UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14F-1

INFORMATION STATEMENT

PURSUANT TO SECTION 14(f) OF THE

SECURITIES EXCHANGE ACT OF 1934

AND RULE 14f-1 THEREUNDER

|

NovAccess Global Inc.

|

|

(Exact name of registrant as specified in its corporate charter)

|

|

|

|

Commission File No.:

|

|

000-29621

|

|

Colorado

|

|

84-1384159

|

|

(State of incorporation)

|

|

(I.R.S. Employer Identification No.)

|

|

8834 Mayfield Road, Suite C, Chesterland, Ohio 44026

|

|

(Address of principal executive offices)

|

|

|

|

440-644-1027

|

|

(Registrant’s telephone number, including area code)

|

|

|

|

Approximate Date of Mailing:

|

|

February 28, 2022

|

NovAccess Global Inc.

Information Statement

Pursuant to Section 14(f) of the Securities Exchange Act of 1934

And Rule 14f-1 Thereunder

Notice of Change in the Majority of the Board of Directors

February 28, 2022

THIS INFORMATION STATEMENT IS BEING PROVIDED SOLELY FOR INFORMATIONAL PURPOSES AND NOT IN CONNECTION WITH ANY VOTE OF THE SHAREHOLDERS OF NOVACCESS GLOBAL INC.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE NOT REQUIRED TO TAKE ANY ACTION.

Schedule 14f-1

We urge you to read this Information Statement carefully and in its entirety. However, you are not required to take any action in connection with this Information Statement. References throughout this Information Statement to “NovAccess,” the “company,” “we,” “us,” and “our” refer to NovAccess Global Inc. and its wholly-owned subsidiary StemVax, LLC.

This Information Statement is being mailed on or about February 28, 2022 to the holders of record at the close of business on January 31, 2022 (the “record date”) of our common stock, no par value (the “common stock”). We are required to provide you with this Information Statement by Section 14(f) of the Securities Exchange Act of 1934 (the “Exchange Act”), and Exchange Act Rule 14f-1, in connection with an anticipated change in majority control of NovAccess’ board of directors (the “board”) other than at a meeting of shareholders. Exchange Act Section 14(f) and Rule 14f-1 require that we mail the information included in this Information Statement to our shareholders of record at least ten days before the date the proposed change in a majority of our directors occurs. Accordingly, the change in a majority of our directors pursuant to the transaction described below will not occur until at least ten days after we mail this Information Statement.

The Preferred Redemption Transaction

Daniel G. Martin, our sole board member and chairman, is the owner of TN3, LLC, a Wyoming limited liability company (“TN3”). TN3 owns 25,000 shares of our Series B Convertible Preferred Stock, $0.01 par value per share (the “preferred shares”). There are no other shares of NovAccess preferred stock outstanding. Each preferred share is convertible at the option of the holder into 10,000 shares of our common stock and entitles the holder to cast 40,000 votes on any action presented to our shareholders.

On January 31, 2022, we entered into a preferred stock redemption agreement (the “redemption agreement”) with TN3, Mr. Martin, Irvin Consulting, LLC, and Dr. Dwain Morris-Irvin. Dr. Irvin, our chief executive officer, is the owner of Irvin Consulting, LLC, a California limited liability company (“IC”). Pursuant to the redemption agreement, NovAccess will redeem 24,400 of the preferred shares and IC will purchase 600 of the preferred shares. In this Information Statement, we refer to the redemption of TN3’s preferred shares and the other transactions required by the redemption agreement collectively as the “redemption” or “transaction.”

To redeem the preferred shares, we will pay TN3 a total of $250,000 over a period of twelve months, with payment accelerated if the company raises at least $2.5 million of equity capital. We have already paid $25,000 of the purchase price, which is refundable if TN3 refuses to close the transaction. Assuming the transaction closes in March, we will make nine additional $25,000 payments to TN3 beginning April 1 and continuing on the first day of each month with the final payment due on December 1, 2022. IC will pay NovAccess $6,000 to reimburse the company for IC’s share of the purchase price. On January 31, we owed TN3 $370,852 under a management services agreement. Pursuant to the redemption agreement, TN3 will agree to forgo these amounts and the parties will terminate the management agreement. NovAccess intends to finance the redemption by issuing additional equity or debt, although the specific sources of capital have not been definitively identified.

