Navios Maritime Holdings Inc. Announces $550 Million of Debt Financing

December 14 2021 - 8:52AM

Navios Maritime Holdings Inc. (“Navios Holdings”) (NYSE: NM), a

global seaborne shipping and logistics company, today announced

that it entered into agreements providing Navios Holdings with a

total of $550 million of debt financing.

The proceeds of this financing together with

available cash will be used to repay at maturity all of Navios

Holdings’ outstanding 7.375% First Priority Ship Mortgage Notes

(“Ship Mortgage Notes”) due January 15, 2022 and redeem $50.0

million of Navios Holdings’ outstanding 11.25% Senior Secured Notes

(the “Senior Secured Notes”) due on August 15, 2022 (after which

$105.0 million will remain outstanding).

Details are as follows:

1) $287.0 Million – Commercial bank

facilities and sale-leaseback agreementsNavios Holdings

entered into two commercial bank facilities and four sale leaseback

agreements in an aggregate principal amount of $287.0 million.

These facilities and agreements are expected to close by the first

half of January 2022, substantially simultaneously with the

repayment of the Ship Mortgage Notes. They reflect the following

terms:

- Credit facility

1: (i) two-year term, (ii) 5.8-year amortization profile, and (iii)

annual interest of LIBOR plus a margin ranging between 3.25% - 4.5%

based on certain conditions.

- Credit facility

2: (i) three-year term, (ii) 4.9-year amortization profile, and

(iii) annual interest of LIBOR plus a margin ranging between 2.85%

- 3.75% based on certain conditions.

- Sale and

leaseback agreements: (i) seven-year term on average, (ii) 9.4-year

amortization profile, and (iii) effective interest rate of

approximately 5.3%.

The credit facilities and sale and leaseback

agreements will be secured by 18 drybulk vessels (17 of which are

now collateral for the Ship Mortgage Notes) plus an additional

collateral of seven drybulk vessels that are subject to bareboat

charters and sale and leaseback agreements.

2) $262.6 Million – PIK loan

facilitiesNavios Holdings entered into two PIK loan

facilities with an entity affiliated with its Chairwoman and Chief

Executive Officer (“Lender”). These facilities provide Navios

Holdings with loans in an aggregate principal amount of $262.6

million (the “Loans”).

These Loans provide for-

- advances of

$150.0 million of additional liquidity

- the release by

the Lender of approximately $300.0 million of collateral (including

approximately $158.9 million of Ship Mortgage Notes), allowing

Navios Holdings to grant additional collateral as security for the

commercial credit facilities and sale and leaseback agreements

- an initial

18-month period during which there will be no cash interest or

amortization; interest payments during this initial period will be

made in the form of a junior debt instrument (“Unsecured

Convertible Debentures”) as described below.

Material Loan FeaturesThe

material terms of the Loans are:

- Annual interest rate:

- PIK - in the form of Unsecured

Convertible Debentures - 18% until the Senior Secured Notes are

repaid in full; 16.5% thereafter

- Or cash – 13.5% after the initial

18-month period;

- Amortization: $10.0 million

quarterly, commencing Q3 of 2023;

- Term: four years; 18-month

non-call;

- Fee: $24.0 million upfront to the

Lender (“Fee”) paid in the form of Unsecured Convertible

Debentures;

- Collateral:

- First lien collateral coverage of ~

20%

- First priority partnership interest

pledge on 2,112,708 Navios Maritime Partners LP (“NMM”) common

units;

- Second lien collateral

- 12,765 shares of Navios South

American Logistics Inc.

- 1,070,491 NMM common units

- Membership interests of Navios GP

L.L.C.

Unsecured Convertible

Debentures:The Fee and all PIK interest on the Loans will

be paid in the form of unsecured convertible debentures. The

unsecured convertible debentures (1) have a five-year term, (2)

carry PIK interest, at an annual rate of 4% and (3) are

convertible, in whole or in part, at any time at the election of

the Lender into shares of common stock of the Company at the

conversion price formula fixed on December 13, 2021. The holder of

the Unsecured Convertible Debentures will be entitled to vote on an

“as converted” basis along with the holders of common stock of the

Company.

Further InformationReports on Form 6-K will be

filed with the Securities and Exchange Commission, providing

further details on the transactions.

Special CommitteeNavios

Holdings’ Board of Directors formed a Special Committee of

independent and disinterested directors to evaluate and negotiate

with the Lender the terms of the Loans with the assistance of its

independent financial and legal advisors. The Loans from the Lender

were unanimously approved by the Special Committee.

