0001465470false02754000000000.000190000000037974252400.00010.00010.00010.000101000020000500000005000000500000050000005000000225000354000472730000290000000000000000000000000031708300.020.0143533243000056075125000000000500000050000000000000001739186123270450000000000000000000917210171565401988914177720000076560000103200000000000500000085500000050000027540000061000003836040000000000592087010004521589580102370.36500006557505464735640442640484710005000000Puts may be delivered by the Company to GHS until the earlier of thirty-six (36) months after the effectiveness of the Registration Statement or the date on which GHS has purchased an aggregate of $11,000,000 worth of Common Stock under the terms of the Equity Financing. Agreement.5000002000000000.00010.350.00010.00010.0001500000050000.00016000000100025400.000136001335000325000032502250000P6M0.27P6MP3M0.21The Employment Agreement provides that in the event the employee is terminated without cause or resigns for good reason (as defined in their Employment Agreement), the employee will receive, as severance the employee’s base salary for a period of 60 months following the date of termination. In the event of a change of control of the Company, the employee may elect to terminate the Employment Agreement within 30 days thereafter and upon such termination would receive a lump sum payment equal to 500% of the employee’s base salary120099009090.4047321230.49200000010.0001360037390.00012450351350400014654702021-04-012021-09-300001465470shmp:ShareExchangeAgreementMember2021-04-012021-04-150001465470shmp:ShareExchangeAgreementMember2021-04-140001465470shmp:NasSecuritiesPurchaseAgreementMember2021-05-012021-05-190001465470shmp:NasSecuritiesPurchaseAgreementMember2021-05-190001465470shmp:LeakOutAgreementsMember2021-05-012021-05-190001465470shmp:GhsPurchaseAgreementMember2021-04-012021-04-140001465470shmp:GhsPurchaseAgreementMember2021-06-012021-06-280001465470shmp:GhsPurchaseAgreementMember2021-06-2800014654702021-04-252021-05-1900014654702021-05-012021-05-0500014654702021-05-2000014654702021-05-0500014654702021-04-1400014654702021-10-180001465470shmp:AprilOneTwoThousandFifteenMember2021-04-012021-09-300001465470shmp:AprilOneTwoThousandFifteenMember2020-04-012021-03-3100014654702021-08-012021-08-1000014654702020-05-1800014654702020-05-012020-05-1800014654702020-07-012020-07-0800014654702019-04-012019-04-3000014654702020-07-012020-07-1500014654702019-06-2400014654702019-06-012019-06-2400014654702021-09-0800014654702021-08-0100014654702021-07-202021-08-0200014654702021-06-0200014654702021-05-012021-05-2600014654702021-09-012021-09-080001465470us-gaap:SeriesBPreferredStockMember2019-09-012019-09-170001465470us-gaap:SeriesBPreferredStockMember2021-04-012021-04-080001465470us-gaap:SeriesBPreferredStockMember2019-09-050001465470shmp:ConsultantMember2020-12-250001465470shmp:ConsultantMember2021-05-240001465470shmp:ConsultantMember2021-04-140001465470shmp:ConsultantMember2020-06-120001465470shmp:ConsultantMember2020-12-150001465470shmp:ConsultantMember2020-04-012021-03-310001465470shmp:ConsultantMember2021-05-012021-05-240001465470shmp:GHSMember2021-06-012021-06-280001465470shmp:SecuritiesPurchaseAgreementMembershmp:SeriesBPreferredEquityOfferingMember2019-04-012020-03-310001465470shmp:SecuritiesPurchaseAgreementMembershmp:SeriesBPreferredEquityOfferingMember2020-03-310001465470shmp:SecuritiesPurchaseAgreementMembershmp:SeriesBPreferredEquityOfferingMember2021-04-012021-04-140001465470shmp:SecuritiesPurchaseAgreementMembershmp:SeriesBPreferredEquityOfferingMember2019-09-170001465470shmp:SecuritiesPurchaseAgreementMembershmp:SeriesBPreferredEquityOfferingMember2020-04-012021-03-310001465470shmp:SecuritiesPurchaseAgreementMembershmp:SeriesBPreferredEquityOfferingMember2019-09-012019-09-170001465470us-gaap:SeriesEPreferredStockMember2021-07-012021-09-300001465470us-gaap:SeriesEPreferredStockMember2020-12-180001465470us-gaap:SeriesEPreferredStockMember2021-04-140001465470us-gaap:SeriesEPreferredStockMember2021-04-012021-04-140001465470us-gaap:SeriesEPreferredStockMember2021-03-310001465470us-gaap:SeriesEPreferredStockMember2020-03-310001465470us-gaap:SeriesEPreferredStockMember2021-09-300001465470shmp:ShareexchangeagreementtMembershmp:SeriesDPreferredStocksMember2021-04-012021-04-140001465470shmp:ShareexchangeagreementtMembershmp:SeriesDPreferredStocksMember2021-04-012021-04-150001465470shmp:ShareexchangeagreementtMembershmp:SeriesDPreferredStocksMember2021-01-082021-01-100001465470shmp:SecuritiesPurchaseAgreementMembershmp:GHSMember2021-05-012021-05-200001465470shmp:SecuritiesPurchaseAgreementMembershmp:GHSMember2021-05-012021-05-050001465470shmp:SecuritiesPurchaseAgreementMembershmp:GHSMember2021-05-050001465470shmp:SecuritiesPurchaseAgreementMembershmp:GHSMember2021-05-200001465470shmp:SecuritiesPurchaseAgreementMembershmp:GHSMember2021-06-280001465470shmp:SecuritiesPurchaseAgreementMembershmp:GHSMember2021-04-140001465470shmp:SecuritiesPurchaseAgreementMembershmp:GHSMember2020-12-180001465470shmp:SecuritiesPurchaseAgreementMembershmp:GHSMember2021-06-012021-06-280001465470shmp:SecuritiesPurchaseAgreementMembershmp:GHSMember2021-04-012021-04-140001465470shmp:SecuritiesPurchaseAgreementMembershmp:GHSMember2020-12-012020-12-180001465470us-gaap:SeriesDPreferredStockMember2020-12-180001465470us-gaap:SeriesDPreferredStockMember2021-03-310001465470us-gaap:SeriesDPreferredStockMember2020-12-012020-12-160001465470us-gaap:SeriesDPreferredStockMember2021-04-012021-04-140001465470us-gaap:SeriesDPreferredStockMember2021-09-300001465470us-gaap:SeriesDPreferredStockMember2020-12-160001465470us-gaap:SeriesDPreferredStockMember2020-04-012021-03-3100014654702021-05-012021-05-240001465470shmp:ConsultantMember2021-04-012021-09-3000014654702021-04-012021-04-080001465470shmp:ConsultantMember2020-12-012020-12-150001465470shmp:GHSMembershmp:EquityFinancingAgreement2019Member2019-08-012019-08-230001465470shmp:GHSMembershmp:EquityFinancingAgreement2019Member2019-08-230001465470shmp:ConsultantMember2020-08-012020-08-240001465470shmp:ConsultantMember2020-12-012020-12-250001465470shmp:ConsultantMember2021-04-012021-04-1400014654702021-04-012021-04-140001465470shmp:ConsultantMember2020-06-012020-06-120001465470us-gaap:SeriesDPreferredStockMembersrt:MaximumMember2020-12-012020-12-160001465470us-gaap:SeriesBPreferredStockMembersrt:MaximumMember2019-09-012019-09-050001465470us-gaap:SeriesBPreferredStockMembersrt:MinimumMember2019-09-012019-09-050001465470us-gaap:SeriesDPreferredStockMembersrt:MinimumMember2020-12-012020-12-160001465470shmp:PromissoryNoteBMember2020-12-012020-12-250001465470shmp:PromissoryNoteAMember2020-12-012020-12-250001465470shmp:MsWilliamsMember2020-12-012020-12-250001465470shmp:MsWilliamsMember2020-07-012020-07-150001465470shmp:PresidentsMember2020-03-3100014654702021-08-100001465470shmp:PresidentsMember2021-04-012021-09-3000014654702021-05-110001465470shmp:PresidentsMember2021-09-300001465470shmp:PresidentsMember2021-03-3100014654702017-03-012017-03-310001465470us-gaap:InvestorMember2020-03-310001465470us-gaap:InvestorMember2021-03-3100014654702016-03-012016-03-070001465470shmp:NASMember2021-04-012021-06-300001465470shmp:NASMember2021-06-300001465470shmp:NASMember2021-05-012021-05-190001465470shmp:SecuritiesPurchaseAgreementMembershmp:SeriesBPreferredEquityOfferingMember2021-05-190001465470shmp:SecuritiesPurchaseAgreementMembershmp:SeriesBPreferredEquityOfferingMember2021-05-012021-05-190001465470shmp:FandTMember2021-05-012021-05-190001465470shmp:LandsMember2020-04-012021-03-310001465470us-gaap:PropertyPlantAndEquipmentOtherTypesMember2020-04-012021-03-310001465470us-gaap:EquipmentMember2020-04-012021-03-310001465470us-gaap:PropertyPlantAndEquipmentOtherTypesMember2021-03-310001465470us-gaap:EquipmentMember2021-03-310001465470shmp:AprilSevenTeenTwoThousandNineTeenDebentureMember2019-04-012019-12-310001465470shmp:AprilSevenTeenTwoThousandNineTeenDebentureMember2020-09-012020-09-140001465470shmp:AprilSevenTeenTwoThousandNineTeenDebentureMember2019-04-012019-04-170001465470shmp:AprilSevenTeenTwoThousandNineTeenDebentureMember2019-04-1700014654702021-04-1600014654702021-04-012021-04-160001465470shmp:AugustTwentyFourTwoThousandEighTeenDebentureMember2020-05-012020-05-050001465470shmp:AugustTwentyFourTwoThousandEighTeenDebentureMember2018-08-012018-08-240001465470shmp:MarcchThirtyOneTwoThousandNineTeenMember2018-04-012019-03-310001465470shmp:AugustTwentyFourTwoThousandEighTeenDebentureMember2019-01-012019-01-1000014654702020-05-0500014654702020-05-012020-05-0500014654702019-11-1200014654702019-11-012019-11-120001465470shmp:MarchTwentyTwoThousandEighTeenDebentureMember2018-03-012018-03-200001465470shmp:SeptemberFourTeenTwoThousandEighTeenDebentureMember2018-09-012018-09-140001465470shmp:SeptemberFourTeenTwoThousandEighTeenDebentureMember2018-09-140001465470