Amended Statement of Beneficial Ownership (sc 13d/a)

December 22 2021 - 4:46PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT

TO § 240.13d-1(a) AND AMENDMENTS THERETO

FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 4)1

Turtle Beach Corporation.

(Name of Issuer)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

900450206

(CUSIP Number)

WILLIAM WYATT

THE DONERAIL GROUP LP

240 26th Street

Suite 3

Santa Monica, CA 90402

ANDREW M. FREEDMAN ESQ.

OLSHAN FROME WOLOSKY LLP

1325 Avenue of the Americas

New York, New York 10019

(212) 451-2250

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

December 20, 2021

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this Schedule because of §§

240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐.

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other parties to whom

copies are to be sent.

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

THE

DONERAIL GROUP LP

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

|

|

|

|

|

|

(b) ☐

|

|

|

|

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS

|

|

|

|

|

|

|

|

|

|

|

|

|

WC,

AF

|

|

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

|

NUMBER OF

|

|

7

|

|

SOLE VOTING POWER

|

|

|

SHARES

|

|

|

|

|

|

|

BENEFICIALLY

|

|

|

|

|

-0-

|

|

|

OWNED BY

|

|

8

|

|

SHARED VOTING POWER

|

|

|

EACH

|

|

|

|

|

|

|

REPORTING

|

|

|

|

|

1,185,816*

|

|

|

PERSON WITH

|

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-0-

|

|

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,185,816*

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

1,185,816*

|

|

|

|

12

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

|

|

|

|

|

7.4%

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

PN,

IA

|

|

*Includes 600,000 Shares underlying call options currently exercisable

as further described in Item 6.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

WILLIAM

WYATT

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

|

|

|

|

|

|

(b) ☐

|

|

|

|

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS

|

|

|

|

|

|

|

|

|

|

|

|

|

WC,

AF

|

|

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

|

|

|

|

|

USA

|

|

|

NUMBER OF

|

|

7

|

|

SOLE VOTING POWER

|

|

|

SHARES

|

|

|

|

|

|

|

BENEFICIALLY

|

|

|

|

|

-0-

|

|

|

OWNED BY

|

|

8

|

|

SHARED VOTING POWER

|

|

|

EACH

|

|

|

|

|

|

|

REPORTING

|

|

|

|

|

1,185,816*

|

|

|

PERSON WITH

|

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-0-

|

|

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,185,816*

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

1,185,816*

|

|

|

|

12

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

|

|

|

|

|

7.4%

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

IN

|

|

*Includes 600,000 Shares underlying call options currently exercisable

as further described in Item 6.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

HARBERT

FUND ADVISORS, INC.

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

|

|

|

|

|

|

(b) ☐

|

|

|

|

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS

|

|

|

|

|

|

|

|

|

|

|

|

|

WC,

AF

|

|

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

|

|

|

|

|

Alabama

|

|

|

NUMBER OF

|

|

7

|

|

SOLE VOTING POWER

|

|

|

SHARES

|

|

|

|

|

|

|

BENEFICIALLY

|

|

|

|

|

-0-

|

|

|

OWNED BY

|

|

8

|

|

SHARED VOTING POWER

|

|

|

EACH

|

|

|

|

|

|

|

REPORTING

|

|

|

|

|

1,185,816*

|

|

|

PERSON WITH

|

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-0-

|

|

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,185,816*

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

1,185,816*

|

|

|

|

12

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

|

|

|

|

|

7.4%

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

CO

|

|

*Includes 600,000 Shares underlying call options currently exercisable

as further described in Item 6.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

HARBERT

MANAGEMENT CORPORATION

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

|

|

|

|

|

|

(b) ☐

|

|

|

|

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS

|

|

|

|

|

|

|

|

|

|

|

|

|

WC,

AF

|

|

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

|

|

|

|

|

Alabama

|

|

|

NUMBER OF

|

|

7

|

|

SOLE VOTING POWER

|

|

|

SHARES

|

|

|

|

|

|

|

BENEFICIALLY

|

|

|

|

|

-0-

|

|

|

OWNED BY

|

|

8

|

|

SHARED VOTING POWER

|

|

|

EACH

|

|

|

|

|

|

|

REPORTING

|

|

|

|

|

1,185,816*

|

|

|

PERSON WITH

|

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-0-

|

|

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,185,816*

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

1,185,816*

|

|

|

|

12

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

|

|

|

|

|

7.4%

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

CO

|

|

*Includes 600,000 Shares underlying call options currently exercisable

as further described in Item 6.

