0000825322

false

0000825322

2021-07-01

2021-12-31

0000825322

2021-06-30

0000825322

2020-06-30

0000825322

2021-12-31

0000825322

2020-07-01

2021-06-30

0000825322

2019-07-01

2020-06-30

0000825322

2021-10-01

2021-12-31

0000825322

2020-10-01

2020-12-31

0000825322

2020-07-01

2020-12-31

0000825322

us-gaap:PreferredStockMember

2019-06-30

0000825322

us-gaap:CommonStockMember

2019-06-30

0000825322

us-gaap:AdditionalPaidInCapitalMember

2019-06-30

0000825322

XDSL:CommonStockToBeIssuedMember

2019-06-30

0000825322

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-06-30

0000825322

us-gaap:RetainedEarningsMember

2019-06-30

0000825322

2019-06-30

0000825322

us-gaap:PreferredStockMember

2020-06-30

0000825322

us-gaap:CommonStockMember

2020-06-30

0000825322

us-gaap:AdditionalPaidInCapitalMember

2020-06-30

0000825322

XDSL:CommonStockToBeIssuedMember

2020-06-30

0000825322

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-06-30

0000825322

us-gaap:RetainedEarningsMember

2020-06-30

0000825322

us-gaap:PreferredStockMember

2021-06-30

0000825322

us-gaap:CommonStockMember

2021-06-30

0000825322

us-gaap:AdditionalPaidInCapitalMember

2021-06-30

0000825322

XDSL:CommonStockToBeIssuedMember

2021-06-30

0000825322

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-06-30

0000825322

us-gaap:RetainedEarningsMember

2021-06-30

0000825322

us-gaap:PreferredStockMember

2021-09-30

0000825322

us-gaap:CommonStockMember

2021-09-30

0000825322

us-gaap:AdditionalPaidInCapitalMember

2021-09-30

0000825322

XDSL:CommonStockToBeIssuedMember

2021-09-30

0000825322

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-09-30

0000825322

us-gaap:RetainedEarningsMember

2021-09-30

0000825322

2021-09-30

0000825322

us-gaap:PreferredStockMember

2020-09-30

0000825322

us-gaap:CommonStockMember

2020-09-30

0000825322

us-gaap:AdditionalPaidInCapitalMember

2020-09-30

0000825322

XDSL:CommonStockToBeIssuedMember

2020-09-30

0000825322

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-09-30

0000825322

us-gaap:RetainedEarningsMember

2020-09-30

0000825322

2020-09-30

0000825322

us-gaap:PreferredStockMember

2019-07-01

2020-06-30

0000825322

us-gaap:CommonStockMember

2019-07-01

2020-06-30

0000825322

us-gaap:AdditionalPaidInCapitalMember

2019-07-01

2020-06-30

0000825322

XDSL:CommonStockToBeIssuedMember

2019-07-01

2020-06-30

0000825322

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-07-01

2020-06-30

0000825322

us-gaap:RetainedEarningsMember

2019-07-01

2020-06-30

0000825322

us-gaap:PreferredStockMember

2020-07-01

2021-06-30

0000825322

us-gaap:CommonStockMember

2020-07-01

2021-06-30

0000825322

us-gaap:AdditionalPaidInCapitalMember

2020-07-01

2021-06-30

0000825322

XDSL:CommonStockToBeIssuedMember

2020-07-01

2021-06-30

0000825322

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-07-01

2021-06-30

0000825322

us-gaap:RetainedEarningsMember

2020-07-01

2021-06-30

0000825322

us-gaap:PreferredStockMember

2021-07-01

2021-09-30

0000825322

us-gaap:CommonStockMember

2021-07-01

2021-09-30

0000825322

us-gaap:AdditionalPaidInCapitalMember

2021-07-01

2021-09-30

0000825322

XDSL:CommonStockToBeIssuedMember

2021-07-01

2021-09-30

0000825322

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-07-01

2021-09-30

0000825322

us-gaap:RetainedEarningsMember

2021-07-01

2021-09-30

0000825322

2021-07-01

2021-09-30

0000825322

us-gaap:PreferredStockMember

2021-10-01

2021-12-31

0000825322

us-gaap:CommonStockMember

2021-10-01

2021-12-31

0000825322

us-gaap:AdditionalPaidInCapitalMember

2021-10-01

2021-12-31

0000825322

XDSL:CommonStockToBeIssuedMember

2021-10-01

2021-12-31

0000825322

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-10-01

2021-12-31

0000825322

us-gaap:RetainedEarningsMember

2021-10-01

2021-12-31

0000825322

us-gaap:PreferredStockMember

2020-07-01

2020-09-30

0000825322

us-gaap:CommonStockMember

2020-07-01

2020-09-30

0000825322

us-gaap:AdditionalPaidInCapitalMember

2020-07-01

2020-09-30

0000825322

XDSL:CommonStockToBeIssuedMember

2020-07-01

2020-09-30

0000825322

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-07-01

2020-09-30

0000825322

us-gaap:RetainedEarningsMember

2020-07-01

2020-09-30

0000825322

2020-07-01

2020-09-30

0000825322

us-gaap:PreferredStockMember

2020-10-01

2020-12-31

0000825322

us-gaap:CommonStockMember

2020-10-01

2020-12-31

0000825322

us-gaap:AdditionalPaidInCapitalMember

2020-10-01

2020-12-31

0000825322

XDSL:CommonStockToBeIssuedMember

2020-10-01

2020-12-31

0000825322

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-10-01

2020-12-31

0000825322

us-gaap:RetainedEarningsMember

2020-10-01

2020-12-31

0000825322

us-gaap:PreferredStockMember

2021-12-31

0000825322

us-gaap:CommonStockMember

2021-12-31

0000825322

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0000825322

XDSL:CommonStockToBeIssuedMember

2021-12-31

0000825322

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0000825322

us-gaap:RetainedEarningsMember

2021-12-31

0000825322

us-gaap:PreferredStockMember

2020-12-31

0000825322

us-gaap:CommonStockMember

2020-12-31

0000825322

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0000825322

XDSL:CommonStockToBeIssuedMember

2020-12-31

0000825322

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-12-31

0000825322

us-gaap:RetainedEarningsMember

2020-12-31

0000825322

2020-12-31

0000825322

XDSL:PeriodEndINRMember

2021-06-30

0000825322

XDSL:PeriodEndINRMember

2020-06-30

0000825322

XDSL:PeriodEndGBPMember

2021-06-30

0000825322

XDSL:PeriodEndGBPMember

2020-06-30

0000825322

XDSL:AveragePeriodINRMember

2020-07-01

2021-06-30

0000825322

XDSL:AveragePeriodINRMember

2019-07-01

2020-06-30

0000825322

XDSL:AveragePeriodGBPMember

2020-07-01

2021-06-30

0000825322

XDSL:AveragePeriodGBPMember

2019-07-01

2020-06-30

0000825322

XDSL:PeriodEndINRMember

2021-12-31

0000825322

XDSL:PeriodEndGBPMember

2021-12-31

0000825322

XDSL:AveragePeriodINRMember

2021-10-01

2021-12-31

0000825322

XDSL:AveragePeriodINRMember

2020-10-01

2020-12-31

0000825322

XDSL:AveragePeriodINRMember

2021-07-01

2021-12-31

0000825322

XDSL:AveragePeriodINRMember

2020-07-01

2020-12-31

0000825322

XDSL:AveragePeriodGBPMember

2021-10-01

2021-12-31

0000825322

XDSL:AveragePeriodGBPMember

2020-10-01

2020-12-31

0000825322

XDSL:AveragePeriodGBPMember

2021-07-01

2021-12-31

0000825322

XDSL:AveragePeriodGBPMember

2020-07-01

2020-12-31

0000825322

XDSL:OneCustomerMember

