Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

Transportation

and Logistics Systems, Inc.

(Name

of Issuer in Its Charter)

|

Nevada

|

|

4215

|

|

26-3106763

|

|

(State or other jurisdiction

of incorporation)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(IRS

Employer

Identification No.)

|

5500

Military Trail, Suite 22-357

Jupiter,

Florida 33458

Telephone:

(833) 764-1443

(Address,

including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Sebastian

Giordano

5500

Military Trail, Suite 22-357

Jupiter,

Florida 33458

Telephone:

(833) 764-1443

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

of communications to:

Akabas

& Sproule

11th

Floor

488

Madison Avenue

New

York, NY 10022

Attn:

Seth A. Akabas, Esq.

Telephone:

(212) 308-8505

Approximate

date of commencement of proposed sale to the public

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act. (Check one):

|

Large

accelerated filer

|

|

☐

|

Accelerated

filer

|

☐

|

|

Non-accelerated

filer

|

|

☒

|

Smaller

reporting company

|

☒

|

|

|

|

|

Emerging

Growth Company

|

☐

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION

OF REGISTRATION FEE

|

Title of Each

Class of Securities to be Registered

|

|

Amount

to be

Registered

(1)(4)

|

|

|

Proposed

Maximum

Offering Price

Per Share

|

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

|

Amount

of

Registration Fee

|

|

|

Common Stock, par value $0.001 per share, underlying Series

G Convertible Preferred Stock

|

|

|

984,687,500

|

(2)(4)

|

|

$

|

0.01

|

(5)

|

|

$

|

9,846,875.00

|

(5)

|

|

$

|

912.81

|

|

|

Common Stock, par value $0.001 per share, underlying warrants

|

|

|

890,626,862

|

(3)(4)

|

|

$

|

0.01

|

(5)(6)

|

|

$

|

8,906,268.62

|

(5)(6)

|

|

$

|

825.61

|

|

|

Total

|

|

|

1,875,314,362

|

(1)(2)(3)(4)

|

|

|

|

|

|

$

|

18,753,143.62

|

|

|

$

|

1,738.42

|

|

|

(1)

|

The

shares of common stock being registered hereunder are being registered for resale by the selling stockholders named in the accompanying

prospectus.

|

|

|

|

|

(2)

|

Represents

shares of common stock issuable upon conversion of 984,687,500 shares of Series G Convertible Preferred Stock into that

number of shares of the Company’s Common Stock calculated by dividing $10.00 (the “Stated Value”) of each share

being converted by the Conversion Price. The initial Conversion Price shall be $0.01. In addition, the Corporation shall issue to

a holder converting all or any portion of Series G Stock an additional sum (the “Make Good Amount”) equal to $210 for

each $1,000 of Stated Value of the Series G Stock converted prorated for amounts more or less than $1,000 (the “Extra Amount”).

Subject to the beneficial ownership limitation, the Make Good Amount shall be paid in shares of Common Stock, as follows: The number

of shares of Common Stock issuable as the Make Good Amount shall be calculated by dividing the Extra Amount by the product of 80%

times the average prevailing market for the five trading days prior to the date a holder delivered a notice of conversion to the

Company.

|

|

|

|

|

(3)

|

Represents

shares of common stock issuable upon the exercise of warrants to purchase 890,626,862 shares of common stock at an exercise price

of $0.01 per share, offered by the selling stockholders.

|

|

|

|

|

(4)

|

Pursuant

to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), the securities being registered hereunder

include such indeterminate number of additional shares of common stock as may from time to time become issuable by reason of anti-dilution

provisions, stock splits, stock dividends, recapitalizations or other similar transactions.

|

|

|

|

|

(5)

|

Estimated

in accordance with Rule 457(c) solely for purposes of calculating the registration fee. The maximum price per Security and the maximum

aggregate offering price are based on the average of the $0.01 (high) and $0.01 (low) sale price of the Registrant’s Common

Stock as reported on the OTCQB market of OTC Markets Group, Inc. on 01/25/2022, which date is within five business days prior to

filing this Registration Statement.

|

|

|

|

|

(6)

|

Estimated

solely for purposes of calculating the amount of the registration fee pursuant to Rule 457(g) of the Securities Act.

|

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Commission acting pursuant to said Section 8(a) may determine.

The

information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and

it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

|

PRELIMINARY

PROSPECTUS

|

SUBJECT

TO COMPLETION

|

DATED

JANUARY 28, 2022

|

Transportation

and Logistics Systems, Inc.

1,875,314,362

Shares of Common Stock

This

prospectus relates to the sale or other disposition from time to time of up to 1,875,314,362 shares (“Shares”) of

our common stock, par value $0.001 per share (“Common Stock”), which consists of (i) 984,687,500 shares issuable upon

the conversion of 685,000 shares of outstanding Series G Convertible Preferred Stock, par value $0.001 per share (the “Series

G Stock”) currently outstanding into that number of shares of the Company’s Common Stock calculated by dividing $10.00

(the “Stated Value”) of each share being converted by the Conversion Price. The initial Conversion Price shall be

$0.01. In addition, the Corporation shall issue to a holder converting all or any portion of Series G Stock an additional sum (the “Make

Good Amount”) equal to $210 for each $1,000 of Stated Value of the Series G Stock converted prorated for amounts more or less

than $1,000 (the “Extra Amount”). Subject to the beneficial ownership limitation, the Make Good Amount shall be paid

in shares of Common Stock, as follows: The number of shares of Common Stock issuable as the Make Good Amount shall be calculated by dividing

the Extra Amount by the product of 80% times the average prevailing market for the five trading days prior to the date a holder delivered

a notice of conversion to the Company and (ii) 890,626,862 shares issuable upon the exercise of outstanding warrants exercisable at $0.01

per share (“Warrants”). All of the shares of common stock being registered in this prospectus are being offered for

resale by the selling stockholders named in this prospectus (the “Selling Stockholders”).

We

are registering the offer and sale of the Shares by the Selling Stockholders to satisfy registration rights we have granted pursuant

to registration rights agreements dated as of August 5, 2021, September 29, 2021, and October 22, 2021, and December 31, 2021 (the “Registration

Rights Agreements”). We have agreed to bear all of the expenses incurred in connection with the registration of the Shares.

The Selling Stockholders will pay or assume brokerage commission and similar charges, if any, incurred in the sale of the Shares.

We

are not selling any shares under this prospectus and will not receive any proceeds from the sale of the shares by the Selling Stockholders.

However, we will receive proceeds for any exercise of Warrants, but not for the subsequent sale of the shares underlying the Warrants.

The shares to which this prospectus relates may be offered and sold from time to time directly by the Selling Stockholders or alternatively

through underwriters, broker dealers or agents. The Selling Stockholders will determine at what price they may sell the shares offered

by this prospectus, and such sales may be made at fixed prices, at prevailing market prices at the time of the sale, at varying prices

determined at the time of sale, or at negotiated prices. For additional information on the methods of sale that may be used by the Selling

Stockholders, see the section entitled “Plan of Distribution.” For a list of the Selling Stockholders, see the section entitled

“Principal and Selling Stockholders.”

