Macarthur Minerals Limited (TSXV: MMS)

(ASX: MIO) (OTCQB: MMSDF) (the

Company or

Macarthur) is pleased to update shareholders on

activities during the fourth quarter of 2021. Q4 2021 was very

active in which the Company continued to focus on the delivery of

the Feasibility Study for its high-grade magnetite Lake Giles Iron

Project in Western Australia. The heavy lifting undertaken in Q4

2021 now sets Macarthur up for an exciting start to 2022.

2021 Fourth Quarter

Highlights

Key highlights during the fourth quarter of 2021

included announcements on the following:

Highlights

- Lake Giles Iron Project Feasibility Study

- Feasibility Study Update - Metallurgical and non-process

infrastructure design advances – study completion now in sight (see

announcement: here ) – 1 October 2021.

- Feasibility Study Update – Rail and port concept plan of

operations advances (see announcement: here ) – 7 October

2021.

- Feasibility Study Update – Geotechnical analysis and mine

planning work advances (see announcement: here ) – 12 October

2021.

- Feasibility Study Update – Major component of Study works now

complete as geotechnical drill campaign finishes at Lake Giles (see

announcement here) 26 October 2021.

- Feasibility Study Update – Definitive Feasibility Study

Delivery Timetable Announced (see announcement here) – 16 December

2021.

- Infinity Mining Limited ASX Spin-out

- Macarthur Minerals $10m IPO spinout of Infinity Mining Limited

closes over-subscribed (see announcement here) - 24 November

2021

- Macarthur’s Spinout of Infinity Mining Limited Launched on the

ASX (see announcement here ) – 22 December 2021

|

Key Areas of Focus for the 2022 Calendar

Year

Macarthur’s primary areas of focus during 2022

will include the following:

- Lake Giles Iron

Project

- Feasibility Study:

Finalising the Mineral Reserves Statement for the Lake Giles Iron

Project in February and release of the Feasibility Study within 45

days after delivery of the Mineral Reserves Statement.

- Project Financing:

Advancing project financing for the development of the Lake Giles

Iron Project post-delivery of the Feasibility Study.

- Project Schedule:

Advancing environmental approvals, contracts and pre-development

deliverables to ensure that achievement of first iron ore shipment

remains on track with the project schedule defined by the

Feasibility Study.

- Ularring Hematite

Project

- Undertaking a programme of work to

ensure that required approvals, mine planning and transport

solutions are in place to enable a short run-up to commencement of

DSO mining operations at the Snark and Drabble Downs deposits,

subject to the iron ore price environment supporting the

commencement of commercial DSO mining operations.

2022 Calendar Year Goals (In

Detail)

Macarthur remains well placed to deliver on its

2022 goals. A more detailed summary of these goals is set out

below:

- Lake Giles Iron

Project:

- The Feasibility Study for the Lake

Giles Iron Project is now in its final stages and is on track for

delivery in accordance with the timetable released to the market on

16 December 2021 (see announcement here). The combined technical

capabilities and experience of Stantec, Orelogy and Macarthur’s

highly experienced owners’ team will ensure the delivery of the

Feasibility Study on time and within budget.

- A large amount of work was

undertaken by Macarthur and its study consultants in 2021 to

advance the technical aspects of the Feasibility Study. The work

undertaken included detailed metallurgical test work, analysis of

power requirements, process engineering design and non-process

engineering design.

- Process and non-process engineering

design has achieved 100% design completion with work now focusing

on cost estimation. Additionally, the Company completed a

geotechnical drilling programme during Q3 and Q4 2021, which

provided critical inputs for the second phase of mine planning. The

mine planning work is nearing completion with a Mineral Reserve

Statement targeting release to the market in February.

- The final Feasibility Study Report

(NI43-101 Technical Report) will be released to the market within

45 days of the delivery of the Mineral Reserve Statement.

- Following delivery of the

Feasibility Study, the Company will progress engagement with

project financiers, and the balance of 2022 will be focused on

project optimisation, securing project financing, identifying

strategic partners and advancing the required approvals, contracts

and pre-development deliverables to ensure that achievement of the

first iron ore shipment remains on track with the project schedule

defined by the Feasibility Study.

- Ularring Hematite:

- The Company continues to examine

options for an early production opportunity for its Ularring

Hematite Project at Lake Giles, subject to a return to a supportive

iron ore pricing environment for Macarthur’s DSO product.