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

2020-07-01

2021-06-30

0000825322

XDSL:OneCustomerMember

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

2019-07-01

2020-06-30

0000825322

XDSL:OneCustomerMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2020-07-01

2021-06-30

0000825322

XDSL:OneCustomerMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2019-07-01

2020-06-30

0000825322

XDSL:OneSupplierMember

XDSL:CostOfRevenueMember

us-gaap:SupplierConcentrationRiskMember

2020-07-01

2021-06-30

0000825322

XDSL:OneSupplierMember

XDSL:CostOfRevenueMember

us-gaap:SupplierConcentrationRiskMember

2019-07-01

2020-06-30

0000825322

XDSL:OneSupplierMember

us-gaap:AccountsPayableMember

us-gaap:SupplierConcentrationRiskMember

2020-07-01

2021-06-30

0000825322

XDSL:OneSupplierMember

us-gaap:AccountsPayableMember

us-gaap:SupplierConcentrationRiskMember

2019-07-01

2020-06-30

0000825322

srt:MinimumMember

2020-07-01

2021-06-30

0000825322

srt:MaximumMember

2020-07-01

2021-06-30

0000825322

XDSL:PatentsAndLicensesMember

2020-07-01

2021-06-30

0000825322

XDSL:PatentsAndLicensesMember

2021-06-30

0000825322

XDSL:PatentsAndLicensesMember

2020-06-30

0000825322

us-gaap:CommonStockMember

XDSL:ThirdPartyAndFormerOfficerMember

2020-07-01

2021-06-30

0000825322

XDSL:NotePayableMember

XDSL:ThirdPartyAndFormerOfficerMember

2020-07-01

2021-06-30

0000825322

XDSL:VendorServicesMember

2020-07-01

2021-06-30

0000825322

us-gaap:CommonStockMember

XDSL:ThirdPartyAndFormerOfficerMember

2019-07-01

2020-06-30

0000825322

XDSL:NotePayableMember

XDSL:ThirdPartyAndFormerOfficerMember

2019-07-01

2020-06-30

0000825322

XDSL:CloseCommsAcquisitionMember

2020-07-01

2021-06-30

0000825322

XDSL:RestrictedSharesMember

XDSL:EmploymentAgreementMember

2020-07-01

2021-06-30

0000825322

XDSL:OneCustomerMember

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

2021-07-01

2021-12-31

0000825322

XDSL:OneCustomerMember

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

2020-07-01

2020-12-31

0000825322

XDSL:OneCustomerMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2021-07-01

2021-12-31

0000825322

XDSL:OneSupplierMember

XDSL:CostOfRevenueMember

us-gaap:ProductConcentrationRiskMember

2021-07-01

2021-12-31

0000825322

XDSL:OneSupplierMember

us-gaap:AccountsPayableMember

us-gaap:ProductConcentrationRiskMember

2021-07-01

2021-12-31

0000825322

XDSL:OneSupplierMember

XDSL:CostOfRevenueMember

us-gaap:ProductConcentrationRiskMember

2020-07-01

2020-12-31

0000825322

XDSL:OneSupplierMember

us-gaap:AccountsPayableMember

us-gaap:ProductConcentrationRiskMember

2020-07-01

2020-12-31

0000825322

XDSL:PatentsAndLicensesMember

2021-12-31

0000825322

XDSL:PatentsAndLicensesMember

2021-07-01

2021-12-31

0000825322

XDSL:PatentsAndLicensesMember

2020-07-01

2020-12-31

0000825322

XDSL:TechnologyPlatformsMember

2021-12-31

0000825322

XDSL:TechnologyPlatformsMember

2021-07-01

2021-12-31

0000825322

XDSL:TechnologyPlatformsMember

2020-07-01

2020-12-31

0000825322

us-gaap:CommonStockMember

2021-07-01

2021-12-31

0000825322

us-gaap:RestrictedStockMember

2021-07-01

2021-12-31

0000825322

us-gaap:CommonStockMember

2020-07-01

2020-12-31

0000825322

XDSL:RestrictedSharesMember

XDSL:EmploymentAgreementMember

2020-07-01

2020-12-31

0000825322

us-gaap:ComputerEquipmentMember

2021-06-30

0000825322

us-gaap:ComputerEquipmentMember

2020-06-30

0000825322

XDSL:ResearchAndDevelopmentEquipmentMember

2021-06-30

0000825322

XDSL:ResearchAndDevelopmentEquipmentMember

2020-06-30

0000825322

us-gaap:FurnitureAndFixturesMember

2021-06-30

0000825322

us-gaap:FurnitureAndFixturesMember

2020-06-30

0000825322

XDSL:AssetPurchaseAgreementMember

2021-03-10

2021-03-11

0000825322

2021-05-10

2021-05-11

0000825322

2021-05-11

0000825322

XDSL:CloseCommsLimitedMember

2021-05-10

2021-05-11

0000825322

XDSL:CloseCommsLimitedMember

2021-05-11

0000825322

XDSL:AlphaPredictionsPurchasedSoftwareMember

2021-06-30

0000825322

XDSL:TravelBuddhiPurchasedSoftwareMember

2021-06-30

0000825322

XDSL:CloseCommsPurchasedSoftwareMember

2021-06-30

0000825322

XDSL:AlphaPredictionsPurchasedSoftwareMember

2021-12-31

0000825322

XDSL:TravelBuddhiPurchasedSoftwareMember

2021-12-31

0000825322

XDSL:CloseCommsPurchasedSoftwareMember

2021-12-31

0000825322

XDSL:DevelopedSoftwareMember

2020-07-01

2021-06-30

0000825322

XDSL:DevelopedSoftwareMember

2019-07-01

2020-06-30

0000825322

XDSL:DevelopedSoftwareMember

2021-07-01

2021-12-31

0000825322

XDSL:DevelopedSoftwareMember

2021-10-01

2021-12-31

0000825322

XDSL:DevelopedSoftwareMember

2020-10-01

2020-12-31

0000825322

XDSL:DevelopedSoftwareMember

2020-07-01

2020-12-31

0000825322

XDSL:SubscriptionMember

2020-07-01

2021-06-30

0000825322

XDSL:SubscriptionMember

2019-07-01

2020-06-30

0000825322

XDSL:ServiceAndSupportMember

2020-07-01

2021-06-30

0000825322

XDSL:ServiceAndSupportMember

2019-07-01

2020-06-30

0000825322

XDSL:ApplicationDevelopmentAndImplementationMember

2020-07-01

2021-06-30

0000825322

XDSL:ApplicationDevelopmentAndImplementationMember

2019-07-01

2020-06-30

0000825322

country:IN

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

2020-07-01

2021-06-30

0000825322

country:IN

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

2019-07-01

2020-06-30

0000825322

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

2020-07-01

2021-06-30

0000825322

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

2019-07-01

2020-06-30

0000825322

XDSL:SubscriptionMember

2021-10-01

2021-12-31

0000825322

XDSL:SubscriptionMember

2020-10-01

2020-12-31

0000825322

XDSL:SubscriptionMember

2021-07-01

2021-12-31

0000825322

XDSL:SubscriptionMember

2020-07-01

2020-12-31

0000825322

XDSL:ServiceAndSupportMember

2021-10-01

2021-12-31

0000825322

XDSL:ServiceAndSupportMember

2020-10-01

2020-12-31

0000825322

XDSL:ServiceAndSupportMember

2021-07-01

2021-12-31

0000825322

XDSL:ServiceAndSupportMember

2020-07-01

2020-12-31

0000825322

XDSL:ApplicationDevelopmentAndImplementationMember

2021-10-01

2021-12-31

0000825322

XDSL:ApplicationDevelopmentAndImplementationMember

2020-10-01

2020-12-31

0000825322

XDSL:ApplicationDevelopmentAndImplementationMember

2021-07-01

2021-12-31

0000825322

XDSL:ApplicationDevelopmentAndImplementationMember

2020-07-01

2020-12-31

0000825322

country:US

us-gaap:SalesRevenueNetMember

us-gaap:GeographicConcentrationRiskMember

2021-10-01

2021-12-31

0000825322

country:US

us-gaap:SalesRevenueNetMember