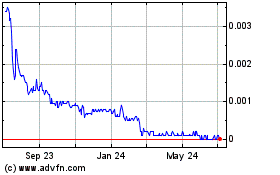

Our

common stock is quoted on the OTCQB market of the OTC Markets Group, Inc. under the symbol “TLSS”. On January 26,

2022, the last reported sale price of our common stock was $0.01395 per share.

Investing

in our common stock is highly speculative and involves a high degree of risk. You should carefully consider the risks and uncertainties

in the section entitled “Risk Factors” beginning on page 31 of this prospectus before making a decision to purchase our stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is January 28, 2022.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

You

should rely only on the information contained in this prospectus and any applicable prospectus supplement. We have not authorized anyone

to provide you with different or additional information. If anyone provides you with different or inconsistent information, you should

not rely on it. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time

of delivery of this prospectus or any sale of securities described in this prospectus. This prospectus is not an offer to sell these

securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. You

should assume that the information appearing in this prospectus or any prospectus supplement, as well as information we have previously

filed with the Securities and Exchange Commission (the “SEC” or the “Commission”) and incorporated by reference

herein, is accurate as of the date on the front of those documents only. Our business, financial condition, results of operations and

prospects may have changed since those dates.

For

investors outside the United States: we have not, and the Selling Stockholders have not, taken any action to permit this offering or

possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United

States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions

relating to, the offer and sale of the shares of Common Stock and the distribution of this prospectus outside the United States.

This

prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our

control. See “Risk Factors” and “Cautionary Notice Regarding Forward-Looking Statements.”

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

We

have filed with the SEC the Registration Statement under the Securities Act to register with the SEC the Shares being offered in this

prospectus. This prospectus, which constitutes a part of the Registration Statement, does not contain all of the information set forth

in the Registration Statement or the exhibits and schedules filed with it. For further information about us and the Shares, reference

is made to the registration statement and the exhibits and schedules filed with it. Statements contained in this prospectus regarding

the contents of any contract or any other document that is filed as an exhibit to the Registration Statement are not necessarily complete,

and each such statement is qualified in all respects by reference to the full text of such contract or other document filed as an exhibit

to the Registration Statement. We file annual, quarterly and current reports, proxy and registration statements and other information

with the SEC. You may read and copy any reports, statements or other information that we file, including the registration statement,

of which this prospectus forms a part, and the exhibits and schedules filed with it, without charge at the Public Reference Room maintained

by the SEC, located at 100 F Street NE, Washington D.C. 20549, and copies of all or any part of the registration statement may be obtained

from the SEC upon the payment of the fees prescribed by the SEC. Please call the SEC at 1-800-SEC-0330 for further information about

the Public Reference Room, including information about the operation of the Public Reference Room. The SEC also maintains an Internet

website that contains reports, proxy and information statements and other information regarding registrants that file electronically

with the SEC. The address of the site is www.sec.gov.

PROSPECTUS

SUMMARY

This

summary highlights certain selected information about us, this offering and the securities offered hereby. This summary is not complete

and does not contain all of the information that you should consider before deciding whether to invest in our common stock. For a more

complete understanding of our company and this offering, we encourage you to read the entire prospectus, including the information presented

under the section entitled “Risk Factors” and the financial data and related notes. Unless we specify otherwise, all references

in this prospectus to “TLSS,” “we,” “our,” “us,” and “our company,” refer

to Transportation and Logistics Systems, Inc. and its wholly-owned subsidiaries, Shyp FX, Inc., TLSS Acquisition, Inc., Shyp CX, Inc.

and Cougar Express, Inc.

OUR

COMPANY

Overview

Transportation

and Logistics Systems, Inc. (“TLSS” or the “Company”) was incorporated under the laws of the State

of Nevada, on July 25, 2008. The Company operates through its active subsidiaries as a logistics and transportation company specializing

in ecommerce fulfillment, last mile deliveries, two-person home delivery, mid-mile, and long-haul services.

On

March 30, 2017 (the “Closing Date”), TLSS and Save On Transport Inc. (“Save On”) entered into a Share

Exchange Agreement, dated as of the same date (the “Share Exchange Agreement”). Pursuant to the terms of the Share

Exchange Agreement, on the Closing Date, Save On became a wholly owned subsidiary of TLSS (the “Reverse Merger”).

Save On was incorporated in the state of Florida and started business on July 12, 2016. On May 1, 2019, the Company entered into a share

exchange agreement with Save On and Steven Yariv, whereby the Company returned all of the stock of Save On to Steven Yariv in exchange

for Mr. Yariv conveying 1,000,000 shares of common stock of the Company back to the Company. In addition, the Company granted an aggregate

of 80,000 options to certain employees of Save On.

On

June 18, 2018 (the “Acquisition Date”), the Company completed the acquisition of 100% of the issued and outstanding

membership interests of Prime EFS, LLC, a New Jersey limited liability company (“Prime EFS”), from its members pursuant

to the terms and conditions of a Stock Purchase Agreement entered into among the Company and the Prime EFS members on the Acquisition

Date (the “SPA”). Prime EFS was a New Jersey based transportation company that generated substantially all of its

revenues from Amazon Logistics, Inc. (“Amazon”) in New York, New Jersey, and Pennsylvania until it ceased operations

on September 30, 2020, due to Amazon’s non-renewal of its Delivery Service Partner (DSP) Agreement with Prime EFS, as described

below.

On

July 24, 2018, we formed Shypdirect LLC (“Shypdirect”), a company organized under the laws of New Jersey. Shypdirect

was a transportation company with a focus on tractor trailer and box truck deliveries of product on the east coast of the United States

from one distributor’s warehouse to another warehouse or from a distributor’s warehouse to the post office. Since its inception,

Shypdirect generated substantially all of its revenues from Amazon, Inc. As described below, Amazon elected to terminate its Amazon Relay

Carrier Terms of Service with Shypdirect. Accordingly, in June 2021, Shypdirect ceased its tractor trailer and box truck delivery services

to Amazon, and in July 2021, Shypdirect ceased all operations.

On

June 19, 2020, Amazon Logistics, Inc. (“Amazon”) notified Prime EFS in writing (the “Prime EFS Termination

Notice”), that Amazon did not intend to renew its Delivery Service Partner (DSP) Agreement with Prime EFS when that agreement

(the “In-Force Agreement”) expired. In the Prime EFS Termination Notice, Amazon stated that the In-Force Agreement

expired on September 30, 2020.

Additionally,

on July 17, 2020, Amazon notified Shypdirect that Amazon had elected to terminate the Amazon Relay Carrier Terms of Service (the “Program

Agreement”) between Amazon and Shypdirect effective as of November 14, 2020 (the “Shypdirect Termination Notice”).

However, on August 3, 2020, Amazon offered to withdraw the Shypdirect Termination Notice and extend the term of the Program Agreement

to and including May 14, 2021, conditioned on Prime EFS executing, for nominal consideration, a separation agreement with Amazon under

which Prime EFS would agree to cooperate in an orderly transition of its Amazon last-mile delivery business to other service providers,

release any and all claims it may have had against Amazon, and covenant not to sue Amazon (the “Aug. 3 Proposal”).

On August 4, 2020, the Company, Prime EFS and Shypdirect accepted the Aug. 3 Proposal.

During

the year ended December 31, 2020, one customer, Amazon, represented 96.7% of the Company’s total net revenues. Approximately 36.7%

of the Company’s revenue of $4,273,498 for the nine months ended September 30, 2021, was attributable to Shypdirect’s now

terminated mid-mile and long-haul business with Amazon.

