UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material Pursuant to Rule 14a-11(c) or rule 14a-12 |

Advaxis,

Inc.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required. |

| ☐ |

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title

of each class of securities to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate

number of securities to which transaction applies: |

| |

|

|

| |

(3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

| |

|

|

| |

(4) |

Proposed

maximum aggregate value of transaction: |

| |

|

|

| |

(5) |

Total

fee paid: |

| |

|

|

| ☐ |

Fee

paid previously with preliminary materials: |

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its

filing. |

| |

(1) |

Amount

previously paid: |

| |

|

|

| |

(2) |

Form,

Schedule or Registration Statement no.: |

| |

|

|

| |

(3) |

Filing

Party: |

| |

|

|

| |

(4) |

Date

Filed: |

| |

|

|

Advaxis,

Inc.

9

Deer Park Drive, Suite K-1

Monmouth

Junction, NJ 08852

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

TO

BE HELD ON MARCH 31, 2022

February 28,

2022

Dear

Stockholders of Advaxis, Inc.:

The

Board of Directors (the “Board”) of Advaxis, Inc., a Delaware corporation (the “Company”) has called for a Special

Meeting of stockholders (the “Special Meeting”). The Special Meeting will be held entirely online. You will be able to attend

and participate in the Special Meeting online by visiting www.virtualshareholdermeeting.com/ADXS2022SM where they will be able

to listen to the meeting live, submit questions and vote.

The

Special Meeting has been called by the Board of Directors to submit to stockholders for approval the following matters:

| |

1. |

To

approve an amendment to the Amended and Restated Certificate of Incorporation (the “Charter”)

to effect a reverse stock split of our common stock at a ratio to be determined by the Board

of Directors within a range of one-for-twenty to one-for-eighty (or any number

in between), without reducing the authorized number of shares of our common stock, to be

effected in the sole discretion of the Board of Directors at any time within one year of

the date of the Special Meeting without further approval or authorization of our stockholders;

and |

| |

|

|

| |

2. |

To

consider and vote upon an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient

votes in favor of Proposal No. 1. |

Pursuant

to the Company’s Amended and Restated Bylaws (the “Bylaws”), the Board has fixed the close of business on February

25, 2022 as the record date for determination of the stockholders entitled to vote at the Special Meeting and any adjournments or

postponements thereof. Please complete, sign and submit your proxy, which is solicited by the Board of

Directors, as soon as possible so that your shares can be voted at the Special Meeting in accordance with your instructions. You can ensure

that your shares are voted at the Special Meeting by submitting a proxy to vote via the internet or by completing, signing and returning

the enclosed proxy. If you do attend the

Special Meeting, you may then withdraw your proxy and vote your shares in person. In any event, you may revoke your proxy prior to its

exercise. Shares represented by proxies that are returned properly signed but unmarked will be voted in favor of proposal made by us.

This

Notice of Special Meeting of Stockholders, Proxy Statement and the proxy card are available online at: www.virtualshareholdermeeting.com/ADXS2022SM.

BY

ORDER OF THE BOARD OF DIRECTORS,

| /s/

Kenneth A. Berlin |

|

| Kenneth

A. Berlin |

|

| President

and Chief Executive Officer, Interim Chief Financial Officer |

|

SPECIAL

MEETING OF STOCKHOLDERS

PROXY

STATEMENT

Table

of Contents

Advaxis, Inc.

9

Deer Park Drive, Suite K-1

Monmouth

Junction, NJ 08852

SPECIAL

MEETING PROXY STATEMENT

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON MARCH 31, 2022

The

Notice of Special Meeting, Proxy Statement and Proxy are available at: www.virtualshareholdermeeting.com/ADXS2022SM

We

are making these proxy materials available to you in connection with the solicitation of proxies by the Board of Directors (the “Board”)

of Advaxis, Inc. (the “Company”) for a Special Meeting of Stockholders (the “Special Meeting”) and for any adjournment

or postponement of the Special Meeting. The mailing of the notice of internet availability of these proxy materials will commence on

February 28, 2022.

The

Special Meeting will be held entirely online. You will be able to attend and participate in the Special Meeting online by visiting www.virtualshareholdermeeting.com/ADXS2022SM

on March 31, 2022, beginning at 10:00 am, local time. In this Proxy Statement, “we,” “us,” “our,”

“Advaxis” and the “Company” refer to Advaxis, Inc.

This

Proxy Statement is being made available to you because you own shares of our Series D convertible redeemable preferred stock, and/or

our common stock, in each case $0.001 par value per share, as of the record date, which entitles you to vote at the Special Meeting.

By use of a proxy, you can vote whether or not you attend the Special Meeting. This Proxy Statement describes the matters we would like

you to vote on and provides information on those matters.

QUESTIONS

AND ANSWERS ABOUT THE SPECIAL MEETING

Q:

What is the purpose of the Special Meeting?

A:

The purposes of the Special Meeting are to hold a stockholder vote on the following matters:

| |

1. |

To

approve an amendment to the Amended and Restated Certificate of Incorporation (the “Charter”)

to effect a reverse stock split of our common stock at a ratio to be determined by the Board

of Directors within a range of one-for-twenty to one-for-eighty (or any number

in between), without reducing the authorized number of shares of our common stock, to be

effected in the sole discretion of the Board of Directors at any time within one year of

the date of the Special Meeting without further approval or authorization of our stockholders;

and |

| |

|

|

| |

2. |

To

consider and vote upon an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient

votes in favor of Proposal No. 1. |

Other

than these proposals, no other proposal will be presented for a vote at the Special Meeting. We refer herein to Proposal No. 1 as the

“Reverse Stock Split Proposal” and to Proposal No. 2 as the “Adjournment Proposal.”

Q:

Who is entitled to vote at the Special Meeting?

A:

Only holders of our common stock, par value $0.001 per share (the “Common Stock”) or Series D convertible redeemable preferred

stock, par value $0.001 per share (the “Preferred Stock”), as of the close of business on February 25, 2022, the record date for the

Special Meeting (the “Record Date”), will be entitled to notice of and to vote at the Special Meeting and at any adjournments

or postponements thereof. Holders of record of shares of common stock are entitled to vote on all matters brought before the Special

Meeting, while holders of the Preferred Stock are entitled to vote only on the Reverse Stock Split Proposal.

On

January 31, 2022, the Company closed a preferred stock offering in which the Company issued 1,000,000 shares of the Preferred Stock,

with an aggregate stated value of $5,000,000. Total net proceeds from the offerings, before deducting the placement agent’s fees

and other estimated offering expenses, were approximately $ 4.75 million. Each share of Preferred Stock is convertible into shares of

Common Stock at an initial conversion price of $0.25 per share, conditioned on the Reverse Stock Split Proposal being approved by the

Company’s stockholders.

As

of the Record Date, there were 145,638,459 shares of Common Stock and 1,000,000 shares Preferred Stock outstanding and entitled

to vote. Holders of Common Stock and Preferred Stock will vote on the Reverse Stock Split Proposal as a single class.

You

do not need to attend the Special Meeting to vote your shares. Instead, you may vote your shares by marking, signing, dating and returning

the enclosed proxy card or submitting a proxy to vote through the internet.

Q:

How will my shares be voted at the Special Meeting?

A:

Holders of Common Stock and Preferred Stock will vote on the Reverse Stock Split Proposal as a single class.

Each

share of our Common Stock outstanding on the Record Date entitles the holder thereof to one vote on each matter submitted to the stockholders

at the Special Meeting. As of the Record Date, there were 145,638,459 shares of our Common Stock issued and outstanding.

