ConocoPhillips Plans 2022 Capex About $7.2 billion

December 06 2021 - 8:59AM

Dow Jones News

By Michael Dabaie

ConocoPhillips said it plans company-wide 2022 capital

expenditures of about $7.2 billion and initiated a three-tier

return of capital program.

The company issued an update following the closing of the its

acquisition of Shell's Permian Basin properties on Dec. 1 for net

cash of $8.6 billion.

The planned capital includes $200 million for Scope 1 and 2

emissions-reduction projects across the company's global operations

and investments in several early-stage low carbon technology

opportunities to address end-use emissions.

ConocoPhillips said it expects 2022 annual average production of

about 1.8 million barrels of oil equivalent per day, representing

low single-digit percentage underlying growth versus pro forma

2021.

The expected 2022 return of capital to shareholders of about $7

billion represents about a 16% increase versus 2021.

The company is initiating a three-tier capital return program

that will consist of an ordinary dividend tier, a share repurchase

tier, and a newly authorized quarterly variable return of cash

tier. The first VROC of 20 cents a share will be paid on Jan. 14,

2022, the company said.

The company said it expects to provide additional 2022 guidance

in conjunction with fourth-quarter 2021 earnings in early

February.

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

December 06, 2021 08:44 ET (13:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

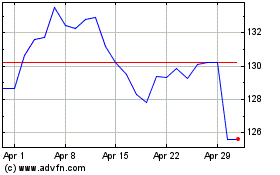

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Mar 2024 to Apr 2024

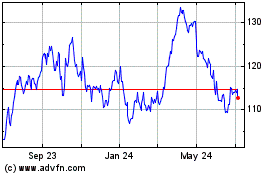

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Apr 2023 to Apr 2024