enterprise Group, Inc. is to own a controlling interest in a publicly quoted company

which has the mission to engage in funding of start-up and developed business ventures using its stock for private placement or

public offerings. IHG and BlackStar are currently managed and controlled by the same individuals, but IHG and BlackStar may each

seek its funding from different and as yet, undetermined sources, with funding structures of different natures.

Definitions

As used throughout this Registration

Statement, capitalized terms used but not defined herein shall have the meanings assigned to such terms in the filing. The following

terms shall have the meanings set forth below, unless the context clearly indicates otherwise:

BlackStar Digital

Trading Platform TM (“BDTP TM”): a peer-to-peer digital equity trading platform enabling

the trading of registered BlackStar common shares in digital form only.

BlackStar Digital

Equity: a digitally evidenced share , also known as an electronic share, (“Digital Share” – see

below ) of BlackStar common stock holding the same characteristics as securities evidenced by a paper certificate which has

been transmitted electronically and protected by cryptographic protocols.

Blockchain:

a disintermediating technology, where each transaction is cryptographically signed, and always appended to an immutable ledger,

visible to all participants, and distributed across boundaries of trust. The ledger runs on a set of nodes, each of which may be

under the control of a separate company, individual or organization. These nodes connect to each other in a dense peer-to-peer

network so that no one node acts as a central point of control or failure. There is no need for a central intermediary, where one

central database is used to rule transaction validity. A ledger is both a network and a database. It has rules and built-in security,

and it maintains internal integrity and its own history. Once a ledger transaction has received a sufficient level of validation,

some cryptography ensures that it can never be replaced or reversed. Transactions are secure, authenticated, and verifiable.

Digital Shares:

common shares holding the same characteristics as securities evidenced by a paper certificate but are recorded via electronic book-entry

through the Deposit and Withdrawal at Custodian (“DWAC”) system in digital form and are protected by cryptographic

protocols , sometimes also referred to as an electronic share .

Implications of

Being an Emerging Growth Company

As a company with less than $1.0 billion

of revenue during our last fiscal year, we qualify as an emerging growth company as defined in the JOBS Act, and we may remain

an emerging growth company for up to five years from the date of the first sale in this offering. However, if certain events occur

prior to the end of such five-year period, including if we become a large accelerated filer, our annual gross revenue exceeds $1.0

billion, or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth

company prior to the end of such five-year period. For so long as we remain an emerging growth company, we are permitted and intend

to rely on exemptions from certain disclosure and other requirements that are applicable to other public companies that are not

emerging growth companies. In particular, in this prospectus, we have provided only two years of audited financial statements and

have not included all of the executive compensation related information that would be required if we were not an emerging growth

company. Accordingly, the information contained herein may be different than the information you receive from other public companies

in which you hold equity interests. However, we have irrevocably elected not to avail ourselves of the extended transition period

for complying with new or revised accounting standards, and, therefore, we will be subject to the same new or revised accounting

standards as other public companies that are not emerging growth companies.

Summary of Financial Information

The following tables set forth, for the periods

and as of the dates indicated, our summary financial data. The statements of operations for the three and nine months ended September

30, 2021, and the balance sheet data as of September 30, 2021 are derived from our unaudited condensed financial statements. The

unaudited financial statements include, in the opinion of management, all adjustments consisting of only normal recurring adjustments,

that management considers necessary for the fair presentation of the financial information set forth in those statements. You should

read the following information together with the more detailed information contained in “Selected Financial Data,”

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements

and related notes included elsewhere in this prospectus. Our historical results are not indicative of the results to be expected

in the future and results of interim periods are not necessarily indicative of results for the entire year. The statements of operations

for the years ended December 31, 2020 and 2019, and balance sheet data as of December 31, 2020, are derived from our audited financial

statements included elsewhere in this prospectus. You should read the following information together with the more detailed information

contained in “Selected Financial Data,” “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and our financial statements and related notes included elsewhere in this prospectus. Our historical

results are not indicative of the results to be expected in the future.

| |

|

September 30, |

|

December 31, |

| |

|

2021 |

|

2020 |

|

2019 |

| Total Assets |

|

$ |

646,384 |

|

|

$ |

94,211 |

|

|

$ |

43,808 |

|

| Current Liabilities |

|

$ |

520,366 |

|

|

$ |

129,062 |

|

|

$ |

278,086 |

|

| Long-term Liabilities |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

| Stockholders’ Equity (Deficit) |

|

$ |

126,018 |

|

|

$ |

(34,851 |

) |

|

$ |

(234,278 |

) |

| |

|

Three Months Ended September 30, 2021

(Unaudited) |

|

Nine Months Ended September 30, 2021

(Unaudited) |

|

December 31, 2020

(Audited) |

|

December 31, 2019

(Audited) |

| Revenues |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

| Net Loss |

|

$ |

(772,953 |

) |

|

|

(1,807,182 |

) |

|

$ |

(1,565,591 |

) |

|

$ |

(879,269 |

) |

At September 30, 2021, the accumulated

deficit was $(7,773,375). At December 31, 2020, the accumulated deficit was $(5,966,193). We anticipate that we will operate in

a deficit position and continue to sustain net losses for the foreseeable future.

CORPORATE ORGANIZATION CHART

Our corporate structure is as follows:

|

INTERNATIONAL HEDGE GROUP, INC.

