As filed with the Securities and Exchange Commission on January 10, 2022

Registration No.: 333-261536

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT No. 1 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ABCO ENERGY, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

20-1914514

|

|

(State or other jurisdiction of incorporation or organization)

|

(Primary Standard Industrial Classification (Code Number)

|

(IRS Employer Identification No.)

|

2505 N. Alvernon Way

Tucson, AZ 85712

(520) 777-0511

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

David Shorey, Chief Executive Officer

2505 Alvernon Way

Tucson, AZ 85712

(520) 777-0511

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Approximate Date of Commencement of Proposed Sale to the Public: from time to time after the effective date of this Registration Statement as determined by market conditions and other factors.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

☐

|

|

Accelerated filer

|

☐

|

|

|

Non-accelerated filer

|

☐

|

(Do not check if a smaller reporting company)

|

Smaller reporting company

|

☒

|

|

|

|

|

|

Emerging Growth Company

|

☒

|

|

If an emerging growth company indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a) (2)(B) of the Securities Act. ☐

|

PRELIMINARY PROSPECTUS

|

SUBJECT TO COMPLETION, DATED JANUARY 10, 2022

|

ABCO Energy, Inc.

150,000,000 Shares of Common Stock

This prospectus relates to the offer and resale of up to 150,000,000 shares of our common stock, par value $0.001 per share, by person or entities which acquire shares during the initial sale of these shares hereunder the Company as a contiguous offering, promptly after the effectiveness of this Registration Statement (within 2 days) and will continue to be offered from such date forward (“Collectively, Effectiveness”).

We will not receive any proceeds from the resale of shares of common stock by purchasers from the Company hereunder. We will, however, receive proceeds from the sale of shares directly by the Selling Shareholders See “Plan of Distribution” below.

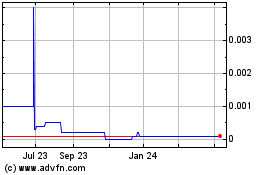

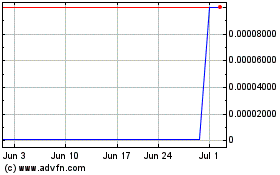

Our common stock is quoted on the OTCPINK Market operated by the OTC Markets Group, Inc., or “OTCPINK,” under the ticker symbol “ABCE.” On December 6, 2021, the average of the high and low sales prices of our common stock was $0.009 per share.

Upon Effectiveness, the shares will sell at $1.00 per share until the Company shares are listed on the OTCQB Market (“OTCQB Listing”) upon the up listing to the OTCQB. Thereafter, the prices at which the Company may sell the shares of Common Stock in this Offering will be determined by the Company for the shares of Common Stock or in negotiated transactions. This Offering will be conducted on a “best-efforts” basis, which means our officers will use their commercially reasonable best efforts in an attempt to offer and sell the Shares. Our officers will not receive any commission or any other remuneration for these sales.

A 20 to 1 Reverse Stock Split became effective with the Financial Industry Regulatory Authority (“Finra”) on January 4, 2021 where upon our common stock began to trade on a reverse split adjusted basis. All common stock per share numbers and prices included herein have been adjusted to reflect this Reverse Stock Split, [other than] audited financial statements. See “Description of Registrant’s Securities to be Registered” herein.

Investing in our common stock involves risks that are described in the “Risk Factors” section beginning on page 4 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is January 2022.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We have not authorized anyone to provide you with different information. We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of shares of our common stock. Our business, financial condition, operating results and prospects may have changed since that date.

GENERAL

As used in this Prospectus, references to “the Company,” “ABCO”, “we”, “our,” “ours” and “us” refer to ABCO Energy, Inc., unless otherwise indicated. In addition, any references to our “financial statements” are to our financial statements except as the context otherwise requires.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in the common stock. You should carefully read the entire Prospectus, including “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Financial Statements, before making an investment decision.

FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K (including the section regarding Management’s Discussion and Analysis.

OVERALL STRATEGIC DIRECTION

The Company is in the Photo Voltaic (PV) solar systems industry, the LED and energy efficient lighting business is a contractor for regular and solar powered air conditioning system (HVAC) and is an electrical product and services supplier. The Company plans to build out a network of operations, through internal growth and acquisitions, in major cities in the USA to establish a national base of PV suppliers, lighting suppliers, HVAC and electrical service operations centers. This combination of services, solar PV, solar AC Systems, lighting and electric, provides the Company with a solid base in the electrical services business and a solid base in the growth markets of solar PV industry and the LED lighting industry.

OVERVIEW

As of September 30,, 2021, we operated in Tucson and Phoenix, Arizona. The Company’s plan is to expand to more locations in North America in the next year as funding becomes available. We believe that the solar and energy efficiency business functions better if the employees are local individuals working and selling in their own community. Our customers have indicated a preference for dealing with local firms and we will continue our focus on company-owned integrated product and services offices. Once a local firm is established, growth tends to come from experience, quality and name recognition. We remain committed to high quality operations.

Our audited statements for the years ended December 31, 2020 and 2019 are presented below with major category details of revenue and expense including the components of operating expenses.

DESCRIPTION OF PRODUCTS

ABCO sells and installs Solar Photovoltaic electric systems that allow the customer to produce their own power on their residence or business property. These products are installed by our crews and are purchased from both USA and offshore manufacturers. We have available and utilize many suppliers of US manufactured solar products from such companies as Photo, Mia Soleil, Canadian Solar, LG and various Korean, German, Italian and Chinese suppliers. In addition, we purchase from several local and regional distributors whose products are readily available and selected for markets and price. ABCO offers solar leasing and long term financing programs from Service Finance Corporation, Green Sky, AEFC and others that are offered to ABCO customers and other marketing and installation organizations.

ABCO also sells and installs energy efficient lighting products, solar powered street lights and lighting accessories. ABCO contracts directly with manufacturers to purchase its lighting products which are sold to residential and commercial customers.

ABCO has Arizona statewide approval as a registered electrical services and solar products installer and as an air conditioning and refrigeration installer. Our license is ROC 258378 electrical and ROC 323162 HVAC and we are fully licensed to offer commercial and residential electrical services, HVAC and solar.

The ABCO subsidiary, Alternative Energy Finance Corporation, (AEFC) a Wyoming Company provides funding for leases of photovoltaic systems. AEFC financed its owned leases from its own cash and now arranges financing with funds provided by other lessors.

ABCO Solar offers solar systems “Operations and Maintenance Services” to residential and commercial customers that have solar systems built by ABCO or other solar installers. Many installers have gone out of business and ABCO’s service enables these customer’s system to continue to operate. ABCO’s service enables customers to maintain their warranties, remove and replace their systems for roof maintenance and to maintain peak efficiency. ABCO now operates and maintains systems in many cities in Arizona and intends to continue to expand this operation and maintenance segment of its business.