shmp:MarchOneTwoThousandNineTeenDebentureMember2021-02-012021-02-260001465470shmp:MarchOneTwoThousandNineTeenDebentureMember2021-03-310001465470shmp:MarchOneTwoThousandNineTeenDebentureMember2020-04-012021-03-310001465470shmp:CommunityNationalBankMember2019-04-012020-03-310001465470shmp:CommunityNationalBankMember2018-07-012018-07-180001465470shmp:CommunityNationalBankMember2015-11-012015-11-030001465470shmp:CommunityNationalBankMember2021-03-310001465470shmp:CommunityNationalBankMember2020-04-012021-03-310001465470shmp:CommunityNationalBankMember2021-09-300001465470shmp:CommunityNationalBankMember2021-04-012021-09-300001465470shmp:CommunityNationalBankMember2020-01-012020-01-100001465470shmp:CommunityNationalBankMember2017-01-012017-01-1000014654702020-04-012020-04-100001465470shmp:CommunityNationalBankMember2020-03-310001465470shmp:ChaseBankLineOfCreditMember2020-03-310001465470shmp:ChaseBankLineOfCreditMember2021-03-310001465470shmp:ChaseBankLineOfCreditMember2021-04-012021-09-300001465470shmp:ChaseBankLineOfCreditMember2021-09-300001465470shmp:CapitalOneBankLineOfCreditMember2021-03-310001465470shmp:CapitalOneBankLineOfCreditMember2020-03-310001465470shmp:CapitalOneBankLineOfCreditMember2021-04-012021-09-300001465470shmp:CapitalOneBankLineOfCreditMember2021-09-300001465470shmp:AdditionalLinesExtracoBankLineOfCreditMember2021-03-310001465470shmp:AdditionalLinesExtracoBankLineOfCreditMember2020-03-310001465470shmp:AdditionalLinesExtracoBankLineOfCreditMember2021-04-012021-09-300001465470shmp:AdditionalLinesExtracoBankLineOfCreditMember2021-09-300001465470shmp:ExtracoBankLineOfCreditMember2021-03-310001465470shmp:ExtracoBankLineOfCreditMember2020-03-310001465470shmp:ExtracoBankLineOfCreditMember2021-09-300001465470shmp:ExtracoBankLineOfCreditMember2021-04-012021-09-300001465470shmp:TechnologyRightsAgreementMember2021-08-250001465470shmp:TechnologyRightsAgreementMember2021-09-300001465470shmp:TechnologyRightsAgreementMember2021-04-012021-09-3000014654702021-08-250001465470shmp:PatentsPurchaseAgreementMember2021-05-190001465470shmp:PatentsPurchaseAgreementMember2021-04-012021-09-300001465470shmp:PatentsPurchaseAgreementMember2021-07-012021-09-3000014654702018-03-012018-03-310001465470shmp:PatentsPurchaseAgreementMember2021-05-012021-05-190001465470shmp:AutomobileMember2021-09-300001465470shmp:AutomobileMember2020-03-310001465470shmp:AutomobileMember2021-03-310001465470us-gaap:MachineryAndEquipmentMember2021-09-300001465470us-gaap:MachineryAndEquipmentMember2020-03-310001465470us-gaap:MachineryAndEquipmentMember2021-03-310001465470us-gaap:BuildingMember2021-09-300001465470us-gaap:BuildingMember2020-03-310001465470us-gaap:BuildingMember2021-03-310001465470shmp:LandsMember2021-09-300001465470shmp:LandsMember2020-03-310001465470shmp:LandsMember2021-03-310001465470us-gaap:VehiclesMember2020-04-012021-03-310001465470us-gaap:MachineryAndEquipmentMember2020-04-012021-03-310001465470us-gaap:VehiclesMember2021-04-012021-09-300001465470us-gaap:MachineryAndEquipmentMember2021-04-012021-09-300001465470us-gaap:FurnitureAndFixturesMember2021-04-012021-09-300001465470us-gaap:BuildingMember2020-04-012021-03-310001465470us-gaap:BuildingMember2021-04-012021-09-300001465470us-gaap:FurnitureAndFixturesMember2020-04-012021-03-3100014654702021-05-012021-05-190001465470us-gaap:RetainedEarningsMember2021-07-012021-09-300001465470shmp:StockPayableMember2021-07-012021-09-300001465470us-gaap:AdditionalPaidInCapitalMember2021-07-012021-09-300001465470us-gaap:CommonStockMember2021-07-012021-09-300001465470us-gaap:NoncontrollingInterestMember2021-09-300001465470us-gaap:RetainedEarningsMember2021-09-300001465470shmp:StockPayableMember2021-09-300001465470us-gaap:AdditionalPaidInCapitalMember2021-09-300001465470us-gaap:CommonStockMember2021-09-300001465470shmp:SeriesBPreferredStocksMember2021-09-300001465470shmp:SeriesAPreferredStocksMember2021-09-3000014654702021-06-300001465470us-gaap:NoncontrollingInterestMember2021-06-300001465470us-gaap:RetainedEarningsMember2021-06-300001465470shmp:StockPayableMember2021-06-300001465470us-gaap:AdditionalPaidInCapitalMember2021-06-300001465470us-gaap:CommonStockMember2021-06-300001465470shmp:SeriesBPreferredStocksMember2021-06-300001465470shmp:SeriesAPreferredStocksMember2021-06-300001465470us-gaap:RetainedEarningsMember2021-04-012021-06-300001465470us-gaap:NoncontrollingInterestMember2021-04-012021-06-300001465470shmp:StockPayableMember2021-04-012021-06-3000014654702021-04-012021-06-300001465470us-gaap:AdditionalPaidInCapitalMember2021-04-012021-06-300001465470us-gaap:CommonStockMember2021-04-012021-06-300001465470shmp:SeriesBPreferredStocksMember2021-04-012021-06-3000014654702021-02-012021-02-260001465470us-gaap:NoncontrollingInterestMember2020-07-012020-09-300001465470us-gaap:CommonStockMember2020-07-012020-09-300001465470us-gaap:RetainedEarningsMember2020-07-012020-09-300001465470us-gaap:AdditionalPaidInCapitalMember2020-07-012020-09-300001465470shmp:SeriesBPreferredStocksMember2020-07-012020-09-300001465470us-gaap:NoncontrollingInterestMember2021-03-310001465470us-gaap:RetainedEarningsMember2021-03-310001465470shmp:StockPayableMember2021-03-310001465470us-gaap:AdditionalPaidInCapitalMember2021-03-310001465470us-gaap:CommonStockMember2021-03-310001465470shmp:SeriesBPreferredStocksMember2021-03-310001465470shmp:SeriesAPreferredStocksMember2021-03-310001465470us-gaap:NoncontrollingInterestMember2020-04-012021-03-310001465470shmp:StockPayableMember2020-04-012021-03-310001465470us-gaap:RetainedEarningsMember2020-04-012021-03-310001465470shmp:SeriesBPreferredStocksMember2020-04-012021-03-310001465470us-gaap:AdditionalPaidInCapitalMember2020-04-012021-03-310001465470us-gaap:CommonStockMember2020-04-012021-03-3100014654702020-09-300001465470us-gaap:NoncontrollingInterestMember2020-09-300001465470us-gaap:RetainedEarningsMember2020-09-300001465470shmp:StockPayableMember2020-09-300001465470us-gaap:AdditionalPaidInCapitalMember2020-09-300001465470us-gaap:CommonStockMember2020-09-300001465470shmp:SeriesBPreferredStocksMember2020-09-300001465470shmp:SeriesAPreferredStocksMember2020-09-3000014654702020-06-300001465470us-gaap:NoncontrollingInterestMember2020-06-300001465470us-gaap:RetainedEarningsMember2020-06-300001465470shmp:StockPayableMember2020-06-300001465470us-gaap:AdditionalPaidInCapitalMember2020-06-300001465470us-gaap:CommonStockMember2020-06-300001465470shmp:SeriesBPreferredStocksMember2020-06-300001465470shmp:SeriesAPreferredStocksMember2020-06-300001465470us-gaap:NoncontrollingInterestMember2020-04-012020-06-300001465470us-gaap:RetainedEarningsMember2020-04-012020-06-300001465470us-gaap:CommonStockMember2020-04-012020-06-3000014654702020-04-012020-06-300001465470us-gaap:AdditionalPaidInCapitalMember2020-04-012020-06-300001465470shmp:SeriesBPreferredStocksMember2020-04-012020-06-300001465470us-gaap:NoncontrollingInterestMember2020-03-310001465470us-gaap:RetainedEarningsMember2020-03-310001465470shmp:StockPayableMember2020-03-310001465470us-gaap:AdditionalPaidInCapitalMember2020-03-310001465470us-gaap:CommonStockMember2020-03-310001465470shmp:SeriesBPreferredStocksMember2020-03-310001465470shmp:SeriesAPreferredStocksMember2020-03-310001465470us-gaap:NoncontrollingInterestMember2019-04-012020-03-310001465470us-gaap:RetainedEarningsMember2019-04-012020-03-310001465470shmp:SeriesBPreferredStocksMember2019-04-012020-03-310001465470us-gaap:AdditionalPaidInCapitalMember2019-04-012020-03-310001465470us-gaap:CommonStockMember2019-04-012020-03-3100014654702019-03-310001465470us-gaap:NoncontrollingInterestMember2019-03-310001465470us-gaap:RetainedEarningsMember2019-03-310001465470shmp:StockPayableMember2019-03-310001465470us-gaap:AdditionalPaidInCapitalMember2019-03-310001465470us-gaap:CommonStockMember2019-03-310001465470shmp:SeriesBPreferredStocksMember2019-03-310001465470shmp:SeriesAPreferredStocksMember2019-03-3100014654702020-04-012020-09-3000014654702020-07-012020-09-3000014654702021-07-012021-09-3000014654702020-04-012021-03-3100014654702019-04-012020-03-310001465470us-gaap:SeriesBPreferredStockMember2021-03-310001465470us-gaap:SeriesBPreferredStockMember2020-03-310001465470us-gaap:SeriesBPreferredStockMember2021-09-300001465470us-gaap:SeriesAPreferredStockMember2021-03-310001465470us-gaap:SeriesAPreferredStockMember2020-03-310001465470us-gaap:SeriesAPreferredStockMember2021-09-300001465470shmp:SeriesDConvertiblePreferredStockMember2021-03-310001465470shmp:SeriesDConvertiblePreferredStockMember2021-09-300001465470shmp:SeriesDConvertiblePreferredStockMember2020-03-310001465470shmp:SeriesEConvertiblePreferredStockMember2021-03-310001465470shmp:SeriesEConvertiblePreferredStockMember2020-03-310001465470shmp:SeriesEConvertiblePreferredStockMember2021-09-3000014654702020-03-3100014654702021-03-3100014654702021-09-30iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