(Parent Company – a Colorado corporation) |

| |

|

|

BLACKSTAR ENTERPRISE GROUP, INC.

(a Delaware corporation)

|

| |

|

|

|

|

|

Crypto Equity Management Corp.

(a Colorado corporation) |

Crypto Industry SRO Inc.

(a Colorado non-profit corporation) |

| |

|

|

|

|

|

PRIVATE PLACEMENT OF CONVERTIBLE NOTES

WITH REGISTRATION RIGHTS

The following convertible promissory notes

and corresponding securities purchase agreements are those that contain registration rights and those which underlying shares are

being registered for resale in this registration statement.

On November 20, 2020, BlackStar Enterprise

Group, Inc. and Quick Capital, LLC. entered into a convertible promissory note totaling $33,275 and a securities purchase agreement.

The note bears interest at 10%, with a default rate of 24%, and is convertible into shares of the Company’s common stock.

The conversion price is to be calculated at 60% of the 2 lowest trading prices of the Company’s common stock for the previous

20 trading days prior to the date of conversion. The lender agrees to limit the amount of stock received to less than 4.99% of

the total outstanding common stock. There are no warrants or options attached to this note, and the Company has reserved 12,000,000

shares for conversion. Net proceeds from the loan were $25,000, after legal fees and offering costs of $8,275. Details of

the promissory note and securities purchase agreement can be found in the Form

8-K and exhibits filed on November 27, 2020. The Company and the holder executed the securities purchase agreement in

accordance with and in reliance upon the exemption from securities registration for offers and sales to accredited investors afforded,

inter alia, by Rule 506 under Regulation D as promulgated by the SEC under the 1933 Act, and/or Section 4(a)(2) of the 1933 Act.

The company filed a Form

D with the Securities and Exchange Commission on November 27, 2020.

On January 28, 2021 BlackStar Enterprise Group,

Inc. and SE Holdings, LLC entered into a convertible promissory note totaling $220,000 and a securities purchase agreement. The

note bears interest at 10%, with a default rate of 24%, and is convertible, at any time after the date of issuance. The conversion

price is to be calculated at 50% of the average of the three lowest trading price of the Company’s common stock for the previous

twenty trading days prior to the date of conversion. The lender agrees to limit the amount of stock received to less than 4.99%

of the total outstanding common stock. There are no warrants or options attached to this note, and the Company has reserved 44,000,000

shares for conversion. Net proceeds from the loan were $177,500, after original issue discount of $20,000 and legal fees and offering

costs of $22,500. Details of the promissory note and securities purchase agreement can be found in the Form

8-K and exhibits filed on February 4, 2021. The Company and the holder executed the securities purchase agreement in accordance

with and in reliance upon the exemption from securities registration for offers and sales to accredited investors afforded, inter

alia, by Rule 506 under Regulation D as promulgated by the SEC under the 1933 Act, and/or Section 4(a)(2) of the 1933 Act. The

company filed a Form D

with the Securities and Exchange Commission on February 4, 2021.

On April 29, 2021 BlackStar Enterprise Group,

Inc. and Adar Alef, LLC entered into a convertible promissory note totaling $550,000 and a securities purchase agreement. The Company

initially reserved out of its authorized Common Stock 86,105,000 shares of Common Stock for conversion pursuant to the note. The

note bears interest at 10%, with a default rate of 24%, and is convertible at the option of the holder, at any time after the date

of issuance. The

conversion price is to be calculated at 50%

of the average of the three lowest closing bid prices of the Company’s common stock for the previous 20 trading days prior

to the date of conversion. The lender agrees to limit the amount of stock received to less than 4.99% of the total outstanding

common stock. There are no warrants or options attached to the note. The Company received the net proceeds from the loan of $462,000,

after original issue discount, legal fees and offering costs of $88,000. Copies of the promissory note, securities purchase agreement,

and transfer agent letter can be found in the Form

10-Q and exhibits filed on May 17, 2021. The Company and the holder executed the securities purchase agreement in accordance

with and in reliance upon the exemption from securities registration for offers and sales to accredited investors afforded, inter

alia, by Rule 506 under Regulation D as promulgated by the SEC under the 1933 Act, and/or Section 4(a)(2) of the 1933 Act. The

company filed a Form D with the Securities and Exchange Commission on June

1, 2021.

The Company has entered into several other

convertible note and promissory note financing arrangements over the past several years and all arrangements are discussed further

in Item 11 herein.

The Offering

We are registering 46,000,000 shares of common

stock underlying convertible notes for sale on behalf of selling shareholders (the “Resale Shares”). The noteholder

will elect, upon conversion, whether they will receive the Resale Shares in paper certificated or electronic form.

Our common stock will be transferable immediately

upon the effectiveness of the Registration Statement. (See “Description of Securities”)

| Common shares outstanding before this registration statement1 |

159,074,757 |

| Maximum common shares being offered by our existing selling shareholders |

46,000,000 |

| Maximum common shares outstanding after this offering |

205,074,757 |

| 1) | There are additionally warrants outstanding for the purchase of 540,000 shares of common stock,

not included in this figure. |

We will not receive any proceeds from the sale

of our securities offered by the selling stockholders under this prospectus. All the shares sold under this prospectus will be

sold or otherwise disposed of for the account of the selling stockholders, or their pledgees, assignees or successors-in-interest.

See “Use of Proceeds” beginning on page 19 of this prospectus.