The following constitutes Amendment

No. 4 to the Schedule 13D filed by the undersigned (“Amendment No. 4”). This Amendment No. 4 amends the Schedule 13D as specifically

set forth herein.

|

|

Item 4.

|

Purpose of the Transaction.

|

Item 4 is hereby amended to add the following:

The Donerail Group (“Donerail”)

has been actively engaged with the Issuer’s board of directors (the “Board”) and management for the past nine months

regarding a number of value-creating and governance-enhancing topics. In a press release dated December 15, 2021 (the “December

15 Press Release”), Donerail announced its intention to submit a revised offer to acquire the Issuer and called for the Issuer to

publicly launch a transparent and comprehensive strategic review process, in which Donerail would intend to participate. The full text

of the December 15 Press Release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

In the early morning of December

20, 2021, Donerail submitted a revised offer to acquire the Issuer at $32.86 per share (the “Revised Offer”), subject to confirmatory

due diligence.

On December 22, 2021, Donerail

issued a press release (the “December 22 Press Release”) announcing that it had submitted the Revised Offer and setting the

record straight on its engagement with the Issuer. The full text of the December 22 Press Release is attached hereto as Exhibit 99.2 and

is incorporated herein by reference.

|

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer.

|

Item 6 is hereby amended to add the following:

Previously, the Donerail Fund

purchased American-style exchange listed put options referencing an aggregate of 750,000 Shares, which had an exercise price of $22.00

and expired on November 19, 2021. These put options were sold, as further detailed on Schedule B attached hereto, which is incorporated

by reference herein, and, accordingly, the Donerail Fund no longer has any exposure to such put options.

Previously, the Donerail Fund

purchased American-style exchange listed put options referencing an aggregate of 750,000 Shares, which had an exercise price of $22.00

and expired on December 17, 2021. These put options were sold, as further detailed on Schedule B attached hereto, which is incorporated

by reference herein, and, accordingly, the Donerail Fund no longer has any exposure to such put options.

The Donerail Fund has purchased

American-style exchange listed put options referencing an aggregate of 850,000 Shares, which have an exercise price of $17.50 and expire

on January 21, 2022, as further detailed on Schedule B attached hereto, which is incorporated by reference herein.

|

|

Item 7.

|

Material to be Filed as Exhibits.

|

Item 7 is hereby amended to

add the following exhibits:

99.1 Press Release, dated December 15, 2021.

99.2 Press Release, dated December 22, 2021.

SIGNATURES

After reasonable inquiry and to the best of his

knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: December 22, 2021

|

|

THE DONERAIL GROUP LP

|

|

|

|

|

|

By:

|

/s/ William Wyatt

|

|

|

|

Name:

|

William Wyatt

|

|

|

|

Title:

|

Managing Partner

|

|

|

|

|

|

|

|

/s/ William Wyatt

|

|

|

William Wyatt

|

|

|

|

|

|

HARBERT FUND ADVISORS, INC.

|

|

|

|

|

|

By:

|

/s/ John W. McCullough

|

|

|

|

Name:

|

John W. McCullough

|

|

|

|

Title:

|

Executive Vice President & General Counsel

|

|

|

|

|

|

|

|

HARBERT MANAGEMENT CORPORATION

|

|

|

|

|

|

By:

|

/s/ John W. McCullough

|

|

|

|

Name:

|

John W. McCullough

|

|

|

|

Title:

|

Executive Vice President & General Counsel

|

SCHEDULE B

Transactions in Securities of the Issuer Since

the Filing of Amendment No. 3 to the Schedule 13D

|

Nature of Transaction

|

Common Stock

Purchased/(Sold)

|

Price Per

Share($)

|

Date of

Purchase/Sale

|

|

Sale of November 19, 2021 Put Options ($22.00 Strike Price)

|

(750,000)

|

0.0470

|

11/19/2021

|

|

Purchase of December 17, 2021 Put Options ($22.00 Strike Price)

|

750,000

|

0.3957

|

11/19/2021

|

|

Sale of December 17, 2021 Put Options ($22.00 Strike Price)

|

(750,000)

|

0.0500

|

12/17/2021

|

|

Purchase of January 21, 2022 Put Options ($17.50 Strike Price)

|

850,000

|

0.3453

|

12/17/2021

|

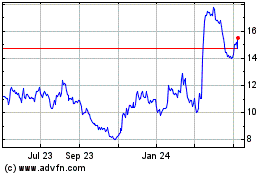

Turtle Beach (NASDAQ:HEAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

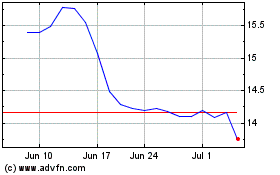

Turtle Beach (NASDAQ:HEAR)

Historical Stock Chart

From Apr 2023 to Apr 2024