Current Report Filing (8-k)

January 26 2022 - 9:16AM

Edgar (US Regulatory)

0001463208

false

0001463208

2022-01-20

2022-01-20

0001463208

dei:FormerAddressMember

2022-01-20

2022-01-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): January 20, 2022

Transportation

and Logistics Systems, Inc.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

001-34970

|

|

26-3106763

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

5500

Military Trail, Suite 22-357

Jupiter,

Florida 33458

(Address

of Principal Executive Offices)

(833)

764-1443

(Issuer’s

telephone number)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under

any of the following provisions:

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act: None.

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Forward

Looking Statements

Statements

in this report regarding Transportation and Logistics Systems, Inc. (the “Company”) that are not historical facts

are forward-looking statements and are subject to risks and uncertainties that could cause actual future events or results to differ

materially from such statements. Any such forward-looking statements, including, but not limited to, financial guidance, are made pursuant

to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements

that do not directly or exclusively relate to historical facts. In some cases, you can identify forward-looking statements by terms such

as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,”

“anticipates,” “intend,” “goal,” “seek,” “strategy,” “future,”

“likely,” “believes,” “estimates,” “projects,” “forecasts,” “predicts,”

“potential,” or the negative of those terms, and similar expressions and comparable terminology. These include, but are not

limited to, statements relating to future events or our future financial and operating results, plans, objectives, expectations and intentions.

Although we believe that the expectations reflected in these forward-looking statements are reasonable, these expectations may not be

achieved. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they represent our intentions,

plans, expectations, assumptions and beliefs about future events and are subject to known and unknown risks, uncertainties and other

factors outside of our control that could cause our actual results, performance or achievement to differ materially from those expressed

or implied by these forward-looking statements. In addition to the risks described above, these risks and uncertainties include: our

ability to successfully execute our business strategies, including integration of acquisitions and the future acquisition of other businesses

to grow our Company; customers’ cancellation on short notice of master service agreements from which we derive a significant portion

of our revenue or our failure to renew such master service agreements on favorable terms or at all; our ability to attract and retain

key personnel and skilled labor to meet the requirements of our labor-intensive business or labor difficulties which could have an effect

on our ability to bid for and successfully complete contracts; the ultimate geographic spread, duration and severity of the coronavirus

outbreak and the effectiveness of actions taken, or actions that may be taken, by governmental authorities to contain the outbreak or

ameliorate its effects; our failure to compete effectively in our highly competitive industry, which could reduce the number of new contracts

awarded to us or adversely affect our market share and harm our financial performance; our ability to adopt and master new technologies

and adjust certain fixed costs and expenses to adapt to our industry’s and customers’ evolving demands; our history of losses,

deficiency in working capital and a stockholders’ deficit and our inability to achieve sustained profitability; material weaknesses

in our internal control over financial reporting and our ability to maintain effective controls over financial reporting in the future;

our substantial indebtedness, which could adversely affect our business, financial condition and results of operations and our ability

to meet our payment obligations; the impact of new or changed laws, regulations or other industry standards that could adversely affect

our ability to conduct our business; and changes in general market, economic, social and political conditions in the United States and

global economies or financial markets, including those resulting from natural or man-made disasters.

These

forward-looking statements represent our estimates and assumptions only as of the date of this report and, except as required by law,

we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future

events or otherwise after the date of this report. Given these uncertainties, you should not place undue reliance on these forward-looking

statements and should consider various factors, including the risks described, among other places, in our most recent Annual Report on

Form 10-K and in our Quarterly Reports on Form 10-Q, as well as any amendments thereto, filed with the Securities and Exchange Commission.

