United States Lime & Minerals, Inc. (NASDAQ: USLM) today

reported fourth quarter and full year 2021 results: The Company’s

revenues in the fourth quarter 2021 were $46.1 million, compared to

$41.0 million in the fourth quarter 2020, an increase of $5.1

million, or 12.5%. For the full year 2021, the Company’s revenues

were $189.3 million, compared to $160.7 million in the full year

2020, an increase of $28.6 million, or 17.8%.

The Company’s revenues from its lime and limestone operations in

the fourth quarter and full year 2021 were $45.5 million and $187.4

million, respectively, compared to $40.7 million and $159.7

million, respectively, in the comparable 2020 periods. Lime and

limestone revenues increased $4.9 million, or 12.0%, and $27.7

million, or 17.3%, in the fourth quarter and full year 2021,

respectively, compared to the fourth quarter and full year 2020.

Carthage Crushed Limestone (“Carthage”), which the Company acquired

on July 1, 2020, contributed $9.9 million to the Company’s lime and

limestone revenues in the full year 2021, compared to $4.6 million

in the full year 2020. The increase in Company revenues

in the fourth quarter 2021, compared to the fourth quarter 2020,

resulted primarily from increased sales of the Company’s lime and

limestone products, principally due to increased demand from the

Company’s environmental, construction, and industrial customers.

Including the additional revenues from Carthage, the increase in

revenues in the full year 2021, compared to the full year 2020,

resulted primarily from increased sales of the Company’s lime and

limestone products, principally due to increased demand from the

Company’s construction, steel, environmental, industrial, roofing,

and agriculture customers. The COVID-19 pandemic and

related restrictions on business activities that began in the first

quarter 2020 resulted in a general economic slowdown, which

disproportionately impacted certain industries that purchase the

Company’s lime and limestone products. Both the fourth quarter and

the full year 2021 were also favorably impacted by slight increases

in the average selling prices for the Company’s lime and limestone

products.

The Company’s gross profit was $13.3 million in the fourth

quarter 2021, compared to $13.2 million in the fourth quarter 2020,

an increase of $0.1 million, or 1.1%. Gross profit in the full year

2021 was $59.3 million, an increase of $11.7 million, or 24.5%,

from $47.6 million in the full year 2020. Lime and limestone gross

profit was $13.0 million in the fourth quarter 2021, compared to

$13.2 million in the fourth quarter 2020, a decrease of $0.2

million or 1.2%. Lime and limestone gross profit in the full year

2021 was $58.7 million, compared to $48.0 million in the full year

2020, an increase of $10.7 million, or 22.2%. The decrease in gross

profit from lime and limestone in the fourth quarter 2021, compared

to the fourth quarter 2020, resulted primarily from increased

energy costs, partially offset by the increased revenues discussed

above. The increase in gross profit from lime and limestone in the

full year 2021, compared to the full year 2020, resulted primarily

from the increased revenues discussed above and increased operating

efficiencies, partially offset by higher energy costs.

Selling, general and administrative (“SG&A”) expenses were

$3.7 million in the fourth quarter 2021, compared to $3.2 million

in the fourth quarter 2020, an increase of $0.5 million, or 16.3%.

SG&A expenses were $12.8 million in the full year 2021,

compared to $12.2 million in the full year 2020, an increase of

$0.7 million, or 5.5%. The increases in SG&A expenses in the

fourth quarter and full year 2021, compared to fourth quarter and

full year 2020, were primarily due to increased personnel

expenses.

The Company reported net income of $7.6 million ($1.34 per share

diluted) and $37.0 million ($6.54 per share diluted) in the fourth

quarter and full year 2021, respectively, compared to $7.3 million

($1.28 per share diluted) and $28.2 million ($5.00 per share

diluted) in the fourth quarter and full year 2020, respectively,

increases of $0.4 million, or 4.9%, and $8.8 million, or 31.3%,

respectively. In the fourth quarter 2020, the Company recognized an

impairment charge of $1.6 million ($1.2 million, net of tax) to the

carrying values of the long-lived assets of its natural gas

interests.

The Company continues to monitor and assess the impact of the

COVID-19 pandemic in the United States, including the emergence of

new variants of the virus, implementation of new or enhanced

pandemic-related restrictions, and the possibility of additional

wide-spread or localized outbreaks of the virus, any of which could

have an adverse effect on the Company’s financial condition,

results of operations, cash flows and competitive position.

Additionally, the Company is experiencing rising costs and supply

chain delays or disruptions which, if they persist, could adversely

affect the Company’s profitability.

“We are pleased with our results for 2021 in the face of what

continues to be a challenging environment against the backdrop of

the ongoing global pandemic,” said Timothy W. Byrne, President and

Chief Executive Officer. Mr. Byrne added, “Our costs have risen

rapidly in recent months, and we believe that inflationary

pressures and supply chain issues will continue to impact our costs

in 2022. We are increasing the prices of our lime and limestone

products in an effort to mitigate our increasing costs.”

Dividend

The Company announced today that the Board of Directors has

declared an increased regular quarterly cash dividend of $0.20 per

share on the Company’s common stock. This dividend is payable on

March 18, 2022 to shareholders of record at the close of business

on February 25, 2022.