AdvisorsLatham & Watkins

LLP acted as legal advisor and Pareto Securities AS acted as

financial advisor to the Special Committee of Navios Holdings.

Thompson Hine LLP acted as legal advisor to Navios Holdings. Fried,

Frank, Harris, Shriver & Jacobson LLP and the Ince Group Plc

acted as legal advisors and S. Goldman Advisors LLC acted as

financial advisor to the Lender.

About Navios HoldingsNavios

Maritime Holdings Inc. (NYSE: NM) is a global seaborne shipping and

logistics company focused on the transport and transshipment of dry

bulk commodities including iron ore, coal and grain. For more

information about Navios Holdings, please visit our

website: www.navios.com.

Forward Looking Statements – Safe

HarborThis press release contains forward-looking

statements (as defined in Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended) concerning future events, including our ability

to refinance our near-term debt maturities. Words such as “may,”

“expects,” “intends,” “plans,” “believes,” “anticipates,” “hopes,”

“estimates,” and variations of such words and similar expressions

are intended to identify forward-looking statements. These

forward-looking statements are based on the information available

to, and the expectations and assumptions deemed reasonable by

Navios Holdings at the time these statements were made. Although

Navios Holdings believes that the expectations reflected in such

forward-looking statements are reasonable, no assurance can be

given that such expectations will prove to have been correct. These

statements involve known and unknown risks and are based upon a

number of assumptions and estimates, which are inherently subject

to significant uncertainties and contingencies, many of which are

beyond the control of Navios Holdings. Actual results may differ

materially from those expressed or implied by such forward-looking

statements. Factors that could cause actual results to differ

materially include, but are not limited to risks relating to:

global and regional economic and political conditions including the

impact of the COVID-19 pandemic and efforts throughout the world to

contain its spread, including effects on global economic activity;

demand for seaborne transportation of the products we ship; the

ability and willingness of charterers to fulfill their obligations

to us; prevailing charter rates; shipyards performing scrubber

installations, drydocking and repairs; changing vessel crews and

availability of financing; potential disruption of shipping routes

due to accidents, diseases, pandemics, political events, piracy or

acts by terrorists, including the impact of the COVID-19 pandemic

and the ongoing efforts throughout the world to contain it;

uncertainty relating to global trade, including prices of seaborne

commodities and continuing issues related to seaborne volume and

ton miles; our continued ability to enter into long-term time

charters; our ability to maximize the use of our vessels; expected

demand in the dry cargo shipping sector in general and the demand

for our Panamax, Capesize, Ultra Handymax and Handysize vessels in

particular; the aging of our fleet and resultant increases in

operations costs; the loss of any customer or charter or vessel;

the financial condition of our customers; changes in the

availability and costs of funding due to conditions in the bank

market, capital markets and other factors; increases in costs and

expenses, including but not limited to: crew wages, insurance,

provisions, port expenses, lube oil, bunkers, repairs, maintenance,

and general and administrative expenses; the expected cost of, and

our ability to comply with, governmental regulations and maritime

self-regulatory organization standards, as well as standard

regulations imposed by our charterers applicable to our business,

general domestic and international political conditions;

competitive factors in the market in which Navios Holdings

operates; the value of our publicly traded subsidiaries; risks

associated with operations outside the United States; and other

factors listed from time to time in Navios Holdings' filings with

the Securities and Exchange Commission, including its Forms 20-F

and Forms 6-K. Navios Holdings expressly disclaims any obligations

or undertaking to release publicly any updates or revisions to any

forward-looking statements contained herein to reflect any change

in Navios Holdings' expectations with respect thereto or any change

in events, conditions or circumstances on which any statement is

based. Navios Holdings makes no prediction or statement about the

performance of its common stock or debt securities.

Contact:

Navios Maritime Holdings

Inc.+1.345.232.3067+1.212.906.8643investors@navios.com

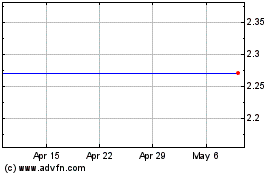

Navios Maritime (NYSE:NM)

Historical Stock Chart

From Mar 2024 to Apr 2024

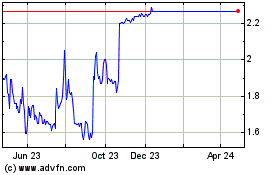

Navios Maritime (NYSE:NM)

Historical Stock Chart

From Apr 2023 to Apr 2024