|

PROSPECTUS

|

Filed Pursuant to Rule 424(b)(4)

Registration No. 333-261453

|

300,000,000 Shares of Common Stock

This prospectus relates to the offer and resale

of up to: 300,000,000 shares of our common stock, par value $0.0001 per share (the “Shares”), that may be purchased

by GHS Investments LLC, a Nevada limited liability company (“GHS”), pursuant to the Equity Financing Agreement dated

November 9, 2021 between the Company and GHS (the “EFA”). GHS is also referred to herein as the “Selling Security

Holder.”

We will not receive any of the proceeds from the

sales of the Shares by the Selling Security Holder.

The Selling Security Holder identified in this

prospectus may offer the shares of Common Stock from time to time through public or private transactions at prevailing market prices or

at privately negotiated prices. The Selling Security Holder can offer all, some or none of its shares of Common Stock, thus we have no

way of determining the number of shares of Common Stock it will hold after this offering. See “Plan of Distribution.”

The Selling Security Holder is an “underwriter”

within the meaning of Section 2(a)(11) of the Securities Act.

Our Common Stock is currently quoted on the OTC

Markets under the symbol “DPLS.” On November 26, 2021, the last reported sale price of our Common Stock on the OTC Markets

was $0.0891.

Investing in our Common Stock involves a high

degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors”

beginning on page 5 of this prospectus, and under similar headings in any amendments or supplements to this prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus.

Any representation to the contrary is a criminal offense.

The date of this prospectus is December

13, 2021

TABLE OF CONTENTS

You should rely only on the information contained

in this prospectus. We have not authorized anyone to provide you with information different from that which is contained in this prospectus.

This prospectus may be used only where it is legal to sell these securities. The information in this prospectus may only be accurate on

the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of securities.

ABOUT THIS PROSPECTUS

The registration statement of which this prospectus

forms a part that we have filed with the U.S. Securities and Exchange Commission (the “SEC”) and includes exhibits

that provide more detail of the matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with

the SEC, together with the additional information described under the heading “Where You Can Find More Information” before

making your investment decision.

You should rely only on the information provided

in this prospectus or in any prospectus supplement or any free writing prospectuses or amendments thereto. Neither we, nor the Selling

Security Holder, have authorized anyone else to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. You should assume that the information in this prospectus is accurate only as of the date hereof.

Our business, financial condition, results of operations and prospects may have changed since that date.

Neither we, nor the Selling Security Holder, are

offering to sell or seeking offers to purchase these securities in any jurisdiction where the offer or sale is not permitted. Neither

we, nor the Selling Security Holder, have done anything that would permit this offering or possession or distribution of this prospectus

in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who

come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities

as to distribution of the prospectus outside of the United States.

Information contained in, and that can be accessed

through, our web site, www.darkpulse.com, does not constitute part of this prospectus.

This prospectus includes market and industry data

that has been obtained from third party sources, including industry publications, as well as industry data prepared by our management

on the basis of its knowledge of and experience in the industries in which we operate (including our management’s estimates and

assumptions relating to such industries based on that knowledge). Management’s knowledge of such industries has been developed through

its experience and participation in these industries. While our management believes the third-party sources referred to in this prospectus

are reliable, neither we nor our management have independently verified any of the data from such sources referred to in this prospectus

or ascertained the underlying economic assumptions relied upon by such sources. Internally prepared and third-party market forecasts in

particular are estimates only and may be inaccurate, especially over long periods of time. In addition, the underwriters have not independently

verified any of the industry data prepared by management or ascertained the underlying estimates and assumptions relied upon by management.

Furthermore, references in this prospectus to any publications, reports, surveys or articles prepared by third parties should not be construed

as depicting the complete findings of the entire publication, report, survey or article. The information in any such publication, report,

survey or article is not incorporated by reference in this prospectus.

PROSPECTUS SUMMARY

This summary highlights information contained

elsewhere in this prospectus; it does not contain all the information you should consider before investing in our Common Stock. You should

read the entire prospectus before making an investment decision. Throughout this prospectus, the terms the “Company”, “DarkPulse”,

“we,” “us,” “our,” and “our company” refer to DarkPulse, Inc., a Delaware corporation.

Company Overview

DarkPulse is a technology-security company incorporated

in 1989 as Klever Marketing, Inc ("Klever"). Its principal wholly-owned subsidiary, DarkPulse Technologies Inc. ("DPTI"),

originally started as a technology spinout from the University of New Brunswick, Fredericton, Canada. DPI is comprised of two security

platforms: Fiber and Ultra-High Sensitivity Sensors ("UHSS").

On April 27, 2018, Klever entered into an Agreement

and Plan of Merger (the “Merger Agreement” or the “Merger”) involving Klever as the surviving parent

corporation and acquiring DPTI as its wholly-owned subsidiary. On July 18, 2018, the parties closed the Merger Agreement, as amended on

July 7, 2018, and the name of the Company was subsequently changed to “DarkPulse, Inc.” With the change of control of the

Company, the Merger was accounted for as a recapitalization in a manner similar to a reverse acquisition.

On July 20, 2018, the Company filed a Certificate

of Amendment to its Certificate of Incorporation with the State of Delaware, changing the name of the Company to “DarkPulse, Inc.”

The Company filed a corporate action notification with the Financial Industry Regulatory Authority (“FINRA”), and the

Company's ticker symbol was changed to “DPLS.”

The Company’s security and monitoring systems

will be delivered in applications for critical infrastructure/ key resources such as but not limited to border security, pipelines, the

oil and gas industry and mine safety. Current uses of fiber optic distributed sensor technology have been limited to quasi-static, long-term

structural health monitoring due to the time required to obtain the data and its poor precision. The Company’s patented BOTDA dark-pulse

sensor technology allows for the monitoring of highly dynamic environments due to its greater resolution and accuracy.

In December 2010 DPTI entered into an Assignment

Agreement with the University of New Brunswick, Canada (the “University”), pursuant to which the University sold, transferred,

and assigned to the Company certain patents related to the University’s BOTDA dark-pulse technology (the "Patents")

in exchange for the issuance of a debenture to the University in the amount of C$1,500,000 (Canadian dollars). In April 2017, DPTI

issued a replacement debenture to the University in the amount of US$1,491,923 (the “Debenture”). The Patents and the

Debenture were initially recorded in the Company’s accounts at $1,491,923, based upon the exchange rate between the U.S. dollar

and the Canadian dollar on December 16, 2010, the date of the original debenture. In addition to the repayment of principal and interest,

the Debenture requires DPTI to pay the University a two percent royalty on sales of any and all products or services which incorporate

the Patents for a period of five years commencing on April 24, 2018, as well as to reimburse the University for its patent-related costs.

