|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

SCHEDULE 13D/A

Under the Securities Exchange

Act of 1934

(Amendment No.

5)*

|

|

|

|

Nocopi Technologies, Inc.

|

|

(Name of Issuer)

|

|

|

|

Common

Stock, par value $.01 per share

|

|

(Title of Class of Securities)

|

|

|

|

655212207

|

|

(CUSIP Number)

|

|

|

Tim Eriksen

Eriksen Capital Management LLC

8695 Glendale Road

Custer, WA 98240

(360) 354-3331

|

|

|

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

|

|

|

|

December 10, 2021

|

|

(Date of Event which Requires Filing of this Statement)

|

|

|

|

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled

out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

|

|

1.

|

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

|

|

|

|

ERIKSEN CAPITAL MANAGEMENT LLC

|

|

|

|

|

2.

|

CHECK THE APPROPRIATE

BOX IF A MEMBER OF A GROUP

|

|

|

(SEE INSTRUCTIONS)

|

|

|

|

(a) ¨

|

|

|

|

|

(b) ¨

|

|

|

|

|

|

|

3.

|

SEC Use Only

|

|

4.

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

|

|

WC

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

¨

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

United States

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7.

|

SOLE VOTING POWER

|

|

|

|

|

|

7,699,139

|

|

8.

|

SHARED VOTING POWER

|

|

|

|

|

|

0

|

|

9.

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

7,699,139

|

|

10.

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

0

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

7,699,139

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

¨

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

11.4%

|

|

14.

|

TYPE OF REPORTING PERSON (see instructions)

|

|

|

|

|

|

IA

|

|

*

|

Percentage calculated based on 67,495,055 shares of common stock, par value $.01 per share, outstanding as of November 9, 2021, as reported

in the 10-Q of Nocopi Technologies, Inc., filed with the Securities and Exchange Commission on November 12, 2021.

|

|

|

|

|

|

|

|

1.

|

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

|

|

|

|

CEDAR CREEK PARTNERS LLC

|

|

|

|

|

2.

|

CHECK THE APPROPRIATE

BOX IF A MEMBER OF A GROUP

|

|

|

(SEE INSTRUCTIONS)

|

|

|

|

(a) ¨

|

|

|

|

|

(b) ¨

|

|

|

|

|

|

3.

|

SEC Use Only

|

|

4.

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

|

|

WC

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

¨

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

United States

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7.

|

SOLE VOTING POWER

|

|

|

|

|

|

6,621,253

|

|

8.

|

SHARED VOTING POWER

|

|

|

|

|

|

0

|

|

9.

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

6,621,253

|

|

10.

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

0

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

6,621,253

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

¨

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

9.8%

|

|

14.

|

TYPE OF REPORTING PERSON (see instructions)

|

|

|

|

|

|

PN

|

|

*

|

Percentage calculated based on 67,495,055 shares of common stock, par value $.01 per share, outstanding as of November 9, 2021, as reported

in the 10-Q of Nocopi Technologies, Inc., filed with the Securities and Exchange Commission on November 12, 2021.

|

|

1.

|

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

|

|

|

|

TIM ERIKSEN

|

|

|

|

|

2.

|

CHECK THE APPROPRIATE

BOX IF A MEMBER OF A GROUP

|

|

|

(SEE INSTRUCTIONS)

|

|

|

|

(a) ¨

|

|

|

|

|

(b) ¨

|

|

|

|

|

|

|

3.

|

SEC Use Only

|

|

4.

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

|

|

PF

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

¨

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

United States

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7.

|

SOLE VOTING POWER

|

|

|

|

|

|

639,886

|

|

8.

|

SHARED VOTING POWER

|

|

|

|

|

|

0

|

|

9.

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

639,886

|

|

10.

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

0

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

639,886

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

¨

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

0.9%

|

|

14.

|

TYPE OF REPORTING PERSON (see instructions)

|

|

|

|

|

|

IN

|

|

*

|

Percentage calculated based on 67,495,055 shares of common stock, par value $.01 per share, outstanding as of November 9, 2021, as reported

in the 10-Q of Nocopi Technologies, Inc., filed with the Securities and Exchange Commission on November 12, 2021.

|

|

|

Item 1.

|

Security and Issuer

|

This Schedule 13D/A relates to shares of the Common

Stock, par value $.01 per share (the “Common Stock”), of Nocopi Technologies, Inc. (the “Issuer” or “Nocopi”).

The address of the issuer is 480 Shoemaker Road, Suite 104, King of Prussia, Pennsylvania 19406.

|

|

Item 2.

|

Identity and Background

|

(a) This

Statement is filed by Tim Eriksen on behalf of Eriksen Capital Management LLC (“ECM”), a registered investment adviser with

the State of Washington, and Cedar Creek Partners, LLC (“CCP”). ECM is the managing member of CCP, a private investment partnership,

and investment advisor to separately managed accounts. Each of the foregoing is referred to as a “Reporting Person” and collectively

as the “Reporting Persons.” By virtue of his position with ECM, Mr. Eriksen has the sole power to vote and dispose of

the Issuer’s Shares owned by CCP.