COMPETITION

The solar power market itself is intensely competitive and rapidly evolving. Price and available financing are the principal methods of competition in the industry. Based upon these two criteria, our position in the industry is relatively small. There is no competitive data available to us in our competitive position within the industry. Our competitors have established market positions more prominent than ours, and if we fail to attract and retain customers and establish a successful distribution network, we may be unable to achieve sales and market share. There are several major multi-national corporations that produce solar power products, including, Suntech, Sunpower, First Solar, Kyocera, Sharp, GE, Mitsubishi, Solar World AG and Sanyo. Also, established integrators are growing and consolidating, including GoSolar, Sunwize and Sunenergy and we expect that future competition will include new entrants to the solar power market. Further, many of our competitors are developing and are currently producing products based on new solar power technologies that may have costs similar to, or lower than, our projected costs.

COMPETITIVE ADVANTAGES

The Company believes that its key competitive advantages are:

|

1.

|

The ability to make decisions and use management’s many years of business experience to make the right decisions.

|

|

2.

|

Experience with National expansion programs by management.

|

|

3.

|

Experience with management of employee operated facilities from a central management office.

|

|

4.

|

Experience with multi-media promotional program for name recognition and product awareness.

|

|

5.

|

Alternative energy is a fast growing and popular industry that relates well to customers and current or future shareholders that recognize the market, products and business focus.

|

ADVANTAGES OF COMPETITORS OVER US

The Company believes the following are advantages of Competitors over us.

|

1.

|

Larger competitors have more capital.

|

|

2.

|

Larger companies have more experience in the market.

|

|

3.

|

Larger companies will get the larger contracts because of the level of experience.

|

|

4.

|

We have the same products but must pay more because of volume. This will be a price consideration in bidding competition.

|

|

5.

|

We are a small company that may not be able to compete because we do not have experience or working capital adequate to compete with other companies.

|

CURRENT BUSINESS FOCUS

We have developed very good promotional material and advertising products. We have developed the key messages and promotional pieces that are relevant to our business and inexpensive to produce. We have built an informative and interactive web site that will allow people to assess their requirements and partially build and price a system, much like the automobile dealers utilize. Additional sales promotion will increase when we have secured outside financing or increased sales through direct sales efforts. Readers should review our websites at www.abcosolar.com and www.abcoac.com.

ABCO does not manufacture its solar voltaic (PV) products. We will continue to be a sales and installation contractor with plans to enter the markets of major US and international cities. We will sell and use commercial off the shelf components. Initially this will include the solar panels and LED lighting products purchased to our specification. A strong alliance with a well-respected distributor will be the most conservative decision for the company at this time.

FINANCIAL RESOURCES

ABCO’s development activities since inception have been financially sustained through the sale of equity and capital contribution from shareholders. We will continue to source capital from the equity and debt markets in order to fund our plans for expansion if we are unable to produce adequate capital from operations. There is no guarantee that the Company will be able to obtain adequate capital from these sources, or at all.

OVERALL STRATEGIC DIRECTION

The Company is in the Photo Voltaic (PV) solar systems industry, the LED and energy efficient lighting business is a contractor for regular and solar powered air conditioning system (HVAC) and is an electrical product and services supplier. The Company plans to build out a network of operations, through internal growth and acquisitions, in major cities in the USA to establish a national base of PV suppliers, lighting suppliers, HVAC and electrical service operations centers. This combination of services, solar PV, solar AC Systems, lighting and electric, provides the Company with a solid base in the electrical services business and a solid base in the growth markets of solar PV industry and the LED lighting industry.

OVERVIEW

As of December 1, 2021, we operated in Tucson and Phoenix, Arizona. The Company plan is to expand to more locations in North America in the next year as funding becomes available. We believe that the solar and energy efficiency business functions better if the employees are local individuals working and selling in their own community. Our customers have indicated a preference for dealing with local firms and we will continue our focus on company-owned integrated product and services offices. Once a local firm is established, growth tends to come from experience, quality and name recognition. We remain committed to high quality operations.

DESCRIPTION OF PRODUCTS

ABCO sells and installs Solar Photovoltaic electric systems that allow the customer to produce their own power on their residence or business property. These products, installed by our crews, are purchased from both USA and offshore manufacturers. We have available and utilize many suppliers of US manufactured solar products from such companies as Global Solar, Mia Soleil, Canadian Solar and various Korean, German and Chinese suppliers. In addition, we purchase from a number of local and regional distributors whose products are readily available and selected for markets and price. ABCO offers solar leasing and long-term financing programs from Alternative Energy Finance Corporation, Service Finance Company, Green Sky, Sunrun and others that are offered to ABCO customers and other marketing and installation organizations.

ABCO also sells and installs energy efficient lighting products and solar powered street lights, HVAC equipment including solar powered HVAC and lighting accessories. ABCO contracts directly with manufacturers to purchase its products which are sold to residential and commercial customers.

ABCO has Arizona statewide approval as a registered electrical services and solar products installer and is an air conditioner and refrigeration installer. Our Solar Electric license is ROC 258378 and our HVAC license is ROC 323162 and we are fully licensed to offer commercial and residential throughout Arizona. As in all states, we will comply with all licensing requirements of those jurisdictions.

The ABCO subsidiary, Alternative Energy Finance Corporation (AEFC) a Wyoming Company provides funding for leases of photovoltaic systems. AEFC financed its owned leases from its own cash and now arranges financing with funds provided by investors and other lessors.

RISK FACTORS

RISKS RELATED TO OUR BUSINESS

COVID-19 is currently impacting countries, communities, businesses, and markets, as well as global financial conditions and results of operations for 2020 and 2021. We believe that it could have a bearing on our ability to follow through with our business plan for the next 12 months, including our ability to obtain necessary financing.

While acknowledging that the impact of COVID-19 and the new Omicron variant is evolving rapidly and involves uncertainties, the SEC encourages companies to provide disclosures that allow investors to evaluate the current and expected impact of COVID-19 and the new Omicron variant through the eyes of management. The SEC also encourages companies to proactively update disclosures as facts and circumstances change. To that end, we have endeavored to address, where applicable, how COVID-19 and the new Omicron variant have impacted our financial conditions in the MD&A. We do not know how COVID-19 and the new Omicron variant will impact future operating results and our long term financial condition. We have indicated what our overall liquidity position is now, but we cannot predict the long term outlook. COVID-19 has had a negative effect on fund raising and both may have a negative effect on our ability to service our debt on a timely basis. We do not currently anticipate any material impairment including increases in allowances for bad debt, restructuring charges or other changes which could have a material impact on our financial statements on a timely basis. We do not expect to experience any significant challenges to implementing our business continuity plans nor do we expect COVID-19 to materially affect the demand for our services nor do we see any material change in the relationship between cost and services. The supply chain disruption and the new Omicron variant have not had any significant effect on our operations to date.