In addition to the cash payments, we will issue to TN3 1,502,670 shares of unregistered common stock, which is equal to 10% of the outstanding common stock of NovAccess on the date the redemption agreement was signed. Pursuant to their terms, the preferred shares are convertible into 250.0 million shares of common stock. IC will pay NovAccess $1,223 to reimburse the company for IC’s share of the common stock portion of the purchase price.

Upon completion of the redemption, Mr. Martin will resign from the NovAccess board and be replaced by John A. Cassarini and Dr. Irvin. In addition, IC will own 600 preferred shares but there will be no other shares of NovAccess preferred stock outstanding. Innovest Global, Inc., a Nevada corporation (“Innovest”), acquired 7.5 million shares of our common stock when Innovest sold StemVax, LLC to NovAccess in September 2020. In connection with the redemption agreement, Innovest has agreed to distribute its NovAcess common stock to Innovest’s shareholders once we have registered the shares. Mr. Martin is the former chairman and chief executive officer of Innovest.

The redemption agreement includes customary representations and covenants of the parties, including release and indemnification provisions. The redemption agreement is filed as an exhibit to our Current Report on Form 8-K dated January 31, 2022. We encourage interested shareholders to read the full text of the redemption agreement.

The proposed redemption is subject to customary closing conditions. We expect to close the redemption in March, after the ten-day waiting period following the mailing of this Information Statement has expired. However, we cannot guarantee when or if the transaction will be completed.

After the transaction closes, we plan to continue our focus on commercializing developmental healthcare solutions in the biotechnology, medical, and health and wellness markets. Initially, we will continue developing novel immunotherapies to treat brain tumor patients through our subsidiary StemVax, LLC and will explore additional strategic acquisitions.

Colorado law requires the approval of the board for NovAccess to proceed with the redemption. As the sole member of the NovAccess board, Mr. Martin approved the transaction. Recognizing that he is conflicted in connection with redemption, Mr. Martin delegated authority to Dr. Irvin and Neil J. Laird, the company’s chief financial officer, to negotiate the terms of the transaction. Dr. Irvin and Mr. Laird obtained the advice and counsel of company counsel Kohrman Jackson & Krantz LLP and independent counsel Perkins Coie LLP in connection with the redemption.

As previously disclosed, on October 26, 2021, TN3 entered into a preferred stock purchase agreement with GPC Holdings, Inc. (“GPC”), a company owed indirectly by Shaheed Bailey. Pursuant to the purchase agreement, TN3 agreed to sell TN3’s preferred shares of NovAccess to GPC. However, the conditions to closing were not satisfied and the proposed sale of the preferred shares to GPC was terminated on December 30, 2021.

THIS INFORMATION STATEMENT IS REQUIRED BY EXCHANGE ACT SECTION 14(F) AND RULE 14F-1 IN CONNECTION WITH THE APPOINTMENT OF DIRECTOR DESIGNEES TO THE BOARD. NO ACTION IS REQUIRED BY OUR SHAREHOLDERS IN CONNECTION WITH THIS INFORMATION STATEMENT.

Change in Majority of the Board of Directors

Pursuant to the redemption agreement, upon completion of the transaction, Mr. Martin, currently our sole director, will resign and Mr. Cassarini and our CEO Dr. Irvin and will be appointed to serve as directors of NovAccess. We believe that Mr. Cassarini’s independence and decades of capital markets experience as an investor and portfolio manager make him well qualified to serve as a member of our board and that Dr. Irvin’s experience as a published researcher, patent author and founder of StemVax will allow him to contribute significantly as a board member. For more information about Mr. Cassarini and Dr. Irvin’s business experience, please refer to Directors and Executive Officers below.

Mr. Cassarini does not currently own any securities of NovAccess. Mr. Cassarini has never been a director of NovAccess or held any previous position with NovAccess and Mr. Cassarini has not otherwise been involved in any transactions with NovAccess or any of our directors, executive officers, affiliates or associates. During the past ten years, neither Mr. Cassarini nor Dr. Irvin has been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations), been subject to any order, judgment or decree, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities, been found by a court of competent jurisdiction (in a civil action), the Securities and Exchange Commission (the “SEC”) or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law or been the subject of or a party to any sanction or order, of any self-regulatory organization, or any registered entity or equivalent organization that has disciplinary authority over its members or associated persons.

