Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

December 07 2021 - 6:18AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

_____________________

FORM 6-K

_____________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2021

Commission File Number: 001-40816

_____________________

Argo Blockchain plc

(Translation

of registrant’s name into English)

_____________________

9th Floor

16

Great Queen Street

London

WC2B 5DG

England

(Address

of principal executive office)

_____________________

Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(7): ☐

EXHIBIT INDEX

|

Exhibit No.

1

|

Description

November

2021 Operational Update dated 7 December 2021

|

Press

Release

07

December 2021

Argo Blockchain PLC

(“Argo”

or “the Company”)

November 2021 Operational Update

Operational Update

Argo

Blockchain plc, a global leader in cryptocurrency mining (LSE: ARB;

NASDAQ: ARBK), is pleased to provide the following operational

update for November 2021.

During

the month of November, Argo mined 185 Bitcoin or Bitcoin Equivalent

(together, BTC) compared to 167 BTC in October. This brings the

total amount of BTC mined year-to-date to 1,831 BTC.

Based

on daily foreign exchange rates and cryptocurrency prices during

the month, mining revenue in November amounted to £8.29

million [$11.20 million*] (October 2021: £7.24 million [$9.75

million*]).

Argo

generated this revenue at a Bitcoin and Bitcoin Equivalent Mining

Margin of approximately 86% for the month of November (October

2021: 86%).

At the

end of November, the Company owned 2,317 Bitcoin or Bitcoin

Equivalent.

Mining Expansion

As of

the end of November, Argo added an additional 310 PH/s to its total

capacity, bringing the Company's total mining capacity to 1.605

EH/s as of 30 November, 2021.

Peter

Wall, Chief Executive of Argo and interim Chairman said:

“Execute. Build. Smart Growth. Onwards and

Upwards”.

Non-IFRS Measures

Bitcoin

and Bitcoin Equivalent Mining Margin is a financial measure not

defined by IFRS and has limitations as an analytical tool. In

particular, Bitcoin and Bitcoin Equivalent Mining Margin excludes

the depreciation of mining equipment and so does not reflect the

full cost of our mining operations, and it also excludes the

effects of fluctuations in the value of digital currencies and

realised losses on the sale of digital assets, which affect our

IFRS gross profit. This measure should not be considered as an

alternative to gross margin determined in accordance with IFRS, or

other IFRS measures. This measure is not necessarily comparable to

similarly titled measures used by other companies. As a result, you

should not consider this measure in isolation from, or as a

substitute analysis for, our gross margin as determined in

accordance with IFRS.

The

following table shows a reconciliation of Bitcoin and Bitcoin

Equivalent Mining Margin to gross margin, the most directly

comparable IFRS measure, for the months of October and November

2021.

|

|

Month Ended 31 October 2021

|

Month Ended 30 November 2021

|

|

|

£

|

$

|

£

|

$

|

|

Gross Profit/(Loss)

|

33,060,353

|

44,532,296

|

(1,108,192)

|

(1,496,606)

|

|

Gross

Margin1

|

422%

|

422%

|

(13%)

|

(13%)

|

|

Depreciation

of mining equipment

|

975,103

|

1,313,464

|

1,203,238

|

1,624,965

|

|

Charge

in fair value of digital currencies

|

(27,446,831)

|

(36,970,882)

|

7,371,093

|

9,954,614

|

|

Realised

loss on sale of digital currencies

|

-

|

-

|

8,364

|

11,296

|

|

Cryptocurrency

management fees

|

(361,578)

|

(487,045)

|

(340,561)

|

(459,925)

|

|

|

|

|

|

|

|

Mining Profit

|

6,227,047

|

8,387,833

|

7,133,942

|

9,634,344

|

|

Bitcoin

and Bitcoin Equivalent Mining Margin

|

86%

|

86%

|

86%

|

86%

|

(1) Due to favourable changes in fair value of Bitcoin and

Bitcoin Equivalents in October 2021, gross profit exceeded

revenue.

*Dollar

values translated from pound sterling into U.S. dollars at the rate

of £1.00 to $1.35 for November 2021 and £1.00 to $1.33

for October 2021. Exchange rates have been calculated using the

noon buying rates of the Federal Reserve Bank of New

York.

This announcement contains inside information.

For

further information please contact:

|

Argo

Blockchain

|

|

|

Peter

Wall

Chief

Executive

|

via

Tancredi +44 203 434 2334

|

|

finnCap

Ltd

|

|

|

Corporate

Finance

Jonny

Franklin-Adams

Tim

Harper

Joint

Corporate Broker

Sunila

de Silva

|

+44

207 220 0500

|

|

Tennyson

Securities

|

|

|

Joint

Corporate Broker

Peter

Krens

|

+44

207 186 9030

|

|

OTC

Markets

|

|

|

Jonathan

Dickson

jonathan@otcmarkets.com

|

+44

204 526 4581

+44

7731 815 896

|

|

Tancredi

Intelligent Communication

UK

& Europe Media Relations

|

|

|

Emma

Valgimigli

Emma

Hodges

Salamander

Davoudi

Fabio

Galloni-Roversi Monaco

argoblock@tancredigroup.com

|

+44

7727 180 873

+44

7861 995 628

+44

7957 549 906

+44

7888 672 701

|

About Argo:

Argo Blockchain plc is a global leader in cryptocurrency mining

with one of the largest and most efficient operations powered by

clean energy. The Company is headquartered in London, UK and its

shares are listed on the Main Market of the London Stock Exchange

under the ticker: ARB and on the Nasdaq Global Select Market in the

United States under the ticker: ARBK.

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

|

Date: 7

December, 2021

|

ARGO BLOCKCHAIN PLC

By:

Name:

Peter WallTitle: Chief Executive Officer

Name:

Davis ZaffeTitle: General Counsel

|

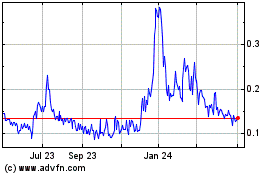

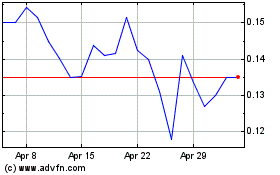

Argo Blockchain (PK) (USOTC:ARBKF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Argo Blockchain (PK) (USOTC:ARBKF)

Historical Stock Chart

From Apr 2023 to Apr 2024