The

termination of the Prime EFS last-mile business with Amazon on September 30, 2020, had a material adverse impact on the operations of

Prime EFS beginning in the 4th fiscal quarter of 2020 and the termination of Shypdirect’s Amazon mid-mile and long-haul business,

which was effective on or about May 14, 2021, had a material adverse impact on operations of Shypdirect beginning in the 2nd fiscal quarter

of 2021. This impact has caused Prime EFS and Shypdirect to become insolvent and to cease operations.

Since

then, the Company has begun replacing its former Amazon business with acquisitions as set forth below. Such initiatives are consistent

with our already existing business plan to: (i) seek new last-mile, mid-mile and long-haul business with other, non-Amazon, customers;

(ii) explore other strategic relationships; and (iii) identify potential acquisition opportunities, while continuing to execute our restructuring

plan which commenced in February 2020.

On

November 13, 2020, we formed a wholly owned subsidiary, Shyp FX, Inc., a company incorporated under the laws of the State of New Jersey

(“Shyp FX”). On January 15, 2021, through Shyp FX, we executed an asset purchase agreement (“APA”) and closed

a transaction to acquire substantially all of the assets and certain liabilities of Double D Trucking, Inc., a northern New Jersey-based

logistics provider specializing in servicing Federal Express over the past 25 years (“DDTI”), including last-mile delivery

services using vans and box trucks. The purchase price was $100,000 of cash and a promissory note of $400,000. The principal assets involved

in the acquisition were vehicles for cargo transport, system equipment for vehicle tracking and navigation of vehicles, and delivery

route rights together with assumption of associated customer relationships. The acquisition of DDTI made the Company an approved contracted

service provider of FedEx, which, the Company believes fits in well with its current geographic coverage area and may lead to additional

expansion opportunities within the FedEx network.

On

November 16, 2020, we formed a wholly owned subsidiary, TLSS Acquisition, Inc., a company incorporated under the laws of the State of

Delaware (“TLSS Acquisition”).

On

March 24, 2021, TLSS Acquisition acquired all of the issued and outstanding shares of capital stock of Cougar Express, Inc., a New York-based

full-service logistics provider specializing in pickup, warehousing, and delivery services in the tri-state area (“Cougar Express”).

The purchase price was $2,000,000 of cash plus cash for the acquisition of security deposits, a cash payment equal to 50% of the difference

between cash and accounts receivable acquired and accounts payable assumed, less the assumption of truck loans and leases, and a promissory

note of $350,000. The previous owner of Cougar Express is barred from competing with the Cougar Express business for five years. Cougar

Express was a family-owned full-service transportation business that has been in operation for more than 30 years providing one-to-four

person deliveries and offering white glove services. It utilizes its own fleet of trucks, warehouse/driver/office personnel and on-call

subcontractors from its convenient and secure New York JFK airport area location, allowing it to pick-up and deliver throughout the New

York tri-state area. Cougar Express serves a diverse base of approximately 50 commercial accounts, which are freight forwarders that

work with some of the most notable retail businesses in the country. We believe that the acquisition of Cougar Express fits our current

business plan, given Cougar Express’s demographic location, services offered, and diversified customer base, and given that it

would provide us with a long-standing, well-run profitable operation as a step to begin replacing the revenue it lost as a result of

Amazon terminating its delivery service provider business. Furthermore, we believe that, because Cougar Express is strategically based

in New York and serves the tri-state area, organic growth opportunities will be available for expanding its footprint.

On

February 21, 2021, the Company formed a wholly owned subsidiary, Shyp CX, Inc., a company incorporated under the laws of the State of

New York (“Shyp CX”).

Due

to the termination of their respective agreements with Amazon and recurring losses, Prime EFS and Shypdirect became insolvent and were

unable to pay their debts when they became due. Accordingly, the Company deemed it to be desirable and in the best interest of Prime

EFS and Shypdirect and its creditors to make an assignment of all of Prime EFS and Shypdirect’s assets for the benefit of the Prime

EFS and Shypdirect’s creditors in accordance with N.J.S.A. §2A:19-1, et seq. (the “ABC Statute”). On August 16,

2021, the Company’s subsidiaries, Prime EFS and Shypdirect, executed Deeds of Assignment for the Benefit of Creditors in the State

of New Jersey pursuant to the ABC Statute, assigning all of the Prime EFS and Shypdirect assets to Terri Jane Freedman as Assignee for

the Benefit of Creditors (the “Assignee”) and filing for dissolution. An “Assignment for the Benefit of Creditors,”

“general assignment” or “ABC” in New Jersey is a state-law, voluntary, judicially supervised corporate liquidation

and unwinding similar to the Chapter 7 bankruptcy process found in the United States Bankruptcy Code. In an ABC, the debtor companies.

Prime EFS and Shypdirect, together referred to as the “Assignors” executed Deeds of Assignment, assigning all of their assets

to the Assignee chosen by the Company, who acts as a fiduciary similar to a Chapter 7 trustee in bankruptcy. On September 7, 2021, the

ABCs were filed with the Bergen County Clerk in Bergen County, New Jersey and filed with the Surrogate Court in the appropriate county,

initiating a judicial proceeding. The Assignee has been charged with liquidating the assets for the benefit of the Prime EFS and Shypdirect

creditors pursuant to the provisions of the ABC Statute.

As

a result of Prime EFS and Shypdirect’s filing of the executed Deeds of Assignment for the Benefit of Creditors on September 7,

2021, the Company ceded authority for managing the businesses to the Assignee, and the Company’s management cannot carry on Prime

EFS or Shypdirect’s activities in the ordinary course of business. Additionally, Prime EFS and Shypdirect no longer conduct any

business and are not permitted by the Assignee and ABC Statute to conduct any business. For these reasons, the Company concluded that

it had lost control of Prime EFS and Shypdirect, and no longer had significant influence over these subsidiaries during the ABC proceedings.

Further, on October 13, 2021, Prime EFS and Shypdirect filed for dissolution with the Secretary of State of New Jersey. Therefore, the

Company deconsolidated Prime EFS and Shypdirect effective with the filing of executed Deeds of Assignment for the Benefit of Creditors

in September 2021.

The

Company’s results of operations for the three and nine months ended September 30, 2021, and 2020 included the results of Prime

EFS and Shypdirect prior to the September 7, 2021, filing of the executed Deeds of Assignment for the Benefit of Creditors with the State

of New Jersey.

In

the Company’s financial statements for the quarter ended September 30, 2021, the assets and liabilities of Prime EFS and Shypdirect

subject to the Assignment for the Benefit of Creditors have been reflected as “Assets subject to assignment for benefit of creditors”

and “Liabilities subject to assignment for benefit of creditors” as of December 31, 2020.

Settlement

of Defaulted Note Owed to Former CEO Related Entity

On

July 3, 2019, the Company entered into a note agreement with an entity that is controlled by the significant other of the former CEO

of the Company (the “Former CEO Related Entity”), in the amount of $500,000.