As filed with the Securities and Exchange Commission on December 7, 2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

NATURALSHRIMP INCORPORATED

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

0900

|

|

74-3262176

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification Number)

|

15150 Preston Road, Suite #300

Dallas, TX 75248

(888) 791-9474

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Gerald Easterling

15150 Preston Road, Suite #300

Dallas, TX 75248

(888) 791-9474

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Joseph M. Lucosky, Esq.

Steven A. Lipstein, Esq.

Lucosky Brookman LLP

101 Wood Avenue South, 5th Floor

Woodbridge, NJ 08830

(732) 395-4400

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☒

|

Smaller reporting company

|

☒

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

Securities to be Registered

|

|

Number of shares of common stock to be

registered (1)

|

|

|

Proposed

Maximum

Aggregate

Offering Price

(1)(2)

|

|

|

Amount of

Registration

Fee (2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, par value $0.0001 per share

|

|

|

20,381,858

|

|

|

$

|

6,573,149.21

|

|

|

$

|

609.33

|

|

|

|

(1)

|

Pursuant to Rule 416(a) promulgated under the Securities Act of 1933, as amended (the “Securities Act”), we are also registering an indeterminate number of shares that may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends, or similar transactions.

|

|

|

|

|

|

|

(2)

|

The proposed maximum offering price per share was computed in accordance with Rule 457(c) promulgated under the Securities Act, based upon the average of the high ($0.355) and low ($0.29) sales prices of shares of our common stock as reported on December 3, 2021.

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 7, 2021

PROSPECTUS

NaturalShrimp Incorporated

20,381,858 Shares

Common Stock

The selling stockholders named in this prospectus may offer and sell, from time to time, in one or more offerings, up to 20,381,858 shares of our common stock, par value $0.0001 per share. The shares of our common stock may be sold by the selling shareholders at prevailing market prices at the times of sale, prices related to the prevailing market prices or negotiated prices. The shares of common stock may be offered by the selling shareholders to or through underwriters, dealers or other agents, directly to investors or through any other manner permitted by law, on a continued or delayed basis. See “Plan of Distribution” beginning on page 73 of this prospectus.

We are not selling any shares of common stock in this offering, and we will not receive any proceeds from the sale of shares by the selling stockholders. The registration of the securities covered by this prospectus does not necessarily mean that any of these securities will be offered or sold by the selling stockholders. The timing and amount of any sale is within the respective selling stockholders’ sole discretion, subject to certain restrictions. To the extent that any selling stockholder resells any securities, the selling stockholder may be required to provide you with this prospectus identifying and containing specific information about the selling stockholder and the terms of the securities being offered.

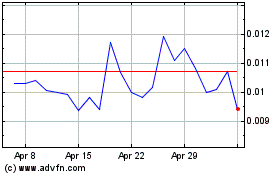

Shares of our common stock are quoted on the OTCQB of the OTC Markets Group Inc. under the symbol “SHMP.” On December 6, 2021, the closing price per share of our common stock as reported by OTC Markets Group Inc. was $0.3155.