The Company has recently completed several acquisitions.

Our Business

The Company offers a full suite of engineering,

installation and security management solutions to industries and governments. Coupled with our patented BOTDA dark-pulse technology (the

“DarkPulse Technology”), DarkPulse provides its customers a comprehensive data stream of critical metrics for assessing

the health and security of their infrastructure. Our comprehensive system provides for rapid, precise analysis and responsive activities

predetermined by the end-user customer.

Historically, distributed sensor systems have

been too costly, slow and limited in their capabilities to attain widespread use. In addition, Brillouin-based sensors have been plagued

with temperature and strain cross-sensitivity, i.e. the inability to distinguish between temperature and strain change along the same

fiber. The loss of spatial resolution with an increase in fiber length has also limited the use of distributed sensor systems. Due to

these shortcomings, existing technologies are unable to succeed within today’s dynamic environments, and needs for more advanced

sensor technologies have remained unsatisfied.

By contrast to existing technologies, the DarkPulse

Technology is a distributed-fiber sensing system, based on dark-pulse Brillouin scattering, which reports in real-time

on conditions such as temperature, stress, strain corrosion and structural health monitoring of Critical Infrastructure/Key Resources

including Bridges, Buildings, Roadways pipelines and mining installations.

DarkPulse Technology’s differentiators from

and advantages over existing technologies:

|

|

·

|

Real-time Reporting: Higher data acquisition speeds allowing for structural monitoring of dynamic systems

|

|

|

|

|

|

|

·

|

Cost to Customer: Significantly lower acquisition and operating costs

|

|

|

|

|

|

|

·

|

Precision: A greater magnitude of precision and spatial resolution than other systems currently available

|

|

|

|

|

|

|

·

|

Applications: Wider range of capabilities than other systems currently available

|

|

|

|

|

|

|

·

|

Power consumption: Lower power consumption than existing systems allowing for off-grid installations

|

|

|

|

|

|

|

·

|

Integration: Capable of integrating with existing systems

|

|

|

|

|

|

|

·

|

Central station monitoring/cloud-based GUI

|

We believe that these key advantages should allow

the Company not only to enter existing markets, but more importantly, to open new market opportunities with new applications. The Company

intends to leverage new applications to target clients that have been unable to make use of distributed fiber optic technology to date.

Available Information

All reports of the Company filed with the SEC

are available free of charge through the SEC’s website at www.sec.gov. In addition, the public may read and copy materials

filed by the Company at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549. The public may also

obtain additional information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330.

Where You Can Find Us

The Company’s executive offices are located

at 1345 Ave of the Americas, 2nd Floor, New York, NY 10105, and our telephone number is (800) 436-1436. Our website address

is www.darkpulse.com. Information contained on our website does not form part of this prospectus and is intended for informational

purposes only.

THE OFFERING

|

Common Stock outstanding before the offering

|

|

5,154,044,407 shares of Common Stock.

|

|

|

|

|

|

Common Stock to be outstanding after giving effect to the issuance of 300,000,000 shares of Common Stock

|

|

5,454,044,407 shares of Common Stock.

|

|

|

|

|

|

Use of Proceeds

|

|

We will not receive any of the proceeds from any sale of the shares of Common Stock by the Selling Security Holder. We will receive proceeds from the purchase of the Common Stock under the EFA from the Selling Security Holder. See “Use of Proceeds.”

|

|

|

|

|

|

Risk Factors

|

|

The Common Stock offered hereby involves a high degree of risk and

should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors”

beginning on page 5.

|

|

|

|

|

|

Trading Symbol

|

|

The Company’s Common Stock is quoted on the OTC Markets quotation service platform under the symbol “DPLS.”

|

The number of shares of Common Stock outstanding

is based on an aggregate of 5,154,044,407 shares outstanding as of November

22, 2021 and excludes the shares of Common Stock issuable upon purchase of the Shares under the EFA.

For a more detailed description of the Shares

and the EFA, see “Private Placement”.

RISK FACTORS

Readers of this Prospectus should carefully consider

the risks and uncertainties described below.

Our failure to successfully address the risks

and uncertainties described below would have a material adverse effect on our business, financial condition and/or results of operations,

and the trading price of our common stock may decline and investors may lose all or part of their investment. We cannot assure you that

we will successfully address these risks or other unknown risks that may affect our business.

As an enterprise engaged in the development of

new technology, our business is inherently risky. Our common shares are considered speculative during the development of our new

business operations. Prospective investors should consider carefully the risk factors set out below.

Risks Related to Our Business

Business interruptions, including any interruptions

resulting from COVID-19, could significantly disrupt our operations and could have a material adverse impact on us if the situation continues.

Further, all employees, including our specialized

technical staff, are working from home or in a virtual environment. The Company always maintains the ability for team members to work

virtual and we will continue to stay virtual, until the applicable State and or the Federal government indicate the environment is safe

to return to work.

The ongoing coronavirus outbreak which began in

China at the beginning of 2020 has impacted various businesses throughout the world, including travel restrictions and the extended shutdown

of certain businesses in impacted geographic regions. If the coronavirus outbreak situation should worsen, we may experience disruptions

to our business including, but not limited to equipment, to our workforce, or to our business relationships with other third parties.

The extent to which the coronavirus impacts our

operations or those of our third-party partners will depend on future developments, which are highly uncertain and cannot be predicted

with confidence, including the duration of the outbreak, new information that may emerge concerning the severity of the coronavirus and

the actions to contain the coronavirus or treat its impact, among others. Any such disruptions or losses we incur could have a material

adverse effect on our financial results and our ability to conduct business as expected.

If we default on the Convertible Debenture, the secured holder

could take possession of our assets, including our patents and other intellectual property.

The Convertible Debenture (Secured) issued April

24, 2017, is secured by our assets, which includes our patents and other intellectual property. In the event that we default on the obligations

in the Debenture, the secured holder could take possession of our assets, including our patents and other intellectual property. If this

were to occur, investors would likely lose all of their investment.

We need to continue as a going concern if our business is to

succeed.

Our independent registered public accounting firm

reports on our audited financial statements for the years ended December 31, 2020 and 2019, indicate that there are a number of factors

that raise substantial risks about our ability to continue as a going concern. Such factors identified in the report are our accumulated

deficit since inception, no sales recorded to date, our failure to attain profitable operations, the excess of liabilities over assets,

and our dependence upon obtaining adequate additional financing to pay our liabilities. If we are not able to continue as a going concern,

investors could lose their investments.

We have made and

expect to continue to make acquisitions that could disrupt our operations and harm our operating results.