us-gaap:GeographicConcentrationRiskMember

2020-10-01

2020-12-31

0000825322

country:US

us-gaap:SalesRevenueNetMember

us-gaap:GeographicConcentrationRiskMember

2021-07-01

2021-12-31

0000825322

country:US

us-gaap:SalesRevenueNetMember

us-gaap:GeographicConcentrationRiskMember

2020-07-01

2020-12-31

0000825322

country:IN

us-gaap:SalesRevenueNetMember

us-gaap:GeographicConcentrationRiskMember

2021-10-01

2021-12-31

0000825322

country:IN

us-gaap:SalesRevenueNetMember

us-gaap:GeographicConcentrationRiskMember

2020-10-01

2020-12-31

0000825322

country:IN

us-gaap:SalesRevenueNetMember

us-gaap:GeographicConcentrationRiskMember

2021-07-01

2021-12-31

0000825322

country:IN

us-gaap:SalesRevenueNetMember

us-gaap:GeographicConcentrationRiskMember

2020-07-01

2020-12-31

0000825322

us-gaap:SalesRevenueNetMember

us-gaap:GeographicConcentrationRiskMember

2021-10-01

2021-12-31

0000825322

us-gaap:SalesRevenueNetMember

us-gaap:GeographicConcentrationRiskMember

2020-10-01

2020-12-31

0000825322

us-gaap:SalesRevenueNetMember

us-gaap:GeographicConcentrationRiskMember

2021-07-01

2021-12-31

0000825322

us-gaap:SalesRevenueNetMember

us-gaap:GeographicConcentrationRiskMember

2020-07-01

2020-12-31

0000825322

country:IN

2021-06-30

0000825322

country:IN

2020-06-30

0000825322

country:GB

2021-06-30

0000825322

country:GB

2020-06-30

0000825322

country:US

2021-12-31

0000825322

country:US

2020-12-31

0000825322

country:IN

2021-12-31

0000825322

country:IN

2020-12-31

0000825322

country:GB

2021-12-31

0000825322

country:GB

2020-12-31

0000825322

XDSL:OneCustomerMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2020-07-01

2021-06-30

0000825322

XDSL:OneCustomerMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2021-07-01

2021-12-31

0000825322

XDSL:OneCustomerMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2020-07-01

2020-12-31

0000825322

XDSL:NotesPayableOneMember

2021-06-30

0000825322

XDSL:NotesPayableOneMember

2020-06-30

0000825322

XDSL:NotesPayableTwoMember

2021-06-30

0000825322

XDSL:NotesPayableTwoMember

2020-06-30

0000825322

XDSL:NotesPayableThreeMember

2021-06-30

0000825322

XDSL:NotesPayableThreeMember

2020-06-30

0000825322

XDSL:NotesPayableFourMember

2021-06-30

0000825322

XDSL:NotesPayableFourMember

2020-06-30

0000825322

XDSL:JudgmentSettlementAgreementMember

2018-12-09

2018-12-10

0000825322

XDSL:JudgementSettlementAgreementMember

2018-12-10

0000825322

XDSL:NotesPayableOneMember

2021-12-31

0000825322

XDSL:NotesPayableTwoMember

2021-12-31

0000825322

XDSL:NotesPayableThreeMember

2021-12-31

0000825322

XDSL:PaycheckProtectionProgramMember

XDSL:NotesPayableOneMember

2020-04-28

0000825322

XDSL:PaycheckProtectionProgramMember

XDSL:NotesPayableOneMember

2020-04-27

2020-04-28

0000825322

XDSL:EconomicInjuryDisasterLoanMember

XDSL:NotesPayableTwoMember

2020-05-28

0000825322

XDSL:EconomicInjuryDisasterLoanMember

XDSL:NotesPayableTwoMember

2020-05-27

2020-05-28

0000825322

XDSL:EconomicInjuryDisasterLoanMember

XDSL:NotesPayableTwoMember

2020-06-01

2020-06-04

0000825322

XDSL:EconomicInjuryDisasterLoanMember

XDSL:NotesPayableTwoMember

2021-06-30

0000825322

XDSL:AccreditedInvestorsMember

XDSL:SecuritiesPurchaseAgreementWithPowerUpLendingGroupMember

XDSL:TwelvePercentagePromissoryNoteMember

2021-02-08

0000825322

XDSL:AccreditedInvestorsMember

XDSL:SecuritiesPurchaseAgreementWithPowerUpLendingGroupMember

XDSL:TwelvePercentagePromissoryNoteMember

2021-02-07

2021-02-08

0000825322

XDSL:AccreditedInvestorsMember

XDSL:SecuritiesPurchaseAgreementWithPowerUpLendingGroupMember

XDSL:TwelvePercentagePromissoryNoteMember

2021-02-09

2021-02-10

0000825322

XDSL:ConvertiblePromissoryNoteMember

XDSL:CommitmentSharesMember

us-gaap:RestrictedStockMember

2021-02-07

2021-02-08

0000825322

XDSL:ConvertiblePromissoryNoteMember

XDSL:ReturnableSharesMember

2021-02-07

2021-02-08

0000825322

XDSL:AccreditedInvestorsMember

XDSL:SecuritiesPurchaseAgreementMember

XDSL:TwelvePercentagePromissoryNoteMember

2021-06-30

0000825322

XDSL:JudgmentSettlementAgreementMember

2020-08-17

0000825322

XDSL:JudgmentSettlementAgreementMember

2020-08-16

2020-08-17

0000825322

XDSL:JudgementSettlementAgreementMember

XDSL:ConvertiblePromissoryNoteMember

2020-08-17

0000825322

XDSL:JudgementSettlementAgreementMember

XDSL:ConvertiblePromissoryNoteMember

2021-04-12

2021-04-13

0000825322

XDSL:JudgementSettlementAgreementMember

XDSL:ConvertiblePromissoryNoteMember

2021-04-15

2021-04-16

0000825322

XDSL:PaycheckProtectionProgramMember

XDSL:NotesPayableOneMember

2021-12-31

0000825322

XDSL:EconomicInjuryDisasterLoanMember

XDSL:NotesPayableTwoMember

2020-06-03

2020-06-04

0000825322

XDSL:EconomicInjuryDisasterLoanMember

XDSL:NotesPayableTwoMember

2021-12-31

0000825322

XDSL:ConvertiblePromissoryNoteMember

XDSL:CommitmentSharesMember

2021-02-07

2021-02-08

0000825322

XDSL:AccreditedInvestorsMember

XDSL:SecuritiesPurchaseAgreementMember

XDSL:TwelvePercentagePromissoryNoteMember

2021-12-31

0000825322

XDSL:JMJFinancialMember

2021-06-30

0000825322

XDSL:JMJFinancialMember

2020-06-30

0000825322

XDSL:JMJFinancialMember

2020-07-01

2021-06-30

0000825322

XDSL:JMJFinancialMember

2019-07-01

2020-06-30

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsOneMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2020-07-24

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsOneMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2020-07-23

2020-07-24

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsTwoMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2020-07-31

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsTwoMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2020-07-30

2020-07-31

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsTwoMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

XDSL:ConvertiblePromissoryNotesMember

2020-08-06

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsTwoMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2020-08-05

2020-08-06

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsTwoMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2020-08-06

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsThreeMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2020-08-19

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsThreeMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2020-08-18

2020-08-19

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsThreeMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2020-08-16