- Near-term access to Western

Australian ports remained elusive during 2021 as a consequence of

increased export demand. Access to road and rail transport (and an

increase in overall associated transport costs during the heated

commodities hike) was also a limiting factor. However, the Company

is confident that these limitations will ease coming into 2022 and

2023.

- To ensure that the Company is well

positioned to take advantage of market opportunities, Macarthur

will leverage previous studies undertaken on the Ularring Hematite

Project that outlined an opportunity for DSO and will continue to

advance preparations to achieve an accelerated export opportunity.

This will include:

- Advancing project approvals and

finalising mine planning requirements for the Snark and Drabble

Downs deposits over the course of 2022; and

- Continuing the Company’s strategy

to develop the lowest cost, end to end transport logistics solution

that can sustain DSO mining operations at Ularring.

- Additional Goals in

2022The Company’s core focus is the advancement of its

Lake Giles Iron Project, however it will also focus on a series of

complementary goals during 2022. These include:

- Strategic

Partnerships: Formalising strategic partnerships for the

key development and infrastructure requirements needed to

commercialise the Lake Giles Iron Project remains a key focus for

the Company this year and in the lead up to delivery of the

Feasibility Study. Macarthur signed a Cooperation Agreement with

diversified Singaporean-based conglomerate Jin Sung International

Pte Ltd on 15 June 2021 and is in active discussions with a number

of other global corporates that have the potential to add capital

and technical capabilities to the project.

- Project Financing:

With the assistance of its financial advisers, the Company

continues to advance terms for financing the development of the

Company’s high grade magnetite project at Lake Giles to ensure a

smooth pathway to the closing of finance post-delivery of a

successful Feasibility Study. The development of the financial

model as part of the Feasibility Study will assist this pathway.

The Company, together with its financial advisers and its study

consultants have been working with FTI Consulting to ensure that

this model is robust and sophisticated with built in sensitivities

to ensure that it can provide adaptive outputs that will satisfy

the requirements of conservative due diligence enquiries.

- Nevada Lithium

Assets: The Company continues to examine the potential for

strategic partnership(s) that can advance a programme of works to

realise an improved value proposition for the Company’s 100% owned

lithium brine claims in the Nevada region of the USA. Macarthur

holds 210 mining claims in Nevada, covering an area of 7 square

miles (18 km2) located in Railroad Valley, in Nye County, Nevada,

USA. The claims are located approximately 180 miles (300 km) North

of Las Vegas, Nevada, and 330 miles (531 km) south east of Tesla’s

Gigafactory.

- Graduation on to main board

of TSX: The Company maintains its aspiration to migrate

from the TSXV onto the main board of the TSX during the course of

2022.

Iron Ore Market Overview – a recent

review and the current position

Iron ore prices are driven by demand from China,

and over the course of Q4 2021, the views of analysts on the iron

ore price outlook for the immediate term have been mixed. However,

the sudden bearish views that emerged in Q3 and Q4 2021 seem to

have turned equally as quickly.

During Q3 2021, some analysts were predicting

sluggish demand would keep prices constrained in the near to medium

term and push prices below $US100 a tonne during Q4 2021, however

by around mid-December, it became clear that the anticipated

collapse in demand during Q4 had not occurred. Whilst demand has

been weaker, some analysts consider that China’s plans to ease

property curbs and pump further stimulus into its economy could

result in increased demand for iron ore.

As at 12 January 2022, the price for 62% iron

ore fines CFR Qingdao was USD 131.50/dmt, which is still well above

pre-covid levels and up from USD 115.76/dmt as at 1 October 2021.

After hitting a low of USD 86.70/dmt on 9 November 2021, the price

recovery to January 2022 for 62% fines represents a 51.67% increase

in just 2 months. (Source: Custeel).

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/dfb388a0-09b4-4e9e-8ec5-d2b54e23182cRaw

data source: Custeel.net

The continued recovery into mid -January 2022 is

an extension to the surge that occurred in the first few days of

2022 after heavy rains appeared to signal a potential disruption to

Brazilian supply. At the same time, (on the demand side), traders

appear to be observing the spread of the omicron variant in China,

specifically within the northern port city of Tianjin. An

anticipated easing of steel production controls in China after the

Winter Olympics in Beijing next month may have also helped underpin

iron ore prices in recent weeks.