The Company has a twelve year operating history upon which to base an evaluation of its business and prospects. We may not be successful in our efforts to grow our business and to earn increased revenues. An investment in our securities represents significant risk and you may lose all or part of your entire investment.

Our business must be considered in light of the risks, expenses and difficulties frequently encountered by companies in our stage of operations, particularly providing services in the well-serviced solar installation service industry. As a result, management may be unable to adjust its spending in a timely manner to compensate for any unexpected revenue shortfall. This inability could cause losses in a given period to be greater than expected.

Since incorporation, we have expended financial resources on the development of our business. As a result, some losses have been incurred. Management anticipates that losses may increase from current levels because the Company expects to incur additional costs and expenses related to: expansion of operations; marketing and promotional activities for business sales; addition of new personnel; and the development of relationships with strategic business partners.

The Company’s ability to sustain profitable operations depends on its ability to generate and sustain sales while maintaining reasonable expense levels. We cannot be certain that we will be able to sustain or increase profitability on a quarterly or annual basis in the future.

Management expects both quarterly and annual operating results to fluctuate significantly in the future. Because our operating results will be volatile and difficult to predict, in some future quarter our operating results may fall below the expectations of securities analysts and investors. If this occurs, the trading price of our common stock may decline significantly. The Company’s operating results are not followed by securities analysts at this time and there is no guarantee that the stock will be followed by securities analysts in the future. A number of factors will cause gross margins to fluctuate in future periods. Factors that may harm our business or cause our operating results to fluctuate include the following: (1) the inability to obtain advertisers at reasonable cost; (2) the ability of competitors to offer new or enhanced services or products; (3) price competition; the failure to develop marketing relationships with key business partners; (4) increases in our marketing and advertising costs; (5) the amount and timing of operating costs and capital expenditures relating to expansion of operations; (6) a change to or changes to government regulations; (7) a general economic slowdown. Any change in one or more of these factors could reduce our ability to earn and grow revenue in future periods.

OUR CURRENT BUSINESS OPERATIONS RELY HEAVILY UPON OUR KEY EMPLOYEE, DAVID SHOREY.

We have been heavily dependent upon the expertise and management of Mr. David Shorey, President, and our future performance will depend upon his continued services. The loss of the services of Mr. Shorey could seriously interrupt our business operations and could have a very negative impact on our ability to fulfill our business plan and to carry out our existing operations. The Company currently does not maintain key man life insurance on this individual. There can be no assurance that a suitable replacement could be found for him upon retirement, resignation, inability to act on our behalf, or death.

RISKS RELATED TO THE INDUSTRY

THE DEMAND FOR PRODUCTS REQUIRING SIGNIFICANT INITIAL CAPITAL EXPENDITURES SUCH AS OUR SOLAR POWER PRODUCTS AND SERVICES ARE AFFECTED BY GENERAL ECONOMIC CONDITIONS.

The United States and countries worldwide have recently experienced a period of declining economies and turmoil in financial markets. A sustained economic recovery is uncertain. In particular, terrorist acts and similar events, continued unrest in the Middle East or war in general could contribute to a slowdown of the market demand for products that require significant initial capital expenditures, including demand for solar power systems and new residential and commercial buildings. In addition, increases in interest rates may increase financing costs to customers, which in turn may decrease demand for our solar power products. If an economic recovery is slowed as a result of the recent economic, political and social events, or if there are further terrorist attacks in the United States or elsewhere, we may experience decreases in the demand for our solar power products, which may harm our operating results.

IF THERE IS A SHORTAGE OF COMPONENTS AND/OR KEY COMPONENTS RISE SIGNIFICANTLY IN PRICE THAT MAY CONSTRAIN OUR REVENUE GROWTH.

The market for photovoltaic installations has continued to grow despite world-wide financial and economic issues. The introduction of significant production capacity has continued and has increased supply and reduced the cost of solar panels. If demand increases and supply contracts, the resulting likely price increase could adversely affect sales and profitability. From 2009 through 2014, there was a tremendous increase in the capacity to produce solar modules, primarily from China, which coupled with the worst economic downturn in nearly a century, significantly reduced the price of solar panels. As demand for solar panels will likely increase with an economic recovery, demand and pricing for solar modules could increase, potentially limiting access to solar modules and reducing our selling margins for panels.

EXISTING REGULATIONS AND POLICIES AND CHANGES TO THESE REGULATIONS AND POLICIES MAY PRESENT TECHNICAL, REGULATORY AND ECONOMIC BARRIERS TO THE PURCHASE AND USE OF SOLAR POWER PRODUCTS, WHICH MAY SIGNIFICANTLY REDUCE DEMAND FOR OUR PRODUCTS.

The market for electricity generation is heavily influenced by foreign, U.S. federal, state and local government regulations and policies concerning the electric utility industry, as well as policies promulgated by electric utilities. These regulations and policies often relate to electricity pricing and technical interconnection of customer-owned electricity generation. In the U.S. these regulations and policies are being modified and may continue to be modified. Customer purchases of or further investment in the research and development of alternative energy sources, including solar power technology, could be deterred by these regulations and policies, which could result in a significant reduction in the potential demand for our solar power products, for example, without certain major incentive programs and or the regulatory mandated exception for solar power systems, utility customers are often charged interconnection or standby fees for putting distributed power generation on the electric utility network. These fees could increase the cost to our customers of using our solar power products and make them less desirable, thereby harming our business, prospects, results of operations and financial condition.

We anticipate that our solar power products and their installation will be subject to oversight and regulation in accordance with national and local ordinances relating to building codes, safety, and environmental protection, utility interconnection and metering and related matters. It is difficult to track the requirements of individual states and design equipment to comply with the varying standards. Any new government regulations or utility policies pertaining to our solar power products may result in significant additional expenses to us and our resellers and their customers and, as a result, could cause a significant reduction in demand for our solar power products.

THE REDUCTION, ELIMINATION OR EXPIRATION OF GOVERNMENT SUBSIDIES AND ECONOMIC INCENTIVES FOR ON-GRID SOLAR ELECTRICITY APPLICATIONS COULD REDUCE DEMAND FOR SOLAR PV SYSTEMS AND HARM OUR BUSINESS.

The market for solar energy applications depends in large part on the availability and size of local, state and federal government and economic incentives that vary by geographic market. The reduction, elimination or expiration of government subsidies and economic incentives for solar electricity may negatively affect the competitiveness of solar electricity relative to conventional and non-solar renewable sources of electricity and could harm or halt the growth of the solar electricity industry and our business.

