Current Report Filing (8-k)

March 01 2022 - 6:29PM

Edgar (US Regulatory)

0000225211

false

0000225211

2022-02-23

2022-02-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (date of earliest event reported): February 23, 2022

Touchpoint

Group Holdings Inc.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

001-36530 |

|

46-3561419 |

| State of Incorporation |

|

Commission File Number |

|

IRS Employer I.D. Number |

4300

Biscayne Blvd, Suite 203

Miami,

Florida 33137

(Address

of Principal Executive Offices)

Registrant’s

telephone number: (305) 420-6640

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(g) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on

which registered |

| Common

Stock, par value $0.0001 |

|

TGHI |

|

NONE |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

February 25, 2022, One Horizon Group Inc. (the “Company” or “we”, “us”) acting through its

subsidiary, Air Race Limited, entered into an “Addendum On Payment to the Host City Agreement between Air Race Limited and

PT Pilar Pacu Percasa and the Vice-Governor of Jakarta.” Pursuant to the Addendum, the HCP will pay the consideration of

2,500,000 Euros (plus applicable taxes, if any, including VAT) in three instalments of 750,000 Euros and a fourth instalment of

250,000 Euros. The first instalment is to be paid once Air Race Limited has entered into its next two host city agreements, the

second and third instalments are to be paid no later than April 30, and June 1, 2022, respectively, and the final instalment is

to be paid no later than August 1, 2022.

We are in the late stages of negotiations with respect to Host City

Agreements with three other locations.

The

Company had entered into a Host City Agreement with PT Pilar Pacu Percasa (“HCP”) with respect to Air Race World Championships

to be held in Jakarta in 2022, 2023 and 2024. The total consideration to be paid by HCP is 7,500,000 Euros, with 2,500,000 Euros

to be paid each year. The Agreement becomes effective upon payment of the initial 2,500,000 Euros by HCP.

Copies

of the Host City Agreement and the Addendum are annexed as exhibits to this Report on Form 8-K and reference is made thereto for

the complete terms and conditions of the Agreement and the Addendum.

Item

3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On February 23, 2022, we received a written alert

from OTC Markets Group notifying us that our closing bid price for the last 30 consecutive calendar days was less than $0.01 per share

and that we no longer meet the Standards for Continued Eligibility for OTCQB. Section 2.3(2) of the OTCQB Standards states that a company

must “maintain proprietary quotes published by a Market Maker in OTC Link with a minimum closing bid price of $0.01 per share on

at least one of the prior thirty consecutive calendar days.”

Pursuant

to Section 4.1 of the OTCQB Listing Standards, we will be granted a cure period of 90 calendar days during which the minimum closing

bid price for our common stock must be $0.01 or greater for ten consecutive trading days in order to continue trading on the OTCQB

marketplace. If this requirement is not met by May 24, 2022, our common stock will be removed from the OTCQB. In addition, if

the bid price for our common stock falls below $0.001 for five consecutive trading days our common stock will be immediately removed

from the OTCQB.

Item 9.01

Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

Dated:

February 28, 2022

| |

TOUCHPOINT GROUP HOLDINGS INC. |

| |

|

|

| |

By: |

/s/

Mark White |

| |

|

Mark White, President |

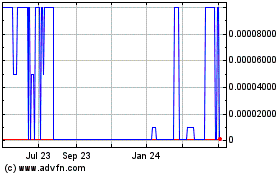

TouchPoint (CE) (USOTC:TGHI)

Historical Stock Chart

From Mar 2024 to Apr 2024

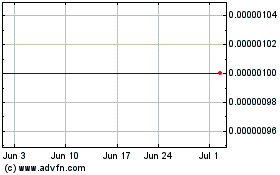

TouchPoint (CE) (USOTC:TGHI)

Historical Stock Chart

From Apr 2023 to Apr 2024