Under

that note, interest only was due and payable commencing September 3, 2019 and continuing on the third day of each month thereafter. Commencing

on January 3, 2020 and continuing on the third day of each month thereafter through January 3, 2021, equal payments of principal and

interest were due and payable. The principal amount of this note and all accrued, but unpaid interest under this note was due and payable

on the earlier to occur of (i) January 3, 2021 (the “Former CEO Note Maturity Date”) or (ii) an Event of Default (as

defined in the note agreement). The interest due under this note prior to any default was 18% per annum. Upon default, all past due principal

and interest bore interest from the date due until paid at the lesser of (i) 20% per annum or (ii) the highest rate allowed by applicable

state law.

Prior

to October 31, 2021, no repayments were made on this note. On September 30, 2021 and December 31, 2020, accrued and unpaid interest under

this note amounted to $241,007 and $173,692, respectively, and was included in due to related parties on the condensed consolidated balance

sheets of the Company as of those dates.

On

March 17, 2021, the Company and the Former CEO Related Entity entered into a forbearance agreement pursuant to which the Former CEO Related

Party agreed to forbear from taking any enforcement action in respect of the note and extended the maturity date of the note to December

31, 2021.

On

October 31, 2021, the Company and Former CEO Related Party entered into a settlement agreement and mutual release, a copy of which is

appended hereto as Exhibit 10.9. Under that agreement, the parties adjusted, settled and compromised all principal then due ($500,000)

and all accrued and unpaid interest then due ($240,822), for $600,000, constituting a discount of $140,822, or 19%, of the aggregate

amount then owed. The settlement amount was paid in full by the Company in November 2021.

Properties

Our

principal executive offices are located in the United States at 5500 Military Trail, Suite 22-357, Jupiter, Florida 33458.

Cougar

Express Lease Expiration

The

lease of the Company’s subsidiary, Cougar Express, of its facility in Valley Stream, NY, expired on December 31, 2021. Cougar Express

is holding over in the facility while it attempts to negotiate a lease renewal with its landlord. The holdover rent is 200% of the base

rental rate Cougar Express paid in 2021. Alternatively, Cougar Express is exploring options to move its operations to another facility.

The Company expects that, whether Cougar Express renegotiates with its existing landlord or finds new space, it will pay materially higher

rent in 2022 and future years.

Critical

Accounting Policies and Significant Accounting Estimates

The

methods, estimates, and judgments that we use in applying our accounting policies have a significant impact on the results that we report

in our consolidated financial statements. Some of our accounting policies require us to make difficult and subjective judgments, often

as a result of the need to make estimates regarding matters that are inherently uncertain. Significant estimates included in the accompanying

condensed consolidated financial statements and footnotes include the valuation of accounts receivable, the useful life of property and

equipment, the valuation of intangible assets, the valuation of assets acquired and liabilities assumed, the valuation of right of use

assets and related liabilities, assumptions used in assessing impairment of long-lived assets, estimates of current and deferred income

taxes and deferred tax valuation allowances, the fair value of non-cash equity transactions, the valuation of derivative liabilities,

the valuation of beneficial conversion features, and the value of claims against the Company.

We

have identified the accounting policies below as critical to our business operation:

Accounts

receivable

Accounts

receivable are presented net of an allowance for doubtful accounts. The Company maintains allowances for doubtful accounts for estimated

losses. The Company reviews the accounts receivable on a periodic basis and makes general and specific allowances when there is doubt

as to the collectability of individual balances. In evaluating the collectability of individual receivable balances, the Company considers

many factors, including the age of the balance, a customer’s historical payment history, its current credit worthiness, and current

economic trends. Accounts are written off after exhaustive efforts at collection.

Impairment

of long-lived assets

In

accordance with ASC Topic 360, we review long-lived assets for impairment whenever events or changes in circumstances indicate that the

carrying amount of the assets may not be fully recoverable, or at least annually. We recognize an impairment loss when the sum of expected

undiscounted future cash flows is less than the carrying amount of the asset. The amount of impairment is measured as the difference

between the asset’s estimated fair value and its book value.

Derivative

financial instruments

We

have certain financial instruments that are embedded derivatives associated with capital raises. We evaluate all our financial instruments

to determine if those contracts or any potential embedded components of those contracts qualify as derivatives to be separately accounted

for in accordance with ASC 810-10-05-4 and 815-40. This accounting treatment requires that the carrying amount of any embedded derivatives

be recorded at fair value at issuance and marked-to-market at each balance sheet date. In the event that the fair value is recorded as

a liability, as is the case with the Company, the change in the fair value during the period is recorded as either other income or expense.

Upon conversion, exercise or repayment, the respective derivative liability is marked to fair value at the conversion, repayment, or

exercise date and then the related fair value amount is reclassified to other income or expense as part of gain or loss on extinguishment.

In

July 2017, FASB issued ASU No. 2017-11, Earnings Per Share (Topic 260); Distinguishing Liabilities from Equity (Topic 480);

Derivatives and Hedging (Topic 815): (Part I) Accounting for Certain Financial Instruments with Down Round Features. These

amendments simplify the accounting for certain financial instruments with down-round features. The amendments require companies to disregard

the down-round feature when assessing whether the instrument is indexed to its own stock, for purposes of determining liability or equity

classification.

Leases

On

January 1, 2019, we adopted ASU No. 2016-02, applying the package of practical expedients to leases that commenced before the effective

date whereby the Company elected to not reassess the following: (i) whether any expired or existing contracts contain leases and (ii)

initial direct costs for any existing leases. For contracts entered into on or after the effective date, at the inception of a contract

the Company assessed whether the contract is, or contains, a lease. The Company’s assessment is based on: (1) whether the contract

involves the use of a distinct identified asset, (2) whether we obtain the right to substantially all the economic benefit from the use

of the asset throughout the period, and (3) whether it has the right to direct the use of the asset. We will allocate the consideration

in the contract to each lease component based on its relative stand-alone price to determine the lease payments. We have elected not

to recognize right-of-use assets and lease liabilities for short-term leases that have a term of 12 months or less.

Operating

lease ROU assets represents the right to use the leased asset for the lease term and operating lease liabilities are recognized based

on the present value of the future minimum lease payments over the lease term at the commencement date. As most leases do not provide

an implicit rate, we use an incremental borrowing rate based on the information available at the adoption date in determining the present

value of future payments. Lease expense for minimum lease payments is amortized on a straight-line basis over the lease term and is included

in general and administrative expenses in the consolidated statements of operations.

Revenue

recognition and cost of revenue

We

adopted ASC 606, Revenue from Contracts with Customers (Topic 606), which supersedes the revenue recognition requirements in ASC Topic

605, Revenue Recognition. This ASC is based on the principle that revenue is recognized to depict the transfer of goods or services to

customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.

This ASC also requires additional disclosure about the nature, amount, timing, and uncertainty of revenue and cash flows arising from

customer service orders, including significant judgments.

We

recognize revenues and the related direct costs of such revenue which generally include compensation and related benefits, gas costs,

insurance, parking and tolls, truck rental fees, and maintenance fees as of the date the freight is delivered which is when the performance

obligation is satisfied. In accordance with ASC Topic 606, we recognize revenue on a gross basis. Our payment terms are net seven days

from acceptance of delivery. We do not incur incremental costs obtaining service orders from our customers, however, if we did, because

all of our customer contracts are less than a year in duration, any contract costs incurred would be expensed rather than capitalized.

