Current Report Filing (8-k)

December 16 2021 - 2:28PM

Edgar (US Regulatory)

0001530163

false

0001530163

2021-12-14

2021-12-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December

14, 2021

Samsara Luggage, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

Nevada

|

|

000-54649

|

|

26-0299456

|

|

(State of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer No.)

|

135 East 57th Street, Suite 18-130

New York, New York 10022

(Address of principal executive offices and Zip

Code)

(877) 421-1574

(Registrant’s telephone number, including

area code)

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: (see General

Instruction A.2. below):

|

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4© under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which

registered

|

|

|

|

|

|

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive

Agreement.

The information set forth in Item 3.02 below

is incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation

or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 3.02 below

is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities.

On December 14, 2021, Samsara

Luggage, Inc. (the “Company”) entered into a securities purchase agreement (the “Securities Purchase Agreement”)

with YA II PN Ltd., a Cayman Islands exempt company (the “Investor”), pursuant to which the Company sold and issued a convertible

debenture in the amount of $500,000 (the “Convertible Debenture”), which is convertible into shares of the Company’s

common stock, par value $0.0001 (the “Common Stock”) (as converted, the “Conversion Shares”).

The Convertible Debenture bears

interest at a rate of 10% per annum (15% on default) and has a maturity date of one (1) year. The Convertible Debenture provides a conversion

right, in which any portion of the principal amount of the Convertible Debenture, together with any accrued but unpaid interest, may be

converted into the Company’s Common Stock at a conversion price equal to 80% of the lowest volume weighted average price of the

Company’s Common Stock during the ten (10) trading days immediately preceding the date of conversion, subject to adjustment. The

Convertible Debenture may not be converted into common stock to the extent such conversion would result in the Investor beneficially owning

more than 4.99% of the Company’s outstanding Common Stock (the “Beneficial Ownership Limitation”); provided, however,

that the Beneficial Ownership Limitation may be waived by the Investor upon not less than 65 days’ prior notice to the Company.

The Convertible Debenture provides the Company with a redemption right, pursuant to which the Company, upon fifteen (15) business days’

prior notice to the Investor, may redeem, in whole or in part, outstanding principal and interest under the Convertible Debenture at a

redemption price equal to the principal amount being redeemed plus a redemption premium equal to 5% of the outstanding principal amount

being redeemed plus outstanding and accrued interest; however, the Investor shall have fifteen (15) business days after receipt of the

Company’s redemption notice to elect to convert all or any portion of the Convertible Debenture, subject to the Beneficial Ownership

Limitation.

The transaction closed on December

15, 2021. The descriptions of the Securities Purchase Agreement, and the Convertible Debenture (the “Transaction Documents”)

are only summaries and are qualified in their entirety by reference to the full text of the form of such Transaction Documents attached

hereto as Exhibits 10.1 and 10.2 respectively.

Item 9.01 Financial statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

SAMSARA LUGGAGE, INC.

|

|

|

|

|

|

|

By

|

/s/ Atara Dzikowski

|

|

|

|

Name:

|

Atara Dzikowski

|

|

|

|

Title:

|

Chief Executive Officer

|

Date: December 16, 2021

2

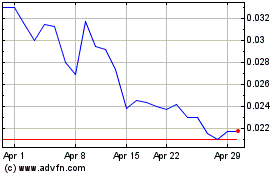

Samsara Luggage (PK) (USOTC:SAML)

Historical Stock Chart

From Mar 2024 to Apr 2024

Samsara Luggage (PK) (USOTC:SAML)

Historical Stock Chart

From Apr 2023 to Apr 2024