2020-08-20

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsThreeMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2020-08-20

0000825322

XDSL:SettlementAgreementMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2021-02-17

0000825322

XDSL:SettlementAgreementMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2021-02-19

0000825322

XDSL:SettlementAgreementMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2021-02-16

2021-02-19

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsFourMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2020-08-20

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsFourMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2020-08-16

2020-08-20

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsFourMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2020-08-15

2020-08-21

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsFourMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2020-08-21

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsFiveMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2020-08-27

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsFiveMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2020-08-26

2020-08-27

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsFiveMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2020-08-25

2020-08-28

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsFiveMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2020-08-28

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsFiveMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

srt:MaximumMember

2020-08-25

2020-08-28

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsSixMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2020-08-31

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsSixMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2020-08-30

2020-08-31

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsSixMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2020-08-29

2020-09-01

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsSixMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2020-09-01

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsSevenMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2021-01-25

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsSevenMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2021-01-24

2021-01-25

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsSevenMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2021-01-24

2021-01-26

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsSevenMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2021-01-26

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsEightMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2021-01-26

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsEightMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2021-01-24

2021-01-26

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsEightMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2021-01-24

2021-01-27

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsEightMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2021-01-27

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsNineMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2021-02-10

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsNineMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2021-02-09

2021-02-10

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsNineMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2021-02-09

2021-02-11

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsNineMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2021-02-11

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsTenMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2021-02-18

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsTenMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2021-02-16

2021-02-18

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsTenMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2021-02-21