We are authorized to issue 700,000,000 shares

of common stock with a par value of $0.001 and 10,000,000 shares of preferred stock. Our current shareholders, officers and directors

collectively own 159,074,757 shares of common stock and 1,000,000 shares of preferred stock as of this date, with warrants

outstanding for 540,000 shares of common stock.

Currently there is a limited public trading

market for our stock on OTCQB under the symbol “BEGI.”

Forward Looking Statements

This prospectus contains various forward-looking

statements that are based on our beliefs as well as assumptions made by and information currently available to us. When used in

this prospectus, “believe,” “expect,” “anticipate,” “estimate,” and similar expressions

are intended to identify forward-looking statements. These statements may include statements regarding seeking business opportunities,

payment of operating expenses, and the like, and are subject to certain risks, uncertainties and assumptions which could cause

actual results to differ materially from projections or estimates. Factors which could cause actual results to differ materially

are discussed at length under the heading “Risk Factors”. Should one or more of the enumerated risks or uncertainties

materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated

or projected. Investors should not place undue reliance on forward-looking statements, all of which speak only as of the date made.

RISK FACTORS RELATED TO OUR BUSINESS

OUR SUCCESS WILL DEPEND, TO A LARGE DEGREE,

ON THE EXPERTISE AND EXPERIENCE OF THE MEMBERS OF OUR MANAGEMENT TEAM.

We will rely exclusively on the skills and

expertise of our management team in conducting our business. Our management team has experience in identifying, evaluating and

acquiring prospective businesses for which we may ultimately provide loans, but there is no assurance our managements assessments

will be successful in placing loans which are repaid with interest. Accordingly, there is only a limited basis upon which to evaluate

our prospects for achieving our intended business objectives.

We will be wholly dependent for the selection,

structuring, closing and monitoring of all of our investments on the diligence and skill of our management team, under the supervision

of our Board of Directors. There can be no assurance that we will attain our investment objective. The management team will have

primary responsibility for the selection of companies to which we will loan or finance, the terms of such loans and the monitoring

of such investments after they are made. However, not all of the management team will devote all of their time to managing us.

These factors may affect our returns.

We have limited resources and limited operating

history.

OUR OPERATIONS AS A MERCHANT BANK MAY AFFECT

OUR ABILITY TO, AND THE MANNER IN WHICH, WE RAISE ADDITIONAL CAPITAL, WHICH MAY EXPOSE US TO RISKS.

Our business will require a substantial amount

of capital. We may acquire additional capital from the issuance of senior securities, including borrowings or other indebtedness,

or the issuance of additional shares of our common stock. However, we may not be able to raise additional capital in the future

on favorable terms or at all. We may issue debt securities, other evidences of indebtedness or preferred stock, and we may borrow

money from banks or other financial institutions, which we refer to collectively as “senior securities”. If the value

of our businesses declines, we may be unable to satisfy loan requirements. If that happens, we may be required to liquidate a portion

of our ventures and repay a portion of our indebtedness at a time when such sales may be disadvantageous. As a result of issuing

senior securities, we would also be exposed to typical risks associated with leverage, including an increased risk of loss. If

we issue preferred stock, the preferred stock would rank “senior” to common stock in our capital structure, preferred

stockholders would have separate voting rights and might have rights, preferences, or privileges more favorable than those of our

common stockholders. If we raise additional funds by issuing more common stock or senior securities convertible into, or exchangeable

for, our common stock, then the percentage ownership of our stockholders at that time will decrease.

WE MAY ENGAGE IN BUSINESS ACTIVITIES THAT COULD

RESULT IN US HOLDING INVESTMENT INTERESTS IN A NUMBER OF ENTITIES WHICH COULD SUBJECT US TO REGULATION UNDER THE INVESTMENT COMPANY

ACT OF 1940.

Although we will be subject to regulation under

the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, we believe we will not be subject

to regulation under the Investment Company Act of 1940 (the “1940 Act”) insofar as we will not be engaged in the business

of investing or trading in securities within the definitions and parameters which would make us subject to the “1940 Act,”

or holding unconsolidated minority interests in multiple companies and cash which might fall within the “holding company”

definitions. In the event we engage in business activities that result in us holding investment interests in a number of nonconsolidated

entities, we might become subject to regulation under the 1940 Act. In such event, we would be required to register as an Investment

Company and incur significant registration and compliance costs. Additionally, the 1940 Act requires that a number of structural

safeguards, such as an independent board of directors and a separate investment adviser whose contract must be approved by a majority

of the company’s shareholders, be put in place within such companies. The 1940 Act also imposes significant disclosure and

reporting requirements beyond those found in the Securities Act and the Exchange Act of 1934, as amended (the Exchange Act). Likewise,

the 1940 Act contains its own anti-fraud provisions and private remedies, and it strictly limits investments made by one investment

company in another to prevent pyramiding of investment companies, leading to consolidated investment companies acting in the interest

of other investment companies rather than in the interest of securities holders. The labeling of the Company as an investment company

could significantly impair our business plan

and operations and have a material adverse effect on our financial condition. Compliance with the 1940 Act is prohibitively expensive

for small companies, in our estimation, and even if it meant divestiture of assets, we would intend to avoid being classified as

an Investment Company.

WE ARE DEPENDENT UPON OUR PART-TIME MANAGEMENT

FOR OUR SUCCESS WHICH IS A RISK TO OUR INVESTORS.