Our growth depends upon

market growth, our ability to enhance our existing products, and our ability to introduce new products on a timely basis. We intend to

continue to address the need to develop new products and enhance existing products through acquisitions of other companies, product lines,

technologies, and personnel. Acquisitions involve numerous risks, including the following:

|

|

•

|

|

Difficulties in integrating the operations, systems, technologies, products, and personnel of the acquired companies, particularly companies with large and widespread operations and/or complex products;

|

|

|

•

|

|

Diversion of management’s attention from normal daily operations of the business and the challenges of managing larger and more widespread operations resulting from acquisitions;

|

|

|

•

|

|

Potential difficulties in completing projects associated with in-process research and development intangibles;

|

|

|

•

|

|

Difficulties in entering markets in which we have no or limited direct prior experience and where competitors in such markets have stronger market positions;

|

|

|

•

|

|

Initial dependence on unfamiliar supply chains or relatively small supply partners;

|

|

|

•

|

|

Insufficient revenue to offset increased expenses associated with acquisitions; and

|

|

|

•

|

|

The potential loss of key employees, customers, distributors, vendors and other business partners of the companies we acquire following and continuing after announcement of acquisition plans.

|

Acquisitions may also

cause us to:

|

|

•

|

|

Issue common stock that would dilute our current shareholders’ percentage ownership;

|

|

|

•

|

|

Use a substantial portion of our cash resources or incur debt;

|

|

|

•

|

|

Significantly increase our interest expense, leverage and debt service requirements if we incur additional debt to pay for an acquisition;

|

|

|

•

|

|

Record goodwill and nonamortizable intangible assets that are subject to impairment testing on a regular basis and potential periodic impairment charges;

|

|

|

•

|

|

Incur amortization expenses related to certain intangible assets;

|

|

|

•

|

|

Incur tax expenses related to the effect of acquisitions on our intercompany research and development cost sharing arrangement and legal structure;

|

|

|

•

|

|

Incur large and immediate write-offs and restructuring and other related expenses; and

|

|

|

•

|

|

Become subject to intellectual property or other litigation.

|

Mergers and acquisitions

are inherently risky and subject to many factors outside of our control, and no assurance can be given that our previous or future acquisitions

will be successful and will not materially adversely affect our business, operating results, or financial condition. Failure to manage

and successfully integrate acquisitions could materially harm our business and operating results. Prior acquisitions could result in a

wide range of outcomes, from successful introduction of new products and technologies to a failure to do so. Even when an acquired company

has already developed and marketed products, there can be no assurance that product enhancements will be made in a timely fashion or that

pre-acquisition due diligence will have identified all possible issues that might arise with respect to such products.

From time to time, we

have made acquisitions that resulted in charges in an individual quarter. These charges may occur in any particular quarter, resulting

in variability in our quarterly earnings. In addition, our effective tax rate for future periods is uncertain and could be impacted by

mergers and acquisitions. Risks related to new product development also apply to acquisitions.

Because of the unique difficulties and uncertainties

inherent in technology development, we face a risk of business failure.

Potential investors should be aware of the difficulties

normally encountered by companies developing new technology and the high rate of failure of such enterprises. The likelihood of success

must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the development

of new technology with limited personnel and financial means. These potential problems include, but are not limited to, unanticipated

technical problems that extend the time and cost of product development, or unanticipated problems with the operation of our technology

or that with which we are licensing that also extend the time and cost of product development.

If we do not obtain additional financing

or sufficient revenues, our business will fail.

Our current operating funds are less than necessary

to complete the full development and marketing of our DarkPulse Technology-based systems, and we will need to obtain additional financing

in order to complete our business plan. We currently have minimal operations and we are not currently generating revenue or net

income.

Our business plan calls for significant expenses

in connection with developing our DarkPulse Technology-based systems and paying our current obligations. We will require additional financing

to execute its business plan through raising additional capital and/or beginning to generate revenue.

Obtaining additional financing is subject to a

number of factors, including investor acceptance of our DarkPulse Technology and current financial condition as well as general market

conditions.

These factors affect the timing, amount, terms

or conditions of additional financing unavailable to us. If additional financing is not arranged, we will face the risk of going out of

business. Our management is currently engaged in actively pursuing multiple financing options in order to obtain the capital necessary

to execute our business plan.

The most likely source of future funds presently

available to us is through the additional sale of private equity capital or through a convertible debt instrument. Any sale of share

capital or conversion of convertible debt will most likely result in dilution to existing shareholders.

There is no history upon which to base any assumption

as to the likelihood we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues

or achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Product development is a long, expensive and uncertain process.

The development of our DarkPulse Technology-based

systems is a costly, complex and time-consuming process, and the investment in product development often involves a long wait until a

return, if any, is achieved on such investment. We continue to make significant investments in research and development relating to our

DarkPulse Technology-based systems and our other businesses. Investments in new technology and processes are inherently speculative.

Successful technical development of our

products does not guarantee successful commercialization.

We may successfully complete the technical development

for one or all of our product development programs, but still fail to develop a commercially successful product for a number of reasons,

including among others the following:

|

|

·

|

ineffective distribution and marketing;

|

|

|

·

|

lack of sufficient cooperation from our partners;

and

|

|

|

·

|

demonstrations of the products not aligning with

or meeting customer needs.

|

Our success in the market for the products we

develop will depend largely on our ability to prove our products’ capabilities. Upon demonstration, our products and/or technology

may not have the capabilities they were designed to have or that we believed they would have. Furthermore, even if we do successfully

demonstrate our products’ capabilities, potential customers may be more comfortable doing business with a larger, more established,

more proven company than us. Moreover, competing products may prevent us from gaining wide market acceptance of our products. Significant

revenue from new product investments may not be achieved for a number of years, if at all.

If we fail to protect our intellectual property rights, we could

lose our ability to compete in the marketplace.

Our intellectual property and proprietary rights

are important to our ability to remain competitive and for the success of our products and our business. We rely on a combination of patent,

trademark and trade secret laws as well as confidentiality agreements and procedures, non-compete agreements and other contractual provisions

to protect our intellectual property, other proprietary rights and our brand. We have confidentiality agreements in place with our consultants,

customers and certain business suppliers and plan to require future employees to enter into confidentiality and non-compete agreements.

