Current Report Filing (8-k)

February 22 2022 - 4:01PM

Edgar (US Regulatory)

0001622879

false

0001622879

2022-02-15

2022-02-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): February

15, 2022

Medicine Man

Technologies, Inc.

(Exact Name of Registrant as

Specified in Its Charter)

| Nevada |

|

000-55450 |

|

46-5289499 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

4880 Havana Street, Suite 201

Denver, Colorado |

80239 |

| (Address of Principal Executive Offices) |

(Zip Code) |

| |

|

| (303) 371-0387 |

| (Registrant’s Telephone Number, Including Area Code) |

| |

|

| Not Applicable |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange On Which Registered |

| Not applicable |

|

Not applicable |

|

Not applicable |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item 7.01. Regulation FD Disclosure.

On February 16, 2022, Medicine Man Technologies,

Inc. (the “Company”) issued a press release announcing the closing of the acquisition of substantially all of the operating

assets of Brow 2, LLC (“Seller”). A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form

8-K and incorporated herein by reference.

The information under Item 7.01 of this Current

Report on Form 8-K and the press release attached as Exhibit 99.1 are being furnished by the Company pursuant to Item 7.01. In accordance

with General Instruction B.2 of Form 8-K, the information under Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1,

shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise

subject to the liability of that section. In addition, this information shall not be deemed incorporated by reference into any of the

Company’s filings with the Securities and Exchange Commission, except as shall be expressly set forth by specific reference in any

such filing.

Item 8.01. Other Events.

On February 15, 2022, Double Brow, LLC (“Brow

Buyer”), a wholly-owned subsidiary of the Company, acquired substantially all of the operating assets of Seller and assumed specified

obligations of Seller pursuant to the terms of the Asset Purchase Agreement, dated August 20, 2021, among Brow Buyer, Seller, and Brian

Welsh, as the owner of Seller (the “Purchase Agreement”). Pursuant to the Purchase Agreement, Brow Buyer acquired all of Seller’s

assets related to its indoor cannabis cultivation operations located in Denver, Colorado (other than assets expressly excluded from the

acquisition under the Purchase Agreement), which included a 37,000 square foot building, the associated lease and equipment designed for

indoor cultivation and assumed certain liabilities for contracts acquired under the Purchase Agreement (collectively, the “Acquisition”).

After purchase price adjustments for pre-closing

inventory, the aggregate consideration for the Acquisition was $6.7 million, of which Brow Buyer paid $6.2 million at closing and held

back $500,000 as collateral for potential claims for indemnification from the Seller and Mr. Welsh under the Purchase Agreement. Any of

the purchase price held back and not used to satisfy indemnification claims will be released on February 15, 2023 plus 3% simple interest.

The Company funded the Acquisition from cash on hand and from the $400,000 deposit on the purchase price made to an escrow agent on August

20, 2021 in anticipation of closing. In addition, the Company reimbursed approximately $200,000 of pre-closing expenses incurred by Seller

related to leasehold improvements.

The Company previously reported the terms of the

Purchase Agreement and the transactions contemplated thereby in Item 1.01 of the Company’s Current Report on Form 8-K filed on August

26, 2021. The foregoing description of the Acquisition and the Purchase Agreement does not purport to be complete and is qualified in

its entirety by reference to the copy of the Purchase Agreement attached hereto as Exhibit 99.2 and incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. |

Description |

| 99.1 |

Press Release, dated February 16, 2022 |

| 99.2* |

Asset Purchase Agreement, dated August 20, 2021, by and among Double Brow, LLC, Brow 2, LLC and Brian Welsh (Incorporated by reference to Exhibit 2.1 to Medicine Man Technologies, Inc.’s Current Report on Form 8-K filed August 26, 2021 (Commission File No. 000-55450)) |

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

* Certain exhibits and schedules to the agreement have been omitted

pursuant to Instruction 4 to Item 1.01 of Form 8-K and Item 601(a)(5), as applicable, of Regulation S-K. The Company hereby undertakes

to supplementally furnish copies of any omitted schedules to the Securities and Exchange Commission upon request.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MEDICINE MAN TECHNOLOGIES, INC. |

| |

|

| |

By: |

/s/ Daniel R. Pabon |

| Date: February 22, 2022 |

|

Daniel R. Pabon

General Counsel |

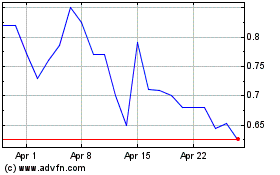

Medicine Man Technologies (QX) (USOTC:SHWZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Medicine Man Technologies (QX) (USOTC:SHWZ)

Historical Stock Chart

From Apr 2023 to Apr 2024