Our lack of full-time management may be an

impediment to our business achievement. Without full-time officers, we may not have sufficient devoted time and effort to find

successful loan prospects, additional capital, or manage our loan portfolio, which could impair our ability to succeed in our business

plan and could cause investment in our Company to lose value.

WE HAVE A LIMITED AMOUNT OF FUNDS AVAILABLE

FOR INVESTMENT IN VENTURES AND AS A RESULT OUR VENTURES MAY LACK DIVERSIFICATION.

Based on the amount of our existing available

funds, it is unlikely that we will be able to commit our funds to loans to large number of ventures. We intend to operate as a

diversified merchant bank. Prospective investors should understand that our venture investments are not, and in the future may

not be, substantially diversified. We may not achieve the same level of diversification as larger entities engaged in similar activities.

Therefore, our assets may be subject to greater risk of loss than if they were more widely diversified. The loss of one or more

of our limited number of investments could have a material adverse effect on our financial condition.

WE HAVE A LACK OF REVENUE HISTORY AND STOCKHOLDERS

CANNOT VIEW OUR PAST PERFORMANCE SINCE WE HAVE A LIMITED OPERATING HISTORY.

We were incorporated on December 17, 2007 for

the purpose of engaging in any lawful business and have adopted a plan as a small and micro-cap market merchant banking company.

During the period of inception through September 30, 2021, we have not recognized revenues. We are not profitable. We must be regarded

as a new venture with all of the unforeseen costs, expenses, problems, risks and difficulties to which such ventures are subject.

WE ARE NOT DIVERSIFIED, AND WE WILL BE DEPENDENT

ON ONLY ONE BUSINESS, MERCHANT BANKING.

Because of the limited financial resources

that we have, it is unlikely that we will be able to diversify our operations. Our probable inability to diversify our activities

into more than one area will subject us to economic fluctuations within the merchant banking industry and therefore increase the

risks associated with our operations due to lack of diversification.

WE CAN GIVE NO ASSURANCE OF SUCCESS OR PROFITABILITY

TO OUR STOCKHOLDERS.

There is no assurance that we will ever operate

profitably. There is no assurance that we will generate revenues or profits, or that the market price of our common stock will

be increased thereby.

WE MAY HAVE A SHORTAGE OF WORKING CAPITAL IN

THE FUTURE WHICH COULD JEOPARDIZE OUR ABILITY TO CARRY OUT OUR BUSINESS PLAN.

Our capital needs consist primarily of expenses

related to general and administrative, legal and accounting, and software development and could exceed $500,000 in the next twelve

months. Such funds are not currently committed, and we have cash of approximately $ 464,877 as of March 8, 2022 .

WE WILL NEED ADDITIONAL FINANCING FOR WHICH

WE HAVE NO COMMITMENTS, AND THIS MAY JEOPARDIZE EXECUTION OF OUR BUSINESS PLAN.

We have limited funds, and such funds may not

be adequate to carry out our business plan in the small and micro-cap market merchant banking industry. Our ultimate success depends

upon our ability to raise additional capital. We are investigating the availability, sources, and terms that might govern the acquisition

of additional capital.

We have no commitment at this time for additional

capital. If we need additional capital, we have no assurance that funds will be available from any source or, if available,

that they can be obtained on terms acceptable to us. If not available, our operations will be limited to those that can be financed

with our modest capital.

WE MAY IN THE FUTURE ISSUE MORE SHARES WHICH

COULD CAUSE A LOSS OF CONTROL BY OUR PRESENT MANAGEMENT AND CURRENT STOCKHOLDERS.

We may issue further shares as consideration

for the cash or assets or services out of our authorized but unissued common stock that would, upon issuance, represent a majority

of the voting power and equity of our Company. The result of such an issuance would be those new stockholders and management would

control our Company, and persons unknown could replace our management at this time. Such an occurrence would result in a greatly

reduced percentage of ownership of our Company by our current stockholders, which could present significant risks to stockholders.

WE HAVE AUTHORIZED AND DESIGNATED A CLASS A

PREFERRED SUPER MAJORITY VOTING CONVERTIBLE STOCK, WHICH HAVE VOTING RIGHTS OF 60% OF OUR COMMON STOCK AT ALL TIMES.

Class A Preferred Super Majority Voting Convertible

Stock (the “Class A Preferred Stock”), of which 1,000,000 shares of preferred stock have been authorized for the Class

A out of 10,000,000 total preferred shares authorized, and which have super majority voting rights (60%) over common stock voting

at all times. At this time, all shares of the Class A Preferred Stock have been issued to International Hedge Group, Inc. which

is controlled by Mr. Harris and Mr. Kurczodyna, our officers and directors.

OUR OFFICERS AND DIRECTORS MAY HAVE CONFLICTS

OF INTERESTS AS TO CORPORATE OPPORTUNITIES WHICH WE MAY NOT BE ABLE OR ALLOWED TO PARTICIPATE IN AND MAY RECEIVE COMPENSATION FROM

OUR PARENT COMPANY.

Presently there is no requirement contained

in our Articles of Incorporation, Bylaws, or minutes which requires officers and directors of our business to disclose to us business

opportunities which come to their attention. Our officers and directors do, however, have a fiduciary duty of loyalty to us to

disclose to us any business opportunities which come to their attention, in their capacity as an officer and/or director or otherwise.