The cost of solar power currently is less than retail electricity rates in most markets, and we believe solar will continue to do so for the foreseeable future. As a result, federal, state and local government bodies, the United States has provided incentives in the form of feed-in tariffs, or FITs, rebates, tax credits and other incentives to system owners, distributors, system integrators and manufacturers of solar PV systems to promote the use of solar electricity in on-grid applications and to reduce dependency on other forms of energy. Many of these government incentives expire, phase out over time, terminate upon the exhaustion of the allocated funding or require renewal by the applicable authority. In addition, electric utility companies or generators of electricity from other non-solar renewable sources of electricity may successfully lobby for changes in the relevant legislation in their markets that are harmful to the solar industry. Reductions in, or eliminations or expirations of, governmental incentives could result in decreased demand for and lower revenue from solar PV systems, which would adversely affect sales of our products.

OUR SUCCESS DEPENDS, IN PART, ON THE QUALITY AND SAFETY OF THE SERVICES WE PROVIDE.

We do not manufacture our own products. We can and do use a variety of products and do not have a commitment to any single manufacturer. We do not warranty our products because this is the responsibility of the manufacturer. However, we do warranty our installation workmanship and could suffer loss of customer referrals and reputation degradation if our quality workmanship is not maintained.

WE MAY NEED ADDITIONAL CAPITAL TO DEVELOP OUR BUSINESS.

The development of our services will require the commitment of resources to increase the advertising, marketing and future expansion of our business. In addition, expenditures will be required to enable us in 2021 and 2022 to conduct planned business research, development of new affiliate and associate offices, and marketing of our existing and future products and services. Currently, we have no established bank-financing arrangements. Therefore, it is possible that we would need to seek additional financing through subsequent future private offering of our equity securities, or through strategic partnerships and other arrangements with corporate partners.

We cannot give any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us. The sale of additional equity securities could result in dilution to our stockholders. Sales of existing shareholders of the common stock and preferred stock in the public market could adversely affect prevailing market prices and could impair the Company’s future ability to raise capital through the sale of the equity securities. The incurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financing covenants that would restrict our compensation. If adequate, additional financing is not available on acceptable terms, we may not be able to implement our business development plan or continue our business operations.

OUR LIABILITY INSURANCE MAY NOT BE ADEQUATE IN A CATASTROPHIC SITUATION.

We currently maintain property damage insurance in the aggregate amount of approximately $500,000. We currently maintain liability insurance of up to $5,000,000 and product liability insurance up to $4,000,000. Material damage to, or the loss to our facilities or equipment due to fire, severe weather, flood or other catastrophe, even if insured against, could result in a significant loss to the Issuer.

THE SERVICES WE INTEND TO PROVIDE TO CUSTOMERS MAY NOT GAIN MARKET ACCEPTANCE, WHICH WOULD PREVENT US FROM ACHIEVING SALES AND MARKET SHARE.

The market for solar power is emerging and rapidly evolving, and its future success is uncertain. If solar power technology proves unsuitable for widespread commercial deployment or if demand for solar power products fails to develop sufficiently, we would be unable to achieve sales and market share. In addition, demand for solar power in the markets and geographic regions we target may not develop or may develop more slowly than we anticipate. Many factors may influence the widespread adoption of solar power technology and demand for solar power, including:

|

|

●

|

Performance and reliability of solar power products as compared with conventional and non-solar alternative energy products

|

|

|

●

|

Cost-effectiveness of solar power technologies as compared with conventional and competitive alternative energy technologies;

|

|

|

●

|

Success of alternative distributed generation technologies such as hydrogen fuel cells, wind turbines, bio-diesel generators and large-scale solar thermal technologies;

|

|

|

●

|

Fluctuations in economic and market conditions that impact the viability of conventional and competitive alternative energy sources;

|

|

|

●

|

Increases or decreases in the prices of oil, coal and natural gas;

|

|

|

●

|

Capital expenditures by customers, who tend to decrease when domestic or foreign economies slow; and

|

|

|

●

|

Continued deregulation of the electric power industry and broader energy industry

|

WE FACE INTENSE COMPETITION FROM OTHER SYSTEM INTEGRATORS AND OTHER ENERGY GENERATION PRODUCTS. IF WE FAIL TO COMPETE EFFECTIVELY, WE MAY BE UNABLE TO INCREASE OUR MARKET SHARE AND SALES.

The mainstream power generation market and related product sectors are well established and we are competing with power generation from more traditional process that can generate power at lower costs than most renewable or environmentally driven processes. Further, within the renewable power generation and technologies markets we face competition from other methods of producing renewable or environmentally positive power. Then, the solar power market itself is intensely competitive and rapidly evolving. Our competitors have established market positions more prominent than ours, and if we fail to attract and retain customers, we may be unable to achieve sales and market share. There are a number of major multi-national corporations that provide solar installation services such as REC, Solar City and Sunpower Corporation. Established integrators are growing and consolidating, including GoSolar, Sunwize, Sunenergy and Real Good Solar and we expect that future competition will include new entrants to the solar power market. Further, many of our competitors are developing and are currently providing products based on new solar power technologies that may have costs similar to, or lower than, our projected costs.

Some of our competitors are substantially larger than we are, have longer operating histories and have substantially greater financial, technical, manufacturing and other resources than we do. Our competitors’ greater sizes in some cases provides them with competitive advantages with respect to manufacturing costs and the ability to allocate costs across a greater volume of production and purchase raw materials at lower prices. They also have far greater name recognition, an established distribution network and an installed base of customers. In addition, many of our competitors have well-established relationships with current and potential resellers, which have extensive knowledge of our target markets. As a result, our competitors will be able to devote greater resources to the research, development, promotion and sale of their products and may be able to respond more quickly to evolving industry standards and changing customer requirements than we can.

WE HAVE CHOSEN TO BECOME A REPORTING COMPANY UNDER THE SECURITIES EXCHANGE ACT OF 1934 (“1934 ACT”) IN COMPLIANCE WITH GOVERNANCE AND ACCOUNTING REQUIREMENTS HAS BEEN EXPENSIVE AND WE MAY NOT BE ABLE TO CONTINUE TO ABSORB SUCH COSTS.

We have incurred significant costs associated by our becoming a company under the 1934 Act for reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the SEC. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs. In addition, we may not be able to absorb these costs of being a public company, which will negatively affect our business operations.

THE LIMITED PUBLIC COMPANY EXPERIENCE OF OUR MANAGEMENT TEAM MAY ADVERSELY IMPACT OUR ABILITY TO COMPLY WITH THE REPORTING REQUIREMENTS OF U.S. SECURITIES LAWS.