(b) The

principal business address of Mr. Eriksen, ECM and CCP is 8695 Glendale Road, Custer, WA 98240.

(c) The

principal business of CCP is acquiring, holding and disposing of investments in various companies. The principal business of ECM is serving

as the investment manager of CCP and separately managed accounts. The principal occupation of Mr. Eriksen is serving as the sole

manager of ECM.

(d) No

Reporting Person described herein has, during the last five years, been convicted in a criminal proceeding (excluding traffic violations

or similar misdemeanors).

(e) None

of the Reporting Parties described herein has, during the last five years, been party to a civil proceeding of a judicial or administrative

body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future

violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violations with respect

to such laws.

(f) Mr. Eriksen

is a citizen of the United States. ECM and CCP are both Washington limited liability companies.

|

|

Item 3.

|

Source and amount of Funds or Other Consideration

|

The shares of Common Stock were acquired in open

market purchases with the working capital (which may, at any given time, include margin loans made by brokerage firms in the ordinary

course of business and may constitute uncommitted cash of SMAs) or personal funds, as applicable, of the applicable Reporting Person.

The aggregate purchase price, excluding commissions, of the 6,621,253 shares of Common Stock owned by CCP was $1,085,556; of the 438,000

shares of Common Stock owned by ECM (on behalf of SMAs) was $63,015; of the 639,886 shares of Common Stock owned by Mr. Eriksen (including

through his spouse’s IRA) was $104,964.

|

|

Item 4.

|

Purpose of Transaction

|

The Reporting Person acquired shares of Nocopi

Technologies for investment purposes.

In pursuing its investment purposes, the Reporting

Persons may further purchase, hold, vote, trade, dispose or otherwise deal in the Common Stock at times, and in such manner, as they deem

advisable to benefit from, among other things, (1) changes in the market prices of the shares of Common Stock; (2) changes in

the Issuer’s operations, business strategy or prospects; or (3) from the sale or merger of the Issuer. To evaluate such alternatives,

the Reporting Persons will closely monitor the Issuer’s operations, prospects, business development, management, competitive and

strategic matters, capital structure, and prevailing market conditions, as well as other economic, securities markets and investment considerations.

Consistent with their investment research methods and evaluation criteria, the Reporting Persons may discuss such matters with the management

or the Issuer’s Board of Directors (the “Board”), other stockholders, industry analysts, existing or potential strategic

partners or competitors, investment and financing professionals, sources of credit, and other investors. Such evaluations and discussions

may materially affect, and result in, among other things, the Reporting Persons (1) modifying their ownership of the Common Stock;

(2) exchanging information with the Issuer pursuant to appropriate confidentiality or similar agreements; (3) proposing changes

in the Issuer’s operations, governance or capitalization; (4) proposing or pursuing changes to the Board or the Issuer’s

organization documents; or (5) pursuing one or more of the other actions described in subsections (a) through (j) of Item

4 of Schedule 13D.

In addition to the information disclosed in this

Statement, the Reporting Persons reserve the right to (1) formulate other plans and proposals; (2) take any actions with respect

to their investment in the Issuer, including any or all of the actions set forth in subsections (a) through (j) of Item 4 of

Schedule 13D; and (3) acquire additional shares of Common Stock or dispose of some or all of the shares of Common Stock beneficially

owned by them, in each case in the open market, through privately negotiated transactions or otherwise. The Reporting Persons may at any

time reconsider and change their plans or proposals relating to the foregoing.

On August 24, 2021 CCP delivered to Nocopi

a written request to call a special meeting of the shareholders of Nocopi. The request was signed by shareholders representing in excess

of 25% of the outstanding shares. The Board rejected the request as failing to comply with the Issuer’s bylaws. We strongly disagree

with the Board’s attempt to reject our validly called special meeting.

On October 28, 2021 the Board, without approval

by shareholders, adopted resolutions to classify the Board. This move could be used to prevent shareholders from voting on some of the

existing directors for two additional years. The bylaw changes also limited or stripped the rights of shareholders to remove directors,

change the size of the Board, and fill vacancies on the Board. We believe every one of these changes is contrary to good corporate governance.

On November 9, 2021, CCP issued a press release

entitled “Largest Shareholder of Nocopi Technologies Objects to Board Entrenchment.” A copy of the release was attached as

Exhibit 3 to our November 10, 2021 amended 13D and is incorporated by reference.