Excluded from this duty would be opportunities which the person learns about through his involvement as an officer and director

of another company. We have no intention of merging with or acquiring a business opportunity from any affiliate or officer or director.

Our current officers and directors also currently serve our parent company, International Hedge Group, Inc., which may have consulting

agreements with some of our venture companies and as such is a direct conflict and such officers and directors may be paid by such

parent. We intend to diversify and/or expand our Board of Directors in the future.

WE HAVE AGREED TO INDEMNIFICATION OF OFFICERS

AND DIRECTORS AS IS PROVIDED BY DELAWARE STATUTES.

Delaware General Corporation Laws provide for

the indemnification of our directors, officers, employees, and agents, under certain circumstances, against attorney’s fees

and other expenses incurred by them in any litigation to which they become a party arising from their association with or activities

our behalf. We will also bear the expenses of such litigation for any of our directors, officers, employees, or agents, upon such

person’s promise to repay us therefore if it is ultimately determined that any such person shall not have been entitled to

indemnification. This indemnification policy could result in substantial expenditures by us that we will be unable to recoup.

OUR DIRECTORS’ LIABILITY TO US AND STOCKHOLDERS

IS LIMITED

Delaware General Corporation Laws exclude personal

liability of our directors and our stockholders for monetary damages for breach of fiduciary duty except in certain specified circumstances.

Accordingly, we will have a much more limited right of action against our directors that otherwise would be the case. This provision

does not affect the liability of any director under federal or applicable state securities laws.

We have no full-time employees which may impede

our ability to carry on our business. Our officers are independent consultants who devote up to 40 hours per week to Company business.

The lack of full-time employees may very well prevent the Company’s operations from being efficient, and may impair the business

progress and growth, which is a risk to any investor.

RISK FACTORS OF THE COMPANY

THERE CAN BE NO CERTAINTY

AS TO MARKET ACCEPTANCE OF THE PROPOSED BDTP TM.

The

Company has no certainty as to whether the market will accept and use the idea of the BDTP TM, should it become operational,

nor is there any certainty as to how the BDTP TM translates to profits for the Company. There is no assurance of market

acceptance or profitability of the concept or Company. The BDTP TM is not yet functional and may never be functional .

THERE ARE ADDITIONAL RISKS TO INVESTORS HOLDING

BLACKSTAR DIGITAL SHARES DUE TO THE LACK OF MARKET.

Investors holding BlackStar Digital Equity

may never be able to transfer BlackStar Digital Equity on the platform, however they will be able to transfer them through

traditional avenues such as Market Makers. BlackStar Digital Equity are not currently traded on the BDTP TM and

may never be . The warrants for BlackStar Digital Equity outstanding are exercisable for shares of common stock ,

however a secondary trading market may never develop for BlackStar Digital Equity that will be distinguishable from

common shares.

WE MAY NOT REALIZE RETURNS ON OUR INVESTMENTS

IN VENTURES FOR SEVERAL YEARS. THUS, AN INVESTMENT IN SHARES OF OUR COMMON STOCK IS ONLY APPROPRIATE FOR INVESTORS WHO DO NOT NEED

SHORT TERM LIQUIDITY IN THEIR MONEY.

We intend to make loans as quickly as possible

consistent with our business objectives in those investments that meet our criteria. However, it is likely that a significant period

of time will be required before we are able to achieve repayment and any additional value from warrants or stock conversions that

we hold in an eligible venture company.

COMPETITION FOR LOANS AND INVESTMENTS.

We expect to encounter competition from other

entities having similar business objectives, some of whom may have greater resources than us. Historically, the primary competition

for venture capital investments has been from venture capital funds and corporations, venture capital affiliates of large industrial

and financial companies, small business investment companies, and wealthy individuals. Additional competition is anticipated from

foreign investors and from large industrial and financial companies investing directly rather than through venture capital affiliates.

Virtually all of our competitors will have a competitive advantage and are much larger. The need to compete for loans or investment

opportunities may make it necessary for us to offer venture companies more attractive transaction terms than otherwise might be

the case. We anticipate being a co-investor with other venture capital groups, and these relationships with other groups may expand

our access to business opportunities.

RISKS OF COMPETITION FOR OUR VENTURE COMPANIES.

Most emerging markets are highly competitive.

We anticipate that nearly all our venture companies will compete against firms with greater financial resources, more extensive

development, manufacturing, marketing, and service capabilities, and a larger number of qualified managerial and technical personnel.

ILLIQUID NATURE OF OUR INVESTMENTS.

We anticipate that substantially all of our

ventures (other than short-term investments) will consist of controlling interests in ventures that at the time of acquisition

are unmarketable, illiquid and for which no ready market will exist, if such a market does in fact exist. Our venture investments

are intended to be in companies in which we will have

controlling interest and will be privately

negotiated transactions. There is not anticipated to be any market for the ventures until such until such have developed successful

businesses.

Because of the illiquid nature of our venture

investments, a substantial portion of our assets will be carried on our books adjusted for accrued losses, depreciation and impairment

which could in some cases result in a write off. This value will not necessarily reflect the amount which could be realized upon

a sale, or payoff in the future.

RISKS OF OUR NEED FOR ADDITIONAL CAPITAL TO

FUND OUR VENTURE COMPANIES.