No action is required by our shareholders in connection with this Information Statement. However, Exchange Act Section 14(f) and Rule 14f-1 require that we mail the information included in this Information Statement to our shareholders of record at least ten days before the date the proposed change in a majority of our directors occurs.

Voting Securities

Our authorized capital stock consists of 2.0 billion shares of common stock, no par value, and 50.0 million shares of preferred stock, par value of $0.01 per share. As of the record date, there were 15,026,697 shares of common stock issued and outstanding. Holders of our common stock are entitled to one vote for each share on all matters voted on by our shareholders. 10,000 of our shares of preferred stock are designated as Series A Preferred Stock and 25,000 are designated as Series B Convertible Preferred Stock. As of the record date, no Series A preferred shares were outstanding and all of the Series B preferred shares were outstanding and held by TN3. No other shares of our preferred stock are designated or issued and outstanding. The holder of our Series B preferred stock is entitled to cast 40,000 votes for each share on all matters voted on by our shareholders. As the holder of the preferred stock, TN3 may cast 1.0 billion votes on all matters voted on by our shareholders.

There is no cumulative voting in the election of directors, and our directors are elected by a plurality of the votes cast. Holders of our stock representing one-third of the voting power of our capital stock issued and outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of our shareholders. A vote by the holders of a majority of the voting power of our capital stock issued and outstanding and entitled to vote is required to effectuate certain fundamental corporate changes.

Security Ownership of Certain Beneficial Owners and Management

The following table summarizes information about ownership of our stock by each of our directors and senior executive officers, including Mr. Cassarini, who will join our board upon completion of the redemption transaction, all of our directors and executive officers as a group, and each other person we know beneficially owns more than 5% of our stock. The information in the Pre-Transaction columns is as of the record date without giving effect to the redemption transaction. The information in the Post-Transaction columns reflects completion of the transaction, including the proposed distribution by Innovest of its NovAcess common stock to Innovest’s shareholders.

Unless otherwise noted, the address of each beneficial owner listed in the table is c/o NovAccess Global Inc., 8834 Mayfield Road, Suite C, Chesterland, Ohio 44026.

We have determined beneficial ownership in accordance with the rules of the SEC. Except as indicated by the footnotes, we believe, based on the information furnished to us, that the persons and entities named in the table below have sole voting and investment power with respect to all shares of stock that they beneficially own, subject to applicable community property laws. Except as indicated by the footnotes, applicable percentage ownership is based on 15,026,697 shares of common stock outstanding.

|

Shareholder

|

|

Pre-Transaction

|

|

|

Post-Transaction

|

|

|

|

|

Shares Held

|

|

|

Percentage

|

|

|

Shares Held

|

|

|

Percentage

|

|

|

Daniel G. Martin, Chairman of the Board (1)

|

|

|

250,000,000

|

|

|

|

94.3

|

%

|

|

|

1,502,670

|

|

|

|

10.0

|

%

|

|

Dwain K. Morris-Irvin, Chief Executive Officer (2)

|

|

|

1,800,000

|

|

|

|

12.0

|

%

|

|

|

7,800,000

|

|

|

|

37.1

|

%

|

|

Neil J. Laird, Chief Financial Officer

|

|

|

260,000

|

|

|

|

1.7

|

%

|

|

|

260,000

|

|

|

|

1.7

|

%

|

|

John A. Cassarini (3)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

All Directors and Executive Officers as a Group (4)

|

|

|

252,060,000

|

|

|

|

95.1

|

%

|

|

|

8,060,000

|

|

|

|

38.3

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Innovest Global, Inc.

8834 Mayfield Road

Chesterland, Ohio 44026

|

|

|

7,500,000

|

|

|

|

33.3

|

%

|

|

|

—

|

|

|

|

—

|

|

|

1.

|

Pre-transaction, represents 250.0 million shares of our common stock issuable upon the conversion of 25,000 shares of our preferred stock owned by TN3, LLC. Post-transaction, represents 1,502,670 shares of our common stock to be issued to TN3 in the transaction. Mr. Martin owns TN3 and is considered to be the beneficial owner of the NovAccess stock owned by TN3. Each share of preferred stock is convertible at the option of the holder into 10,000 shares of our common stock and entitles the holder to cast 40,000 votes on any action presented to our shareholders. The common shares issuable upon conversion of the preferred were added to our outstanding shares to determine Mr. Martin’s percentage.

