Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

February 24 2022 - 4:56PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2022

Commission File Number: 001-38307

RETO

ECO-SOLUTIONS, INC.

(Translation

of registrant’s name into English)

c/o Beijing REIT Technology Development Co., Ltd.

Building X-702, 60 Anli Road, Chaoyang District,

Beijing

People’s Republic of China 100101

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Unregistered Sales of Equity Securities

On February 22, 2022, ReTo Eco-Solutions,

Inc. (the “Company”) issued an aggregate of 2,580,000 common shares (the “Shares”), par value $0.001

per share, of the Company to Xiaoping Li and Jing Peng (and/or their designees), former shareholders of Hainan REIT Mingde Investment

Holding Co., Ltd. (“REIT Mingde”), a limited liability company incorporated in the People’s Republic of China,

which was acquired by ReTo Technology Development Co., Ltd. (“ReTo Technology”), a wholly owned subsidiary of the Company,

pursuant to an Equity Transfer Agreement (the “Agreement”) dated December 27, 2021, by and among ReTo Technology, Xiaoping

Li and Jing Peng, REIT Mingde and its subsidiaries. The Shares were issued to Xiaoping Li and Jing Peng (and/or their designees) at $0.61

per share in lieu of the cash payment of RMB 10 million payable to Xiaoping Li and Jing Peng under the Agreement. The Shares represent

approximately 8.45% of the issued and outstanding Shares of the Company immediately prior to the issuance.

The issuance of the Shares was

exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), in reliance on Regulation S

promulgated under of the Securities Act since the Shares were issued to non-U.S. persons (as defined under Rule 902 section (k)(2)(i)

of Regulation S) in an offshore transaction, and no directed selling efforts were made in the United States by the Company, a distributor,

any of their respective affiliates, or any person acting on behalf of any of the foregoing. The Shares are subject to transfer restrictions,

and the certificates evidencing the Shares contain an appropriate legend stating that the Shares are not registered under the Securities

Act and such securities may not be offered or sold in the United States absent registration or an exemption from registration under the

Securities Act and any applicable state securities laws.

In addition, as of February 22,

2022, the Company had issued an aggregate of approximately 2,453,611 common shares (the “Conversion Shares”) to an investor

upon conversion of the principal and accrued interest in the amount of $2,561,785 under a convertible debenture, dated July 6, 2021. The

Conversion Shares were issued in reliance on exemptions from registration under Section 4(a)(2) of the Securities Act and Regulation D

promulgated thereunder because the investor is an accredited investor as defined under Regulation D and the issuance of Conversion Shares

did not involve a public offering.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: February 23, 2022

RETO ECO-SOLUTIONS, INC.

| By: |

/s/ Hengfang Li |

|

| |

Name: |

Hengfang Li |

|

| |

Title: |

Chief Executive Officer |

|

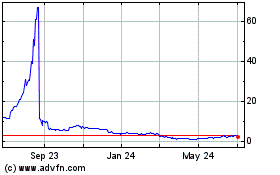

ReTo Eco Solutions (NASDAQ:RETO)

Historical Stock Chart

From Mar 2024 to Apr 2024

ReTo Eco Solutions (NASDAQ:RETO)

Historical Stock Chart

From Apr 2023 to Apr 2024