See “Risk Factors” beginning on page 17 of this prospectus for a discussion of risk factors that should be considered by prospective purchasers of the shares of common stock offered under this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is December _, 2021.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This Prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process. Under this shelf registration process, the selling stockholders may, from time to time, offer and sell shares of common stock offered under this Prospectus.

We and the selling stockholders have not authorized anyone to provide any information or make any representations other than those contained in this Prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This Prospectus is an offer to sell only the shares of common stock offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information in this Prospectus is current only as of its date.

The selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this Prospectus is accurate only as of the date of this Prospectus regardless of the time of delivery of this Prospectus or of any sale of the Common Stock. Neither the delivery of this Prospectus, nor any sale made hereunder, will under any circumstances create any implication that there has been no change in our affairs since the date hereof or that the information contained herein is correct as of any time subsequent to the date of such information.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Forward-looking statements involve risks and uncertainties and include statements regarding, among other things, our projected revenue growth and profitability, our growth strategies and opportunity, anticipated trends in our market and our anticipated needs for working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plans,” “potential,” “projects,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend” or the negative of these words or other variations on these words or comparable terminology. These statements may be found under the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” as well as in this prospectus generally. In particular, these include statements relating to future actions, prospective products, market acceptance, future performance or results of current and anticipated products, sales efforts, expenses, and the outcome of contingencies such as legal proceedings and financial results.

Examples of forward-looking statements in this prospectus include, but are not limited to, our expectations regarding our business strategy, business prospects, operating results, operating expenses, working capital, liquidity and capital expenditure requirements. Important assumptions relating to the forward-looking statements include, among others, assumptions regarding demand for our products, the cost, terms and availability of components, pricing levels, the timing and cost of capital expenditures, competitive conditions and general economic conditions. These statements are based on our management’s expectations, beliefs and assumptions concerning future events affecting us, which in turn are based on currently available information. These assumptions could prove inaccurate. Although we believe that the estimates and projections reflected in the forward-looking statements are reasonable, our expectations may prove to be incorrect.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Should one or more of these risks or uncertainties materialize or should any of the assumptions made by our management prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this report. Except as required by law, we do not undertake to update or revise any of the forward-looking statements to conform these statements to actual results, whether as a result of new information, future events or otherwise.

We operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for us to predict all of those risks, nor can we assess the impact of all of those risks on our business or the extent to which any factor may cause actual results to differ materially from those contained in any forward-looking statement. The forward-looking statements in this prospectus are based on assumptions management believes are reasonable. However, due to the uncertainties associated with forward-looking statements, you should not place undue reliance on any forward-looking statements. Further, forward-looking statements speak only as of the date they are made, and unless required by law, we expressly disclaim any obligation or undertaking to publicly update any of them in light of new information, future events, or otherwise.

PROSPECTUS SUMMARY

This summary highlights selected information appearing elsewhere in this prospectus. While this summary highlights what we consider to be important information about us, you should carefully read this entire prospectus before investing in our Common Stock, especially the risks and other information we discuss under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and our consolidated financial statements and related notes beginning on page F-1. Our fiscal year end is March 31 and our fiscal years ended March 31, 2021 and 2020 are sometimes referred to herein as fiscal years 2021 and 2020, respectively. Some of the statements made in this prospectus discuss future events and developments, including our future strategy and our ability to generate revenue, income and cash flow. These forward-looking statements involve risks and uncertainties which could cause actual results to differ materially from those contemplated in these forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements”. Unless otherwise indicated or the context requires otherwise, the words “we,” “us,” “our”, the “Company” or “our Company” or “NaturalShrimp” refer to NaturalShrimp Incorporated., a Nevada corporation, and each of our subsidiaries.

When used in this prospectus the following terms have the following meanings related to our subsidiaries.

|

|

·

|

“NSC” refers to NaturalShrimp Corporation, a company organized under the law of the state of Delaware.

|

|

|

|

|

|

|

·

|

“NS Global” refers to NaturalShrimp Global, Inc., a company organized under the law of the state of Delaware.

|

|

|

|

|

|

|

·

|

“NAS” refers to Natural Aquatic Systems, Inc., a company organized under the law of the state of Texas.

|

Corporate History

We were incorporated in the State of Nevada on July 3, 2008 under the name “Multiplayer Online Dragon, Inc.” Effective November 5, 2010, we effected an 8-for-1 forward stock split, increasing the issued and outstanding shares of our common stock from 12,000,000 shares to 96,000,000 shares. On October 29, 2014, we effected a 1-for-10 reverse stock split, decreasing the issued and outstanding shares of our common stock from 97,000,000 to 9,700,000.

On November 26, 2014, we entered into an Asset Purchase Agreement (the “Agreement”) with NaturalShrimp Holdings, Inc. a Delaware corporation (“NSH”), pursuant to which we agreed to acquire substantially all of the assets of NSH which assets consisted primarily of all of the issued and outstanding shares of capital stock of NaturalShrimp Corporation (“NSC”), a Delaware corporation, and NaturalShrimp Global, Inc. (“NS Global”), a Delaware corporation, and certain real property located outside of San Antonio, Texas (the “Assets”).

On January 30, 2015, we consummated the acquisition of the Assets pursuant to the Agreement. In accordance with the terms of the Agreement, we issued 75,520,240 shares of our common stock to NSH as consideration for the Assets. As a result of the transaction, NSH acquired 88.62% of our issued and outstanding shares of common stock; NSC and NS Global became our wholly owned subsidiaries; and we changed our principal business to a global shrimp farming company.

In connection with our receipt of approval from the Financial Industry Regulatory Authority (“FINRA”), effective March 3, 2015, we amended our Articles of Incorporation to change our name to “NaturalShrimp Incorporated.”

Business Overview

We are a biotechnology company and have developed a proprietary technology that allows us to grow Pacific White shrimp (Litopenaeus vannamei, formerly Penaeus vannamei) in an ecologically controlled, high-density, low-cost environment, and in fully contained and independent production facilities. Our system uses technology which allows us to produce a naturally grown shrimp “crop” weekly, and accomplishes this without the use of antibiotics or toxic chemicals. We have developed several proprietary technology assets, including a knowledge base that allows us to produce commercial quantities of shrimp in a closed system with a computer monitoring system that automates, monitors and maintains proper levels of oxygen, salinity and temperature for optimal shrimp production. Our initial production facility is located outside of San Antonio, Texas.

NS Global, one of our wholly owned subsidiaries, owns less than 1% of NaturalShrimp International A.S. in Europe. Our European-based partner, NaturalShrimp International A.S., Oslo, Norway, was responsible for the construction cost of its facility and operating capital.

The first facility built in Spain for NaturalShrimp International A.S. is GambaNatural de España, S.L. The land for the first facility was purchased in Medina del Campo, Spain, and construction of the 75,000 sq. ft. facility was completed in 2016. Medina del Campo is approximately seventy-five miles northwest of Madrid, Spain.

On October 16, 2015, we formed Natural Aquatic Systems, Inc. (“NAS”). The purpose of NAS is to formalize the business relationship between our Company and F&T Water Solutions LLC for the joint development of certain water technologies. The technologies shall include, without limitation, any and all inventions, patents, intellectual property and know-how dealing with enclosed aquatic production systems worldwide. This includes construction, operation, and management of enclosed aquatic production, other than shrimp, facilities throughout the world, co-developed by both parties at our facility located outside of La Coste, Texas. On October 16, 2015, we formed Natural Aquatic Systems, Inc. (“NAS”). The purpose of NAS is to formalize the business relationship between our Company and F&T Water Solutions LLC for the joint development of certain water technologies. The technologies shall include, without limitation, any and all inventions, patents, intellectual property, and know-how dealing with enclosed aquatic production systems worldwide. This includes construction, operation, and management of enclosed aquatic production, other than shrimp, facilities throughout the world, co-developed by both parties at our facility located outside of La Coste, Texas. On December 25, 2018, we were awarded U.S. Patent “Recirculating Aquaculture System and Treatment Method for Aquatic Species” covering all indoor aquatic species that utilizes proprietary art.