Each

share of Preferred Stock outstanding on the Record Date entitles the holder thereof to 30,000 votes on the Reverse Stock Split Proposal,

and shall have no votes as to any other matter. As of the Record Date, there were 1,000,000 shares of our Preferred Stock issued and

outstanding, convertible into an aggregate of 20,000,000 shares of Common Stock, and having a total of 30,000,000,000 votes on the Reverse

Stock Split Proposal (and no votes on the Adjournment Proposal).

With

respect to the Reverse Stock Split Proposal, there are thus an aggregate of 30,145,638,459 votes that may be cast by the holders

of Common Stock and Preferred Stock.

The

holders of the Preferred Stock have agreed, through the date the reverse stock split contemplated by the Reverse Stock Split Proposal

is consummated, that they will not convert any shares of the Preferred Stock into Common Stock nor will they transfer, offer, sell, contract

to sell, hypothecate, pledge or otherwise dispose of (or enter into any transaction which is designed to, or might reasonably be expected

to, result in the disposition of any shares of Preferred Stock.

The

holders have also agreed to vote, and to cause its affiliates to vote, all shares of Preferred Stock owned by such holder or its affiliates,

as applicable, on any resolution presented to the stockholders of the Company for purposes of approving the Reverse Stock Split Proposal.

The terms of the Preferred Stock provide that the shares of Preferred Stock, when cast, shall automatically be voted in a manner that

“mirrors” the proportions on which the shares of Common Stock (excluding any shares of Common Stock that are not voted) are

voted on the Reverse Stock Split Proposal. For example, if 30% of the aggregate votes cast by Common Stock voting in connection with

the Reverse Stock Split Proposal are voted against such resolutions and 70% of the aggregate votes cast by Common Stock voting in connection

with the Reverse Stock Split Proposal are voted in favor thereof, then 30% of the votes cast by the shares of Preferred Stock voting

in connection with the Reverse Stock Split Proposal shall vote against the approval of the Reverse Stock Split Proposal and 70% of such

votes shall be cast in favor of such Reverse Stock Split Proposal. The holders of the Preferred Stock have also agreed, promptly upon

request by the Company, to grant the Company (or its designee) an irrevocable proxy to vote all shares of Preferred Stock in accordance

with the description of voting in this paragraph.

Q:

How do I vote?

A:

If you were a holder of our Common Stock or Preferred Stock as of the Record Date, you may vote in person at the Special Meeting, submit

a proxy through the internet or vote by proxy using the enclosed proxy card. To submit a proxy through the internet, go to

www.virtualshareholdermeeting.com/ADXS2022SM and complete an electronic proxy card. You will be asked for a Control Number, which

has been provided with the Notice of Internet Availability.

Whether

you plan to attend the Special Meeting or not, we urge you to vote by proxy to ensure your vote is counted. Voting by proxy will not

affect your right to attend the Special Meeting and vote. If you submit a proxy via the internet or properly complete your proxy

card and submit it to us in time, the “proxy” (one of the individuals named on the proxy card) will vote your shares as you

have directed. If you sign the proxy card but do not make specific choices, the proxy will vote your shares as recommended by the Board

and, as to any other matters properly brought before the Special Meeting, in the sole discretion of the proxy.

Q:

What shares may I vote?

A:

If you vote by proxy, the individuals named on the proxy, or their substitutes, will vote your shares in the manner you indicate. If

a beneficial owner who holds shares in street name does not provide specific voting instructions to their brokerage firm, bank, broker

dealer or other nominee, under the rules of certain securities exchanges, the brokerage firm, bank, broker dealer or other nominee holding

those shares may generally vote as the nominee determines in its discretion on behalf of the beneficial owner on routine matters but

cannot vote on non-routine matters, the latter of which results in “broker non-votes.” The proposals involve matters

we consider routine under the applicable rules. Accordingly, if you do not give instructions to your broker, the broker may vote your

shares in its discretion on the proposals and therefore no broker non-votes are expected in connection with the proposals.

If you date, sign, and return the proxy card without indicating your instructions, your shares will be voted as follows:

| |

● |

Proposal

No. 1. “FOR” an amendment to the Amended and Restated Certificate of Incorporation (the “Charter”) to

effect a reverse stock split of our Common Stock at a ratio to be determined by the Board of Directors within a range of one-for-twenty

to one-for-eighty (or any number in between), without reducing the authorized number of shares of our Common Stock,

to be effected in the sole discretion of the Board of Directors at any time within one year of the date of the Special Meeting without

further approval or authorization of our stockholders; and |

| |

|

|

| |

● |

Proposal

No. 2. “FOR” an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not

sufficient votes in favor of Proposal No. 1. |

You

may revoke or change your proxy at any time before it is exercised by delivering to us a signed proxy with a date later than your previously

delivered proxy, by voting via the live webcast at the Special Meeting, or by sending a written revocation of your proxy addressed to

our Corporate Secretary at our principal executive office. Your latest dated proxy card is the one that will be counted.

Q:

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

A:

Most stockholders hold their shares through a bank, broker or other financial intermediary rather than directly in their own name. As

summarized below, there are some distinctions between shares held of record and shares held beneficially.

Stockholder

of Record: If your shares are registered directly in your name with Advaxis’ transfer agent, Continental Stock Transfer and

Trust Company, or the Transfer Agent, you are considered, with respect to those shares, the stockholder of record. As the stockholder

of record, you have the right to grant your proxy directly to Advaxis or to vote your shares in person at the Special Meeting.

Beneficial

Owner: If you hold shares in a stock brokerage account or through a bank or other financial intermediary, you are considered the

beneficial owner of shares held in street name. Your bank, broker or other financial intermediary is considered, with respect

to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your bank, broker or other financial

intermediary on how to vote your shares, but because you are not the stockholder of record, you may not vote these shares in person at

the Special Meeting unless you obtain a signed proxy from the stockholder of record giving you the right to vote the shares. As a beneficial

owner, you are, however, welcome to attend the Special Meeting.

Q:

What are the recommendations of the Board?

A.

The Board recommends that you vote:

| |

1. |

“FOR”

the proposed amendment to the Amended and Restated Certificate of Incorporation (the “Charter”)

to effect a reverse stock split of our Common Stock at a ratio to be determined by the Board

of Directors within a range of one-for-twenty to one-for-eighty (or any number

in between), without reducing the authorized number of shares of our Common Stock, to be

effected in the sole discretion of the Board of Directors at any time within one year of

the date of the Special Meeting without further approval or authorization of our stockholders. |

| |

|

|

| |

2. |

“FOR”

an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor

of Proposal No. 1. |

Q:

What constitutes a quorum at the Special Meeting?

A: The presence, by accessing online or being

represented by proxy, at the Special Meeting of the holders of a one-third of the outstanding shares of our Common Stock and Preferred

Stock (on an as-converted basis), or 55,212,814 shares, constitutes a quorum. Each share of Preferred Stock is, or will

be, convertible into 20 shares of Common Stock and shall be counted on that basis, for a total of 20,000,000 votes, solely for purposes

of determining a quorum.

Q:

What vote is required to approve each proposal?

A:

The proposals to be voted upon at the Special Meeting have the following vote requirement:

Proposal

No. 1: Proposed Amendment to the Charter to effect the reverse stock split of our Common Stock. The affirmative vote of the holders

of a majority of the outstanding voting power of our Common Stock and Preferred Stock entitled to vote on the proposal,

voting as a single class, assuming a quorum is present, is required to approve the Reverse Stock Split Proposal.

