Newtek Business Services Corp., (NASDAQ: NEWT), an internally

managed business development company (“BDC”), today announced that

it has closed its eleventh small business loan securitization, with

the sale of $103,430,000 of Unguaranteed SBA 7(a) Loan-Backed

Notes, Series 2021-1, consisting of $79,680,000 of Class A Notes

and $23,750,000 Class B Notes (collectively, the “Notes”), rated

“A” and “BBB-”, respectively, by S&P Global, Inc. (“S&P”).

The Notes had an 82.50% advance rate, and were priced at an average

initial yield of approximately 2.02% (Note interest rates are

floating rate and adjust monthly), which is equivalent to a spread

of 192 basis points over LIBOR, across both classes.

The Notes are collateralized by the right to receive payments

and other recoveries attributable to the unguaranteed portions of

SBA 7(a) loans made by Newtek Small Business Finance, LLC ("NSBF")

pursuant to Section 7(a) of the Small Business Act, and

overcollateralized by NSBF's participation interest in the

unguaranteed portions. Deutsche Bank Securities and Capital One

Securities acted as joint book running managers for the

transaction.

Barry Sloane, Chairman, President and Chief Executive Officer of

Newtek Business Services Corp. said, “We are extremely pleased that

NSBF was able to issue its eleventh securitization, as we have

reestablished our core SBA 7(a) lending business. According to data

from the Small Business Administration (“SBA”), NSBF is ranked by

dollar origination volume as the largest non-bank SBA lender and

the third largest SBA lender, including banks, at SBA’s fiscal year

end of September 30, 2021. This 2021-1 Securitization has

attractive economics for the Company, with the unguaranteed

portions of the SBA 7(a) loans having been funded with 100% equity

prior to the securitization, raising approximately $100.3 million

of total cash liquidity, which includes $76.9 million of cash at

closing, and a prefunding amount of $23.3 million, which we expect

to draw down within 90 days, and with an advance rate of 82.50%

across the A rated and BBB- rated Notes. The proceeds from this

2021-1 Securitization, which is classified as non-recourse

financing, can be used to refinance higher-cost debt, fund loan

originations, as well as other general corporate purposes. In

addition, we are pleased to report that the Class A Notes were 4.7

times oversubscribed and the Class B Notes were 3.4 times

oversubscribed with 10 of some of the largest and most

sophisticated institutional investors participating in this

deal.”

Mr. Sloane continued, “We have continued to augment our loan

servicing staff and are pleased that we have been able to service

our existing loan portfolio, maintaining delinquency and default

data that is consistent with pre-pandemic levels. We attribute this

solid credit performance to working closely with the SBA and our

borrowers on three rounds of PPP financing, payments associated

with Section 1112 of the Cares Act, Economic Injury Disaster Loan

financing, and the Employee Retention Credit Program, offering our

customer base assistance in weathering the pandemic effects.”

Mr. Sloane further commented, “We currently have a full pipeline

of loans across SBA 7(a), SBA 504, and non-conforming conventional

loan categories and, as such, are reaffirming our guidance across

several metrics. We are reaffirming our full year 2021 SBA 7(a)

loan funding forecast of between $560 and $600 million, which would

represent record annual SBA 7(a) fundings for Newtek, as well as a

12% increase, at the midpoint of the 2021 forecasted range, over

SBA 7(a) loan fundings in 2019. In addition, the Company will pay

its fourth quarter 2021 dividend of $1.05 per share on December 30,

2021 to shareholders of record on December 20, 2021. With that

payment, the Company will have paid $3.15 per share in dividends in

2021, which would represent a 53.7% increase over dividends paid in

2020. The Company is reaffirming its first quarter 2022 dividend of

$0.65 per share1, which would represent a 30% increase over the

first quarter 2020 dividend. Finally, we are reiterating our

earnings guidance and expect 2021 full year 2021 NII of $0.80 per

share and ANII of $3.40 per share. We look forward to reporting our

2021 full year results during the first quarter of 2022.”

Mr. Sloane concluded, “We would like to thank Deutsche Bank

Securities and Capital One Securities for their hard-earned

efforts, especially during choppy markets, and we appreciate the

loyalty of our repeat investors, as well as the interest of new

investors, and their faith in our securitization notes, that have

consistently maintained their ratings or been upgraded.”

1Amount and timing of dividends, if any, remain subject to the

discretion of the Company’s Board of Directors.

Newtek Business Services Corp., Your Business Solutions

Company®, is an internally managed BDC, which along with its

controlled portfolio companies, provides a wide range of business

and financial solutions under the Newtek® brand to the small- and

medium-sized business (“SMB”) market. Since 1999, Newtek has

provided state-of-the-art, cost-efficient products and services and

efficient business strategies to SMB relationships across all 50

states to help them grow their sales, control their expenses and

reduce their risk.

Newtek’s and its portfolio companies’ products and services

include: Business Lending, SBA Lending Solutions, Electronic

Payment Processing, Technology Solutions (Cloud

Computing, Data Backup, Storage and Retrieval, IT Consulting),

eCommerce, Accounts Receivable Financing & Inventory Financing,

Insurance Solutions, Web Services, and Payroll and Benefits

Solutions.

Newtek® and Your Business Solutions Company®,

are registered trademarks of Newtek Business Services Corp.

Note Regarding Forward Looking

Statements

This press release contains certain

forward-looking statements. Words such as “believes,” “intends,”

“expects,” “projects,” “anticipates,” “forecasts,” “goal” and

“future” or similar expressions are intended to identify

forward-looking statements. All forward-looking statements involve

a number of risks and uncertainties that could cause actual results

to differ materially from the plans, intentions and expectations

reflected in or suggested by the forward-looking statements. Such

risks and uncertainties include, among others, intensified

competition, operating problems and their impact on revenues and

profit margins, anticipated future business strategies and

financial performance, anticipated future number of customers,

business prospects, legislative developments and similar matters.

Risk factors, cautionary statements and other conditions, which

could cause Newtek’s actual results to differ from management’s

current expectations, are contained in Newtek’s filings with the

Securities and Exchange Commission and available through

http://www.sec.gov/. Newtek cautions you that forward-looking

statements are not guarantees of future performance and that actual

results or developments may differ materially from those projected

or implied in these statements.

SOURCE: Newtek Business Services Corp.

Investor Relations & Public

RelationsContact: Jayne Cavuoto Telephone: (212) 273-8179

/ jcavuoto@newtekone.com

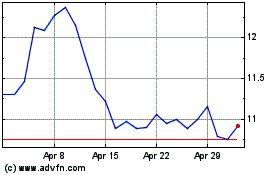

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Mar 2024 to Apr 2024

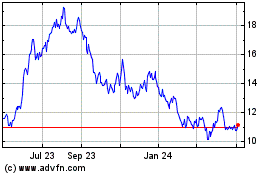

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Apr 2023 to Apr 2024