|

|

|

|

|

2.

|

Post-transaction, includes 6.0 million shares of our common stock issuable upon the conversion of 600 shares of our preferred stock owned to be acquired by Irvin Consulting, LLC from TN3 in the redemption transaction. Dr. Irvin owns IC and is considered to be the beneficial owner of the NovAccess stock owned by IC. The common shares issuable upon conversion of the preferred were added to our outstanding shares to determine Dr. Irvin’s percentage.

|

|

|

|

|

3.

|

Mr. Cassarini is not currently a director, but will be appointed to our board upon completion of the redemption transaction.

|

|

|

|

|

4.

|

Pre-transaction, includes Messrs Martin, Irvin and Laird. Post-transaction, includes Messrs Irvin, Laird and Cassarini.

|

Directors and Executive Officers

Before the Transaction

The following provides information about each of our current directors and executive officers as of the date of this Information Statement.

Daniel G. Martin, age 48, is a life-long entrepreneur and the founder and president of Martin Ventures, a diversified international investment vehicle. In June 2020, Mr. Martin became the sole director, chairman of the board and interim chief executive and financial officer of NovAccess and he currently serves as the sole director and chairman. He served as the chairman of the board and chief executive officer of Innovest Global (OTC Pink: IVST), a publicly-traded diversified industrials company and significant shareholder of NovAccess, from August 2016 to October 26, 2021. Mr. Martin led Innovest through eight acquisitions, transforming Innovest into a diversified industrial company. Mr. Martin credits his business tenacity to growing up in his father’s drugstore which required managing very low margins and critically important services. From December 2014 to January 2016, Mr. Martin was the chief financial officer of global operations of Momentis International, where he was instrumental in stabilizing the company post-acquisition. In November 2015, he established TN3, LLC to pursue diverse investment opportunities, including the acquisition of preferred stock of NovAccess and Innovest. Mr. Martin has a Bachelor of Science in Business Administration from John Carrol University. Mr. Martin previously filed for bankruptcy as a result of his personal guarantee of the obligations of an unrelated company, and the bankruptcy was discharged in May 2015.

Dwain K. Morris-Irvin, PhD, MPH, age 54, is a published researcher and patent author. Dr. Irvin stepped into the CEO role at NovAccess in October 2020, after heading the biotechnology division of Innovest Global. NovAccess acquired StemVax, LLC from Innovest in September 2020. Dr. Irvin received his PhD from the University of California, Los Angeles School of Medicine, his MPH from UCLA School of Public Health, and trained at The Wallenberg Neuroscience Center at Lund University in Lund, Sweden. He was also a professor, faculty member at Cedars-Sinai Medical Center, Department of Neurosurgery. Dr. Irvin received his PhD in Molecular & Medical Pharmacology and Developmental Neuroscience with an emphasis on neural stem cell fate and differentiation. His research focused on neural development and notch signaling in mammalian neural stem cells. He also worked as an NIH/NINDS post-doctoral fellow in Dr. Anders Bjorklund’s laboratory in Lund, Sweden. There, his focus was on research projects that investigated the potential role of cell replacement therapy for patients with Parkinson’s disease. They developed several protocols for the efficient generation of dopaminergic neurons from forebrain and ventral midbrain stem and progenitor cells. Dr. Irvin also worked as a research scientist, assistant professor, and faculty member at Cedars-Sinai Medical Center, Department of Neurosurgery. He led research investigations in the role of adaptive immunity in Parkinson’s disease. He also developed two patents in the area of immunotherapy for brain tumor patients, specifically glioblastoma multiforme (GBM). His research team focused on molecular mechanisms that impart therapeutic resistance in cancer cells, including cancer stem cells, to develop novel immunotherapies for brain tumor patients.

Neil J. Laird, age 69, is an experienced financial executive who works with emerging companies to provide accounting and finance related services. He joined NovAccess as fractional chief financial officer on September 10, 2021. Since 2017, he has worked with several technology and other companies as a consultant and currently serves as the chief operating officer of Letzhangout, LLC, a provider of outsourced accounting and related services. From June 2011 until November 2016, Mr. Laird served as the chief financial officer of Mobileum Inc., a private company providing roaming and other solutions to the telecommunications industry. Previously he was CFO of SumTotal Systems, Inc., a provider of enterprise learning management systems, and before that, CFO of ADAC Laboratories, a provider of nuclear medicine and PET systems. Both SumTotal Systems and ADAC Laboratories were publicly traded companies. Mr. Laird has an MA from the University of Cambridge and is qualified as a UK chartered accountant.