Proposal

No. 2: Proposed adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in

favor of Proposal No. 1. The affirmative vote of the holders of a majority in voting power of shares of Common Stock present

in person or represented by proxy at the Special Meeting and entitled to vote on the proposal, assuming a quorum is present, is required

for approval of Proposal No. 2.

Q:

What is the effect of abstentions and broker non-votes?

A:

An “abstention” occurs when a stockholder sends in a proxy with explicit instructions to decline to vote regarding a particular

matter or attends the Special Meeting and elects not to vote or fails to cast a ballot. Abstentions are treated as shares present in

person or by proxy and entitled to vote, so abstaining has the same effect as a negative vote for purposes of determining whether our

stockholders approved the proposals presented.

A: “broker non-vote” occurs when

a broker, bank or other holder of record holding shares for a beneficial owner properly executes and returns a proxy without voting on

a particular proposal because such holder of record does not have discretionary voting power for that particular item and has not received

instructions from the beneficial owner. Proposals No. 1 and No. 2 involve matters we consider routine under the applicable

rules. Accordingly, if you do not give instructions to your broker, the broker may vote your shares in its discretion on Proposals

No. 1 and No. 2 and therefore no broker non-votes are expected in connection with Proposals No. 1 and No. 2.

The

votes of the Preferred Stock on Proposal No. 1 will mirror only votes cast by the Common Stock, without regard to abstentions by holders

of our Common Stock.

Q:

May I change my vote?

A.

Yes. You may change your proxy instructions or revoke your proxy at any time prior to the vote at the Special Meeting. For shares held

directly in your name, you may accomplish this by: (a) delivering a written notice of revocation to the Secretary of the Company or the

Secretary’s designated agent bearing a later date than the proxy being revoked, (b) signing and delivering a later dated written

proxy relating to the same shares, or (c) attending the Special Meeting and voting in person (although attendance at the Special Meeting

will not in and of itself constitute a revocation of a proxy). For shares held in street name, you may change your vote by submitting

new voting instructions to your broker, trustee or nominee.

Q:

Who is paying for this proxy solicitation?

A.

We are paying for this proxy solicitation. Our officers and other regular employees may solicit proxies by mail, in person or by telephone

or telecopy. These officers and other regular employees will not receive additional compensation. The Company may retain a third-party

proxy solicitor for the Special Meeting, whose costs we estimate would be approximately $50,000. We will reimburse banks, brokers,

nominees, custodians and fiduciaries for their reasonable out-of-pocket expenses incurred in sending the proxy materials to beneficial

owners of the shares.

Q:

Am I entitled to dissenters’ rights?

A:

No dissenters’ rights are available under the General Corporation Law of the State of Delaware, our Charter, or our bylaws to any

stockholder with respect to any of the matters proposed to be voted on at the Special Meeting.

Q:

How can I find out the results of the voting at the Special Meeting?

A:

Preliminary voting results will be announced at the Special Meeting. In addition, final voting results will be published in a Current

Report on Form 8-K that we expect to file within four business days after the completion of the Special Meeting.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Advaxis

has determined beneficial ownership in accordance with the rules of the SEC. These rules generally attribute beneficial ownership of

securities to persons who possess sole or shared voting power or investment power with respect to those securities. In addition, these

rules require that Advaxis includes shares of Common Stock issuable pursuant to the vesting of restricted stock units and the exercise

of stock options and warrants that are either immediately exercisable or exercisable within 60 days of February 1, 2022. These shares

are deemed to be outstanding and beneficially owned by the person holding those options or warrants for the purpose of computing the

percentage ownership of that person, but they are not treated as outstanding for the purpose of computing the percentage ownership of

any other person. Unless otherwise indicated, the persons or entities identified in this table have sole voting and investment power

with respect to all shares shown as beneficially owned by them, subject to applicable community property laws.

| Name

and Address of Beneficial Owner | |

Number

of Shares of Common Stock | | |

Percentage

of Shares of Common Stock Beneficially Owned | | |

Number

of Shares of Preferred Stock | | |

Percentage

of Shares of Preferred Stock Beneficially Owned | |

| | |

| | |

| | |

| | |

| |

| Directors

and Named Executive Officers | |

| | | |

| | | |

| | | |

| | |

| Kenneth Berlin(1) | |

| 143,000 | | |

| * | % | |

| - | * | |

| | % |

| Igor Gitelman(2) | |

| 16,667 | | |

| * | % | |

| - | * | |

| | % |

| David Sidransky(3) | |

| 29,021 | | |

| * | % | |

| - | * | |

| | % |

| Roni Appel(4) | |

| 32,659 | | |

| * | % | |

| - | * | |

| | % |

| Richard Berman(5) | |

| 24,112 | | |

| * | % | |

| - | * | |

| | % |

| Samir Khleif(6) | |

| 27,973 | | |

| * | % | |

| - | * | |

| | % |

| James Patton(7) | |

| 39,878 | | |

| * | % | |

| - | * | |

| | % |

| Andres Gutierrez(8) | |

| 62,084 | | |

| * | % | |

| - | * | |

| | % |

| All current Directors and

Executive Officers as a group (8 individuals)(9) | |

| 375,394 | | |

| * | % | |

| - | * | |

| | % |

*

Constitutes less than 1% of our outstanding Common Stock.

| (1) |

Represents

21,667 issued shares of our Common Stock, and options to purchase 121,333 shares of our Common Stock exercisable within 60 days. |

| (2) |

Represents options to purchase

16,667 shares of our Common Stock exercisable within 60 days. |

| (3) |

Represents 7,355 issued

shares of our Common Stock and options to purchase 21,666 shares of our Common Stock exercisable within 60 days. |

| (4) |

Represents 10,476 issued

shares of our Common Stock, options to purchase 20,294 shares of our Common Stock exercisable within 60 days and warrants to purchase

1,889 shares of our Common Stock exercisable within 60 days. |

| (5) |

Represents 3,711 issued

shares of our Common Stock and options to purchase 20,401 shares of our Common Stock exercisable within 60 days. |

| (6) |

Represents 4,639 issued

shares of our Common Stock and options to purchase 23,334 shares of our Common Stock exercisable within 60 days. |

| (7) |

Represents 19,117 issued

shares of our Common Stock and options to purchase 20,761 shares of our Common Stock exercisable within 60 days. |

| (8) |

Represents 3,750 issued

shares of our Common Stock and options to purchase 58,334 shares of our Common Stock exercisable within 60 days. |

| (9) |

Represents 70,715 issued

shares of our Common Stock and options to purchase 302,790 shares of our Common Stock exercisable within 60 days and warrants to

purchase 1,889 shares of our Common Stock exercisable within 60 days. |

MANAGEMENT

The

Board of Directors of the Company, or the “Board,” are elected at the annual meeting of stockholders, and serve for the term

for which each director is elected and until his or her successor is elected and qualified. Executive officers of the Company are elected

by the Board, and serve for a term of one year and until their successors have been elected and qualified or until their earlier resignation

or removal by the Board. There are no family relationships among any of the directors and executive officers of the Company. None of

the executive officers or directors has been involved in any legal proceedings of the type requiring disclosure by the Company during

the past ten years.