We have little protection when we must rely on trade secrets and nondisclosure agreements. Our intellectual property rights may be challenged,

invalidated or circumvented by third parties. We may not be able to prevent the unauthorized disclosure or use of our technical knowledge

or other trade secrets by employees or competitors. Furthermore, our competitors may independently develop technologies and products that

are substantially equivalent or superior to our technologies and/or products, which could result in decreased revenues. Moreover, the

laws of foreign countries may not protect our intellectual property rights to the same extent as the laws of the U.S. Litigation may be

necessary to enforce our intellectual property rights which could result in substantial costs to us and substantial diversion of management

attention. If we do not adequately protect our intellectual property, our competitors could use it to enhance their products. Our inability

to adequately protect our intellectual property rights could adversely affect our business and financial condition, and the value of our

brand and other intangible assets.

Other companies may claim that we infringe

their intellectual property, which could materially increase our costs and harm our ability to generate future revenue and profit.

We do not believe that we infringe the proprietary

rights of any third party, but claims of infringement are becoming increasingly common and third parties may assert infringement claims

against us. It may be difficult or impossible to identify, prior to receipt of notice from a third party, the trade secrets, patent position

or other intellectual property rights of a third party, either in the United States or in foreign jurisdictions. Any such assertion may

result in litigation or may require us to obtain a license for the intellectual property rights of third parties. If we are required to

obtain licenses to use any third-party technology, we would have to pay royalties, which may significantly reduce any profit on our products.

In addition, any such litigation could be expensive and disruptive to our ability to generate revenue or enter into new market opportunities.

If any of our products were found to infringe other parties’ proprietary rights and we are unable to come to terms regarding a license

with such parties, we may be forced to modify our products to make them non-infringing or to cease production of such products altogether.

The nature of our business involves significant

risks and uncertainties that may not be covered by insurance or indemnity.

We develop and sell products where insurance or

indemnification may not be available, including:

|

|

·

|

designing and developing products using advanced

and unproven technologies in intelligence and homeland security applications that are intended to operate in high demand, high risk situations;

and

|

|

|

·

|

designing and developing products to collect,

distribute and analyze various types of information.

|

Failure of certain of our products could result

in loss of life or property damage. Certain products may raise questions with respect to issues of privacy rights, civil liberties, intellectual

property, trespass, conversion and similar concepts, which may raise new legal issues. Indemnification to cover potential claims or liabilities

resulting from a failure of technologies developed or deployed may be available in certain circumstances but not in others. We are not

able to maintain insurance to protect against all operational risks and uncertainties. Substantial claims resulting from an accident,

failure of our product, or liability arising from our products in excess of any indemnity or insurance coverage (or for which indemnity

or insurance is not available or was not obtained) could harm our financial condition, cash flows, and operating results. Any accident,

even if fully covered or insured, could negatively affect our reputation among our customers and the public, and make it more difficult

for us to compete effectively.

We are heavily reliant on Dennis O’Leary,

our Chairman and Chief Executive Officer, and the departure or loss of Dennis O’Leary could disrupt our business.

We depend heavily on the continued efforts of

Dennis O’Leary, Chairman, Chief Executive Officer and director. Mr. O’Leary is essential to our strategic vision and day-to-day

operations and would be difficult to replace. We currently do not have an employment agreement with Mr. O’Leary, thus we cannot

be certain that he will desire to continue with us for the necessary time it will to complete the product development and initial sales

channel development. The departure or loss of Mr. O’Leary, or the inability to hire and retain a qualified replacement, could negatively

impact our ability to manage our business.

If we are unable to recruit and retain key

management, technical and sales personnel, our business would be negatively affected.

For our business to be successful, we need to

attract and retain highly qualified technical, management and sales personnel. The failure to recruit additional key personnel when needed

with specific qualifications and on acceptable terms or to retain good relationships with our partners might impede our ability to continue

to develop, commercialize and sell our products. To the extent the demand for skilled personnel exceeds supply, we could experience higher

labor, recruiting and training costs in order to attract and retain such employees. We face competition for qualified personnel from other

companies with significantly more resources available to them and thus may not be able to attract the level of personnel needed for our

business to succeed.

Material weaknesses in our internal control

over financial reporting may, until remedied, cause errors in our financial statements or cause our filings with the SEC to not be timely.

We believe that material weaknesses exist

in our internal control over financial reporting as of December 31, 2020, including those related to (i) our

internal audit functions and (ii) a lack of segregation of duties within accounting functions. If our internal control over financial

reporting or disclosure controls and procedures are not effective, there may be errors in our financial statements that could require

a restatement or our filings may not be timely made with the SEC. We intend to implement additional corporate governance and control measures

to strengthen our control environment as we are able, but we may not achieve our desired objectives. Moreover, no control environment,

no matter how well designed and operated, can prevent or detect all errors or fraud. We may identify material weaknesses and control deficiencies

in our internal control over financial reporting in the future that may require remediation and could lead investors losing confidence

in our reported financial information, which could lead to a decline in our stock price.

Risks Related to Our Organization and Our Common

Stock

You may experience dilution of your ownership

interests because of the future issuance of additional shares of our common or preferred stock or other securities that are convertible

into or exercisable for our common or preferred stock.

On July 1, 2019, the majority stockholders holding

a majority of the issued and outstanding voting shares of the Company approved an amendment to our Certificate of Incorporation, to increase

the number of authorized shares of Common Stock from 3,000,000,000 to 20,000,000,000. We are authorized to issue an aggregate of 20,000,000,000

shares of common stock and 2,000,000 shares of “blank check” preferred stock. In the future, we may issue our authorized but

previously unissued equity securities, resulting in the dilution of the ownership interests of our present stockholders. We may issue

additional shares of our common stock or other securities that are convertible into or exercisable for our common stock in connection

with hiring or retaining employees, future acquisitions, future sales of our securities for capital raising purposes, or for other business

purposes. The future issuance of any such additional shares of our common stock may create downward pressure on the trading price of the

common stock. We will need to raise additional capital in the near future to meet our working capital needs, and there can be no assurance

that we will not be required to issue additional shares, warrants or other convertible securities in the future in conjunction with these

capital raising efforts, including at a price (or exercise or conversion prices) below the price an investor paid for stock.

Because the SEC imposes additional sales

practice requirements on brokers who deal in our shares that are penny stocks, some brokers may be unwilling to trade them. This means

that investors may have difficulty reselling their shares and may cause the price of the shares to decline.