2021-02-22

0000825322

XDSL:SecuritiesPurchaseAgreementMember

XDSL:AccreditedInvestorsTenMember

XDSL:EightPercentageConvertiblePromissoryNoteMember

2021-02-22

0000825322

XDSL:EvergreenAgreementMember

XDSL:AccreditedInvestorsElevenMember

XDSL:EvergreenCapitalManagementLLCMember

2021-04-06

0000825322

XDSL:EvergreenAgreementMember

XDSL:AccreditedInvestorsElevenMember

XDSL:EvergreenCapitalManagementLLCMember

XDSL:FirstTrancheMember

2021-04-06

0000825322

XDSL:EvergreenAgreementMember

XDSL:AccreditedInvestorsElevenMember

XDSL:EvergreenCapitalManagementLLCMember

XDSL:SecondTrancheMember

2021-04-06

0000825322

XDSL:EvergreenAgreementMember

XDSL:AccreditedInvestorsElevenMember

XDSL:EvergreenCapitalManagementLLCMember

XDSL:FirstTrancheMember

2021-04-04

2021-04-06

0000825322

XDSL:EvergreenAgreementMember

XDSL:AccreditedInvestorsElevenMember

XDSL:EvergreenCapitalManagementLLCMember

XDSL:SecondTrancheMember

2021-04-04

2021-04-06

0000825322

XDSL:EvergreenAgreementMember

XDSL:AccreditedInvestorsElevenMember

XDSL:EvergreenCapitalManagementLLCMember

2021-04-05

2021-04-06

0000825322

XDSL:EvergreenAgreementMember

XDSL:AccreditedInvestorsElevenMember

XDSL:EvergreenCapitalManagementLLCMember

2021-04-04

2021-04-06

0000825322

us-gaap:ConvertibleDebtMember

XDSL:EvergreenAgreementMember

2021-06-30

0000825322

XDSL:InvestorsAgreementMember

XDSL:AccreditedInvestorsTwelveMember

2021-05-04

0000825322

XDSL:InvestorsAgreementMember

XDSL:AccreditedInvestorsTwelveMember

XDSL:FirstTrancheMember

2021-05-04

0000825322

XDSL:InvestorsAgreementMember

XDSL:AccreditedInvestorsTwelveMember

XDSL:SecondTrancheMember

2021-05-04

0000825322

XDSL:InvestorsAgreementMember

XDSL:AccreditedInvestorsTwelveMember

XDSL:FirstTrancheMember

2021-05-03

2021-05-04

0000825322

XDSL:InvestorsAgreementMember

XDSL:AccreditedInvestorsTwelveMember

XDSL:SecondTrancheMember

2021-05-03

2021-05-04

0000825322

XDSL:InvestorsAgreementMember

XDSL:AccreditedInvestorsTwelveMember

2021-05-03

2021-05-04

0000825322

XDSL:InvestorsAgreementMember

XDSL:AccreditedInvestorsTwelveMember

2021-06-30

0000825322

us-gaap:ConvertibleDebtMember

XDSL:InvestorsAgreementMember

2021-06-30

0000825322

XDSL:ConvertibleNotesMember

2020-07-01

2021-06-30

0000825322

XDSL:SecuritiesPurchaseAgreementMember

2021-06-30

0000825322

XDSL:SecuritiesPurchaseAgreementMember

2020-06-30

0000825322

XDSL:JMJFinancialMember

2021-12-31

0000825322

XDSL:JMJFinancialMember

2020-12-31

0000825322

XDSL:JMJFinancialMember

2021-07-01

2021-12-31

0000825322

XDSL:EvergreenAgreementMember

XDSL:AccreditedInvestorsElevenMember

XDSL:EvergreenCapitalManagementLLCMember

2021-04-02

2021-04-06

0000825322

2021-04-02

2021-04-06

0000825322

XDSL:EvergreenAgreementMember

XDSL:AccreditedInvestorsElevenMember

XDSL:EvergreenCapitalManagementLLCMember

2021-12-31

0000825322

us-gaap:ConvertibleDebtMember

XDSL:EvergreenCapitalManagementLLCMember

2021-10-01

2021-12-31

0000825322

us-gaap:ConvertibleDebtMember

XDSL:EvergreenAgreementMember

2021-12-31

0000825322

2021-05-03

2021-05-04

0000825322

2021-05-04

0000825322

XDSL:InvestorsAgreementMember

XDSL:AccreditedInvestorsTwelveMember

2021-07-01

2021-12-31

0000825322

us-gaap:ConvertibleDebtMember

XDSL:InvestorsAgreementMember

2021-12-31

0000825322

XDSL:SecuritiesPurchaseAgreementMember

2021-12-31

0000825322

XDSL:AccreditedInvestorsMember

2021-06-30

0000825322

XDSL:AccreditedInvestorsMember

2020-06-30

0000825322

XDSL:UnamortizedOIDDeferredFinancingsCostsAndDebtDiscountsMember

2021-06-30

0000825322

XDSL:UnamortizedOIDDeferredFinancingsCostsAndDebtDiscountsMember

2020-06-30

0000825322

XDSL:AccreditedInvestorsMember

2021-12-31

0000825322

XDSL:UnamortizedOIDDeferredFinancingsCostsAndDebtDiscountsMember

2021-12-31

0000825322

us-gaap:FairValueInputsLevel1Member

2021-06-30

0000825322

us-gaap:FairValueInputsLevel2Member

2021-06-30

0000825322

us-gaap:FairValueInputsLevel3Member

2021-06-30

0000825322

us-gaap:FairValueInputsLevel1Member

2020-06-30

0000825322

us-gaap:FairValueInputsLevel2Member

2020-06-30

0000825322

us-gaap:FairValueInputsLevel3Member

2020-06-30

0000825322

2019-09-03

0000825322

2019-09-04

0000825322

2020-07-13

0000825322

2020-07-14

0000825322

2020-08-03

0000825322

2020-08-04

0000825322

us-gaap:PrivatePlacementMember

2019-07-01

2020-06-30

0000825322

us-gaap:CommonStockMember

us-gaap:PrivatePlacementMember

2019-07-01

2020-06-30

0000825322

XDSL:CancelledWarrantsMember

XDSL:ExchangeAgreementMember

2020-07-01

2021-06-30

0000825322

XDSL:AdditionalWarrantsMember

2020-07-01

2021-06-30

0000825322

XDSL:CancelledWarrantsMember

XDSL:ExchangeAgreementMember

2021-06-30

0000825322

XDSL:ExchangeAgreementMember

2020-07-01

2021-06-30

0000825322

XDSL:MrCutchensMember

2020-07-01

2021-06-30

0000825322

XDSL:MrCutchensMember

2021-01-29

2021-01-31

0000825322

srt:ChiefOperatingOfficerMember

2020-07-01

2021-06-30

0000825322

srt:ChiefFinancialOfficerMember

2019-07-01

2020-06-30

0000825322

2018-07-01

2019-06-30

0000825322

XDSL:ConsultingPublicRelationsAndMarketingAgreementMember

2020-07-01

2021-06-30

0000825322

us-gaap:CommonStockMember

XDSL:FormerOfficersMember

2019-07-01

2020-06-30

0000825322

us-gaap:CommonStockMember

XDSL:RelatedPartiesAndStrategicConsultantsMember

2019-07-01

2020-06-30

0000825322

srt:ChiefExecutiveOfficerMember

2020-07-01

2021-06-30

0000825322

XDSL:TwoThousandFourteenUnderAnEquityLineOfCreditMember

2021-06-30

0000825322

XDSL:WarranrAgreementMember

2020-06-30

0000825322

XDSL:WarrantAgreementMember

XDSL:MrBhatnagarMember

us-gaap:CommonStockMember

2021-06-30

0000825322

XDSL:InvestorsMember

XDSL:SecuritiesPurchaseAgreementMember

XDSL:ConvertibleNotesMember

2021-04-30

0000825322

XDSL:InvestorsMember

XDSL:SecuritiesPurchaseAgreementMember

2021-04-30

0000825322

XDSL:SecuritiesPurchaseAgreementMember

2020-07-01

2021-06-30

0000825322

XDSL:EvergreenCapitalManagementLLCMember

XDSL:SecuritiesPurchaseAgreementMember

2021-04-05

0000825322

XDSL:EvergreenCapitalManagementLLCMember

XDSL:SecuritiesPurchaseAgreementMember

2020-07-01

2021-06-30

0000825322

XDSL:EvergreenCapitalManagementLLCMember

XDSL:SecuritiesPurchaseAgreementMember

2021-06-30

0000825322

XDSL:MrBhatnagarMember

XDSL:WarrantAgreementEarnedWarrantsMember

2020-07-01

2021-06-30

0000825322

XDSL:MrBhatnagarMember

XDSL:WarrantAgreementEarnedWarrantsMember

2021-06-30

0000825322

XDSL:MrBhatnagarMember

XDSL:WarrantAgreementAcceleratedWarrantsMember

2020-07-01

2021-06-30

0000825322

XDSL:MrBhatnagarMember

XDSL:WarrantAgreementAcceleratedWarrantsMember

2021-06-30

0000825322

XDSL:MrBhatnagarMember

XDSL:WarrantAgreementEarnedWarrantsMember

2019-07-01

2020-06-30

0000825322

XDSL:WarrantAgreementMember

XDSL:MrBhatnagarMember

2021-06-30

0000825322

us-gaap:WarrantMember

2019-07-01

2020-06-30

0000825322

us-gaap:WarrantMember

2020-06-30

0000825322

us-gaap:WarrantMember

XDSL:ExercisePriceRangeMember

2020-06-30

0000825322

us-gaap:WarrantMember

XDSL:ExercisePriceRangeMember

2019-07-01

2020-06-30

0000825322

XDSL:SeriesASuperVotingPreferredMember

2021-12-31

0000825322

2019-08-23

0000825322

2019-08-27

0000825322

2020-06-09

0000825322

2020-06-10

0000825322

2020-08-02

0000825322

srt:ChiefOperatingOfficerMember

2021-07-01

2021-12-31

0000825322

XDSL:ExchangeAgreementMember

XDSL:CancelledWarrantsMember

2020-12-31

0000825322

XDSL:WarrantAgreementMember

2020-12-31

0000825322

XDSL:AdditionalWarrantsMember

2020-07-01

2020-12-31

0000825322

XDSL:AdditionalWarrantsMember

XDSL:ExchangeAgreementMember

2020-12-31

0000825322

XDSL:MrCutchensMember

2020-07-01

2020-12-31

0000825322

srt:ChiefOperatingOfficerMember

2020-07-01

2020-12-31

0000825322

XDSL:ConsultingPublicRelationsAndMarketingAgreementMember

2021-07-01

2021-12-31

0000825322

XDSL:ConsultingPublicRelationsAndMarketingAgreementMember

2020-07-01

2020-12-31

0000825322

XDSL:BoardOfDirectorsAgreementsMember

2021-07-01

2021-12-31

0000825322

XDSL:TwoThousandFourteenUnderAnEquityLineOfCreditMember

2021-12-31

0000825322

XDSL:SecuritiesPurchaseAgreementMember

2021-07-01

2021-12-31

0000825322

XDSL:EvergreenCapitalManagementLLCMember

XDSL:SecuritiesPurchaseAgreementMember

2021-07-01

2021-12-31

0000825322

XDSL:EvergreenCapitalManagementLLCMember

XDSL:SecuritiesPurchaseAgreementMember

2021-12-31

0000825322

us-gaap:WarrantMember

XDSL:ExercisePriceRangeMember

2021-06-30

0000825322

us-gaap:WarrantMember

XDSL:ExercisePriceRangeMember

2020-07-01

2021-06-30

0000825322

us-gaap:WarrantMember

2021-06-30

0000825322

us-gaap:WarrantMember

2020-07-01

2021-06-30

0000825322

us-gaap:WarrantMember

XDSL:ExercisePriceRangeMember

2021-12-31

0000825322

us-gaap:WarrantMember

XDSL:ExercisePriceRangeMember

2021-07-01

2021-12-31

0000825322

us-gaap:WarrantMember

2021-12-31

