Current Report Filing (8-k)

December 17 2021 - 5:16PM

Edgar (US Regulatory)

0001481028

false

--06-30

0001481028

2021-12-15

2021-12-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 15, 2021

SUNHYDROGEN, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

000-54437

|

|

26-4298300

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

10 E. Yanonali, Suite 36

Santa Barbara, CA 93101

(Address of principal executive offices and Zip

Code)

Registrant’s telephone number, including

area code: (805) 966-6566

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Not applicable

|

|

Not applicable

|

|

Not applicable

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b2 of the Securities

Exchange Act of 1934 (§240.12b2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On

December 15, 2021, SunHydrogen, Inc. (the “Company”) entered into a securities purchase agreement (the “Securities Purchase

Agreement”) with an accredited investor (the “Investor”). Under the terms of the Securities Purchase Agreement, the

Company and Investor acknowledge there was $187,800 of principal remaining under the note issued to the Investor by the Company on February

3, 2017, plus $80,365 of accrued interest, representing a total aggregate note balance of $268,165 (the “Note”). Pursuant

to the Securities Purchase Agreement, the Company and Investor agreed that the Company shall sell and the Investor agreed to purchase

2,700 shares of the Company’s newly designated Series C Preferred Stock (the “Shares”) for a total purchase price of

$268,165 (the “Purchase Price”). The Shares have a 10% stated annual dividend, no voting rights, has a face value of $100

per share, and is convertible into the Company’s Common Stock at a fixed conversion price that equals the effective conversion price

of the Note on the date of the Securities Purchase Agreement. Pursuant to the Securities Purchase Agreement, the Investor agreed to tender

the Note to the Company for cancellation and foregoes all future accrued interest rights under the Note, as the total Purchase Price of

the Shares.

The

description of the Securities Purchase Agreement is only a summary and is qualified in its entirety by reference to the full text of the

Securities Purchase Agreement attached as Exhibit 10.1 hereto. A summary of the rights and preferences of the Certificate of Designation

of the Shares is disclosed below and is qualified in its entirety by reference to the full text of the form of the Certificate of Designation

attached as Exhibit 3.1 hereto.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change

in Fiscal Year

On December 15, 2021,the Company

filed a certificate of designation of preferences, rights and limitations (the “Certificate of Designation”) of Series C Preferred

Stock (the “Series C Preferred Stock”), with the Secretary of State of Nevada, designating 17,000 shares of preferred stock,

par value $0.001 of the Company, as Series C Preferred Stock. Each share of Series C Preferred Stock shall have a stated face value of

$100.00 (“Stated Value”), and is convertible into shares of common stock (“Common Stock”) of the Company at a

conversion price equal to $0.00095.

The Series C Preferred Stock

holders shall be entitled to receive out of any funds and assets of the Company legally available prior and in preference to any declaration

or payment of any dividend on the common stock of the Company (the “Common Stock”), cumulative dividends, at an annual rate

of 10% of the Stated Value (the “Preferred Dividend”). The Preferred Dividend will accrue commencing on the date of issuance

of the Series C Preferred Stock and shall be payable in cash or shares of Common Stock. In the event the Company shall declare or pay

a dividend on its shares of Common Stock (other than dividend payable in shares of Common Stock), the holders of Series C Preferred Stock

shall also be entitled to receive payment of such dividend on an as-if-converted basis with respect to the Series C Preferred Stock.

The Series C Preferred Stock

confers no voting rights on holders, except with respect to matters that materially and adversely affect the voting powers, rights or

preferences of the Series C Preferred Stock or as otherwise required by applicable law.

This description of the Certificate

of Designation is only a summary and is qualified in its entirety by reference to the full text of the form of the Certificate of Designation

attached as Exhibit 3.1 hereto.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

SUNHYDROGEN, INC.

|

|

|

|

|

Date: December 17, 2021

|

/s/ Timothy Young

|

|

|

Timothy Young

|

|

|

Chief Executive Officer

|

2

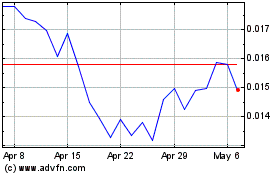

SunHydrogen (QB) (USOTC:HYSR)

Historical Stock Chart

From Mar 2024 to Apr 2024

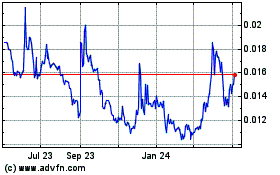

SunHydrogen (QB) (USOTC:HYSR)

Historical Stock Chart

From Apr 2023 to Apr 2024