We have elected to become a reporting company under the Act of 1934. Our management team has limited public company experience, which could impair our ability to comply with legal and regulatory requirements such as those imposed by Sarbanes-Oxley Act of 2002. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our senior management may not be able to implement programs and policies in an effective and timely manner that adequately respond to such increased legal, regulatory compliance and reporting requirements, including the establishing and maintaining internal controls over financial reporting. Any such deficiencies, weaknesses or lack of compliance could have a materially adverse effect on our ability to comply with the reporting requirements, which may be necessary in the future to maintain our public company status. If we were to fail to fulfill those obligations, our ability to continue as a public company would be in jeopardy.

RISKS RELATED TO THE OWNERSHIP OF OUR SECURITIES AND RISKS RELATED TO THIS OFFERING.

WE MAY NEVER PAY ANY DIVIDENDS TO SHAREHOLDERS.

We have never declared or paid any cash dividends or distributions on our common stock. We currently intend to retain our future earnings, if any, to support operations and to finance expansion and therefore we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

The declaration, payment and amount of any future dividends will be made at the discretion of the board of directors, and will depend upon, among other things, the results of our operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and, if dividends are paid, there is no assurance with respect to the amount of any such dividend.

OUR CONTROLLING SECURITY HOLDERS MAY TAKE ACTIONS THAT CONFLICT WITH YOUR INTERESTS.

Mr. David Shorey, President, CEO, CFO and Secretary, own collectively more than 65% of our common and preferred stock voting rights. In this case, he will be able to exercise control over all matters requiring stockholder approval, including the election of directors, amendment of our certificate of incorporation and approval of significant corporate transactions, and they will have significant control over our management and policies.

The directors elected by our controlling security holders will be able to significantly influence decisions affecting our capital structure. This control may have the effect of delaying or preventing changes in control or changes in management, or limiting the ability of our other security holders to approve transactions that they may deem to be in their best interest. For example, our controlling security holders will be able to control the sale or other disposition of our operating businesses and subsidiaries to another entity.

OUR COMMON STOCK IS CONSIDERED PENNY STOCK, WHICH MAY BE SUBJECT TO RESTRICTIONS ON MARKETABILITY, SO YOU MAY NOT BE ABLE TO SELL YOUR SHARES.

Our common stock is tradable in the secondary market but we are subject to the penny stock rules adopted by the SEC that require brokers to provide extensive disclosure to their customers prior to executing trades in penny stocks. These disclosure requirements may cause a reduction in the trading activity of our common stock, which in all likelihood would make it difficult for our shareholders to sell their securities.

Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the FINRA system). Penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. The broker-dealer must also make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security that becomes subject to the penny stock rules. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from effecting transactions in our securities, which could severely limit the market price and liquidity of our securities. These requirements may restrict the ability of broker-dealers to sell our common stock and may affect your ability to resell our common stock.

THERE IS NO ASSURANCE OF A PUBLIC MARKET ON A RECOGNIZED EXCHANGE. THEREFORE, YOU MAY BE UNABLE TO LIQUIDATE YOUR INVESTMENT IN OUR STOCK.

There is a limited established public trading market for our common stock. On October 14, 2021, the Company common stock was delisted from the OTCQB to the OTC Pink market for failure to meet the closing bid price requirement that the shares close at or above $0.01 for 30 consecutive trading days. [“Trading Day Requirement”] Since January 4, 2021, the Company has continued to meet the Trading Day Requirement but the Company has now re-applied for listing again on the OTCQB. There can be no assurance that the Company can continue to meet the $0.01 requirement or that a regular trading market will be sustained. In the absence of a trading market, an investor may be unable to liquidate their investment.

WE ARE AN “EMERGING GROWTH COMPANY” AND WE CANNOT BE CERTAIN IF THE REDUCED DISCLOSURE REQUIREMENTS APPLICABLE TO EMERGING GROWTH COMPANIES WILL MAKE OUR COMMON STOCK LESS ATTRACTIVE TO INVESTORS.

We are an “emerging growth company,” as defined in the Jumpstart our Business Startups Act of 2012, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we will rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

Unless the Jumpstart Our Business Startups Act, “emerging growth companies” can delay adopting new or revised accounting standards, and until such time as those standards apply to private companies, we have elected to avail ourselves to this exemption from new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not “emerging growth companies.”

CAUTIONARY STATEMENT ON FORWARD-LOOKING STATEMENTS

This prospectus may contain certain “forward-looking” statements as such term is defined by the Securities and Exchange Commission in its rules, regulations and releases, which represent the registrant’s expectations or beliefs, including but not limited to, statements concerning the registrant’s operations, economic performance, financial condition, growth and acquisition strategies, investments, and future operational plans. For this purpose, any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intent,” “could,” “estimate,” “might,” “plan,” “predict” or “continue” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. These statements by their nature involve substantial risks and uncertainties, certain of which are beyond the registrant’s control, and actual results may differ materially depending on a variety of important factors, including uncertainty related to acquisitions, governmental regulation, managing and maintaining growth, the operations of the company and its subsidiaries, volatility of stock price, commercial viability of OTEC systems and any other factors discussed in this and other registrant filings with the Securities and Exchange Commission.

These risks and uncertainties and other factors include but are not limited to those set forth under “Risk Factors” of this prospectus. Given these risks and uncertainties, readers are cautioned not to place undue reliance on our forward-looking statements. All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Except as otherwise required by applicable law, we undertake no obligation to publicly update or revise any forward-looking statements or the risk factors described in this prospectus or in the documents we incorporate by reference, whether as a result of new information, future events, changed circumstances or any other reason after the date of this prospectus.

Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described in prospectus generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this prospectus will in fact occur. We caution you not to place undue reliance on these forward-looking statements. In addition to the information expressly required to be included in this prospectus, we will provide such further material information, if any, as may be necessary to make the required statements, in light of the circumstances under which they are made, not misleading.

These risks and uncertainties and other factors include, but are not limited to, those set forth under “Risk Factors.” All subsequent written and oral forward-looking statements, attributable to the company or to persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Except as required by federal securities laws, we do not intend to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

OFFERING SUMMARY

|

Common stock that may be offered by selling stockholder

|

|

150,000,000 shares

|

|

|

|

|

|

Common stock outstanding before this offering

|

|

245,308,636 shares (as of December 31, 2021) (1)

|

|

|

|

|

|

Common stock outstanding after offering

|

|

245,308,636 shares (1)

|

|

|

|

|

|

Use of proceeds

|

|

Management will have broad discretion in the allocation of the proceeds of this Offering. See “Net Proceeds”.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For further information, see “The Offering” beginning on page 12.

|

|

|

|

|

|

|

|

The Selling Shareholders may, from time to time, sell any or all of their shares of common stock at a price of $1.00 per share until the shares are listed on OTCQB. Thereafter these sales may be at fixed or negotiated prices, or on the stock exchange, market or trading facility on which the shares are traded, or in private transactions, etc.

|

|

|

|

|

|

Plan of Distribution

|

|

For further information, see “Plan of Distribution” beginning on page 20.

|

|

|

|

|

|

Risk factors

|

|

You should read the “Risk Factors” section of this prospectus and the other information in this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock.

|

(1) Includes the issuance of all of the 150,000,000 shares offered hereby.