On December 15, 2020, we entered into an Asset Purchase Agreement (“APA”) between VeroBlue Farms USA, Inc., a Nevada corporation (“VBF”), VBF Transport, Inc., a Delaware corporation (“Transport”), and Iowa’s First, Inc., an Iowa corporation (“Iowa’s First”) (each a “Seller” and collectively, “Sellers”). Transport and Iowa’s First were wholly-owned subsidiaries of VBF. The agreement called for us to purchase all of the tangible assets of VBF, the motor vehicles of Transport and the real property (together with all plants, buildings, structures, fixtures, fittings, systems, and other improvements located on such real property) of Iowa’s First. The consideration was $10,000,000, consisting of $5,000,000 in cash, paid at closing on December 17, 2020, (ii) $3,000,000 payable in 36 months with interest thereon at the rate of 5% per annuum, interest only payable quarterly on the first day of the quarter, with the remaining balance to be paid to VBF as a balloon payment on the maturity date, and (iii) $2,000,000 payable in 48 months with interest thereon at the rate of 5% per annuum, interest only payable quarterly on the first day of the quarter, with the remaining balance to be paid to VBF as a balloon payment on the maturity date. The Company also agreed to issue 500,000 shares of Common Stock as a finder’s fee, with a fair value of $135,000 based on the market value of the Common Stock as of the closing date of the acquisition.

On August 25, 2021, the Company, through their 100% owned subsidiary NAS, entered into an Equipment Rights Agreements with Hydrenesis-Delta Systems, LLC (“Hydrenesis-Delta”), and a Technology Rights Agreement in a sub-license agreement with Hydrenesis Aquaculture LLC (“Hydrenesis-Aqua”). The Equipment Rights involve specialized and proprietary equipment used to produce and control, dose, and infuse Hydrogas® and RLS® into both water and other chemical species, while the Technology sublicense pertains to the rights to Hydrogas® and RLS®. Both Rights agreements are for a 10-year term, which shall automatically renew for ten-year successive terms. The term can be terminated by written notice by mutual consent or by either party upon a breach of contract, insolvency, or filing of bankruptcy. The agreements accord the exclusive rights to purchase or distribute the technology or buy or rent the equipment in the Industry Sector, which is the primary business and revenue stream generated from indoor aquaculture farming of any species in the Territory, defined as anywhere in the world except for the countries in the Gulf Corporation Council.

The Company has three wholly owned subsidiaries: NSC, NS Global, and NAS.

Recent Developments

Securities Purchase Agreement – Series E Preferred Stock and Warrant

On November 22, 2021, NaturalShrimp Incorporated (the “Company”) entered into a securities purchase agreement (the “Purchase Agreement”) with one accredited investor (the “Purchaser”), for the offering (the “Offering”) of (i) one thousand five hundred (1,500) shares of the Company’s Series E Convertible Preferred stock, par value $0.0001 (the “Series E Preferred Stock”) at a price of one thousand dollars ($1,000.00) per share and (ii) a warrant to purchase up to one million five hundred thousand (1,500,000) shares of the Company’s common stock (the “Warrant”), with an exercise price equal to $0.75, subject to adjustment therein. Pursuant to the Purchase Agreement, the Purchaser is purchasing the one thousand five hundred (1,500) shares of Series E Preferred Stock (the “Purchased Shares”) and the Warrant for an aggregate purchase price of one million five hundred thousand dollars ($1,500,000.00). The Warrant expires on November 22, 2026, the five (5)-year anniversary of the issue date. The Offering was a private placement with the Purchaser. The Offering closed on November 23, 2021.

The Company expects to receive approximately one million three hundred fifty thousand dollars ($1,350,000.00) in net proceeds from the Offering before exercise of the Warrant and after deducting the commission of Joseph Gunnar & Co., LLC (the placement agent) and other estimated offering expenses payable by the Company.

The Purchase Agreement contains customary representations, warranties and agreements by the Company and the other parties thereto, customary conditions to closing, indemnification obligations of the parties, including for liabilities under the Securities Act of 1933, as amended (the “Securities Act”) and other obligations of the parties.

Pursuant to the Purchase Agreement, from the date thereof until the date when the Purchaser no longer holds any of the Purchased Shares or the Warrant (the “Securities”), upon any issuance by the Company of its securities for cash consideration (a “Subsequent Financing”), the Purchaser may elect, in its sole discretion, to exchange (in lieu of conversion), if applicable, all or some of the Securities then held for any securities or units issued in a Subsequent Financing on a $1.00-for-$1.00 basis and under the same terms and conditions as provided for in the Subsequent Financing.

The shares of Series E Preferred Stock have a stated value of $1,200 per share (the “Series E Stated Value”) and are convertible into shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”) at the election of the holder of the Series E Preferred Stock at any time at a price of $0.35 per share, subject to adjustment (the “Conversion Price”). The Series E Preferred Stock is convertible into that number of shares of Common Stock determined by dividing the Series E Stated Value (plus any and all other amounts which may be owing in connection therewith) by the Conversion Price, subject to certain beneficial ownership limitations.

The Company has the right to redeem the Series E Preferred Stock shares by paying, in cash, a premium rate (with such rate ranging from 1.15 to 1.25) multiplied by the sum of (a) the Stated Value and (b) all amounts owed pursuant the Series E Preferred Stock Certificate of Designation (the “Certificate of Designation”) (included any accrued but unpaid dividends). The Company is required to redeem the Series E Preferred Stock shares on the one year anniversary of the date of issuance.

In addition, the Company shall, at the holder’s sole option, upon the occurrence of a Triggering Event and following a five (5) day opportunity to cure following written notice, to require the Company to redeem all of the Series E Preferred Stock shares for a redemption price, in cash, equal to the Triggering Redemption Amount ((a) 150% of the Stated Value and (b) all amounts owed pursuant the Certificate of Designation (included any accrued but unpaid dividends)). The Certificate of Designation defines Triggering Events as one of eleven (11) items including, a failure to deliver conversion shares, a failure to have a sufficient amount of authorized but unreserved shares available to issue to a holder upon a conversion, a bankruptcy event, a monetary judgment of over $500,000, and an event of default as defined in the Certificate of Designation.

Each holder of Series E Preferred Stock shall be entitled to receive, with respect to each share of Series E Preferred Stock then outstanding and held by such holder, dividends at the rate of twelve percent (12%) per annum, payable quarterly (the “Preferred Dividends”).

The holders of Series E Preferred Stock rank senior to the Common Stock and Common Stock Equivalents (as defined in the Certificate of Designation) with respect to payment of dividends and rights upon liquidation and will vote together with the holders of the Common Stock on an as-converted basis, subject to beneficial ownership limitations, on each matter submitted to a vote of holders of Common Stock (whether at a meeting of shareholders or by written consent).

Registration Rights Agreement

On November 22, 2021, in connection with the Purchase Agreement, the Company and the Purchaser entered into a registration rights agreement (the “Rights Agreement”) pursuant to which the Company agreed to, within fifteen (15) calendar days of November 22, 2021, the date of execution of the Rights Agreement, use its best efforts to file a registration statement or registration statements (as is necessary) with the SEC on Form S-1 (or, if such a form is unavailable, on such other form as is available for such registration) covering the resale of the Securities and the shares of Common Stock underlying the Securities, and pursuant to which the Company agreed that such registration statement will state, according to Rule 416 promulgated under the Securities Act, that such registration statement also covers such indeterminate number of additional shares of Common Stock as may become issuable upon stock splits, dividends, or similar transactions. The shares of Common Stock underlying the Securities are being registered in the registration statement of which this prospectus forms a part.

The Warrant’s cashless exercise provision will go into effect if the Company violates the Rights Agreement.

Waiver

On April 14, 2021, the Company entered into a securities purchase agreement (the “April SPA”) to sell: (a) 9,090,909 shares of Common Stock at a price per share of $0.55; (b) warrants to purchase up to 10,000,000 shares of Common Stock, at an exercise price of $0.75 per share (the “April Warrants”); and (c) 1,000,000 shares of Common Stock with a value (although no purchase price will be paid) of $0.65 per share, with GHS Investments LLC (“GHS”), an accredited investor. Pursuant to the April SPA, until April 14, 2022, GHS has a right to participate in any subsequent financing that the Company conducts.