Iron Ore Pricing Overview

Price differentials between low and high-grade

ores have traditionally ebbed and flowed with mill profitability

and coking coal prices. However, with China now taking a

longer-term and far stricter stance on the environmental impacts of

steel production, and with its willingness to impose production

curbs on mills, the global iron ore market is arguably entering a

phase where a structural trend away from low-grade ores is now

developing. Healthy mill profit margins, high cooking coal prices,

and seasonal anti-pollution restrictions are creating both a profit

incentive, as well as cost and compliance concerns – and the

convergence of these factors appears to be motivating steel mills

to moderate their consumption of low-grade ores. There is no

starker example of this than the forced supply response that

occurred in Q3 and Q4 of 2021, with a number of lower grade

producers being adversely impacted by the price shift.

As at 12 January 2022, 65% iron ore fines CFR

Qingdao, were selling for USD 161.20/dmt, representing a 22.5%

premium over the 62% price, and a 93.05% premium to 58% Fe fines

CFR Qingdao, demonstrating the widening premium gap for high grade

ore. (Source: Custeel).

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/8f7abadc-9a92-45e8-b723-23e6f6192ec6Raw

data source: Custeel.net

On average, approximately two tonnes of carbon

dioxide (CO₂) are emitted for every tonne of steel produced. This

accounts for roughly 7% of global greenhouse gas emissions. The

trend towards higher grade ores demonstrates a change in demand

preferences aimed at factoring in the global shift towards

decarbonisation. Macarthur’s strategy to meet and help lead the

future growth in demand for high grade ore is the right strategy

moving into the third decade of this century which will be defined

by how industries respond to the challenges of meeting net zero

targets.

As outlined by Macarthur in its second quarter

update in 2021, the premium for steel products may arguably result

in increased direct investment by the rest of the world (excluding

China) of new steel production capacity that has the eventual

function of replacing older bast furnace steel technology needed by

the mid-2030s to meet the strict C02 emissions standards announced

in the Paris Accord and by Japan and the USA in 2020.

Completing the journey to net zero emissions in

steel production has been demonstrated as technically possible by

the use of high-grade magnetite and scrap steel in electric arc

furnaces with ‘green hydrogen’ as the reductant. The first green

steel production was achieved in Sweden in 2021, with the the only

output from that process being H2O.

With Macarthur’s high grade 1.3 billion tonne

magnetite resource, it aims to take advantage of the coming

structural shift in global iron ore market and help lead

Australia’s contribution to a cleaner steel future.

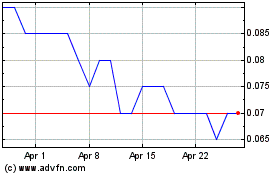

Share Price

Both ASX and TSXV continue to demonstrate

reasonably synchronised share price trading patterns for MIO and

MMS. Although Macarthur’s share price has pulled back over the

fourth quarter, this is not an anomaly that is specific to

Macarthur, as it reflects the broader patterns and impacts felt

across the entire iron ore industry following the pull-back in

global prices during Quarter 3 of 2021. Encouragingly, iron ore

prices are still above pre-Covid levels, demonstrating the

resilience of a sector that supplies a critical global resource

necessary for many facets of human endeavour and advancement.

A summary of MIO/MMS trading activity from October to December

2021 is shown

below:https://www.globenewswire.com/NewsRoom/AttachmentNg/fc57d1c5-4be2-4628-8854-60caedb8a065

Andrew Bruton, Chief Executive Officer

of Macarthur Minerals commented:

“The fourth quarter of 2021 was a very active

period for the Company as it moves into the final stage of delivery

for its Feasibility Study in early 2022.

The fundamental value driver for the Company is

its massive 1.3 billion tonne high grade magnetite mineral

resources, and Macarthur’s flagship project at Lake Giles will

provide significant upside potential for shareholders not only in

the near term, but for many decades to come.

The Company has committed to delivering the

Mineral Reserves Statement and the final Feasibility Study outputs

for the Lake Giles Iron Project to the market in accordance with

the timeframes announced in December and has big plans to

accelerate into 2022 with a clear strategy to finance the project

and bring it out of the ground.

For Macarthur shareholders, the most important

takeaway as we enter 2022 is that the structural shift in the

global iron ore market towards high-grade iron ore (and magnetite

in particular) is well and truly ‘on’. Global policy changes and

the realisation amongst producers of lower grade ore that they are

vulnerable to pricing movements have already resulted in very

visible shifts in the strategic positioning of the Company’s

competitors over the last two months.

The market will eventually catch up when it

digests the broader significance of those strategic pivots, and

when it realises that the value of iron ore companies moving

further into the current decade must now be inherently linked to:

(1) product grade; and (2) the new normal of net zero.

