Current Report Filing (8-k)

December 10 2021 - 9:15AM

Edgar (US Regulatory)

false

0001063537

0001063537

2021-12-10

2021-12-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): December 10, 2021

|

RICEBRAN TECHNOLOGIES

|

|

(Exact Name of registrant as specified in its charter)

|

|

|

California

|

|

|

|

(State or other jurisdiction of incorporation)

|

|

|

|

|

|

|

0-32565

|

|

87-0673375

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

25420 Kuykendahl Rd., Suite B300

Tomball, TX

|

|

77375

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

|

|

|

|

(281) 675-2421

|

|

Registrant’s telephone number, including area code

|

|

|

|

|

|

Not Applicable

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common stock, no par value per share

|

|

RIBT

|

|

The NASDAQ Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On December 6, 2021, RiceBran Technologies d/b/a RiceBran Technologies, Inc. (the “Company”) entered into a Mortgage with Security Agreement and Fixture Filing (the “Mortgage”), in favor of Continental Republic Capital, LLC d/b/a Republic Business Credit (“Republic”), pursuant to a Secured Promissory Note, dated as of December 6, 2021 (the “Secured Promissory Note”) made by the Company and its subsidiaries MGI Grain Incorporated and Golden Ridge Rice Mills, Inc., (the “Borrowers”), in favor of Republic.

Under the terms of the Secured Promissory Note, Republic will lend to the Borrowers up to $2.5 million (the “New Term Loan”). The amounts outstanding under the Secured Promissory Note will be secured by the Company’s interest in that certain real property commonly known as 1784 Highway 1 North, Wynne, Cross County, Arkansas 72396, pursuant to the Mortgage. The foregoing description of the Secured Promissory Note does not purport to be complete and is qualified in its entirety by reference its full text, a copy of which is attached as Exhibit 10.1 and incorporated herein by reference.

The principal amount of the New Term Loan will be used to pay off the company’s prior Term Loan and for general working capital needs. The New Term Loan will accrue interest at a rate equal to 7.0% plus the prime rate of interest announced from time to time by Wells Fargo Bank, N.A., or any successor thereof. The principal amount of the New Term Loan must be repaid in 24 equal monthly installments ending in December 2023. In addition, the Borrowers will incur an administrative fee equal to 1.0% of the increase in the principal amount borrowed under the agreement after repayment of the existing Term Loan.

In addition, on December 6, 2021, the Borrowers and Republic entered into a Second Amendment to the Agreement for Purchase and Sale, dated as of December 6, 2021 (the “Amendment”). The Amendment amends the Agreement for Purchase and Sale (as modified, amended or supplemented, the “APS”) that the Company entered into on or about October 28, 2019. The Amendment memorializes and reflects the addition of the New Term Loan facility to the APS, and the removal of the prior Term Loan from the APS, as well as changes in the security interests required by Republic and the conflict resolution provisions of the APS.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information disclosed in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03

Item 9.01 Financial Statements and Exhibits

|

Exhibit

No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

RICEBRAN TECHNOLOGIES

|

|

|

|

|

|

|

|

Date: December 10, 2021

|

By:

|

/s/ Todd T. Mitchell

|

|

|

|

Name:

|

Todd T. Mitchell

|

|

|

|

Title:

|

Chief Financial Officer

|

|

|

|

|

(Duly Authorized Officer)

|

|

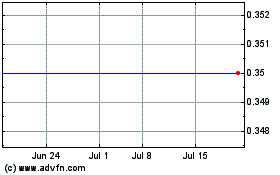

RiceBran Technologies (NASDAQ:RIBT)

Historical Stock Chart

From Mar 2024 to Apr 2024

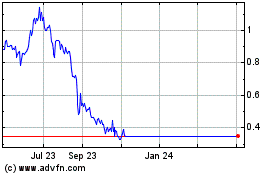

RiceBran Technologies (NASDAQ:RIBT)

Historical Stock Chart

From Apr 2023 to Apr 2024