LITHIUM CHILE COMMENCES PHASE TWO OF THE RESOURCE EXPANSION PROGRAM ON THEIR SALAR DE ARIZARO PROJECT.

February 15 2022 - 8:40AM

CALGARY, ALBERTA, February 14, 2022 – Lithium Chile Inc. (“Lithium

Chile” or the “Company”) is pleased to announce it has commenced

their phase 2 drilling program consisting of three, 500-metre-deep

step-out holes aimed at expanding the lithium resource and

increasing the grade on the Arizaro property. The program is

announced after an initial resource of 1,420,000 tonnes of lithium

carbonate (“Li2CO3”) equivalent in the Indicated and Inferred

Resource categories was reported on their maiden well (see February

8, 2022 News Release). Well permitting and an environmental impact

study are currently underway. Drilling of the first well is

anticipated by the end of March. The 3 well program is scheduled to

take 6 months.

As recommended by the company's QP, Montgomery & Associates,

steel casing will be installed down the wellbore and the upper

halite will be cemented off to prevent dilution by lithium-poor

brine from the upper zones. On the Company’s initial well, samples

during various tests returned values up to 555 mg/ls.

Steve Cochrane, President and CEO of Lithium Chile, commented on

the Salar de Arizaro Project: “After such encouraging results on

the NI 43-101 resource estimate of our maiden well, the important

next steps for our Company and its Shareholders are to expand the

lithium resource and prove the overall grade with the phase 2

drilling program on the Arizaro property. As a result of our deep

relationships with the Argentina community, we have secured a

drilling rig for the duration of the project, which we estimate to

take around 6 months"

See attachment photo for Phase 2 Well locations.

The Company also reports on their successful Warrant Program. An

additional 1,959,043 common shares have been issued in

consideration of C$1,175,425 as the result of the exercise of

outstanding warrants. A total of 3,789,528 Warrants from the

February 23, 2021, financing remain outstanding at C$0.60 and are

due to expire on February 23, 2023 (see February 23, 2021 News

Release).

About Lithium Chile

Lithium Chile is advancing a lithium property portfolio

consisting of 69,200 hectares covering sections of 10 salars and

two laguna complexes in Chile and 23,300 hectares in Argentina.

Lithium Chile also owns 5 properties, totaling 20,429 hectares,

that are prospective for gold, silver and copper. Exploration

efforts are continuing on Lithium Chile’s Carmona

gold/silver/copper property which lies in the heart of the Chilean

mega porphyry gold/ silver/copper belt.

Lithium Chile’s common shares are listed on the TSX-V under the

symbol “LITH” and on the OTC-BB under the symbol “LTMCF”.

To find out more about Lithium Chile Inc., please contact Steven

Cochrane, President and CEO via email: steve@lithiumchile.ca, Jose

de Castro Alem, Argentina Manager via email

jdecastroalem@gmail.com or Michelle DeCecco, Vice President

of Corporate Development via email michelle@lithiumchile.ca or at

587-393-1990.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION

SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE

TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR

ACCURACY OF THIS RELEASE.

Forward Looking Statements: This news release may contain

certain forward-looking information and forward-looking statements

within the meaning of applicable securities legislation

(collectively "forward-looking statements"). Generally,

forward-looking statements can be identified by the use of

forward-looking terminology such as "expected", "anticipated",

"aims to", "plans to" or "intends to" or variations of such words

and phrases or statements that certain actions, events or results

"will" occur. In particular, this news release contains

forward-looking statements relating to, among other things: the

estimates in the Report, future drilling programs and the results

thereof. Such forward-looking statements are based on various

assumptions and factors that may prove to be incorrect, including,

but not limited to, factors and assumptions with respect to: the

general stability of the economic and political environment in

which the Company operates; the timely receipt of required

regulatory approvals; the ability of the Company to obtain future

financing on acceptable terms; currency, exchange and interest

rates; operating costs; the success the Company will have in

exploring its prospects and the results from such prospects. You

are cautioned that the foregoing list of material factors and

assumptions is not exhaustive. Although the Company believes that

the assumptions and factors on which such forward-looking

statements are based are reasonable, undue reliance should not be

placed on the forward-looking statements because the Company can

give no assurance that they will prove to be correct or that any of

the events anticipated by such forward-looking statements will

transpire or occur, or if any of them do so, what benefits the

Company will derive there from. Actual results could differ

materially from those currently anticipated due to a number of

factors and risks including, but not limited to: fluctuations in

market conditions, including securities markets; economic factors;

the risk that the new lithium exploration tender process does not

yield the anticipated benefits to the Company, if at all; the risk

that the Offering will not be completed as anticipated or at all,

including the risk that the Company will not receive the approvals

necessary in connection with the Offering; and the impact of

general economic conditions and the COVID-19 pandemic. The Company

does not undertake to update any forward-looking statements herein,

except as required by applicable securities laws. All

forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

Steve Cochrane

Lithium Chile

steve@lithiumchile.ca

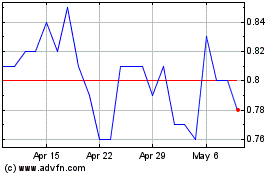

Lithium Chile (TSXV:LITH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lithium Chile (TSXV:LITH)

Historical Stock Chart

From Apr 2023 to Apr 2024