SUMMARY FINANCIAL INFORMATION

The following table summarizes our financial data. We have derived the Consolidated Balance Sheet data as of December 31, 2020 and 2019 from our audited consolidated financial statements included elsewhere in this prospectus. We prepare our financial statements in accordance with U.S. generally accepted accounting principles (GAAP). Our historical results are not necessarily indicative of the results that should be expected in the future. The summary of our consolidated financial data set forth below should be read together with our consolidated financial statements and the related notes, as well as “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” included elsewhere in this prospectus.

|

ABCO Energy, Inc.

|

|

As of September 30,

|

|

|

As of December 31,

|

|

|

Consolidated Condensed Balance Sheets

|

|

2021

|

|

|

2020

|

|

|

2019

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

$

|

275,973

|

|

|

$

|

416,490

|

|

|

$

|

376,282

|

|

|

Fixed Assets

|

|

|

374,967

|

|

|

|

393,887

|

|

|

|

354,938

|

|

|

Other Assets

|

|

|

3,759

|

|

|

|

3,995

|

|

|

|

9,336

|

|

|

Total Assets

|

|

$

|

654,699

|

|

|

$

|

814,372

|

|

|

$

|

740,556

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities & Stockholder’s Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities

|

|

$

|

2,032,354

|

|

|

$

|

2,398,499

|

|

|

$

|

2,234,382

|

|

|

Preferred stock

|

|

|

27,800

|

|

|

|

30,000

|

|

|

|

30,000

|

|

|

Common stock issued and outstanding

|

|

|

70,462

|

|

|

|

15,702

|

|

|

|

886

|

|

|

Additional Paid in Capital in Excess of Par $.001

|

|

|

5,819,645

|

|

|

|

5,456,438

|

|

|

|

5,036,796

|

|

|

Retained Deficit

|

|

|

(7,295,562

|

)

|

|

|

(7,086,267

|

)

|

|

|

(6,561,508

|

)

|

|

Total Stockholder’s equity

|

|

|

(1,377,655

|

)

|

|

|

(1,584,127

|

)

|

|

|

(1,493,826

|

)

|

|

Total liabilities and Stockholder’s Equity

|

|

$

|

654,699

|

|

|

$

|

814,372

|

|

|

$

|

740,556

|

|

|

ABCO Energy, Inc.

|

|

For the Nine Months Ended

September 30,

|

|

|

For the 12 Months Ended December 31,

|

|

|

Consolidated Statement of Operations

|

|

2021

|

|

|

2020

|

|

|

2019

|

|

|

Sales revenue

|

|

$

|

998,228

|

|

|

$

|

1,161,106

|

|

|

$

|

2,352,167

|

|

|

Cost of sales

|

|

|

619,173

|

|

|

|

784,730

|

|

|

|

1,701,353

|

|

|

Gross Margin

|

|

|

379,055

|

|

|

|

376,376

|

|

|

|

650,814

|

|

|

Operating expenses

|

|

|

(697,591

|

)

|

|

|

(846,640

|

)

|

|

|

(1,113,398

|

)

|

|

Net Income (loss) from operations

|

|

|

(318,536

|

)

|

|

|

(470,264

|

)

|

|

|

(462,584

|

)

|

|

Other expenses Interest and derivative accruals

|

|

|

109,241

|

|

|

|

(54,495

|

)

|

|

|

(918,493

|

)

|

|

Net Income (loss)

|

|

$

|

(209,295

|

)

|

|

$

|

(524,759

|

)

|

|

$

|

(1,381,077

|

)

|

USE OF PROCEEDS

We will not receive any proceeds from the resale of the common stock by the purchasers of common stock sold hereunder. However, we will receive proceeds from the sale of shares of our common stock pursuant to this Prospectus. We will use these proceeds for general corporate and working capital purposes, or for other purposes that our Board of Directors, in its good faith, deems to be in the best interest of our Company. We have agreed to bear the expenses relating to the registration of the offer and resale by the selling stockholder of the shares being offered hereby.

THE OFFERING

The Company may offer up to 150,000,000 shares of our common stock, par value $0.001 per share, pursuant to this prospectus.

DIVIDEND POLICY

We have never paid or declared any dividends on our shares. Moreover, even if future operations were to lead to significant levels of profits that would allow us to pay dividends, we currently intend to retain all available funds for reinvestment in our business. Any decision to declare and pay dividends in the future will be made pursuant to a resolution by our board of directors, and will depend on, among other things, our results of operations, financial condition, future prospects, contractual restrictions, restrictions imposed by applicable law and other factors our board of directors and general meeting of shareholders may deem relevant.

DILUTION

“Dilution” represents the difference between the offering price of the shares of common stock and the net tangible book value per share of common stock immediately after completion of the offering. “Net tangible book value” is the amount that results from subtracting total liabilities from total tangible assets. As of December 31, 2020, our Company had a negative book value of $(1,377,655), which represents approximately $(.02) per share post-split, based upon shares outstanding of 70,462,489. This is due in part to shares of common stock issued upon conversion of certain promissory notes during the fiscal years ended December 31, 2020 and December 31, 2019.

Please refer to the section entitled “Interest of Management and others in Certain Transactions” for more information. Assuming all shares offered are sold at an assumed offering price of $.02 and in effect we receive the maximum estimated proceeds of this offering, our total shareholders’ equity will be approximately $1,322,345 and our net book value will be approximately $.006 per share. Therefore, any investor will incur an immediate dilution of approximately $(.014) per share. Our present shareholders will receive an increase of $.026. This will result in a 70% increase for 100% of offering. If 10% of the offering is sold, any investor will incur an immediate dilution of approximately $(.013) per share. Our present shareholders will receive an increase of $.007 per share. This will result in a 65 % increase for 10% of the offering. The following table illustrates the dilution to the purchaser of the common stock in this offering assuming the maximum proceeds or the minimum proceeds are raised and that the total outstanding shares at September 30 , 2021 was 70,462,489 shares.

