The Donerail Group LP (together with its affiliates, “Donerail”,

“We”, or “Us”), is one of the largest shareholders of Turtle Beach

Corporation (the “Company” or “Turtle Beach”) (NASDAQ: HEAR) with

beneficial ownership of approximately 7.4% of the Company’s

outstanding shares, and released the following statement on

December 15, 2021:

Spanning nearly four months since our last

public commentary in August, Donerail has attempted to work

constructively with the Turtle Beach Board of Directors (the

“Board”), the Company’s management team and the Company’s financial

advisors at Bank of America to offer value-creative solutions that

we believe would benefit all shareholders.

In these recent communications, Donerail has

provided a multitude of strategic options for the Company to

pursue. These included i) a re-affirmation of Donerail’s previously

disclosed bid to acquire the Company, ii) detailed terms under

which Donerail would feel comfortable to sign a limited NDA, and

iii) an offer to aid the Board in a strategic review to maximize

alignment with all shareholders.

It is with regret that we report that our

efforts for cooperation and productive conversations have largely

proven unsuccessful.

As has been publicly reported, the Board

rebuffed our previous offers to acquire the Company, which

culminated in an offer of $36.50 per share in August. In doing so,

the Board specifically cited two principal concerns: i) that the

Board “did not view Donerail’s proposed acquisition price to be

sufficient” and ii) that the Board “had concerns regarding

Donerail’s ability to consummate a transaction and its financing

sources.”1

We respectfully disagreed with the Board and

believed that an offer of $36.50 was clearly adequate and fair. In

hindsight, that offer looks particularly attractive, standing at a

nearly 70% premium from where Turtle Beach's stock price closed

yesterday.

With regard to financing concerns, while we have

provided the Board and its advisors with a comprehensive amount of

supporting documentation regarding our prospective financing

package that details our financing partners and structure, what we

have provided appears to be insufficient for the Board to relieve

them of ‘significant concerns’.

At this point, it is unclear what we could do

differently to provide the Board with sufficient comfort that

engaging with us as a bona fide prospective acquiror would be a

worthwhile endeavor on behalf of all shareholders.

With that being said, we remain interested

in acquiring the Company, and we will be submitting a revised LOI

to the Company in short order. Our revised LOI will likely

include an offer at a lower price than $36.50 per share but at

a price that we believe to be both an attractive premium to the

current trading price of Turtle Beach’s stock as well as to

the 30-day volume weighted average price of the shares.

As a large shareholder of the Company, we have

additional frustrations. The share price is hovering near 52-week

lows and has declined over 40% in the last six months. While demand

for the Company’s product continues to be robust, unforeseen

operational challenges have impaired profitability, surprising

management and creating a recent, violent sell-off of the shares.

Further, three of the Company’s peers have either been acquired or

have received acquisition offers in recent months (HyperX,

SteelSeries, and Razer); extrapolating the same multiples for

Turtle Beach would imply a share price for Turtle Beach that would

be exponentially higher than where the stock currently trades. In

our regular communication with other shareholders, we find that

there is meaningful discontent with the current status quo,

meaningful uncertainty about the future, and we are certain the

Board and management share similar frustration, as well.

Recognizing that we are in the midst of a global

consolidation in the video game peripheral space, we have suggested

for some time now that Turtle Beach should test the market to

assess the appetite of strategic buyers.

To the casual onlooker, it may appear that the

Turtle Beach Board has agreed that now is an appropriate time to

test the market, as well. In fact, numerous press reports in recent

months have detailed that Turtle Beach has hired Bank of America to

launch a sales process for the Company and that multiple parties

“are circling”, “some of the potentially interested parties [are]

‘deep pocketed’ players”, and that “Donerail’s bid marked the

bottom of the range of potential offer prices.” 2,3 Nonetheless,

the Company has not confirmed that such events are taking place,

causing confusion in the marketplace.

Given the continual speedbumps that the Board

created for us as a potential acquiror that seem to be in direct

conflict with the aforementioned press reports, we are highly

confused — as both a large shareholder and as a potential

acquiror — as to what the Board is actually seeking to

achieve.

In an effort to both clear the air for

shareholder confusion as well as provide a potential pathway for us

to engage with the Company in a comprehensive fashion that may

allow the Board to better assess our viability as a potential

acquiror, we call on the Company to publicly disclose that it is

running a Strategic Review process, if such a process is underway,

and if it is not, we call on the Company to initiate one in short

order.

Indeed, the Board continues to repeat its doubts

about the level of seriousness that we have in acquiring the

Company, and we, likewise, have doubts about the Board’s

willingness to sell the Company at an attractive price. We believe

that public disclosure of a Strategic Review process, while

potentially disadvantageous to our efforts of acquiring the

Company, would create appropriate accountability for this Board and

do well to provide shareholders with a full and transparent

understanding as to the actions that this Board is undertaking to

create shareholder value.

As a sign of our commitment to join an auction

process for the Company, Donerail is declaring its intent to enter

into a customary non-disclosure agreement in conjunction with a

publicly disclosed Strategic Review process, and we will also agree

to a customary standstill that would provide the Company with

surety of our standing as a willing acquiror while simultaneously

protecting our rights as shareholders to nominate directors at next

year’s Annual Meeting, should the need arise.

About Donerail

The Donerail Group LP is a Los Angeles-based

investment adviser that employs a value-oriented investment lens

focusing on special situations and event driven investments.

Investor Contact:

Wes Calvert, (310) 564-9992

________________________1 Turtle Beach Press Release dated

23-Aug-20212 “Donerail Prepared to ‘Go Nuclear’ in Its Bid for

Turtle Beach.” CTFN. 19-Jul-2021.3 “Multiple Parties Circling

Turtle Beach with Announcement Possible Next Month.” CTFN.

7-Oct-2021.

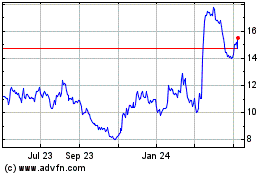

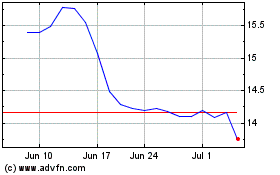

Turtle Beach (NASDAQ:HEAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Turtle Beach (NASDAQ:HEAR)

Historical Stock Chart

From Apr 2023 to Apr 2024