The

following table sets forth the names and ages of all directors continuing in office, director nominees and executive officers of the

Company and their respective positions with the Company as of the date of this Proxy Statement:

| Name |

|

Age |

|

Position |

| Dr. David Sidransky |

|

61 |

|

Chairman of our Board

of Directors |

| Dr. James P. Patton |

|

64 |

|

Vice Chairman of our Board

of Directors |

| Roni A. Appel |

|

55 |

|

Director |

| Kenneth A. Berlin |

|

57 |

|

President,

Chief Executive Officer, Interim Chief Financial

Officer and Director |

| Richard J. Berman |

|

79 |

|

Director |

| Dr. Samir N. Khleif |

|

58 |

|

Director |

| Andres Gutierrez |

|

61 |

|

Chief Medical Officer

and Executive Vice President |

| Igor Gitelman |

|

46 |

|

Chief

Accounting Officer, VP of Finance |

Board

of Directors

The

following information summarizes, for each of our directors, his or her principal occupations and other public company directorships

for at least the last five years and information regarding the specific experiences, qualifications, attributes and skills of such director:

Dr.

David Sidransky

Dr.

Sidransky currently serves as the Chairman of our Board of Directors and has served as a member of our Board of Directors since July

2013. He is a renowned oncologist and research scientist named and profiled by TIME magazine in 2001 as one of the top physicians and

scientists in America, recognized for his work with early detection of cancer. Since 1994, Dr. Sidransky has been the Director of the

Head and Neck Cancer Research Division and Professor of Oncology, Otolaryngology, Genetics, and Pathology at Johns Hopkins University

School of Medicine. He has served as Chairman or Lead of the Board of Directors of Champions Oncology since October 2007 and was a director

and Vice-Chairman of ImClone Systems until its merger with Eli Lilly Inc. He is the Chairman of Tamir Biotechnology and Ayala and serves

on the Board of Directors of Galmed and Orgenesis. He has served on scientific advisory boards of MedImmune, Roche, Amgen, and Veridex,

LLC (a Johnson & Johnson diagnostic company), among others. Dr. Sidransky served as Director (2005-2008) of the American Association

for Cancer Research (AACR). He earned his B.S. from Brandeis University and his Medical Doctorate from Baylor College of Medicine. Dr.

Sidransky’s experience in life science companies, as well as his scientific knowledge, qualify him to service as our director and

non-executive chairman.

Dr.

James P. Patton

Dr.

Patton currently serves as the Vice Chairman of our Board of Directors, has served as the Chairman of our Board and has been a member

of our Board of Directors since February 2002. Furthermore, Dr. Patton was the Chairman of our Board of Directors from November 2004

until December 2005, as well as a period from July 2013 until May 2015, and was our Chief Executive Officer from February 2002 to November

2002. Since February 1999, Dr. Patton has been the Vice President of Millennium Oncology Management, Inc., which is a consulting company

in the field of oncology services delivery. Dr. Patton was a trustee of Dundee Wealth US, a mutual fund family, from October 2006 through

September 2014. He is a founder and has been chairman of VAL Health, LLC, a health care consultancy, from 2011 to the present. In addition,

he was President of Comprehensive Oncology Care, LLC, a company that owned and operated a cancer treatment facility in Exton, Pennsylvania

from 1999 until its sale in 2008. From February 1999 to September 2003, Dr. Patton also served as a consultant to LibertyView Equity

Partners SBIC, LP, a venture capital fund based in Jersey City, New Jersey. From July 2000 to December 2002, Dr. Patton served as a director

of Pinpoint Data Corp. From February 2000 to November 2000, Dr. Patton served as a director of Healthware Solutions. From June 2000 to

June 2003, Dr. Patton served as a director of LifeStar Response. He earned his B.S. from the University of Michigan, his Medical Doctorate

from Medical College of Pennsylvania, and his M.B.A. from Penn’s Wharton School. Dr. Patton was also a Robert Wood Johnson Foundation

Clinical Scholar. He has published papers regarding scientific research in human genetics, diagnostic test performance and medical economic

analysis. Dr. Patton’s experience as a trustee and consultant to funds that invest in life science companies provide him with the

perspective from which we benefit. Additionally, Dr. Patton’s medical experience and service as a principal and director of other

life science companies make Dr. Patton particularly qualified to serve as our director and non-executive vice chairman.

Roni

A. Appel

Mr.

Appel has served as a member of our Board of Directors since November 2004. He was our President and Chief Executive Officer from January

1, 2006 until December 2006 and Secretary and Chief Financial Officer from November 2004 to September 2006. From December 15, 2006 to

December 2007, Mr. Appel served as a consultant to us. Mr. Appel currently is a self-employed consultant and the Co-Founder and President

of Spirify Pharma Inc. Previously, he served as Chief Executive Officer of Anima Biotech Inc., from 2008 through January 31, 2013. From

1999 to 2004, he was a partner and managing director of LV Equity Partners (f/k/a LibertyView Equity Partners). From 1998 until 1999,

he was a director of business development at Americana Financial Services, Inc. From 1994 to 1996, he worked as an attorney. Mr. Appel

holds an M.B.A from Columbia University (1998) and an LL.B. from Haifa University (1994). Mr. Appel’s longstanding service with

us and his entrepreneurial investment career in early stage biotech businesses qualify him to serve as our director.

Kenneth

Berlin

Mr.

Berlin has served as our President and Chief Executive Officer and a member of our Board of Directors since April 2018. Mr. Berlin has

served as our Interim Chief Financial Officer since September 2020. Prior to joining Advaxis, Mr. Berlin served as President and Chief

Executive Officer of Rosetta Genomics from November 2009 until April 2018. Prior to Rosetta Genomics, Mr. Berlin was Worldwide General

Manager at cellular and molecular cancer diagnostics developer Veridex, LLC, a Johnson & Johnson company. At Veridex he grew the

organization to over 100 employees, launched three cancer diagnostic products, led the acquisition of its cellular diagnostics partner,

and delivered significant growth in sales as Veridex transitioned from an R&D entity to a commercial provider of oncology diagnostic

products and services. Mr. Berlin joined Johnson & Johnson in 1994 and served as corporate counsel for six years. From 2001 until

2004 he served as Vice President, Licensing and New Business Development in the pharmaceuticals group, and from 2004 until 2007 served

as Worldwide Vice President, Franchise Development, Ortho-Clinical Diagnostics. Mr. Berlin holds an A.B. degree from Princeton University

and a J.D. from the University of California Los Angeles School of Law. Mr. Berlin’s experience in life science companies, as well

as his business experience in general qualify him to service as our director.

Richard

J. Berman

Mr. Berman has served

as a member of our Board of Directors since September 1, 2005. Richard Berman’s business career spans over 35 years of venture

capital, senior management and merger and acquisitions experience. In the past 5 years, Mr. Berman has served as a director and/or officer

of over a dozen public and private companies. From 2006-2011, he was Chairman of National Investment Managers, a company with $12 billion

in pension administration assets. Mr. Berman currently serves as a director of four public healthcare companies Cryoport Inc., Advaxis,

Inc., BioVie, Inc. and BriaCell Therapeutics. Recently, he became a director of Comsovereign Holding Corp, a leader in the drone market.

From 2002 to 2010, he was a director at Nexmed Inc. (now Apricus Biosciences, Inc.) where he also served as Chairman/CEO in 2008 and

2009. From 1998-2000, he was employed by Internet Commerce Corporation (now Easylink Services) as Chairman and CEO and served as director

from 1998-2012. Previously, Mr. Berman worked at Goldman Sachs, was Senior Vice President of Bankers Trust Company, where he started

the M&A and Leveraged Buyout Departments, created the largest battery company in the world in the 1980s by merging Prestolite, General

Battery and Exide to form Exide Technologies (XIDE), helped to create what is now Soho (NYC) by developing five buildings, and advised

on over $4 billion of M&A transactions (completed over 300 deals). He is a past Director of the Stern School of Business of NYU where

he obtained his B.S. and M.B.A. He also has US and foreign law degrees from Boston College and The Hague Academy of International Law,

respectively. Mr. Berman’s extensive knowledge of our industry, his role in the governance of publicly held companies and his directorships

in other life science companies qualify him to serve as our director.