These numbers are calculated on Post Reverse 1 for 170 reverse split calculated at January 4, 2021

|

Description

|

|

For 100%

No. of Shares

|

|

|

Amount for 100%

|

|

|

For 10%

No. of Shares

|

|

|

Amount for 10%

|

|

|

Book Value Calculation:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net stockholders’ equity at September 30, 2021

|

|

|

70,262,489

|

|

|

$

|

(1,377,655

|

)

|

|

|

70,462,489

|

|

|

$

|

(1,377,655

|

)

|

|

Offering amount

|

|

|

150,000,000

|

|

|

|

3,000,000

|

|

|

|

15,000,000

|

|

|

|

300,000

|

|

|

Offering expenses

|

|

|

|

|

|

|

300,000

|

|

|

|

|

|

|

|

30,000

|

|

|

Book value after offering

|

|

|

|

|

|

|

1,322,345

|

|

|

|

|

|

|

|

(1,107,655

|

)

|

|

Total shares

|

|

|

220,462,489

|

|

|

|

|

|

|

|

85,462,489

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Offering Price Per Share

|

|

|

|

|

|

$

|

.02

|

|

|

|

|

|

|

$

|

.02

|

|

|

Book value before Offering (Per Share)

|

|

|

|

|

|

|

(020

|

)

|

|

|

|

|

|

|

(.020

|

)

|

|

Book value after Offering (Per Share)

|

|

|

|

|

|

|

.006

|

|

|

|

|

|

|

|

(.013

|

)

|

|

Increase per share attributable to New Stockholders

|

|

|

|

|

|

|

.026

|

|

|

|

|

|

|

|

.007

|

|

|

Dilution in offering price based upon new book value per share

|

|

|

|

|

|

|

.014

|

|

|

|

|

|

|

|

.013

|

|

|

Dilution as percentage of purchase price

|

|

|

|

|

|

|

70

|

%

|

|

|

|

|

|

|

65

|

%

|

Officers and Directors acquired 26,509,442 shares from providing of services or cash investment or both when the Company was founded and thereafter. Mr. Marx, a former Director, purchased his initial 1,000,000 shares for $50,000 and this calculates to be $0.05 per share. Thereafter, Mr. Shorey and Mr. Marx were issued various shares which after reverse split, total 9,412 and 30 shares respectively. On January 9, 2021 Mr. Shorey was awarded 3,500,000 shares and Mr. Marx was awarded 1,000,000 shares for services rendered. As of the date of this offering, Mr. Shorey is the beneficial owner of 25,509,412 shares and Mr. Marx owns 1,000,030shares of common stock. After completion of 100% of the offering, Company officers, directors, promoters and affiliated persons will own less than 12%of the outstanding shares of common stock. After completion of 10% of the offering, Company officers, directors, promoters and affiliated persons will own 65% of the outstanding shares of common stock.

DETERMINATION OF OFFERING PRICE

The Company will sell our shares at privately negotiated prices. See “Plan of Distribution”.

DESCRIPTION OF BUSINESS

OVERALL STRATEGIC DIRECTION

The Company is in the Photo Voltaic (PV) solar systems industry, the LED and energy efficient lighting business is a dealer for a solar powered air conditioning system (HVAC) and is an electrical product and services supplier. The Company plans to build out a network of operations, through internal growth and acquisitions, in major cities in the USA to establish a national base of PV suppliers, lighting suppliers, HVAC and electrical service operations centers. This combination of services, solar PV, solar AC Systems, lighting and electric, provides the Company with a solid base in the electrical services business and a solid base in the growth markets of solar PV industry and the LED lighting industry.

OVERVIEW

As of September 30, 2020, we operated in Tucson and Phoenix, Arizona. The Company’s plan is to expand to more locations in North America in the next year as funding becomes available. We believe that the solar and energy efficiency business functions better if the employees are local individuals working and selling in their own community. Our customers have indicated a preference for dealing with local firms and we will continue our focus on company-owned integrated product and services offices. Once a local firm is established, growth tends to come from experience, quality and name recognition. We remain committed to high quality operations.

Our audited statements for the years ended December 31, 2020 and 2019 are presented below with major category details of revenue and expense including the components of operating expenses.

DESCRIPTION OF PRODUCTS

ABCO sells and installs Solar Photovoltaic electric systems that allow the customer to produce their own power on their residence or business property. These products are installed by our crews and are purchased from both USA and offshore manufacturers. We have available and utilize many suppliers of US manufactured solar products from such companies as Peimar, Mia Soleil, Canadian Solar, Boviet, Westinghouse Solar and various Korean, German, Italian and Chinese suppliers. In addition, we purchase from several local and regional distributors whose products are readily available and selected for markets and price. ABCO offers solar leasing and long term financing programs from Service Finance Corporation, Green Sky, AEFC and others that are offered to ABCO customers and other marketing and installation organizations.

ABCO also sells and installs energy efficient lighting products, solar powered street lights and lighting accessories. ABCO contracts directly with manufacturers to purchase its lighting products which are sold to residential and commercial customers.

ABCO has Arizona statewide approval as a registered electrical services and solar products installer and as an air conditioning and refrigeration installer. Our license is ROC 258378 electrical and ROC 323162 HVAC and we are fully licensed to offer commercial and residential electrical services, HVAC and solar.

The ABCO subsidiary, Alternative Energy Finance Corporation, (AEFC) a Wyoming Company provides funding for leases of photovoltaic systems. AEFC financed its owned leases from its own cash and now arranges financing with funds provided by other lessors.

ABCO Solar offers solar systems “Operations and Maintenance Services” to residential and commercial customers that have solar systems built by ABCO or other solar installers. Many installers have gone out of business and ABCO’s service enables these customer’s system to continue to operate. ABCO’s service enables customers to maintain their warranties, remove and replace their systems for roof maintenance and to maintain peak efficiency. ABCO now operates and maintains systems in many cities in Arizona and intends to continue to expand this operation and maintenance segment of its business.

COMPETITION

The solar power market itself is intensely competitive and rapidly evolving. Price and available financing are the principal methods of competition in the industry. Based upon these two criteria, our position in the industry is relatively small. There is no competitive data available to us in our competitive position within the industry. Our competitors have established market positions more prominent than ours, and if we fail to attract and retain customers and establish a successful distribution network, we may be unable to achieve sales and market share. There are several major multi-national corporations that produce solar power products, including, Suntech, Sunpower, First Solar, Kyocera, Sharp, GE, Mitsubishi, Solar World AG and Sanyo. Also, established integrators are growing and consolidating, including GoSolar, Sunwize and Sunenergy and we expect that future competition will include new entrants to the solar power market. Further, many of our competitors are developing and are currently producing products based on new solar power technologies that may have costs similar to, or lower than, our projected costs.