The revenue that we recognize arises from deliveries of packages on behalf of the Company’s customers. Primarily, our performance

obligations under these service orders correspond to each delivery of packages that we make under the service agreements. Control of

the delivery transfers to the recipient upon delivery. Once this occurs, we have satisfied our performance obligation and we recognize

revenue.

Management

has reviewed the revenue disaggregation disclosure requirements pursuant to ASC 606 and determined that no further disaggregation disclosure

is required to be presented.

Stock-based

compensation

Stock-based

compensation is accounted for based on the requirements of ASC 718 – “Compensation –Stock Compensation”,

which requires recognition in the financial statements of the cost of employee, director, and non-employee services received in exchange

for an award of equity instruments over the period the employee, director, or non-employee is required to perform the services in exchange

for the award (presumptively, the vesting period). The ASC also requires measurement of the cost of employee, director, and non-employee

services received in exchange for an award based on the grant-date fair value of the award. We have elected to recognize forfeitures

as they occur as permitted under ASU 2016-09 Improvements to Employee Share-Based Payment.

Deconsolidation

of Subsidiaries

The

Company accounts for a gain or loss on deconsolidation of a subsidiary or derecognition of a group of assets in accordance with ASC 810-10-40-5.

The Company measures the gain or loss as the difference between (a) the aggregate of fair value of any consideration received, the fair

value of any retained noncontrolling investment and the carrying amount of any noncontrolling interest in the former subsidiary at the

date the subsidiary is deconsolidated and (b) the carrying amount of the former subsidiary’s assets and liabilities or the carrying

amount of the group of assets.

FINANCIAL

STATEMENTS

Consolidated

financial statements of the Company for the years ended December 31, 2020 and 2019 are shown on Exhibit 13.1 of this Registration Statement

on Form S-1 and are incorporated herein in by reference. Interim consolidated financial statements of the Company for the nine months

ended September 30, 2021 are shown on Exhibit 13.2 of this Registration Statement on Form S-1 and are incorporated herein in by reference.

RESULTS

OF OPERATIONS

Our

condensed consolidated financial statements have been prepared assuming that we will continue as a going concern and, accordingly, do

not include adjustments relating to the recoverability and realization of assets and classification of liabilities that might be necessary

should we be unable to continue our operation.

We

expect we will require additional capital to meet our long-term operating requirements. We expect to raise additional capital through,

among other things, the sale of equity or debt securities.

For

the year ended December 31, 2020 compared with the year ended December 31, 2019

The

following table sets forth our revenues, expenses and net loss for the year ended December 31, 2020 and 2019. The financial information

below is derived from our consolidated financial statements included in this Annual Report.

|

|

|

For the Year Ended

December 31,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

Revenues

|

|

$

|

25,826,632

|

|

|

$

|

31,356,251

|

|

|

Cost of revenues

|

|

|

23,284,240

|

|

|

|

28,752,889

|

|

|

Gross profit

|

|

|

2,542,392

|

|

|

|

2,603,362

|

|

|

Operating expenses

|

|

|

10,757,943

|

|

|

|

22,893,963

|

|

|

Loss from operations

|

|

|

(8,215,551

|

)

|

|

|

(20,290,601

|

)

|

|

Other expenses, net

|

|

|

(34,566,407

|

)

|

|

|

(23,892,435

|

)

|

|

Loss from discontinued operations

|

|

|

-

|

|

|

|

(681,426

|

)

|

|

Net loss

|

|

|

(42,781,958

|

)

|

|

|

(44,864,462

|

)

|

|

Deemed dividend related to ratchet adjustment and beneficial conversion features

|

|

|

(19,223,242

|

)

|

|

|

(981,548

|

)

|

|

Net loss attributable to common shareholders

|

|

$

|

(62,005,200

|

)

|

|

$

|

(45,846,010

|

)

|

For

the three and nine months ended September 30, 2021 compared with the three and nine months ended September 30, 2020

The

following table sets forth our revenues, expenses and net loss for the three and nine months ended September 30, 2021 and 2020. The financial

information below is derived from our condensed consolidated financial statements included in this Quarterly Report.

|

|

|

Three Months ended

September 30,

|

|

|

Nine Months ended

September 30,

|

|

|

|

|

2021

|

|

|

2020

|

|

|

2021

|

|

|

2020

|

|

|

Revenues

|

|

$

|

1,207,305

|

|

|

$

|

6,309,509

|

|

|

$

|

4,273,498

|

|

|

$

|

23,503,384

|

|

|

Cost of revenues

|

|

|

1,178,113

|

|

|

|

5,978,265

|

|

|

|

4,422,429

|

|

|

|

20,831,870

|

|

|

Gross profit (loss)

|

|

|

29,192

|

|

|

|

331,244

|

|

|

|

(148,931

|

)

|

|

|

2,671,514

|

|

|

Operating expenses

|

|

|

1,924,725

|

|

|

|

1,502,829

|

|

|

|

5,102,405

|

|

|

|

6,591,345

|

|

|

Loss from operations

|

|

|

(1,895,533

|

)

|

|

|

(1,171,585

|

)

|

|

|

(5,251,336

|

)

|

|

|

(3,919,831

|

)

|

|

Other income (expenses), net

|

|

|

8,150,463

|

|

|

|

36,773,882

|

|

|

|

12,919,943

|

|

|

|

(31,586,542

|

)

|

|

Net income (loss)

|

|

|

6,254,930

|

|

|

|

35,602,297

|

|

|

|

7,668,607

|

|

|

|

(35,506,373

|

)

|

|

Deemed dividend related to ratchet adjustment, beneficial conversion features, and accrued dividends

|

|

|

(21,386

|

)

|

|

|

-

|

|

|

|

(1,007,319

|

)

|

|

|

(18,696,012

|

)

|

|

Net income (loss) attributable to common shareholders

|

|

$

|

6,233,544

|

|

|

$

|

35,602,297

|

|

|

$

|

6,661,288

|

|

|

$

|

(54,202,385

|

)

|

Results

of Operations

Revenues

For

the year ended December 31, 2020, our revenues from continuing operations were $25,826,632 as compared to $31,356,251 for the year ended

December 31, 2019, a decrease of $5,529,619, or 17.6%. This decrease was primarily a result of a decrease in revenue attributable to

Prime EFS’s last-mile DSP business of $7,306,507 offset by an increase in revenue from Shypdirect’s mid-mile and long-haul

business with Amazon of $1,335,230 and an increase in revenue from other customers of $441,658.

Approximately

54.0% and 42.7% of our revenue of $25,826,632 for the year ended December 31, 2020 were attributable to Prime EFS’s last-mile DSP

business and Shypdirect’s mid-mile and long-haul business with Amazon, respectively. The termination of the Amazon last-mile business

had a material adverse impact on our business in the 4th fiscal quarter of 2020 and will have a material adverse impact thereafter. If

the Amazon mid-mile and long-haul business is discontinued after May 14, 2021, it would have a material adverse impact on the Company’s

business in 2nd fiscal quarter of 2021 and thereafter.

For

the three months ended September 30, 2021, our revenues were $1,207,305 as compared to $6,309,509 for the three months ended September

30, 2020, a decrease of $5,102,204, or 80.9%. This decrease was primarily a result of a decrease in revenue attributable to Prime EFS’s

last-mile DSP business of $3,528,236, a decrease in revenue from Shypdirect’s mid-mile and long-haul business with Amazon of $2,400,597,

and a decrease in revenue from other customers of $340,956. These decreases were offset from revenues generated from our newly acquired

companies, DDTI and Cougar Express, of $292,884 and $874,701, respectively.

