Small Company Offering and Sale of Securities Without Registration (d)

January 21 2022 - 9:45AM

Edgar (US Regulatory)

o

NoneEntity Type | 0001077640 | Triband Enterprise Corp. Wealth Minerals WEALTH MINERALS TRIBAND RESOURCE CORP |

x

Corporation

o

Limited Partnership

o

Limited Liability Company

o

General Partnership

o

Business Trust

o

Other |

| Name of Issuer |

Wealth Minerals Ltd. |

| Jurisdiction of Incorporation/Organization |

| BRITISH COLUMBIA, CANADA |

| |

| Year of Incorporation/Organization |

| |

x

| Over Five Years Ago |

| |

o

| Within Last Five Years (Specify Year) | |

| |

o

| Yet to Be Formed | |

| 2. Principal Place of Business and Contact Information |

| Name of Issuer | |

| Wealth Minerals Ltd. | |

| Street Address 1 | Street Address 2 |

| Suite 2710 - 200 Granville Street | |

| City | State/Province/Country | ZIP/Postal Code | Phone No. of Issuer |

| VANCOUVER | BRITISH COLUMBIA, CANADA | V6C 1S4 | 604-331-0096 |

| Last Name | First Name | Middle Name |

| van Alphen | Hendrik | |

| Street Address 1 | Street Address 2 |

| Suite 2710 - 200 Granville Street | |

| City | State/Province/Country | ZIP/Postal Code |

| Vancouver | BRITISH INDIAN OCEAN TERRITORY | V6C 1S4 |

| Relationship: |

x

| Executive Officer |

x

| Director |

o

| Promoter |

| Clarification of Response (if Necessary) |

| | |

| Last Name | First Name | Middle Name |

| Rtichie | Marla | |

| Street Address 1 | Street Address 2 |

| Suite 2710 - 200 Granville Street | |

| City | State/Province/Country | ZIP/Postal Code |

| Vancouver | BRITISH INDIAN OCEAN TERRITORY | V6C 1S4 |

| Relationship: |

x

| Executive Officer |

o

| Director |

o

| Promoter |

| Clarification of Response (if Necessary) |

| | |

| Last Name | First Name | Middle Name |

| Hamzagic | Sead | |

| Street Address 1 | Street Address 2 |

| Suite 2710 - 200 Granville Street | |

| City | State/Province/Country | ZIP/Postal Code |

| Vancouver | BRITISH INDIAN OCEAN TERRITORY | V6C 1S4 |

| Relationship: |

x

| Executive Officer |

o

| Director |

o

| Promoter |

| Clarification of Response (if Necessary) |

| | |

| Last Name | First Name | Middle Name |

| Neal | Gordon | |

| Street Address 1 | Street Address 2 |

| |

| City | State/Province/Country | ZIP/Postal Code |

| Vancouver | BRITISH INDIAN OCEAN TERRITORY | V6C 1S4 |

| Relationship: |

o

| Executive Officer |

x

| Director |

o

| Promoter |

| Clarification of Response (if Necessary) |

| | |

| Last Name | First Name | Middle Name |

| Schauss | Stefan | |

| Street Address 1 | Street Address 2 |

| Suite 2710 - 200 Granville Street | |

| City | State/Province/Country | ZIP/Postal Code |

| Vancouver | BRITISH INDIAN OCEAN TERRITORY | V6C 1S4 |

| Relationship: |

o

| Executive Officer |

x

| Director |

o

| Promoter |

| Clarification of Response (if Necessary) |

| | |

| Last Name | First Name | Middle Name |

| Tang | Xiaohuan | |

| Street Address 1 | Street Address 2 |

| Suite 2710 - 200 Granville Street | |

| City | State/Province/Country | ZIP/Postal Code |

| Vancouver | BRITISH INDIAN OCEAN TERRITORY | V6C 1S4 |

| Relationship: |

o

| Executive Officer |

x

| Director |

o

| Promoter |

| Clarification of Response (if Necessary) |

| | |

| Last Name | First Name | Middle Name |

| Lies | David | |

| Street Address 1 | Street Address 2 |

| Suite 2710 - 200 Granville Street | |

| City | State/Province/Country | ZIP/Postal Code |

| Vancouver | BRITISH INDIAN OCEAN TERRITORY | V6C 1S4 |

| Relationship: |

o

| Executive Officer |

x

| Director |

o

| Promoter |

| Clarification of Response (if Necessary) |

| | |

|

o

| Agriculture | | Health Care |

o

| Retailing |

| | Banking & Financial Services | |

o

| Biotechnology |

o

| Restaurants |

| |

o

| Commercial Banking | |

o

| Health Insurance | | Technology |

| |

o

| Insurance | |

o

| Hospitals & Physicians | |

o

| Computers |

| |

o

| Investing | |

o

| Pharmaceuticals | |

o

| Telecommunications |

| |

o

| Investment Banking | |

o

| Other Health Care | |

o

| Other Technology |

| |

o

| Pooled Investment Fund

| | | | | Travel |

| |

o

| Other Banking & Financial Services |

o

| Manufacturing | |

o

| Airlines & Airports |

| | Real Estate | |

o

| Lodging & Conventions |

| |

o

| Commercial | |

o

| Tourism & Travel Services |

| |

o

| Construction | |

o

| Other Travel |

| |

o

| REITS & Finance |

x

| Other |

| |

o

| Residential | |

| |

o

| Other Real Estate | |

|

o

| Business Services | |