Dr.

Samir Khleif

Dr.

Khleif has served as a member of our Board of Directors since October 2014. He currently serves as the Director of the State of Georgia

Cancer Center, Georgia Regents University Cancer Center and the Cancer Service Line. Dr. Khleif was formerly Chief of the Cancer Vaccine

Section at the NCI, and also served as a Special Assistant to the Commissioner of the FDA leading the Critical Path Initiative for oncology.

Dr. Khleif is a Georgia Research Alliance Distinguished Cancer Scientist and Clinician and holds a professorship in Medicine, Biochemistry

and Molecular Biology, and Graduate Studies at Georgia Regents University. Dr. Khleif’s research program at Georgia Regents University

Cancer Center focuses on understanding the mechanisms of cancer-induced immune suppression, and utilizing this knowledge for the development

of novel immune therapeutics and vaccines against cancer. His research group designed and performed some of the first cancer vaccine

clinical trials targeting specific genetic changes in cancer cells. He led many national efforts and committees on the development of

biomarkers and integration of biomarkers in clinical trials, including the AACR-NCI-FDA Cancer Biomarker Collaborative and the ASCO Alternative

Clinical Trial Design. Dr. Khleif is the author of many book chapters and scientific articles on tumor immunology and biomarkers process

development, and he is the editor for two textbooks on cancer therapeutics, tumor immunology, and cancer vaccines. Dr. Khleif was inducted

into the American Society for Clinical Investigation, received the National Cancer Institute’s Director Golden Star Award, the

National Institutes of Health Award for Merit, the Commendation Medal of the US Public Health Service, and he was recently appointed

to the Institute of Medicine National Cancer Policy Forum. Dr. Khleif’s distinguished career as well as his extensive expertise

in vaccines and immunotherapies qualify him to serve as our director.

Andres

Gutierrez, M.D., Ph.D.

Dr.

Gutierrez has served as our Executive Vice President and Chief Medical Officer since April 2018. Prior to joining Advaxis, Dr. Gutierrez

served as Chief Medical Officer for Oncolytics Biotech, Inc. from November 2016 to April 2018. Prior to Oncolytics, Dr. Gutierrez was

Chief Medical Officer at SELLAS Life Sciences Group from November 2015 to September 2016 and was Medical Director, Early Development

Immuno-Oncology at Bristol-Myers Squibb from October 2012 to November 2015, where he oversaw the development of translational and clinical

development of immuno-oncology programs in solid tumors and hematological malignancies. Earlier, Dr. Gutierrez was Medical Director for

several biotechnology companies, including Sunesis Pharmaceuticals, BioMarin Pharmaceutical, Proteolix and Oculus Innovative Sciences,

leading key programs with talazoparib and carfilzomib, among others. Prior to Oculus, he served as Director of the Gene & Cell Therapy

Unit at the National Institutes of Health in Mexico City and as a consultant physician at the Hospital Angeles del Pedregal.

Independence

of the Board of Directors

Each

of our incumbent non-employee directors is independent in accordance with the definition set forth in the OTCQX rules. Each nominated

member of each of our Board committees is an independent director under the OTCQX standards applicable to such committees. The Board

considered the information included in transactions with related parties as outlined below along with other information the Board considered

relevant, when considering the independence of each director.

Board

Committees

Presently,

the Board has the following standing committees: Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee

and the Research and Development Committee. Each of the standing committees is comprised solely of independent directors.

The

members of the Committees of the Board as of the date of this Proxy Statement are:

Board

Committees

Audit

Committee: The Audit Committee of our Board of Directors is currently composed of three directors, all of whom satisfy the independence

and other standards for Audit Committee members under the Nasdaq rules and the Exchange Act rules. The Audit Committee is responsible

for recommending the engagement of auditors to the full Board, reviewing the results of the audit engagement with the independent registered

public accounting firm, identifying irregularities in the management of our business in consultation with our independent accountants,

and suggesting an appropriate course of action, reviewing the adequacy, scope, and results of the internal accounting controls and procedures,

reviewing the degree of independence of the auditors, as well as the nature and scope of our relationship with our independent registered

public accounting firm, and reviewing the auditors’ fees. For fiscal year 2021, the Audit Committee was composed of Messrs. Berman

and Appel and Dr. Patton, with Mr. Berman serving as the Audit Committee’s financial expert as defined under Item 407 of Regulation

S-K. The Audit Committee held five meetings during the most recent fiscal year.

The

Audit Committee operates under a written Audit Committee Charter, which is available to stockholders on our website at https://www.advaxis.com/corporate-governance/governance-overview.

Compensation

Committee: The Compensation Committee of our Board of Directors currently consists of Mr. Berman, and Drs. Khleif and Sidransky.

The Compensation Committee determines the salaries, bonuses, and incentive and equity compensation of our officers subject to applicable

employment agreements, provides recommendations for the salaries and incentive compensation of our other employees and consultants, and

reviews and oversees our compensation programs and policies generally. For executives other than the Chief Executive Officer, the Compensation

Committee receives and considers performance evaluations and compensation recommendations submitted to the Committee by the Chief Executive

Officer. In the case of the Chief Executive Officer, the evaluation of his performance is conducted by the Compensation Committee, which

determines any adjustments to his compensation as well as awards to be granted. The agenda for meetings of the Compensation Committee

is usually determined by its Chairman, with the assistance of the Company’s Chief Executive Officer. The Compensation Committee

held one meeting during the 2021 fiscal year.

The Compensation Committee operates under

a written Compensation Committee Charter, which is available to stockholders on our website at https://www.advaxis.com/corporate-governance/governance-overview.

Nominating

and Corporate Governance Committee: The Nominating and Corporate Governance Committee of our Board of Directors currently consists

of Mr. Berman, and Drs. Patton, Khleif and Sidransky. The functions of the Nominating and Corporate Governance Committee include identifying

and recommending to the Board individuals qualified to serve as members of the Board and on the committees of the Board, advising the

Board with respect to matters of board composition, procedures and committees, developing and recommending to the Board a set of corporate

governance principles applicable to us and overseeing corporate governance matters generally including review of possible conflicts and

transactions with persons affiliated with directors or members of management, and overseeing the annual evaluation of the Board and our

management. The Nominating and Governance Committees held one meeting during the 2021 fiscal year.

The Nominating and Corporate Governance Committee

operates under a written Nominating and Corporate Governance Committee Charter, which is available to stockholders on our website at

https://www.advaxis.com/corporate-governance/governance-overview.

Nominating

and Corporate Governance Committee will consider director candidates recommended by eligible stockholders. Stockholders may recommend

director nominees for consideration by the Nominating and Corporate Governance Committee by writing to the Nominating and Corporate Governance

Committee, Attention: Chairman, Advaxis, Inc., 9 Deer Park Drive, Suite K-1, Monmouth Junction, NJ 08852. Any recommendations for director

made to the Nominating and Corporate Governance Committee should include the nominee’s name and qualifications for membership on

our Board and must include the information required pursuant to the By-Laws with respect to the nominating stockholder and the director

nominee.

The

Company must receive the written nomination for an annual meeting not less than 90 days and not more than 120 days prior to the first

anniversary of the previous year’s annual meeting of stockholders, or, if no annual meeting was held the previous year or the date

of the annual meeting is advanced more than 30 days before or delayed more than 60 days after the anniversary date, we must receive the

written nomination not later than the later of 90 days prior to such annual meeting or the close of business on the tenth day following

the day on which public announcement of the date of such annual meeting is made by the Company.