As the most technically advanced magnetite

project in the Yilgarn region of Western Australia at present, and

with a high grade, low impurity magnetite product that can

contribute to the global shift towards net zero emissions,

Macarthur is ideally positioned to take advantage of this shift and

help lead Australia’s contribution to a cleaner steel future.

2022 will be an exciting year for the Company as

it focuses on core fundamentals and project delivery. I look

forward to sharing the Company’s progress with you.”

On behalf of the Board of Directors, Mr

Cameron McCall, Chairman

| For more information please contact: |

| |

|

| Joe Phillips |

|

| Managing Director |

|

| +61 7 3221 1796 |

|

| communications@macarthurminerals.com |

|

| |

|

| Investor Relations – Australia |

Investor Relations - Canada |

| Advisir |

Investor Cubed |

| Sarah Lenard, Partner |

Neil Simon, CEO |

| sarah.lenard@advisir.com.au |

+1 647 258 3310 |

| |

info@investor3.ca |

No new informationTo the extent

that this announcement contains references to prior exploration

results and Mineral Resource estimates, which have been cross

referenced to previous market announcements (including supporting

JORC reporting tables) made by the Company, unless explicitly

stated, no new information is contained in accordance with Table 1

checklist in the JORC Code. The Company confirms that it is not

aware of any new information or data that materially affects the

information included in the relevant market announcements and, in

the case of Mineral Resources that all assumptions and technical

parameters underpinning the estimates in the relevant market

announcement continue to apply and have not materially changed.

Company profileMacarthur is an

iron ore development, gold and lithium exploration company that is

focused on bringing to production its Western Australia iron ore

projects. The Lake Giles Iron Project mineral resources include the

Ularring hematite resource (approved for development) comprising

Indicated resources of 54.5 million tonnes at 47.2% Fe and Inferred

resources of 26 million tonnes at 45.4% Fe; and the Lake Giles

magnetite resource of 53.9 million tonnes (Measured), 218.7 million

tonnes (Indicated) and 997 million tonnes (Inferred). The JORC

reporting tables and Competent Person statement for the magnetite

and hematite mineral resources have previously been disclosed in

ASX market announcements dated 12 August 2020 and 5 December 2019.

Macarthur has (~23.97 square kilometre tenement area) gold, lithium

and copper exploration interests in Pilbara region of Western

Australia. In addition, Macarthur has lithium brine Claims in the

emerging Railroad Valley region in Nevada, USA.

This news release is not for

distribution to United States services or for dissemination in the

United States

Caution Regarding Forward Looking

StatementsCertain of the statements made and information

contained in this press release may constitute forward-looking

information and forward-looking statements (collectively,

“forward-looking statements”) within the meaning of applicable

securities laws. All statements herein, other than statements of

historical fact, that address activities, events or developments

that the Company believes, expects or anticipates will or may occur

in the future, including but not limited to statements regarding

expected completion of the Feasibility Study; conversion of Mineral

Resources to Mineral Reserves or the eventual mining of the

Project, are forward-looking statements. The forward-looking

statements in this press release reflect the current expectations,

assumptions or beliefs of the Company based upon information

currently available to the Company. Although the Company believes

the expectations expressed in such forward-looking statements are

based on reasonable assumptions, such statements are not guarantees

of future performance and no assurance can be given that these

expectations will prove to be correct as actual results or

developments may differ materially from those projected in the

forward-looking statements. Factors that could cause actual results

to differ materially from those in forward-looking statements

include but are not limited to: unforeseen technology changes that

results in a reduction in iron or magnetite demand or substitution

by other metals or materials; the discovery of new large low cost

deposits of iron magnetite; the general level of global economic

activity; failure to complete the FS; inability to demonstrate

economic viability of Mineral Resources; and failure to obtain

mining approvals. Readers are cautioned not to place undue reliance

on forward-looking statements due to the inherent uncertainty

thereof. Such statements relate to future events and expectations

and, as such, involve known and unknown risks and uncertainties.

The forward-looking statements contained in this press release are

made as of the date of this press release and except as may

otherwise be required pursuant to applicable laws, the Company does

not assume any obligation to update or revise these forward-looking

statements, whether as a result of new information, future events

or otherwise.

Macarthur Minerals (TSXV:MMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Macarthur Minerals (TSXV:MMS)

Historical Stock Chart

From Apr 2023 to Apr 2024