| | Energy | |

| |

o

| Coal Mining | |

| |

o

| Electric Utilities | |

| |

o

| Energy Conservation | |

| |

o

| Environmental Services | |

| |

o

| Oil & Gas | |

| |

o

| Other Energy | |

| Revenue Range | Aggregate Net Asset Value Range |

|

x

| No Revenues |

o

| No Aggregate Net Asset Value |

|

o

| $1 - $1,000,000 |

o

| $1 - $5,000,000 |

|

o

| $1,000,001 - $5,000,000 |

o

| $5,000,001 - $25,000,000 |

|

o

| $5,000,001 - $25,000,000 |

o

| $25,000,001 - $50,000,000 |

|

o

| $25,000,001 - $100,000,000 |

o

| $50,000,001 - $100,000,000 |

|

o

| Over $100,000,000 |

o

| Over $100,000,000 |

|

o

| Decline to Disclose |

o

| Decline to Disclose |

|

o

| Not Applicable |

o

| Not Applicable |

| 6. Federal Exemption(s) and Exclusion(s) Claimed (select all that apply) |

|

o

| Rule 504(b)(1) (not (i), (ii) or (iii)) |

o

| Rule 505 |

|

o

| Rule 504 (b)(1)(i) |

x

| Rule 506(b) |

|

o

| Rule 504 (b)(1)(ii) |

o

| Rule 506(c) |

|

o

| Rule 504 (b)(1)(iii) |

o

| Securities Act Section 4(a)(5) |

| |

o

| Investment Company Act Section 3(c) |

|

x

| New Notice | Date of First Sale | 2021-10-22 |

o

| First Sale Yet to Occur |

| Does the Issuer intend this offering to last more than one year? |

x

| Yes |

o

| No |

| 9. Type(s) of Securities Offered (select all that apply) |

|

o

| Pooled Investment Fund Interests |

x

| Equity |

|

o

| Tenant-in-Common Securities |

x

| Debt |

|

o

| Mineral Property Securities |

o

| Option, Warrant or Other Right to Acquire Another Security |

|

x

| Security to be Acquired Upon Exercise of Option, Warrant or Other Right to Acquire Security |

x

| Other (describe) |

| | Each unit is comprised of one common share and one common share purchase right. Each whole purchase right is exercisable for one common share at an exercise price of $0.33 per share for three years. |

| 10. Business Combination Transaction |

| Is this offering being made in connection with a business combination transaction, such as a merger, acquisition or exchange offer? |

o

| Yes |

x

| No |

| |

| Clarification of Response (if Necessary) | |

| |

| Minimum investment accepted from any outside investor | $ 0 USD |

| Recipient | Recipient CRD Number |

o

| None |

| | |

| (Associated) Broker or Dealer |

o

| None | (Associated) Broker or Dealer CRD Number |

o

| None |

| | |

| Street Address 1 | Street Address 2 |

| | |

| City | State/Province/Country | ZIP/Postal Code |

| | | |

| State(s) of Solicitation |

o

| All States |

| |

| |

| 13. Offering and Sales Amounts |

| Total Offering Amount | $ 5817146 USD |

o

Indefinite |

| Total Amount Sold | $ 2549982 USD | |

| Total Remaining to be Sold | $ 3267164 USD |

o

Indefinite |

| |

| Clarification of Response (if Necessary) |

| The additional $3,267,164 may be received upon the exercise of common share purchase rights sold inside and outside the U.S. Dollar amounts are based on the Bank of Canada average daily rate of exchange reported on 10/22/21 which was US$1.00=CDN$1.2357. |

|

o

| Select if securities in the offering have been or may be sold to persons who do not qualify as accredited investors,

Number of such non-accredited investors who already have invested in the offering

| |

| | Regardless of whether securities in the offering have been or may be sold to persons who do not qualify as accredited investors, enter the total number of investors who already have invested in the offering: | 5 |

| 15. Sales Commissions & Finders’ Fees Expenses |

Provide separately the amounts of sales commissions and finders' fees expenses, if any. If the amount of an expenditure is not known, provide an estimate and check the box next to the amount.

|

| Sales Commissions | $ 0 USD |

o

| Estimate |

| Finders' Fees | $ 0 USD |

o

| Estimate |

| |

| Clarification of Response (if Necessary) |

| |

Provide the amount of the gross proceeds of the offering that has been or is proposed to be used for payments to any of the persons required to be named as executive officers, directors or promoters in response to Item 3 above. If the amount is unknown, provide an estimate and check the box next to the amount.

|

| | $ 0 USD |

o

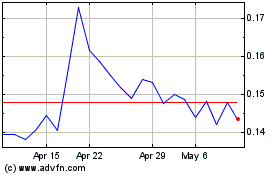

Wealth Minerals (QB) (USOTC:WMLLF) Historical Stock Chart From Mar 2024 to Apr 2024

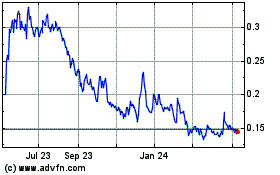

Wealth Minerals (QB) (USOTC:WMLLF) Historical Stock Chart From Apr 2023 to Apr 2024

See More Message Board Posts

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

|