0000825322

us-gaap:WarrantMember

2021-07-01

2021-12-31

0000825322

XDSL:MicrophaseCorporationMember

2021-06-30

0000825322

srt:ChiefExecutiveOfficerMember

XDSL:TwoThousandTwentyFiscalYearMember

2020-07-01

2021-06-30

0000825322

XDSL:OfficersMember

2021-06-30

0000825322

XDSL:FormerOfficersMember

2021-06-30

0000825322

XDSL:FormerOfficersMember

2020-06-30

0000825322

XDSL:FormerOfficersMember

2020-07-01

2021-06-30

0000825322

XDSL:FormerOfficersMember

2019-07-01

2020-06-30

0000825322

XDSL:EventOfDefaultAndDemandLetterMember

2020-10-21

2020-10-22

0000825322

XDSL:EventOfDefaultAndDemandLetterMember

2020-10-22

0000825322

XDSL:OfficersMember

2020-06-30

0000825322

srt:ChiefFinancialOfficerMember

2020-07-01

2021-06-30

0000825322

srt:ChiefFinancialOfficerMember

2021-06-30

0000825322

XDSL:MrCutchensMember

2021-01-01

2021-01-31

0000825322

srt:ChiefOperatingOfficerMember

XDSL:FourYearAnniversaryMember

2021-06-30

0000825322

srt:ChiefOperatingOfficerMember

XDSL:ThreeYearAnniversaryMember

2020-06-30

0000825322

srt:ChiefFinancialOfficerMember

2018-07-01

2019-06-30

0000825322

XDSL:MrSmileyMember

2019-07-01

2020-06-30

0000825322

XDSL:MrSmileyMember

2019-10-01

2019-10-31

0000825322

2021-02-06

2021-02-08

0000825322

XDSL:MicrophaseCorporationMember

2021-12-31

0000825322

XDSL:FormerOfficersMember

2021-07-01

2021-12-31

0000825322

XDSL:FormerOfficersMember

2020-07-01

2020-12-31

0000825322

XDSL:EventOfDefaultAndDemandLetterMember

2020-10-20

2020-10-22

0000825322

XDSL:OfficersMember

2021-12-31

0000825322

XDSL:MrSmileyMember

2021-07-01

2021-12-31

0000825322

XDSL:AngeliaHrytsyshynMember

2021-07-01

2021-12-31

0000825322

2021-02-06

2021-03-31

0000825322

XDSL:OfficemMember

2021-07-01

2021-12-31

0000825322

XDSL:PaycheckProtectionProgramMember

2020-05-01

2020-05-31

0000825322

XDSL:JudgmentSettlementAgreementMember

2018-12-10

0000825322

XDSL:JudgmentSettlementAgreementMember

2021-04-13

0000825322

XDSL:JudgmentSettlementAgreementMember

2021-04-12

2021-04-13

0000825322

XDSL:JudgmentSettlementAgreementMember

2021-04-15

2021-04-16

0000825322

XDSL:JudgmentSettlementAgreementMember

2021-06-28

2021-06-30

0000825322

XDSL:DirectorAgreementMember

2021-08-26

2021-08-27

0000825322

us-gaap:InvestorMember

XDSL:AmendedAndRestatedFutureReceivablesAgreementMember

us-gaap:SubsequentEventMember

2022-01-01

2022-01-30

0000825322

XDSL:AmendedAndRestatedFutureReceivablesAgreementMember

us-gaap:SubsequentEventMember

2022-01-01

2022-01-30

0000825322

XDSL:AnshuBhatnagarMember

us-gaap:SubsequentEventMember

2022-02-09

2022-02-10

0000825322

2020-04-01

2020-04-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

XDSL:Integer

As

filed with the Securities and Exchange Commission on February 28, 2022

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

mPHASE

TECHNOLOGIES, INC.

(Exact

name of registrant as specified in its charter)

| New

Jersey |

|

7385 |

|

22-2287503 |

(State

or Other Jurisdiction of

Incorporation or Organization) |

|

(Primary

Standard Industrial

Classification Code Number) |

|

(I.R.S.

Employer

Identification Number) |

1101

Wootton Parkway, Suite

1040

Rockville,

MD 20852

(301)

329-2700

(Address,

including zip code, and telephone number including

area code, of Registrant’s principal executive offices)

Anshu

Bhatnagar

Chief

Executive Officer

mPhase

Technologies, Inc.

1101 Wootton Parkway, Suite 1040

Rockville, MD 20852

(301)

329-2700

(Name,

address, including zip code, and telephone number

including area code, of agent for service)

With

copies to:

Joseph M. Lucosky, Esq.

Scott E. Linsky, Esq.

Lucosky Brookman LLP

101 Wood Avenue South, 5th Floor

Woodbridge, NJ 08830

Tel. No.: (732) 395-4400

Fax No.: (732) 395-4401 |

Robert F. Charron, Esq.

Ellenoff Grossman & Schole LLP

1345 Avenue of the Americas, 5th Floor

New York, NY 10105

Tel. No.: (212) 370-1300

|

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by checkmark if the registrant has not elected to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date

as the Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is

not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

SUBJECT

TO COMPLETION |

DATED

FEBRUARY 28, 2022 |

___________

Units

Each Unit Consisting of One Share of Common

Stock and

One

Warrant To Purchase One Share of Common Stock

mPhase

Technologies, Inc.1

We are offering an aggregate of

Units (the “Units”) based

on a public offering price of

$ per Unit. Each Unit

consists of one shares of common stock of mPhase Technologies, Inc., a New Jersey corporation, par value $0.01 per share

(“Common Stock”), and one warrant (“Warrant”) to purchase one share of Common Stock. The Warrants may be

exercised in whole, with an exercise price equal to 100% of the public offering price of each Unit sold in this offering.

This offering also relates to the shares of Common Stock issuable upon exercise of any Warrants sold in this offering.

Our

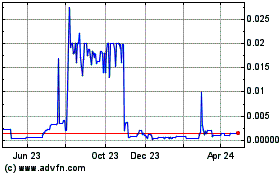

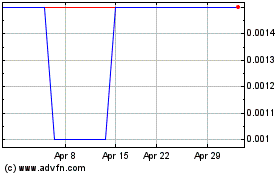

Common Stock is presently quoted on the OTC Pink Marketplace operated by OTC Markets Group,

Inc. (“OTC Pink”) under the symbol “XDSL.” We intend to apply to list our shares of Common Stock

and Warrants on The Nasdaq Capital Market under the symbols “XDSL” and “XDSLW”, respectively, upon

our satisfaction of the exchange’s initial listing criteria. If our Common Stock and Warrants are not approved for listing

on The Nasdaq Capital Market, we will not consummate this offering. No assurance can be given that our application will be approved.

As of February 28, 2022, the last reported sale price for our Common Stock on the OTC Pink was $0.19 per share.

Our

board of directors (“Board of Directors”) intends to effect a 1-for-

reverse stock split of our issued and outstanding shares of Common Stock following the effective date of the registration statement

of which this prospectus forms a part, but prior to and in connection with this offering and our intended listing of our Common Stock

and Warrants on Nasdaq. However, we cannot guarantee that such reverse stock split will occur, that such reverse stock split will

be necessary or will occur in connection with the listing of our Common Stock on Nasdaq, or that the Nasdaq Stock Market, LLC

will approve our initial listing application for our Common Stock upon such reverse stock split. The share and per share information

in this prospectus does not give effect to the proposed reverse stock split. Unless specifically provided otherwise herein, such numbers

and prices above and used elsewhere in this registration statement, of which this prospectus forms a part, do not assume the effectiveness

of such reverse stock split or the uplist of our Common Stock and Warrants to Nasdaq.

The offering is being underwritten on a firm commitment

basis. The underwriters may offer the securities from time to time to purchasers directly or through agents, or through brokers in brokerage

transactions on Nasdaq, or to dealers in negotiated transactions or in a combination of such methods of sale, or otherwise, at fixed

price or prices, which may be changed, or at market prices prevailing at the time of sale, at prices related to such prevailing market

prices.

The

final public offering price per Unit will be determined through negotiation between us and the underwriter in this offering

and will take into account the recent market price of our Common Stock, the general condition of the securities market at the time

of this offering, the history of, and the prospects for, the industry in which we compete, and our past and present operations and

our prospects for future revenues. The recent market price per share of Common Stock used throughout this prospectus may not be

indicative of the final public offering price per Unit.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 16 of this prospectus for a

discussion of information that should be considered in connection with an investment in our securities.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED

UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| | |

Per Unit (1) | | |

Total (1) | |

| Public offering price | |

$ | | | |

$ | | |

| Underwriting discounts and commissions (2) | |

$ | | | |

$ | | |

| Proceeds to us, before expenses (3) | |

$ | | | |

$ | | |

| (1) |

The

public offering price and underwriting discount in respect of the Units corresponds

to a public offering price per share of Common Stock of $ and

a public offering price per Warrant of $ . |

| |

|

| (2) |

We

have agreed to reimburse the underwriters for certain expenses. The underwriters will receive

an underwriting discount equal to 7.0% of the gross proceeds in this offering. In

addition, we have agreed to pay up to a maximum of $75,000 of the fees and expenses of H.C.