COMPETITIVE ADVANTAGES

The Company believes that its key competitive advantages are:

|

1.

|

The ability to make decisions and use management’s many years of business experience to make the right decisions.

|

|

2.

|

Experience with National expansion programs by management.

|

|

3.

|

Experience with management of employee operated facilities from a central management office.

|

|

4.

|

Experience with multi-media promotional program for name recognition and product awareness.

|

|

5.

|

Alternative energy is a fast growing and popular industry that relates well to customers and current or future shareholders that recognize the market, products and business focus.

|

ADVANTAGES OF COMPETITORS OVER US

The Company believes the following are advantages of Competitors over us.

|

1.

|

Larger competitors have more capital.

|

|

2.

|

Larger companies have more experience in the market.

|

|

3.

|

Larger companies will get the larger contracts because of the level of experience.

|

|

4.

|

We have the same products but must pay more because of volume. This will be a price consideration in bidding competition

|

|

5.

|

We are a small company that may not be able to compete because we do not have experience or working capital adequate to compete with other companies.

|

CURRENT BUSINESS FOCUS

We have developed very good promotional material and advertising products. We have developed the key messages and promotional pieces that are relevant to our business and inexpensive to produce. We have built an informative and interactive web site that will allow people to assess their requirements and partially build and price a system, much like the automobile dealers utilize. Additional sales promotion will increase when we have secured outside financing or increased sales through direct sales efforts. Readers should review our websites at www.abcosolar.com and www.abcoac.com.

We have established a direct sales force to sell to Government agencies including State, Local and Federal resources and a separate division to call on the many American Indian governments in the US. This allows us to quote with our specifications, products and services on Requests for Proposals (RFP’s) that are issued by the Government Services Agency (GSA), Bureau of Indian Affairs (BIA) and other agencies. We have found that many projects are not known to the general public and most contractors because governmental agencies do not widely advertise their projects. By departmentalizing this opportunity, we get more information on projects than is available in the normal course of business.

ABCO does not manufacture its solar voltaic (PV) products. We will continue to be a sales and installation contractor with plans to enter the markets of major US and international cities. We will sell and use commercial off the shelf components. Initially this will include the solar panels and LED lighting products purchased to our specification. A strong alliance with a well-respected distributor will be the most conservative decision for the company at this time.

ABCO will contract directly with manufacturers for its Solar Street Light and other lighting products and will sell, install and maintain these products.

Our business and the industry are reliant upon several state and federal programs to assist our customers in the acquisition of our products and services. Such programs are the utility rebates paid directly to customers for wattage installations and the state and federal tax credit programs that allow a percentage of the actual cost of installations to be refunded in the form of tax credits. Many states have mandated the utilities to collect funds from their customers for the payment of rebates. All of these programs are listed on the website www.dsireusa.org.

Most of these programs are slated for expiration at differing times in the future. The federal tax credit of 30% of installation cost expired at the end of 2019 but will continue at reduced rates through 2024. The 2020 and 2021 rate is 26%. The customers benefit from the federal and state tax credits which pass through to the owners of the solar systems. Investors often require the ownership to remain in their hands so that the tax credits can be passed through to them. This results in a lesser amount to finance and a benefit to the lessee because it lowers the lease payments. To the extent known, the curtailment or reduction of this tax credit will make a material change in our business and will very likely lower our sales prices and gross margins. Extension of the program or small reductions will probably not have a material effect on sales or gross margins because the suppliers will adjust to the new norm. We again emphasize, we cannot predict any of the future or the outcome of unknowns. State rebate mandates and state tax credits are variable by state. All of these programs provide incentives for our customers that result in reduced cost. The price of solar products has also been reduced drastically in the past few years which is helping to balance the reduction of the subsidies.

The State of Arizona subsidized incentives are not material to our programs at this time. Since the State of Arizona offers $1,000 tax credit per residential installation and no utility rebates for residential or commercial installations of solar systems, this amount of credit is not likely to negatively impact our business because it will not materially affect the price of the installation. This amount currently represents less than 5% of the price of an average residential installation.

CUSTOMER BASE

Referrals are important in any market and time in business makes the customer base grow. No customer represented a significant percentage of the Company’s total revenue in the fiscal years ended December 31, 2020 or 2019. The company believes that the knowledge, relationships, reputation and successful track record of its management will help it to build and maintain its customer base.

EXPERIENCED MANAGEMENT

The Company believes that it has experienced management. ABCO’s president, David Shorey, has 12 years of experience in the sales and installation of solar products and more than 40 years of business experience. Mr. Shorey has the ability and experience to attract and hire experienced and talented individuals to help manage the company.

ABCO has several experienced and long term employees on staff with a number of years of experience in provision of electrical services including lighting, HVAC and solar installations. The Company believes that the knowledge, relationships, reputation and successful track record of its management will help it to build and maintain its customer base.

FINANCIAL RESOURCES

ABCO’s development activities since inception have been financially sustained through the sale of equity and capital contribution from shareholders. We will continue to source capital from the equity and debt markets in order to fund our plans for expansion if we are unable to produce adequate capital from operations. There is no guarantee that the Company will be able to obtain adequate capital from these sources, or at all.

EMPLOYEES

The Company presently has 10 full-time employees with four (3) in management, and two (2) in sales and the balance are in various labor crew positions. The Company anticipates that it will need to hire additional employees as the business grows. In addition, the Company may expand the size of our Board of Directors in the future. Mr. Shorey devotes full time (40 plus hours) to the affairs of the Company. No employees are represented by a union and there have not been any work stoppages.

DESCRIPTION OF SECURITIES

Capital Stock

Pursuant to our articles of incorporation, as amended to date, our authorized capital stock consists of 2,100,000,000 shares, comprised of 2,000,000,000 shares of common stock, par value $0.001 per share, and 100,000,000 shares of preferred stock, par value $0.001 per share. As of December 1, 2021, there were 70,462,489 shares of common stock [excluding the 150,000,000 offered hereby] and 27,800,000 shares of preferred stock issued and outstanding. Our common stock is quoted on the OTCPINK operated by the OTC Markets Group, Inc., under the trading symbol “ABCE.”

The following description summarizes the material terms of our capital stock. This summary is, however, subject to the provisions of our articles of incorporation and bylaws. For greater detail about our capital stock, please refer to our articles of incorporation and bylaws.

Common Stock

Voting. Holders of our common stock are entitled to one vote for each outstanding share of common stock owned by such stockholder on every matter properly submitted to the stockholders for their vote. Stockholders are not entitled to vote cumulatively for the election of directors. At any meeting of the stockholders, a quorum as to any matter shall consist of a majority of the votes entitled to be cast on the matter, except where a larger quorum is required by law, by our articles of incorporation or by our bylaws.