Pioneer Municipal High Income Opportunities Fund, Inc. Required Notice to Shareholders Sources of Distribution Under Section 19(a)

January 31 2022 - 9:00AM

Business Wire

Pioneer Municipal High Income Opportunities Fund, Inc. (NYSE:

MIO) today reported sources of distribution for January and for

distributions this fiscal year to date.

Distribution Period

January 2022

Distribution Amount Per Share

$0.0525

The following table sets forth estimates of the character of the

current distribution and the cumulative distributions paid this

fiscal year to date from the following sources: Net Investment

Income; Net Realized Short-Term Capital Gains; Net Realized

Long-Term Capital Gains or Return of Capital. All amounts are

expressed per common share.

Percentage

Make up of

Total

Total

Percentage

Cumulative

Cumulative

Make up of

Distributions

Distributions

Current

Current

Fiscal Year

Fiscal Year

Distribution

Distribution

to Date

to Date

Net Investment Income

$0.03938

75.0%

$0.13813

80.1%

Net Realized Short-Term Capital Gains

$0.00000

0.0%

$0.00000

0.0%

Net Realized Long-Term Capital Gains

$0.00000

0.0%

$0.00000

0.0%

Return of Capital

$0.01313

25.0%

$0.03438

19.9%

Total per Common Share

$0.05250

100.0%

$0.17250

100.0%

Note Investors should not necessarily draw any

conclusions about the fund's investment performance from the amount

of this distribution.

The fund estimates that a portion of the distribution does not

represent income or realized capital gains. Therefore, such portion

of the distribution may be a return of capital. A return of capital

may occur when some or all of the money invested in the fund is

returned to the investor. A return of capital distribution does not

necessarily reflect the fund's investment performance and should

not be considered "yield" or "income."

The amounts and sources of distributions reported under the

notice are only estimates and are not being provided for tax

reporting purposes. The actual amounts and sources for tax

reporting purposes will depend upon the fund's investment

experience during the remainder of its fiscal year and may be

subject to change based on tax regulations. The fund will provide

investors with a Form(s) 1099 for the calendar year that explains

how to report these distributions for federal income tax

purposes.

Pioneer Municipal High Income Opportunities Fund, Inc. is a

closed-end investment company traded on the New York Stock Exchange

(NYSE) under the symbol MIO.

Keep in mind, distribution rates are not guaranteed. A fund’s

distribution rate may be affected by numerous factors, including

changes in actual or projected investment income, the level of

undistributed net investment income, if any, and other factors.

Closed-end funds, unlike open-end funds, are not continuously

offered. Once issued, common shares of closed-end funds are bought

and sold in the open market through a stock exchange and frequently

trade at prices lower than their net asset value. Net Asset Value

(NAV) is total assets less total liabilities divided by the number

of common shares outstanding. For performance data on Amundi US’

closed-end funds, please call 800-225-6292 or visit our closed-end

pricing page.

About Amundi US Amundi US is the US business of Amundi,

Europe’s largest asset manager by assets under management and

ranked among the ten largest globally[1]. Boston is one of Amundi’s

six main global investment hubs[2] and offers a broad range of

fixed-income, equity, and multi-asset investment solutions in close

partnership with wealth management firms, distribution platforms,

and institutional investors across the Americas, Europe, and

Asia-Pacific.

With our financial and extra-financial research capabilities and

long-standing commitment to responsible investment, Amundi is a key

player in the asset management landscape. Amundi clients benefit

from the expertise and advice of close to 4,800 employees in 36

countries. A subsidiary of the Crédit Agricole group and listed on

the Paris stock exchange, Amundi currently manages approximately

$2.09 trillion of assets[3].

Amundi, a Trusted Partner, working every day in the interest of

our clients and society

www.amundi.com/us

Follow us on linkedin.com/company/amundi-us/ and

twitter.com/amundi_us.

1. Source: IPE “Top 500 Asset Managers” published in June 2021,

based on assets under management as of 12/31/2020 2. Boston,

Dublin, London, Milan, Paris, and Tokyo 3. Amundi data as of

9/30/21

Amundi Asset Management US, Inc. 60 State Street, Boston, MA

02109 ©2022 Amundi Asset Management US, Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220131005127/en/

Shareholder Inquiries: Please contact your financial advisor or

visit www.amundi.com/us. Broker/Advisor Inquiries Please Contact:

800-622-9876 Media Inquiries Please Contact: Geoff Smith,

617-504-8520

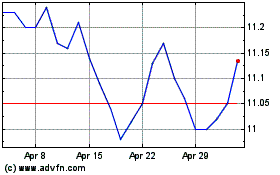

Pioneer Municipal High I... (NYSE:MIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pioneer Municipal High I... (NYSE:MIO)

Historical Stock Chart

From Apr 2023 to Apr 2024