Wainwright & Co., LLC, the representative of the underwriters in this offering (“Wainwright”

or the “Representative”) in connection with this offering, which includes

the fees and expenses of underwriters’ counsel, and we have agreed to issue common

stock purchase warrants (the “Representative’s Warrants”) to the Representative, which are exercisable for up to shares

of Common Stock. See “Underwriting”

for more information. |

| |

|

| (3) |

The

amount of offering proceeds to us presented in this table does not give effect to any exercise of the: (i) option (if any) we have

granted to the Representative of the underwriters as described below and (ii) the Warrants or the Representative’s Warrants

being issued in this offering. |

We

have granted a 30-day option to the Representative exercisable one or more times in whole or in part, to purchase up to an

additional shares of Common

Stock and/or Warrants to purchase up to an additional

shares of Common stock (equal to

15% of the number of shares of Common Stock and/or Warrants sold in this offering) less the underwriting discounts payable by

us, solely to cover over-allotments, if any.

The

underwriters expect to deliver our securities to purchasers in the offering on or about , 2022.

H.C.

Wainwright & Co.

The

date of this prospectus is , 2022.

TABLE

OF CONTENTS

You

should rely only on information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide

you with additional information or information different from that contained in this prospectus. We are not making an offer of these

securities in any state or other jurisdiction where the offer is not permitted. The information in this prospectus may only be accurate

as of the date on the front of this prospectus regardless of time of delivery of this prospectus or any sale of our securities.

No

person is authorized in connection with this prospectus to give any information or to make any representations about us, the Common

Stock hereby or any matter discussed in this prospectus, other than the information and representations contained in this prospectus.

If any other information or representation is given or made, such information or representation may not be relied upon as having been

authorized by us. This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy our securities in any circumstance

under which the offer or solicitation is unlawful. Neither the delivery of this prospectus nor any distribution of our securities in

accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the date of

this prospectus.

Neither

we nor the underwriter have done anything that would permit this offering or possession or distribution of this prospectus in

any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourself about,

and to observe any restrictions relating to, this offering and the distribution of this prospectus.

PROSPECTUS

SUMMARY

This

summary highlights selected information appearing elsewhere in this prospectus. While this summary highlights what we consider to be

important information about us, you should carefully read this entire prospectus before investing in our securities, especially

the risks and other information we discuss under the headings “Risk Factors” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operation” and our consolidated financial statements and related notes beginning

on page F-1. Our fiscal year end is June 30 and our fiscal years ended June 30, 2021, and 2020 are sometimes referred to herein as fiscal

years 2021, and 2020, respectively. Some of the statements made in this prospectus discuss future events and developments, including

our future strategy and our ability to generate revenue, income and cash flow. These forward-looking statements involve risks and uncertainties

which could cause actual results to differ materially from those contemplated in these forward-looking statements. See “Cautionary

Note Regarding Forward-Looking Statements”. Unless otherwise indicated or the context requires otherwise, the words “we,”

“us,” “our”, the “Company” or “our Company” or “mPhase” refer to mPhase Technologies,

Inc., a New Jersey corporation, and our subsidiaries.

Our Business

mPhase

Technologies, Inc. (“mPhase,”, “we,” “us,” “our,” or the “Company”) began

as Tecma Laboratory, Inc., which was incorporated under the laws of the State of Nevada in 1979. In 1987, we changed our name to Tecma

Laboratories, Inc. On February 17, 1997, we acquired Lightpaths, Inc., a Delaware corporation, which was engaged in the development of

telecommunications products incorporating DSL technology and the Company changed its name to Lightpaths TP Technologies, Inc. Lightpaths

TP Technologies, Inc. completed a reverse merger and changed its name to mPhase Technologies, Inc. on June 2, 1997.

We

have 85,008,099 shares of Common Stock outstanding as of February 28, 2022. The Common Stock is currently quoted on the OTC Pink under

the ticker symbol “XDSL”. We are headquartered in Rockville, Maryland. Our website is available at https://mpower.co.

Information on our website or any other website is not incorporated by reference herein and does not constitute a part of this prospectus.

Over

our history, we have explored a number of different business opportunities.

From

1997 until June 29, 2010, we focused in the commercial deployment of our TV+ products for delivery of broadcast Internet Protocol Television,

and Digital Subscriber Line (DSL) component products which include Plain Old Telephone Service (OTS) splitters that entail devices using low-pass and high-pass filters

to DSL signals to different lines. On June 30, 2010, we discontinued our TV+ line of products as well as our electronic sensor products

and shifted their business focus on the development of innovative power cells and related products through the science of microfluidics,

microelectromechanical systems (“MEMS”) and nanotechnology. This led to the development of a battery that has a significantly

longer shelf life prior to activation than conventional batteries and capable of disposal after use without harm to the environment.

From

February of 2004 through March of 2007, we engaged Lucent/Bell Labs (now Nokia) to develop, using the science of nanotechnology, micro

power cell arrays creating a structure for zinc batteries that separated the chemicals or electrolytes prior to initial activation. This

was done by suspending on nano grass or small spoke-like pieces of silicon a liquid electrolyte taking advantage of a superhydrophobic

effect that occurs as a result of the ability to manipulate materials of a very small size or less than 1/50,000 the size of a human

hair. We had a strategic alliance with the U.S. Army to successfully test, under military combat conditions, its SmartBattery design,

leading to further validation of its path to product development under a Cooperative Research and Development Agreement (CRADA). This

continues to be a potential opportunity for the Company which we intend to visit at a more strategic time. In addition, the Company formed

a relationship with Energy Storage Research Group, a center of excellence at Rutgers University, in New Jersey, that enabled us to expand

its battery development from a zinc to a lithium battery capable of delivering significantly more power. During fiscal years 2009 and

2010, we outsourced considerable foundry work for final development of the Smart NanoBattery to Silex, a Swedish company.

In

February 2008, we successfully deployed a prototype of its Smart NanoBattery in a gun-fired test at the Aberdeen Proving Ground in Maryland.

The battery not only survived the harsh conditions of deployment at a gravitational force in excess of 45,000 g, but it was also flawlessly

activated in the process. In 2010, we received from the appropriations committee of the U.S. Congress an “earmark” of $2.5

million to develop with Picatinny Arsenal a battery based upon the specifications of the Smart NanoBattery. Due to circumstances out

of our control, the funding was not made for such development as Congress eliminated the use of “earmarks” at the end of

2010.

On

May 20, 2011, we announced that we had been granted a U.S. patent for multi-chemistry battery architecture. Thereafter, on February 10,

2012, we filed a U.S. provisional patent with the USPTO for a Non-Pump Enabled Drug Delivery System.

We

refocused on two new products; a high-end portable emergency flashlight and a jump starter for a dead car battery developed for the Company

by Porsche Design Studio. From 2011 to 2016, we generated revenue from these products, but could not establish sufficient sales. We were

unable to obtain sufficient financing to continue its operations as of 2018 and began to seek new management.

As

of 2018, we were not able to obtain sufficient financing to continue its operations and on January 11, 2019, we underwent a major change

in management and control. The new management began positioning our focus as a technology leader in artificial intelligence (“AI”)

and machine learning. We saw opportunities to generate significant revenue by embedding artificial intelligence and machine learning

into business operations, platform architectures, business services, and customer experiences.

On

February 15, 2019, we acquired Travel Buddhi, a software platform to enhance travel via ultra-customization tools that tailor a planned

trip experience by understanding a traveler’s profile and travel patterns and react in real time during travel.

On

June 30, 2019, we acquired the assets of Alpha Predictions LLP (“Alpha Predictions”) and integrated its staff and some of

its data analysis products into the Company’s business operations.

On

May 11, 2020, the Company entered into an Asset Purchase Agreement to acquire all assets owned, used or held in connection with the business,

other than excluded assets and assumed certain liabilities of CloseComms Limited (“CloseComms”). The most substantial acquired

asset was a patented, software application platform. We have integrated into a retail customer’s existing Wi-Fi infrastructure,

giving the retailer important customer data and enabling AI-enhanced, targeted promotions to drive store traffic and sales.