The

Nominating and Corporate Governance Committee expects, as minimum qualifications, that nominees to our Board of Directors (including

incumbent directors) will enhance our Board of Director’s management, finance and/or scientific expertise, will not have a conflict

of interest and will have a high ethical standard. A director nominee’s knowledge and/or experience in areas such as, but not limited

to, the medical, biotechnology, or life sciences industry, equity and debt capital markets and financial accounting are likely to be

considered both in relation to the individual’s qualification to serve on our Board of Directors and the needs of our Board of

Directors as a whole. Other characteristics, including but not limited to, the director nominee’s material relationships with us,

time availability, service on other boards of directors and their committees, or any other characteristics that may prove relevant at

any given time as determined by the Nominating and Corporate Governance Committee shall be reviewed for purposes of determining a director

nominee’s qualification.

Candidates

for director nominees are evaluated by the Nominating and Corporate Governance Committee in the context of the current composition of

our Board, our operating requirements and the long-term interests of our stockholders. The Nominating and Corporate Governance Committee

then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional

search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds

and qualifications of possible candidates after considering the function and needs of our Board. In the case of incumbent directors whose

terms of office are set to expire, the Nominating and Corporate Governance Committee reviews such directors’ overall service to

us during their term, including the number of meetings attended, level of participation, quality of performance, and any other relationships

and transactions that might impair such directors’ independence. The Nominating and Corporate Governance Committee meets to discuss

and consider such candidates’ qualifications and then selects a nominee for recommendation to our Board by majority vote. To date,

the Nominating and Corporate Governance Committee has not paid a fee to any third party to assist in the process of identifying or evaluating

director candidates.

In

identifying candidates for membership on the Board, the Nominating and Corporate Governance Committee takes into account all factors

it considers appropriate and will seek to ensure that its membership consists of sufficiently diverse backgrounds, meaning a mix of backgrounds

and experiences that will enhance the quality of the Board’s deliberations and decisions. In considering candidates for the Board,

the independent directors will consider, among other factors, diversity with respect to viewpoints, skills, experience and other demographics.

In February 2020, the Nominating and Corporate Governance Committee instituted a policy whereby diversity, including diversity of gender,

origin and background, became a key consideration when identifying candidates for membership on the Board. The Nominating and Corporate

Governance Committee also may consider the extent to which the candidate would fill a present need on the Board.

Research

and Development Committee: The Research and Development Committee was established in August 2013 with the purpose of providing

advice and guidance to the Board on scientific and medical matters and development. The Research and Development Committee currently

consists of Drs. Sidransky, Khleif and Patton. The functions of the Research and Development Committee include providing advice and guidance

to the Board on scientific matters and providing advice and guidance to the Board on medical matters. The Research and Development Committee

held one meeting during the 2021 fiscal year.

Board

Leadership Structure

On

May 27, 2015, David Sidransky was appointed Chairman and continues to serve as Chairman. Dr. Sidransky’s experience in life science

companies, as well as his scientific knowledge, his history with our Company and his own history of innovation and strategic thinking,

qualify him to serve as our Chairman. Additionally, on April 23, 2018, Kenneth Berlin was appointed President and Chief Executive Officer

and named a member of the Board of Directors. Mr. Berlin’s knowledge of industry standards and his experience in industry operations,

and his leadership experience complements Dr. Sidransky’s scientific knowledge.

While

we do not have a formal policy regarding the separation of our principal executive officer and chairman of our Board, we believe the

current structure is in the best interest of the Company at this time. Further, this structure demonstrates to our employees, customers

and stockholders that we are under strong leadership, with multiple skills and sets the tone for managing our operations. This leadership

structure promotes strategic development and execution, timely decision-making and effective management of our resources. We believe

that we are well-served by this structure.

Code

of Ethics

We

have adopted a Code Business Conduct and Ethics that applies to our employees, senior management and Board of Directors, including the

Chief Executive Officer and Chief Financial Officer. The Code of Business Conduct and Ethics is available on our website at https://www.advaxis.com/corporate-governance/governance-overview.

Risk

Oversight

The

Board has an active role in overseeing our risk management and is responsible for discussing with management and the independent auditors

our major financial risk exposures, the guidelines and policies by which risk assessment and management is undertaken, and the steps

management has taken to monitor and control risk exposure. The Board regularly engages in discussions of the most significant risks that

we are facing and how those risks are being managed. The Board believes that its work and the work of the Chairman and the principal

executive officer, enables the Board to effectively oversee our risk management function.

Certain

Relationships and Related Person Transactions

Our

policy is to enter into transactions with related parties on terms that, on the whole, are no more favorable, or no less favorable, than

those available from unaffiliated third parties. Based on our experience in the business sectors in which we operate and the terms of

our transactions with unaffiliated third parties, we believe that all transactions that we enter will meet this policy standard at the

time they occur. Presently, we have no such related party transactions.

Communications

with the Board of Directors

Stockholders

may contact an individual director, the Board as a group, or a specified Board committee or group, including the non-employee directors

as a group, by writing to the following address:

Advaxis,

Inc.

9 Deer Park Drive, Suite K-1

Monmouth Junction, NJ 08852

Attn: Board of Directors

Each

communication should specify the applicable addressee or addressees to be contacted as well as the general topic of the communication.

We will initially receive and process communications before forwarding them to the addressee. We generally will not forward to the directors

a stockholder communication that we determine to be primarily commercial in nature or relates to an improper or irrelevant topic, or

that requests general information about us.

PROPOSALS

TO BE ACTED UPON AT THE SPECIAL MEETING

PROPOSAL

NO. 1 – APPROVAL OF THE AMENDMENT TO AMENDED AND RESTATED CERTIFICATE OF INCORPORATION (THE “CHARTER”) OF ADVAXIS TO

EFFECT THE REVERSE STOCK SPLIT

General

At

the Special Meeting, our stockholders will be asked to approve a proposal to amend the amended and restated certificate of incorporation

of Advaxis to effect a reverse stock split of the issued and outstanding shares of our Common Stock, at a reverse stock ratio to be determined

by the Board in the range of one-for-twenty to one-for-eighty (or any number in between) shares outstanding.

Upon the effectiveness of such amendment to the amended and restated certificate of incorporation of Advaxis to effect the reverse stock

split, or the reverse stock split effective time, the issued and outstanding shares of our Common Stock immediately prior to the reverse

stock split effective time will be reclassified into a smaller number of shares such that an Advaxis stockholder will own one new share

of our Common Stock for each 20 to 80 (or any number in between) shares of issued Common Stock held by such stockholder immediately

prior to the reverse stock split effective time, as specified.

By

approving this Proposal No. 1, Advaxis stockholders will: (a) approve an amendment to the amended and restated certificate of incorporation

of Advaxis pursuant to which any whole number of issued and outstanding shares of Common Stock between and including 20 to 80

could be combined and reclassified into one share of Common Stock; and (b) authorize the Company’s

board of directors to file only one such amendment, as determined by the Company’s board of directors in its sole discretion, and

to abandon each amendment not selected by the Company’s board of directors. Should Company receive the required stockholder approval

for this Proposal No. 1, and following such stockholder approval, the Company’s board of directors determines that effecting the

reverse stock split is in the best interests of Company and its stockholders, the reverse stock split will become effective as specified

in the amendment filed with the Secretary of State of the State of Delaware. The amendment filed thereby will contain the number of shares

selected by the Company’s board of directors within the limits set forth in this Proposal No. 1 to be combined and reclassified

into one share of our Common Stock. Accordingly, upon the effectiveness of the amendment to the amended and restated certificate of incorporation

of Advaxis to effect the reverse stock split, or the split effective time, every 20 to 80 shares (or any number in between) of

our Common Stock outstanding immediately prior to the split effective time will be combined and reclassified into one share of our Common

Stock.