Our shares qualify as penny stocks and are covered

by Section 15(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which imposes additional

sales practice requirements on broker/dealers who sell our securities in this offering or in the aftermarket. In particular, prior to

selling a penny stock, broker/dealers must give the prospective customer a risk disclosure document that: contains a description of the

nature and level of risk in the market for penny stocks in both public offerings and secondary trading; contains a description of the

broker/dealers’ duties to the customer and of the rights and remedies available to the customer with respect to violations of such

duties or other requirements of Federal securities laws; contains a brief, clear, narrative description of a dealer market, including

“bid” and “ask” prices for penny stocks and the significance of the spread between the bid and ask prices; contains

the toll free telephone number for inquiries on disciplinary actions established pursuant to section 15(A)(i); defines significant terms

used in the disclosure document or in the conduct of trading in penny stocks; and contains such other information, and is in such form

(including language, type size, and format), as the SEC requires by rule or regulation. Further, for sales of our securities, the broker/dealer

must make a special suitability determination and receive from you a written agreement before making a sale to you. Because of the imposition

of the foregoing additional sales practices, it is possible that brokers will not want to make a market in our shares. This could prevent

reselling of shares and may cause the price of the shares to decline.

We do not expect to declare or pay any dividends.

We have not declared or paid any dividends on

our common stock since our inception, and we do not anticipate paying any such dividends for the foreseeable future.

Volatility of Stock Price.

Our common shares are currently publicly traded

on the OTC Markets under the symbol “DPLS.” In the future, the trading price of our common shares may be subject to wide fluctuations.

Trading prices of the common shares may fluctuate in response to a number of factors, many of which will be beyond our control. In addition,

the stock market in general, and the market for sensor technology companies in particular, has experienced extreme price and volume fluctuations

that have often been unrelated or disproportionate to the operating performance of such companies. Market and industry factors may adversely

affect the market price of the common shares, regardless of our operating performance. Readers should carefully consider the risks and

uncertainties described below before deciding whether to invest in shares of our common stock.

Our failure to successfully address the risks

and uncertainties described below would have a material adverse effect on our business, financial condition and/or results of operations,

and the trading price of our common stock may decline and investors may lose all or part of their investment. We cannot assure you that

we will successfully address these risks or other unknown risks that may affect our business.

As an enterprise engaged in the development of

new technology, our business is inherently risky. Our common shares are considered speculative during the development of our new business

operations. Prospective investors should consider carefully the risk factors set out herein. The market price of our common stock

has fluctuated significantly.

Being a public company is expensive and administratively burdensome.

As a public reporting company, we are subject

to the information and reporting requirements of the Securities Act, the Exchange Act and other federal securities laws, rules and regulations

related thereto, including compliance with the Sarbanes-Oxley Act. Complying with these laws and regulations requires the time and attention

of our Board of Directors and management team, and increases our expenses. We estimate we will incur approximately $200,000 to $300,000

annually in connection with being a public company.

Among other things, we are required to:

|

|

·

|

maintain and evaluate a system of internal controls

over financial reporting in compliance with the requirements of Section 404 of the Sarbanes-Oxley Act and the related rules and regulations

of the SEC and the Public Company Accounting Oversight Board;

|

|

|

·

|

prepare and distribute periodic reports in compliance

with our obligations under federal securities laws;

|

|

|

·

|

institute a more comprehensive compliance function,

including with respect to corporate governance; and

|

|

|

·

|

involve, to a greater degree, our outside legal

counsel and accountants in the above activities.

|

The costs of preparing and filing annual and quarterly

reports, proxy statements and other information with the SEC and furnishing audited reports to stockholders are expensive and much greater

than that of a privately-held company, and compliance with these rules and regulations may require us to hire additional financial reporting,

internal controls and other finance personnel, and will involve a material increase in regulatory, legal and accounting expenses and the

attention of management. There can be no assurance that we will be able to comply with the applicable regulations in a timely manner,

if at all. In addition, being a public company makes it more expensive for us to obtain director and officer liability insurance. In the

future, we may be required to accept reduced coverage or incur substantially higher costs to obtain this coverage.

If we fail to establish and maintain an

effective system of internal control, we may not be able to report our financial results accurately or to prevent fraud. Any inability

to report and file our financial results accurately and timely could harm our reputation and adversely impact the trading price of our

common stock.

Effective internal control is necessary for us

to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent fraud, we may not

be able to manage our business as effectively as we would if an effective control environment existed, and our business and reputation

with investors may be harmed. As a result, our small size and any current internal control deficiencies may adversely affect our financial

condition, results of operation and access to capital. We have not performed an in-depth analysis to determine if historical un-discovered

failures of internal controls exist, and may in the future discover areas of our internal control that need improvement.

Public company compliance may make it more

difficult to attract and retain officers and directors.

The Sarbanes-Oxley Act and new rules subsequently

implemented by the SEC have required changes in corporate governance practices of public companies. As a public company, we expect these

new rules and regulations to increase our compliance costs in 2021 and beyond and to make certain activities more time consuming and costly.

As a public company, we also expect that these new rules and regulations may make it more difficult and expensive for us to obtain director

and officer liability insurance in the future and we may be required to accept reduced policy limits and coverage or incur substantially

higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified persons

to serve on our Board of Directors or as executive officers.

You could lose all of your investment.

An investment in our securities is speculative

and involves a high degree of risk. Potential investors should be aware that the value of an investment in the Company may go down as

well as up. In addition, there can be no certainty that the market value of an investment in the Company will fully reflect its underlying

value. You could lose your entire investment.

The ability of our Board of Directors to

issue additional stock may prevent or make more difficult certain transactions, including a sale or merger of the Company.

Our Board of Directors is authorized to issue

up to 2,000,000 shares of preferred stock with powers, rights and preferences designated by it. Shares of voting or convertible preferred

stock could be issued, or rights to purchase such shares could be issued, to create voting impediments or to frustrate persons seeking

to effect a takeover or otherwise gain control of the Company. The ability of the Board of Directors to issue such additional shares

of preferred stock, with rights and preferences it deems advisable, could discourage an attempt by a party to acquire control of the Company

by tender offer or other means. Such issuances could therefore deprive stockholders of benefits that could result from such an attempt,

such as the realization of a premium over the market price for their shares in a tender offer or the temporary increase in market price

that such an attempt could cause. Moreover, the issuance of such additional shares of preferred stock to persons friendly to the

Board of Directors could make it more difficult to remove incumbent officers and directors from office even if such change were to be

favorable to stockholders generally.

Our stock may be traded infrequently and

in low volumes, so you may be unable to sell your shares at or near the quoted bid prices if you need to sell your shares.

Until our common stock is listed on a national

securities exchange such as the New York Stock Exchange or the Nasdaq, we expect our common stock to remain eligible for quotation on

the OTC Markets, or on another over-the-counter quotation system. In those venues, however, the shares of our common stock may trade infrequently

and in low volumes, meaning that the number of persons interested in purchasing our common shares at or near bid prices at any given time

may be relatively small or non-existent. An investor may find it difficult to obtain accurate quotations as to the market value of our

common stock or to sell his or her shares at or near bid prices or at all. In addition, if we fail to meet the criteria set forth in SEC

regulations, various requirements would be imposed by law on broker-dealers who sell our securities to persons other than established

customers and accredited investors. Consequently, such regulations may deter broker-dealers from recommending or selling our common stock,

which may further affect the liquidity of our common stock. This would also make it more difficult for us to raise capital.