On November 22, 2021, GHS entered into a Waiver (the “Waiver”) whereby GHS agreed to waive its right to participate in the Offering and to participate in a possible $16.32 million debt financing for which the Company is still negotiating definitive documentation. There is no guarantee the Company will be able to secure such debt financing at all or on favorable terms to the Company. GHS also agreed to waive its right, pursuant to the Certificate of Designation, to exchange shares of Series E Preferred Stock held by GHS for securities issued in the debt financing, if the Company enters into such financing.

In consideration for GHS entering into the Waiver, the Company agreed to lower the exercise price of the April Warrants to $0.35 per share (the Conversion Price) and to issue warrants to purchase 3,739,000 shares of Common Stock with an exercise price of $0.75 per share with such warrants being substantially in the form of the Warrants. The shares of Common Stock underlying the warrant issued to GHS are being registered in the registration statement of which this prospectus forms a part.

The foregoing descriptions of the Purchase Agreement, the Warrant, the Certificate of Designation, the Rights Agreement, and the Waiver are qualified in their entirety by reference to the full text of such Purchase Agreement, Warrant, Certificate of Designation, Rights Agreement, and Waiver, the forms of which are attached as exhibits to the registration statement of which this prospectus forms a part.

The Private Offering

The shares of Series E Preferred Stock, the Warrants and the GHS warrant were not registered for sale under the Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States absent registration under the Securities Act or an applicable exemption from the registration requirements. The issuance and sale of the Securities was made in reliance upon the exemption provided in Section 4(a)(2) of the Securities Act and/or Rule 506(b) of Regulation D promulgated thereunder. No form of general solicitation or general advertising was conducted in connection with the issuance. The Securities contain (or will contain, where applicable) restrictive legends preventing the sale, transfer, or other disposition of such securities, unless registered under the Securities Act, or pursuant to an exemption therefrom.

Evolution of Technology and Revenue Expectations

Historically, efforts to raise shrimp in a high-density, closed system at the commercial level have been met with either modest success or outright failure through “BioFloc Technology.” Infectious agents such as parasites, bacteria and viruses are the most damaging and most difficult to control. Bacterial infection can in some cases be combated through the use of antibiotics (although not always), and in general, the use of antibiotics is considered undesirable and counter to “green” cultivation practices. Viruses can be even worse, in that they are immune to antibiotics. Once introduced to a shrimp population, viruses can wipe out entire farms and shrimp populations, even with intense probiotic applications.

Our primary solution against infectious agents is our “Vibrio Suppression Technology.” We believe this system creates higher sustainable densities, consistent production, improved growth and survival rates and improved food conversion without the use of antibiotics, probiotics or unhealthy anti-microbial chemicals. Vibrio Suppression Technology helps to exclude and suppress harmful organisms that usually destroy “BioFloc” and other enclosed technologies.

In 2001, we began research and development of a high density, natural aquaculture system that is not dependent on ocean water to provide quality, fresh shrimp every week, fifty-two weeks a year. The initial NaturalShrimp system was successful, but the Company determined that it would not be economically feasible due to high operating costs. Over the next several years, using the knowledge we gained from developing the first system, we developed a shrimp production system that eliminated the high costs associated with the previous system. We have continued to refine this technology, eliminating bacteria and other problems that affect enclosed systems, and now have a successful shrimp growing process. We have produced thousands of pounds of shrimp over the last few years in order to develop a design that will consistently produce quality shrimp that grow to a large size at a specific rate of growth. This included experimenting with various types of natural live and synthesized feed supplies before selecting the most appropriate nutritious and reliable combination. It also included utilizing monitoring and control automation equipment to minimize labor costs and to provide the necessary oversight for proper regulation of the shrimp environment. However, there were further enhancements needed to our process and technology in order to begin production of shrimp on a commercially viable scale and to generate revenues.

Our current system consists of a nursery tank where the shrimp are acclimated and then moved to a larger grow-out tank for the rest of the twenty-four-week cycle. During 2016, we engaged in additional engineering projects with third parties to further enhance our indoor production capabilities. For example, through our relationship with Trane, Inc., a division of Ingersoll-Rand Plc (“Trane”), Trane provided a detailed audit to use data to build and verify the capabilities of then initial Phase 1 prototype of a Trane-proposed three tank system at our La Coste, Texas facility. The Company working with F&T Water Solutions contracted RGA Labs, Inc. (“RGA Labs”), to build the initial NaturalShrimp patented Electrocoagulation system for the grow-out, harvesting, and processing of fully mature, antibiotic-free Pacific White Leg shrimp. The design provided a viable pathway to begin generating revenue and producing shrimp on a commercially viable scale. The equipment was installed in early June 2018 by RGA Labs, and final financing for the system was provided by one of the Company’s institutional investors. The first post larvae (PL) arrived from the hatchery on July 3, 2018. The Company used the shrimp for sampling to key potential customers and special events such as the Texas Restaurant Association trade show. The Company also received two production PL lots from Global Blue Technologies on March 21, 2019, and April 17, 2019, and from American Penaeid, Inc., on August 7, 2019. Because the shrimp displayed growth that was slower than normal, the Company had a batch tested by an independent lab at the University of Arizona. The shrimp tested positive for Infectious hypodermal and hematopoietic necrosis (“IHHNV”) and the Texas Parks and Wildlife Department was notified that the facility was under quarantine. On August 26, 2019, the Company was forced to terminate all lots due to the infection. On August 30, 2019, the Company received notice that it was in compliance again and the quarantine had been lifted and the Company began restocking shrimp in the refurbished facility sections. During the aforementioned quarantine, the Company decided to begin an approximately $2,000,000 facility renovation demolishing the interior 16 wood structure lined tanks (720,000 gallons). The Company began replacing the previous tanks with 40 new fiberglass tanks (600,000 gallons) at a cost of approximately $400,000 allowing complete production flexibility with more smaller tanks.

On March 18, 2020, our research and development plant in La Coste, Texas, was destroyed by a fire. The Company believed that it was caused by a natural gas leak, but the fire was so extensive that the cause was undetermined. No one was injured as a result of the fire. The majority of the damage was to our pilot production plant, which comprised approximately 35,000 square feet of the total size of all facilities at the La Coste location of approximately 53,000 square feet, but the fire did not impact the separate greenhouse, reservoirs, or utility buildings. We received total insurance proceeds in the amount of $917,210, the full amount of our claim. These funds were utilized to rebuild a 40,000 square foot production facility at the La Coste facility and to repurchase the equipment needed to replace what was lost in the fire. The Company continues to work towards full capacity at this plant in La Coste and expects that sales will be generated from the facility in the fourth calendar quarter of 2021. While we have experienced supply chain issues due to COVID-19, we do expect ramping up full production of 3,000 pounds per week by the end of the first calendar quarter of 2022. Also, the Company is expecting to break ground on an 80,000 square foot expansion in La Coste within the next sixty days.

Overview of Industry

Shrimp is a well-known and globally-consumed commodity, constituting one of the most important types of seafood and a staple protein source for much of the world. According to the USDA Foreign Agricultural Service, the world consumes approximately 9 billion pounds of shrimp annually with over 1.7 billion pounds consumed in the United States alone. Approximately 65% of the global supply of shrimp is caught by ocean trawlers and the other 35% is produced by open-air shrimp farms, mostly in developing countries.

Shrimp boats catch shrimp through the use of large, boat-towed nets. These nets are quite toxic to the undersea environment as they disturb and destroy ocean-bottom ecosystems. These nets also catch a variety of non-shrimp sea life, which is typically killed and discarded as part of the shrimp harvesting process. Additionally, the world’s oceans can only supply a finite amount of shrimp each year, and in fact, single-boat shrimp yields have fallen by approximately 20% since 2010 and continue to decrease. The shrimping industry’s answer to this problem has been to deploy more (and larger) boats that deploy ever-larger nets, which has in the short-term been successful at maintaining global shrimp yields. However, this benefit cannot continue forever, as eventually global demand has the potential of outstripping the oceans’ ability to maintain the natural ecosystem’s balance, resulting in a permanent decline in yields. When taken in light of global population growth and the ever-increasing demand for nutrient-rich foods such as shrimp, this is clearly an unsustainable production paradigm.