United States Lime & Minerals, Inc., a

NASDAQ-listed public company with headquarters in Dallas, Texas, is

a manufacturer of lime and limestone products, supplying primarily

the construction (including highway, road and building

contractors), industrial (including paper and glass manufacturers),

metals (including steel producers), environmental (including

municipal sanitation and water treatment facilities and flue gas

treatment processes), roof shingle manufacturers, agriculture

(including poultry and cattle feed producers), and oil and gas

services industries. The Company operates lime and limestone plants

and distribution facilities in Arkansas, Colorado, Louisiana,

Missouri, Oklahoma and Texas through its wholly owned subsidiaries,

Arkansas Lime Company, Colorado Lime Company, Texas Lime Company,

U.S. Lime Company, U.S. Lime Company – Shreveport, U.S. Lime

Company – St. Clair, ART Quarry TRS LLC (DBA Carthage Crushed

Limestone), and U.S. Lime Company – Transportation. In addition,

the Company, through its wholly owned subsidiary, U.S. Lime Company

– O & G, LLC, has royalty and non-operating working

interests pursuant to an oil and gas lease and a drillsite

agreement on its Johnson County, Texas property, located in the

Barnett Shale Formation.

Any statements contained in this news release, including, but

not limited to, statements relating to the impact of the COVID-19

pandemic, inflationary pressures, and supply chain issues, that are

not statements of historical fact are forward-looking statements as

defined in the Private Securities Litigation Reform Act of 1995.

The Company undertakes no obligation to publicly update or revise

any forward-looking statements, and investors are cautioned that

such statements involve risks and uncertainties that could cause

actual results to differ materially from expectations, including

without limitation those risks and uncertainties indicated from

time to time in the Company’s filings with the Securities and

Exchange Commission.

(Tables Follow)

United States Lime &

Minerals, Inc.CONDENSED CONSOLIDATED

FINANCIAL DATA(In thousands, except per share

amounts)(Unaudited)

| |

Three Months Ended |

|

Year Ended |

| |

December 31, |

|

December 31, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

INCOME STATEMENTS |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

$ |

46,108 |

|

|

$ |

40,990 |

|

|

$ |

189,255 |

|

|

$ |

160,704 |

|

| Cost of revenues |

|

32,789 |

|

|

|

27,819 |

|

|

|

129,995 |

|

|

|

113,117 |

|

|

Gross profit |

$ |

13,319 |

|

|

$ |

13,171 |

|

|

$ |

59,260 |

|

|

$ |

47,587 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and

administrative expenses |

$ |

3,674 |

|

|

$ |

3,159 |

|

|

$ |

12,843 |

|

|

$ |

12,168 |

|

| Impairment of long-lived

assets |

|

— |

|

|

|

1,550 |

|

|

|

— |

|

|

|

1,550 |

|

|

Operating profit |

$ |

9,645 |

|

|

$ |

8,462 |

|

|

$ |

46,417 |

|

|

$ |

33,869 |

|

| Interest expense |

|

63 |

|

|

|

62 |

|

|

|

250 |

|

|

|

248 |

|

| Interest and other income,

net |

|

(79 |

) |

|

|

(51 |

) |

|

|

(351 |

) |

|

|

(451 |

) |

| Income tax expense |

|

2,048 |

|

|

|

1,197 |

|

|

|

9,473 |

|

|

|

5,849 |

|

|

Net income |

$ |

7,613 |

|

|

$ |

7,254 |

|

|

$ |

37,045 |

|

|

$ |

28,223 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Income per share of common

stock: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

1.35 |

|

|

$ |

1.29 |

|

|

$ |

6.55 |

|

|

$ |

5.01 |

|

|

Diluted |

$ |

1.34 |

|

|

$ |

1.28 |

|

|

$ |

6.54 |

|

|

$ |

5.00 |

|

| Weighted-average shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

5,658 |

|

|

|

5,634 |

|

|

|

5,656 |

|

|

|

5,629 |

|

|

Diluted |

|

5,669 |

|

|

|

5,647 |

|

|

|

5,668 |

|

|

|

5,640 |

|

| Cash dividends per share of

common stock |

$ |

0.160 |

|

|

$ |

0.160 |

|

|

$ |

0.640 |

|

|

$ |

0.640 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

December 31, |

|

|

|

|

|

|

|

|

2021 |

|

2020 |

| BALANCE

SHEETS |

|

|

|

|

|

|

|

|

|

|

|

|

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

$ |

150,430 |

|

|

$ |

123,996 |

|

|

Property, plant and equipment, net |

|

|

|

|

|

|

|

162,172 |

|

|

|

152,461 |

|

|

Other non-current assets |

|

|

|

|

|

|

|

3,594 |

|

|

|

2,641 |

|

|

Total assets |

|

|

|

|

|

|

$ |

316,196 |

|

|

$ |

279,098 |

|

|

Liabilities and Stockholders’ Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

$ |

11,188 |

|

|

$ |

11,588 |

|

|

Deferred tax liabilities, net |

|

|

|

|

|

|

|

23,055 |

|

|

|

21,531 |

|

|

Other long-term liabilities |

|

|

|

|

|

|

|

3,747 |

|

|

|

2,787 |

|

|

Stockholders’ equity |

|

|

|

|

|

|

|

278,206 |

|

|

|

243,192 |

|

|

Total liabilities and stockholders’ equity |

|

|

|

|

|

|

$ |

316,196 |

|

|

$ |

279,098 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact: Timothy W. Byrne(972) 991-8400

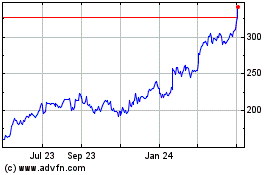

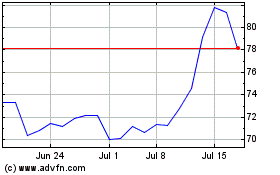

United States Lime and M... (NASDAQ:USLM)

Historical Stock Chart

From Mar 2024 to Apr 2024

United States Lime and M... (NASDAQ:USLM)

Historical Stock Chart

From Apr 2023 to Apr 2024