After the Transaction

Upon completion of the transaction, Mr. Martin will appoint John Cassarini and Dr. Irvin to our board of directors and Mr. Martin will resign from the board. Dr. Irvin will continue as our CEO and Mr. Laird will remain as CFO. Information about Dr. Irvin is provided above and Mr. Cassarini’s business experience is summarized below.

John A. Cassarini, age 55, has decades of capital markets experience as an investor and portfolio manager. During the past five years he has been a private investor. Prior to that, he managed small-cap portfolios for numerous institutions, including Lehman Brothers, Barclays and Ingalls & Snyder. Mr. Cassarini has a BA in finance from Fordham University and an MBA from Columbia University.

Corporate Governance

Director Independence

The sole member of our board of directors, Daniel Martin, previously served as our interim chief executive and financial officer and is a significant shareholder. As a result, he is not considered an independent director. Because our board has only one member, we do not currently have a formal policy concerning the review and approval or ratification of transactions with directors, officers and other parties related to NovAccess. Following completion of the transaction and as our new biotechnology-oriented business expands, we intend to add members to our board and adopt a formal policy addressing transactions with related parties. We believe that Mr. Cassarini qualifies as an “independent director” as defined in the OTCMarkets’ OTCQX Rules for U.S. Companies.

Meetings of the Board of Directors

The board met once in fiscal 2021 and all of our directors attended. The board also acted by written consent ten times in fiscal 2021. The holder of our preferred stock is entitled to elect the members of our board. As a result, we have not held an annual meeting of our shareholders and do not have a policy concerning our directors’ attendance at annual meetings.

Board Committees

Because our board of directors has only one member, we do not currently have audit, compensation or other board committees, although we believe that based on his experience Mr. Martin qualifies as an “audit committee financial expert” as defined by the SEC. As our new healthcare-oriented business expands we intend to add members to our board and form appropriate committees.

Director Nominations

We do not have a formal policy for considering director candidates. Nominees are not required to possess specific skills or qualifications; however, nominees are recommended and approved based on various criteria including relevant skills and experience, personal integrity and ability and willingness to devote their time and efforts to NovAccess. Qualified nominees are considered without regard to age, race, color, gender, religion, disability or national origin. We do not use a third party to locate or evaluate potential director candidates. The board would consider nominees recommended by shareholders according to the same criteria.

Audit Process

Our board relies on the insight and expertise of the management team and consultants in reviewing our audit process and audited financial statements for inclusion in the company’s annual report on Form 10‑K. Without an audit committee, we have not designated a director as an “audit committee financial expert” as defined by SEC rules, although we believe that based on his experience Mr. Martin qualifies.

Compensation Decisions

Our board relies on the insight and expertise of our management team in determining the compensation of our executive officers. The board has not engaged a compensation consultant in making decisions concerning our officers’ compensation.

Board Leadership Structure

Currently, Daniel Martin, who is not an officer of NovAccess, serves as the chairman of the board, and Dwain Irvin, who is not a director, serves as our CEO, which we believe is an appropriate leadership structure for NovAccess.

Policy Concerning Hedging Transactions

We have adopted an insider trading policy that governs the ability of our directors, officers and employees to trade in stock of NovAccess. Under the policy our board members and executive officers are only permitted to trade in our stock during prescribed “open window” periods and generally only after obtaining pre-clearance for the transaction. Although the policy does not specifically address transactions that hedge or offset a decrease in the market value of our shares (an equity swap or collar, for example), the policy applies broadly to all NovAccess “securities.” We have not been requested to approve any hedging transaction and would deny a request to hedge our stock. We do not believe that any of our directors or executive officers have engaged in any hedging transactions relating to our shares.

Certain Relationships and Related Transactions

We have adopted a code of ethics and business conduct that applies to our directors, advisory board members and officers (including our chief executive and financial officers). Our code of ethics is reasonably designed to deter wrongdoing and to promote: (1) honest and ethical conduct; (2) full and accurate disclosure in reports that we file with the SEC; (3) compliance with applicable governmental laws, rules and regulations; (4) the prompt internal reporting of violations of the code to our chief compliance officer; and (5) accountability for adherence to the code. Under the code of ethics, directors, advisory board member and executive officers must seek determinations and prior authorizations or approvals of potential conflicts of interest, including transactions with related parties, exclusively from our board of directors. Our code of ethics is available on our website at www.NovAccessGlobal.com.