Shrimp farming, known in the industry as “aquaculture,” has ostensibly stepped in to fill this demand/supply imbalance. Shrimp farming is typically done in open-air lagoons and man-made shrimp ponds connected to the open ocean. Because these ponds constantly exchange water with the adjacent sea, the farmers are able to maintain the water chemistry that allows the shrimp to prosper. However, this method of cultivating shrimp also carries severe ecological peril. First of all, most shrimp farming is primarily conducted in developing countries, where poor shrimp farmers have little regard for the global ecosystem. Because of this, these farmers use large quantities of antibiotics and other chemicals that maximize each farm’s chance of producing a crop, putting the entire system at risk. For example, a viral infection that crops up in one farm can spread to all nearby farms, quite literally wiping out an entire region’s production. In 1999, the White Spot virus invaded shrimp farms in at least five Latin American countries: Honduras, Nicaragua, Guatemala, Panama and Ecuador and in 2013-14 EMS (Early Mortality Syndrome) wiped out most of the Asia Pacific region and Mexico. Secondly, there is also a finite amount of coastline that can be used for shrimp production – eventually shrimp farms that are dependent on the open ocean will have nowhere to expand. Again, this is an ecologically damaging and ultimately unsustainable system for producing shrimp.

In both the cases, the current method of shrimp production is unsustainable. As global populations rise and the demand for shrimp continues to grow, the current system is bound to fall short. Shrimp trawling cannot continue to increase production without completely depleting the oceans’ natural shrimp population. Trends in per-boat yield confirm that this industry has already crossed the overfishing threshold, putting the global open-ocean shrimp population in decline. While open-air shrimp aquaculture may seem to address this problem, it is also an unsustainable system that destroys coastal ecological systems and produces shrimp with very high chemical contamination levels. Closed-system shrimp farming is clearly a superior alternative, but its unique challenges have prevented it from becoming a widely-available alternative – until now.

Of the 1.7 billion pounds of shrimp consumed annually in the United States, over 1.3 billion pounds are imported – much of this from developing countries’ shrimp farms. These farms are typically located in developing countries and use high levels of antibiotics and pesticides that are not allowed under USDA regulations. As a result, these shrimp farms produce chemical-laden shrimp in an ecologically unsustainable way.

Unfortunately, most consumers here in the United States are not aware of the origin of their store-bought shrimp or worse, that which they consume in restaurants. This is due to a USDA rule that states that only bulk-packaged shrimp must state the shrimp’s country of origin; any “prepared” shrimp, which includes arrangements sold in grocery stores and seafood markets, as well as all shrimp served in restaurants, can simply be sold “as is.” Essentially, this means that most U.S. consumers may be eating shrimp laden with chemicals and antibiotics. NaturalShrimp’s product is free of pesticide chemicals and antibiotics, a fact that we believe is highly attractive and beneficial in terms of our eventual marketing success.

Technology

Intensive, Indoor, Closed-System Shrimp Production Technology

Historically, efforts to raise shrimp in a high-density, closed system at the commercial level have been met with either modest success or outright failure through “BioFloc Technology”. Infectious agents such as parasites, bacteria and viruses are the most damaging and most difficult to control. Bacterial infection can in some cases be combated through the use of antibiotics (although not always), and in general, the use of antibiotics is considered undesirable and counter to “green” cultivation practices. Viruses can be even worse, in that they are immune to antibiotics. Once introduced to a shrimp population, viruses can wipe out entire farms and shrimp populations, even with intense probiotic applications.

Our primary solution against infectious agents is our “Vibrio Suppression Technology”. We believe this system creates higher sustainable densities, consistent production, improved growth and survival rates and improved food conversion without the use of antibiotics, probiotics or unhealthy anti-microbial chemicals. Vibrio Suppression Technology helps to exclude and suppress harmful organisms that usually destroy “BioFloc” and other enclosed technologies.

Automated Monitoring and Control System

The Company’s “Automated Monitoring and Control System” uses individual tank monitors to automatically control the feeding, oxygenation, and temperature of each of the facility tanks independently. In addition, a facility computer running custom software communicates with each of the controllers and performs additional data acquisition functions that can report back to a supervisory computer from anywhere in the world. These computer-automated water controls optimize the growing conditions for the shrimp as they mature to harvest size, providing a disease-resistant production environment.

The principal theories behind the Company’s system are characterized as:

|

|

·

|

High-density shrimp production

|

|

|

|

|

|

|

·

|

Weekly production

|

|

|

|

|

|

|

·

|

Natural ecology system

|

|

|

|

|

|

|

·

|

Regional production

|

|

|

|

|

|

|

·

|

Regional distribution

|

These principles form the foundation for the Company and our potential distributors so that consumers can be provided with continuous volumes of live and fresh shrimp at competitive prices.

Target Markets and Sales Price

Our goal is to establish production systems and distribution centers in metropolitan areas of the United States, as well as international distribution networks through joint venture partnerships throughout the world. This should allow the Company to capture a significant portion of world shrimp sales by offering locally grown, environmentally “green,” naturally grown, fresh shrimp at competitive wholesale prices.

The United States population is approximately 325 million people with an annual shrimp consumption of 1.7 billion pounds, of which less than 400 million pounds are domestically produced. According to IndexMundi.com, the wholesale price for frozen, commodity grade shrimp has risen 15% since January 2015 (shell-on headless, 26-30 count; which is comparable to our target growth size). With world shrimp problems, this price is expected to rise more in the next few years.

We strive to build a profitable global shrimp production company. We believe our foundational advantage is that we can deliver fresh, organically grown, gourmet-grade shrimp, 52 weeks a year to retail and wholesale buyers in major market areas at competitive, yet premium prices. By locating regional production and distribution centers in close proximity to consumer demand, we can provide a fresh product to customers within 24 hours after harvest, which is unique in the shrimp industry. We can be the “first to market” and perhaps “sole weekly provider” of fresh shrimp and capture as much market share as production capacity can support.

For those customers that want a frozen product, we may be able to provide this in the near future and the product will still be differentiated as a “naturally grown, sustainable seafood” that will meet the increasing demand of socially conscious consumers.

Our patent-pending technology and eco-friendly, bio-secure production processes enable the delivery of a chemical and antibiotic free, locally grown product that lives up to the Company’s mantra: “Always Fresh, Always Natural,” thereby solving the issue of “unsafe” imported seafood.

Product Description

Nearly all of the shrimp consumed today are shipped frozen. Shrimp are typically frozen from six to twenty-four months before consumption. Our system is designed to harvest a different tank each week, which provides for fresh shrimp throughout the year. We strive to create a niche market of “Always Fresh, Always Natural” shrimp. As opposed to many of the foreign shrimp farms, we can also claim that our product is 100% free of antibiotics. The ability to grow shrimp locally, year-round allows us to provide this high-end product to specialty grocery stores and upscale restaurants throughout the world. We rotate the stocking and harvesting of our tanks each week, which allows for weekly shrimp harvests. Our product is free of all pollutants and is fed only all-natural feeds.

The seafood industry lacks a consistent “Source Verification” method to track seafood products as they move through countries and customs procedures. With worldwide overfishing leading to declining shrimp freshness and sustainability around the world, it is vital for shrimp providers to be able to realistically identify the source of their product. We have well-managed, sustainable facilities that are able to track shrimp from hatchery to plate using environmentally responsible methods.

Distribution and Marketing

We plan to build these environmentally “green” production systems near major metropolitan areas of the United States. Today, we have one pilot production facility in La Coste, Texas (near San Antonio) and plan to begin construction of a full-scale production facility in La Coste and plans for Nevada and New York. Over the next five years, our plan is to increase construction of new facilities each year. In the fifth year, we plan for a new system to be completed each month, expanding first into the largest shrimp consumption markets of the United States.

Harvesting, Packaging and Shipment

Each location is projected to include production, harvesting/processing and a general shipping and receiving area, in addition to warehousing space for storage of necessary supplies and products required to grow, harvest, package and otherwise make ready for delivery, a fresh shrimp crop on a weekly basis to consumers in each individual market area within 24 hours following harvest.

The seafood industry lacks a consistent source verification method to track seafood products as they move through countries and customs procedures. With worldwide overfishing leading to declining shrimp freshness and sustainability around the world, it is vital for shrimp providers to be able to realistically identify the source of their product. Our future facilities will be designed to track shrimp from hatchery to plate using environmentally responsible methods.