We expect that most venture companies will

require additional financing to satisfy their working capital requirements. The amount of additional financing needed will depend

upon the maturity and objectives of the particular opportunity. Each round of venture financing (whether from us or other investors)

is typically intended to provide a venture company with enough capital to reach the next major valuation milestone. If the funds

provided are not sufficient, a company may have to raise additional capital at a price or at terms unfavorable to the existing

investors, including our Company. This additional financing or the availability of any form of equity or debt capital is generally

a function of capital market conditions that are beyond our control or any venture company. Our management team may not be able

to predict accurately the future capital requirements necessary for success of our Company or venture companies. Additional funds

may not be available from any source.

OUR VENTURE PORTFOLIO IS AND MAY CONTINUE TO

BE CONCENTRATED IN A LIMITED NUMBER OF VENTURE COMPANIES AND INDUSTRIES, WHICH WILL SUBJECT US TO A RISK OF SIGNIFICANT LOSS IF

ANY OF THESE COMPANIES FAIL OR BY A DOWNTURN IN THE PARTICULAR INDUSTRY.

Our venture is and may continue to be concentrated

in a limited number of venture companies and industries. We do not have fixed guidelines for diversification, and since we are

targeting some specific industries, our venture investments could continue to be, concentrated in relatively few industries. As

a result, the aggregate returns we realize may be significantly adversely affected if our venture investments perform poorly or

if we need to write down the value of any one investment. Additionally, a downturn in any particular industry in which we are invested

could also significantly impact the aggregate returns we realize.

WE INTEND TO CONTROL ALL OF OUR VENTURES.

We will control all of our venture companies,

and we will maintain financial supervision until divestiture, spin-off or liquidation.

WE MAY NOT REALIZE GAINS FROM OUR VENTURES.

Our goal is ultimately to dispose of our control

interests we receive from our venture companies to attempt to realize gains upon our disposition of such interests by sale, for

cash spin-off, or liquidation. However, any interests we hold may not appreciate in value and, in fact, may decline in value. Accordingly,

we may not be able to realize gains from any venture interests, and any gains that we do realize on the disposition of any venture

interests may not be sufficient to offset any other losses we experience.

THE INABILITY OF OUR VENTURE COMPANIES TO COMMERCIALIZE

THEIR TECHNOLOGIES OR CREATE OR DEVELOP COMMERCIALLY VIABLE PRODUCTS OR BUSINESSES WOULD HAVE A NEGATIVE IMPACT ON OUR INVESTMENT

RETURNS.

The possibility that our venture companies

will not be able to commercialize their technology, products or business concepts presents significant risks to the value of our

ventures. Additionally, although some of our venture companies may already have a commercially successful product or product line

when we invest, technology related products and services often have a more limited market or life span than have products in other

industries. Thus, the ultimate success of these venture companies often depends on their ability to continually innovate in increasingly

competitive markets. Their inability to do so could affect our investment return. We cannot assure you that any of our venture

companies will successfully acquire or develop any new technologies, or that the intellectual property the companies currently

hold will remain viable. Even if our venture companies are able to develop commercially viable products, the market for new products

and services is highly competitive and rapidly changing. Neither our venture companies nor we have

any control over the pace of technology development.

Commercial success is difficult to predict, and the marketing efforts of our venture companies may not be successful.

RISK FACTORS RELATING TO OUR BUSINESS

WE HAVE INCURRED SIGNIFICANT LOSSES AND ANTICIPATE

FUTURE LOSSES.

As of September 30, 2021, we had an accumulated

deficit of $(7,773,375).

Future losses are likely to occur until we

are able to receive returns on our loans and investments since we have no other sources of income to meet our operating expenses.

As a result of these, among other factors, we received from our registered independent public accountants in their report for the

financial statements for the years ended December 31, 2014 through 2020, an explanatory paragraph stating that there is substantial

doubt about our ability to continue as a going concern.

OUR EXISTING FINANCIAL RESOURCES ARE INSUFFICIENT

TO MEET OUR ONGOING OPERATING EXPENSES.

We have no sources of income at this time and

insufficient assets to meet our ongoing operating expenses. In the short term, unless we are able to raise additional debt and,

or, equity we shall be unable to meet our ongoing operating expenses. On a longer-term basis, we intend to merge with another entity

with experienced management and opportunities for growth in return for shares of our common stock to create value for our shareholders.

There can be no assurance that these events will be successfully completed.

UNFAVORABLE CONDITIONS IN OUR INDUSTRY OR THE

GLOBAL ECONOMY OR REDUCED ACCESS TO LENDING MARKETS COULD HARM OUR BUSINESS.

Our results of operations may vary based on

the impact of changes in our industry or the global economy on us or our potential customers. Current or future economic uncertainties

or downturns could adversely affect our business and results of operations. Negative conditions in the general economy both in

the United States and abroad, including conditions resulting from changes in gross domestic product growth, financial and credit

market fluctuations, political turmoil, natural catastrophes, warfare, public health issues, such as the recent outbreak of coronavirus

(COVID-19), and terrorist attacks on the United States, Europe, the Asia Pacific region, or elsewhere, could cause a decrease in

business investments or decrease access to financing which would harm our business. To the extent that our platform is perceived

by potential customers as too costly, or difficult to deploy or migrate to, our revenue may be disproportionately affected by delays

or reductions in general technology spending. Also, we may have competitors, many of whom may be larger and have greater financial

resources than we do and may respond to market conditions by attempting to lure away our customers. We cannot predict the timing,

strength, or duration of any economic slowdown, instability, or recovery, generally or within any particular industry.