Because our board has only one member, the board does not currently have a formal policy concerning the review and approval or ratification of transactions with directors, officers and other parties related to NovAccess. Following completion of the transaction and as our new biotechnology-oriented business expands, we intend to add members to our board and adopt a formal policy addressing transactions with related parties.

On September 4, 2020, we entered into a management services agreement with TN3, LLC. Pursuant to the agreement, TN3 provides us with office space in Chesterland, Ohio and management, administrative, marketing, bookkeeping and IT services for a fee of $30,000 a month. The initial term of the agreement is three years, with subsequent one-year renewals. TN3 holds all of our outstanding preferred stock and is owned by Daniel Martin. We paid TN3 $99,148 under the agreement in fiscal 2021, but did not make all required payments. As of September 30, 2021, we owed TN3 $290,852 under this agreement and as of January 31, 2022, we owed TN3 $370,852 under the agreement. In connection with the completion of the redemption transaction, NovAccess and TN3 will terminate the management services agreement and agree that all services to be provided by TN3 to NovAccess under the agreement, and all payments to be made by NovAccess to TN3 under the agreement, are considered satisfied by both NovAccess and TN3.

On September 4, 2020, TN3, LLC issued promissory notes to two private investors each for $25,000 and provided the $50,000 in note proceeds to NovAccess to fund working capital. On November 23, 2020, we issued 64,103 shares of our common stock to each of the two investors in cancellation of the TN3 promissory notes. TN3 holds all of our outstanding preferred stock and is owned by Daniel Martin.

During fiscal 2020, we received advances of $23,802 from our chairman Daniel Martin and $485 from our chief executive officer Dwain Irvin. The advances were used to fund operating expenses and were paid in full during fiscal 2021.

During fiscal and 2020 and 2021, Innovest Global paid $82,922 of NovAccess expenses on our behalf. These amounts remained outstanding in full as of September 30, 2021. On March 30, 2021, NovAccess issued an unsecured promissory note to Innovest with principal and waived interest in the amount of $25,000. The note was paid in full during fiscal 2021. At the time of these transactions, Daniel Martin was the chief executive officer, chairman of the board and a significant shareholder of Innovest.

On December 30, 2021, we obtained a $25,000 loan from each of Dwain Irvin, the Company’s chief executive officer, Neil Laird, the Company’s chief financial officer, and Amit Mulchandani, the owner and chief executive officer of Letzhangout, LLC, a company that provides accounting consulting services to NovAccess. NovAccess issued to each of Messrs Irvin, Laird and Mulchandani a demand promissory note for $25,000 evidencing the loans. The notes are due on demand and bear interest at 10% per year. NovAccess used the $75,000 loan proceeds to retire a loan from Power Up Lending Group Ltd. and for general working capital purposes. Mr. Laird is the chief operating officer of Letzhangout.

On January 10, 2022, we issued 250,000 unregistered common shares to Mr. Laird for $50,000, $25,000 of which was the cancellation of the $25,000 loan from Mr. Laird described in the previous paragraph. On January 28, 2022, we issued 250,000 unregistered common shares to Letzhangout for $50,000, $25,000 of which was the cancellation of the $25,000 loan from Mr. Mulchandani described in the previous paragraph. Also on January 28, 2022, we issued 85,000 unregistered shares of common stock to Letzhangout in payment of $17,000 of invoices for accounting services rendered to NovAccess in November and December 2021. Mr. Laird is the chief operating officer of Letzhangout.

Section 16(A) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our directors, executive officers and persons who own more than 10% of our common stock to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock. Based solely on review of Forms 3 and 4 filed with the SEC we believe that all Section 16(a) filing requirements were met in fiscal 2021.

Legal Proceedings

There are no proceedings in which our current or incoming directors, officers or affiliates, or any record or beneficial holder of 5% or more of our common stock, is an adverse party or has a material interest adverse to our interest.