Go to Market Strategy and Execution

Our strategy is to develop regional production and distribution centers near major metropolitan areas throughout the United States and internationally. Today, we have 53,000 sq. ft. of R&D facilities, which includes, a pilot production system, greenhouse/reservoirs and utility buildings in La Coste, TX (near San Antonio). We intend to begin construction of a new free-standing facility with the next generation shrimp production system in place on the property in 2019.

The reasoning behind building additional shrimp production systems in La Coste is availability of trained production personnel, our research and development team, and an opportunity to develop the footprint and model for additional facilities. Our current plan based on adequate funding is to develop six regional production and distribution centers near major markets starting in 2020, adding one system per month in a selected production center, depending on market demand.

We have sold product to restaurants up to $12.00 per pound and to retail consumers at $16.50 to $21.00 per pound, depending on size, which helps to validate our pricing strategy. Additionally, from 2011 to 2013, we had two successful North Texas test markets which distributed thousands of pounds of fresh product to customers within 24 hours following harvest. The fresh product was priced from $8.40 to $12.00 per pound wholesale, heads on, net price to the Company.

Competition

There are a number of companies conducting research and development projects in their attempt to develop closed-system technologies in the U.S., some with reported production and sales. Florida Organic Aquaculture uses a Bio-Floc Raceway System to intensify shrimp growth, while Marvesta Shrimp Farms tanks in water from the Atlantic to use in their indoor system. Since these are privately held companies, it is not possible to know, with certainty, their state of technical development, production capacity, need for water exchange, location requirements, financial status and other matters. To the best of our knowledge, none are producing significant quantities of shrimp relative to their local markets, and such fresh shrimp sales are likely confined to an area near the production facility.

Additionally, any new competitor would face significant barriers for entry into the market and would likely need years of research and development to develop the proprietary technology necessary to produce similar shrimp at a commercially viable level. We believe our technology and business model sets us apart from any current competition. It is possible that additional competitors will arise in the future, but with the size and growth of the worldwide shrimp market, many competitors could co-exist and thrive in the fresh shrimp industry.

Intellectual Property

We intend to take appropriate steps to protect our intellectual property. We have applied for the trademark “NATURALSHRIMP” which is being reviewed by the U.S. Patent and Trademark Office. As of the date of this filing this trademark has not been approved for registration. There are potential technical processes for which the Company may be able to file a patent. However, there are no assurances that such applications, if filed, would be issued and no right of enforcement is granted to a patent application. Therefore, the Company has filed a provisional patent with the U.S. Patent Office and plans to use a variety of other methods, including copyright registrations as appropriate, trade secret protection, and confidentiality and non-compete agreements to protect its intellectual property portfolio.

Government Approvals and Regulations

We are subject to government regulation and require certain licenses. The following list includes regulations to which we are subject and/or the permits and licenses we currently hold:

|

|

·

|

Texas Parks and Wildlife Department (TPWD) - “Exotic species permit” to raise exotic shrimp (non-native to Texas). The La Coste facility is north of the coastal shrimp exclusion zone (east and south of H-35, where it intersects Hwy 21 down to Laredo) and therefore outside of TPWD’s major area of concern for exotic shrimp. Currently Active - Expires December 31, 2019.

|

|

|

|

|

|

|

·

|

Texas Department of Agriculture (TDA) - “Aquaculture License” for aquaculture production facilities. License to “operate a fish farm or cultured fish processing plant.” Currently Active – Expires June 30, 2020.

|

|

|

|

|

|

|

·

|

Texas Commission on Environmental Quality (TCEQ) - Regulates facility wastewater discharge. According to the TCEQ permit classification system, we are rated Level 1 – Recirculation system with no discharge. Currently Active – No expiration.

|

|

|

|

|

|

|

·

|

San Antonio River Authority - No permit required, but has some authority over any effluent water that could impact surface and ground waters.

|

|

|

|

|

|

|

·

|

OSHA - No permit required but has right to inspect facility.

|

|

|

·

|

HACCP (Hazard Analysis and Critical Control Point) - Not needed unless we process shrimp on site. Training and preparation of HACCP plans remain to be completed. There are multiple HACCP plans listed at http://seafood.ucdavis.edu/haccp/Plans.htm and other web sites that can be used as examples.

|

|

|

|

|

|

|

·

|

Texas Department of State Health Services - Food manufacturer license # 1011080.

|

|

|

|

|

|

|

·

|

Aquaculture Certification Council (ACC) and Best Aquaculture Practices (BAP) - Provide shrimp production certification for shrimp marketing purposes to mainly well-established vendors. ACC and BAP certifications require extensive record keeping. No license is required at this time.

|

We are subject to certain regulations regarding the need for field employees to be certified. We strictly adhere to these regulations. The cost of certification is an accepted part of expenses. Regulations may change and become a cost burden, but compliance and safety are our main concern.

Market Advantages and Corporate Drivers

The following are what we consider to be our advantages in the marketplace:

|

|

·

|

Early-mover Advantage: Commercialized technology in a large growing market with no significant competition yet identified. Most are early stage start-ups or early stage companies with limited production and distribution.

|

|

|

|

|

|

|

·

|

Farm-to-Market: This has significant advantages including reduced transportation costs and a product that is more attractive to local consumers.

|

|

|

|

|

|

|

·

|

Bio-secured Building: Our process is a re-circulating, highly-filtered water technology in an indoor-regulated environment. External pathogens are excluded.

|

|

|

|

|

|

|

·

|

Eco-friendly “Green” Technology: Our closed-loop, re-circulating system has no ocean water exchange requirements, does not use chemical or antibiotics and therefore is sustainable, eco-friendly, environmentally sound and produces a superior quality shrimp that is totally natural.

|

|

|

|

|

|

|

·

|

Availability of Weekly Fresh Shrimp: Assures consumers of optimal freshness, taste, and texture of product which will command premium prices.

|

|

|

|

|

|

|

·

|

Sustainability: Our naturally grown product does not deplete wild supplies, has no by-catch kill of marine life, does not damage sensitive ecological environments and avoids potential risks of imported seafood.

|

Subsidiaries

The Company has three wholly owned subsidiaries including NaturalShrimp Corporation, NaturalShrimp Global, Inc. and Natural Aquatic Systems, Inc.

Employees

As of October 1, 2019, we had 6 full-time employees. We intend to hire additional staff and to engage consultants in general administration on an as-needed basis. We also intend to engage experts in general business, finance and accounting to advise us in various capacities. None of our employees are covered by a collective bargaining agreement, nor are they represented by a labor union. We have not experienced any work stoppages, and we consider relations with our employees to be good.

Website

Our corporate website address is http://www.naturalshrimp.com.

The Offering

This prospectus relates to the offer and sale from time to time of up to an aggregate of 20,381,858 shares of the Company’s common stock by the selling stockholders.

In connection with the Private Offering, under the terms of the Rights Agreement entered into with the selling stockholders on the same date and in connection with the Purchase Agreement, we agreed to register with the Securities and Exchange Commission, or SEC, 6,642,858 shares of common stock issuable upon the conversion of the Series E Convertible Preferred Shares and exercise of the Warrants. We have also agreed to register with the SEC: (a) 3,739,000 shares of our common stock issuable upon exercise of the additional warrant issued to GHS in exchange for the Waiver; and (b) the 10,000,000 shares of our common stock issuable upon exercise of the April Warrants whose exercise price was lowered to $0.35 per share in November 2021 in connection with the signing of the Waiver.

The number of shares ultimately offered for resale by the selling stockholders depends upon how many of the Preferred Shares, Warrants and additional warrants the selling stockholders elect to convert and exercise, respectively, and the liquidity and market price of shares of our common stock.

|

Issuer

|

|

NaturalShrimp Incorporated.

|

|

|

|

|

|

Common stock to be offered by the selling stockholders

|

|

The selling stockholders are offering up to 20,381,858 shares of the Company’s common stock, par value $0.0001 per share.

|

|

|

|

|

|

Common stock outstanding prior to this offering (1)

Common stock to be outstanding after the offering (1)

|

|

638,586,044 shares of common stock