Credit Agricole CIB to Ramp Up Green Energy Financing as Part of Net-Zero Plan

December 09 2021 - 6:39AM

Dow Jones News

By Maitane Sardon

Credit Agricole SA's corporate and investment banking arm said

Thursday that it would increase its financing of companies spending

on renewables and technologies to cut emissions as part of its

net-zero program.

The French investment bank said that, by 2025, it will grow its

exposure to companies producing and storing green energy by 60%.

Its primary focus will be on financing renewable energies, it said.

It will also finance and advise companies developing low-carbon

hydrogen.

"I am convinced that we all have a personal responsibility in

the fight against global warming, for ourselves and future

generations," said Jacques Ripoll, chief executive officer of

Credit Agricole CIB.

The commitment, the bank said, is part of Credit Agricole

Group's strategy to meet the goals of the Net-Zero Banking

Alliance, a joint pledge to cut exposure to carbon that 92 banks

representing $66 trillion have signed.

Credit Agricole CIB said it has also introduced exclusion

policies for some polluting energies and will work to reduce its

exposure to oil.

The bank, which in 2017 promised to stopping direct financing of

oil projects in the Arctic on environmental concerns, said it would

extend the exclusion criteria to all new liquefied natural gas

projects in the region.

The company said that, by 2025, it aims to reduce its exposure

to upstream oil production by 20%, compared to 2020 levels.

Write to Maitane Sardon at maitane.sardon@wsj.com

(END) Dow Jones Newswires

December 09, 2021 06:24 ET (11:24 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

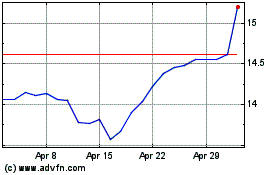

Credit Agricole (EU:ACA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Credit Agricole (EU:ACA)

Historical Stock Chart

From Apr 2023 to Apr 2024