Nostrum Oil & Gas Agrees Terms on $1.1 Billion Bond Restructuring

January 28 2022 - 3:30AM

Dow Jones News

By Jaime Llinares Taboada

Nostrum Oil & Gas PLC said Friday that it has reached an

agreement to restructure an outstanding $1.1 billion in bonds due

in 2022 and 2025.

The oil-and-gas company, its largest shareholder and an ad hoc

committee of noteholders have agreed a partial reinstatement of the

bonds in the form of $250 million of senior secured notes with a

cash coupon of 5.0%, and $300 million senior unsecured notes with

cash coupon of 1.0% and payment-in-kind interest of 13%, both

maturing in June 2026.

The remainder of the outstanding notes, which had aggregate

principals of $725 million and $400 million, respectively, are to

be converted into equity. The final Nostrum shareholding to be

received by the noteholders will depend on the results of an

extraordinary general meeting of shareholders.

The deal also includes arrangements regarding corporate

governance, cashflow utilization and the transfer of the company's

listing to the standard listing segment of the LSE.

"This agreement removes significant obstacles as we look to

negotiate long term contracts to fill the spare capacity in our

world class processing facilities and so secure the group's medium-

and long-term future," Chief Executive Arfan Khan said.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

January 28, 2022 03:15 ET (08:15 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

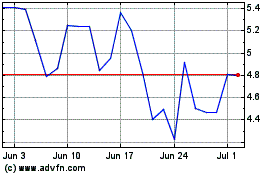

Nostrum Oil & Gas (LSE:NOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nostrum Oil & Gas (LSE:NOG)

Historical Stock Chart

From Apr 2023 to Apr 2024