For

the nine months ended September 30, 2021, our revenues were $4,273,498 as compared to $23,503,384 for the nine months ended September

30, 2020, a decrease of $19,229,886, or 81.8%. This decrease was primarily a result of a decrease in revenue attributable to Prime EFS’s

last-mile DSP business of $13,732,513, a decrease in revenue from Shypdirect’s mid-mile and long-haul business with Amazon of $7,607,842,

and a decrease in revenue from other customers of $509,659. These decreases were offset from revenues generated from our newly acquired

companies, DDTI and Cougar Express, of $836,428 and $1,783,700, respectively.

During

the year ended December 31, 2020 and 2019, one customer, Amazon, represented 96.7% and 98.7% of the Company’s total net revenues.

Additionally, as discussed above, approximately 36.7% of our revenue of $4,273,498 for the nine months ended September 30, 2021 was attributable

to Shypdirect’s now terminated mid-mile and long-haul business with Amazon. The termination of the Prime EFS last-mile business

with Amazon on September 30, 2020 had a material adverse impact on the operations of Prime EFS beginning in the 4th fiscal quarter of

2020 and the termination of Shypdirect’s Amazon mid-mile and long-haul business, which was effective on or about May 14, 2021,

had a material adverse impact on operations of Shypdirect beginning in the 2nd fiscal quarter of 2021. This impact has caused Prime EFS

and Shypdirect to become insolvent and to cease operations.

Cost

of Revenues

For

the year ended December 31, 2020, our cost of revenues from continuing operations was $23,284,240 compared to $28,752,889 for the year

ended December 31, 2019, a decrease of $5,468,649, or 19.0%. Cost of revenues relating to our Prime EFS and Shypdirect segments consists

of truck and van rental fees, insurance, gas, maintenance, parking and tolls, and compensation and related benefits.

For

the three months ended September 30, 2021, our cost of revenues was $1,178,113 compared to $5,978,265 for the three months ended September

30, 2020, a decrease of $4,800,152, or 80.3%. For the nine months ended September 30, 2021, our cost of revenues was $4,422,429 compared

to $20,831,870 for the nine months ended September 30, 2020, a decrease of $16,409,441, or 78.8%. Cost of revenues consists of truck

and van rental fees, insurance, gas, maintenance, parking and tolls, and compensation and related benefits. In the first quarter of 2021,

Prime EFS received a bill for approximately $304,000 for excess wear and tear on trucks that were rented for its last-mile DSP business

that terminated in September 2020, which is included in cost of sales. The decrease in cost of sales was consistent with the decrease

in revenues.

Gross

Profit (Loss)

For

the year ended December 31, 2020, our gross profit was $2,542,392, or 9.8% of revenues, as compared to $2,603,362, or 8.3% of revenues,

for the year ended December 31, 2019, a decrease of $60,970, or 2.3%. The decrease in gross profit for the year ended December 31, 2020

as compared to the year ended December 31, 2019 primarily resulted from a decrease in revenues and a decrease in operational efficiencies

in Prime EFS due to the termination of the Amazon last-mile business. Additionally, during the year ended December 31, 2020, we received

a reduction in workers’ compensation balances due of approximately $155,000 resulting from positive results from a prior period

workers’ compensation premium audit.

For

the three months ended September 30, 2021, we had gross profit of $29,192, or 2.4% of revenues, as compared to gross profit of $331,244,

or 5.2% of revenues, for the three months ended September 30, 2020, a decrease of $302,052, or 91.2%. For the nine months ended September

30, 2021, we had a gross loss of $(148,931), or (3.5)% of revenues, as compared to gross profit of $2,671,514, or 11.4% of revenues,

for the nine months ended September 30, 2020, a decrease of $2,820,445, or 105.6%. The decreases in gross profit for the three and nine

months ended September 30, 2021 as compared to the three and nine months ended September 30, 2020 primarily resulted from a decrease

in revenues and a decrease in operational efficiencies in Prime EFS and Shypdirect due to the termination of the Amazon last-mile business

and decrease in revenues from our mid-mile and long-haul business. Additionally, as discussed above, during the three months ended March

31, 2021, Prime EFS received a bill for approximately $304,000 for excess wear and tear on trucks that were rented for its last-mile

DSP business that terminated in September 2020.

Operating

Expenses

For

the year ended December 31, 2020, total operating expenses amounted to $10,757,943 as compared to $22,893,963 for the year ended December

31, 2019, a decrease of $12,136,020, or 53.0%. For the years ended December 31, 2020 and 2019, operating expenses consisted of the following:

|

|

|

For the Year Ended

December 31,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

Compensation and related benefits

|

|

$

|

2,335,388

|

|

|

$

|

13,158,040

|

|

|

Legal and professional Fees

|

|

|

3,920,606

|

|

|

|

2,096,359

|

|

|

Rent

|

|

|

651,806

|

|

|

|

419,249

|

|

|

General and administrative expenses

|

|

|

814,306

|

|

|

|

2,791,272

|

|

|

Contingency loss

|

|

|

3,035,837

|

|

|

|

586,784

|

|

|

Impairment loss

|

|

|

-

|

|

|

|

3,842,259

|

|

|

Total Operating Expenses

|

|

$

|

10,757,943

|

|

|

$

|

22,893,963

|

|

For

the three months ended September 30, 2021, total operating expenses amounted to $1,924,725 as compared to $1,502,829 for the three months

ended September 30, 2020, an increase of $421,896, or 28.1%. For the nine months ended September 30, 2021, total operating expenses amounted

to $5,102,405 as compared to $6,591,345 for the nine months ended September 30, 2020, a decrease of $1,488,940, or 22.6%. For the three

and nine months ended September 30, 2021 and 2020, operating expenses consisted of the following:

|

|

|

Three Months ended

September 30,

|

|

|

Nine Months ended

September 30,

|

|

|

|

|

2021

|

|

|

2020

|

|

|

2021

|

|

|

2020

|

|

|

Compensation and related benefits

|

|

$

|

351,908

|

|

|

$

|

551,306

|

|

|

$

|

1,064,570

|

|

|

$

|

1,955,854

|

|

|

Legal and professional Fees

|

|

|

487,473

|

|

|

|

621,105

|

|

|

|

1,470,926

|

|

|

|

3,523,811

|

|

|

Rent

|

|

|

154,132

|

|

|

|

156,738

|

|

|

|

521,688

|

|

|

|

496,349

|

|

|

General and administrative expenses

|

|

|

323,658

|

|

|

|

173,680

|

|

|

|

821,593

|

|

|

|

615,331

|

|

|

Loss on lease abandonment

|

|

|

607,554

|

|

|

|

-

|

|

|

|

1,223,628

|

|

|

|

-

|

|

|

Total Operating Expenses

|

|

$

|

1,924,725

|

|

|

$

|

1,502,829

|

|

|

$

|

5,102,405

|

|

|

$

|

6,591,345

|

|

Compensation

and related benefits

For

the year ended December 31, 2020, compensation and related benefits amounted to $2,335,388 as compared to $13,158,040 for the year ended

December 31, 2019, a decrease of $10,822,652, or 82.3%. Compensation and related benefits for the year ended December 31, 2020 and 2019

included stock-based compensation of $0 and $8,200,809, respectively, a decrease of $8,200,809, from the granting of shares of our common

stock to employees, our former chief executive officer, and our current chief executive officer for services rendered. Additionally,

during the year ended December 31, 2020, the overall decrease in compensation and related benefits was attributable to a decrease in

compensation paid to significant employees and the reduction of staff.