BECAUSE INSIDERS CONTROL OUR ACTIVITIES, THAT

MAY CAUSE US TO ACT IN A MANNER THAT IS MOST BENEFICIAL TO THEM AND NOT TO OUTSIDE SHAREHOLDERS WHICH COULD CAUSE US NOT TO TAKE

ACTIONS THAT OUTSIDE INVESTORS MIGHT VIEW FAVORABLY

Our executive officers, directors, and holders

of 5% or more of our issued and outstanding common stock, including International Hedge Group, Inc., beneficially own approximately

20.58% of our issued and outstanding common stock, in addition to the Super Majority Voting Class A Preferred Stock. As a result,

they effectively control all matters requiring director and stockholder approval, including the election of directors, the approval

of significant corporate transactions, such as mergers and related party transaction. These insiders also have the ability to delay

or perhaps even block, by their ownership of our stock, an unsolicited tender offer. This concentration of ownership could have

the effect of delaying, deterring or preventing a change in control of our company that you might view favorably.

OUR OFFICERS AND DIRECTORS HAVE THE ABILITY

TO EFFECTIVELY CONTROL SUBSTANTIALLY ALL ACTIONS TAKEN BY STOCKHOLDERS.

Mr. Harris and Mr. Kurczodyna, the officers

and directors of the Company and of our parent, International Hedge Group, Inc. (“IHG”), control approximately 7.66%

of our issued and outstanding common stock and 100% of our issued and outstanding preferred shares through IHG and their own holdings

and have significant influence over all actions taken by our stockholders, including the election of directors, based on the BlackStar

Super Majority Voting Class A Preferred Stock held by IHG. On December 18, 2020, the IHG shareholders voted to issue 1,000,000

IHG Class A Preferred shares to Mr. Kurczodyna as compensation for services provided to IHG, giving Mr. Kurczodyna supermajority

voting rights over IHG and the ability to convert the IHG Class A Preferred Stock into shares of IHG common stock at the rate of

one (1) IHG Class A Preferred for two-hundred ten (210) IHG common shares. This is a significant increase to the control of IHG

by Mr. Kurczodyna, which effectively means that Mr. Kurczodyna has control of BlackStar through IHG’s ownership of BlackStar

Super Majority Voting Class A Preferred Stock.

Such concentration of ownership could also

have the effect of delaying, deterring, or preventing a change in control that might otherwise be beneficial to stockholders and

may also discourage the market for our stock due to the concentration.

WE MAY DEPEND UPON OUTSIDE ADVISORS, WHO MAY

NOT BE AVAILABLE ON REASONABLE TERMS AND AS NEEDED.

To supplement the business experience of our

officers and directors, we may be required to employ accountants, technical experts, appraisers, attorneys, or other consultants

or advisors. Our Board without any input from stockholders will make the selection of any such advisors. Furthermore, it is anticipated

that such persons may be engaged on an “as needed” basis without a continuing fiduciary or other obligation to us.

In the event we consider it necessary to hire outside advisors, we may elect to hire persons who are affiliates, if they are able

to provide the required services.

RISKS RELATING TO OUR VENTURE INVESTMENTS

THE INABILITY OF OUR VENTURE COMPANIES TO ADEQUATELY

EXECUTE THEIR GROWTH OR EXPANSION STRATEGIES WOULD HAVE A NEGATIVE IMPACT ON OUR LOAN OR INVESTMENT RETURNS.

The possibility that our venture companies

will not be able to fully carry out or execute on their expansion or growth plans presents significant risk. Our venture investments

success in our subsidiary companies will ultimately depend on the success of our ventures. If the intended expansion or growth

plan that was one of the main reasons we had originally formed the venture does not come to fruition or is otherwise impeded, the

value of the venture may negatively reflect this information, making our investment not profitable or may subject us to a substantial

loss. In such case, we may incur an entire loss of our investment.

OUR VENTURE COMPANIES WILL LIKELY HAVE SIGNIFICANT

COMPETITION FROM MORE ESTABLISHED COMPANIES AS WELL AS INNOVATIVE EARLY-STAGE COMPANIES.

Emerging growth companies often face significant

competition, both from early-stage companies and from more established companies. Early-stage competitors may have strategic capabilities

such as an innovative management team or an ability to react quickly to changing market conditions, while more established companies

may possess significantly more experience and greater financial resources than our venture companies. These factors could affect

our investment returns.

OUR INVESTMENT RETURNS WILL DEPEND ON THE SUCCESS

OF OUR VENTURES AND, ULTIMATELY, THE ABILITIES OF THEIR KEY PERSONNEL.

Our success will depend upon the success of

our ventures. Their success, in turn, will depend in large part upon the abilities of their key personnel. The day-to-day operations

of our ventures will remain the responsibility of their key personnel. The loss of one or a few key managers can hinder or delay

a company’s implementation of its business

plan. Our ventures may not be able to attract

qualified managers and personnel. Any inability to do so may negatively impact our financial picture.

SOME OF OUR VENTURE COMPANIES MAY NEED ADDITIONAL

CAPITAL, WHICH MAY NOT BE READILY AVAILABLE.