Item

3.02 Unregistered Sales of Equity Securities.

Transportation

and Logistics Systems, Inc. (OTC:TLSS), (“TLSS” or the “Company”), an eCommerce fulfillment service provider,

announced that, on January 25, 2022, pursuant to an exemption from the registration requirements of Section 5 of the Securities Act contained

in Section 4(a)(2) thereof and/or Rule 506(b) thereunder, the Company issued and sold additional units (the “Units”), each

consisting of one share of the Company’s Series G Convertible Preferred Stock, $0.001 par value per share (the “Series G

Shares”), and a warrant to purchase 1,000 shares of the Company’s Common Stock, subject to adjustment (the “Warrant

Shares”), at an initial exercise price of $0.01 per share, at a purchase price of $10.00 per Unit, subject to the terms and conditions

set forth in that stock purchase agreement, entered into effective as of December 31, 2021 (“Agreement”), raising $700,000

at closing. The Company shall use the proceeds for working capital purposes and, subject to identifying one or more prudent opportunities,

for acquisitions.

The

Company shall pay the placement agent, who acted on its behalf in connection with sale of the Units, a cash transaction fee in the amount

of 10% of the amount of the securities financing and warrants with a 5-year term and cashless exercise, equal to 10% of the amount of

securities sold (on an as converted basis), at an exercise price $0.01 per share.

A

copy of the Agreement and the form of warrant were filed with the Company’s Current Report on Form 8-K filed with the Securities

and Exchange Commission on January 3, 2022. Under the Agreement, the Company has agreed to file with the Securities and Exchange Commission

a registration statement covering the resale of the Series G Shares and the Warrant Shares for an offering to be made on a continuous

basis pursuant to Rule 415.

Item

5.02 Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers.

On

January 20, 2022, the Board of Directors of the Company elected Charles Benton (age 71) to the Board of Directors of the Company to serve

until his successor is elected and qualified. Mr. Benton will serve as Chairman of the Company’s Audit Committee and will serve

on the Company’s Compensation Committee. Mr. Benton was appointed to the Board based on his extensive experience in the transportation

and supply chain industries and his experience with the boards of directors of publicly-traded companies, including his various roles,

such as Chairman and on governance committees. Currently, he serves as a director and Audit Chairman of Vision Hydrogen Corp. (OTC:VIHD),

a company focused on the production, storage and distribution of hydrogen for the green energy economy supply chain. In the past, Mr.

Benton has held the positions of Audit Committee Chairman and then Chairman of the Board of WPCS International Incorporated (NASDAQ:WPCS),

a design-build engineering firm focused on the deployment of wireless networks and related services including site design, technology

integration, electrical contracting, construction and maintenance.

On

January 20, 2022, the Board of Directors of the Company elected Norman Newton (age 55) to the Board of Directors of the Company to serve

until his successor is elected and qualified. Mr. Newton will serve as Chairman of the Company’s Nominating Committee and will

serve on the Company’s Audit Committee. Mr. Newton was appointed to the Board based on his high-level executive skills across a

multiple of large organizations and his background in implementing digital technology in various areas relevant to the Company’s

plans and operations. Currently, Mr. Newton is the President and CEO of AmeriCasa Solutions, LLC, a vertically integrated provider of

housing to the Hispanic Community in the United States. Mr. Newton is also the Managing Director of Newton Vision Corporation, a privately

held investment and consulting company with deep experience in business process reengineering, optimization, and digital transformation.

On

January 20, 2022, the Board of Directors of the Company appointed John Mercadante, a current member of its Board of Directors, to serve

as Chairman of the Company’s Compensation Committee and to serve on the Company’s Nominating Committee.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

Dated:

January 26, 2022

|

TRANSPORTATION

AND LOGISTICS SYSTEMS, INC.

|

|

|

|

|

|

|

By:

|

/s/

Sebastian Giordano

|

|

|

Name:

|

Sebastian

Giordano

|

|

|

Title:

|

Chief

Executive Officer

|

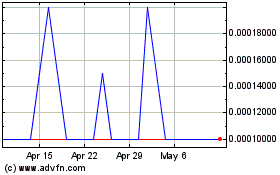

Transportation and Logis... (PK) (USOTC:TLSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

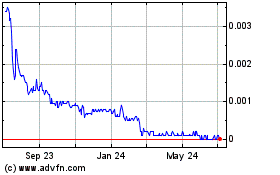

Transportation and Logis... (PK) (USOTC:TLSS)

Historical Stock Chart

From Apr 2023 to Apr 2024