For

the three months ended September 30, 2021, compensation and related benefits amounted to $351,908 as compared to $551,306 for the three

months ended September 30, 2020, a decrease of $199,398, or 36.2%. For the nine months ended September 30, 2021, compensation and related

benefits amounted to $1,064,570 as compared to $1,955,854 for the nine months ended September 30, 2020, a decrease of $891,284, or 45.6%.

During the three and nine months ended September 30, 2021, the overall decrease in compensation and related benefits was attributable

to a decrease in compensation paid to significant employees and the reduction of staff due to the significant decrease in revenues and

operations.

Legal

and professional fees

For

the year ended December 31, 2020, legal and professional fees were $3,920,606 as compared to $2,096,359 for the year ended December 31,

2019, an increase of $1,824,247, or 87.0%. During the year ended December 31, 2020 and 2019, we incurred stock-based consulting fees

of $1,999,749 and $325,395, respectively, from the issuance of our common shares and warrants to consultants for business development

services rendered, an increase of $1,674,354. Additionally, we had an increase in legal fees related to an increase in ongoing legal

matters.

For

the three months ended September 30, 2021, legal and professional fees were 487,473 as compared to $621,105 for the three months ended

September 30, 2020, a decrease of $133,632, or 21.5%. During the three months ended September 30, 2021, we had a decrease in legal fees

of $207,206 related to a decrease in activities on ongoing legal matters, and a decrease in other professional fees of $54,344. These

decreases were offset by an increase in accounting fees of $98,272, and an increase in consulting fees of $29,646.

For

the nine months ended September 30, 2021, legal and professional fees were $1,470,926 as compared to $3,523,811 for the nine months ended

September 30, 2020, a decrease of $2,052,885, or 58.3%. During the nine months ended September 30, 2021, we had a decrease in legal fees

of $86,443 related to a decrease in activities on ongoing legal matters, a decrease in consulting fees of $133,312 and a decrease in

stock-based consulting fees of $1,999,749 that we incurred in the 2020 period and not in the 2021. These decreases were offset by an

increase in accounting fees of $107,400 incurred, and an increase in other professional fees of $59,219 which primarily consisted of

fees for the mailing of proxy and shareholder information.

Rent

expense

For

the year ended December 31, 2020, rent expense was $651,806 as compared to $419,249 for the year ended December 31, 2019, an increase

of $232,557, or 55.5%. These increases were attributable to a significant expansion in office, warehouse, and parking spaces pursuant

to short and long-term operating leases related to the Prime EFS and Shypdirect businesses.

For

the three months ended September 30, 2021, rent expense was $154,132 as compared to $156,738 for the three months ended September 30,

2020, a decrease of $2,606, or 1.7%. For the nine months ended September 30, 2021, rent expense was $521,688 as compared to $496,349

for the nine months ended September 30, 2020, an increase of $25,339, or 5.1%. This increase was attributable to an increase in rental

space due to the acquisition of Cougar Express. As of September 30, 2021, we abandoned our lease and vacated the premises related to

the ceased operations of Prime EFS and Shypdirect.

General

and administrative expenses

For

the year ended December 31, 2020, general and administrative expenses were $814,306 as compared to $2,791,272 for the year ended December

31, 2019, a decrease of $1,976,966, or 70.8%. This decrease is primarily attributable to a decrease in general administrative expenses

of $1,109,182 and a decrease in depreciation and amortization of $867,784. The decrease in depreciation and amortization expense was

related to a decrease in amortization of intangible assets of $826,075 due to impairment of the intangible in 2019, and a decrease in

depreciation expense of $41,709. In 2020, we cut our overall general and administrative expenses due to cost-cutting measures taken.

For

the three months ended September 30, 2021, general and administrative expenses were $323,658 as compared to $173,680 for the three months

ended September 30, 2020, an increase of $149,978, or 86.3%. For the nine months ended September 30, 2021, general and administrative

expenses were $821,593 as compared to $615,331 for the nine months ended September 30, 2020, an increase of $206,262, or 33.5%. These

increases were primarily attributable to the acquisition of Double D Trucking and Cougar Express and were offset by decreases in general

and administrative expenses due to cost-cutting measures taken.

Contingency

loss

For

the year ended December 31, 2020, contingency loss amounted to $3,035,837 as compared to $586,784 for the year ended December 31, 2020,

an increase of $2,449,053. For the year ended December 31, 2020, contingency loss consisted or the write off of securities deposits of

$164,565 and the recorded of a contingent liability of $2,871,272 which are related to the default on truck leases for non-payment of

monthly lease payments and the lessors demand for payment of lease termination fees. For the year ended December 31, 2019, contingency

loss amounted to $586,784. On or about January 10, 2020, we were named as sole defendant in a civil action captioned Elrac LLC v.

Prime EFS, filed in the United States District Court for the Eastern District of New York, assigned Case No. 1 :20-cv-00211 (the

“Elrac Action”). The complaint in the Elrac Action alleged that Prime EFS failed to pay in full for repairs allegedly required

by reason of property damage to delivery vehicles leased by Prime EFS from Elrac to conduct its business. In connection with this dispute,

in 2019, we wrote off all remaining deposits held by Elrac and accrued any additional potential amount due to Elrac in the aggregate

amount of $586,784.

Impairment

expense

During

the year ended December 31, 2019, management tested the intangible asset for impairment. Based on our analysis, we recorded intangible

asset impairment expense of $3,842,259 in the consolidated statement of operations for the year ended December 31, 2019. Such analysis

considered future cash flows and other industry factors. No impairment expense was recorded during the year ended December 31, 2020.

Loss

from lease abandonment

Due

to a reduction in our revenues and the loss of its Amazon revenues, during the second and third quarter of 2021, we abandoned our leased

premises related to the ceased operations of Prime EFS and Shypdirect. Accordingly, during the three and nine months ended September

30, 2021, we wrote the remaining balance of this right of use asset and recorded a loss on lease abandonment of $607,554 and $1,223,628,

respectively.

Loss

from operations

For

the year ended December 31, 2020, loss from continuing operations amounted to $42,781,958 as compared to $44,183,036 for the year ended

December 31, 2019, a decrease of $1,401,078, or 3.2%.

For

the year ended December 31, 2020, loss from operations amounted to $8,215,551 as compared to $20,290,601 for the year ended December

31, 2019, a decrease of $12,075,050, or 59.5%.

For

the three months ended September 30, 2021, loss from operations amounted to $1,895,533 as compared to $1,171,585 for the three months

ended September 30, 2020, an increase of $723,948, or 61.8%. For the nine months ended September 30, 2021, loss from operations amounted

to $5,251,336 as compared to $3,919,831 for the nine months ended September 30, 2020, an increase of $1,331,505, or 34.0%.