Ventures in which we may make investments will

often require substantial additional financing to fully execute their growth strategies. Each round of venture financing is typically

intended to provide a company with only enough capital to reach the next stage of development, or in the case of our financings,

the turn-around stage or offering stage which might provide us with a liquidity event. We cannot predict the circumstances or market

conditions under which our ventures may seek additional capital. It is possible that one or more of our ventures will not be able

to raise additional financing or may be able to do so at a price or on terms which are unfavorable to us, either of which could

negatively impact our success. A likely economic downturn due to the recent pandemic known as coronavirus (COVID-19) may also cause

lasting damage to the markets and potential ventures, from capital access and lack of investment issues to staffing and supply

chain issues.

RISKS RELATING TO OWNERSHIP OF OUR COMMON

STOCK

A LIMITED PUBLIC MARKET EXISTS FOR OUR COMMON

STOCK AT THIS TIME, AND THERE IS NO ASSURANCE OF A FUTURE MARKET.

There is a limited public market for our common

stock, and no assurance can be given that a market will continue or that a shareholder ever will be able to liquidate his investment

without considerable delay, if at all. If a market should continue, the price may be highly volatile. Factors such as those discussed

in the “Risk Factors” section may have a significant impact upon the market price of the shares offered hereby. Due

to the low price of our securities, many brokerage firms may not be willing to effect transactions in our securities. Even if a

purchaser finds a broker willing to effect a transaction in our shares, the combination of brokerage commissions, state transfer

taxes, if any, and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the

use of our shares as collateral for any loans.

OUR STOCK WILL, IN ALL LIKELIHOOD, BE THINLY

TRADED AND AS A RESULT YOU MAY BE UNABLE TO SELL AT OR NEAR ASK PRICES OR AT ALL IF YOU NEED TO LIQUIDATE YOUR SHARES.

The shares of our common stock may be thinly

traded. We are a small company which is relatively unknown to stock analysts, stock brokers, institutional stockholders and others

in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons,

they tend to be risk-averse and would be reluctant to follow an unproven, early-stage company such as ours or purchase or recommend

the purchase of any of our securities until such time as we became more seasoned and viable. As a consequence, there may be periods

of several days or more when trading activity in our securities is minimal or non-existent, as compared to a seasoned issuer which

has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on Securities

price. We cannot give you any assurance that a broader or more active public trading market for our common securities will develop

or be sustained, or that any trading levels will be sustained. Due to these conditions, we can give stockholders no assurance that

they will be able to sell their shares at or near ask prices or at all if they need money or otherwise desire to liquidate their

securities.

OUR COMMON STOCK MAY BE VOLATILE, WHICH SUBSTANTIALLY

INCREASES THE RISK THAT YOU MAY NOT BE ABLE TO SELL YOUR SECURITIES AT OR ABOVE THE PRICE THAT YOU MAY PAY FOR THE SECURITY.

Because of the possible price volatility, you

may not be able to sell your shares of common stock when you desire to do so. The inability to sell your securities in a rapidly

declining market may substantially increase your risk of loss because of such illiquidity and because the price for our securities

may suffer greater declines because of our price volatility.

The price of our common stock that will prevail

in the market after this offering may be higher or lower than the price you may pay. Certain factors, some of which are beyond

our control, that may cause our share price to fluctuate significantly include, but are not limited to the following:

- Variations

in our quarterly operating results;

- Loss

of a key relationship or failure to complete significant transactions;

- Additions

or departures of key personnel;

- Fluctuations

in stock market price and volume;

- Changes

to the Distributed Ledger Technology industry; and

- Regulatory

developments, particularly those affecting cryptocurrency.

Additionally, in recent years the stock market

in general, has experienced extreme price and volume fluctuations. In some cases, these fluctuations are unrelated or disproportionate

to the operating performance of the underlying company. These market and industry factors may materially and adversely affect our

stock price, regardless of our operating performance. In the past, class action litigation often has been brought against companies

following periods of volatility in the market price of those company’s common stock. If we become involved in this type of

litigation in the future, it could result in substantial costs and diversion of management attention and resources, which could

have a further negative effect on your investment in our stock.

THE REGULATION OF PENNY STOCKS BY THE SEC AND

FINRA MAY DISCOURAGE THE TRADABILITY OF OUR SECURITIES.

We are a “penny stock” company,

as our stock price is less than $5.00 per share. If we are able to obtain an exchange listing for our stock, we cannot make an

assurance that we will be able to maintain a stock price greater than $5.00 per share and if the share price was to fall to such

prices, that we wouldn’t be subject to the Penny Stocks rules. None of our securities currently trade in any market and,

if ever available for trading, will be subject to a Securities and Exchange Commission rule that imposes special sales practice

requirements upon broker-dealers who sell such securities to persons other than established customers or accredited stockholders.

For purposes of the rule, the phrase “accredited stockholders” means, in general terms, institutions with assets in

excess of $5,000,000, or individuals having a net worth in excess of $1,000,000 or having an annual income that exceeds $200,000

(or that, when combined with a spouse’s income, exceeds $300,000). For transactions covered by the rule, the broker-dealer

must make a special suitability determination for the purchaser and receive the purchaser’s written agreement to the transaction

prior to the sale. Effectively, this discourages broker-dealers from executing trades in penny stocks. Consequently, the rule will

affect the ability of purchasers in this offering to sell their securities in any market that might develop therefore because it

imposes additional regulatory burdens on penny stock transactions.

In addition, the Securities and Exchange Commission

has adopted a number of rules to regulate “penny stocks”. Such rules include Rules 3a51-1, 15g-1, 15g-2, 15g-3, 15g-4,