British American Tobacco Backs 2021 Revenue Growth Guidance

December 07 2021 - 2:56AM

Dow Jones News

By Kyle Morris

British American Tobacco PLC backed its revenue growth guidance

on Tuesday, and said that it recognizes the value of a share

buyback.

The tobacco company said it continues to expect revenue growth

for 2021 to be above 5% at constant currency as it is benefiting

from strong new-category revenue growth. New categories will

contribute to profit growth for the first time as their losses

start to reduce, it said.

BAT said it is on track to deliver its revised cost-savings

target of 1.5 billion pounds ($1.99 billion) by the end of 2022, as

set out at its first-half results.

"Benefitting from a continued strong new-category performance,

which is now a sizeable contributor to group revenue growth, we are

making excellent progress towards our GBP5 billion revenue target

by 2025," Chief Executive Jack Bowles said.

Write to Kyle Morris at kyle.morris@dowjones.com

(END) Dow Jones Newswires

December 07, 2021 02:41 ET (07:41 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

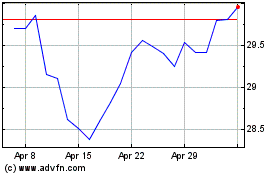

British American Tobacco (NYSE:BTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

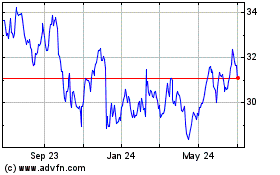

British American Tobacco (NYSE:BTI)

Historical Stock Chart

From Apr 2023 to Apr 2024