Current Report Filing (8-k)

January 07 2022 - 8:31AM

Edgar (US Regulatory)

0001350073false00013500732022-01-052022-01-05iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): January 5, 2022

|

Iconic Brands, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

333-227420

|

|

13-4362274

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

44 Seabro Avenue

Amityville, New York 11701

(Address of Principal Executive Offices)

(631) 464-4050

(Registrant’s telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Securities Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange

on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.02 Unregistered Sales of Equity Securities.

As previously reported by Iconic Brands, Inc. (the “Company”) in its Current Report on Form 8-K dated July 27, 2021 (the “July 2021 8-K”), on July 26, 2021, the Company entered into securities purchase agreements dated as of July 26, 2021 for the sale of an aggregate of 32,303.11 shares of the Company’s newly-created Series A-2 Convertible Preferred Stock, par value $0.001 per share (the “Series A-2 Preferred Stock”), 11,320,201 shares of Common Stock, and warrants (the “Warrants”) to purchase 114,690,150 shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”), for gross proceeds of $35,840,672, before deducting placement agent and other offering expenses. Pursuant to the Purchase Agreement, the shares of Series A-2 Preferred Stock, Common Stock and Warrants were sold in two tranches. The first tranche closed on July 26, 2021, the details of which are further described in the July 2021 8-K. The second tranche closed on January 5, 2022 in which the Company sold 12,257.76 shares of Series A-2 Preferred Stock, 4,301,004 shares of Common Stock and Warrants to purchase 40,018,583 shares of Common Stock for gross proceeds of approximately $12.2 million and net proceeds of approximately $10.8 after deduction of placement agent commissions and expenses of the offering. Such net proceeds are expected to be used by the Company for domestic and international expansion of its Bellissima brand, the expansion of the production facilities of the Company’s TopPop subsidiary, new product launches, marketing, and other general working capital purposes. The terms of the Series A-2 Preferred Stock, the Common Stock and the Warrants are described in further detail in the July 2021 8-K.

The above-described sales and issuances pursuant to the Purchase Agreement were made in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”) and Regulation D promulgated thereunder on the basis that the sales or issuances did not involve a public offering and the recipients made certain representations to the Company, including without limitation, that the recipients of the securities were “accredited investors” as defined in Rule 501 under the Securities Act.

Item 8.01 Other Events.

On January 7, 2022, the Company issued a press release announcing the transactions described under Item 3.02 above, a copy of which is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The information under this Item 8.01, including Exhibit 99.1, is deemed “furnished” and not “filed” under Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Iconic Brands, Inc.

|

|

|

|

|

|

|

|

Dated: January 7, 2022

|

By:

|

/s/ David Allen

|

|

|

|

Name:

|

David Allen

|

|

|

|

Title:

|

Chief Financial Officer

|

|

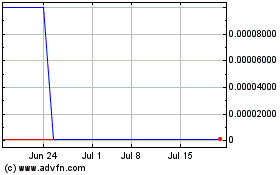

Iconic Brands (CE) (USOTC:ICNB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Iconic Brands (CE) (USOTC:ICNB)

Historical Stock Chart

From Apr 2023 to Apr 2024