There currently is no active public market

for our common stock and there can be no assurance that an active public market will ever develop. Failure to develop or maintain a trading

market could negatively affect the value of our common stock and make it difficult or impossible for you to sell your shares.

There is currently no active public market for

shares of our common stock and one may never develop. Our common stock is quoted on the OTC Markets. The OTC Markets is a thinly traded

market and lacks the liquidity of certain other public markets with which some investors may have more experience. We may not ever be

able to satisfy the listing requirements for our common stock to be listed on a national securities exchange, which is often a more widely-traded

and liquid market. Some, but not all, of the factors which may delay or prevent the listing of our common stock on a more widely-traded

and liquid market include the following: our stockholders’ equity may be insufficient; the market value of our outstanding securities

may be too low; our net income from operations may be too low; our common stock may not be sufficiently widely held; we may not be able

to secure market makers for our common stock; and we may fail to meet the rules and requirements mandated by the several exchanges and

markets to have our common stock listed. Should we fail to satisfy the initial listing standards of the national exchanges, or our common

stock is otherwise rejected for listing, and remains listed on the OTC Markets or is suspended from the OTC Markets, the trading price

of our common stock could suffer and the trading market for our common stock may be less liquid and our common stock price may be subject

to increased volatility, making it difficult or impossible to sell shares of our common stock.

Our common stock is subject to the “penny

stock” rules of the SEC and the trading market in the securities is limited, which makes transactions in the stock cumbersome and

may reduce the value of an investment in the stock.

Rule 15g-9 under the Exchange Act establishes

the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less

than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction

involving a penny stock, unless exempt, the rules require: (a) that a broker or dealer approve a person’s account for transactions

in penny stocks; and (b) the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity

and quantity of the penny stock to be purchased.

In order to approve a person’s account for

transactions in penny stocks, the broker or dealer must: (a) obtain financial information and investment experience objectives of the

person and (b) make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient

knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior

to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight

form: (a) sets forth the basis on which the broker or dealer made the suitability determination; and (b) confirms that the broker or dealer

received a signed, written agreement from the investor prior to the transaction. Generally, brokers may be less willing to execute

transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of

our common stock and cause a decline in the market value of our common stock.

Disclosure also has to be made about the risks

of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker or

dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in

cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for

the penny stock held in the account and information on the limited market in penny stocks.

Our stock price may be volatile.

The market price of our common stock is likely

to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including

the following:

|

|

·

|

changes in our industry;

|

|

|

·

|

competitive pricing pressures;

|

|

|

·

|

our ability to obtain working capital financing;

|

|

|

·

|

additions or departures of key personnel;

|

|

|

·

|

sales of our common stock;

|

|

|

·

|

our ability to execute our business plan;

|

|

|

·

|

operating results that fall below expectations;

|

|

|

·

|

loss of any strategic relationship;

|

|

|

·

|

regulatory developments; and

|

|

|

·

|

economic and other external factors.

|

In addition, the securities markets have from

time-to-time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies.

These market fluctuations may also materially and adversely affect the market price of our common stock.

Offers or availability for sale of a substantial

number of shares of our common stock may cause the price of our common stock to decline.

If our stockholders sell substantial amounts of

our common stock in the public market, including upon the expiration of any statutory holding period under Rule 144, or issued upon the

conversion of preferred stock or exercise of warrants, it could create a circumstance commonly referred to as an "overhang"

and in anticipation of which the market price of our common stock could fall. The existence of an overhang, whether or not sales have

occurred or are occurring, also could make more difficult our ability to raise additional financing through the sale of equity or equity-related

securities in the future at a time and price that we deem reasonable or appropriate.

Risks Related to the Offering

Our existing stockholders may experience

significant dilution from the sale of our common stock pursuant to the GHS Equity Financing Agreement.

The sale of our common stock to GHS in accordance

with the EFA may have a dilutive impact on our shareholders. As a result, the market price of our common stock could decline. In addition,

the lower our stock price is at the time we exercise Puts, the more shares of our common stock we will have to issue to GHS in order to

exercise a Put under the EFA. If our stock price decreases, then our existing shareholders would experience greater dilution for any given

dollar amount raised through the offering.

The perceived risk of dilution may cause our stockholders

to sell their shares, which may cause a decline in the price of our common stock. Moreover, the perceived risk of dilution and the resulting

downward pressure on our stock price could encourage investors to engage in short sales of our common stock. By increasing the number

of shares offered for sale, material amounts of short selling could further contribute to progressive price declines in our common stock.

The issuance of shares pursuant to the EFA

may have a significant dilutive effect.

Depending on the number of shares we issue pursuant

to the EFA, it could have a significant dilutive effect upon our existing shareholders. Although the number of shares that we may issue

pursuant to the EFA will vary based on our stock price (the higher our stock price, the less shares we have to issue), there may be a

potential dilutive effect to our shareholders, based on different potential future stock prices, if the full amount of the EFA is realized.

Dilution is based upon common stock put to GHS and the stock price discounted to GHS’s purchase price.

GHS will pay less than the then-prevailing

market price of our common stock which could cause the price of our common stock to decline.

Our common stock to be issued under the EFA will

be purchased at an 8% discount, or 92% of the volume-weighted average price for the Company’s common stock during the ten consecutive

trading days immediately preceding each Put.

GHS has a financial incentive to sell our shares

immediately upon receiving them to realize the profit between the discounted price and the market price. If GHS sells our shares, the

price of our common stock may decrease. If our stock price decreases, GHS may have further incentive to sell such shares. Accordingly,

the discounted sales price in the EFA may cause the price of our common stock to decline.

We may not have access to the full amount

under the financing agreement.

The lowest volume-weighted average price for the

ten days ended November 22, 2021 was $0.08931. At that price we would be able to sell shares to GHS under the EFA at the discounted price

of $0.0875238. At that discounted price, the 300,000,000 shares would only represent $26,257,140, which is below the full amount of the

EFA. In addition, any single drawdown must be at least $10,000 and cannot exceed $3,000,000 and any single drawdown may not exceed 200%

of the average daily trading dollar volume of our Common Stock during the ten trading days preceding the put.

There could be unidentified risks involved

with an investment in our securities.