During

2021, we announced the addition of the EV Charging Network and Consumer Engagement Platform as part of the mPower ecosystem with the

purpose to monetize additional services and products offerings such as the high-speed millimeter wave 5G relating to consumer travel.

Layered on top of this mobile experience, we also announced the buildout of a marketplace with a loyalty and rewards program.

Also,

during the same year, we rolled out the pilot program for the EV Charging Network with one of our customers for their multiple locations.

By

late-2021, we transitioned into clean technology company that bridges the gap between the green consumers and customers such as

retailers and other service providers. Although we had initially contemplated the design and build of the marketplace into our

ecosystem, we have since evaluated this business model and the resources required to fully launch such a concept and have decided

that it remains better suited as a concept to implement through partnerships with other third-party companies. Although the

marketplace remains a natural choice for our ecosystem for numerous reasons, in order for us to scale up and fully integrate this

concept into our larger business model, we would rather work directly with other third-party companies that have this as their

primary business. We will consider strategic partnerships with third party companies with an already established marketplace infrastructure, where

we can simply secure revenue streams via contracts or other commercial structures.

Today,

mPhase is an EV Charging company with over four decades of experience, technology and a team working to enhance the existing

business lines through the integration of cloud-based systems and to deliver software as a service (“SaaS”) and

technology as a service (“TaaS”). The focus of our business and central to our success is the full build out

and deployment of our EV Charging Network and Consumer Engagement Platform under our mPower ecosystem. As we work to grow the mPower

ecosystem, we seek to tailor it to each individual’s tastes and needs, with particular emphasis on empowering today’s

green consumer. We are working to build, grow and expand quickly our unique mPower ecosystem globally, as our technology and

services give us a competitive advantage over our competition. Our vision of the mPower ecosystem will consist of the following

products and services offered through the mPower application (“mPower App”): (1) mPower EV Charging Network and (2)

Consumer Engagement Platform. The goal is to leverage our mPower ecosystem to allow for other businesses and third parties such as

retailers and service providers to partner with us in order to utilize our ecosystem (i.e. data, locations, consumers), which in

return will create further contracted revenue for mPhase. This path forward will allow us to still layer on the right offerings to

our mPower ecosystem but mPhase will not divert any resources, financially or otherwise to build out the infrastructure of the CBRS

spectrum and millimeter-wave 5G and the marketplace.

Branded

under the mPower name, we are taking our EV Charging Network offering and combining it with the Consumer Engagement Platform and creating

a circular ecosystem where people shop, dine, fuel and interact with the world to create a richer life experience, all through our mPower

App.

mPower

EV Charging Network

We

continue to build out our mPower EV Charging Network across the United States by offering the high-quality hardware and software subscriptions

with turn-key support and warranty services. We will be partnering with third party suppliers and manufacturers for its charging stations

in order to build out the network, which includes Level 2 Alternative Current (“AC”) Chargers and Level 3 Direct Current

(“DC”) Fast Charging systems for commercial and residential use. In addition, we will engage third-party contractors to provide

the basic electrical charging installation and on-going O&M (operations and maintenance) to the customer base seeking to have on

premise EV charging capability. We also see exponential growth in EVs and microgrids due to the rapid innovation in technology, which

is why with the right partnerships, we would seek to offer renewable energy sources + microgrids wrapped around the EV Charging Network.

The microgrids can support EV charging as their batteries can be used as an energy resource to charge vehicles during peak times, reducing

the grid demand and therefore providing stability and an even better benefit of providing charge with clean energy. Through the use of

our mPower App, customers will have the ability to access the mPower EV Charging Network.

Consumer

Engagement Platform

To

create the Consumer Engagement Platform, we are combining the consumer engagement framework acquired from the CloseComms acquisition

with the AI based travel optimization framework from Travel Buddhi.

Fundamentally

the platform uses AI to understand behavior patterns of consumers and allows the customers (i.e., retailers) to make these just in time

offers available to the end consumer as they travel. In addition to providing charging station hardware, we are building a Consumer Engagement

Platform which will interconnect a set of business systems and functions that includes using software solutions within the framework

of SaaS and TaaS model to optimize consumer engagement as they travel by making just in time offers available as they travel. One of

our customer base is the retail store owners. The consumers are the every-day travelers (i.e., drivers) that will benefit from the offers

those customers are setting up through our secure portal. For consumers, they will utilize the mPower App and set up a profile that has

information about their preferences and demographics. In turn, the customer initiates an offer on the secure power portal and only the

consumers, based on their preferences and demographics on their mPower App, receive such select offers. The customers are the contracting

party entering into subscription agreements with us for the SaaS and TaaS services. The SaaS service allows for the customer to set up

their own offers directly without the Company providing any management services. While the TaaS service offers a managed service where

we handle all the back end work for the consumers. In both models, the Company generates recurring monthly revenue. As customers incentivize

the consumers by providing offers, the mPower App increases in subscribers.

Employee

Count

As

of February 28, 2022, the Company employs 35 full-time employees with a range of expertise in technology platform development services,

sales and marketing services, human resources, and accounting services. The Company’s subsidiary in India employs a total of 16

software engineers and data analysis experts.

Products

under continued Research and Development

mPower

Ecosystem

Our

mPower Ecosystem (as discussed above) is still being developed and therefore it is the majority of our R&D.

Smart

Surfaces

We

have a technology platform known as the Smart Surface. By being able to control the surface properties of materials down to the nanometer

scale, new and improved devices can be designed and built that may lead to compelling business opportunities. One type of smart surface

that we provide allows properties to be changed in response to an external stimulus.

As

our research and development efforts evolve, in addition to silicon materials, the ability to control the surface properties of materials

can be extended to other substances such as polymers, ceramics, metals, and fibers providing opportunities for our platform technology

to be used in a range of potential applications such as energy storage and power management for portable electronics and microelectronics,

self-cleaning surfaces, filters for water purification or desalination systems, materials for environmental remediation that separate

liquids or solvents, and other situations where the control of the interaction of a solid surface exposed to a liquid is vitally important.

Towards the end of 2022, we plan to focus on advancing this technology platform, as well as consider potential collaborations or strategic

partnerships.

Smart

NanoBattery

We

challenged conventional norms of battery development by using our proprietary superhydrophobic porous silicon membrane technology as

the basis to build the Smart NanoBattery, a reserve battery providing Power On Command™ prior to initial activation. The Smart

NanoBattery is a product and technology owned by us, with ongoing efforts to provide the product to the United States Army in the future.

To the best of our knowledge, no other battery technology available today can deliver the long-term performance requirements specified

by the U.S. Army for this application. Super-hydrophobicity initially keeps the liquid electrolyte physically separated from the solid

electrodes of the battery, thus preventing the chemical reactions from occurring that cause the battery to provide power. This gives

the Smart NanoBattery the benefit of potentially infinite shelf life.

A

conventional battery loses some capacity while sitting on the shelf in its package or stored in an electronic or electrical device, even

before being used for the first time. On the other hand, the Smart NanoBattery is built so that it is inactive and remains that way indefinitely

until it is turned on. No power is lost to self-discharge or leakage current prior to activation. When needed, the Smart NanoBattery

can be activated on command via the phenomenon of electrowetting, which is the modification of the wetting properties of a surface with

an applied electric field. In such a case, when effective, surface properties of the porous silicon membrane are selectively controlled

to shift instantly from a superhydrophobic to hydrophilic state. In other words, electrowetting acts as the triggering mechanism.

We

have successfully fabricated and demonstrated our first 3-volt lithium-based Smart NanoBattery, based on a design allowing either manual

or remote activation by the user, the feature known as Power on Command™.

By

incorporating the phenomenon of electrowetting on nanostructured surfaces into a revolutionary way of storing energy, the Smart NanoBattery

provides power to portable electronic and microelectronic devices exactly when and where it is needed. As a reserve battery, it can be