Compensation of Directors and Executive Officers

In June 2020, Daniel G. Martin became the sole director, chairman of the board and interim chief executive and financial officer of NovAccess after acquiring all of the outstanding shares of our preferred stock from Tom Djokovich, who served as our president and chief executive officer prior to Mr. Martin joining the company. After we acquired StemVax, Dr. Dwain K. Morris-Irvin joined NovAccess as CEO in October 2020. In October 2020, L. Michael Yukich joined NovAccess as our fractional chief financial officer. Mr. Yukich retired on September 10, 2021 and was replaced by Neil J. Laird.

The following table summarizes information with respect to compensation earned by our executive officers in fiscal 2021 and 2020.

|

Name and

Principal Position

|

|

Year

|

|

Salary

|

|

|

Stock

Awards (1)

|

|

|

Deferred

Compensation

|

|

|

All Other

Compensation

|

|

|

Total

|

|

|

Dwain K. Morris-Irvin (2)

Chief Executive Officer

|

|

2021

|

|

$

|

183,232

|

|

|

$

|

846,000

|

|

|

$

|

201,383

|

|

|

$

|

42,931

|

|

|

$

|

1,273,547

|

|

|

Daniel G. Martin (3)

Chairman of the Board

|

|

2021

2020

|

|

|

—

—

|

|

|

|

—

—

|

|

|

|

—

—

|

|

|

|

—

—

|

|

|

|

—

—

|

|

|

Neil J. Laird

Chief Financial Officer

|

|

2021

|

|

|

—

|

|

|

|

8,000

|

|

|

|

—

|

|

|

|

—

|

|

|

|

8,000

|

|

|

L. Michael Yukich

Former CFO

|

|

2021

|

|

|

31,470

|

|

|

|

116,000

|

|

|

|

—

|

|

|

|

—

|

|

|

|

147,470

|

|

|

1.

|

The amounts reported reflect awards of unregistered shares of our common stock. The shares are not subject to vesting or forfeiture. We value stock awards in accordance with Financial Accounting Standards Board Accounting Standards Codification No. 718. For more information about the assumptions underlying our valuation, please see Note 2 of the notes to our consolidated financial statements for the year ended September 30, 2021 included in our 2021 Annual Report on Form 10-K.

|

|

|

|

|

2.

|

To assist NovAccess conserve cash in fiscal 2021, Dr. Irvin agreed to defer payment of $151,383 in salary and a $50,000 bonus. These amounts are reported in the Deferred Compensation column. The amount reported in the All Other Compensation Column reflects payments made by NovAccess for Dr. Irvin’s health, vision and dental insurance and $30,000 paid to Dr. Irvin as a consultant before he joined NovAccess as CEO.

|

We do not have employment, retirement or change-of-control agreements with any of our executive officers. Daniel Martin, the sole member of our board in fiscal 2021, did not receive any compensation for serving as a director during the year.

Shareholders Communications with the Board of Directors

Our website includes an “Investors” page on which we offer a toll-free phone number which is staffed 24/7 as well as an investor email link. Telephone and email messages from shareholders are received by our CEO, Dr. Irvin, for review. Our policy is that all incoming communications related to the duties and responsibilities of the board will be forwarded to the board. Communications that are determined to be primarily commercial in nature, product/service complaints or inquires, and comments or materials that are offensive or otherwise inappropriate, will not be forwarded to the board, but will be addressed by an executive officer.

Any proposal submitted by a shareholder for submission to our shareholders, pursuant to Rule 14a-8 or otherwise, and director nominations, are not viewed as shareholder communications subject to this policy.

Signature

Pursuant to the requirements of the Securities Exchange Act, the Company has duly caused this information statement on Schedule 14f-1 to be signed on its behalf by the undersigned hereunto duly authorized.

NovAccess Global Inc.

/s/ Dwain K. Morris-Irvin

By Dwain K. Morris-Irvin

Chief Executive Officer

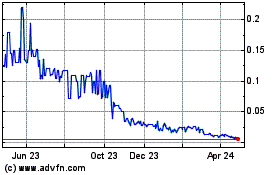

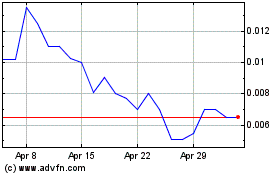

NovAccess Global (QB) (USOTC:XSNX)

Historical Stock Chart

From Mar 2024 to Apr 2024

NovAccess Global (QB) (USOTC:XSNX)

Historical Stock Chart

From Apr 2023 to Apr 2024