The foregoing risk factors are not a complete

list or explanation of the risks involved with an investment in the securities. Additional risks will likely be experienced that are not

presently foreseen by us. Prospective investors must not construe this the information provided herein as constituting investment, legal,

tax or other professional advice. Before making any decision to invest in our securities, you should read this entire Prospectus and consult

with your own investment, legal, tax and other professional advisors. An investment in our securities is suitable only for investors who

can assume the financial risks of an investment in us for an indefinite period of time and who can afford to lose their entire investment.

We make no representations or warranties of any kind with respect to the likelihood of the success or the business of our Company, the

value of our securities, any financial returns that may be generated or any tax benefits or consequences that may result from an investment

in us.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains various “forward-looking

statements.” You can identify forward-looking statements by the use of forward-looking terminology such as “believes,”

“expects,” “may,” “would,” “could,” “should,” “seeks,” “approximately,”

“intends,” “plans,” “projects,” “estimates” or “anticipates” or the negative

of these words and phrases or similar words or phrases. You can also identify forward-looking statements by discussions of strategy, plans

or intentions. These statements may be impacted by a number of risks and uncertainties.

The forward-looking

statements are based on our beliefs, assumptions and expectations of our future performance taking into account all information currently

available to us. These beliefs, assumptions and expectations are subject to risks and uncertainties and can change as a result of many

possible events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity and results

of operations may vary materially from those expressed in our forward-looking statements. You should carefully consider these risks before

you make an investment decision with respect to our securities. For a further discussion of these and other factors that could impact

our future results, performance or transactions, see the section entitled “Risk Factors.”

PRIVATE PLACEMENT

Equity Financing Agreement

On November 9, 2021,

we entered an EFA and Registration Rights Agreement (the “Registration Rights Agreement”) with GHS, pursuant to which

GHS agreed to purchase up to $30,000,000 in shares of our Common Stock, from time to time over the course of 24 months (the “Contract

Period”) after effectiveness of a registration statement on Form S-1 (the “Registration Statement”) of the

underlying shares of Common Stock.

The EFA grants us the

right, from time to time at our sole discretion (subject to certain conditions) during the Contract Period, to direct GHS to purchase

shares of Common Stock on any business day (a “Put”), provided that at least ten Trading Days (as defined in the EFA)

have passed since the most recent Put. The purchase price of the shares of Common Stock contained in a Put shall be 92% of the Market

Price with “Market Price” defined as the lowest volume weighted average price (VWAP) price of the Common Stock during the

Pricing Period (as defined in the EFA). No Put will be made in an amount less than $10,000 or greater than $3,000,000. In no event are

we entitled to make a Put or is GHS entitled to purchase that number of shares of Common Stock of the Company, which when added to the

sum of the number of shares of Common Stock beneficially owned (as such term is defined under Section 13(d) and Rule 13d-3 of the Exchange

Act), by GHS, would exceed 4.99% of the number of shares of Common Stock outstanding on such date, as determined in accordance with Rule

13d-1(j) of the Exchange Act.

The EFA will terminate

upon any of the following events: when GHS has purchased an aggregate of $30,000,000 in the Common Stock of the Company pursuant to the

EFA; on the date that is 24 months from the date of the EFA; or by mutual written consent of the parties. Actual sales of shares of Common

Stock to GHS under the EFA will depend on a variety of factors to be determined by us from time to time, including, among others, market

conditions, the trading price of the Common Stock and determinations by us as to the appropriate sources of funding for the Company and

its operations. The net proceeds under the EFA to us will depend on the frequency and prices at which we sell shares of our stock to GHS.

The Registration Rights

Agreement provides that we shall (i) use our best efforts to file with the SEC the Registration Statement within 45 days of the date of

the Registration Rights Agreement; and (ii) have the Registration Statement declared effective by the SEC within 30 days after the date

the Registration Statement is filed with the SSEC, but in no event more than 90 days after the Registration Statement is filed.

We to use the proceeds

from the Puts for operational expenses and also potential acquisitions deemed beneficial

to the operational capabilities of the Company.

See “Plan of Distribution” elsewhere

in this prospectus for more information.

USE OF PROCEEDS

The Selling Security Holder will receive all the

proceeds from the sales of the Shares under this prospectus. We will not receive any proceeds from these sales. To the extent we receive

proceeds from the Puts to the Selling Security Holder, we will use those proceeds for operations and acquisitions. We have agreed

to bear the certain expenses relating to the registration of the shares of Common Stock being registered herein for Selling Security Holder.

See “Plan of Distribution” elsewhere

in this prospectus for more information.

SELLING SECURITY HOLDER

This prospectus covers the offering of up to 300,000,000

shares of Common Stock being offered by the Selling Security Holder, which includes shares of Common Stock acquirable upon the issuance

of a Put to the Selling Security Holder, as described herein. We are registering the Shares in order to permit the Selling Security Holder

to offer their shares of Common Stock for resale from time to time.

The table below lists the Selling Security Holder

and other information regarding the “beneficial ownership” of the shares of Common Stock by the Selling Security Holder. In

accordance with Rule 13d-3 of the Exchange Act, “beneficial ownership” includes any shares of Common Stock as to which the

Selling Security Holder has sole or shared voting power or investment power and any shares of Common Stock the Selling Security Holder

has the right to acquire within 60 days.

The Selling Security Holder is an “underwriter”

within the meaning of Section 2(a)(11) of the Securities Act.

The second column indicates the number of shares

of Common Stock beneficially owned by the Selling Security Holder, based on its ownership as of November 22, 2021. The second column also

assumes purchase of all shares of stock to be acquired under the maximum amount of securities to be sold by the Company to the Selling

Security Holder, without regard to any limitations on purchase described in this prospectus or in the EFA.

The third column lists the shares of Common Stock

being offered by this prospectus by the Selling Security Holder. Such aggregate amount of Common Stock does not take into account any

applicable limitations on purchase of the securities under the EFA.

This prospectus covers the resale of (i) all of

the shares of Common Stock issued and issuable upon the Company issuing a Put, and (ii) any securities issued or then issuable upon any

full anti-dilution protection, stock split, dividend or other distribution, recapitalization or similar event with respect to the common

shares.

Because the issuance price of the common shares

may be adjusted, the number of shares of Common Stock that will actually be issued upon issuance of the common shares may be more or less

than the number of shares of Common Stock being offered by this prospectus. The Selling Security Holder can offer all, some or none of

its shares of Common Stock, thus we have no way of determining the number of shares of Common Stock it will hold after this offering.

Therefore, the fourth and fifth columns assume that the Selling Security Holder will sell all shares of Common Stock covered by this prospectus.

See “Plan of Distribution.”