On December 6, 2021, CCP requested via email

to Nocopi’s CFO, for Nocopi to provide a copy of their director’s questionnaire in order for CCP to nominate director(s) at

the next annual meeting, which Nocopi stated it intends to hold in the spring of 2022. We have not received a response from Nocopi.

|

|

Item 5.

|

Interest in Securities of the Issuer

|

(a) and (b) The responses of the Reporting

Persons to rows 7, 8, 9, 10, 11 and 13 on the cover pages of this Statement are incorporated by reference. The following sets forth

the aggregate number and percentage (based on 67,495,055 shares of Common Stock outstanding on November 9, 2021, as reported in the

Form 10-Q of the Issuer filed with the Securities and Exchange Commission on November 12, 2021) of outstanding shares of Common

Stock owned beneficially by the Reporting Persons.

|

Name

|

|

No. of Shares

|

|

|

Percent of

Class

|

|

|

Cedar Creek Partners LLC (1)

|

|

|

6,621,253

|

|

|

|

9.8

|

%

|

|

SMAs (2)

|

|

|

438,000

|

|

|

|

0.6

|

%

|

|

Tim Eriksen (3)

|

|

|

639,886

|

|

|

|

0.9

|

%

|

|

Total

|

|

|

7,699,139

|

|

|

|

11.4

|

%

|

|

|

(1)

|

CCP is an investment partnership for which ECM is Managing Member and acts as the discretionary portfolio manager.

|

|

|

(2)

|

Shares held by the SMAs are owned by investment clients of ECM, who are also responsible to vote the shares. ECM does not own these

shares directly, but by virtue of ECM’s Investment Advisory Agreement, ECM may be deemed to beneficially own these shares by reason

of its power to dispose of such Shares. ECM, CCP and Mr. Eriksen disclaim beneficial ownership of these shares.

|

|

|

(3)

|

These shares are owned by Mr. Eriksen in his individual capacity.

|

Each Reporting Person may be deemed to be a member

of a “group” with the other Reporting Persons for the purposes of Section 13(d)(3) of the Securities Exchange Act

of 1934, as amended. As such, each Reporting Person may be deemed to be the beneficial owner of the shares of Common Stock directly owned

by the other Reporting Persons. Each Reporting Person disclaims beneficial ownership of such shares except to the extent of his or its

pecuniary interest therein.

(c) The following table sets forth all transactions

with respect to the Common Stock effected by Reporting Persons since Amendment No. 4 was filed.

|

|

|

Date

|

|

Shares

|

|

|

Buy/Sell

|

|

Price

|

|

|

Cedar Creek Partners

|

|

11/24/2021

|

|

|

326,300

|

|

|

Buy

|

|

|

0.1700

|

|

|

Cedar Creek Partners

|

|

12/2/2021

|

|

|

150,000

|

|

|

Buy

|

|

|

0.1600

|

|

|

Cedar Creek Partners

|

|

12/3/2021

|

|

|

21,000

|

|

|

Buy

|

|

|

0.1525

|

|

|

Cedar Creek Partners

|

|

12/6/2021

|

|

|

50,000

|

|

|

Buy

|

|

|

0.1380

|

|

|

|

|

Date

|

|

Shares

|

|

|

Buy/Sell

|

|

Price

|

|

|

ECM SMA

|

|

12/6/2021

|

|

|

330,000

|

|

|

Buy

|

|

|

0.1383

|

|

(d) No other person is known to the Reporting

Persons to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the shares

of Common Stock covered by this Statement.

(e) Not applicable.

|

|

Item 6.

|

Contracts, Arrangements, Understanding or Relationships with Respect to Securities of the Issuer.

|

Other than as described herein, there are no contracts,

arrangements, understandings or relationships among the Reporting Persons, or between the Reporting Persons and any other person, with

respect to the securities of the Issuer.

|

|

Item 7.

|

Material to be Filed as Exhibits.

|

Exhibit 1 Joint

Filing Agreement*

Exhibit 2 Press

Release, dated August 26, 2021*

Exhibit 3 Press

Release, dated November 9, 2021*

* Previously filed.

SIGNATURE

After reasonable inquiry, and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: December 13, 2021

|

|

ERIKSEN CAPITAL MANAGEMENT LLC

|

|

|

|

|

|

By:

|

/s/ Tim Eriksen

|

|

|

|

Tim Eriksen

|

|

|

|

Managing Member

|

|

|

|

|

|

CEDAR CREEK PARTNERS LLC

|

|

|

|

|

|

By:

|

/s/ Tim Eriksen

|

|

|

|

Tim Eriksen

|

|

|

|

Managing Member

|

|

|

|

|

|

TIM ERIKSEN

|

|

|

|

|

|

/s/ Tim Eriksen

|

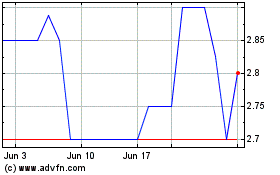

Nocopi Technologies Inc MD (PK) (USOTC:NNUP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nocopi Technologies Inc MD (PK) (USOTC:NNUP)

Historical Stock Chart

From Apr 2023 to Apr 2024