Discontinued

Operations

On

May 1, 2019, the Company entered into a Share Exchange Agreement with Save On and Steven Yariv, whereby the Company returned all of the

stock of Save On to Steven Yariv in exchange for Mr. Yariv conveying 1,000,000 shares of common stock of the Company back to the Company.

In addition, the Company granted an aggregate of 80,000 options to certain employees of Save On. Accordingly, we reflected Save On as

a discontinued operations beginning in the second quarter of 2019, the period that Save On was disposed of, and retroactively for all

periods presented in the accompanying consolidated financial statements. The businesses of Save On are considered discontinued operations

because: (a) the operations and cash flows of Save On were eliminated from the Company’s operations; and (b) the Company has no

interest in the divested operations. For the year ended December 31, 2019, loss from discontinued operations amounted to $681,426. We

did not have discontinued operations during the 2020 period.

Other

expenses (income)

Total

other expenses (income) include interest expense, derivative expense, loan fees, gain on debt extinguishment, and other income. For the

years ended December 31, 2020 and 2019, other expenses (income) consisted of the following:

|

|

|

For the Year Ended

December 31,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

Interest expense

|

|

$

|

7,377,164

|

|

|

$

|

6,318,122

|

|

|

Interest expense – related parties

|

|

|

174,947

|

|

|

|

222,328

|

|

|

Loan fees

|

|

|

-

|

|

|

|

601,121

|

|

|

Gain on debt extinguishment

|

|

|

(7,847,073

|

)

|

|

|

(39,090,168

|

)

|

|

Settlement expense

|

|

|

545,616

|

|

|

|

-

|

|

|

Other income

|

|

|

(376,750

|

)

|

|

|

-

|

|

|

Derivative expense

|

|

|

34,692,503

|

|

|

|

55,841,032

|

|

|

Total Other Expenses, net

|

|

$

|

34,566,407

|

|

|

$

|

23,892,435

|

|

For

the year ended December 31, 2020 and 2019, aggregate interest expense was $7,552,111 and $6,540,450, respectively, an increase of $1.011,661,

or 4.5%. During the year ended December 31, 2020, we incurred a 30% default interest penalty of $1,531,335, which was included in interest

expense. We did not incur this expense during the 2019 period. This increase in interest expense was offset by a decrease in interest

expense attributable to a decrease in interest-bearing loans due to the conversion of debt to equity and a decrease in the amortization

of original issue discount.

For

the year ended December 31, 2019, loan fees were $601,121. In connection with previous promissory notes payable, on June 11, 2019, we

issued 55,000 warrants to purchase 55,000 shares of common stock an exercise price of $1.00 per share. On June 11, 2019, we calculated

the fair value of these warrants of $601,121, which was expensed and included in loan fees on the accompanying consolidated statement

of operations. We did not incur such expense during the 2020 period.

For

the year ended December 31, 2020 and 2019, the net gain on extinguishment of debt was $7,847,073 and $39,090,168, respectively, a decrease

of $31,243,095. The gains on debt extinguishment were attributable to the settlement of convertible debt and warrants, the settlement

of secured merchant loans, the conversion of convertible debt, and the settlement of other payables.

On

December 17, 2020, we issued 18,685,477 common shares to certain August 2019 equity and debt purchasers as settlement related to the

difference between $2.50, the purchase price, and $0.40. These shares were valued at $545,616, or $0.029 per share, based on the quoted

trading price on the date of grant. In connection with these shares, we recorded settlement expense of $545,616.

During

the year ended December 31, 2020, we recorded other income of $376,750 which primarily related to the collection of rental income from

the sublease of excess office, warehouse, and parking spaces.

For

the year ended December 31, 2020 and 2019, derivative expense was $34,692,503 and $55,841,032, respectively, a decrease of $21,148,529.

During the year ended December 31, 2020 and 2019, we recorded a derivative expense related to the calculated initial derivative fair

value of conversion options and warrants. Additionally, we adjusted our derivative liabilities to fair value and recorded derivative

expense or income.

Total

other expenses (income) include interest expense, derivative expense, warrant exercise inducement expense, gain on debt extinguishment,

and other income. For the three and nine months ended September 30, 2021 and 2020, other expenses (income) consisted of the following:

|

|

|

Three Months ended

September 30,

|

|

|

Nine Months ended

September 30,

|

|

|

|

|

2021

|

|

|

2020

|

|

|

2021

|

|

|

2020

|

|

|

Interest expense

|

|

$

|

71,939

|

|

|

$

|

2,028,958

|

|

|

$

|

290,898

|

|

|

$

|

7,016,597

|

|

|

Interest expense – related party

|

|

|

22,685

|

|

|

|

22,686

|

|

|

|

67,315

|

|

|

|

152,262

|

|

|

Warrant exercise inducement expense

|

|

|

4,193,134

|

|

|

|

-

|

|

|

|

4,193,134

|

|

|

|

-

|

|

|

Loss (gain) on debt extinguishment

|

|

|

-

|

|

|

|

(907,447

|

)

|

|

|

(1,564,941

|

)

|

|

|

(7,151,041

|

)

|

|

Other income

|

|

|

(11,001

|

)

|

|

|

(91,950

|

)

|

|

|

(194,823

|

)

|

|

|

(266,918

|

)

|

|

Gain on deconsolidation of subsidiaries

|

|

|

(12,427,220

|

)

|

|

|

-

|

|

|

|

(12,427,220

|

)

|

|

|

-

|

|

|

Derivative (income) expense

|

|

|

-

|

|

|

|

(37,826,129

|

)

|

|

|

(3,284,306

|

)

|

|

|

31,835,642

|

|

|

Total Other Expenses (Income)

|

|

$

|

(8,150,463

|

)

|

|

$

|

(36,773,882

|

)

|

|

$

|

(12,919,943

|

)

|

|

$

|

31,586,542

|

|

For

the three months ended September 30, 2021 and 2020, aggregate interest expense was $94,624 and $2,051,644, respectively, a decrease of

$1,957,020, or 96.4%. For the nine months ended September 30, 2021 and 2020, aggregate interest expense was $358,213 and $7,168,859,

respectively, a decrease of $6,810,646, or 95.0%. During the nine months ended September 30,2020, we recorded a 30% default interest

penalty of $1,531,335, which was included in interest expense. We did not incur this expense during the 2021 periods. Additionally, the

decrease in interest expense was attributable to a decrease in interest-bearing loans due to the conversion of debt to equity and a decrease

in the amortization of original issue discount.

During

the six months ended September 30, 2021, we entered into Securities Purchase Agreements with certain of the holders of its existing Series

E preferred warrants (“Exercising Warrants Holders”). Pursuant to the Securities Purchase Agreements, the Exercising Warrants

Holders and we agreed that the Exercising Warrants Holders would cash exercise their existing warrants, into shares of common stock underlying

such existing warrants Shares. In order to induce the Exercising Warrant Holders to cash exercise their existing Warrants, the Securities

Purchase Agreements provided for the issuance of new warrants (“New Warrants”) with such New Warrants to be issued in an

amount equal to 50% of the number of shares acquired by the Existing Warrant Holder through the exercise of existing warrants for cash.

The New Warrants are exercisable upon issuance and terminate five years following the initial exercise date. The New Warrants have an

exercise price per share of $0.01. In connection with the exercise of these existing warrants for cash, the Company issued an aggregate