The Selling Security Holder identified below has

confirmed to us that it is not a broker-dealer or an affiliate of a broker-dealer within the meaning of United States federal securities

laws.

|

|

|

Number of

Shares of

Common Stock

Owned Prior to

Offering(1)

|

|

|

Maximum

Number of

Shares of

Common Stock

to be Sold

Pursuant to this

Prospectus

|

|

|

Number of

Shares of

Common Stock

Owned After

Offering

|

|

|

Percentage

Beneficially

Owned After

Offering

|

|

|

GHS Investments, LLC (1)

|

|

|

0

|

|

|

|

300,000,000

|

(2)

|

|

|

–

|

|

|

|

–

|

|

|

TOTAL

|

|

|

0

|

|

|

|

300,000,000

|

|

|

|

–

|

|

|

|

–

|

|

__________

|

(1)

|

GHS Investments, LLC is a limited liability company organized under the laws of Nevada. Mark Grober has dispositive power over the shares owned by GHS.

|

|

(2)

|

300,000,000 shares to be issued pursuant to the EFA.

|

Material Relationships with Selling Security

Holder

The Selling Security Holder has not at any time

during the past three years acted as one of our employees, officers or directors or had a material relationship with us except (i) with

respect to transactions described above in “Private Placement,” and (ii) the Purchase Agreement dated August 19, 2021 with

GHS.

MARKET PRICE OF COMMON STOCK AND OTHER STOCKHOLDER

MATTERS

Our Common Stock is currently quoted on the OTC

Markets, which is sponsored by OTC Markets Group, Inc. The OTC Markets is a network of security dealers who buy and sell stock. The dealers

are connected by a computer network that provides information on current “bids” and “asks,” as well as volume

information. Our shares are quoted on the OTC Markets under the symbol “DPLS.”

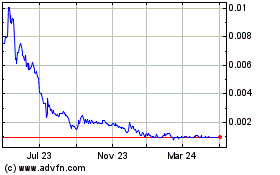

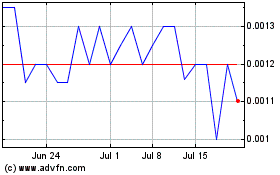

The table below sets forth for the periods indicated

the quarterly high and low bid prices as reported by OTC Markets. Limited trading volume has occurred during these periods. These quotations

reflect inter-dealer prices, without retail mark-up, mark-down, or commission and may not necessarily represent actual transactions.

|

2021:

|

|

High

|

|

|

Low

|

|

|

First Quarter

|

|

$

|

0.0510

|

|

|

$

|

0.0007

|

|

|

Second Quarter

|

|

$

|

0.0969

|

|

|

$

|

0.0106

|

|

|

Third Quarter

|

|

$

|

0.2020

|

|

|

$

|

0.0653

|

|

|

2020:

|

|

High

|

|

|

Low

|

|

|

First Quarter

|

|

$

|

0.0002

|

|

|

$

|

0.0001

|

|

|

Second Quarter

|

|

$

|

0.0002

|

|

|

$

|

0.0001

|

|

|

Third Quarter

|

|

$

|

0.0006

|

|

|

$

|

0.0001

|

|

|

Fourth Quarter

|

|

$

|

0.0011

|

|

|

$

|

0.0001

|

|

|

2019:

|

|

High

|

|

|

Low

|

|

|

First Quarter

|

|

$

|

0.0500

|

|

|

$

|

0.0035

|

|

|

Second Quarter

|

|

$

|

0.0062

|

|

|

$

|

0.0005

|

|

|

Third Quarter

|

|

$

|

0.0008

|

|

|

$

|

0.0001

|

|

|

Fourth Quarter

|

|

$

|

0.0003

|

|

|

$

|

0.0001

|

|

The Company’s common stock is considered

to be penny stock under rules promulgated by the SEC. Under these rules, broker-dealers participating in transactions in these securities

must first deliver a risk disclosure document which describes risks associated with these stocks, broker-dealers’ duties, customers’

rights and remedies, market and other information, and make suitability determinations approving the customers for these stock transactions

based on financial situation, investment experience and objectives. Broker-dealers must also disclose these restrictions in writing, provide

monthly account statements to customers, and obtain specific written consent of each customer. With these restrictions, the likely effect

of designation as a penny stock is to decrease the willingness of broker-dealers to make a market for the stock, to decrease the liquidity

of the stock and increase the transaction cost of sales and purchases of these stocks compared to other securities.

The high and low bid price for shares of our Common

Stock on November 26, 2021, was $0.092 and $0.0863, respectively, based upon bids that represent prices quoted by broker-dealers on the

OTC Markets.

Approximate Number of Equity Security Holders

As of November 22, 2021, there were approximately

939 stockholders of record. Because shares of our Common Stock are held by depositaries, brokers and other nominees, the number of beneficial

holders of our shares is substantially larger than the number of stockholders of record.

Dividends

We have not declared or paid a cash dividend to

our stockholders since we were organized and does not intend to pay dividends in the foreseeable future. Our board of directors presently

intends to retain any earnings to finance our operations and does not expect to authorize cash dividends in the foreseeable future. Any

payment of cash dividends in the future will depend upon our earnings, capital requirements and other factors.

Section 15(g) of the Securities Exchange Act of 1934

Our shares are covered by section 15(g) of the

Exchange Act that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established

customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess

of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). For transactions covered by the Rule, the broker/dealer

must make a special suitability determination for the purchase and have received the purchaser's written agreement to the transaction

prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell our securities and also may affect your ability

to sell your shares in the secondary market.

Section 15(g) also imposes additional sales practice

requirements on broker/dealers who sell penny securities. These rules require a one-page summary of certain essential items. The items

include the risk of investing in penny stocks in both public offerings and secondary marketing; terms important to in understanding of

the function of the penny stock market, such as bid and offer quotes, a dealers spread and broker/dealer compensation; the broker/dealer

compensation, the broker/dealers’ duties to its customers, including the disclosures required by any other penny stock disclosure

rules; the customers’ rights and remedies in cases of fraud in penny stock transactions; and, the FINRA’s toll free telephone

number and the central number of the North American Securities Administrators Association, for information on the disciplinary history

of broker/dealers and their associated persons.

Penny Stock

Our stock is considered a penny stock. The SEC

has adopted rules that regulate broker-dealer practices in transactions in penny stocks. Penny stocks are generally equity securities

with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ

system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange

or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure

document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both

public offerings and secondary trading; (b) contains a description of the broker’s or dealer’s duties to the customer and

of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities

laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance

of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines

significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and

is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to

effecting any transaction in a penny stock, the customer with: (a) bid and offer quotations for the penny stock; (b) the compensation

of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other