The

amendment to the amended and restated certificate of incorporation of Advaxis to effect the reverse stock split, as more fully described

below, will affect the reverse stock split but will not change the number of authorized shares of our Common Stock or Preferred

Stock, or the par value of our Common Stock or Preferred Stock.

A

copy of the proposed form of certificate of amendment to the amended and restated certificate of incorporation of Advaxis to effect the

reverse stock split is attached as Appendix A to this proxy statement/prospectus/information statement.

Notwithstanding

approval of this Proposal No. 1 by Advaxis stockholders, the Company’s board of directors may, in its sole discretion, abandon

the proposed amendment and determine prior to the effectiveness of any filing with the Secretary of State of the State of Delaware not

to effect the reverse stock split, as permitted under Section 242(c) of the DGCL.

Outstanding

Shares

Our

Amended and Restated Certificate of Incorporation currently authorizes us to issue a maximum of 170,000,000 shares of Common Stock, par

value $0.001 per share, and 5,000,000 shares of Preferred Stock, $0.001 par value per share. Our issued and outstanding securities as

of February 25, 2022 are as follows:

| |

● |

145,638,459 shares

of Common Stock; and |

| |

|

|

| |

● |

1,000,000

shares of Preferred Stock. |

Purpose

The

Company’s board of directors approved the proposal to amend the amended and restated certificate of incorporation of Advaxis to

effect a reverse stock split for the following reasons:

| |

● |

the

Company’s board of directors believes effecting the reverse stock split will result in an increase in the minimum bid price

of our Common Stock and allow for the relisting of our Common Stock on The Nasdaq Capital Market in the future; and |

| |

|

|

| |

● |

the

Company’s board of directors believes a higher stock price may help generate investor interest in Advaxis and help Advaxis

attract and retain employees. |

If

the reverse stock split successfully increases the per share price of our Common Stock, the Company’s board of directors also believes

this increase may increase trading volume in our Common Stock and facilitate future financings by Company.

Background

As

previously disclosed on its Current Report on Form 8-K filed on July 6, 2021, the Company, Advaxis Ltd., a company organized under the

laws of the State of Israel and a wholly owned subsidiary of the Company and Biosight, Ltd., a company organized under the laws of the

State of Israel (“Biosight”) entered into an Agreement and Plan of Merger and Reorganization (the “Merger Agreement”).

Subsequently,

on November 16, 2021, the Company convened a Special Meeting of Stockholders. The purpose of that special meeting was described in the

Company’s definitive proxy statement as filed with the Securities and Exchange Commission on October 21, 2021 (the “Definitive

Proxy Statement”). The Special Meeting was adjourned to December 7, 2021 to solicit additional proxies to vote in favor of the

proposals described in the Definitive Proxy Statement, one of which included a reverse stock split proposal.

On

December 7, 2021, the Company’s reconvened its Special Meeting of Stockholders (the “Reconvened Special Meeting”).

As previously disclosed on its Current Report on Form 8-K filed on December 7, 2021, the Reconvened Special Meeting was adjourned to

December 16, 2021 to solicit additional proxies to vote in favor of Proposal No. 2 – Reverse Stock Split Proposal (“Proposal

No. 2”) and one other proposal, as described in the Definitive Proxy Statement.

On

December 16, 2021, the Company’s reconvened its Special Meeting of Stockholders (the “Second Reconvened Special Meeting”).

As previously disclosed on its Current Report on Form 8-K filed on December 17, 2021, the Company’s stockholders did not approve

Proposal No. 2 or the other proposal. Approval of Proposal No. 2 was necessary for the Company’s to issue the merger consideration

to the Biosight Shareholders. Accordingly, the Company’s stockholder approval, which was a condition to the obligations of each

party under the Merger Agreement, was not obtained, and the Merger Agreement was subsequently terminated in accordance with its terms.

Issuance

of Preferred Stock with 30,000 Votes per Share

At

the Special Meeting of Stockholders convened on November 16, 2021, and such meeting as it reconvened following the adjournments described

above, a proposal to approve a reverse stock split received the support of a clear majority of the votes cast on the proposal, with 60.3%

of the votes cast on the proposal voting in favor of approval. However, because the approval of the proposal required the affirmative

vote of the holders of a majority of the outstanding shares of the Company’s common stock entitled to vote, the total number of

shares voted in favor of the proposal was not sufficient to effect approval, even though the clear desire of the voting stockholders

was in favor of approval.

This

followed a similar dynamic that occurred at the Company’s Annual Meeting of Stockholders convened on June 3, 2021, which meeting

was adjourned twice, to June 17, 2021 and then to July 1, 2021. At that meeting, a proposal to approve a reverse stock split also received

the support of a clear majority of the votes cast on the proposal, with 65.4% of the votes cast on the proposal voting in favor of approval.

However, due to the requirement that the proposal received for approval the affirmative vote of the holders of a majority of the outstanding

shares of the Company’s common stock entitled to vote, the total number of shares voted in favor of the proposal was not sufficient

to effect approval, even though, as with the later meeting, the clear desire of the voting stockholders was in favor of approval.

In

preparing for both meetings, the Company engaged proxy solicitors, and with their assistance, engaged in substantial efforts to encourage

holders of the Common Stock to vote at the meeting. However, despite these efforts, the total number of votes received at each meeting

was not sufficient to allow even the substantial percentage of such votes voted in favor of the reverse split proposals to cause them

to be effected.

As

a result, following a structure that has been used by several companies in recent months when confronted with similar difficulty in soliciting

sufficient total votes at a meeting, on January 31, 2022, the Company issued, pursuant to a Securities Purchase Agreement with several

institutional investors, 1,000,000 shares of the Preferred Stock, at an offering price of $4.75 per share, representing a 5% original

issue discount to the stated value of $5.00 per share, for gross proceeds of approximately $4.75 million in the aggregate for the Offering,

before the deduction of the fees and offering expenses of the Company’s financial advisor. Following the approval of the Reverse

Stock Split Proposal, the shares of Preferred Stock will be convertible, at a conversion price of $0.25 per share, into shares of Common

Stock (subject in certain circumstances to adjustments).

The

holders of the Preferred Stock have agreed, through the date the reverse stock split contemplated by the Reverse Stock Split Proposal

is consummated, that they will not convert any shares of the Preferred Stock into Common Stock nor will they transfer, offer, sell, contract

to sell, hypothecate, pledge or otherwise dispose of (or enter into any transaction which is designed to, or might reasonably be expected

to, result in the disposition of) any shares of Preferred Stock.

The

holders have also agreed to vote, and to cause its affiliates to vote, all shares of Preferred Stock owned by such holder or its affiliates,

as applicable, on any resolution presented to the stockholders of the Company for purposes of approving the Reverse Stock Split Proposal.

The terms of the Preferred Stock provide that the shares of Preferred Stock, when cast, shall automatically be voted in a manner that

“mirrors” the proportions on which the shares of Common Stock (excluding any shares of Common Stock that are not voted) are

voted on the Reverse Stock Split Proposal. For example, if 30% of the aggregate votes cast by Common Stock voting in connection with

the Reverse Stock Split Proposal are voted against such resolutions and 70% of the aggregate votes cast by Common Stock voting in connection

with the Reverse Stock Split Proposal are voted in favor thereof, then 30% of the votes cast by the shares of Preferred Stock voting

in connection with the Reverse Stock Split Proposal shall vote against the approval of the Reverse Stock Split Proposal and 70% of such

votes shall be cast in favor of such Reverse Stock Split Proposal. The holders of the Preferred Stock have also agreed, promptly upon

request by the Company, to grant the Company (or its designee) an irrevocable proxy to vote all shares of Preferred Stock in accordance

with the description of voting in this paragraph.

Nasdaq

Requirements for Listing on Nasdaq

As

previously disclosed on its Current Report on Form 8-K filed on December 22, 2021, the Company received a notification from Nasdaq indicating

that, as a result of the Company’s previously disclosed noncompliance with Nasdaq Listing Rules 5550(b), Nasdaq had determined

to delist our Common Stock from the Nasdaq Capital Market and, accordingly, suspended trading in our Common Stock on December 23, 2021.

Our

Common Stock was then listed on OTCQX® Best Market under the symbol “ADXS”, where it is still currently listed.

In

order to relist on Nasdaq, the listing standards of Nasdaq will require the Company to have, among other things, a $4.00 per share minimum

bid price for a certain number of trading days. Therefore, the reverse stock split is necessary to relist on Nasdaq.

One

of the effects of the reverse stock split will be to effectively increase the proportion of authorized shares which are unissued relative

to those which are issued. This could result in the Company’s management being able to issue more shares without further stockholder

approval. The reverse stock split will not affect the number of authorized shares of Company’s capital stock that will continue

to be authorized pursuant to the restated certificate of incorporation of Advaxis, as amended.

Potential

Increased Investor Interest

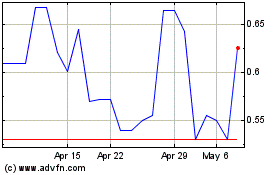

On February 15,

2022, our Common Stock closed at $0.12 per share. An investment in our Common Stock may not appeal to brokerage firms that are

reluctant to recommend lower-priced securities to their clients. Investors may also be dissuaded from purchasing lower-priced stocks

because the brokerage commissions, as a percentage of the total transaction, tend to be higher for such stocks. Moreover, the analysts

at many brokerage firms do not monitor the trading activity or otherwise provide research coverage of lower-priced stocks. Also, the

Company’s board of directors believes that most investment funds are reluctant to invest in lower-priced stocks.

There

are risks associated with the reverse stock split, including that the reverse stock split may not result in an increase in the per share

price of our Common Stock.

The

Company cannot predict whether the reverse stock split will increase the market price for our Common Stock. The history of similar stock

split combinations for companies in like circumstances is varied. There is no assurance that:

| |

● |

the

market price per share of our Common Stock after the reverse stock split will rise in proportion to the reduction in the number of

shares of our Common Stock outstanding before the reverse stock split; |

| |

|

|

| |

● |

the

reverse stock split will result in a per share price that will attract brokers and investors who do not trade in lower-priced stocks; |

| |

|

|

| |

● |

the

reverse stock split will result in a per share price that will increase the ability of the Company to attract and retain employees;

and |

| |

|

|

| |

● |

the

market price per share will achieve the $4.00 minimum bid price requirement for a sufficient period for our Common Stock to be approved

for listing by Nasdaq. |

The

market price of our Common Stock will also be based on the performance of the Company and other factors, some of which are unrelated

to the number of shares outstanding. If the reverse stock split is effected and the market price of our Common Stock declines, the percentage

decline as an absolute number and as a percentage of the overall market capitalization of the Company may be greater than would occur

in the absence of a reverse stock split. Furthermore, the liquidity of our Common Stock could be adversely affected by the reduced number

of shares that would be outstanding after the reverse stock split.

Principal

Effects of the Reverse Stock Split

The

reverse stock split will be realized simultaneously for all shares of our Common Stock and options to purchase shares of our Common Stock

outstanding immediately prior to the effective time of the reverse stock split. The reverse stock split will affect all holders of shares

of our Common Stock outstanding immediately prior to the effective time of the reverse stock split uniformly and each such stockholder

will hold the same percentage of our Common Stock outstanding immediately following the reverse stock split as that stockholder held

immediately prior to the reverse stock split, except for immaterial adjustments that may result from the treatment of fractional shares

as described below. The reverse stock split will not change the par value of our Common Stock or Preferred Stock and will not reduce

the number of authorized shares of our Common Stock or Preferred Stock. Our Common Stock issued pursuant to the reverse stock split will

remain fully paid and non-assessable. The reverse stock split will not affect the Company’s continuing to be subject to the periodic

reporting requirements of the Exchange Act.

Procedure

for Effecting Reverse Stock Split and Exchange of Stock Certificates

If

the Advaxis stockholders approve the amendment to the Advaxis amended and restated certificate of incorporation as amended effecting

the reverse stock split, and if the Company’s board of directors still believes that a reverse stock split is in the best interests

of the Company and its stockholders, the Company will file the amendment to the restated certificate of incorporation as amended with

the Secretary of State of the State of Delaware following the determination by the Company’s board of directors of the appropriate

split ratio. The Company has agreed with the purchasers of the Preferred Stock that it will file such amendment with the Secretary

of State of the State of Delaware as soon as practicable, but in no event later than one (1) Business Day following stockholder approval

of the amendment. Beginning at the split effective time, each stock certificate representing pre-split shares will be deemed for all

corporate purposes to evidence ownership of post-split shares.

As

soon as practicable after the split effective time, stockholders will be notified that the reverse stock split has been effected. the

Company expects that the Company’s transfer agent will act as exchange agent for purposes of implementing the exchange of stock

certificates. Holders of pre-split shares will be asked to surrender to the exchange agent stock certificates representing pre-split

shares in exchange for stock certificates (or book-entry positions) representing post-split shares in accordance with the procedures

to be set forth in a letter of transmittal to be sent by the Company. No new certificates (or book-entry positions) will be issued to

a stockholder until such stockholder has surrendered such stockholder’s outstanding certificate(s) together with the properly completed

and executed letter of transmittal to the exchange agent. Shares held in book-entry form will be automatically exchanged. Any pre-split

shares submitted for transfer, whether pursuant to a sale or other disposition, or otherwise, will automatically be exchanged for post-split

shares. Stockholders should not destroy any stock certificate(s) and should not submit any certificate(s) unless and until requested

to do so.

Fractional

Shares

No

fractional shares will be issued in connection with the reverse stock split. Stockholders of record who otherwise would be entitled to

receive fractional shares because they hold a number of pre-split shares not evenly divisible by the number of pre-split shares for which

each post-split share is to be reclassified, will be entitled, upon surrender to the exchange agent of certificates representing such

shares, to a cash payment in lieu thereof at a price equal to the fraction to which the stockholder would otherwise be entitled multiplied

by the closing price of our Common Stock on the OTCQX on the date of the filing of the amendment to the restated certificate of incorporation

as amended effecting the reverse stock split. For the foregoing purposes, all shares of common stock held by a holder will be aggregated

(thus resulting in no more than one fractional share per holder). The ownership of a fractional interest will not give the holder thereof

any voting, dividend or other rights except to receive payment therefor as described herein.

Stockholders

should be aware that, under the escheat laws of the various jurisdictions where stockholders reside, where the Company is domiciled and

where the funds will be deposited, sums due for fractional interests that are not timely claimed after the effective date of the split

may be required to be paid to the designated agent for each such jurisdiction, unless correspondence has been received by the Company